Top 10 Cash Flow Management Solutions for Corporates

- Top 10 Cash Flow Management Solutions for Corporates

- 1. Banktrack

- 2. Oracle Cash Management

- 3. Kyriba

- 4. Tipalti

- 5. Tesorio

- 6. Coupa

- 7. HighRadius

- 8. BlackLine

- 9. Cashforce

- 10. Anaplan

- Understanding Cash Flow Management

- What is a Cash Flow Management Solution

- Key Components of Cash Flow Management

- 3 Reasons for Corporates to Use Cash Flow Management Solutions

- 1. Enhanced Financial Visibility

- 2. Improved Decision Making

- 3. Increased Efficiency and Productivity

- How to Choose the Right Cash Flow Management Solution

- Assess Your Corporate Needs

- Evaluating Features and Benefits

- Considering Costs and ROI

- Common Mistakes to Avoid in Cash Flow Management

- Overlooking Small Expenses

- Ignoring Forecasting

- Failing to Monitor Cash Flow Regularly

- Conclusion

- Frequently Asked Questions - FAQs

- What is the most important aspect of cash flow management?

- How often should cash flow be monitored?

- Can small businesses benefit from corporate cash flow management solutions?

- What are the risks of not managing cash flow properly?

- How can cash flow management solutions be customized for different industries?

The best cash flow management solutions for corporates:

- Banktrack

- Oracle

- Kyriba

- Tipalti

- Tesoro

- Coupa

- HighRadius

- BlackLine

- Cashforce

- Anaplan

Poor cash flow management can lead to liquidity issues, stunted growth, and even bankruptcy.

But what about having great cash flow management?

Yes, this is possible.

This article delves into the various cash flow management solutions available for corporates, their benefits, and how to implement them for optimal financial performance so you don't have to ever worry about poor cash flow management.

Top 10 Cash Flow Management Solutions for Corporates

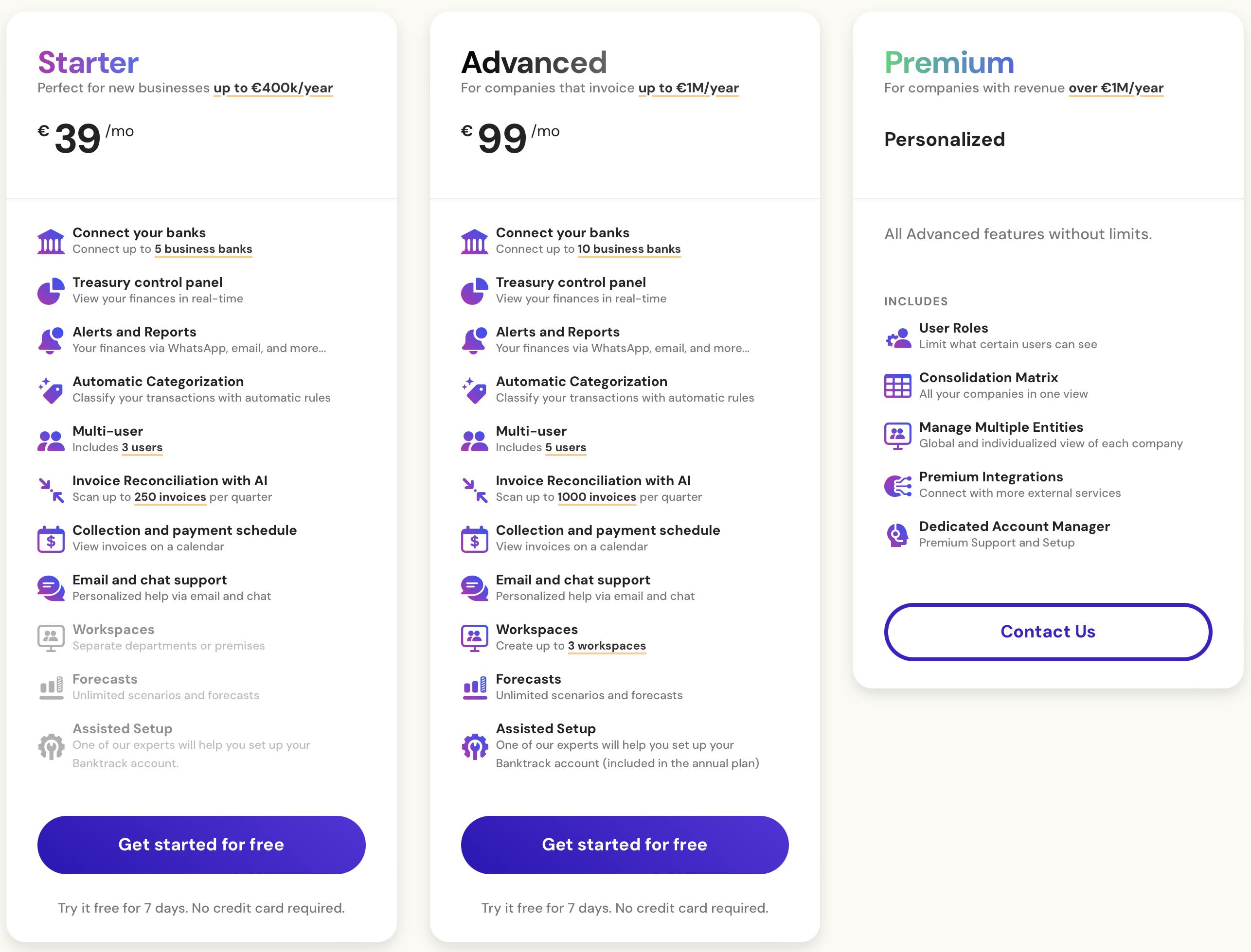

1. Banktrack

Banktrack is the best solution for corporations this 2024.

Let us walk you through the reasons:

- It gives consumers quick access to important financial data through configurable dashboards that combine views from various bank accounts, businesses, and financial products.

- By creating and customizing categories for revenues and expenses, users can track and understand their financial activities in great detail.

- The app also provides personalized reports and alerts, enabling users to stay informed about their expenses via various channels such as WhatsApp, SMS, email, Slack, or Telegram.

- In addition, Banktrack is the best app to link all bank accounts, because its bank aggregator allows users to sync with over 120 banks, offering both Open Banking (PSD2) and Direct Access connections for efficient and secure integration of financial data.

- Pricing: This app accommodates the needs and budgets of individuals, small businesses, and enterprises with a range of competitively priced plans.

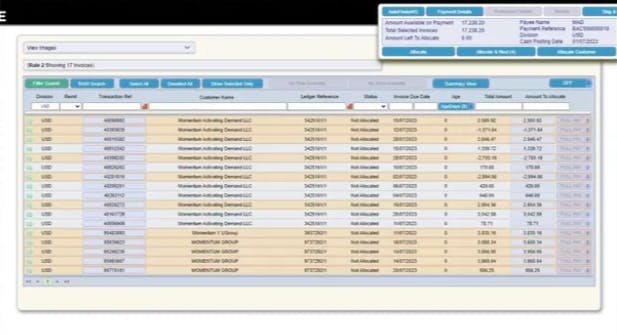

2. Oracle Cash Management

Oracle Cash Management is a management tool designed to help businesses efficiently manage their cash flow.

It offers extensive reporting capabilities, providing detailed insights into cash positions, transactions, and variances.

Oracle's solution includes automated reconciliation processes. What does this mean?

That it streamlines the matching of bank statements with internal records. This reduces the time and effort required for manual reconciliation and minimizes errors.

The platform's forecasting tools enable companies to anticipate cash needs and make decisions about investments and financing.

Lastly, integration with Oracle's broader suite of financial applications ensures seamless data flow and consistency across financial operations.

3. Kyriba

Kyriba specializes in cloud-based treasury and cash management solutions that focus on enhancing visibility, forecasting, and risk management.

The platform provides real-time data on cash positions, liquidity, and financial risk, enabling companies to make informed decisions quickly.

Kyriba's advanced forecasting tools use historical data and predictive analytics to project future cash flows accurately.

The solution also includes capabilities for managing foreign exchange risk, ensuring that businesses are protected against currency fluctuations.

Integration with various ERP systems allows for smooth data exchange and comprehensive financial oversight.

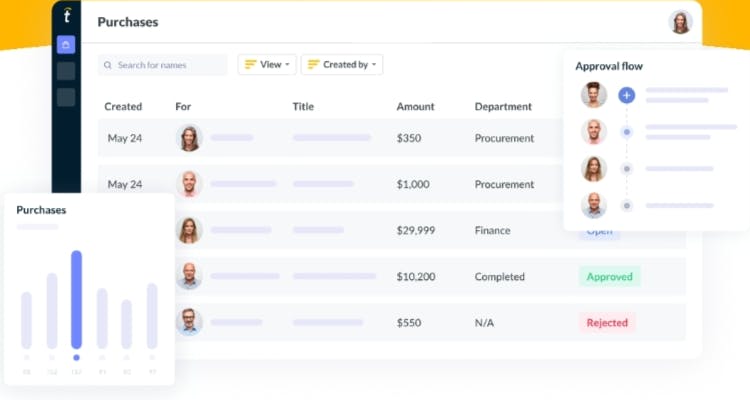

4. Tipalti

Tipalti is an end-to-end accounts payable automation solution that streamlines the entire payment process.

From invoice management to payments, Tipalti automates repetitive tasks, reducing manual errors and increasing efficiency.

The platform supports multiple payment methods and currencies, making it ideal for businesses with global operations.

Tipalti's real-time reporting and analytics provide insights into payment status, cash outflows, and supplier performance.

By automating compliance with tax and regulatory requirements, it helps companies avoid costly penalties and maintain good standing with authorities.

The solution's integration capabilities ensure that data flows seamlessly between the software and any existing financial systems.

5. Tesorio

Tesorio offers an AI-driven cash flow management platform that emphasizes predictive analytics and real-time data.

The solution helps corporations optimize their financial operations by providing accurate forecasts of cash flows and working capital needs.

The platform integrates with ERP and accounting systems, enabling data exchange and ensuring that financial information is always up-to-date.

The AI algorithms analyze historical data and current trends to identify patterns and predict future cash flows. This allows businesses to make good decisions about managing liquidity and mitigating financial risks.

The platform also offers tools for automating collections, enhancing cash conversion cycles, and improving overall cash management efficiency.

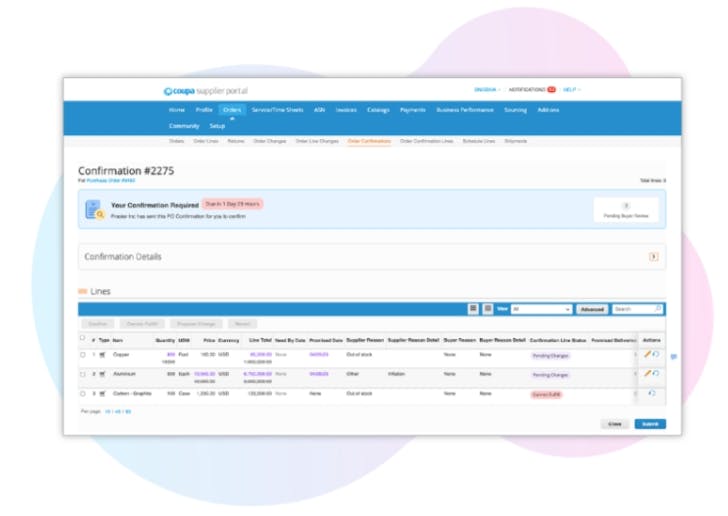

6. Coupa

Coupa's cash flow management solution integrates spend management and treasury functions into a single platform.

This provides businesses with complete visibility and control over their cash. Coupa's real-time analytics and forecasting tools enable companies to track cash inflows and outflows accurately, identify trends, and predict future cash needs.

The platform's spend management capabilities help businesses control expenses, optimize procurement processes, and ensure that cash is used efficiently.

Coupa's integration with various financial systems ensures consistent data across the organization, enhancing financial decision-making and strategic planning.

Not sure if this software would be a great fit for you? Check out Coupa’s best alternatives.

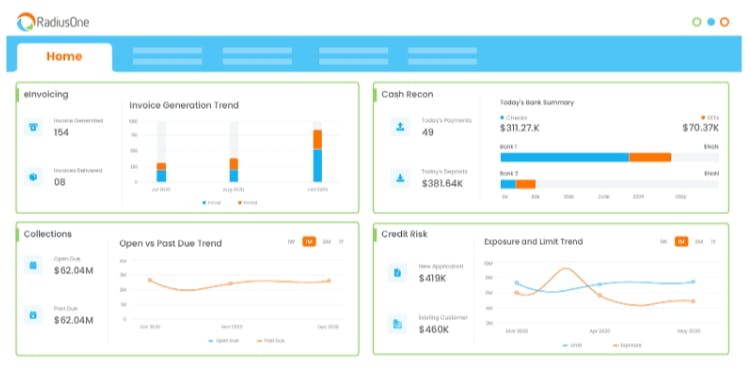

7. HighRadius

HighRadius provides a suite of AI-powered solutions for receivables and treasury management.

The platform helps companies optimize their cash conversion cycle by automating credit and collections processes, improving cash flow predictability, and reducing days sales outstanding (DSO).

HighRadius' AI algorithms analyze customer payment behaviors and provide insights that help businesses make informed credit decisions.

The treasury management tools offer real-time visibility into cash positions and liquidity, enabling better cash forecasting and risk management.

Integration with ERP systems ensures seamless data flow and accurate financial reporting, enhancing overall financial operations.

8. BlackLine

BlackLine's platform focuses on financial close management, providing tools to automate and streamline the reconciliation process.

This solution improves the accuracy and efficiency of financial operations by reducing manual effort and minimizing errors.

BlackLine's real-time reconciliation capabilities ensure that all transactions are accounted for promptly, improving the reliability of financial data.

The platform's reporting and analytics tools provide insights into cash positions, variances, and reconciliation status, enabling better decision-making.

Integration with various financial systems also allows for consistent data flow and comprehensive financial oversight.

9. Cashforce

Cashforce offers a powerful analytics platform designed to improve cash forecasting and working capital management.

The solution integrates with ERP systems, providing real-time visibility into cash positions and financial data.

Cashforce's advanced analytics tools analyze historical data and current trends to generate accurate cash flow forecasts.

The platform also offers scenario planning capabilities, allowing businesses to model different financial situations and assess their impact on cash flow.

What does this mean?

It enables proactive management of liquidity and working capital, helping companies maintain financial stability and make much more informed strategic decisions!

10. Anaplan

Anaplan provides cloud-based planning solutions that include cash flow management, enabling businesses to model and forecast cash flows accurately.

The platform's powerful modeling capabilities allow companies to create detailed cash flow plans based on various scenarios and assumptions.

Anaplan's real-time analytics provide insights into cash positions, variances, and future cash needs, helping businesses make informed decisions.

Another great capability is its integration with other financial systems, which ensures consistent data flow and accurate financial reporting.

Corporations especially like this solution because its collaborative features enable cross-functional teams to work together on financial planning, enhancing overall financial strategy and execution.

Understanding Cash Flow Management

What is a Cash Flow Management Solution

Cash flow management involves tracking, analyzing, and optimizing the net amount of cash receipts minus cash expenses.

It has a very important role because it ensures that a company has enough cash to meet its obligations, invest in growth opportunities, and navigate any potential financial crisis.

Key Components of Cash Flow Management

Now that we have a general understanding of what these solutions are and why they are so important for corporations. Let’s understand how these function by breaking their functions up.

- Cash Inflows: This is the money businesses receive from sales, investments, and financing. Basically everything that comes in the business.

- Cash Outflows: The money spent on operations, salaries, investments, and debt repayments. Everything that the company has an obligation to pay, money flowing out of the business.

- Net Cash Flow: And finally, this is the difference between inflows and outflows, indicating liquidity.

Liquidity refers to the ability of a company to quickly and easily convert its assets into cash without significantly affecting its value. High liquidity means that a company can meet its short-term obligations and cover unexpected expenses efficiently.

It is crucial for maintaining smooth operations and financial stability.

3 Reasons for Corporates to Use Cash Flow Management Solutions

1. Enhanced Financial Visibility

These solutions provide a clear picture of your cash position, aiding in better decision-making.

By being able to picture the company’s current position, businesses can make long-term strategic shifts and drive more growth.

They basically have a magic ball to predict the future! Well…almost.

2. Improved Decision Making

With accurate data and predictive analytics, managers can make informed decisions that drive growth and efficiency.

And who doesn’t want to make more informed decisions, right?

3. Increased Efficiency and Productivity

Automating repetitive tasks frees up a lot of time for strategic activities or planning, enhancing overall productivity and long-term success.

How to Choose the Right Cash Flow Management Solution

Assess Your Corporate Needs

First of all, you need to know what your needs are.

Identify your specific requirements, such as real-time monitoring, forecasting, or integration capabilities.

And only then will you be able to know which option suits you best.

Evaluating Features and Benefits

Compare the features and benefits of various solutions to find the best fit for your business.

Don't stick with the first option you come across with.

Considering Costs and ROI

Analyze the costs involved and the potential return on investment to ensure the solution is financially viable.

Common Mistakes to Avoid in Cash Flow Management

We all make mistakes. And having a cash flow management solution will not make you immune to them. But it will definitely make your life easier if you know how to spot them.

So let’s point them out.

Overlooking Small Expenses

The typical mistake. Small expenses can add up over time and impact cash flow. As little as they are, they do make a difference long-term.

We would recommend you regularly review and manage these costs to make sure they are really necessary for the business to continue thriving.

Ignoring Forecasting

Failing to forecast can lead to unexpected cash shortfalls. This can be very detrimental for your company if it caughts you off guard.

Use forecasting tools, which you will easily find in any good cash flow management solution to anticipate future cash needs.

Failing to Monitor Cash Flow Regularly

As we mentioned earlier, regular monitoring helps in early detection of issues and allows for timely interventions.

This will help you avoid many undesirable situations.

Conclusion

Effective cash flow management is essential for the financial health of any corporation.

By making use of advanced cash flow management solutions, businesses can enhance visibility, improve decision-making, and increase efficiency.

Whether you're dealing with small expenses or large-scale investments, these tools can provide the insights and automation needed to maintain a healthy cash flow.

Frequently Asked Questions - FAQs

What is the most important aspect of cash flow management?

The most important aspect is maintaining a positive cash flow, ensuring that inflows consistently exceed outflows to support ongoing operations and growth.

How often should cash flow be monitored?

Cash flow should be monitored regularly, ideally on a daily or weekly basis, to quickly identify and address any potential issues.

Can small businesses benefit from corporate cash flow management solutions?

Yes, small businesses can benefit significantly from these solutions, as they offer automation, accuracy, and insights that can help in managing finances more effectively.

What are the risks of not managing cash flow properly?

Poor cash flow management can lead to liquidity issues, increased debt, missed growth opportunities, and in severe cases, bankruptcy.

How can cash flow management solutions be customized for different industries?

These solutions often offer customizable features that can be tailored to specific industry needs, such as unique reporting requirements, integration capabilities, and compliance standards.

Share this post

Related Posts

How to track your business cash flow: complete guide

Failing to track cash flow properly can lead to serious financial issues. In this article, we provide efficient solutions to manage and optimize it effectively.Advanced cash flow forecasting: techniques and tools

Master advanced cash flow forecasting with top techniques and tools like treasury software, AI analytics, BI platforms, and ERP systems to streamline financial planning and decision-making.How to keep track of business expenses in 2024

Effectively track business expenses in 2024 to maximize tax deductions and keep your finances organized.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed