5 best software for financial projection

- The 5 best financial forecasting software in 2024

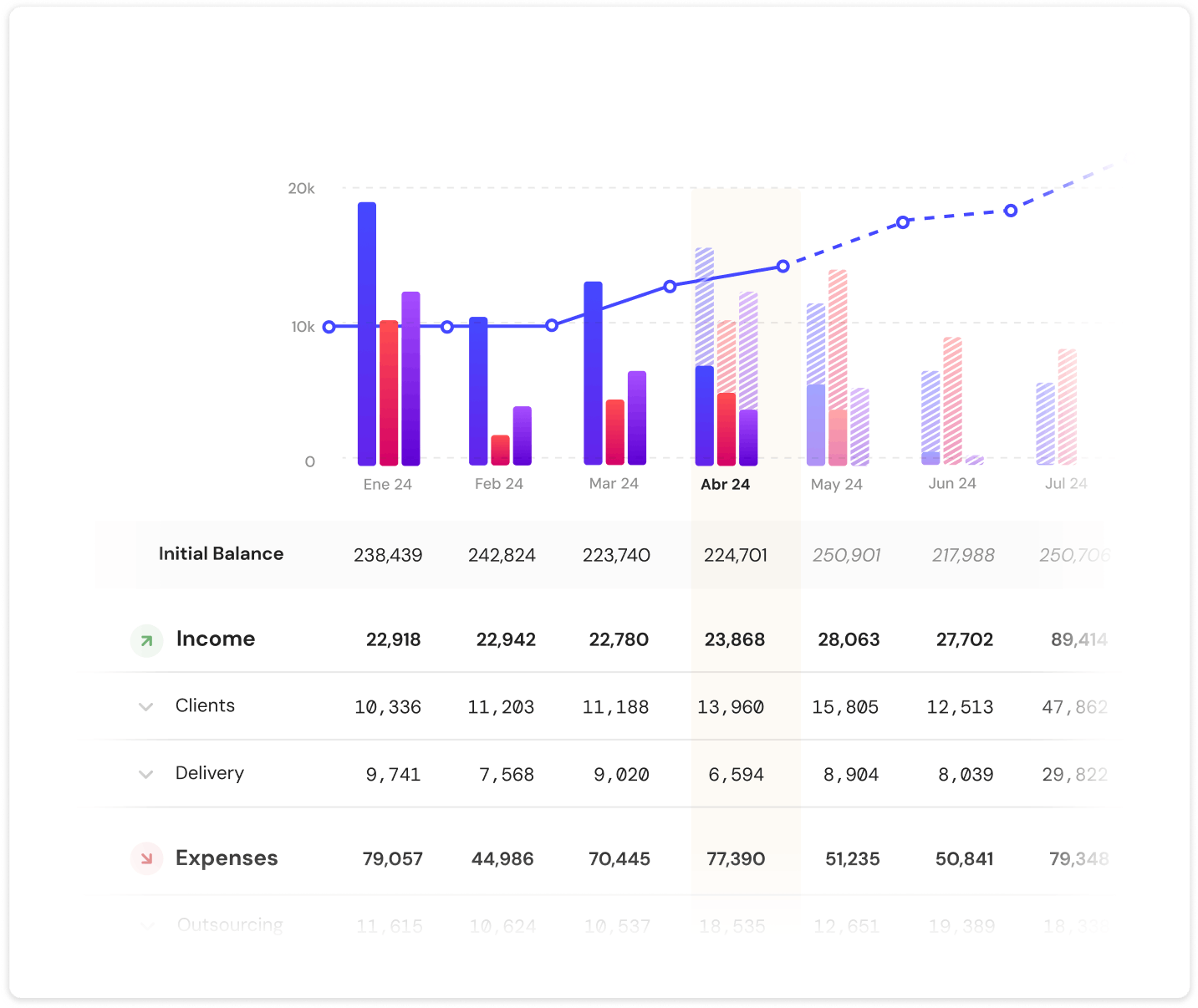

- 1. Banktrack

- 2. Anaplan

- 3. Cube

- 4. Planful

- 5. Vena Solutions

- Why choose software for financial projections?

- 1. Increased accuracy in forecasts

- 2. Scalability and adaptability to different scenarios

- 3. Time savings and automation of repetitive tasks

- 4. Improved strategic decision-making

- 5. Promoting collaboration and transparency

- 6. Adaptation to the digital and cloud era

- 7. Regulatory compliance and risk reduction

- Steps to create a reliable financial projection

- 1. Define the objectives of the projection

- 2. Collect and analyze historical data

- 3. Identify key variables

- 4. Establish clear assumptions

- 5. Choose the appropriate time horizon

- 6. Build a financial model

- 7. Validate and adjust the model

- 8. Generate clear and understandable reports

- 9. Monitor and update the projections

- 10. Integrate the projection into strategic planning

- 3 frequently asked questions about financial projections

- 1. What is the purpose of financial projections?

- 2. How are scenarios created in financial projections?

- 3. How often should financial projections and scenarios be updated?

When running a company that handles large volumes of data, relying on manual processes for cash flow forecasting reduces efficiency, increases the risk of human error, and can lead to unreliable results.

Ultimately, this makes manual forecasting ineffective for managing your company’s finances.

Fortunately, this is no longer a problem thanks to advancements in technology.

There are numerous financial forecasting software solutions that can help you predict what might happen in your business and prepare for any scenario.

In this article, we’ll introduce you to the 5 best financial forecasting tools for your business.

We’ll also explain the benefits and reasons why having reliable software can significantly enhance your business management.

The 5 best financial forecasting software in 2024

1. Banktrack

Banktrack is a cash flow management software that allows you to control both the past and future of your cash flow and automatically manage your invoices.

With the treasury forecasting tool, you can define different scenarios for the future of your company and anticipate various situations:

1. Create scenarios and alternative plans

Anticipating challenges and changes in the business environment is crucial to ensuring the stability of a company. With Bantrank, you can create different financial scenarios that allow you to:

- Evaluate strategies: compare alternatives to select the best time for making investments or expanding the business.

- Prepare for contingencies: identify potential financial risks, such as negative balances, and prevent them before they affect daily operations.

- Explore new opportunities: simulate the viability of projects or ideas and adjust plans based on the results obtained.

This not only reduces uncertainty but also improves the company's ability to respond to unforeseen situations.

2. Customization of income and expense forecasts

Detailed control of income and expenses is essential for making realistic financial projections. Bantrank allows you to customize these forecasts with practical and adaptable tools:

- Flexible calculation options: quickly increase, decrease, or adjust figures to analyze different scenarios.

- Organization by categories: filtering data by accounts or categories makes it easier to identify trends and specific patterns within the company's finances.

This level of customization ensures that the forecasts are tailored to the specific reality of each business, improving the quality of financial decision-making.

3. Use of historical data as the basis for analysis

Analysis based on historical data is a proven methodology for making more accurate forecasts. Bantrank uses this information to generate projections grounded in the company's previous performance.

By utilizing historical data, companies can identify patterns of financial behavior, seasonalities, and trends that affect their income and expenses.

This allows for more precise adjustments to forecasts and the projection of more realistic scenarios for the future.

4. Real-time data: informed and timely decisions

One of the greatest benefits of financial forecasting software is the ability to work with up-to-date data. Bantrank uses bank synchronization to keep information current:

- Constant updates: financial data from bank accounts and payment gateways are synchronized in real time, eliminating the need for manual updates.

- Error reduction: by avoiding data export and import processes, human errors—often a major cause of inconsistencies in projections—are minimized.

Agility in decision-making: the availability of precise, up-to-date information enables quick responses to market changes or internal needs.

2. Anaplan

Anaplan is a cloud-based business planning platform, ideal for complex financial scenarios and treasury management.

Its "Hyperblock" technology enables companies to connect data and models in real-time, facilitating agile strategic and tactical decision-making based on accurate data.

Use Cases:

- Cash flow planning and forecasting.

- Business scenario modeling to evaluate risks and opportunities.

- Integration of planning processes across departments (finance, sales, operations).

Advantages:

- Flexibility to create custom models without advanced programming knowledge.

- Integration capability with multiple ERP, CRM, and database systems.

- Real-time collaboration among global teams.

3. Cube

Cube is an FP&A (financial planning and analysis) solution designed to simplify and automate financial processes.

Its main appeal lies in its native integration with spreadsheet tools like Excel and Google Sheets, enabling teams to work in a familiar environment while leveraging the benefits of a cloud-based platform.

Use Cases:

- Automation of budgeting and financial forecasting.

- Consolidation and analysis of financial data from various systems.

- Creation of customized reports for presentation to management or stakeholders.

Advantages:

- Fast learning curve thanks to its intuitive interface and spreadsheet integration.

- Dynamic reporting and real-time analytics.

- Scalability for small and medium-sized growing businesses.

4. Planful

Planful (formerly Host Analytics) is a comprehensive financial performance management (FPM) platform. It offers tools for planning, budgeting, forecasting, and financial reporting.

The platform focuses on automating tedious processes and improving the accuracy of financial forecasts for large organizations and complex teams.

Use Cases:

- Centralized management of budgeting and cash flow forecasting.

- Creation of advanced financial models based on hypothetical scenarios.

- Consolidation of financial data to gain a global view of treasury operations.

Advantages:

- Automation of manual tasks such as reconciliations and financial close processes.

- Integration with advanced analytics tools to identify trends and risks.

- Collaboration-oriented, allowing teams to easily share and review data.

5. Vena Solutions

Vena Solutions is an FP&A software that leverages the familiarity of Excel as its primary interface, supported by the robustness of a cloud-based platform.

It combines the flexibility of spreadsheets with advanced collaboration and analytics capabilities, enabling businesses to optimize financial and treasury processes.

Use Cases:

- Creation of collaborative budgets and financial forecasts.

- Real-time analysis of cash flow and liquidity.

- Management of regulatory and financial compliance reports.

Advantages:

- Use of Excel as the main interface, minimizing the learning curve.

- Powerful collaborative workflows with built-in auditing capabilities.

- Integration with ERP and CRM solutions for centralized financial analysis.

Why choose software for financial projections?

Financial management is one of the most critical areas to ensure the sustainability and growth of a company.

Financial projections are essential for forecasting revenues, expenses, liquidity needs, and making informed strategic decisions.

Choosing specialized software for financial projections can make a significant difference in the accuracy, efficiency, and effectiveness of this process. Here are the main reasons:

1. Increased accuracy in forecasts

Errors in financial projections, such as incorrect calculations or imprecise assumptions, can have serious consequences for a company. Financial software:

- Uses advanced models based on historical data and current trends to provide more accurate predictions.

- Automatically integrates data from various sources (ERP, CRM, spreadsheets, etc.), reducing the risk of human error.

2. Scalability and adaptability to different scenarios

Specialized software allows companies to model multiple financial scenarios to evaluate the impact of potential decisions or market changes. For example:

- Scenario modeling: what happens if inflation rises? How does a 10% increase in sales affect performance?

- Flexibility: tools can adjust to the needs of small or large companies, adapting to the complexity of their operations.

3. Time savings and automation of repetitive tasks

Financial projection software automates tedious tasks such as:

- Consolidating data from diverse sources.

- Real-time report updates.

- Automatically generating charts and reports ready for presentation to stakeholders.

This frees up time for finance teams to focus on strategic tasks instead of manual ones.

4. Improved strategic decision-making

Financial software not only generates forecasts but also provides detailed analyses of company performance.

- Identifies financial trends and potential risks before they become problems.

- Facilitates the analysis of key performance indicators (KPIs) to ensure decisions are based on solid, objective data.

5. Promoting collaboration and transparency

Most of these software tools are designed to be collaborative, allowing different teams (finance, sales, operations) to work on a single financial model in real-time.

- Transparency: All teams have access to the same information, reducing inconsistencies.

- Collaboration: Tasks can be assigned, comments shared, and changes reviewed efficiently.

6. Adaptation to the digital and cloud era

Modern software operates in the cloud, enabling:

- Remote access from anywhere and any device.

- Automatic updates without user maintenance.

- Scalability and secure data backed by specialized providers.

7. Regulatory compliance and risk reduction

Financial projection software also helps ensure compliance with local and international regulations.

- Automatically generates regulatory reports and performs internal audits.

- Minimizes financial risks related to liquidity shortages or excessive spending.

Steps to create a reliable financial projection

Creating accurate and reliable financial projections is essential for the strategic planning of any business.

This process combines the analysis of historical data, current trends, and well-grounded future assumptions.

Below are the key steps to building a solid financial projection:

1. Define the objectives of the projection

Before starting, it is important to have a clear understanding of the purpose of the financial projection.

Examples of objectives:

- Estimate future revenues and expenses.

- Determine cash flow needs.

- Assess the feasibility of a project or investment.

- Prepare risk scenarios.

A clear objective will guide the level of detail and the tools needed for the projection.

2. Collect and analyze historical data

Analyzing past data is the foundation of any financial projection.

Collect:

- Revenues, expenses, profit margins, and growth trends from at least 2-3 previous years.

- External data such as interest rates, inflation, or market conditions.

- Analyze: identify patterns, seasonality, critical points, or areas for improvement in the historical data.

3. Identify key variables

Determine the factors that significantly impact financial outcomes.

Internal variables:

- Sales, production costs, operating expenses, capital investments.

External variables:

- Market demand, competition, regulations, global economy.

Prioritizing key elements will focus calculations and models on the most relevant factors.

4. Establish clear assumptions

Every financial projection is based on assumptions that must be realistic and well-supported.

Examples of assumptions:

- Annual sales growth of 10%.

- Increased operating costs due to inflation.

- Launch of new products in the second quarter.

- Validation: review assumptions using current data or benchmarking against industry standards.

5. Choose the appropriate time horizon

Select the time frame for the projection based on the established objectives:

- Short term: 6 months to 1 year (useful for cash flow and operations).

- Medium term: 1 to 3 years (ideal for strategic planning).

- Long term: More than 3 years (relevant for investment or expansion projects).

6. Build a financial model

A financial model is a structured representation of the company’s revenues, expenses, assets, and liabilities.

- Common methods:

- Revenue and cost models: based on detailed projections of sales and expenses.

- Cash flow models: focused on cash inflows and outflows.

- Scenario-based models: evaluate "best case," "worst case," and "most likely case."

- Tools: Use advanced spreadsheets or specialized software like Anaplan, Planful, or Vena Solutions.

7. Validate and adjust the model

Before presenting the projection, it is crucial to review it for accuracy.

- Sensitivity testing: assess how changes in key variables affect results.

- Benchmark comparison: Compare results with industry averages or historical goals.

- Expert review: Share the model with internal teams or external consultants to gather feedback.

8. Generate clear and understandable reports

Financial projections should be presented in a way that stakeholders can easily understand.

- Data visualization: use charts, tables, and summaries to facilitate interpretation.

- Key performance indicators (KPIs): highlight key metrics such as EBITDA, profit margins, net cash flow, etc.

- Scenarios: include projections for different scenarios (optimistic, base, and pessimistic).

9. Monitor and update the projections

The business environment changes constantly, so projections should be reviewed periodically.

- Frequency: update monthly, quarterly, or whenever significant changes occur in the business.

- Tracking: compare actual results with projections to identify deviations and adjust assumptions.

10. Integrate the projection into strategic planning

Finally, financial projections should serve as a tool to guide strategic decisions.

- Evaluate the feasibility of new projects or investments.

- Identify areas for improvement in costs or revenues.

- Design contingency plans based on negative scenarios.

3 frequently asked questions about financial projections

1. What is the purpose of financial projections?

Financial projections are used to estimate a company's future performance based on historical data, current trends, and assumptions.

They help businesses plan for the future, assess risks, secure funding, and make informed strategic decisions.

Additionally, projections allow for the creation of different financial scenarios (optimistic, pessimistic, and base) to show how changes in key factors might impact the company's financial situation. This helps businesses prepare for various potential outcomes.

2. How are scenarios created in financial projections?

Scenarios in financial projections are based on different sets of assumptions about how certain key variables—such as revenue, costs, interest rates, or economic growth—will develop. Typically, three types of scenarios are created:

- Optimistic scenario: assumes that conditions will be more favorable than expected, such as higher sales or lower costs.

- Pessimistic scenario: considers unfavorable conditions, like reduced sales or increased expenses.

- Base or most likely scenario: represents the most realistic outlook based on current assumptions and historical data.

These scenarios help companies visualize potential outcomes under different conditions and prepare to adapt to any significant changes.

3. How often should financial projections and scenarios be updated?

Financial projections and their scenarios should be updated regularly to reflect changes in the business’s internal and external environment.

Typically, projections are reviewed quarterly or annually.

However, if significant changes occur—such as market fluctuations, regulatory changes, or unforeseen events—it is crucial to review the scenarios more frequently.

Updating the scenarios helps ensure the projections remain relevant and allows for more agile decision-making based on current data, adjusting strategies in response to changing business conditions.

Share this post

Related Posts

The 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.8 Steps to Deal with Cash Flow Problems Effectively

These are 8 actionable steps to tackle cash flow issues effectively and maintain smooth financial operations for your business.The Worst 9 Limitations of Cash Flow Forecasting

Cash flow forecasting predicts how much cash will come in out over a certain period. Here are 12 limitations that you should have in mind.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed