12 Tips to Improve Cash Flow for Better Financial Health

- 12 Tips to Improve Cash Flow

- 1. Keep an Eye on Your Cash Flow Regularly

- 2. Make a Cash Flow Forecast

- 3. Speed Up Invoicing and Collections

- 4. Negotiate Better Terms with Suppliers

- 5. Manage Your Inventory Wisely

- 6. Control Your Operating Costs

- 7. Find New Ways to Generate Revenue

- 8. Consider Financing Options

- 9. Manage Payroll Efficiently

- 10. Build Up a Cash Reserve

- 11. Review and Adjust Your Pricing

- 12. Use Technology to Your Advantage

- What is Cash Flow?

- Why Banktrack is the Best Choice for Cash Management Software

- 1. Personalized Dashboards

- 2. Integration with Multiple Bank Accounts and Products

- 3. Customizable Spending Metrics

- 4. Automated Alerts and Reports

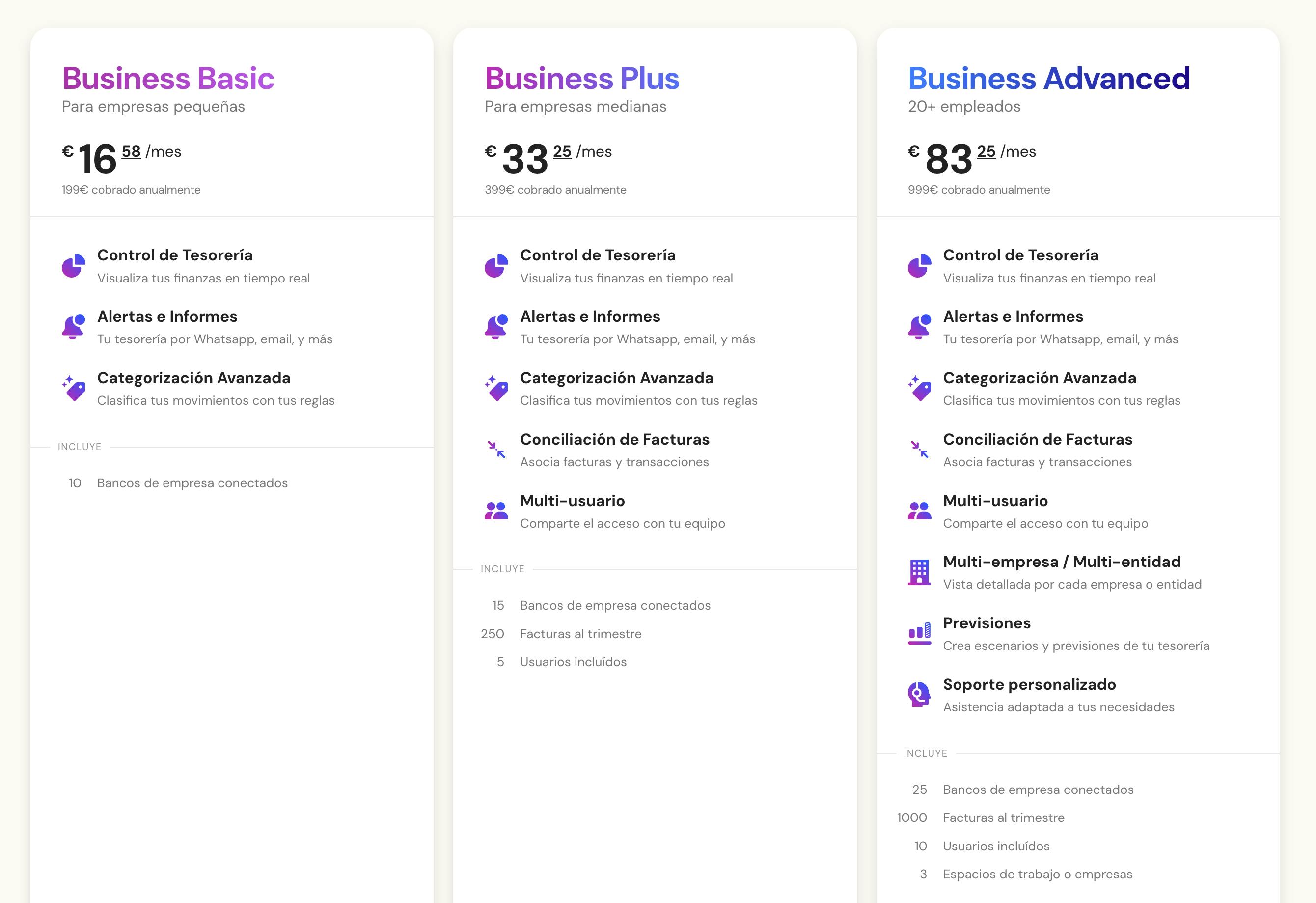

- 5. Affordable Pricing

Tips to improve cash flow for better financial health:

- Keep an Eye on Your Cash Flow Regularly

- Make a Cash Flow Forecast

- Speed Up Invoicing and Collections

- Negotiate Better Terms with Suppliers

- Manage Your Inventory Wisely

- Control Your Operating Costs

- Find New Ways to Generate Revenue

- Consider Financing Options

- Manage Payroll Efficiently

- Build Up a Cash Reserve

- Review and Adjust Your Pricing

- Use Technology to Your Advantage

Managing cash flow is key to running a successful business.

Whether you're just starting out or have been around for years, having a steady cash flow helps you cover expenses, invest in new opportunities, and stay prepared for unexpected challenges.

This guide will share straightforward tips to help you boost your cash flow and keep your business on track.

12 Tips to Improve Cash Flow

1. Keep an Eye on Your Cash Flow Regularly

Checking your cash flow regularly lets you spot trends and issues before they become big problems.

It helps you stay on top of your financial situation and make smart decisions.

How to Do It:

- Use Accounting Software: Tools like Banktrack can track your expenses and cash flow automatically and give you clear reports.

- Review Financial Statements: Regularly look over your income statement, balance sheet, and cash flow statement. This can be easier to do with a clear dashboard that lets you view all expenses and cash flows. Simplify the process with Banktrack.

- Set Up Alerts: Create alerts for things like low cash reserves or overdue invoices so you can act quickly. This can be easily set up with Banktrack’s intelligent alerts.

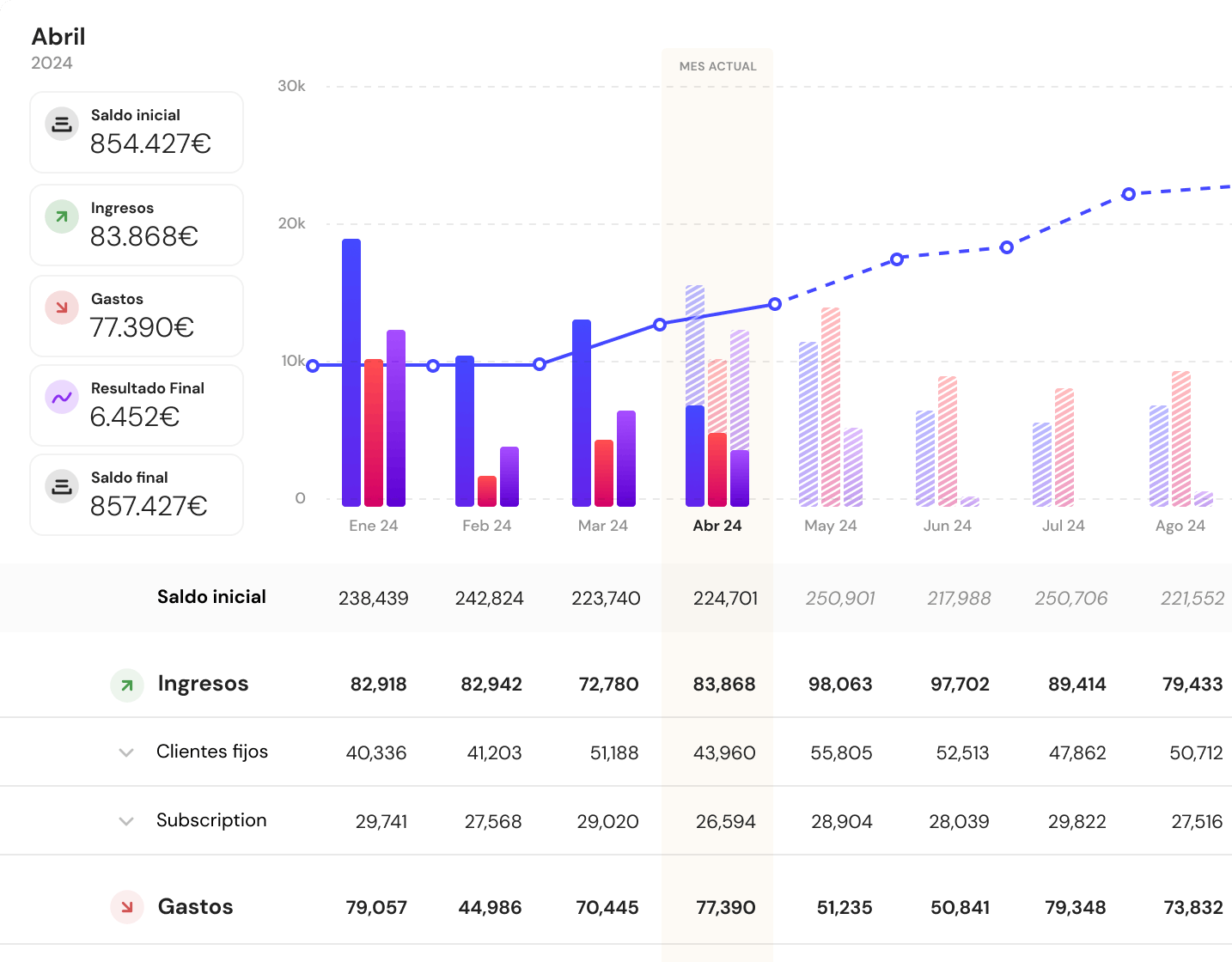

2. Make a Cash Flow Forecast

A cash flow forecast helps you predict how much cash you'll have in the future based on your expected income and expenses.

This way, you can plan for slow periods and avoid running out of cash.

How to do a cash flow projection the simple way:

- Look at Past Data: Use your previous financial records to estimate future cash flow.

- Factor in Variables: Think about things like seasonal changes, market trends, and upcoming expenses.

- Update Regularly: Adjust your forecast based on what’s actually happening in your business.

3. Speed Up Invoicing and Collections

Getting paid quickly is crucial for maintaining a healthy cash flow.

If customers delay payments, it can cause cash flow problems.

How to Do It:

- Send Invoices Quickly: Issue invoices right after providing a product or service.

- Offer Multiple Payment Options: Make it easy for customers to pay by accepting various payment methods.

- Set Clear Terms: Clearly state payment terms on your invoices and remind customers if they’re overdue.

- Follow Up: Have a system in place for following up on overdue payments.

4. Negotiate Better Terms with Suppliers

Negotiating better terms with your suppliers can give you more time to pay your bills and help manage your cash flow more effectively.

How to Do It:

- Ask for Extended Terms: Try to negotiate longer payment periods with your suppliers.

- Seek Discounts: Request discounts for early payments or bulk purchases.

- Compare Options: Shop around and find suppliers that offer the best terms and prices.

5. Manage Your Inventory Wisely

Keeping too much inventory ties up cash that could be used elsewhere.

Effective inventory management helps free up cash for other uses.

How to Do It:

- Use Just-In-Time Inventory: Order stock only as needed to reduce excess inventory.

- Track Sales and Inventory: Monitor how quickly your inventory sells and adjust orders accordingly.

- Use Inventory Software: Tools can help you track inventory levels and manage orders more efficiently.

6. Control Your Operating Costs

Keeping your operating expenses under control ensures that you’re not overspending, which helps improve cash flow.

How to Do It:

- Track Your Spending: Regularly review your expenses to find areas where you can cut back.

- Reduce Overhead Costs: Look for ways to lower costs like utilities and subscriptions.

- Review Contracts: Make sure your contracts and subscriptions are still necessary and cost-effective.

7. Find New Ways to Generate Revenue

Bringing in more revenue can boost your cash flow and help you stay financially healthy.

How to Do It:

- Offer New Products or Services: Expand your offerings to attract more customers.

- Explore New Markets: Look for opportunities to enter new markets or target new customer groups.

- Use Online Channels: Leverage e-commerce and online marketing to reach a broader audience.

8. Consider Financing Options

Sometimes, a little extra funding can help smooth out cash flow issues and support growth.

How to Do It:

- Look into Business Loans: Research loans that offer favorable terms for your business.

- Use Lines of Credit: Set up a line of credit for short-term cash needs.

- Attract Investors: Consider seeking investment if it suits your business model.

9. Manage Payroll Efficiently

Efficient payroll management ensures you’re paying employees correctly and on time, which affects your cash flow.

How to Do It:

- Use Payroll Software: Automate payroll to reduce errors and save time.

- Adjust Staffing Levels: Ensure you have the right number of employees based on your needs and sales.

- Control Overtime Costs: Monitor and manage overtime to avoid unexpected expenses.

10. Build Up a Cash Reserve

Having a cash reserve provides a safety net for unexpected expenses and helps you handle cash flow fluctuations.

How to Do It:

- Save a Portion of Revenue: Set aside a percentage of your revenue for emergencies.

- Review and Adjust: Regularly check your cash reserve and adjust contributions as needed.

- Use for Emergencies Only: Avoid dipping into your reserve for regular expenses.

11. Review and Adjust Your Pricing

Setting the right prices ensures you cover costs and make a profit, which supports better cash flow.

How to Do It:

- Check Your Costs: Make sure your pricing covers all expenses and leaves room for profit.

- Compare Market Rates: See how your prices stack up against competitors.

- Use Dynamic Pricing: Adjust prices based on demand, seasonality, and other factors.

12. Use Technology to Your Advantage

Technology can help streamline your operations, reduce costs, and make managing cash flow easier.

How to Do It:

- Adopt Automation Tools: Automate tasks like invoicing and payroll to save time and reduce errors.

- Use Cloud Solutions: Cloud cash management softwares offer real-time access to financial data and help with management.

- Leverage Data Analytics: Use data to understand cash flow trends and make better decisions.

What is Cash Flow?

First, let’s clarify what cash flow means.

Simply put, cash flow is the movement of money into and out of your business.

When you have more money coming in than going out, your cash flow is positive. If the opposite is true, you’re dealing with negative cash flow.

Keeping a close eye on your cash flow helps ensure that you can pay bills, invest in growth, and handle any financial bumps in the road.

Do you want to know the real tip? All of this can be easily done with a cash flow forecasting software. Let us prove it to you.

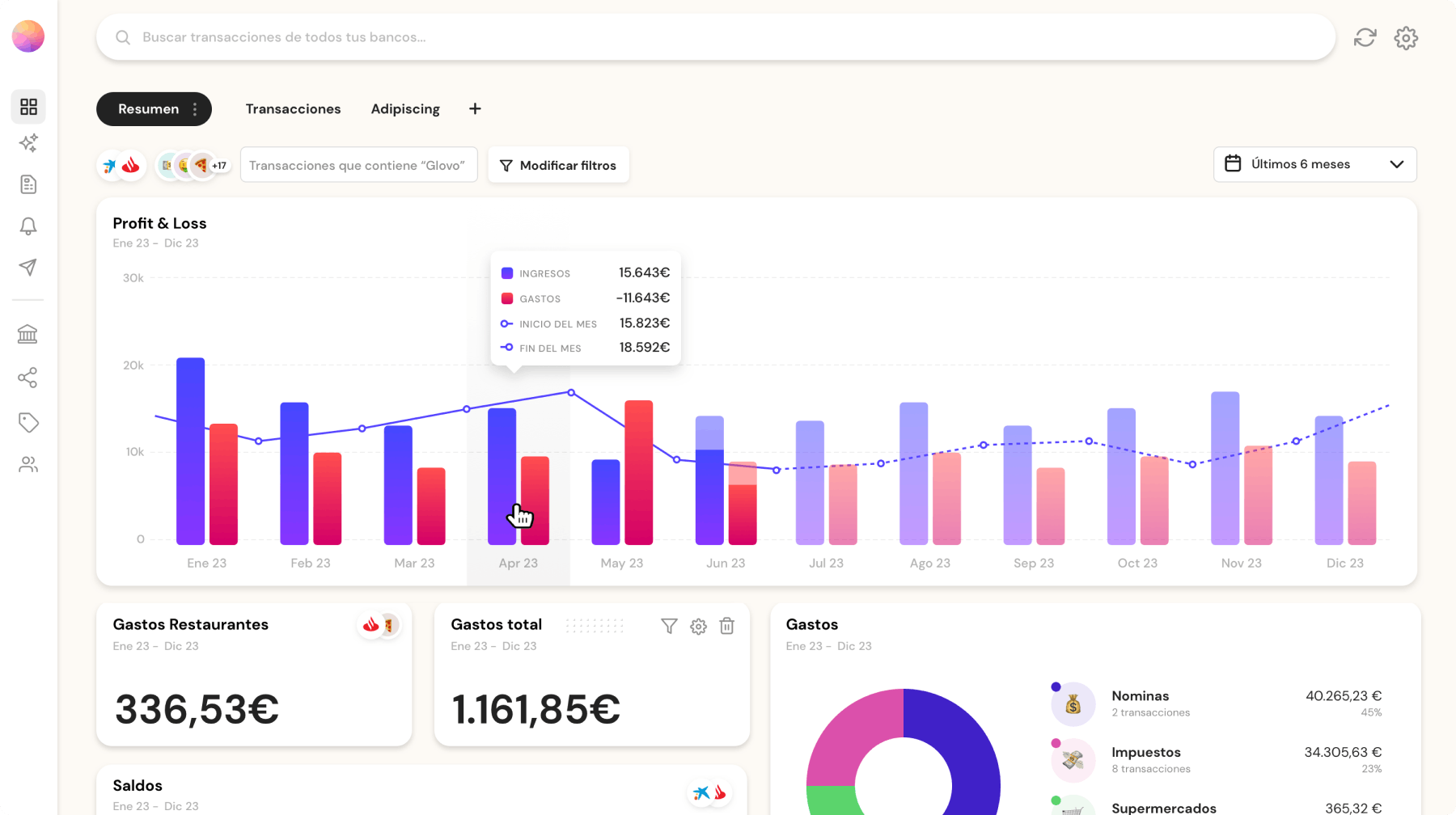

Why Banktrack is the Best Choice for Cash Management Software

In the world of cash management, Banktrack shines as a top choice for businesses of all sizes.

Its unique features and capabilities make it an excellent tool for effectively managing finances. Here’s why Banktrack stands out as the best option for cash management:

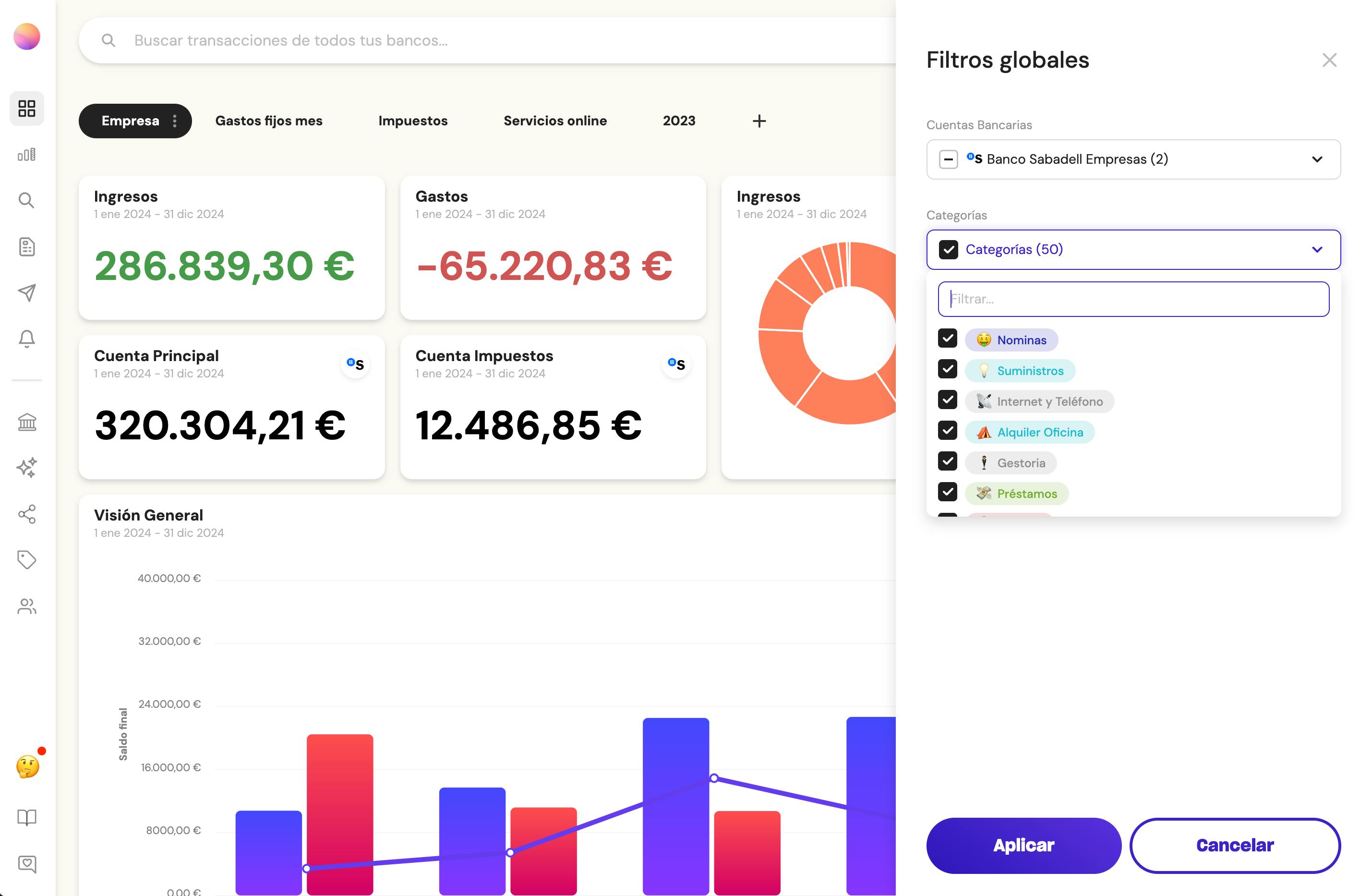

1. Personalized Dashboards

Banktrack offers customizable dashboards that allow users to view their financial data in a way that suits their specific needs.

Whether you’re interested in tracking cash flow, monitoring expenses, or analyzing income, you can set up your dashboard to highlight the information that matters most to you.

This level of personalization helps you stay focused on key financial metrics and make more informed decisions.

2. Integration with Multiple Bank Accounts and Products

One of Banktrack's standout features is its ability to integrate with multiple bank accounts and financial products.

This integration means you can consolidate all your financial information into a single platform, streamlining your cash management process.

Instead of juggling different bank accounts and platforms, you can manage everything from one place, saving time and reducing the risk of errors.

3. Customizable Spending Metrics

Banktrack allows you to set up customizable spending metrics tailored to your business’s needs.

You can categorize expenses, track income, and analyze spending patterns with ease.

This flexibility ensures that you have a clear understanding of where your money is going and helps you make strategic adjustments to optimize your financial health.

4. Automated Alerts and Reports

Staying on top of your finances can be challenging, but Banktrack’s automated alerts and reports make it easier.

You can set up alerts for various financial thresholds, such as low balances or upcoming payments.

Additionally, the software generates detailed reports on a regular basis, giving you valuable insights into your financial situation without having to manually compile data.

5. Affordable Pricing

Banktrack offers competitive pricing starting at just €16.58 per month. This affordability makes it accessible for businesses of all sizes, from small startups to larger enterprises.

Given the robust features and capabilities it provides, Banktrack delivers excellent value for money.

Share this post

Related Posts

Top 10 Small Business Expense Tracking Softwares

Managing your small business finances can be stressful and overwhelming at times. That is where these expense tracking software solutions come in.The potential of EBITA to evaluate cash flow

EBITA is a very useful metric to evaluate cash flow. Ever wondered how businesses gauge their true operational performance? Meet EBITA!

Try it now with your data

- Your free account in 2 minutes

- No credit card needed