How to track your business cash flow: complete guide

- What is cash flow in a company?

- Why is cash flow important in a company?

- 4 ways to track cash flow

- Excel

- Specialized treasury software

- How to track cash flow with Banktrack

- Tips for tracking cash flow

- Frequently asked questions for tracking the company's cash flow correctly

- 1. How can I improve the accuracy of my cash flow forecast?

- 2. Why is it important to control cash flow?

- 3. How can I know if I have enough cash to cover my expenses?

- 4. What should I do if I have a negative cash flow?

- 5. How do I separate cash flow for different areas or departments of the company?

Cash flow is the lifeblood of any business, but many companies struggle to monitor and manage it effectively.

Without a clear understanding of where the money is coming from and where it is going, businesses risk facing liquidity issues, missing opportunities, and even experiencing financial instability.

In this article, we will share the most efficient ways to track cash flow.

Whether you run a startup or a large company, implementing these strategies will help you maintain stability, plan for growth, and make informed financial decisions.

What is cash flow in a company?

Cash flow in a company refers to the movement of money in and out of the business over a specific period. It reflects the company’s liquidity and its ability to meet financial obligations, pay suppliers, employees, and cover operating expenses.

There are three main types of cash flow:

- Operating cash flow: money generated from the company’s core business activities, such as sales of products or services.

- Investing cash flow: cash movements related to the purchase or sale of assets, investments, and equipment.

- Financing cash flow: inflows and outflows of money related to loans, stock issuance, or dividend payments.

A positive cash flow means the company generates more money than it spends, indicating financial stability.

On the other hand, a negative cash flow can signal financial problems if it persists over time.

Why is cash flow important in a company?

Cash flow is essential for maintaining financial stability and ensuring smooth operations. Effective cash flow management enables businesses to:

- Cover daily expenses: ensuring there is enough money to pay for rent, salaries, utilities, and other operating costs.

- Avoid liquidity issues: preventing cash shortages that could lead to financial difficulties or even bankruptcy.

- Support growth and investment: a healthy cash flow enables companies to invest in new opportunities, expand operations, and improve products or services.

- Manage debt effectively: helping businesses pay off loans, interest, and other financial obligations on time.

- Make informed decisions: providing a clear picture of the company’s financial health, allowing better planning and strategy development.

Without proper cash flow management, even profitable businesses can struggle to sustain operations and grow successfully.

4 ways to track cash flow

Excel

- Custom templates: you can create a custom spreadsheet to record income and expenses and track cash flow in detail. Excel allows you to use formulas, charts, and pivot tables to facilitate analysis and visualization.

- Automatic formulas: use functions like SUM, SUBTRACT, and cash flow forecasts based on historical data to automate calculations and get a clear picture of your cash.

- Graphical visualization: with line or bar charts, you can easily identify cash flow fluctuations over a specific period.

Specialized treasury software

The use of specialized treasury software facilitates cash flow control by enabling efficient management of bank accounts, real-time monitoring of inflows and outflows, and optimization of payments and collections.

Additionally, these systems allow integration with banking platforms, providing up-to-date data and improving the accuracy of treasury forecasts.

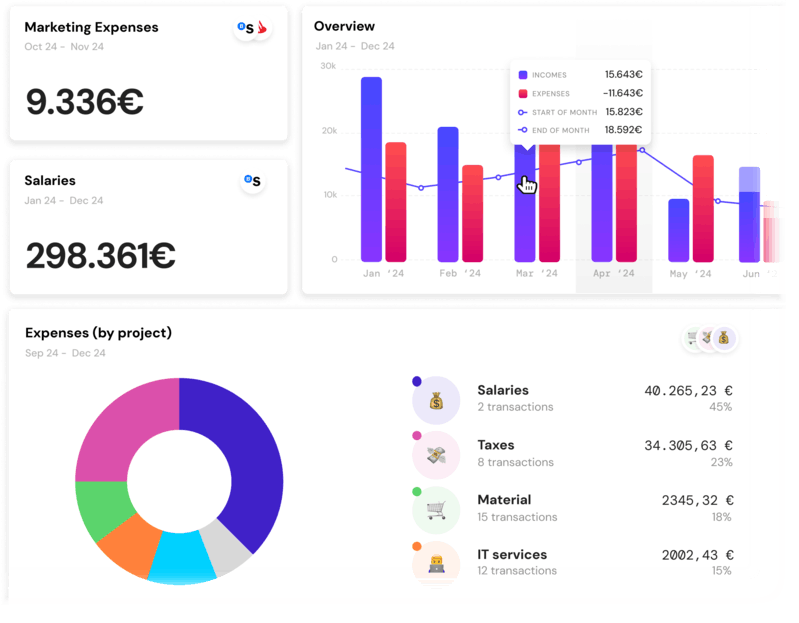

One example is Banktrack, a treasury tool that facilitates liquidity and cash flow management, allowing businesses to accurately track transactions and make more precise financial predictions through integration with banking systems.

ERP (Enterprise Resource Planning) platforms

- SAP: SAP is a comprehensive ERP solution that includes modules for cash flow management, accounts receivable, accounts payable, and other financial aspects. It offers detailed reports and tools to forecast cash flow and optimize liquidity.

- Microsoft Dynamics 365: with Dynamics 365, businesses can manage cash flow centrally and track financial transactions accurately. The platform provides complete visibility of cash inflows and outflows.

- Oracle ERP: oracle offers advanced ERP solutions for treasury and cash flow management. It facilitates financial planning and provides detailed reports on the company’s financial situation.

Other financial management platforms

- QuickBooks: QuickBooks is a popular accounting tool that allows you to track cash flow, generate financial reports, and manage accounts receivable and payable. It is ideal for small and medium-sized businesses.

- Xero: Xero is a cloud-based platform that helps businesses track cash flow in real time, manage invoices and payments, and generate detailed financial reports.

- Zoho Books: Zoho Books helps manage cash flow, track income and expenses, and generate financial reports. It integrates with bank accounts to automate cash flow processes.

How to track cash flow with Banktrack

Banktrack is a treasury management software that allows businesses to efficiently track and manage cash flow. Here’s how you can use BankTrack to monitor your cash flow:

- Set up bank accounts:

First, integrate your bank accounts with Banktrack to ensure the software can automatically pull in real-time data for all transactions.

This allows you to track cash inflows and outflows across multiple accounts.

- Track cash flow in real-time:

BankTrack allows businesses to monitor their cash position in real-time, providing an up-to-date view of available cash, balances, and any transactions made.

This feature helps avoid liquidity issues by ensuring you know exactly how much cash is on hand at any given time.

- Manage payments and receivables:

Use Banktrack to track incoming payments and receivables. You can monitor the timing of cash inflows, set payment reminders, and ensure customers’ payments are processed efficiently.

Likewise, you can manage accounts payable, tracking when payments are due and helping to ensure timely payment to suppliers.

- Generate cash flow reports:

Banktrack enables you to generate detailed cash flow reports.

These reports provide insights into your cash inflows and outflows, which are essential for understanding your liquidity position and making strategic financial decisions.

You can view historical trends to identify patterns, helping with forecasting and future cash flow predictions.

- Create cash flow forecasts:

Banktrack offers forecasting tools that allow you to project your future cash flow based on historical data and upcoming transactions.

This can help you anticipate potential cash shortages or surpluses, allowing you to plan accordingly.

- Liquidity management:

The software helps you optimize liquidity by providing a detailed view of available funds and future cash needs.

By monitoring cash reserves and upcoming liabilities, you can make informed decisions about financing, investments, or necessary cost-cutting measures.

- Integrate with other financial systems:

Banktrack can integrate with other accounting or ERP systems, allowing seamless data transfer and creating a unified platform for managing cash flow, financial planning, and reporting.

- Monitor multiple currencies (if applicable):

If your business operates in multiple countries or currencies, Banktrack can manage and track cash flow across different currencies, helping you account for fluctuations and manage foreign exchange risks.

Tips for tracking cash flow

Here are some tips for separating cash flow in a corporate setting:

- Create separate cash flow reports for different divisions or departments:

If your company operates across different departments or business units, create separate cash flow reports for each.

This helps to track the financial health of each unit individually and identify any specific issues.

- Use segmented accounting codes:

Use different accounting codes for each business unit, division, or project.

This will allow you to categorize expenses and income more clearly, making it easier to track cash flow in each area.

- Establish Clear Corporate and Operational Cash Flow Categories:

Separate your corporate cash flow (such as funds from investors or financing activities) from operational cash flow (income from daily business activities).

This distinction helps you understand the sources of cash flow and how each part of the business is performing.

- Track cash flow for capital expenditures (CapEx) and operating expenses (OpEx):

Separate cash flow related to capital expenditures (such as purchasing long-term assets) from cash flow tied to operating expenses (such as payroll, rent, and utilities).

This allows better planning for reinvestment or scaling.

- Implement cost centers or profit centers:

Establish cost centers or profit centers for different areas of the business.

This will allow you to isolate and track the cash inflows and outflows for each part of your organization, such as specific products, services, or geographical regions.

- Use dedicated bank accounts:

Open separate bank accounts for different operational areas or projects, if possible.

This will help ensure that funds for specific business functions are kept distinct, making it easier to track cash flow for each area of your corporate operations.

- Use cash flow forecasting for different business units:

Implement cash flow forecasting for each division or department separately.

This gives you better visibility into how each unit is projected to perform financially, helping you allocate resources more effectively.

- Monitor accounts receivable and payable for each division:

Track the receivables and payables for each unit separately.

This helps to manage cash flow more efficiently by identifying outstanding invoices or overdue payments that may be impacting each unit’s liquidity.

- Implement internal transfers and allocations:

For corporations with multiple departments or divisions, set up internal transfers and allocate cash flow accordingly.

Ensure that internal cash movements are tracked so that each department or unit receives its fair share of available cash when needed.

- Use treasury management systems (TMS) for centralized oversight:

Use a centralized treasury management system (TMS) to oversee and manage cash flow across the entire organization.

This allows for a high-level view while ensuring that individual departments and business units have the data they need for local decision-making.

- Establish clear policies for cash flow allocation:

Implement clear internal policies for how cash should be allocated across various business units and projects.

This ensures that the cash flow remains consistent and aligned with corporate goals and prevents departments from unintentionally affecting the corporate cash pool.

- Separate Business and Investment Activities:

Keep cash flow from core business operations separate from cash flow generated by investments or financial activities.

This will help clarify how much of your cash flow is directly tied to your business operations versus returns from investments or financial maneuvers.

Frequently asked questions for tracking the company's cash flow correctly

1. How can I improve the accuracy of my cash flow forecast?

To improve accuracy, you should rely on historical data, consider your business's seasonality, and regularly update your forecasts as circumstances change.

It's also helpful to include a margin of error for unforeseen events.

2. Why is it important to control cash flow?

Cash flow is crucial to ensure that a business can cover its operational expenses, pay its employees and suppliers, and maintain financial stability.

Without proper control, liquidity issues can arise, affecting operations.

3. How can I know if I have enough cash to cover my expenses?

You can create a cash flow forecast, projecting the cash inflows and outflows over a period.

This will help you determine if you have enough liquidity to cover upcoming payments.

4. What should I do if I have a negative cash flow?

If cash flow is negative, you should review your expenses, look for cost-cutting opportunities, and explore ways to increase revenue, such as speeding up customer payments or renegotiating terms with suppliers.

You may also need to seek short-term financing.

5. How do I separate cash flow for different areas or departments of the company?

You can create separate cash flow reports for each area or department and use specific accounting codes for each one.

This allows you to track the financial performance of each business unit independently.

Share this post

Related Posts

How to keep track of business expenses in 2024

Effectively track business expenses in 2024 to maximize tax deductions and keep your finances organized.How to do a cash flow projection in 9 steps

Cash flow projection is an indispensable financial practice for businesses of all sizes. It helps predict future cash inflows and outflows, providing valuable insights for making informed financial decisions.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed