Best 9 Cube Software Alternatives

- Top 9 Cube Software Alternatives

- 1. Banktrack - Best Cube Alternative

- 2. Scoro

- 3. Float

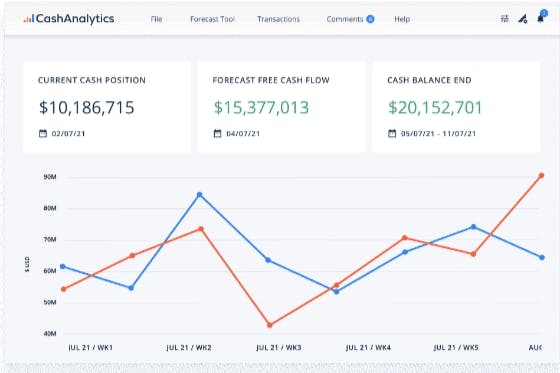

- 4. CashAnalytics

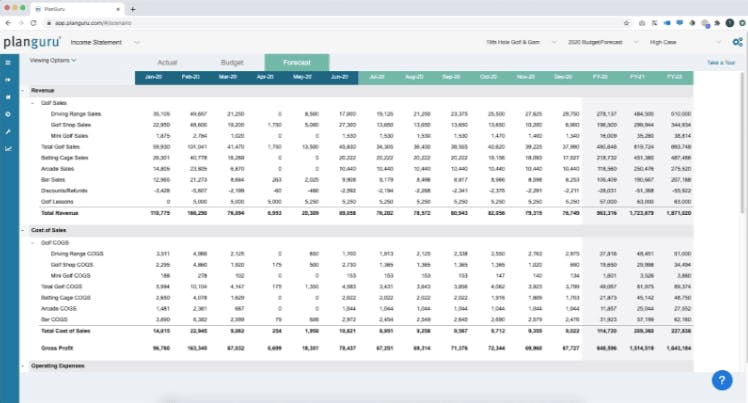

- 5. PlanGuru

- 6. Pulse

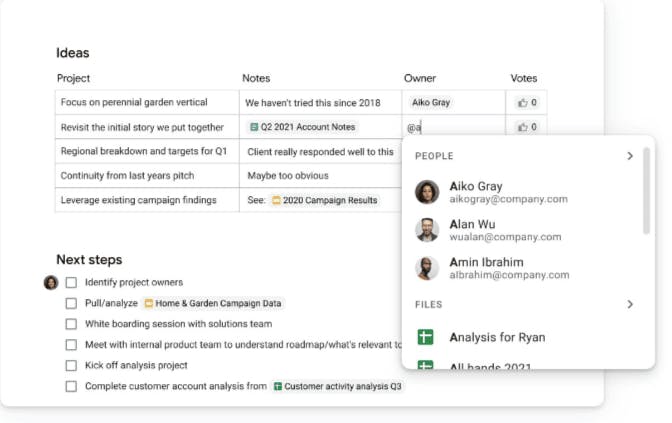

- 7. Google Docs

- 8. Vena Solutions

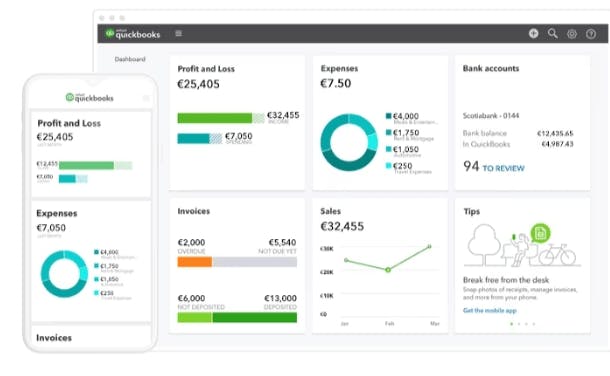

- 9. QuickBooks

- Key Features of Cube Software

- Comparison Criteria for Alternatives

- 9 Applications of Each Cash Management Software

- 1. Banktrack

- 2. Scoro

- 3. Float

- 4. CashAnalytics

- 5. PlanGuru

- 6. Pulse

- Google Docs

- Vena Solutions

- QuickBooks

- Benefits and Limitations of a Cash Management Software

- 3 Advantages

- 3 Drawbacks

- 3 Mitigation Strategies

- Conclusion

The best Cube software alternatives:

- Banktrack

- Scoro

- Float

- CashAnalytics

- PlanGuru

- Pulse

- Vena Solutions

- QuickBooks

Picture this: your business, flourishing and thriving, skillfully navigating through the shifting trends of the market.

What's the secret behind this success?

It's not just about the brilliance of your ideas or the dedication of your team; it's also about having the right tools at your disposal.

When it comes to financial management, the right software can be your trusted companion, guiding you through the maze of transactions, forecasts, and reports.

Top 9 Cube Software Alternatives

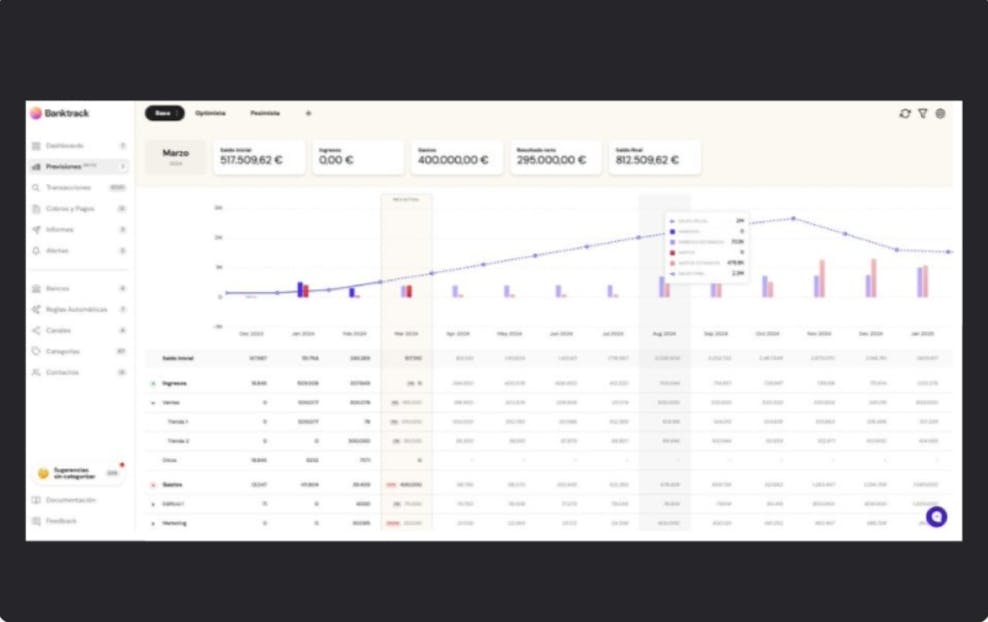

1. Banktrack - Best Cube Alternative

Banktrack offers a comprehensive solution for cash management, helping businesses track their financial transactions, manage cash flow, and optimize their financial performance.

Key Features

- Transaction Tracking: Monitor all financial transactions in real-time. Its customizable dashboards enable users to access real-time financial information efficiently, while its flexible categorization options allow for precise tracking of expenses and income.

- Cash Flow Forecasting: Predict future cash flow based on historical data.

- Bank Reconciliation: Automates the process of reconciling bank statements with internal records.

This makes it perfect for enterprises who work and are associated with different bank accounts or who intertwine their bank statements as it makes the process easier for them.

- Forecasts: You can create estimates of cash flow and make sure they are met. Formulas also allow you to add a lot more dynamic functionality to your calculations.

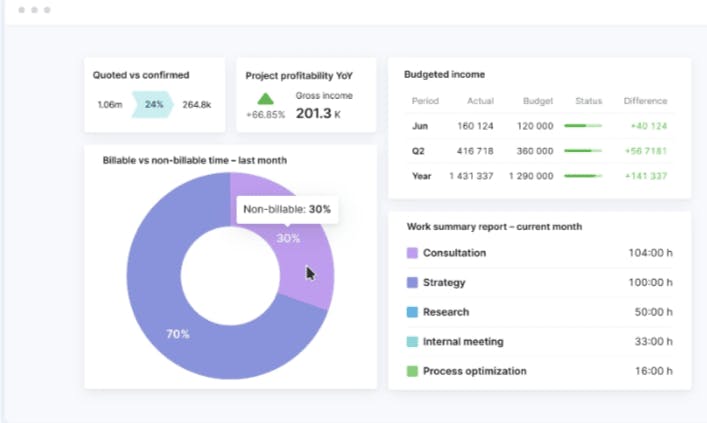

2. Scoro

Scoro is an all-in-one business management software that integrates project management, CRM, billing, and reporting into a single platform, including robust financial management tools.

Key Features

- Project Management: Manage projects and tasks efficiently.

- Financial Management: Track budgets, expenses, and invoices.

- CRM: Manage customer relationships and sales pipelines.

- Customizable Dashboards: Create tailored dashboards to monitor key metrics.

Pros and Cons

Pros:

- Comprehensive business management suite.

- Customizable dashboards.

- Strong project and financial management integration.

Cons:

- Steep learning curve.

- Higher pricing tiers.

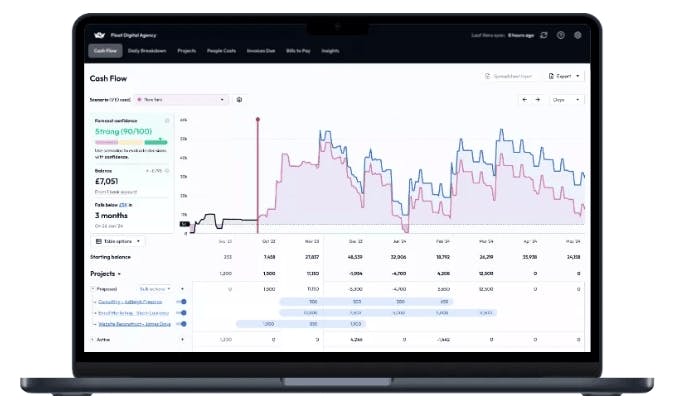

3. Float

Float is a cash flow forecasting software designed to integrate seamlessly with accounting software like Xero, QuickBooks, and FreeAgent.

Key Features

- Cash Flow Forecasting: Provides real-time cash flow projections.

- Budgeting: Set and track budgets with ease.

- Scenario Planning: Create and compare different financial scenarios.

- Integration: Seamless integration with popular accounting tools.

Pros and Cons

Pros:

- Real-time cash flow forecasting.

- Easy integration with accounting software.

- User-friendly interface.

Cons:

- Limited to cash flow management.

- Higher cost for advanced features.

4. CashAnalytics

CashAnalytics is a comprehensive cash flow management and forecasting tool designed for large enterprises and finance teams.

Key Features

- Cash Flow Forecasting: Advanced forecasting tools for accurate predictions.

- Data Consolidation: Automate the collection and consolidation of financial data.

- Reporting and Analytics: Generate detailed reports and analytics.

- Scenario Analysis: Model different financial scenarios.

Pros and Cons

Pros:

- Advanced forecasting capabilities.

- Robust data consolidation.

- Detailed reporting and analytics.

Cons:

- Expensive for small businesses.

- Steep learning curve.

5. PlanGuru

PlanGuru is a powerful budgeting, forecasting, and financial planning tool designed for small to mid-sized businesses.

Key Features

- Budgeting and Forecasting: Create detailed budgets and forecasts.

- Financial Analysis: Analyze financial performance with various tools.

- Consolidation: Consolidate financial data from multiple sources.

- Scenario Analysis: Conduct what-if analyses to plan for different scenarios.

Pros and Cons

Pros:

- Strong budgeting and forecasting capabilities.

- Detailed financial analysis tools.

- Scenario planning.

Cons:

- Limited integration options.

- Can be complex for new users.

6. Pulse

Pulse is a simple and intuitive cash flow management tool designed for small to mid-sized businesses.

Key Features

- Cash Flow Tracking: Track cash flow in real-time.

- Forecasting: Create simple and accurate cash flow forecasts.

- Customizable Reports: Generate reports tailored to your needs.

- Integration: Integrates with popular accounting tools.

Pros and Cons

Pros:

- User-friendly interface.

- Affordable pricing.

- Easy to set up and use.

Cons:

- Limited advanced features.

- Basic reporting capabilities.

7. Google Docs

Google Docs is a spreadsheet tool with a range of downloadable templates that can be customized for various financial management tasks, including budgeting, forecasting, and reporting.

Key Features

- Customizable Templates: Use or create templates for financial management.

- Collaboration: Real-time collaboration and sharing.

- Data Analysis: Utilize built-in functions for data analysis.

- Integration: Integrates with various Google Workspace tools.

Pros and Cons

Pros:

- Highly customizable.

- Free to use.

- Strong collaboration features.

Cons:

- Requires manual setup.

- Limited advanced financial features.

8. Vena Solutions

Vena Solutions combines Excel with advanced financial planning and analysis tools, offering a powerful platform for budgeting, forecasting, and reporting.

Key Features

- Excel-Based Interface: Familiar Excel interface.

- Financial Planning and Analysis: Advanced planning and analysis tools.

- Data Consolidation: Automated data consolidation.

- Scenario Planning: Conduct detailed scenario analyses.

Pros and Cons

Pros:

- Familiar Excel interface.

- Strong planning and analysis capabilities.

- Flexible and customizable.

Cons:

- Can be slow with large datasets.

- Higher pricing tiers.

9. QuickBooks

QuickBooks is a widely-used accounting software that offers comprehensive tools for financial management, including cash flow tracking and forecasting.

Key Features

- Accounting: Comprehensive accounting features.

- Invoicing: Create and send invoices.

- Expense Tracking: Track expenses and categorize them.

- Cash Flow Forecasting: Predict future cash flow.

Pros and Cons

Pros:

- Comprehensive accounting suite.

- Easy to use.

- Strong integration capabilities.

Cons:

- Can be expensive for small businesses.

- Some advanced features require additional training.

Key Features of Cube Software

In order to fully analyze Cube’s alternatives, let’s understand what this software’s key features are:

- Automated Data Consolidation: Simplifies the process of gathering financial data from various sources.

- Customizable Dashboards and Reports: Allows for tailored financial reporting to meet specific business needs.

- Scenario Planning and Analysis Tools: Facilitates strategic financial planning and forecasting.

- Integration with Accounting Software: Ensures seamless data synchronization and flow.

Comparison Criteria for Alternatives

Now that we know what its main features are, let’s understand which criteria was followed when evaluating alternatives to Cube:

- Feature Set: The volume and utility of features provided.

- Usability: Ease of use and user interface design.

- Integration: Compatibility with other software and tools.

- Pricing: Cost-effectiveness for different organizational sizes.

- Customer Support: Availability and quality of user support services.

9 Applications of Each Cash Management Software

Every business is unique. For this reason, the software you choose should adapt to your needs and activities.

This is why we're bringing to you various use cases from different industries so that you can evaluate each solution based on its intended use.

1. Banktrack

Banktrack is ideal for financial institutions, large enterprises, startups and entrepreneurs needing detailed transaction tracking and cash flow management.

This solution adapts perfectly to the needs of every corporation or individual.

It is versatile enough to track personal finances or even manage joint finances for couples!

2. Scoro

Best suited for service-based businesses and project-based industries looking for integrated project management and financial tools.

3. Float

Perfect for small businesses and startups needing real-time cash flow forecasting integrated with their accounting software.

4. CashAnalytics

Targeted at large enterprises and finance teams requiring advanced cash flow forecasting and data consolidation.

5. PlanGuru

Designed for small to mid-sized businesses seeking robust budgeting and financial analysis capabilities.

6. Pulse

Best for small to mid-sized businesses looking for a simple, affordable cash flow management tool.

Google Docs

Versatile tool suitable for any business with low budget needing customizable financial management solutions.

Vena Solutions

Best for businesses comfortable with Excel seeking advanced financial planning and analysis capabilities.

QuickBooks

Ideal for small to medium businesses needing comprehensive accounting and financial management tools.

Benefits and Limitations of a Cash Management Software

3 Advantages

1. Improved Financial Management

All these tools provide robust features for managing and forecasting cash flow, budgeting, and financial reporting, helping businesses make informed financial decisions.

2. Improved Data Accuracy

Automated data consolidation and integration with accounting software reduce the risk of errors and ensure data accuracy.

3. Time and Resource Efficiency

These tools automate many financial management tasks, saving time and resources that can be redirected to other strategic areas of the business.

3 Drawbacks

1. Cost

Many advanced features come at a premium price, which can be a barrier for smaller businesses or startups.

2. Complexity

Some tools have a steep learning curve, requiring training and time to master. This increases the cost for many businesses that already have a tight budget.

3. Integration

Not all tools integrate seamlessly with existing systems, which can lead to inefficiencies, manual error and increased costs.

We recommend you read reviews online to know what other users think about these options.

3 Mitigation Strategies

If you're concerned about these drawbacks, don't worry. There are effective strategies to mitigate most of these potential issues.

- Training: Investing in training can help overcome complexity and improve user adoption. Although it may seem like a high upfront cost, it may turn out to be very profitable over time.

- Customization: Tailoring the tools to meet specific business needs can enhance usability and effectiveness.

- Support: Choosing tools with good customer support can mitigate potential issues.

Conclusion

Choosing the right financial management tool is crucial for optimizing cash flow, improving financial planning, and ensuring accurate reporting.

Banktrack stands out as an excellent choice for detailed transaction tracking and cash flow management.

By carefully considering your business's specific requirements and comparing features, usability, integration capabilities, and pricing, you can find the best tool to support your financial management efforts.

Share this post

Related Posts

How to improve forecasting: key strategies and techniques

Discover essential strategies and advanced methods to enhance your forecasting accuracy and make more informed decisions for your business.5 best software for financial projection

Explore the 5 best software for financial projection to enhance forecasting, streamline planning, and make data-driven decisions for your business's financial success.Best 5 short-term cash forecasting methods

Discover effective short-term cash forecasting methods like receipts and disbursements, rolling forecasts, and scenario planning to optimize your business’s liquidity.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed