Best 5 short-term cash forecasting methods

- Short-Term Cash Forecasting Methods

- 1. Receipts and Disbursements Method

- 2. Adjusted Net Income Method

- 3. Rolling Forecast Method

- 4. Scenario Planning

- 5. Short-Term Cash Flow Software

- What is Short-Term Cash Forecasting?

- Why Short-Term Cash Forecasting Matters

- Best Practices for Short-Term Cash Forecasting

- The Impact of Effective Short-Term Forecasting

- Why Choose Banktrack for Short-Term Cash Forecasting?

These are the best short-term cash forecasting methods:

- Receipts and Disbursements Method

- Adjusted Net Income Method

- Rolling Forecast Method

- Scenario Planning

- Short-Term Cash Flow Software

Short-term cash forecasting is a critical practice for businesses aiming to manage their immediate liquidity needs effectively.

By projecting cash inflows and outflows over a short horizon, typically a week, month, or quarter, businesses can ensure they meet their obligations, avoid cash shortages, and seize opportunities without jeopardizing financial stability.

In this guide, we’ll explore some practical methods for short-term cash forecasting and how they can help you maintain a healthy financial position.

Short-Term Cash Forecasting Methods

Different businesses use varying methods to forecast short-term cash flow, depending on their size, industry, and available data. Below are some of the most effective approaches:

1. Receipts and Disbursements Method

This method focuses on tracking cash inflows and outflows within a specific time frame.

It involves listing all anticipated receipts (e.g., customer payments, loans, refunds) and disbursements (e.g., bills, payroll, inventory purchases) to calculate the net cash position at the end of the period.

Key Steps:

- Record all known income sources and their expected payment dates.

- List all upcoming expenses and their due dates.

- Subtract total disbursements from total receipts to determine the net cash flow.

Benefits:

This method is highly detailed and provides a clear view of cash movement. It’s particularly useful for businesses with predictable cash flows.

2. Adjusted Net Income Method

This approach starts with the net income from the income statement and adjusts it by adding or subtracting changes in non-cash items and working capital.

Key Steps:

- Start with net income for the period.

- Adjust for non-cash expenses (e.g., depreciation and amortization).

- Factor in changes in accounts receivable, accounts payable, and inventory.

Benefits:

The adjusted net income method provides a more comprehensive view of cash flow, accounting for operational changes that may impact liquidity.

3. Rolling Forecast Method

A rolling forecast continuously updates cash flow predictions by extending the forecast period as time progresses.

For example, if you forecast for the next 30 days, the forecast is updated daily or weekly to reflect the next 30-day period.

Key Steps:

- Establish a baseline forecast for a set period (e.g., 30 days).

- Regularly update the forecast with the latest actual figures and adjust for new information.

- Repeat the process to maintain an ongoing forecast.

Benefits:

Rolling forecasts provide flexibility and real-time accuracy, making them ideal for businesses operating in dynamic or unpredictable environments.

4. Scenario Planning

This method involves creating multiple cash flow scenarios based on different assumptions about future events.

For example, you might prepare a "best-case," "worst-case," and "most likely" cash flow projection.

Key Steps:

- Identify variables that impact cash flow (e.g., sales volume, payment delays, unexpected expenses).

- Create separate forecasts for each scenario.

- Plan actions for each case, such as cost-cutting measures or accelerating collections.

Benefits:

Scenario planning helps businesses prepare for uncertainties and ensures they can respond effectively to unexpected changes.

5. Short-Term Cash Flow Software

Leveraging technology simplifies short-term forecasting by automating data collection, calculations, and reporting. These are the 10 best cash flow management solutions for corporates.

Tools like Banktrack can integrate with your accounting systems to provide accurate, real-time projections.

Short-term cash forecasting is all about precision, real-time insights, and the ability to adapt quickly to changing financial circumstances.

Banktrack is an ideal tool for this purpose, offering features specifically designed to enhance cash flow visibility, automate tracking, and provide actionable insights.

Let’s explore why Banktrack is a perfect companion for effective short-term cash forecasting.

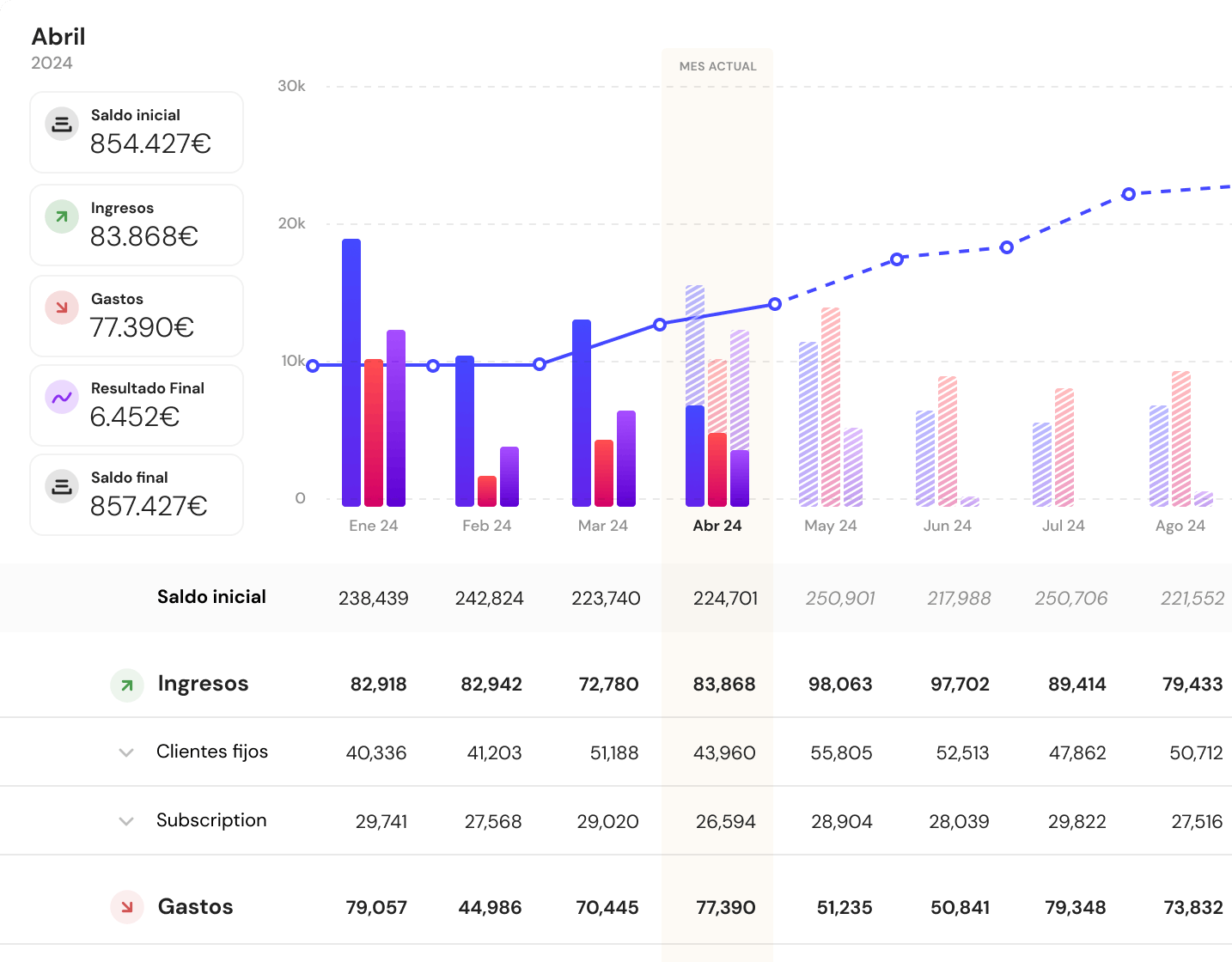

1. Real-Time Financial Data

Short-term forecasting relies heavily on up-to-the-minute data. Banktrack provides real-time updates by integrating seamlessly with multiple bank accounts and financial products.

This ensures that businesses always have the most accurate picture of their cash position.

Real-time insights mean you can make adjustments to your forecasts quickly, whether that involves reallocating funds, rescheduling payments, or pursuing collections.

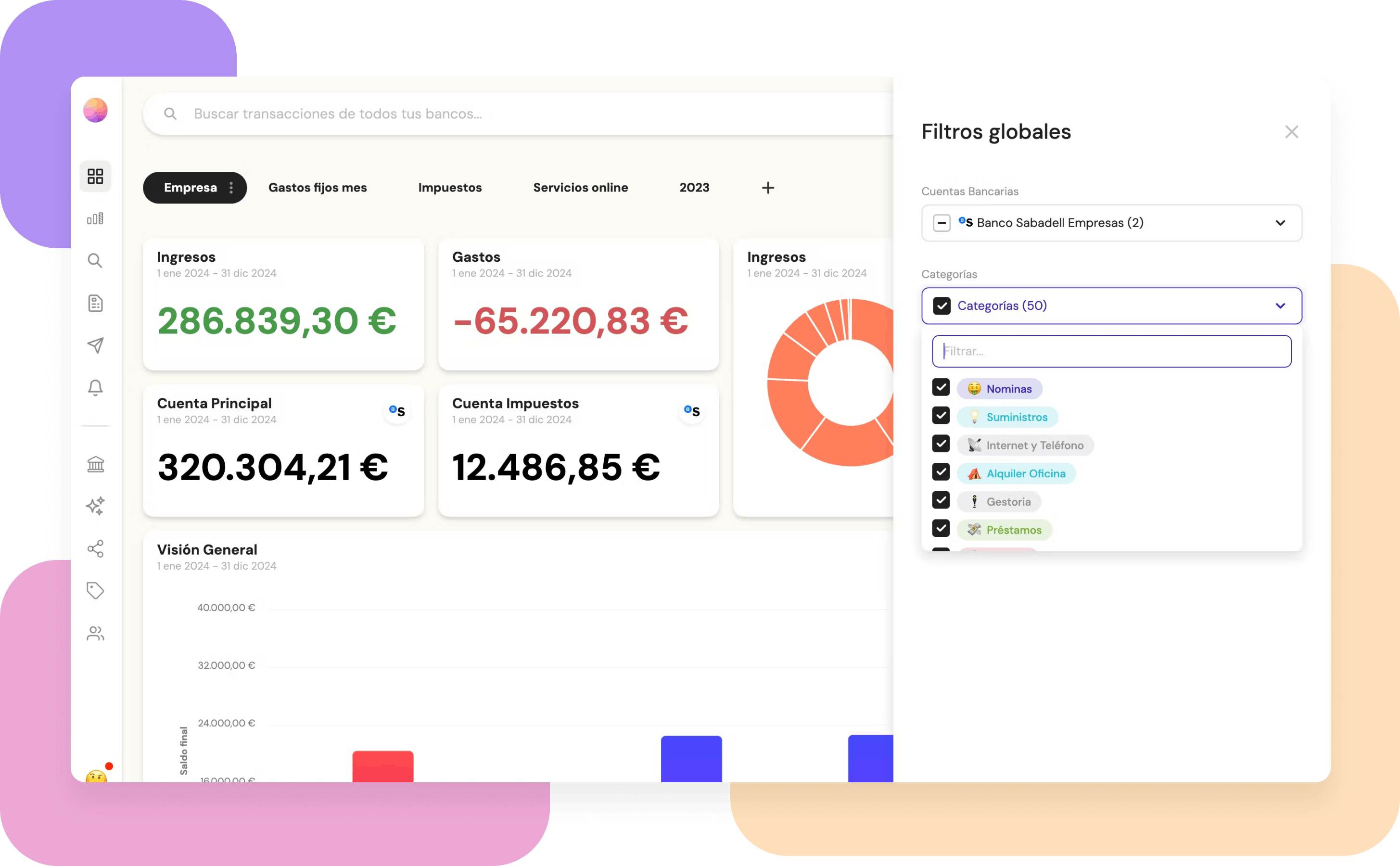

2. Customizable Dashboards for Tracking

Banktrack’s intuitive and personalized dashboards allow users to focus on the key metrics needed for short-term forecasting.

You can track cash inflows and outflows by category, prioritize urgent transactions, and drill down into specific data points.

This level of customization ensures that your short-term cash forecast aligns perfectly with your business’s unique needs and immediate priorities.

3. Automated Alerts and Reports

Staying ahead of cash flow challenges requires early warnings about potential issues.

Banktrack’s automated alerts notify you of critical financial changes, such as low balances, unexpected spikes in expenses, or delayed receivables.

These alerts allow businesses to adjust their short-term forecasts before problems escalate. Additionally, automated reports provide valuable insights into patterns and variances, helping refine your forecasting accuracy over time.

4. Integration with Forecasting Methods

Banktrack’s features complement popular short-term forecasting methods like the Receipts and Disbursements Method and Rolling Forecasts:

- Receipts and Disbursements Method: Banktrack allows you to categorize and track all expected receipts and disbursements effortlessly, reducing the manual effort required to maintain accuracy.

- Rolling Forecasts: Its continuous real-time updates mean your rolling forecast remains current without requiring constant manual input.

This seamless integration between software functionality and forecasting methods makes Banktrack an invaluable tool for maintaining precision in short-term cash planning.

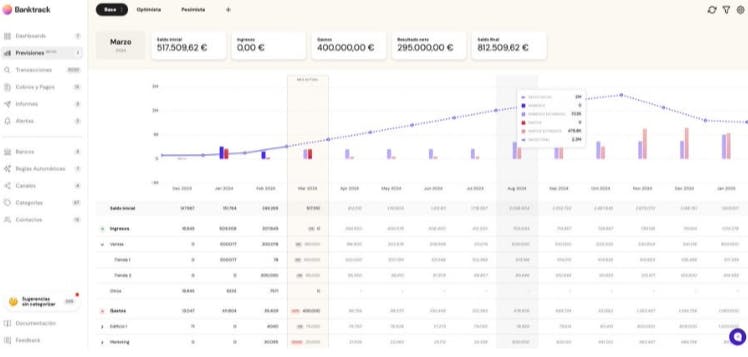

5. Scenario Planning Made Easy

Banktrack supports scenario analysis by enabling users to simulate different cash flow situations. For example, you can create forecasts based on varying payment delays, unexpected expenses, or revenue changes.

The tool’s flexibility allows you to compare scenarios side by side and prepare contingency plans for each, ensuring that your business is ready for any eventuality.

6. Improved Cash Flow Control

Short-term cash forecasting often requires businesses to identify small adjustments that can have a big impact on liquidity.

Banktrack’s detailed categorization and custom spending metrics make it easy to pinpoint areas where costs can be trimmed or payment schedules can be optimized.

This improved control ensures businesses can manage cash flow fluctuations effectively without scrambling for solutions.

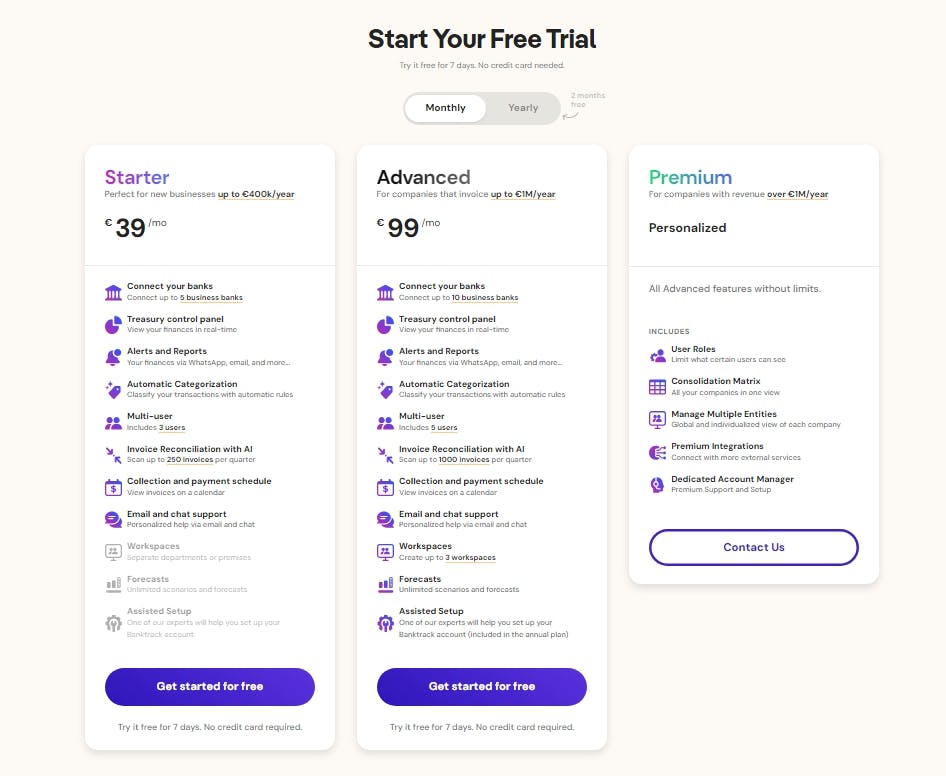

7. Cost-Effective and Accessible

Banktrack provides an affordable solution for businesses of all sizes. Unlike more expensive enterprise software, it offers robust forecasting tools at a price point that small and medium-sized businesses can easily afford.

This affordability ensures that even companies with tight budgets can access professional-grade tools for short-term cash flow management.

What is Short-Term Cash Forecasting?

Short-term cash forecasting involves predicting an organization’s cash position over a brief period.

Unlike long-term forecasting, which focuses on strategic planning for the future, short-term forecasting is tactical and operational.

A cash flow forecasting software ensures there’s enough liquidity to cover day-to-day expenses, such as payroll, rent, inventory, and loan repayments.

The goal is simple: maintain a positive cash balance and avoid disruptions caused by unexpected expenses or delayed revenues.

Why Short-Term Cash Forecasting Matters

Even profitable businesses can run into trouble if they experience cash flow gaps. A short-term cash forecast provides:

- Visibility: Real-time insights into current and near-future cash positions.

- Control: The ability to make quick adjustments to spending or collections to address cash flow challenges.

- Confidence: Assurance that bills, salaries, and other obligations can be met without strain.

Best Practices for Short-Term Cash Forecasting

No matter which method you choose, these best practices can help improve the accuracy and reliability of your short-term cash forecasts:

- Maintain Accurate Records: Ensure all income and expense data is up to date for better predictions.

- Update Forecasts Regularly: Short-term forecasts are most effective when updated frequently to reflect real-time changes.

- Involve Key Stakeholders: Collaborate with team members across departments to identify upcoming expenses or revenue changes.

- Prepare for Contingencies: Always have a backup plan for unexpected expenses or revenue delays.

The Impact of Effective Short-Term Forecasting

Short-term cash forecasting isn’t just about managing the day-to-day, it’s about building resilience and enabling growth. By staying on top of your cash flow, you can:

- Avoid overdraft fees or penalties from missed payments.

- Build trust with suppliers by paying on time.

- Take advantage of opportunities, such as discounts for early payments or investments in growth.

Whether you’re a small business owner or managing the finances of a larger organization, short-term cash forecasting is an essential tool for ensuring stability and success.

Why Choose Banktrack for Short-Term Cash Forecasting?

Short-term forecasting demands speed, accuracy, and flexibility, all of which Banktrack delivers.

By leveraging its real-time data integration, customizable features, and automation, businesses can streamline their forecasting processes and make data-driven decisions with confidence.

Whether you’re preparing for payroll next week, estimating your liquidity for an upcoming expense, or planning for seasonal fluctuations, Banktrack ensures you’re always in control of your cash flow.

Ready to simplify your short-term cash forecasting? Try Banktrack today and see the difference it can make!

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed