Best 6 Practices for Managing Cash Effectively

- 6 Key Strategies for Effective Cash Management

- 1. Forecast Your Cash Needs

- 2. Optimize Accounts Receivable

- 3. Manage Accounts Payable

- 3. Control Inventory Levels

- 4. Secure Working Capital

- 6. Monitor Cash Position Regularly

- What Is Cash Management?

- Why Is Managing Cash Important?

- 4 Types of Tools for Better Cash Management

- Why Choose Banktrack to Manage your Cash Effectively

Best practices for managing cash effectively:

- Forecast Your Cash Flow

- Optimize Accounts Receivable

- Manage Accounts Payable

- Control Inventory Levels

- Secure Working Capital

- Monitor Cash Flow Regularly

Effective cash management is very important for any business.

Properly managing cash ensures you have enough money to meet your short-term obligations, take advantage of growth opportunities, and handle unexpected expenses.

We will explore key strategies and best practices for managing cash effectively. By the end, you'll understand how to keep your business financially healthy and prepared for the future.

6 Key Strategies for Effective Cash Management

Here are some essential strategies to help you manage cash more effectively:

1. Forecast Your Cash Needs

Creating a cash needs forecast involves estimating your future cash inflows and outflows. This helps you predict whether you'll have enough cash to cover your expenses and avoid shortfalls.

To create a cash needs forecast:

- Gather Historical Data: Review past cash flow statements to understand trends and patterns in your cash movements.

- Estimate Future Inflows: Project future cash inflows based on expected sales, customer payments, and other sources of income.

- Estimate Future Outflows: Predict future cash outflows, including operating expenses, loan payments, and other costs.

- Update Regularly: Regularly update your forecast to reflect changes in your business conditions and financial performance.

A well-prepared cash forecast helps you plan for the future and make informed decisions.

2. Optimize Accounts Receivable

Accounts receivable is the money your business is owed by customers.

Efficient management of accounts receivable ensures you get paid on time and maintain a healthy cash position.

To optimize accounts receivable:

- Set Clear Payment Terms: Clearly define payment terms for your customers, such as due dates and late fees.

- Offer Incentives for Early Payment: Provide discounts or other incentives to encourage customers to pay their invoices early.

- Implement Efficient Invoicing: Use automated invoicing systems to send out invoices promptly and accurately.

- Follow Up on Overdue Invoices: Regularly follow up and manage overdue invoices to prompt customers to pay and minimize delays. Effective management of accounts receivable improves cash availability and reduces the risk of late payments.

3. Manage Accounts Payable

Accounts payable is the money your business owes to suppliers and creditors. Properly managing accounts payable helps you maintain good relationships with suppliers and avoid late fees.

To manage accounts payable:

- Negotiate Payment Terms: Work with suppliers to negotiate favorable payment terms, such as extended payment deadlines.

- Prioritize Payments: Prioritize payments based on due dates and the importance of maintaining supplier relationships.

- Take Advantage of Discounts: Use early payment discounts offered by suppliers to reduce costs.

- Monitor Payable Aging: Regularly review your accounts payable aging report to ensure timely payments and avoid late fees.

Managing accounts payable effectively helps balance cash flow and maintain positive supplier relationships.

3. Control Inventory Levels

Inventory management is a critical aspect of cash management.

Excessive inventory ties up cash that could be used elsewhere, while insufficient inventory can lead to lost sales and customer dissatisfaction.

To control inventory levels:

- Implement Inventory Tracking: Use inventory management software to track stock levels and sales trends.

- Optimize Stock Levels: Maintain optimal inventory levels based on your sales forecasts and historical data.

- Reduce Obsolete Inventory: Regularly review your inventory for obsolete or slow-moving items and consider discounts or liquidation to free up cash.

- Improve Supply Chain Efficiency: Work with suppliers to improve lead times and reduce inventory holding costs.

Effective inventory control helps free up cash and ensures that resources are used efficiently.

4. Secure Working Capital

Working capital is the difference between your current assets and current liabilities. Adequate working capital is essential for meeting short-term financial obligations and supporting business operations.

To secure and manage working capital:

- Monitor Working Capital Ratio: Regularly review and manage your working capital ratio to ensure it meets your business needs.

- Manage Short-Term Financing: Explore short-term financing options, such as lines of credit or trade credit, to address temporary cash flow gaps.

- Optimize Cash Reserves: Maintain an appropriate level of cash reserves to handle unexpected expenses or fluctuations in cash flow.

Proper working capital management helps ensure that your business can meet its financial obligations and support growth.

6. Monitor Cash Position Regularly

Regularly monitoring your cash position is crucial for maintaining financial control and making timely adjustments.

Keeping a close eye on cash helps you identify potential issues early and take corrective actions.

To monitor your cash position effectively:

- Use Cash Management Reports: Generate and review regular cash management reports to track inflows, outflows, and your net cash position.

- Set Up Alerts: Implement cash management tools that provide alerts for critical thresholds or potential issues.

- Review Financial Statements: Regularly review your balance sheets and income statements to gain insights into your overall financial health.

Ongoing monitoring helps ensure that your cash remains available when needed and supports sound financial decision-making.

What Is Cash Management?

Cash management involves the collection, handling, and utilization of cash to ensure your business can meet its financial obligations and optimize its financial position.

It includes managing cash inflows and outflows, maintaining liquidity, and investing surplus cash wisely (also known as extra cash). Effective cash management ensures that your business remains stable, avoids insolvency, and can capitalize on growth opportunities.

There are three main types of cash management:

- Operating Cash Management: This involves managing the cash generated from daily business activities, such as receiving payments from sales and paying for operating expenses.

- Investing Cash Management: This includes managing cash flows related to purchasing or selling assets, like equipment or property.

- Financing Cash Management: This encompasses cash flows from borrowing money, repaying loans, or issuing stock.

Understanding these different aspects helps you manage your cash more effectively and ensure your business remains financially healthy.

Why Is Managing Cash Important?

Managing cash well is vital for several reasons:

- Liquidity: Proper cash management ensures you have enough cash on hand to meet your short-term needs, such as paying suppliers and employees.

- Operational Efficiency: Effective cash management prevents disruptions in your business operations due to cash shortages, helping you run your day-to-day activities smoothly.

- Financial Stability: Keeping track of your cash helps you avoid financial trouble and insolvency. It provides a cushion for unexpected expenses or downturns in the business.

- Growth Opportunities: With healthy cash management, you can invest in growth opportunities, like expanding your business, launching new products, or entering new markets.

- Creditworthiness: A strong cash position enhances your ability to secure loans or favorable terms from lenders and suppliers.

By managing cash effectively, you set your business up for success and sustainability.

4 Types of Tools for Better Cash Management

Using the right tools can enhance your cash management efforts. Here are some tools and software options that can help:

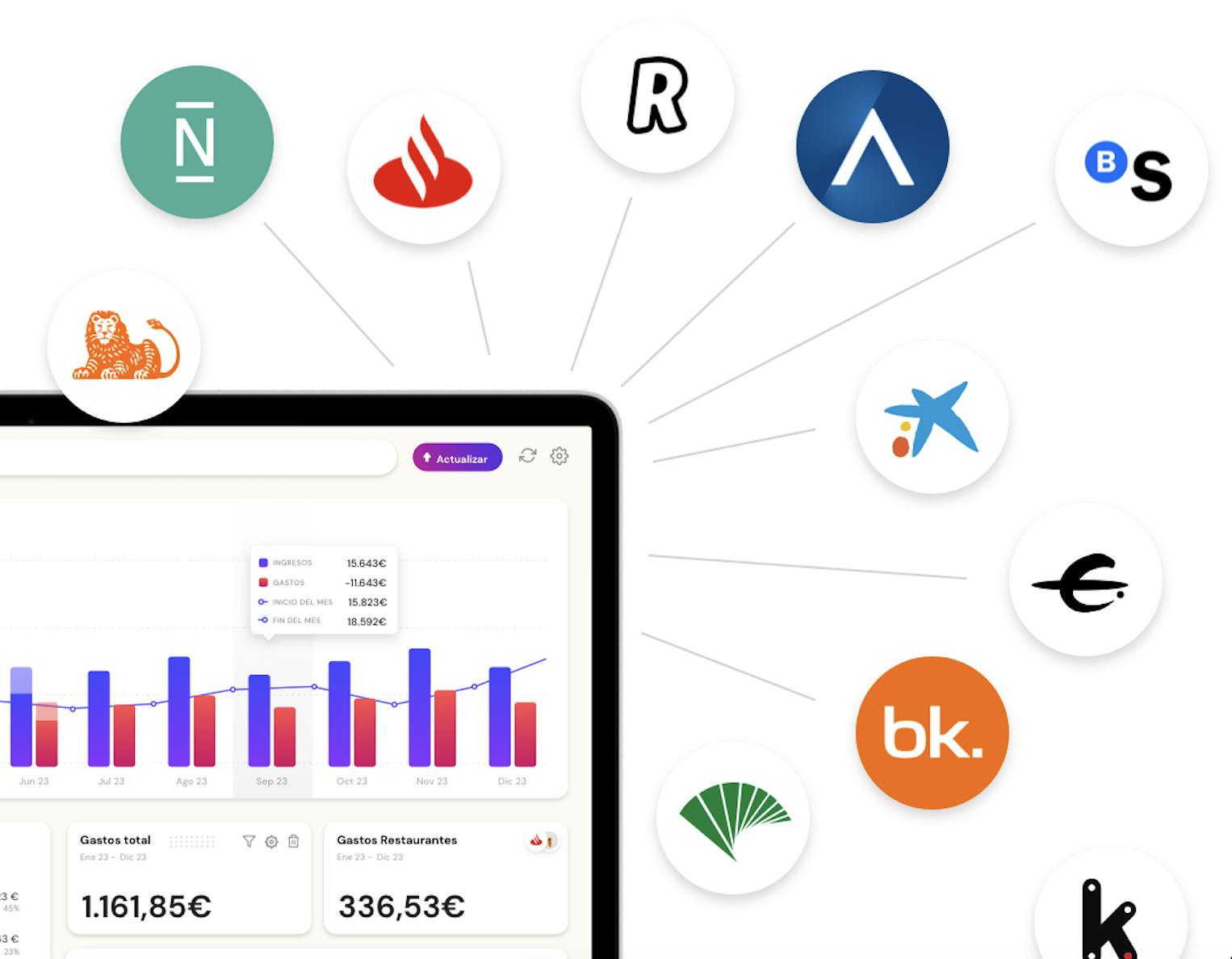

- Cash Management Software: Tools like Banktrack offer real-time insights, customizable dashboards, and integration with multiple bank accounts to streamline cash management.

Here’s why Banktrack is considered the best cash management app for corporations this year:

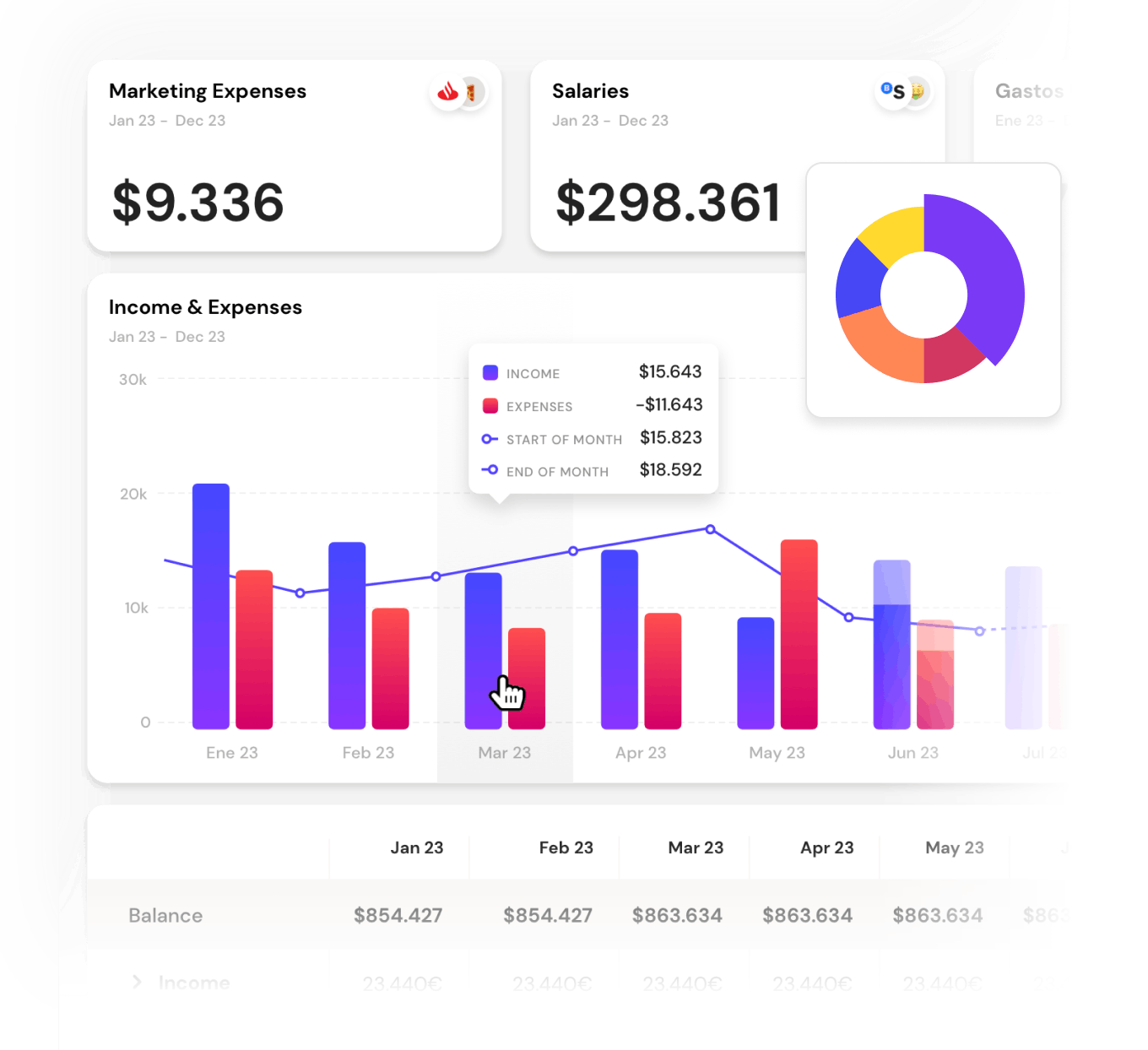

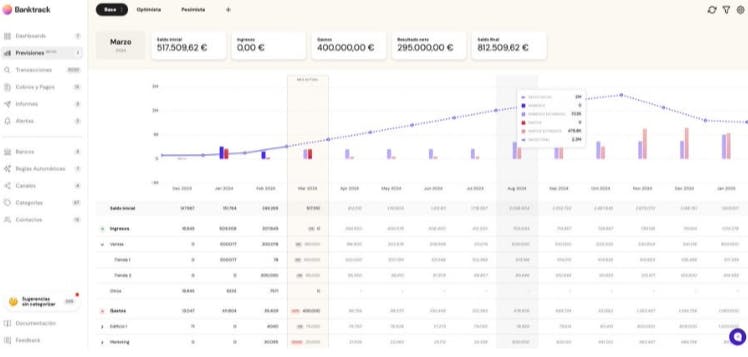

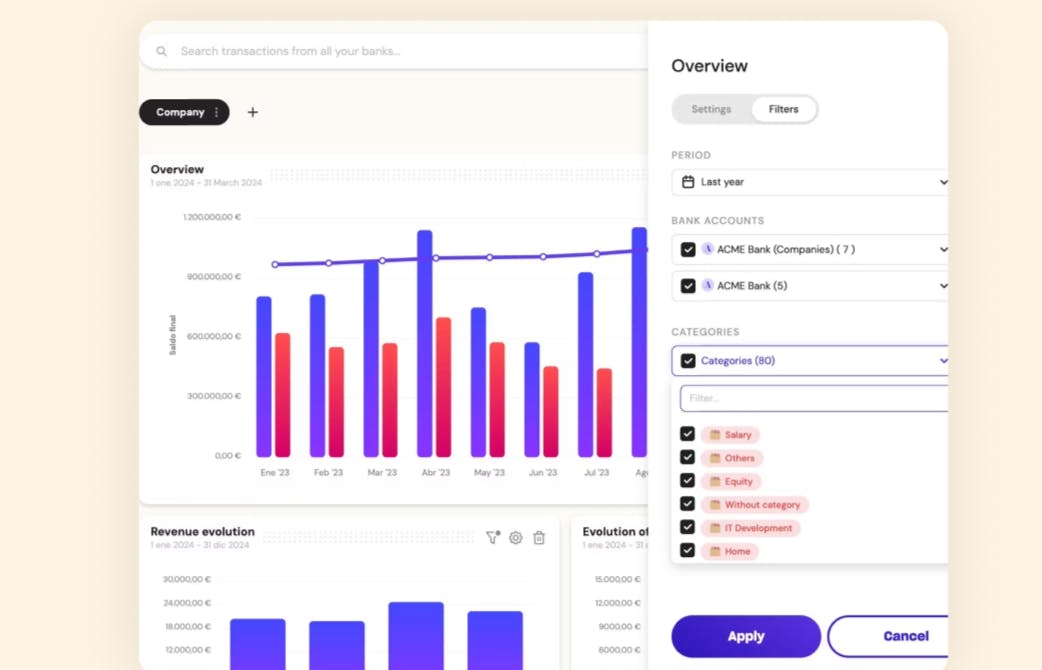

- Configurable Dashboards: Banktrack provides quick access to important financial data through configurable dashboards. These dashboards consolidate views from various bank accounts, businesses, and financial products, allowing users to monitor their cash position and financial activities comprehensively.

- Detailed Financial Tracking: The app enables users to create and customize categories for revenues and expenses. This feature helps in tracking and understanding financial activities in great detail, giving you a clearer picture of where your money is coming from and going to.

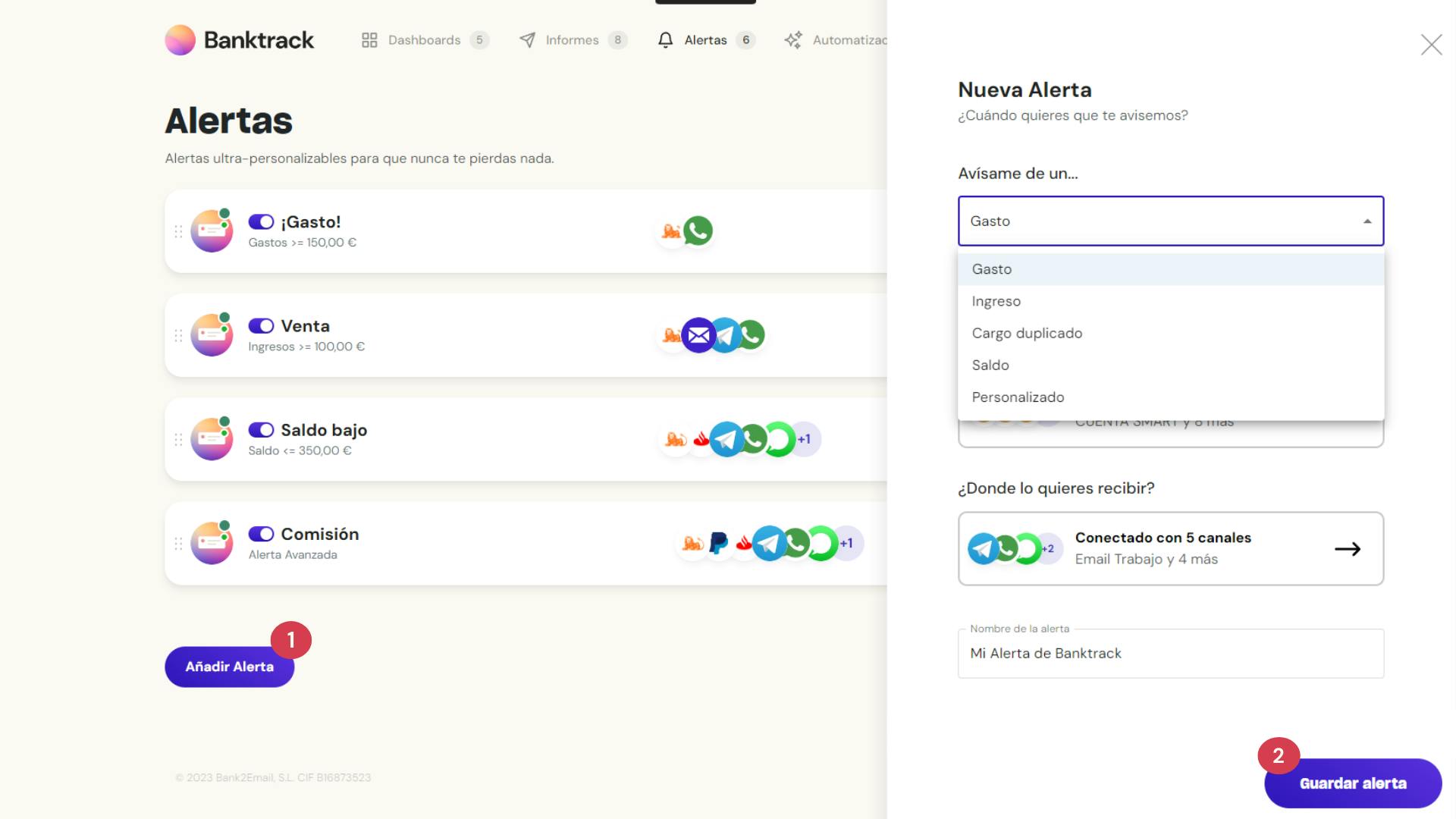

- Personalized Reports and Alerts: Banktrack offers personalized reports and alerts to keep users informed about their financial status. Notifications can be sent through various channels, including WhatsApp, SMS, email, Slack, or Telegram. This ensures that you receive timely updates on your expenses and financial activities.

- Bank Aggregation: One of Banktrack’s standout features is its bank aggregator, which allows users to link all their bank accounts. The app supports bank sync features with over 120 banks through both Open Banking (PSD2) and Direct Access connections. This efficient and secure integration provides a comprehensive view of your financial data across multiple accounts.

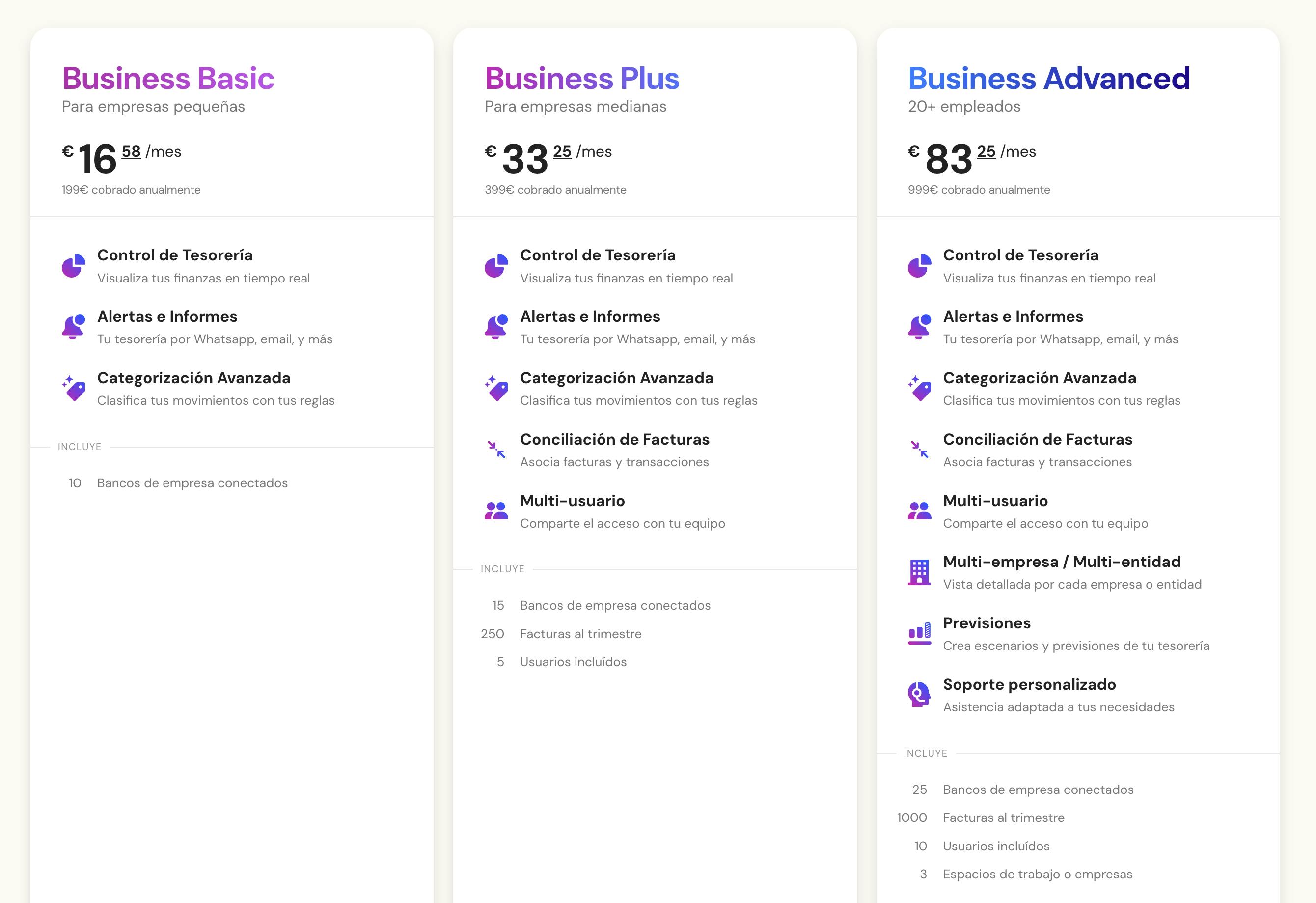

- Flexible Pricing: Banktrack offers a range of competitively priced plans to accommodate the needs and budgets of individuals, small businesses, and large enterprises. This flexibility ensures that businesses of all sizes can benefit from its advanced cash management features.

- Accounting Software: Accounting software helps automate invoicing, track expenses, and generate financial reports, making cash management easier.

- Inventory Management Software: Inventory management tools assist in tracking inventory levels, managing stock, and optimizing inventory turnover.

- Expense Management Tools: Tools for managing and tracking expenses help control costs and improve your cash position.

Making use of these tools can enhance your ability to manage cash effectively and make informed financial decisions.

Why Choose Banktrack to Manage your Cash Effectively

Managing cash is essential for the financial health and success of any business. By implementing key strategies such as forecasting cash needs, optimizing accounts receivable and payable, controlling inventory, and securing working capital, you can maintain liquidity, avoid financial difficulties, and support growth.

Regularly monitoring your cash position and using appropriate tools can further enhance your cash management efforts.

Banktrack’s combination of comprehensive financial overviews, customizable tracking, personalized alerts, advanced bank aggregation, flexible pricing, enhanced security, and user-friendly interface makes it the best cash management solution for businesses in 2024.

By choosing Banktrack, businesses can streamline their cash management processes, gain valuable insights, and maintain greater control over their financial health.

Share this post

Related Posts

Top 7 best cash flow management software in 2025

Wondering what the best cash flow management software is? With a cash flow management software by your side, you gain the clarity needed to understand how money moves within your business.Guide to liquidity management for businesses

Liquidity management is a crucial aspect of a company's financial strategy, it makes sure that a business can meet its short-term obligations and operate without financial disruptions.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed