How to keep track of business expenses in 2024

Effectively track business expenses in 2024 to maximize tax deductions and keep your finances organized.

- Why is it Important to Track Business Expenses?

- Financial Visibility and Control

- Tax Preparation and Compliance

- Budgeting and Planning

- 4 Key Strategies to Track Your Business Expenses

- 1. Separate Personal and Business Finances

- 2. Use a cash management software

- 3. Track Receipts

- 4. Categorize Expenses

- 4 Tips for Better Expense Tracking

- 1. Stay Consistent

- 2. Use Automation Wherever Possible

- 3. Regularly Review Your Expenses

- 4. Involve Your Team

- 3 Common Challenges in Expense Tracking

- Challenge 1: Overlooked Cash Expenses

- Challenge 2: Lost Receipts

- Challenge 3: Lack of a System

- Creating an Expense Tracking System for Your Business in 4 Steps

- Step 1: Choose Your Tracking Method

- Step 2: Set Up Categories

- Step 3: Establish a Process for Receipt Management

- Step 4: Implement Weekly and Monthly Reviews

- Benefits of Keeping Accurate Expense Records

- Tax Savings

- Improved Cash Flow Management

- Financial Insight for Strategic Planning

- Simplified Audits and Financial Reviews

- Choose Backtrack to Control Your Business Expenses

How to keep track of business expenses 2024

Keeping track of business expenses may seem like a hassle, but it's actually one of the smartest decisions you can make for your business.

When you know exactly where your money is going, you not only stay organized, but you set yourself up to make better decisions and avoid surprises at tax time.

So what if expense tracking really could make your life easier and your business stronger?

Why is it Important to Track Business Expenses?

Tracking expenses can reveal insights into your business that might otherwise go unnoticed.

Financial Visibility and Control

Knowing exactly where your money goes provides clarity on your spending patterns, enabling budgeting and spending decisions.

Tax Preparation and Compliance

Keeping accurate records of your expenses simplifies tax time and ensures you get all the deductions you’re eligible for.

Budgeting and Planning

Expense tracking allows you to compare actual spending against budgeted amounts, helping you adjust and plan for future business growth.

4 Key Strategies to Track Your Business Expenses

1. Separate Personal and Business Finances

One of the steps in tracking expenses is keeping personal and business finances separate. This makes tracking easier and can save you headaches later on.

- Open a Business Bank Account: Maintain a separate account to keep business transactions distinct.

- Get a Business Credit Card: Use a dedicated business credit card to build business credit and easily track expenses.

Looking for the best app for personal finance tracking? Finding the best app for personal finance tracking can make a significant difference in managing expenses, budgeting effectively, and achieving financial goals.

2. Use a cash management software

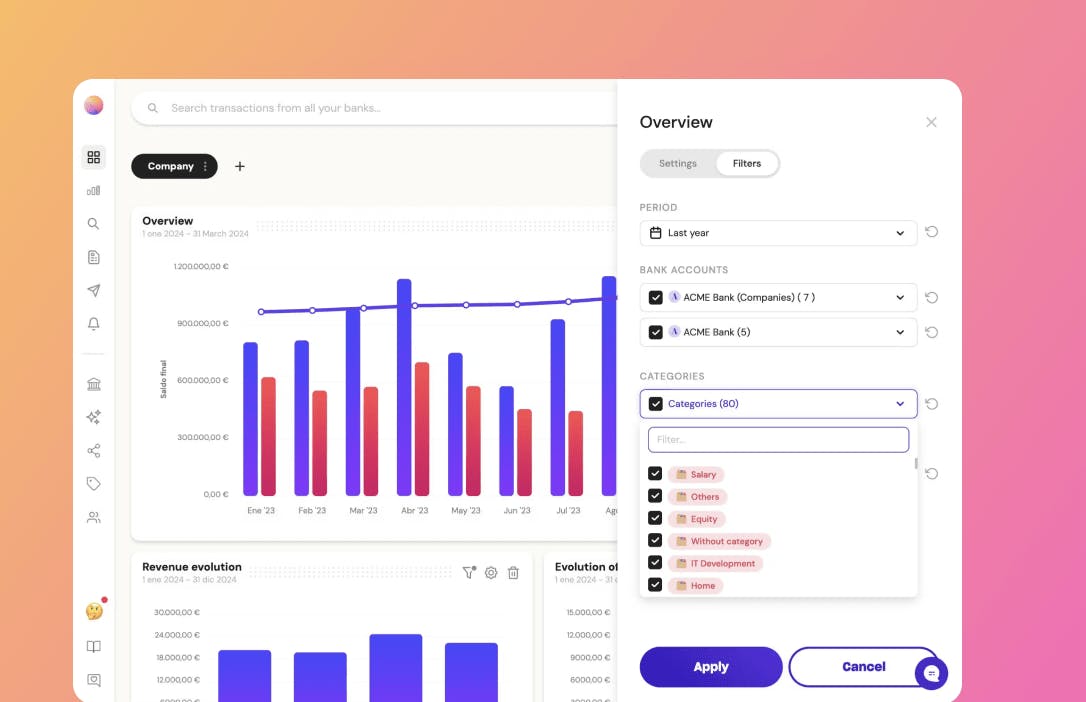

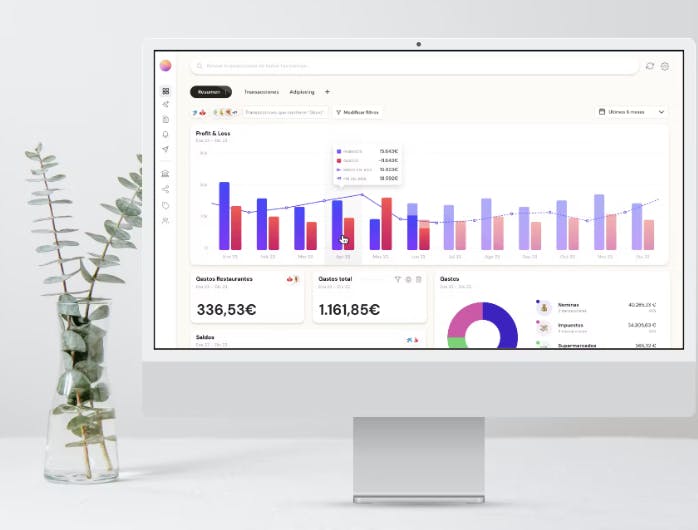

- Backtrack is the best cash management software for small and medium enterprises.

- Banktrack’s main strength lies in its ability to create personalized dashboards that integrate and link all bank accounts, enterprises and products.

- This flexibility allows users to rapidly access the information they need in the moment and in the most efficient way possible.

- You can also customize them to your specific needs at a given time.

Using a software can automate categorization and streamline data entry, letting you focus more on your business operations.

3. Track Receipts

Keeping receipts for all business purchases may seem tedious, but it’s essential for accurate record-keeping and tax compliance.

- Digitalize Receipts: Snap a photo or scan your receipts as soon as you receive them.

- Organize in Folders: Create folders for different categories like “Supplies,” “Marketing,” and “Travel” to make future searches easier.

- Use Expenses and Tracking Receipts Apps: Apps like Bankctrack can scan, categorize, and store receipts automatically, eliminating paper clutter.

4. Categorize Expenses

Categorizing expenses helps you understand quickly where your money is going. Typical business expense categories include:

- Office Supplies: Pens, paper, computers, and other office essentials.

- Travel and Meals: Flights, hotels, business meals, and mileage.

- Marketing and Advertising: Social media ads, printed materials, and promotions.

- Professional Services: Legal, consulting, and accounting fees.

Categorizing your expenses accurately can make analyzing spending patterns much easier.

If you are looking for a business expense tracker app that offers a complete set of features to help businesses manage their finances effectively, Banktrack is the right fit for you.

4 Tips for Better Expense Tracking

1. Stay Consistent

Consistency is key. Make it a habit to log expenses weekly (or even daily) to avoid a backlog of receipts and transactions.

2. Use Automation Wherever Possible

Automate tasks like bank transaction imports, expense categorization, and receipt scanning. Automation saves time and minimizes human error.

3. Regularly Review Your Expenses

Set aside time monthly to review and reconcile expenses. Reviewing expenses regularly helps identify errors, catch overspending, and adjust your budget if needed.

4. Involve Your Team

If you have a team, make sure everyone understands the importance of proper expense reporting. Clear guidelines and training can prevent errors and ensure accuracy.

3 Common Challenges in Expense Tracking

Challenge 1: Overlooked Cash Expenses

Cash transactions are easy to forget but need to be tracked. To avoid this, record cash transactions immediately or use a petty cash account to keep them separate.

Challenge 2: Lost Receipts

Lost receipts can lead to discrepancies. Digitalizing receipts after purchase ensures you have a record and reduces paper clutter.

Challenge 3: Lack of a System

Without a system, expense tracking can get messy. Use a cash flow spreadsheet, app, or software to stay organized.

Creating an Expense Tracking System for Your Business in 4 Steps

Step 1: Choose Your Tracking Method

Choose between manual tracking or an automated app or software. Consider factors like the size of your business, your budget, and how much time you can dedicate to tracking expenses.

Step 2: Set Up Categories

Define expense categories relevant to your business. Clear categories make it easier to stay organized and analyze expenses for future budgeting.

Step 3: Establish a Process for Receipt Management

Decide whether you’ll store physical receipts, digitalize them, or use a hybrid system. Set up folders in your app or cloud storage to make retrieval easy.

Step 4: Implement Weekly and Monthly Reviews

Weekly reviews keep you on top of expenses and let you address any discrepancies quickly. Monthly reviews are ideal for assessing your overall spending and planning for future budgets.

Benefits of Keeping Accurate Expense Records

Tax Savings

Detailed records of expenses help you take advantage of every tax deduction available. Consult with a tax professional to ensure you’re maximizing deductions.

Improved Cash Flow Management

Understanding your expenses helps you make informed cash flow decisions, which is crucial for the longevity of your business.

Financial Insight for Strategic Planning

Expense tracking reveals spending patterns and helps you decide where to allocate funds for growth.

Simplified Audits and Financial Reviews

Having organized records can make audits and financial reviews less stressful. You’ll have documentation ready if your business ever faces an audit.

Choose Backtrack to Control Your Business Expenses

Effectively tracking business expenses may seem overwhelming, but with the right tools and a clear system, it becomes a manageable task.

Banktrack stands out for its real-time transaction tracking, extensive bank integration, strong security measures, and dynamic cash flow forecasting, making it an excellent choice for businesses looking for a complete solution.

By implementing these strategies and utilizing technology, you can keep track of your business expenses with ease and accuracy, setting a strong financial foundation for your business.

Share this post

Related Posts

Top 10 Small Business Expense Tracking Softwares

Managing your small business finances can be stressful and overwhelming at times. That is where these expense tracking software solutions come in.The potential of EBITA to evaluate cash flow

EBITA is a very useful metric to evaluate cash flow. Ever wondered how businesses gauge their true operational performance? Meet EBITA!

Try it now with your data

- Your free account in 2 minutes

- No credit card needed