These are the best alternatives to Quicken, featuring tools that make managing your finances, budgeting, and tracking expenses easier and more efficient.

Best alternatives to Quicken:

- Banktrack

- Empower

- Simplifi

- PocketGuard

- Everydollar

- Rocket Money

- YNAB

- PocketSmith

- CountAbout

- GoodBudget

Managing a company's finances effectively is key to long-term success, and having the right treasury management software can make a huge difference.

While Quicken has been a go-to for personal finance and small businesses for years, it might not have everything that growing companies need, especially when it comes to more advanced, scalable solutions.

Whether you're seeking advanced cash flow analysis, better integration with your existing systems, or improved reporting capabilities, it's important to explore the best alternatives to Quicken that offer improved functionality for treasury management.

In this article, we’ll look at the top 10 software options that can simplify your financial operations, offer valuable insights, and help your business stay competitive in today's busy market.

Best 10 Alternatives to Quicken

To simplify your search for the perfect treasury management software, we’ve created a list of the 10 best alternatives to Quicken.

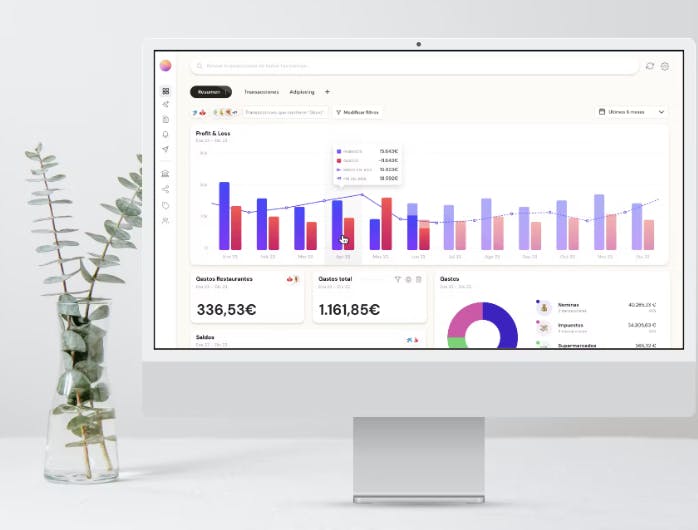

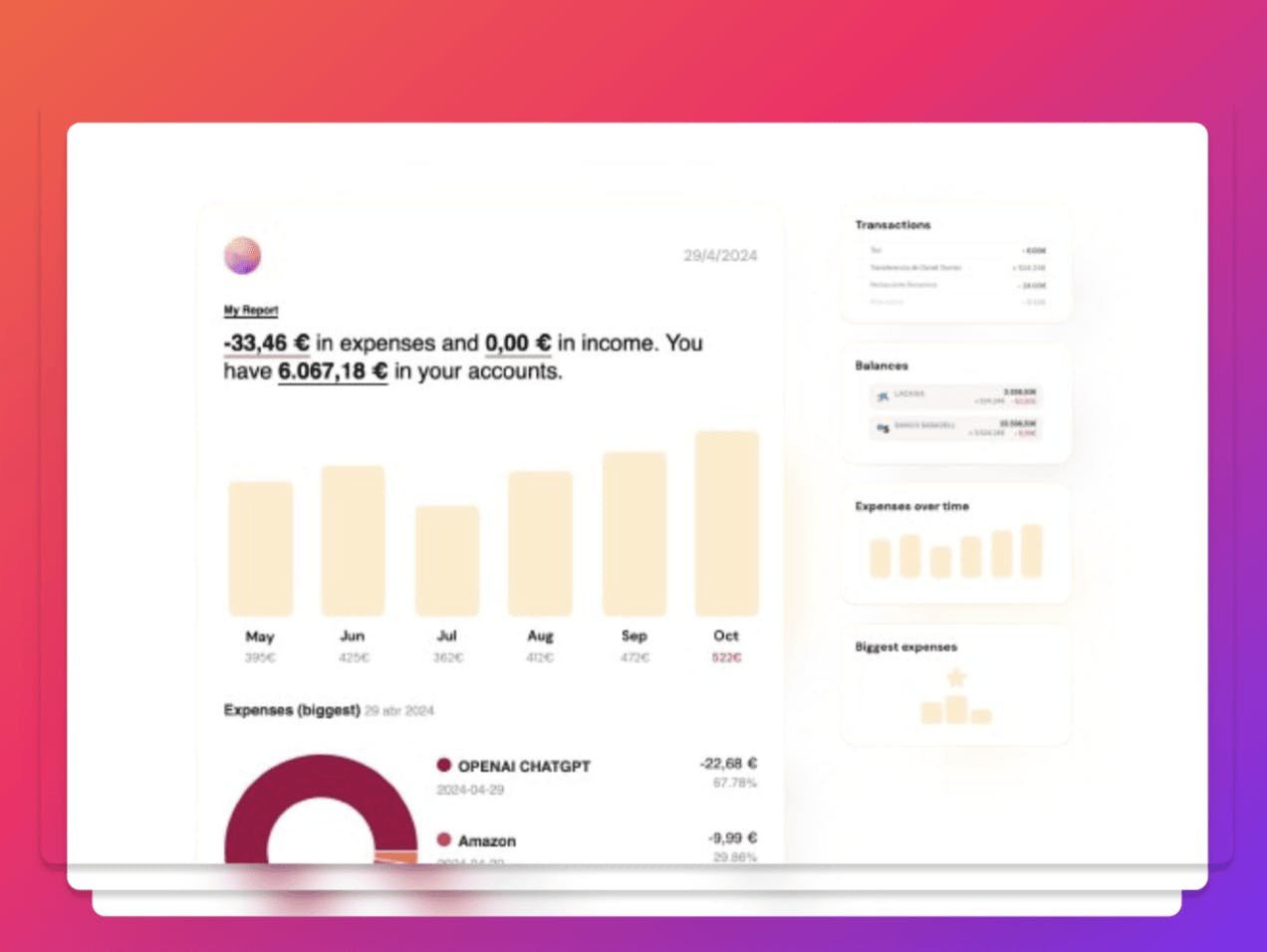

1. Banktrack

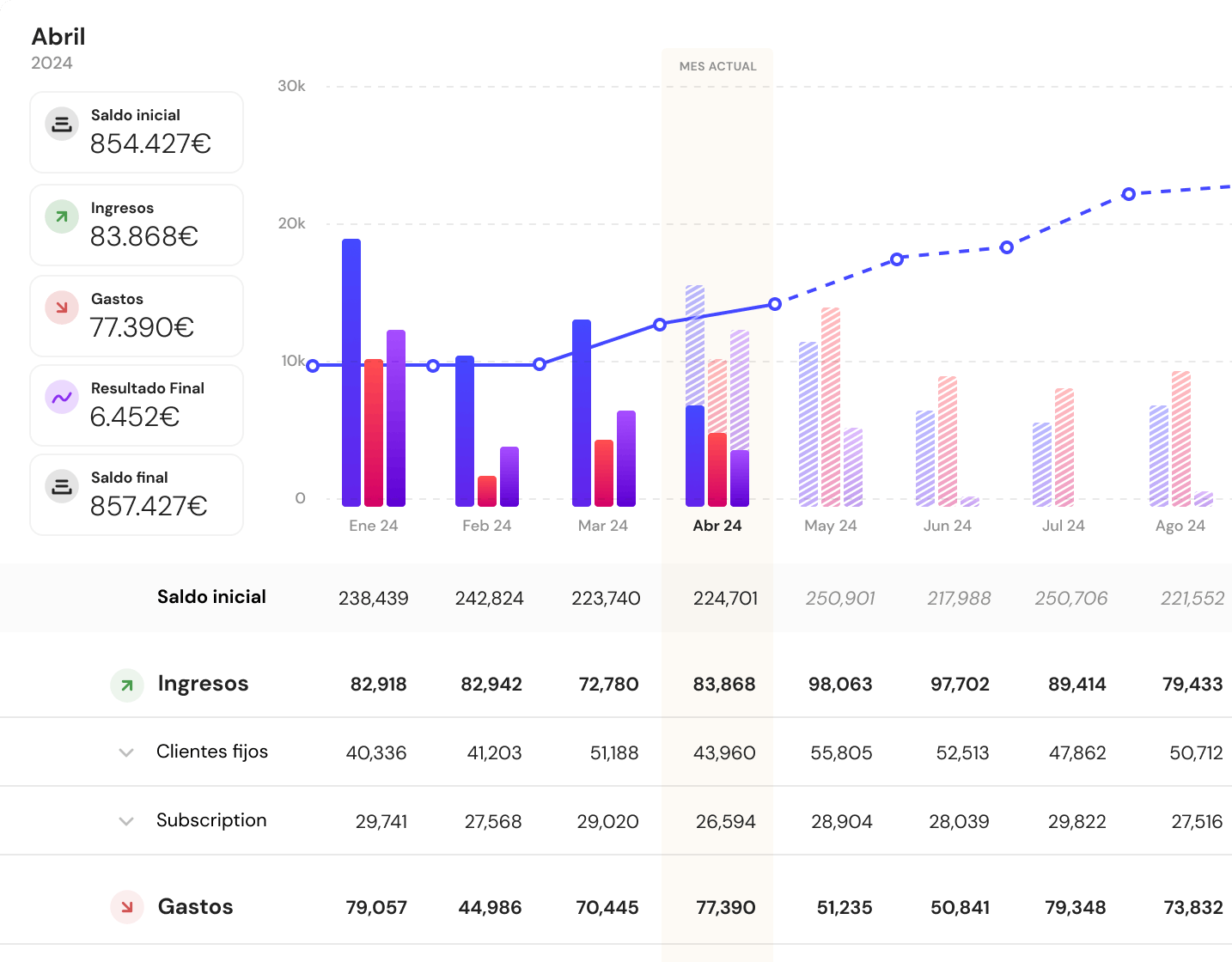

Banktrack is a treasury management tool designed to help businesses gain complete control over their cash flow. This software offers highly customizable dashboards and reports, allowing users to monitor income, expenses, and forecasts in real-time.

With integration to various banks, it simplifies the tracking of multiple accounts, making it an excellent fit for businesses of all sizes.

Key Features:

- Real-time financial tracking: Get a global view of your income, expenses, and cash flow.

- Automated invoice management: Automatic reconciliation of invoices and easy digitalization of financial documents.

- Accurate forecasting: historical data to generate reliable cash flow forecasts, enabling better financial decision-making.

- Custom reports: Tailor reports to your business needs for better financial analysis and performance tracking.

Why Choose Banktrack?

Banktrack offers a perfect mix of powerful features and ease of use, making it an ideal choice for businesses that want to optimize their financial operations.

With strong forecasting tools and automated invoice processing, it helps simplify complex financial processes while offering insights into cash flow management.

One of the aspects of Banktrack is its customizable dashboard, which allows users to view key financial metrics at a glance. This feature not only saves time but also enables businesses to make informed decisions quickly.

Additionally, Banktrack's integration capabilities mean it can connect with other financial tools and banking systems, further enhancing efficiency.

For companies looking to their financial management while gaining valuable insights, Banktrack provides a user-friendly platform that meets their needs.

2. Empower (Formerly Personal Capital)

Empower is another alternative to Quicken, offering a range of financial management tools. Empower excels in budget tracking, expense monitoring, and savings management.

Its feature is automation, whether it’s categorizing transactions, tracking subscriptions, or optimizing savings.

Key Features:

- Advanced automation: Automatically track and categorize transactions.

- Savings tools: Empower’s AutoSave feature helps businesses save more efficiently.

- Real-time updates: Instant access to cash flow and expense data.

- Customizable reports: Create personalized reports based on your business needs.

Why Choose Empower?

For businesses looking for more automated features to monitor recurring payments and subscriptions, Empower is a top pick. Its combination of automation, real-time monitoring, and easy setup makes it a great choice for both individuals and small business owners.

3. Simplifi

Simplifi is an intuitive app designed to simplify financial tracking and budgeting. As the name suggests, Simplifi is perfect for users seeking a more straightforward approach to managing their money.

While it’s less complex than Quicken, it still offers real-time expense tracking and powerful budgeting features.

Key Features:

- Personalized budgeting tools: Track spending by categories and set financial goals.

- Real-time tracking: Stay updated with automatic syncing to your bank accounts.

- Expense categorization: Simplifies understanding where your money is going.

Why Choose Simplifi?

Simplifi is perfect for businesses or individuals who don’t require the full range of features that Quicken offers but still want clear financial insights.

Its ease of use and automated features make it a great option for those looking for a simpler yet effective solution.

4. PocketGuard

PocketGuard is ideal for users who want a quick and simple way to manage their finances. This app tracks income and expenses and helps you stay on top of your spending.

It’s particularly useful for those who want to know how much disposable income they have left after bills, savings, and recurring payments.

What sets PocketGuard apart is its “In My Pocket” feature, which gives you a clear picture of how much money you can spend after accounting for bills and savings goals. This straightforward approach helps users avoid overspending and encourages smarter financial decisions.

Key Features:

- Simple budget management: Automatically calculates how much you can spend.

- Expense categorization: Automatically categorizes transactions into relevant categories.

- Bill tracking: Keeps tabs on recurring bills and subscriptions.

Why Choose PocketGuard?

PocketGuard’s key strength is its simplicity. It’s ideal for businesses or individuals who want straightforward financial oversight without getting bogged down by complex tools. It helps track spending and make better-informed financial decisions with minimal effort.

5. EveryDollar

EveryDollar, designed by the team at Ramsey Solutions, uses a zero-based budgeting approach, which means every dollar of income is assigned a purpose.

This simple yet effective system can be adapted for small businesses looking for a cash flow management software.

One of the features of EveryDollar is its user-friendly interface. The app allows users to easily set up budgets by category, making it straightforward to see where money is going each month.

Users can manually enter their expenses or connect their bank accounts for automatic tracking, giving them flexibility in how they manage their finances.

This flexibility makes it a great option for both individuals and small business owners who want to take control of their financial situation without feeling overwhelmed.

Key Features:

- Zero-based budgeting: Plan out every dollar and avoid overspending.

- User-friendly interface: Simplified budgeting experience for quick adjustments.

- Expense tracking: Monitor income and spending in real-time.

Why Choose EveryDollar?

EveryDollar’s zero-based budgeting system is excellent for businesses looking to allocate every penny effectively. It may not offer advanced forecasting tools, but its simplicity and budgeting discipline make it a good choice for small businesses.

6. Rocket Money

Rocket Money is an all-in-one financial management tool that focuses on helping businesses and individuals manage subscriptions and bills. It offers automatic tracking of recurring payments and provides insights into where your money is going.

Key Features:

- Subscription management: Easily track and manage recurring subscriptions.

- Bill negotiation: Helps reduce monthly costs by negotiating bills.

- Spending insights: Provides detailed spending breakdowns to identify areas for improvement.

Why Choose Rocket Money?

Rocket Money is particularly useful for businesses with multiple recurring expenses, helping in bill management and track spending. Its ability to monitor subscriptions makes it a valuable tool for optimizing cash flow.

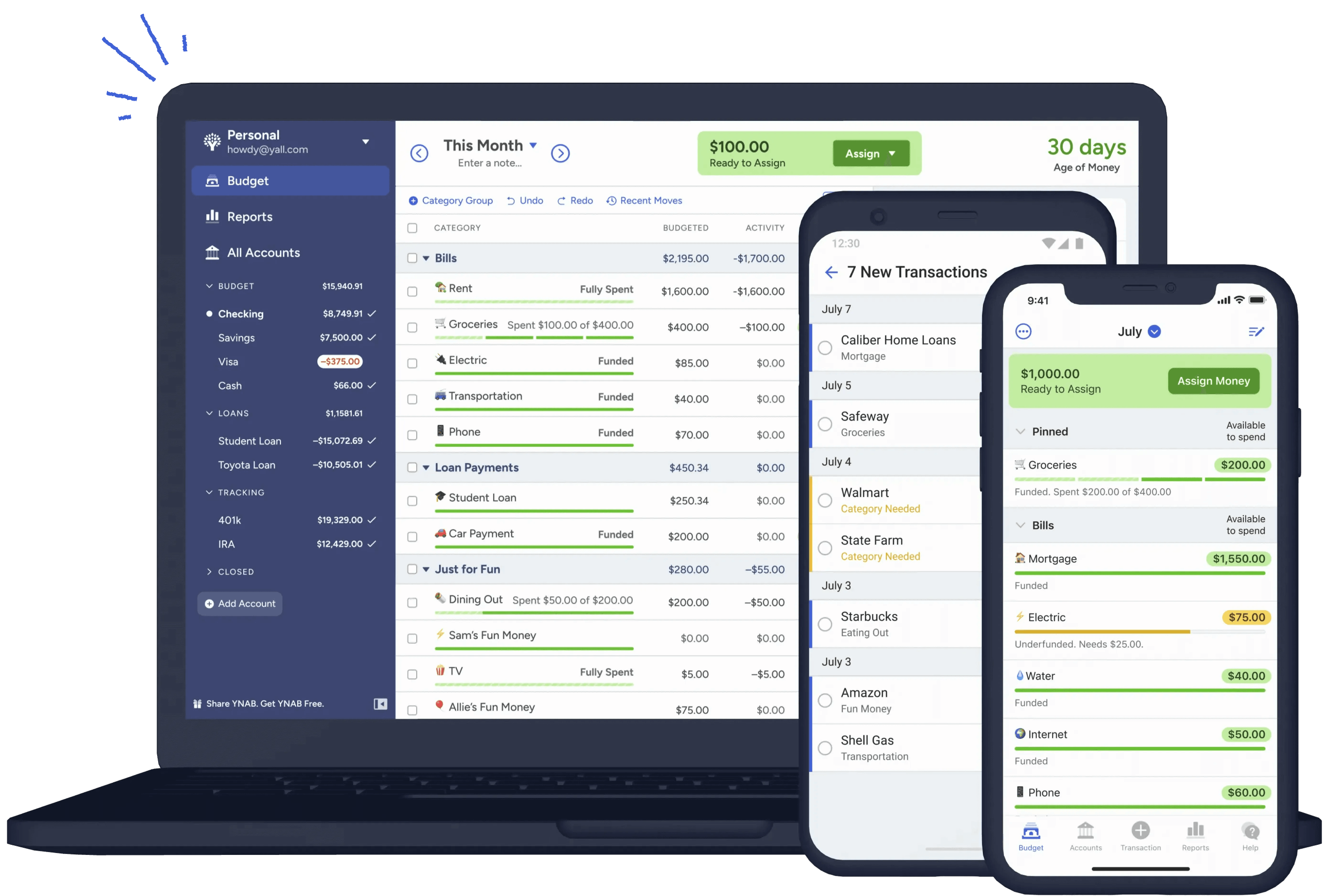

7. You Need a Budget (YNAB)

You Need a Budget (YNAB) is a financial management tool based on zero-based budgeting, like EveryDollar. It offers a highly disciplined approach to money management, helping users give every dollar a job and plan for upcoming expenses.

Key Features:

- Zero-based budgeting: A proactive approach to managing money.

- Real-time financial tracking: Stay updated with real-time changes in cash flow.

- Financial education: YNAB offers resources and workshops to improve budgeting skills.

Why Choose YNAB?

YNAB helps you get a handle on your finances, making it a solid pick for anyone, whether a business or an individual, who wants to build better money habits.

Its educational tools are a nice bonus, providing users with the skills they need to manage their finances more effectively.

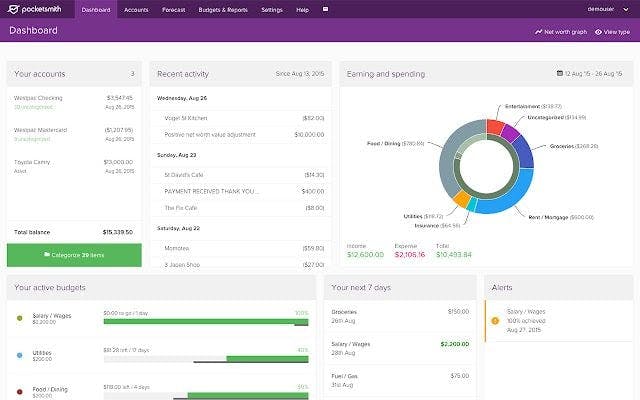

8. PocketSmith

PocketSmith is designed for those who need advanced forecasting tools to project their financial future. Its detailed cash flow projections and budgeting tools are ideal for businesses needing to make long-term financial plans.

Key Features:

- Cash flow forecasting: Predict your financial future with detailed insights.

- Customizable budgeting: Tailor budgets to meet your specific needs.

- Multi-account tracking: Manage multiple accounts in one platform.

Why Choose PocketSmith?

For businesses that rely on long-term planning and forecasting, PocketSmith is one of the most powerful tools available. Its forecasting capabilities are unmatched, helping users prepare for future expenses and make better decisions.

9. CountAbout

CountAbout is a flexible financial management tool perfect for integrating data from Quicken and Mint, making it easy for businesses to transition between platforms without losing historical financial information.

Key Features:

- Seamless data import: Transition from Quicken or Mint without losing data.

- Customizable reports: Create detailed financial reports that meet your needs.

- Expense tracking: Automatic syncing with bank accounts for real-time tracking.

Why Choose CountAbout?

CountAbout is perfect for businesses that have been using Quicken but are looking for a more customizable and user-friendly platform. Its transition process makes it a top choice for anyone wanting to switch without any hassle

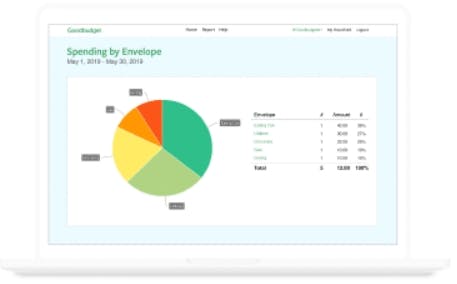

10. GoodBudget

GoodBudget uses the envelope budgeting system, making it ideal for those who want to allocate specific amounts of money to different spending categories. While it’s a simple tool, it’s effective for businesses and individuals that want a hands-on approach to budgeting.

Key Features:

- Envelope budgeting: Allocate funds to specific spending categories.

- Multi-device syncing: Manage finances from any device.

- Real-time expense tracking: Stay on top of your spending with real-time updates.

Why Choose GoodBudget?

GoodBudget is perfect for users looking for a simple, straightforward budgeting tool. While it lacks advanced forecasting and reporting tools, its envelope system helps users control spending effectively.

Why Choose Banktrack as your Treasury Management Tool

While all of the alternatives listed offer great features and capabilities, Banktrack stands out as the best treasury management software.

Its ability to provide real-time cash flow tracking, accurate forecasts, and highly customizable reports gives businesses the edge they need to efficiently manage their finances and make data-driven decisions.

Unlike some of the simpler tools like GoodBudget or EveryDollar, which focus on personal finance or basic budgeting, Banktrack is designed specifically for businesses.

It offers powerful automation features, integrates with multiple bank accounts, and offers personalized information to meet your business needs.

By using business budgeting softwares like Banktrack, businesses of all sizes can do their treasury operations, reduce manual processes and get a clearer picture of their financial health.

Share this post

Related Posts

Best 11 alternatives to Monarch Money

These are the best 11 alternatives to Monarch Money for budgeting and finance tracking in 2024.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed