8 Steps to Deal with Cash Flow Problems Effectively

- Understanding Cash Flow: The Heartbeat of Your Business

- The Basics of Cash Flow

- 1. Make a Detailed Cash Flow Statement

- How to Create a Cash Flow Statement

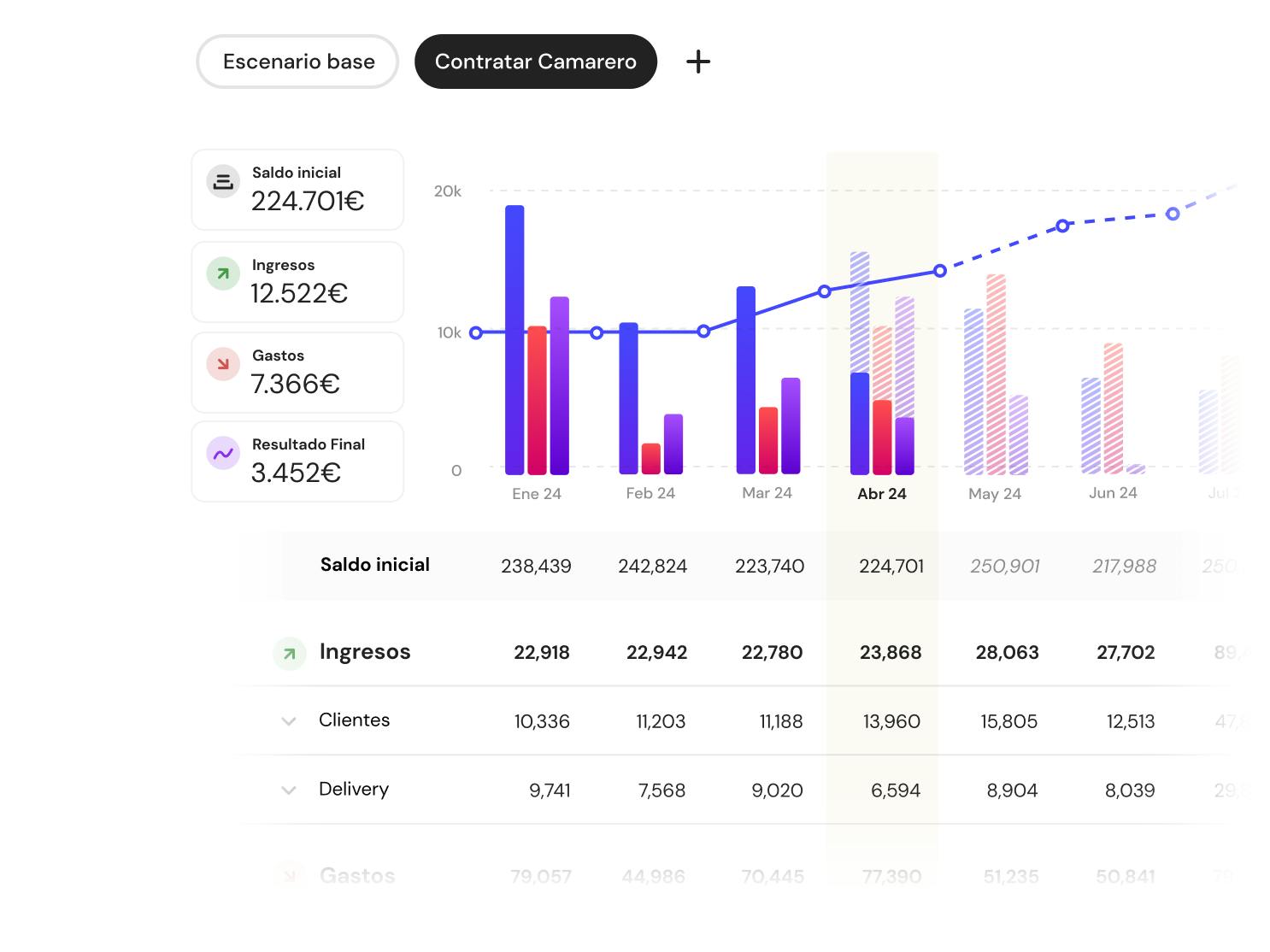

- How Banktrack Makes It Easier

- 2. Streamline Your Invoicing Process

- Tips for Better Invoicing

- How Banktrack Helps

- 3. Trim Unnecessary Costs

- Where to Start Cutting Costs

- How Banktrack Fits In

- 4. Manage Your Inventory Wisely

- Tips for Better Inventory Management

- How Banktrack Can Help

- 5. Explore Financing Options

- Types of Financing to Consider

- How Banktrack Supports Financing Decisions

- 6. Build a Cash Reserve

- How to Build a Cash Reserve

- How Banktrack Makes Saving Easier

- 7. Keep the Lines of Communication Open

- Why Communication Matters

- How Banktrack Supports Communication

- 8. Plan for Seasonality and Market Changes

- Tips for Planning Ahead

- How Banktrack Helps with Planning

- Take Control of Your Cash Flow with Banktrack

Steps to deal with cash flow problems effectively:

- Make a detailed cash flow statement

- Streamline your invoicing process

- Trim unnecessary costs

- Manage your inventory wisely

- Explore financing options

- Build a cash reserve

- Keep the lines of communication open

- Plan for seasonalities and market changes

Let’s face it, cash flow issues are every business owner's nightmare.

You’ve got bills to pay, employees to keep happy, and hopefully, some profits to pocket.

But when the cash isn't flowing as it should, things can get stressful fast. The good news?

There are practical ways to tackle cash flow problems head-on.

In this guide, we’ll walk you through some effective strategies to keep your cash flow in check. And to make things even easier, we'll show you how tools like Banktrack can help you manage it all without breaking a sweat.

Understanding Cash Flow: The Heartbeat of Your Business

Before we jump into fixing problems, let’s make sure we’re all on the same page about what cash flow actually is.

Simply put, cash flow is the movement of money in and out of your business.

You’ve got money coming in (hopefully!) from sales and other sources, and money going out to cover expenses.

The goal is to have more coming in than going out, pretty straightforward, right?

The Basics of Cash Flow

- Cash Inflows: This is your income: money from sales, loans, investments, or any other cash injections into your business.

- Cash Outflows: These are your expenses, including rent, payroll, supplies, utilities, and those surprise costs that seem to pop up at the worst times.

- Net Cash Flow: This is the difference between your inflows and outflows. Positive net cash flow means you’re doing well, while negative net cash flow means it’s time to take action.

Now that we’ve got the basics down, let’s dive into some practical steps to get your cash flow in shape.

1. Make a Detailed Cash Flow Statement

First things first, you need to know exactly where your money is going.

A cash flow statement is your best friend here. It’s a simple document that tracks all the money coming into and going out of your business over a specific period. Think of it as your financial roadmap.

How to Create a Cash Flow Statement

- List Your Income Sources: Start by listing all the ways money comes into your business, like sales revenue or loans.

- Track Your Spending: Next, write down all your expenses. This includes everything from payroll to office supplies to that coffee subscription for the break room.

- Calculate Net Cash Flow: Subtract your total expenses from your total income. If the number is positive, you’re in good shape. If it’s negative, it’s time to make some changes.

How Banktrack Makes It Easier

Manually creating a cash flow statement can feel stressful and extremely time consuming. This is where Banktrack comes to the rescue.

Banktrack lets you track all your cash inflows and outflows in real-time, pulling data from all your bank accounts and financial products into one neat dashboard.

You get a clear, up-to-date picture of your cash flow without all the number-crunching. Plus, it’s all automated, so you can spend less time on paperwork and more time growing your business.

2. Streamline Your Invoicing Process

One of the biggest reasons businesses run into cash flow problems is late payments. If your customers aren’t paying on time, it can throw everything off balance.

That’s why it’s crucial to have a smooth and efficient invoicing process. Here you have the best invoice reconciliation software this 2024.

Tips for Better Invoicing

- Send Invoices Quickly: Don’t wait, send out invoices as soon as you deliver a product or service. The sooner your customers get the invoice, the sooner you get paid.

- Clear Payment Terms: Make sure your invoices clearly state when payment is due. Whether it’s “Due upon receipt” or “Net 30 days,” set expectations upfront.

- Offer Early Payment Discounts: Consider giving customers a small discount if they pay early. It’s a great way to encourage timely payments.

- Chase Up Late Payments: Don’t be shy about following up on late payments. A friendly reminder can go a long way in speeding up the process.

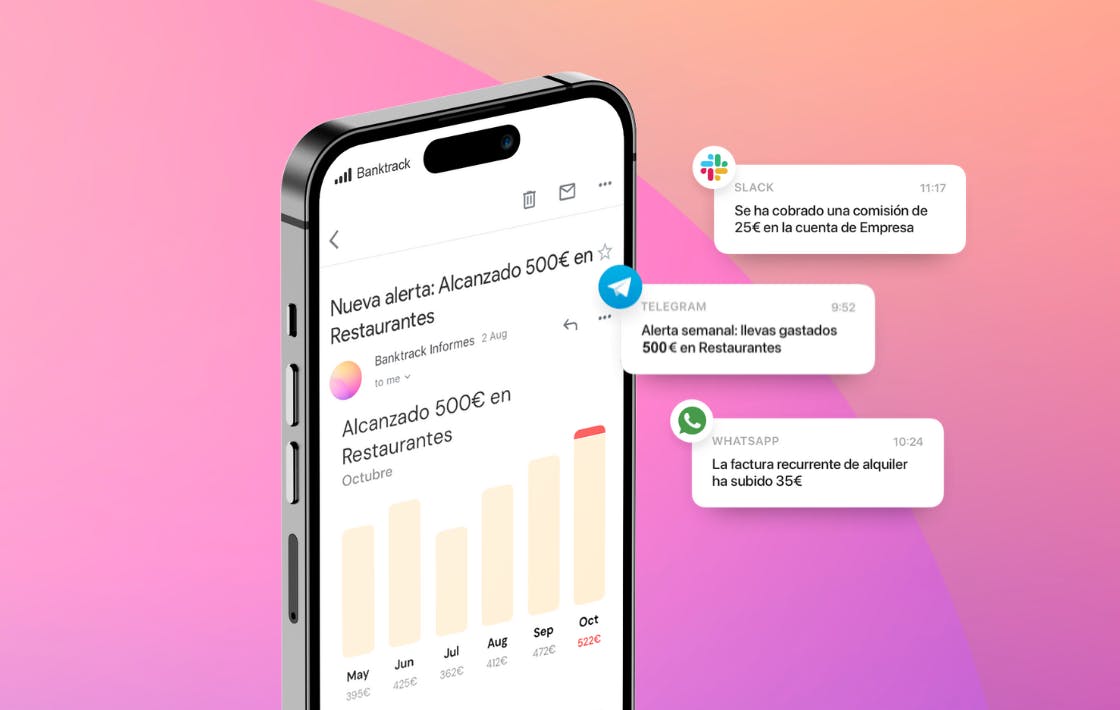

How Banktrack Helps

Banktrack simplifies the whole invoicing game. You can create, send, and track invoices right from the app.

It also sends you reminders about unpaid invoices, so nothing slips through the cracks.

What’s more, Banktrack can notify you via WhatsApp, SMS, email, Slack, or Telegram, whichever channel works best for you. This means you’ll never miss a beat when it comes to getting paid.

3. Trim Unnecessary Costs

When cash is tight, it’s time to tighten the belt. Cutting back on unnecessary expenses can free up cash that you can use where it really matters.

Where to Start Cutting Costs

- Review Subscriptions and Services: Are you paying for software or services you hardly use? Cancel or downgrade them to save some cash.

- Negotiate with Suppliers: Have a chat with your suppliers and see if you can negotiate better terms. A little haggling could lead to discounts or extended payment deadlines.

- Lower Overhead Costs: Look at your fixed costs, like rent and utilities. Can you find a cheaper office space or reduce energy usage? Small changes can add up.

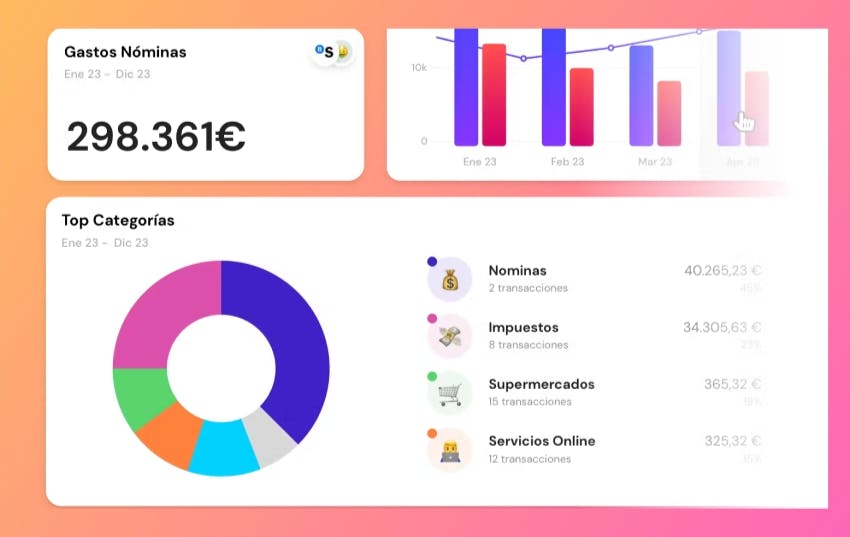

How Banktrack Fits In

Banktrack helps you keep a close eye on your expenses.

By categorizing every expense, it makes it easy to spot where your money is going and where you can cut back.

Plus, with real-time updates, you can see the impact of your cost-cutting measures immediately, giving you more control over your finances.

4. Manage Your Inventory Wisely

Inventory can be a big drain on your cash flow if not managed properly.

Too much stock ties up cash that could be used elsewhere, while too little can lead to missed sales opportunities.

Tips for Better Inventory Management

- Just-In-Time Inventory: Order stock as you need it to avoid overstocking. This way, you’re not sitting on piles of unsold goods.

- Monitor Inventory Levels: Keep a close eye on how quickly your inventory moves. If something isn’t selling, it might be time to stop stocking it or put it on sale.

- Move Excess Stock Quickly: If you have too much of something, consider holding a sale or offering discounts to move it quickly and free up cash.

How Banktrack Can Help

While Banktrack doesn’t manage inventory directly, its still an expense tracking app, which can help you understand how much cash is tied up in inventory.

You can also track sales trends to make smarter purchasing decisions. By aligning your spending with actual demand, you can keep your inventory levels just right.

5. Explore Financing Options

If you’re really in a pinch, financing can be a lifeline. There are various options out there, depending on your needs and situation.

Here you have the best app for personal tracking.

Types of Financing to Consider

- Business Loans: A traditional business loan can provide a lump sum of cash to help cover expenses during tough times.

- Lines of Credit: A line of credit gives you flexible access to funds as needed. You borrow what you need and pay it back as your cash flow improves.

- Invoice Factoring: If you’re waiting on customer payments, invoice factoring allows you to sell your unpaid invoices to a third party for immediate cash.

How Banktrack Supports Financing Decisions

Banktrack can provide insights into your cash flow trends, helping you determine whether you need financing and which option might be best for your situation.

By keeping all your financial data in one place, it makes it easier to prepare the documentation often required for financing applications.

6. Build a Cash Reserve

One of the best ways to protect your business from cash flow problems is to build up a cash reserve. Think of it as your rainy-day fund, money you can dip into when times get tough.

How to Build a Cash Reserve

- Set Aside Profits Regularly: Whenever you can, set aside a portion of your profits into a separate savings account. It’s easier to save when you make it a habit.

- Save During Good Times: When your cash flow is strong, resist the urge to splurge. Instead, funnel some of that extra cash into your reserve.

- Automate Savings: Set up automatic transfers from your main business account to your reserve account. This ensures you’re consistently building your safety net.

How Banktrack Makes Saving Easier

Banktrack can help you manage your cash reserve by tracking your savings goals and providing insights into your cash flow.

You can then set up transfers to your savings account, ensuring that you’re steadily building your cash reserve without having to think about it.

Really consider a business cash management tool to help you in this process.

7. Keep the Lines of Communication Open

When you’re dealing with cash flow problems, transparency is key.

Keeping open communication with your employees, suppliers, and creditors can help you navigate tough times more smoothly.

Why Communication Matters

- With Employees: If your team understands the financial situation, they can be more supportive and even contribute ideas for cutting costs or increasing efficiency.

- With Suppliers: Being upfront with suppliers can lead to better payment terms or even discounts, especially if you’ve built a good relationship over time.

- With Creditors: If you’re having trouble making payments, reach out to your creditors before things get worse. Many are willing to work out a payment plan if you’re proactive.

How Banktrack Supports Communication

Banktrack’s real-time reporting features make it easier to communicate your financial status to stakeholders.

Whether you’re sharing updates with your team or negotiating with suppliers, having accurate and up-to-date financial information at your fingertips makes those conversations smoother and more productive.

8. Plan for Seasonality and Market Changes

Every business experiences ups and downs, whether due to seasonality or shifts in the market. The key is to plan for these fluctuations rather than being caught off guard.

Tips for Planning Ahead

- Forecast Cash Flow: Look at your historical data to predict when cash flow might dip. Plan for these times by saving more during your busy seasons. You can opt for a cash flow management solution if you want to automate this task.

- Diversify Your Revenue Streams: If possible, find ways to generate income during your slow periods. This might mean offering different products or services or targeting a new customer segment.

- Stay Agile: Be ready to adapt to market changes. The more flexible your business model, the better you’ll be able to handle unexpected shifts.

How Banktrack Helps with Planning

Banktrack’s customizable dashboards allow you to forecast future cash flow based on past trends.

By giving you a clear view of your financial patterns, it helps you anticipate slow periods and plan accordingly.

Plus, with its ability to sync with over 120 banks, you get a complete picture of your financial health, making it easier to make strategic decisions.

Take Control of Your Cash Flow with Banktrack

Cash flow problems don’t have to spell disaster. By taking proactive steps, you can keep your business on solid financial ground.

From creating detailed cash flow statements to cutting unnecessary costs and building a cash reserve, there are plenty of ways to improve your cash flow situation. And with tools like Banktrack in your corner, managing your finances becomes a whole lot easier.

Remember, cash flow is all about balance. By keeping a close eye on your income and expenses, planning for the future, and using the right tools, you can ensure that your business not only survives but thrives in 2024 and beyond!

Share this post

Related Posts

7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.Best 7 Cash Flow Management Tools in Finland for 2025

These are the best cash flow management tools in Finland: Banktrack Procountor Netvisor Visma eAccounting Fennoa Float QuickBooks Online In Finland’s competitive business environment, from Helsinki’sBest 6 Subscription Manager Apps for 2025

Tired of losing track of subscriptions? Check out the top subscription manager apps that make it easy to organize, monitor, and cancel services you no longer need.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed