A guide to cash flow monitoring

- What is Cash Flow Monitoring?

- Why is Cash Flow Monitoring Important?

- 1. Ensures Financial Stability

- 2. Supports Business Growth

- 3. Avoids Overdrafts and Debt

- 4. Helps in Tax Compliance

- 3 Types of Cash Flow

- 1. Operating Cash Flow

- 2. Investing Cash Flow

- 3. Financing Cash Flow

- 4 Key Components of a Cash Flow Statement

- 1. Beginning Cash Balance

- 2. Cash Inflows

- 3. Cash Outflows

- 4. Ending Cash Balance

- How to Monitor Cash Flow Effectively

- Create a Realistic Budget

- Track Transactions Daily

- Perform Cash Flow Forecasting

- Compare Actual vs. Projected Cash Flow

- Maintain a Cash Reserve

- Leverage Technology

- 4 Common Challenges in Cash Flow Management

- 1. Late Payments

- 2. Overestimated Revenue

- 3. Uncontrolled Spending

- 4. Seasonal Fluctuations

- A Tool for Cash Flow Monitoring

- Real-Time Financial Insights

- Seamless Bank Account Integration

- Customizable Spending Metrics

- Automated Alerts and Reports

- Affordable Pricing

- Best Practices for Maintaining Positive Cash Flow

- Invoice Promptly

- Negotiate Payment Terms

- Reduce Overheads

- Diversify Revenue Streams

- Monitor Key Metrics

- Plan for Growth

This is a guide to cash flow management.

Cash flow monitoring is the backbone of financial management for businesses, entrepreneurs, and individuals.

Proper cash flow management ensures that you maintain a healthy balance between incoming and outgoing funds, enabling you to meet short-term obligations, invest in growth opportunities, and avoid financial pitfalls.

In this comprehensive guide, we’ll explore everything you need to know about cash flow monitoring, from its importance to actionable strategies for maintaining a stable cash flow.

What is Cash Flow Monitoring?

Cash flow monitoring involves tracking the movement of money into and out of a business or personal account.

It helps you understand your financial position, ensuring that you have enough liquidity to cover expenses while planning for future growth.

Cash flow is broadly categorized into two streams:

- Inflows: Money coming in from sales, investments, loans, or other income sources.

- Outflows: Money going out to cover operational expenses, debt repayments, salaries, and other costs.

Effective cash flow monitoring requires regularly reviewing financial transactions, forecasting future cash needs, and addressing any discrepancies before they escalate into bigger problems.

Why is Cash Flow Monitoring Important?

1. Ensures Financial Stability

Without proper cash flow management, even profitable businesses can face liquidity crises.

Monitoring cash flow ensures that your organization remains solvent and prepared for unforeseen expenses.

2. Supports Business Growth

By understanding cash flow patterns, you can make informed decisions about investing in new opportunities, hiring staff, or expanding operations without overextending financially.

3. Avoids Overdrafts and Debt

Regular monitoring prevents over-reliance on credit or loans, reducing the risk of overdraft fees and high-interest debt.

4. Helps in Tax Compliance

Accurate cash flow records simplify tax filing and ensure that you set aside enough funds for tax obligations.

3 Types of Cash Flow

Understanding the different types of cash flow is essential for effective monitoring. These include:

1. Operating Cash Flow

This is the cash generated from a company’s core business activities, such as selling goods or providing services.

It excludes cash flows from investments and financing activities.

2. Investing Cash Flow

Investing cash flow refers to cash spent on or generated from investments, such as purchasing equipment, real estate, or securities.

3. Financing Cash Flow

Financing cash flow tracks the inflow and outflow of funds related to debt, equity, and dividends. Examples include loan repayments or issuing shares.

4 Key Components of a Cash Flow Statement

A cash flow statement offers a detailed breakdown of how money flows through an organization over a specific period. Let’s examine its main components:

1. Beginning Cash Balance

The beginning cash balance is the amount of cash available at the start of a reporting period. This figure acts as a baseline for understanding cash movements.

A healthy beginning balance ensures the ability to meet immediate financial obligations while providing a foundation for planning future activities.

2. Cash Inflows

Cash inflows are the total funds entering a business or account during the period. These include revenue from product or service sales, loan proceeds, grants, or other income sources.

Monitoring inflows allows businesses to identify which activities generate the most revenue and assess the timing of cash receipts to avoid liquidity gaps.

3. Cash Outflows

Cash outflows represent all the payments and expenses incurred over the reporting period.

This includes costs such as rent, payroll, utilities, loan repayments, and inventory purchases.

Analyzing outflows helps pinpoint areas for cost reduction and ensures spending aligns with the organization's goals.

4. Ending Cash Balance

The ending cash balance reflects the remaining cash at the close of the reporting period after accounting for all inflows and outflows.

This figure serves as a snapshot of financial liquidity. A positive ending balance is essential for meeting future expenses, while a declining balance signals the need for corrective action.

By analyzing these components regularly, businesses can identify patterns, optimize cash use, and make strategic decisions to enhance financial stability.

How to Monitor Cash Flow Effectively

Effective cash flow monitoring requires discipline, technology, and strategic planning. Follow these steps to stay on top of your finances:

Create a Realistic Budget

A well-crafted budget serves as the roadmap for your financial activities. Use historical data to estimate expected cash inflows and outflows, accounting for recurring expenses and potential revenue fluctuations.

Regularly update your budget to reflect changing circumstances, such as new business opportunities or unexpected expenses.

Track Transactions Daily

Recording daily transactions ensures a clear picture of your financial activity. Use accounting software or spreadsheets to automate this process and categorize expenses and income.

Daily tracking not only helps you avoid errors but also ensures that you’re always aware of your cash position.

Perform Cash Flow Forecasting

Cash flow forecasting involves predicting future cash movements based on historical data and anticipated changes. This process helps you plan for seasonal variations, large expenditures, or revenue fluctuations.

Accurate forecasting enables proactive decision-making and reduces the risk of cash shortages. You can make use of a treasury cash flow forecasting software to help you with this task.

Compare Actual vs. Projected Cash Flow

Regularly comparing your actual cash flow to your forecasts helps you identify discrepancies and refine your forecasting methods.

Analyzing variances can reveal unexpected expenses or delays in revenue collection, allowing you to address issues promptly.

Maintain a Cash Reserve

A cash reserve acts as a financial safety net. Setting aside a portion of your profits ensures you’re prepared for unexpected expenses or periods of reduced revenue.

Aim to build a reserve that covers at least three to six months of operating expenses.

Leverage Technology

Modern cash flow management tools simplify tracking and analysis. Platforms like Banktrack provide real-time insights, automate reporting, and help you identify trends.

Using technology reduces manual errors and saves time, enabling you to focus on strategic planning.

4 Common Challenges in Cash Flow Management

Even with careful monitoring, businesses often encounter cash flow challenges. Here’s how to address some of the most common issues:

1. Late Payments

Delayed payments from clients can disrupt your cash flow. Combat this by implementing clear payment terms, issuing invoices promptly, and following up with reminders.

Offering incentives such as early payment discounts can also encourage faster payments.

2. Overestimated Revenue

Overestimating revenue leads to overspending and financial strain.

Use conservative estimates when forecasting income, and base your spending decisions on actual cash inflows rather than optimistic projections.

3. Uncontrolled Spending

Unplanned or excessive spending can drain cash reserves. Regularly review your expenses and categorize them to identify areas where costs can be reduced.

For instance, renegotiating supplier contracts or streamlining operations can help lower overheads.

4. Seasonal Fluctuations

Seasonal businesses often experience uneven cash flow. To navigate this, build up a cash reserve during peak periods to sustain operations during slower months.

Additionally, consider diversifying your offerings to reduce reliance on seasonal income.

A Tool for Cash Flow Monitoring

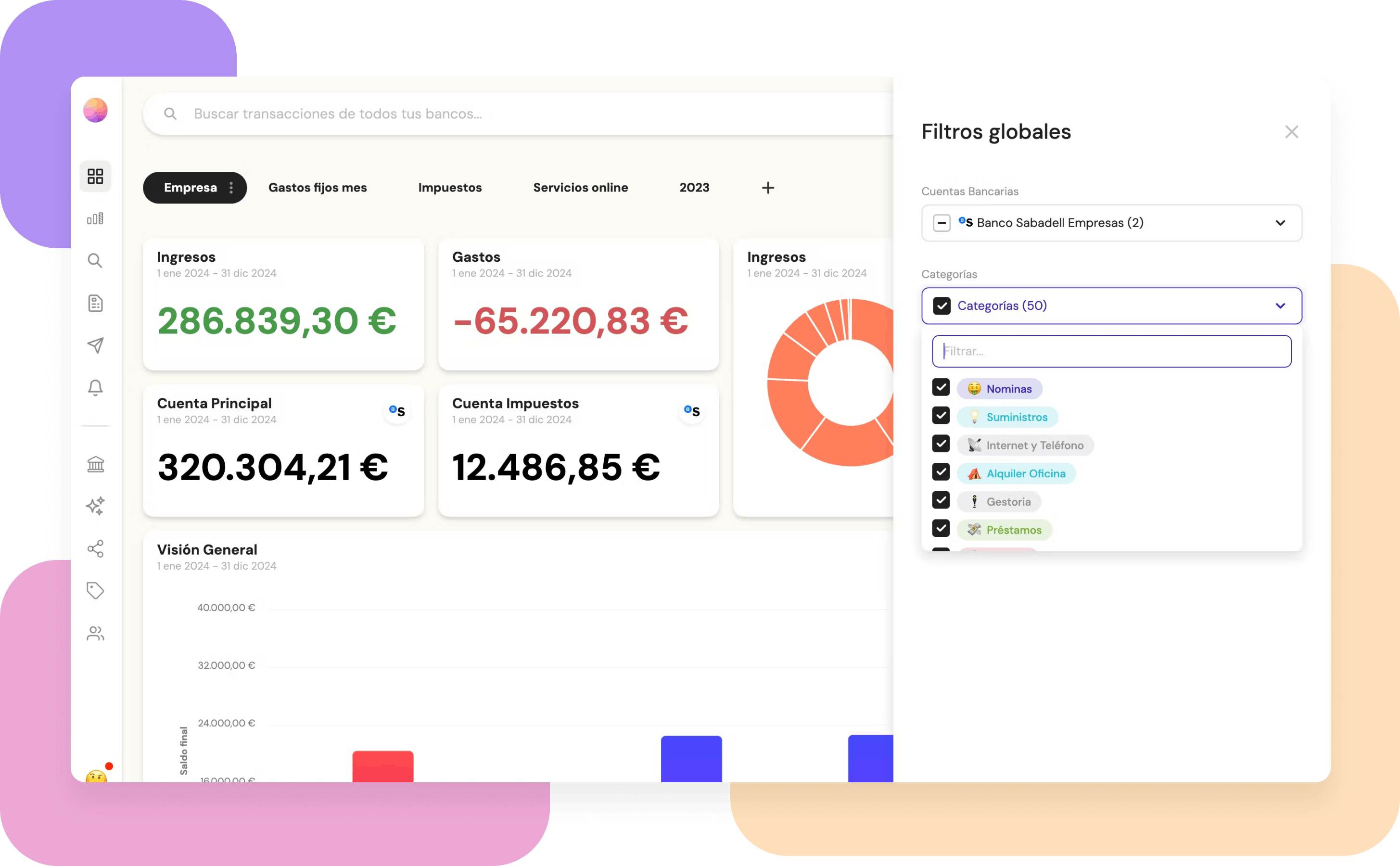

Modern cash flow management relies heavily on technology, and Banktrack stands out as one of the most efficient tools for businesses of all sizes.

This cash flow management software simplifies the process of monitoring, analyzing, and optimizing cash flow, empowering enterprises to stay in control of their finances in real time.

With Banktrack, businesses can move beyond manual tracking methods like spreadsheets and take advantage of robust, user-friendly features that streamline cash management.

The tool’s ability to provide personalized insights and real-time financial data makes it an invaluable resource for staying on top of cash flow trends.

Real-Time Financial Insights

The software’s customizable dashboards provide instant access to financial data. This feature ensures that users can track income, expenses, and account balances as they occur, helping them make timely, data-driven decisions.

Real-time insights reduce the risk of cash shortages and allow for immediate adjustments when financial discrepancies arise.

Seamless Bank Account Integration

One of the best things of Banktrack is that it is the best app to link all bank accounts. This eliminates the hassle of juggling accounts or manually consolidating data.

By syncing all financial activity in one place, businesses gain a holistic view of their cash flow without the need for additional tools or manual input.

Customizable Spending Metrics

Banktrack allows users to create and track specific spending categories that align with their business needs. This helps identify areas where expenses can be reduced or optimized.

Whether it’s tracking payroll, inventory costs, or marketing spend, the software’s flexible categorization options give businesses the clarity they need to refine their budgets and improve profitability.

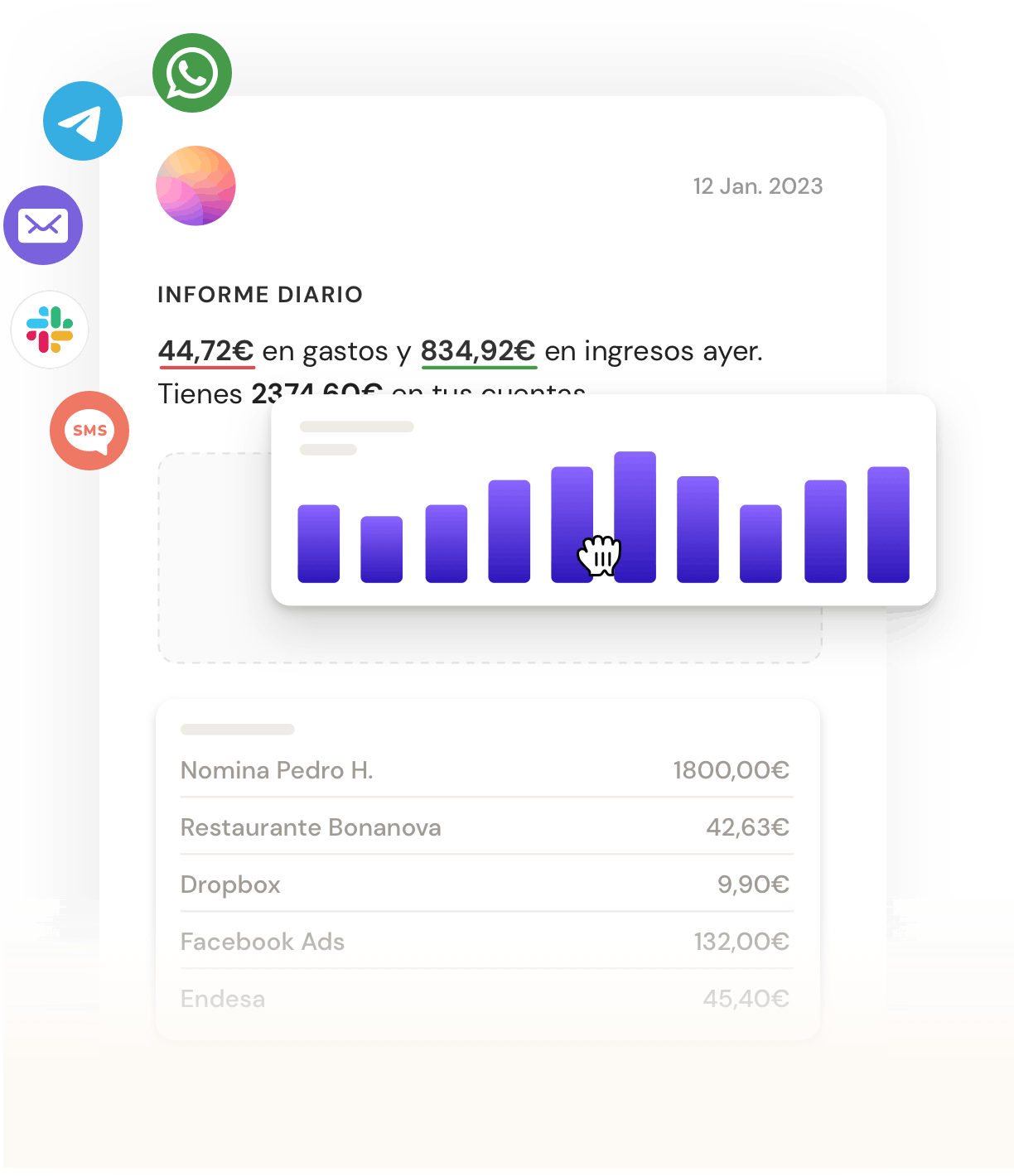

Automated Alerts and Reports

Staying informed about financial activity is crucial for maintaining healthy cash flow. Banktrack’s automated alerts notify users of critical events, such as low account balances or overdue payments.

Additionally, the tool generates personalized reports that highlight trends, discrepancies, and opportunities for growth. These automated features save time and reduce the risk of human error, ensuring nothing falls through the cracks.

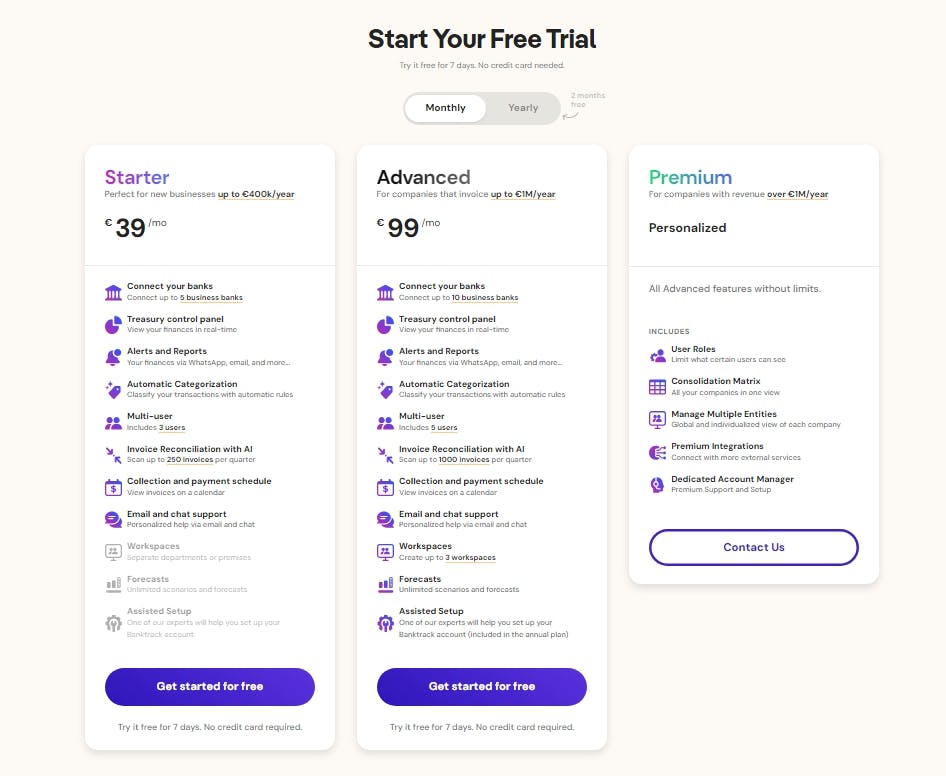

Affordable Pricing

Banktrack offers an affordable solution for businesses seeking to enhance their cash flow monitoring. Its cost-effective pricing makes it accessible to startups and small enterprises while still providing the functionality needed by larger organizations.

Best Practices for Maintaining Positive Cash Flow

Maintaining a positive cash flow requires proactive management and strategic planning. Follow these best practices to stay financially healthy:

Invoice Promptly

Send invoices immediately after delivering products or services. The sooner you invoice, the sooner you’re likely to receive payment. Ensure your invoices are clear, professional, and include all necessary details to avoid payment delays.

Negotiate Payment Terms

Negotiate favorable terms with suppliers to extend payment deadlines without incurring penalties. This allows you to hold onto cash longer, improving liquidity.

Reduce Overheads

Analyze your expenses to identify areas where you can cut costs. For instance, you might renegotiate lease agreements, switch to more affordable suppliers, or adopt energy-efficient practices to lower utility bills.

Diversify Revenue Streams

Relying on a single client or product can make your cash flow vulnerable. Diversify your income sources by introducing new products, targeting different customer segments, or exploring partnerships.

Monitor Key Metrics

Track metrics like the cash conversion cycle (how quickly you turn investments into cash), operating cash flow ratio (cash flow compared to liabilities), and accounts receivable turnover (how efficiently you collect payments). These metrics provide actionable insights into your financial performance.

Plan for Growth

As your business grows, revisit your cash flow strategy to ensure it accommodates increased expenses and investments. Growth often requires upfront costs, so careful planning is essential to avoid liquidity challenges.

Share this post

Related Posts

7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.How to improve forecasting: key strategies and techniques

Discover essential strategies and advanced methods to enhance your forecasting accuracy and make more informed decisions for your business.How to track your business cash flow: complete guide

Failing to track cash flow properly can lead to serious financial issues. In this article, we provide efficient solutions to manage and optimize it effectively.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed