The Best 11 HighRadius Alternatives

- Top 11 HighRadius Alternatives

- 1. Banktrack

- 2. AvidXchange

- 3. Billtrust

- 4. Versapay

- 5. YayPay

- 6. Invoiced

- 7. Tipalti

- 8. MineralTree

- 9. Paystand

- 10. Anybill

- 11. Sage Intacct

- Why Look for HighRadius Alternatives?

- 5 Criteria for Choosing Alternatives

- 1. Cost-Effectiveness

- 2. Features and Functionality

- 3. Ease of Use

- 4. Customer Support

- 5. Integration Capabilities

- How to Decide Which Alternative is Right for You

- Think About You. Well..Your Business Needs

- Budget Considerations

- Trial Periods and Demos

- Scalability

- Conclusion

The best HighRadius alternatives:

- Banktrack

- AvidXchange

- Billtrust

- Versapay

- YayPay

- Invoiced

- Tipalti

- MineralTree

- Paystand

- Anybill

- Sage

If you're in the market for financial automation solutions, you've probably come across HighRadius.

It’s a platform known for its functionalities in accounts receivable, cash management, and order-to-cash processes.

However, it might not be the perfect fit for everyone. We are here to discover that.

Whether it's the price tag, specific features, or user experience, there are plenty of reasons to explore other options.

In this article, we’ll dive into some of the best HighRadius alternatives that can offer similar, if not better, benefits for your business.

Top 11 HighRadius Alternatives

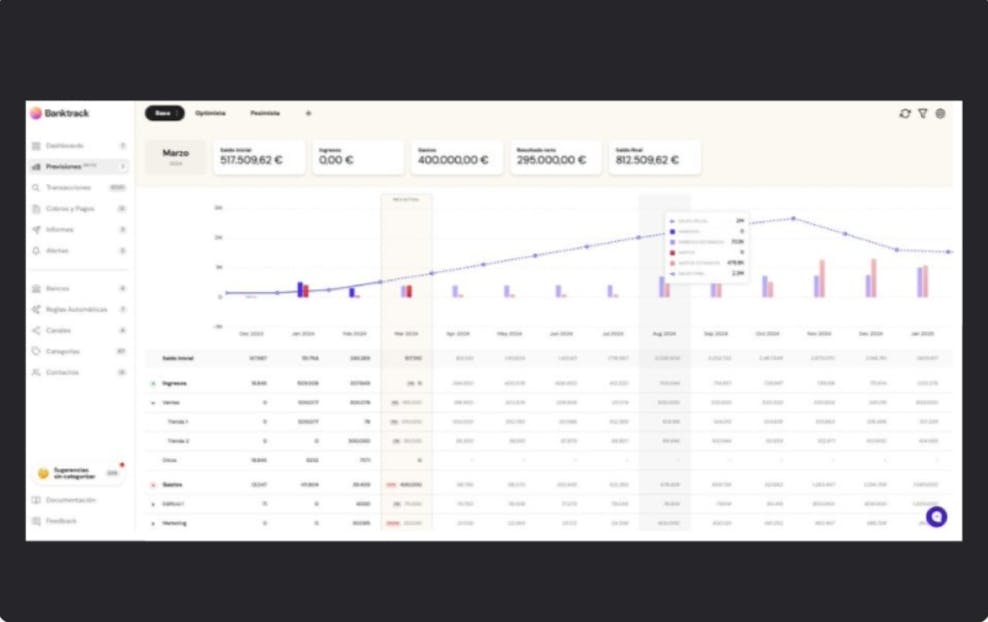

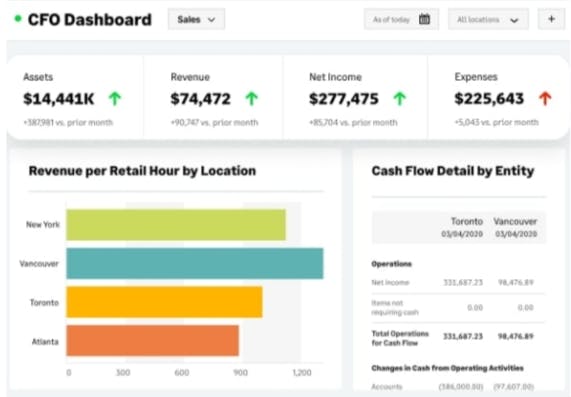

1. Banktrack

Banktrack is the best cash management application for this 2024.

Let us guide you through the reasons that led here.

Custom Dashboards

This cash management solution is a great alternative in the first place because it can create customized dashboards that combine views from different financial products, businesses, and bank accounts.

You can quickly get the information you need to control your spending with Banktrack.

Adapted Categories

Because the categories are specifically made to fit your expenses, good cash management software lets you change them to suit your needs.

To arrange your revenue and expenses as you see fit, you can use complex rules to create and modify an infinite number of categories.

This flexibility allows you to keep an eye on your finances and track where your money is going.

Custom Reports and Alerts

Moreover, Banktrack offers personalized reports and alerts.

Customized reports can be generated, and you can get alerts regarding your spending via email, Slack, Telegram, WhatsApp, and SMS.

You can even configure these alerts to tell you when there are duplicate charges, low balances, or other significant events.

This will help you stay on top of your finances and make wise decisions at all times.

Forecasts

Even cash flow estimates can be made, and you can monitor how well they are followed..

You can also incorporate much more dynamic functionality into your calculations with the help of formulas.

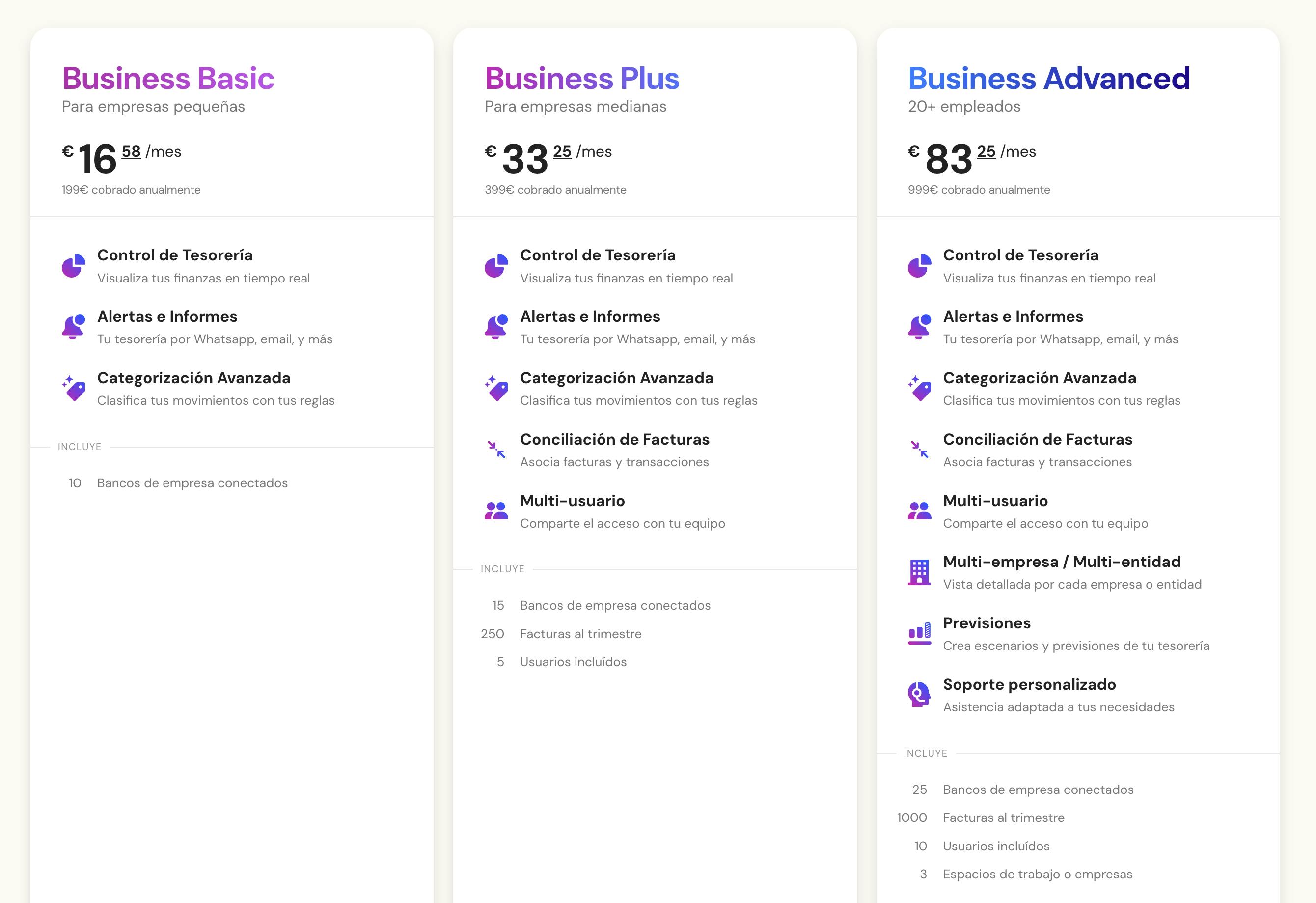

Affordable Prices

Banktrack offers a variety of plans with different functionalities at affordable prices.

For example, the "Business Basic" plan allows the connection of up to 10 bank accounts for just €16.58 per month.

2. AvidXchange

AvidXchange is a good alternative to HighRadius, particularly focusing on accounts payable processes.

What sets AvidXchange apart is its features and solutions designed to:

- Streamline invoice processing

- Supplier management

- Payment automation

Businesses who work with AvidXchange can benefit from its extensive network of suppliers, making it easier to manage transactions.

Additionally, AvidXchange has a user-friendly interface, facilitating smoother adoption and reducing the need for extensive training.

However, it's worth noting that while AvidXchange offers useful functionalities, it may come with a higher price tag, especially for smaller businesses.

Additionally, the setup process for integration can be complex, requiring careful attention to ensure seamless compatibility with existing systems.

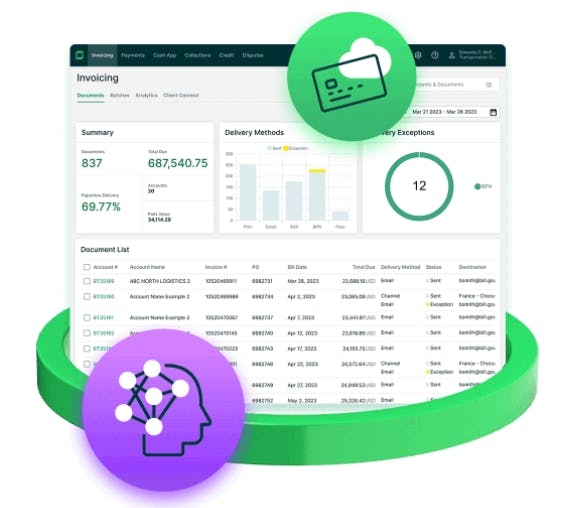

3. Billtrust

Billtrust shines in the area of billing and payments, offering good solutions to expedite the invoice-to-cash process.

With Billtrust, businesses can:

- Automate invoicing

- Improve payment portals

- Streamline cash application

- Enhance credit and collections management

One of Billtrust's key strengths lies in its ability to provide extensive invoicing solutions, catering to the diverse needs of businesses across various industries.

Moreover, Billtrust offers reporting tools, giving businesses the power to access valuable insights into their financial operations.

However, it is also important to consider that while Billtrust delivers advanced features, it may come with a higher cost, particularly for accessing more sophisticated functionalities.

For very small businesses, Billtrust might be perceived as overkill, offering more capabilities than necessary.

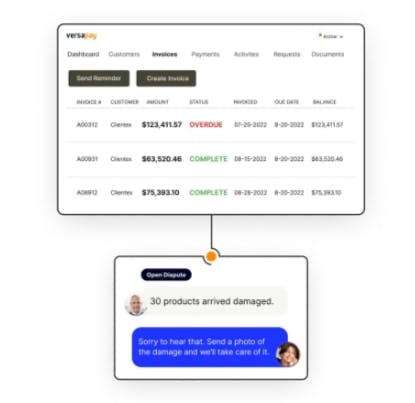

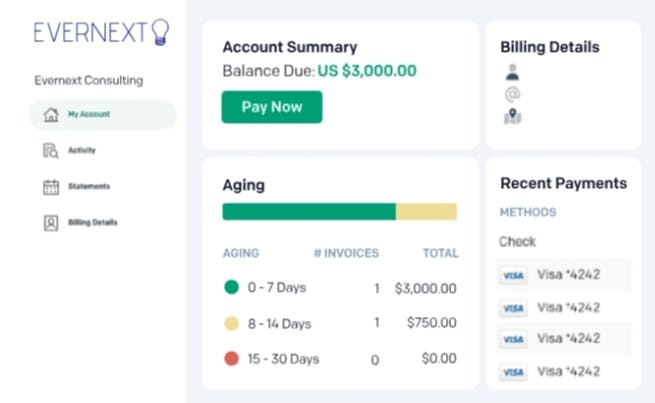

4. Versapay

Versapay is a good alternative to HighRadius for accounts receivable management and bridging finance teams with customers to facilitate smoother payment processes.

The platform offers a range of features:

- Collaborative AR management

- Automated invoicing

- Online payment portals

- Customer communication tools

What makes Versapay stand out is its emphasis on fostering stronger customer relationships through real-time tracking and improved interaction capabilities.

However, beginners to Versapay might face a learning curve as they familiarize themselves with its features and functionalities.

Additionally, certain features may require additional setup, needing careful consideration during the implementation phase.

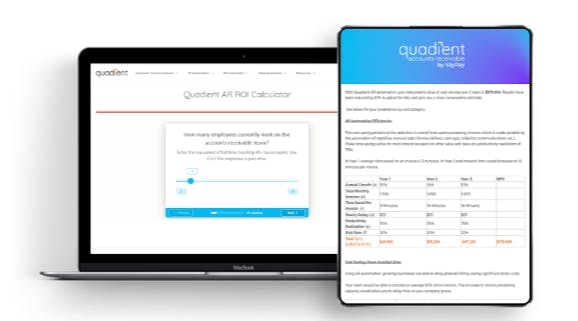

5. YayPay

YayPay distinguishes itself with its intelligent AR automation, providing end-to-end solutions for the order-to-cash process.

With YayPay, businesses can:

- Leverage predictive analytics

- Automate collections

- Offer customer payment portals

- Streamline cash application

Businesses can now make well-informed decisions thanks to the platform's highly sophisticated analytics capabilities, which provide insightful data on customer behavior and payment trends.

Furthermore, YayPay takes great satisfaction in its intuitive user interface, which enables users with different degrees of technical proficiency to utilize it.

But, it's important to remember that YayPay's more sophisticated features come at a higher cost, which might be an issue for companies on a tight budget.

Furthermore, although YayPay allows integration with other systems, there might not be as much customization as there is with other options.

6. Invoiced

Invoiced offers a flexible AR automation platform designed to simplify invoicing and payment processes for businesses of all sizes.

With features such as:

- Automated invoicing

- Recurring billing

- Payment plans

- Customer portals

Invoiced provides a comprehensive solution to streamline financial operations.

What sets Invoiced apart is its flexibility in billing options, allowing businesses to tailor their invoicing processes to suit their specific needs.

Moreover, this platform has a really good user-friendly interface, ensuring a good user experience for both businesses and their customers.

However, businesses considering Invoiced should be aware that while it offers cost-effective solutions, some advanced features may be limited compared to other alternatives.

Additionally, it has been reported that customer support response times may vary, requiring patience during troubleshooting or assistance requests.

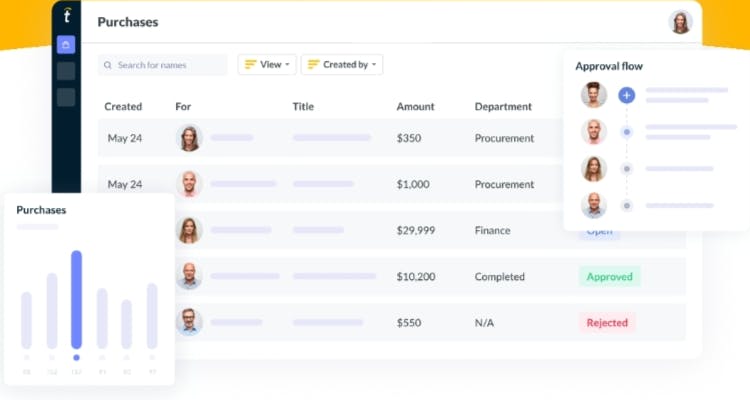

7. Tipalti

Tipalti specializes in automating accounts payable processes, making it an excellent alternative for businesses seeking streamlined payment solutions.

With Tipalti, businesses can:

- Automate invoice processing

- Manage supplier payments

- Ensure compliance with tax regulations

The platform's features include multi-entity management, global payment processing, and tax form generation.

It also has a strong emphasis on compliance and security makes it a trusted choice for businesses dealing with complex payment workflows.

However, businesses considering Tipalti should be aware that its advanced features may come with a higher price point, particularly for smaller organizations.

8. MineralTree

MineralTree offers end-to-end accounts payable automation, this makes it a good option for businesses of all sizes.

The platform has the following functions:

- Simplifies invoice capture

- Approval workflows

- Payment processing

This helps businesses save time and reduce manual errors.

MineralTree has an intuitive interface and good integration capabilities with existing accounting systems. This makes it easy to adopt and implement.

Additionally, MineralTree prioritizes security and compliance, offering features such as fraud detection and audit trails to safeguard financial transactions.

While MineralTree provides comprehensive AP automation solutions, businesses should evaluate their pricing structure to ensure it aligns with their budget and requirements.

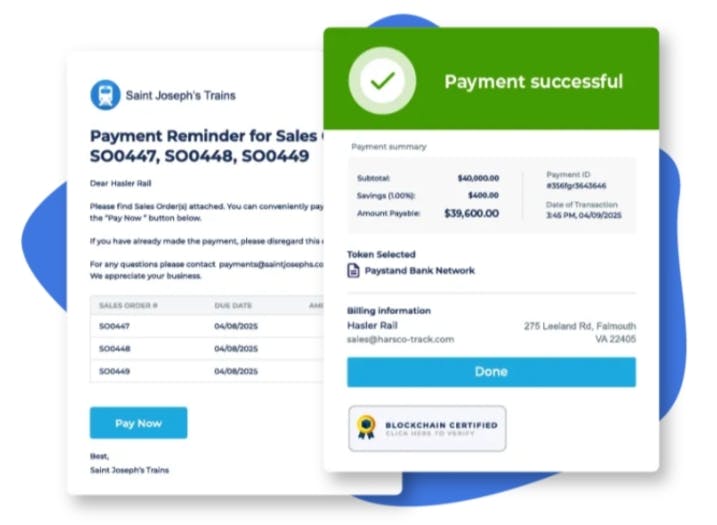

9. Paystand

Paystand revolutionizes B2B payments with its blockchain-powered payment network, offering businesses an alternative to traditional payment methods.

With Paystand, businesses can streamline invoice-to-cash processes, reduce transaction costs, and accelerate cash flow.

The platform's features include:

- Digital payments

- Automated reconciliation

- Real-time reporting

These empower businesses with greater transparency and efficiency in their financial operations.

10. Anybill

Anybill provides accounts payable automation solutions designed to simplify invoice processing and payment workflows.

Businesses can:

- Automate invoice capture

- Approval routing

- Payment execution

All while reducing manual tasks and improving efficiency.

The platform's flexible features cater to businesses of all sizes and industries, offering customizable workflows and integration capabilities with existing ERP systems.

However, businesses should consider their pricing model and scalability options to ensure Anybill meets their long-term needs.

11. Sage Intacct

Sage Intacct offers cloud-based financial management software that includes accounts receivable and accounts payable features.

As an alternative to HighRadius, Sage Intacct provides businesses with comprehensive tools for managing:

- Billing

- Invoicing

- Payment processes

The platform's scalability and flexibility make it suitable for businesses of all sizes, from startups to enterprise-level organizations.

Sage Intacct's advanced reporting and analytics capabilities offer valuable insights into financial performance.

Businesses should evaluate their pricing structure and implementation process to ensure a seamless transition to the platform as many users report it is not always easy to do so.

Why Look for HighRadius Alternatives?

While Tesorio is a good option, you might be looking for alternatives for several reasons.

Maybe you're seeking a tool with a specific feature Tesorio lacks, or perhaps you need a more budget-friendly option.

Alternatively, you might prefer a tool that's tailored to a specific industry or offers better customer support.

Whatever your reason, there's a range of excellent cash flow management tools out there to consider.

5 Criteria for Choosing Alternatives

You want straight to the point criteria to make the best decision. We are up for it.

When hunting for a HighRadius alternative, keep these key factors in mind:

1. Cost-Effectiveness

Budget is often a top consideration. You'll want a solution that provides good value for money without compromising on essential features.

2. Features and Functionality

Different businesses have different needs. Ensure the alternative you choose has all the necessary features to handle your specific requirements.

3. Ease of Use

No one wants to spend weeks figuring out how to use new software. Look for user-friendly options that won't require extensive training.

4. Customer Support

Good customer support can make or break your experience with a new tool. Look for alternatives with strong, responsive support teams.

5. Integration Capabilities

Ensure the software can seamlessly integrate with your existing systems, such as your ERP, CRM, or accounting software.

How to Decide Which Alternative is Right for You

Think About You. Well..Your Business Needs

Start by identifying your business's specific needs. Start by questioning everything

Do you need better AR automation, payment processing, or comprehensive invoicing solutions?

Budget Considerations

Evaluate your budget and determine how much you can afford to spend on an AR automation tool.

Remember to factor in any potential setup or integration costs.

Trial Periods and Demos

Take advantage of trial periods and demos to get a hands-on feel for the software. This will help you assess its usability and suitability for your business.

Scalability

Ensure the solution you choose can scale with your business.

You don't want to outgrow your software in a couple of years.

Conclusion

In a nutshell, Banktrack is a great alternative to HighRadius that focuses on financial process automation.

With intuitive tools for accounts receivable and payable management, as well as bank reconciliation, Banktrack simplifies financial operations.

Its user-friendly interface facilitates quick adoption, making it a solid choice for improving efficiency in businesses of any size.

Share this post

Related Posts

Advanced cash flow forecasting: techniques and tools

Master advanced cash flow forecasting with top techniques and tools like treasury software, AI analytics, BI platforms, and ERP systems to streamline financial planning and decision-making.A guide to cash flow monitoring

A guide to cash flow monitoring, highlighting strategies and tools for tracking business inflows and outflows to ensure financial stability and growth.9 steps to master money management

Mastering money management doesn’t have to be overwhelming. Our 9-step guide offers simple, actionable strategies to help you budget effectively and build a secure financial future.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed