Everything you need to know about the cash conversion cycle

- What is a Cash Conversion Cycle (CCC)

- What is the Cash Conversion Cycle?

- 3 Components of the Cash Conversion Cycle

- 1. Days Inventory Outstanding (DIO):

- 2. Days Sales Outstanding (DSO):

- 3. Days Payables Outstanding (DPO):

- Calculating the Cash Conversion Cycle

- Importance of the Cash Conversion Cycle

- How to Improve the Cash Conversion Cycle in 3 Steps

- 1. Optimizing Inventory Management:

- 2. Enhancing Receivables Collection:

- 3. Extending Payables Period:

- Advanced Analysis of Cash Conversion Cycle

- Seasonal Variations and Their Impact on CCC

- The Role of Technology in CCC Management

- Challenges in Managing the Cash Conversion Cycle

- Strategies for Different Industries

- Retail Industry

- Manufacturing Industry

- Service Industry

- Future Trends in CCC Management

- Conclusion

Ever wondered how quickly your business can turn investments into cash?

Think of it as a race where you want to turn inventory into sales and collect payments faster than ever.

The shorter the cycle, the better! Join us as we break down the CCC, uncover its best tips, and explore how you can turbocharge your business’s cash flow.

Buckle up, it’s time to get your finances in top gear!

What is a Cash Conversion Cycle (CCC)

An efficient cash flow management tool is vital for business success, and the cash conversion cycle (CCC) is a key metric in this process.

CCC measures the time it takes for a company to convert its investments in inventory into cash from sales. A shorter CCC indicates better operational efficiency and financial health.

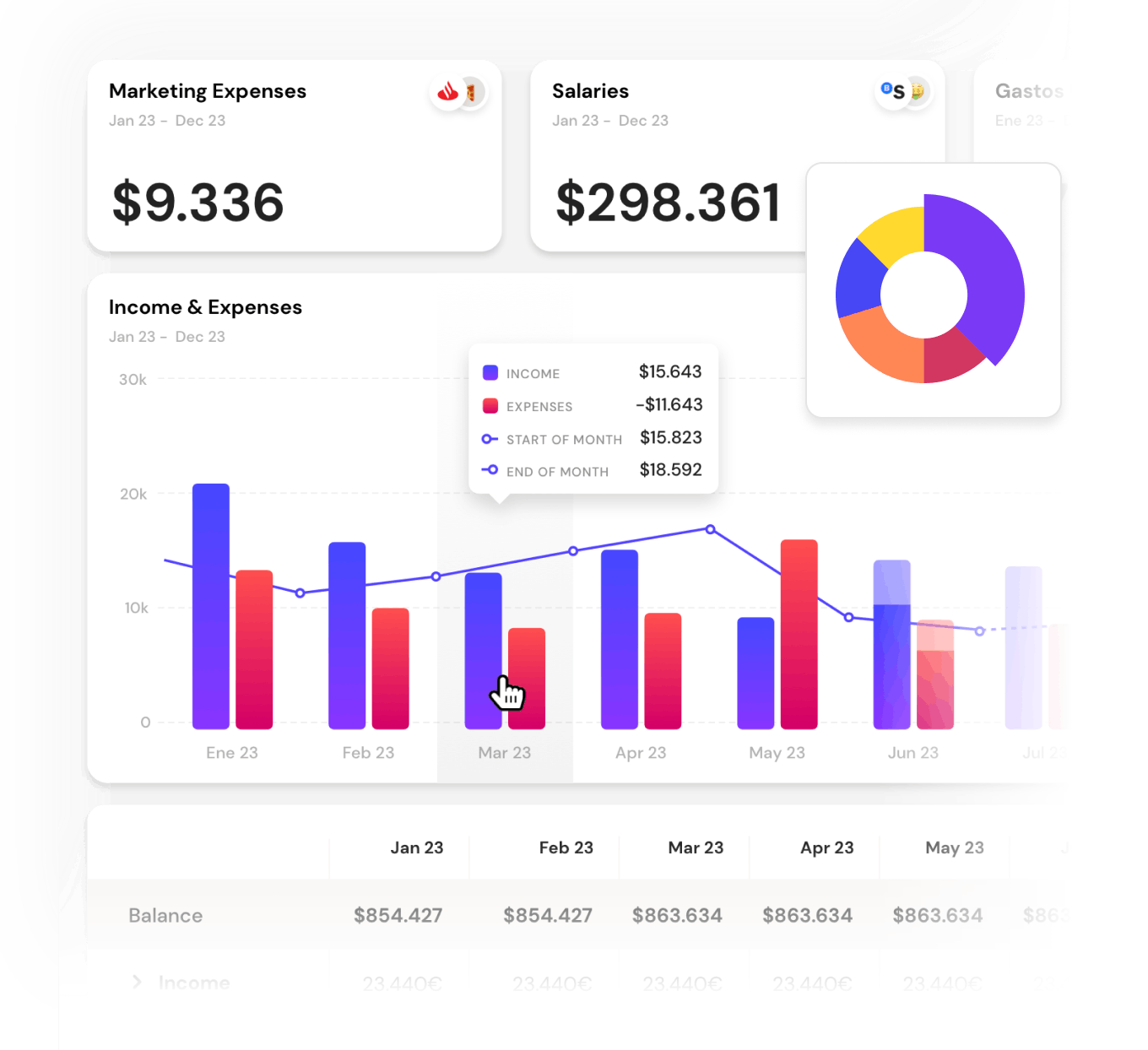

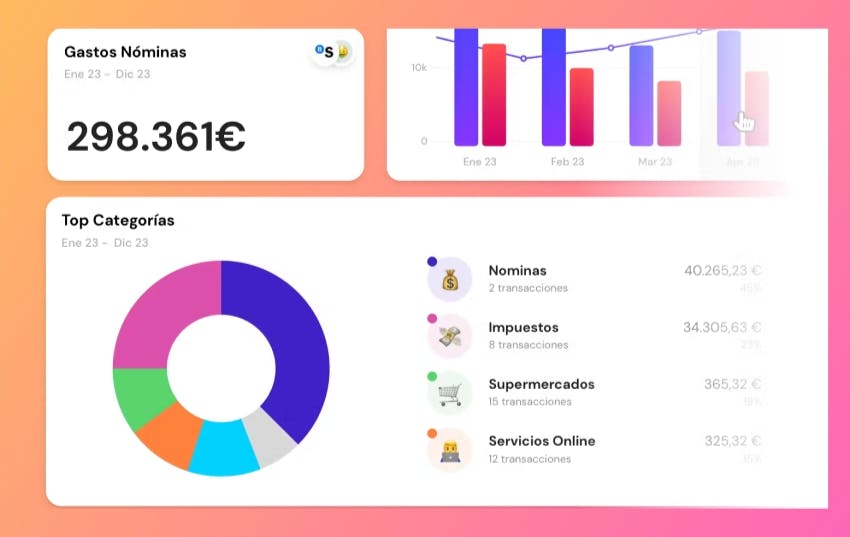

So, if you truly want to have the best control over your finances, we suggest you make use of a cash flow management software. This cash management tool can be your life savour as it allows you to categorize expenses, set spending limits, and generate customizable reports to gain insights into your spending patterns.

What is the Cash Conversion Cycle?

The CCC represents the duration, in days, that a company needs to turn its inventory investments into cash flows from sales.

The cycle starts when a company purchases inventory and ends when it collects payments from customers.

3 Components of the Cash Conversion Cycle

The CCC is comprised of three main components:

1. Days Inventory Outstanding (DIO):

The average number of days that inventory remains in stock before being sold.

DIO = (Average Inventory / Cost of Goods Sold) × 365

If a company’s average inventory is $4,000 and COGS is $100,000, DIO is: DIO = (4,000 / 100,000) × 365 = 14.6 days DIO

2. Days Sales Outstanding (DSO):

The average number of days it takes to collect payment after a sale.

DSO = (Average Accounts Receivable / Net Credit Sales) × 365

If average accounts receivable is $10,000 and net credit sales are $200,000, DSO is: DSO = (10,000 / 200,000) × 365 = 18.25 days

3. Days Payables Outstanding (DPO):

The average number of days a company takes to pay its suppliers.

DPO=(Average Accounts Payable / Cost of Goods) × 365

If average accounts payable is $3,000 and COGS is $100,000, DPO is: DPO= (3,000100,000)×365=10.95 days

Calculating the Cash Conversion Cycle

The formula for the CCC is: CCC = DIO + DSO − DPO

Using the previous examples: CCC = 14.6 + 18.25 − 10.95 = 21.9 days

This means it takes the company approximately 21.9 days to convert its inventory investment into cash.

Importance of the Cash Conversion Cycle

- Operational Efficiency: A shorter CCC indicates more efficient management of inventory, receivables, and payables.

- Liquidity Management: CCC helps in assessing the liquidity position of a company, ensuring it has enough cash to meet obligations.

- Benchmarking: Comparing CCC with industry peers helps in understanding relative performance and identifying areas for improvement.

How to Improve the Cash Conversion Cycle in 3 Steps

1. Optimizing Inventory Management:

Implement just-in-time (JIT) inventory systems to reduce holding periods.

Use demand forecasting to better align inventory levels with sales.

2. Enhancing Receivables Collection:

Implement invoice reconciliation and offer early payment discounts.

Use automated billing systems to streamline the collection process.

3. Extending Payables Period:

Negotiate better payment terms with suppliers.

Leverage strong supplier relationships to delay cash outflows without straining the relationship.

Advanced Analysis of Cash Conversion Cycle

Seasonal Variations and Their Impact on CCC

Many businesses experience seasonal variations that can significantly impact their CCC. For example, a retail company might have a longer CCC during off-peak seasons due to slower inventory turnover and extended receivables periods.

Conversely, during peak seasons, the CCC might shorten as inventory sells quickly and receivables are collected faster.

The Role of Technology in CCC Management

Technological advancements have revolutionized the way companies manage their CCC. Here are some ways technology can help:

- Inventory Management Systems: Advanced software can provide real-time tracking of inventory levels, predict demand, and optimize stock levels.

- Automated Invoicing and Payment Systems: These systems can speed up the invoicing process, reduce errors, and ensure timely payments from customers.

- Supplier Management Platforms: These platforms can help negotiate better terms with suppliers, track payment schedules, and optimize the payables process.

Challenges in Managing the Cash Conversion Cycle

Despite its importance, managing the CCC comes with several challenges:

- Market Fluctuations: Changes in market demand can lead to excess inventory or stockouts, affecting the CCC.

- Supplier Reliability: Delays from suppliers can disrupt production schedules and extend the CCC.

- Customer Payment Practices: Slow-paying customers can lengthen the DSO, increasing the CCC and straining cash flow.

Strategies for Different Industries

Retail Industry

In the retail industry, where inventory turnover is typically high, strategies to improve CCC include:

- Efficient Inventory Management: Implementing systems like JIT to minimize holding periods.

- Customer Incentives: Offering discounts for early payments to reduce DSO.

Manufacturing Industry

Manufacturing companies, often dealing with longer production cycles, can benefit from:

- Lean Manufacturing: Adopting lean principles to streamline production and reduce inventory holding periods.

- Supplier Negotiations: Working closely with suppliers to secure favorable payment terms, thus extending DPO.

Service Industry

For service-based businesses, where inventory management is less of a concern:

- Streamlined Billing: Using automated billing systems to ensure prompt invoicing and faster collection.

- Client Agreements: Structuring client agreements to include favorable payment terms and reduce DSO.

Future Trends in CCC Management

As businesses continue to evolve, several trends are likely to shape the future of CCC management:

- Artificial Intelligence: AI can predict demand more accurately, optimize inventory levels, and identify payment patterns, enhancing CCC management.

- Blockchain: Blockchain technology can provide transparent and secure transaction records, reducing disputes and speeding up payment processes.

- Sustainability: Companies are increasingly focusing on sustainable practices, which may influence inventory management and supplier relations, impacting the CCC.

Conclusion

The cash conversion cycle is a very important metric for evaluating a company’s efficiency in managing its working capital.

By understanding and optimizing the CCC, companies can improve their liquidity, enhance operational efficiency, and strengthen their overall financial health.

Implementing best practices in inventory, receivables, and payables management can significantly shorten the CCC, providing a competitive edge in the marketplace.

Share this post

Related Posts

Top 5 Xero alternatives in 2025

If Xero no longer meets your business needs, explore other accounting solutions that offer better features, pricing, and flexibility for your company.Top 7 best cash flow management software in 2025

Wondering what the best cash flow management software is? With a cash flow management software by your side, you gain the clarity needed to understand how money moves within your business.Everything About the Activity-Based-Budgeting Method

Budgeting can be tricky, but the right tools make it a breeze. Activity-Based Budgeting (ABB) is one such tool, helping you pinpoint costs and allocate resources smarter.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed