How to improve forecasting: key strategies and techniques

- What is cash forecasting?

- How to optimise your cash forecasting

- 1. Use historical data for projections

- 2. Integrate real-time data

- 3. Create different forecasting scenarios

- 4. Adjust for seasonality and business cycles

- 5. Collaborate across departments

- 6. Review and update regularly

- 7. Use forecasting tools and software

- 8. Improve receivables and payables management

- 9. Maintain a cash reserve

- 10. Monitor economic and market conditions

- How to improve cash flow forecast with Banktrack

- Create Scenarios

- Change forecasts with just two clicks

- Real-time updates

- What are the main external factors that can affect the accuracy of a cash flow forecast, and how can they be mitigated?

- How can businesses use historical data to improve cash flow forecasting, especially in volatile markets?

- What advanced methodologies can businesses use to improve their cash flow forecasts, and how can they implement them?

- How can cash flow forecasting be integrated with other areas of financial planning, such as risk management and investment planning?

What is cash forecasting?

Cash forecasting refers to the process of estimating and predicting the future cash inflows and outflows of a business over a specific period of time.

This process is crucial for understanding a company’s liquidity and ensuring that it has enough cash to meet its financial obligations.

It involves looking at historical financial data, current trends, and expected changes to project cash flow in the near future.

Effective cash forecasting allows businesses to make informed decisions regarding investments, debt repayments, and operations, preventing cash shortfalls and optimizing working capital.

It is a critical tool for financial management, helping businesses to avoid financial crises, plan for growth, and maintain smooth day-to-day operations.

Cash forecasting can be done using different time horizons:

- Short-term forecasting: usually covers a period of days, weeks, or months. It helps businesses plan for immediate cash needs such as payroll, supplier payments, and overhead costs.

- Medium-term forecasting: typically spans a quarter or a year. It is useful for planning larger expenses, such as capital investments or upcoming tax liabilities.

- Long-term forecasting: focuses on cash needs over several years and is generally used for strategic planning, major expansions, or long-term debt management.

The accuracy of cash forecasting is crucial, as it directly impacts a company’s ability to make sound financial decisions and avoid liquidity problems.

How to optimise your cash forecasting

Optimizing cash flow forecasting is essential for ensuring that a business can effectively manage its liquidity, plan for future expenses, and avoid financial surprises.

Here are several strategies to improve the accuracy and efficiency of cash flow forecasting:

1. Use historical data for projections

- Analyze past trends: review historical financial data to understand recurring cash inflows and outflows, such as seasonal sales fluctuations or regular monthly expenses.

- Identify patterns: look for patterns in payments, receipts, and other variables that can be anticipated in future forecasts.

2. Integrate real-time data

- Link accounting systems: ensure that your cash flow forecast is based on real-time data by integrating your cash flow forecasting tools with accounting software or enterprise resource planning (ERP) systems. This helps provide a more accurate and up-to-date view of your cash position.

- Monitor ongoing transactions: track transactions as they occur, rather than relying only on historical data. This helps you make adjustments quickly if there are unexpected changes in cash flow.

3. Create different forecasting scenarios

- Use best, worst, and most likely cases: instead of relying on a single forecast, create multiple scenarios to prepare for different situations. This helps you anticipate how cash flow may behave under various circumstances (e.g., a surge in sales, delays in payments).

- Include buffer amounts: add a buffer or contingency to account for unexpected cash flow fluctuations.

4. Adjust for seasonality and business cycles

- Factor in seasonal variations: for businesses with seasonal revenue or expenses, account for these fluctuations in your forecast. For example, retail businesses may see increased sales during holidays, while service-based companies may have quieter months.

- Plan for cyclical trends: if your business experiences regular peaks and valleys, ensure that these are included in your forecasting.

5. Collaborate across departments

- Work with sales, procurement, and operations: collaborate with key departments, such as sales and procurement, to gather information about expected customer payments, upcoming purchases, and inventory needs. This helps create a more accurate and holistic cash flow forecast.

- Include input from the finance team: the finance team should work closely with the departments managing revenue and expenses to ensure alignment in cash flow expectations.

6. Review and update regularly

- Make regular adjustments: cash flow forecasts should be updated frequently, particularly if there are significant changes in the business environment or unexpected events. Monthly or weekly reviews help keep forecasts accurate and aligned with current circumstances.

- Track actual vs. forecasted performance: compare actual cash flow against forecasts regularly to identify any discrepancies. This analysis can help fine-tune future projections.

7. Use forecasting tools and software

- Leverage forecasting tools: there are several cash flow forecasting tools and software available that automate the process, making it easier to track cash inflows and outflows in real time.

- Integrate financial data: many tools integrate directly with accounting systems, helping to streamline the forecasting process and improve accuracy.

8. Improve receivables and payables management

- Tighten credit control: to enhance cash flow, ensure that accounts receivable are collected promptly. Implement strategies such as early payment discounts or more efficient invoicing processes to speed up cash inflows.

- Negotiate better payment terms: work with suppliers to extend payment terms or adjust the timing of major expenses to ensure a smoother cash flow.

9. Maintain a cash reserve

- Create an emergency fund: even with a solid forecast, unexpected events can occur. Maintain a cash reserve to handle short-term cash shortages or unpredicted expenses, reducing reliance on external financing during lean times.

10. Monitor economic and market conditions

- Stay updated on market trends: keep an eye on macroeconomic factors that could impact your business, such as changes in interest rates, inflation, or shifts in demand for your products and services.

- Plan for uncertainty: external factors, such as political changes, supply chain disruptions, or economic downturns, can affect cash flow. Regularly assess these factors and adjust forecasts accordingly.

How to improve cash flow forecast with Banktrack

Banktrack helps improve your cash flow forecasts by allowing you to create dynamic projections quickly and easily with its powerful tools.

Here’s how it assists you in each key aspect:

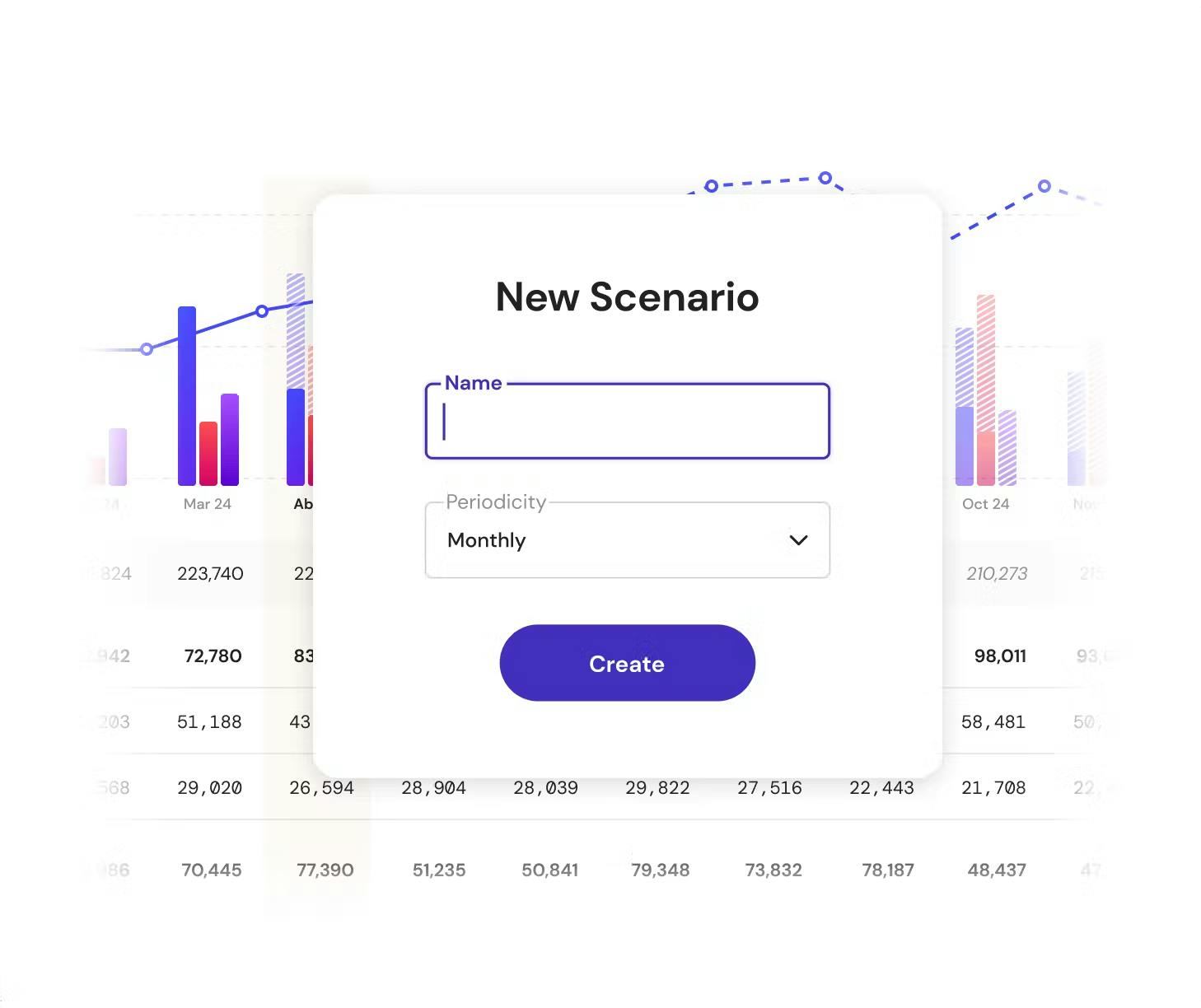

Create Scenarios

Banktrack allows you to explore and create different financial scenarios to forecast how various situations could affect your company’s cash flow.

For example, you can simulate how changes in revenue, delayed customer payments, or rising expenses would impact cash flow.

This ability to create scenarios gives you the flexibility to be prepared for various situations and make informed decisions about your business’s financial future.

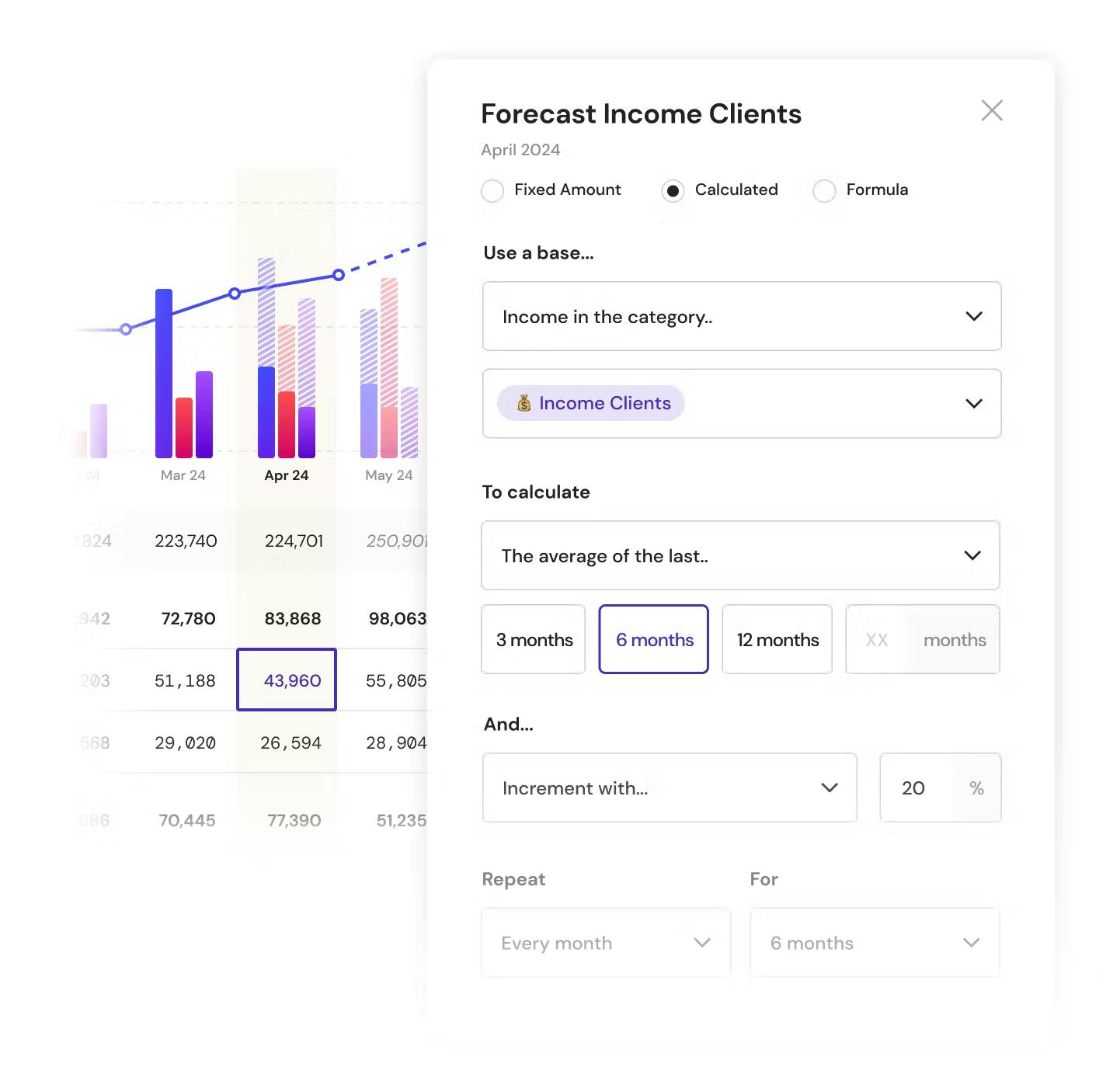

Change forecasts with just two clicks

With Banktrack, updating cash flow forecasts is incredibly easy.

You can modify cash flow projections with just a couple of clicks, allowing you to quickly adapt to any changes, whether it’s a new cash inflow or an unexpected expense.

This ease of adjusting forecasts ensures that your projections are always up to date and accurately reflect your company’s financial situation in real-time.

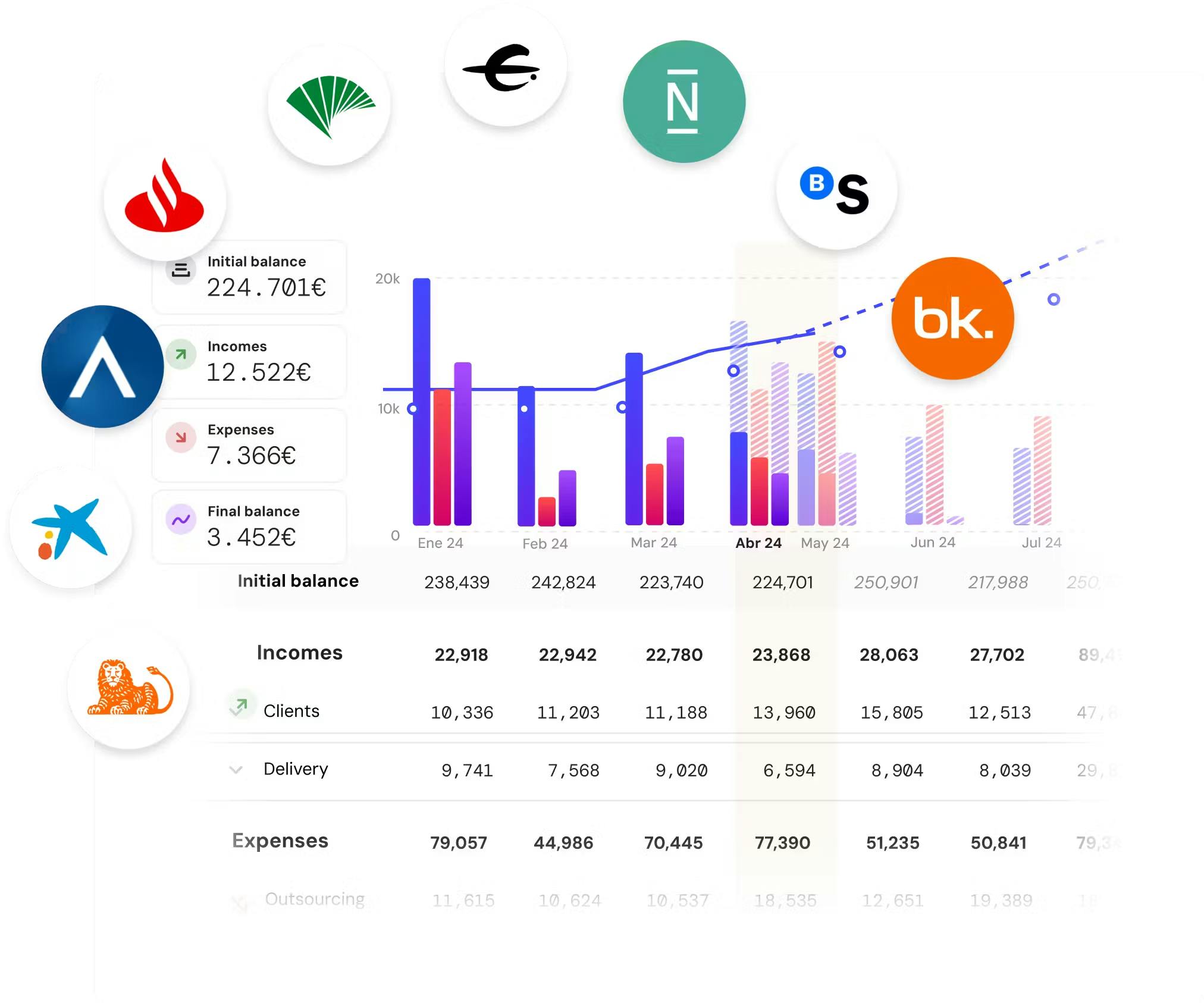

Real-time updates

Banktrack connects directly with your bank accounts and other financial systems, enabling you to access real-time data on account balances, recent transactions, and cash flows.

Automatic updates ensure that your cash flow forecast is constantly adjusted to reflect changes in your company’s financial movements.

This helps you maintain an accurate, up-to-date view of your liquidity at all times, reducing the risk of financial surprises.

What are the main external factors that can affect the accuracy of a cash flow forecast, and how can they be mitigated?

External factors such as changes in the economy (inflation, interest rates), fluctuations in input prices, changes in tax legislation, or market demand variability can significantly affect the accuracy of forecasts.

To mitigate these, it is essential to conduct sensitivity analyses, continuously monitor the economic environment, and adjust forecasts with "best," "worst," and "realistic" scenarios.

Additionally, diversifying income sources and maintaining a reserve fund can provide greater flexibility in response to these changes.

How can businesses use historical data to improve cash flow forecasting, especially in volatile markets?

In volatile markets, historical data is essential for identifying patterns and trends that can help anticipate future cash flow behavior.

Analyzing past fluctuations in income and expenses, especially during periods of uncertainty, allows for the creation of more robust forecasting models.

It is recommended to use time series analysis, adjusted for extraordinary events, to forecast more realistic behaviors.

Additionally, segmenting cash flows by categories (such as customers, products, or regions) can provide a more detailed and accurate view.

What advanced methodologies can businesses use to improve their cash flow forecasts, and how can they implement them?

Advanced methodologies like predictive analytics and artificial intelligence (AI) are gaining traction in improving cash flow forecasting.

Predictive analytics uses statistical algorithms to identify patterns and predict future cash flows based on historical data and external variables.

AI, on the other hand, can learn from real-time data and automatically adjust forecasts as new behaviors are detected.

To implement these, businesses need to invest in specialized software and ensure the availability of accurate, up-to-date data, which in turn improves the ability of predictive models to make more accurate forecasts.

How can cash flow forecasting be integrated with other areas of financial planning, such as risk management and investment planning?

Integrating cash flow forecasting with risk management and investment planning allows for a holistic financial view and better decision-making.

To achieve this, businesses should align their cash flow forecasts with financial risk models (e.g., credit, market, and operational risks) and long-term investment planning.

Using integrated financial planning tools, such as advanced ERP systems, facilitates the simultaneous tracking of these areas.

This way, liquidity availability can be identified to take advantage of investment opportunities or cover potential contingencies arising from financial risks.

Implementing a more dynamic treasury management strategy also enables adjusting investment decisions according to forecasted cash flows and associated risks.

Share this post

Related Posts

5 best software for financial projection

Explore the 5 best software for financial projection to enhance forecasting, streamline planning, and make data-driven decisions for your business's financial success.Top 10 Cash Flow Management Solutions for Corporates

Poor cash flow management can lead to liquidity issues, stunted growth, and even bankruptcy. But what about having great cash flow management?6 Best Coupa Alternatives in 2025

Looking for the best Coupa Alternatives this 2025? Find on this article the best alternatives to manage your finances.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed