A guide to investment tracking

- Why Investment Tracking is Essential for Every Investor

- Step 1: Understand Your Financial Goals

- Step 2: Set Up an Organized System for Tracking

- Manual Tracking

- Investment Tracking Software

- Step 3: Track 5 Key Metrics for Each Investment

- 1. Total Return

- 2. Expense Ratios

- 3. Dividend Yield

- 4. Price-to-Earnings (P/E) Ratio

- 5. Risk Levels

- Step 4: Use Banktrack for Comprehensive Investment Tracking

- Why Banktrack Stands Out for Investment Tracking

- How to Set Up Investment Tracking in Banktrack

- Step 5: Review and Adjust Your Portfolio Regularly

- How Often Should You Review?

- Portfolio Rebalancing

- Step 6: Keep an Eye on Fees and Taxes

- 3 Types of Fees to Watch

- Minimize Taxes

- Step 7: Use Historical Data for Long-Term Planning

- Step 8: Set Up Alerts and Notifications

- Types of Alerts to Set Up

- Consistently Track your Investments with Banktrack

This is a guide to investment tracking.

Investing can be a powerful way to grow wealth and secure your financial future, but the key to successful investing is keeping a close eye on how your investments perform over time.

Tracking your investments doesn’t just mean checking stock prices, it’s about understanding your portfolio, monitoring its progress, and making adjustments as needed.

This guide will walk you through the essentials of investment tracking and show you how to manage your portfolio with ease.

Why Investment Tracking is Essential for Every Investor

Whether you’re a beginner or a seasoned investor, tracking your investments is crucial for maximizing returns and minimizing risks.

By keeping track of your portfolio’s performance, you can:

- Evaluate Progress Toward Financial Goals: Regular tracking helps you see if you’re on track to meet your financial goals, like retirement or buying a home.

- Identify Underperforming Assets: Tracking lets you spot investments that aren’t performing as expected, so you can make timely adjustments.

- Manage Risk: By regularly reviewing your portfolio, you can ensure it stays balanced and in line with your risk tolerance.

Now, let’s dive into the steps you need to take for effective investment tracking.

Step 1: Understand Your Financial Goals

Before you start tracking investments, clarify your financial goals. Different goals may require different investment strategies:

- Short-term goals: If you’re investing for a short-term goal (like a vacation or down payment), you may prefer lower-risk assets.

- Long-term goals: For retirement or long-term wealth building, you might focus on higher-risk, high-reward assets like stocks.

Identifying your goals will help you track progress and measure if your portfolio is aligned with your objectives.

Step 2: Set Up an Organized System for Tracking

An organized system is crucial to make tracking easier. You can choose between a manual method (like a cash flow spreadsheet) or investment tracking software.

Manual Tracking

Creating a spreadsheet in Excel or Google Sheets can be a straightforward way to monitor investments. You can list:

- Investment name and type (stock, bond, ETF, etc.)

- Purchase date and price

- Current value

- Dividends or interest earned

- Gain/loss percentage

Spreadsheets offer flexibility but require manual updating. They’re ideal if you have a smaller portfolio and enjoy the hands-on approach.

Investment Tracking Software

For a more automated experience, use dedicated investment tracking software.

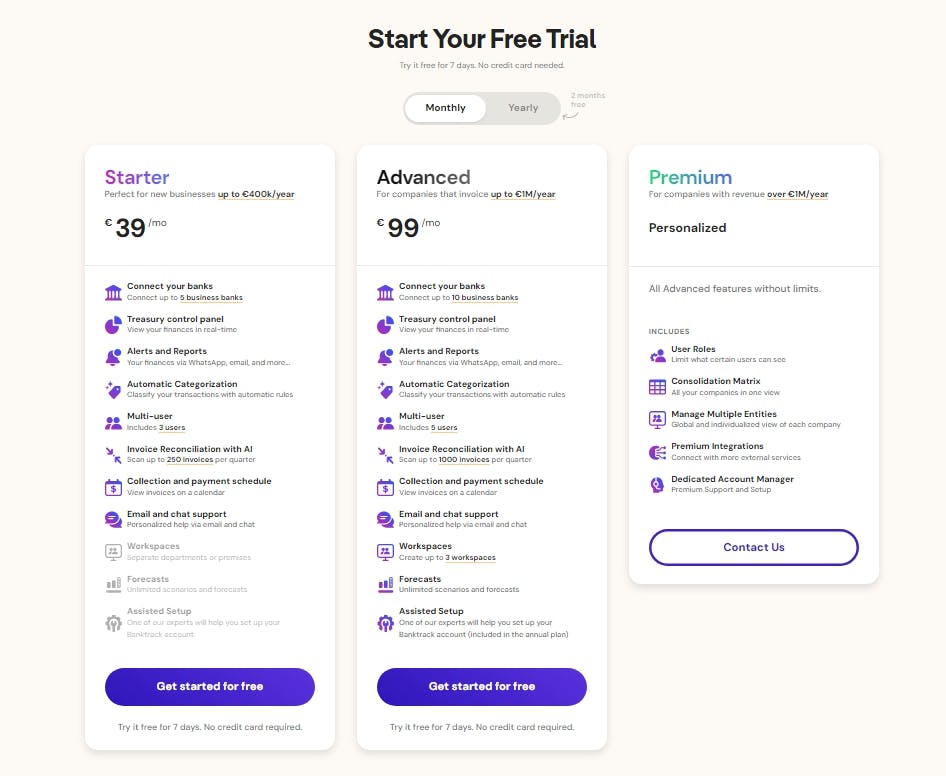

Many tools connect with your brokerage accounts, providing real-time updates on your portfolio’s performance. Examples of popular investment tracking software include Banktrack, Personal Capital and Quicken.

Step 3: Track 5 Key Metrics for Each Investment

When tracking investments, focus on metrics that reflect each asset’s performance and help guide your investment decisions. Here are some key metrics to track:

1. Total Return

Total return includes both capital gains and dividends. This metric provides a holistic view of how an investment has performed over time.

2. Expense Ratios

For mutual funds and ETFs, check the expense ratios. High expense ratios can cut into returns, so aim for funds with low fees.

3. Dividend Yield

If you invest in dividend stocks, track the dividend yield to understand the income generated from these investments.

4. Price-to-Earnings (P/E) Ratio

The P/E ratio indicates whether a stock is over- or undervalued. By tracking this metric, you can evaluate if your stock picks align with your investment strategy.

5. Risk Levels

Volatility and beta (a measure of a stock’s sensitivity to the market) are useful for understanding an asset’s risk level. This is crucial for maintaining a portfolio that matches your risk tolerance.

By regularly monitoring these metrics, you’ll have a clearer picture of your investments’ performance and risk profile.

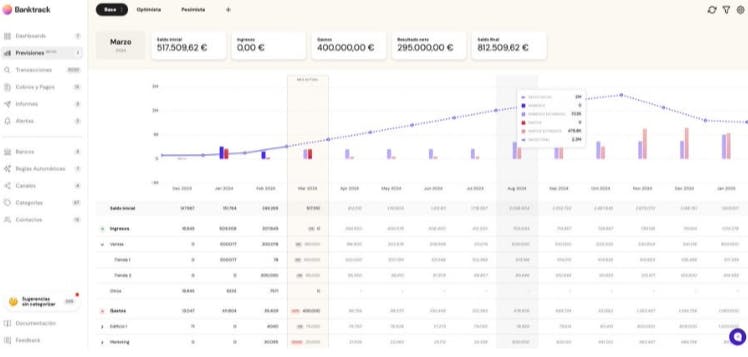

Step 4: Use Banktrack for Comprehensive Investment Tracking

One of the most comprehensive tools for investment tracking is Banktrack.

Originally designed as a treasury management software, Banktrack offers a suite of features that make it easy for businesses to manage investments.

Why Banktrack Stands Out for Investment Tracking

Banktrack provides unique features tailored to simplify investment tracking:

- Real-Time Financial Tracking: Connect Banktrack to multiple accounts to monitor cash flow, asset values, and portfolio performance in real-time. This feature saves you the hassle of manual updates.

- Customizable Dashboards: Banktrack allows you to create personalized dashboards, so you can view key metrics at a glance. Track overall portfolio performance or zoom in on specific investments.

- Accurate Forecasting Tools: Banktrack’s forecasting capabilities are useful for anticipating future performance based on historical data, helping you make informed investment decisions.

- Automatic Reports: Banktrack offers automated reporting, so you can track gains, losses, and other essential metrics without extra work. Generate reports monthly, quarterly, or annually to see how your portfolio evolves over time.

How to Set Up Investment Tracking in Banktrack

- Connect Your Accounts: Link your brokerage or bank accounts to Banktrack for real-time data.

- Customize Your Dashboard: Set up widgets that show essential metrics, such as total return, asset allocation, and dividend yield.

- Schedule Reports: Choose how often you want Banktrack to generate reports, so you always have up-to-date information on your investments.

Using a tool like Banktrack not only saves time but also ensures you have the data you need to make smart financial choices.

Step 5: Review and Adjust Your Portfolio Regularly

Investment tracking doesn’t end with watching the numbers. You should also regularly review and adjust your portfolio to keep it aligned with your goals.

How Often Should You Review?

For most investors, a quarterly review is sufficient. However, if there’s a major life change or market shift, consider reviewing more frequently.

Portfolio Rebalancing

Over time, some investments may outperform others, causing your portfolio to become unbalanced. Rebalancing involves selling overperforming assets and buying underperforming ones to maintain your desired asset allocation.

- Example: If your goal is a 70/30 stock-to-bond allocation but stocks have grown to 80%, you’d sell some stocks and buy bonds to get back to 70/30.

Rebalancing ensures you’re not exposed to unnecessary risk and keeps your investments in line with your strategy.

Step 6: Keep an Eye on Fees and Taxes

Investment fees and taxes can eat into your returns if you’re not careful. Regularly review fees associated with your investments to ensure you’re not overpaying.

Additionally, consider the tax implications of buying and selling assets.

3 Types of Fees to Watch

- Trading Fees: These are charged by brokers whenever you buy or sell investments. Look for low-fee brokers to keep costs down.

- Management Fees: Many mutual funds and ETFs charge management fees. Compare funds and choose ones with low expense ratios.

- Advisor Fees: If you’re working with a financial advisor, ensure you understand their fee structure and consider if it’s worth the value they provide.

Minimize Taxes

Investment profits are often subject to capital gains taxes. To minimize taxes:

- Hold investments for over a year to benefit from lower long-term capital gains tax rates.

- Invest in tax-advantaged accounts like IRAs or 401(k)s, which offer tax breaks on contributions or withdrawals.

Understanding fees and tax strategies is essential for keeping more of your money invested and growing over time.

Step 7: Use Historical Data for Long-Term Planning

One of the best ways to make informed decisions about your portfolio is by analyzing historical data.

This can show you how your investments have performed over different market cycles and help you predict future trends.

- Compare Yearly Performance: Look at how each investment has performed year over year. Some tracking tools, like Banktrack, allow you to view historical data trends easily.

- Examine Market Conditions: Consider how broader economic conditions have affected your portfolio. Tracking this data helps you understand how investments react to economic changes.

Using historical data as part of your tracking routine can provide valuable insights, especially if you’re planning for long-term financial goals.

You can take advantage of Banktrack’s dashboard so you can visually see all expenses and plan ahead.

Step 8: Set Up Alerts and Notifications

Many investment tracking tools allow you to set up alerts. These notifications can inform you about significant changes, like price drops or news related to your investments.

By staying informed, you can make adjustments quickly and avoid potential losses.

Types of Alerts to Set Up

- Price Alerts: Get notified if an asset’s price falls below or rises above a set threshold.

- Dividend Notifications: Know when dividend payments are scheduled to be issued.

- News Alerts: Receive news updates on companies or sectors you’ve invested in.

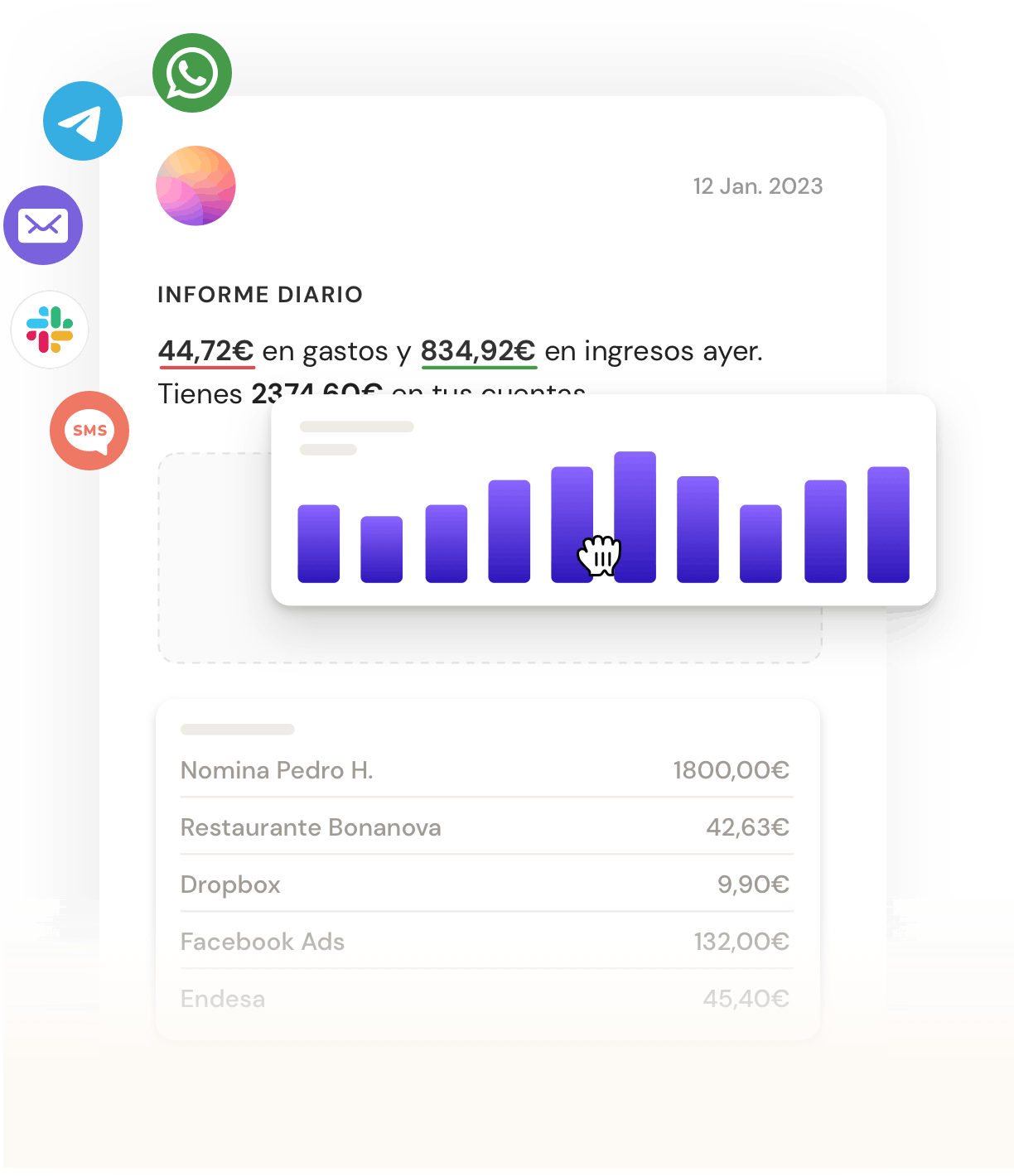

With Banktrack’s alerts, you can stay proactive and manage your expenses without constantly checking their status.

Consistently Track your Investments with Banktrack

Investment tracking is a simple but effective way to ensure your portfolio is aligned with your goals. Whether you’re tracking manually with spreadsheets or using an advanced tool like Banktrack, having a reliable system in place can make a big difference in managing your investments.

With these steps, you can confidently monitor your portfolio, make informed decisions, and keep your investments on track toward long-term financial success.

Remember, investment tracking isn’t about obsessing over every little change; it’s about staying informed, balanced, and ready for whatever the market throws your way.

Share this post

Related Posts

9 steps to master money management

Mastering money management doesn’t have to be overwhelming. Our 9-step guide offers simple, actionable strategies to help you budget effectively and build a secure financial future.How to manage your money when your income is seasonal

Managing money on a seasonal income can be challenging, but with the right strategies, you can thrive.How to take control of your money in 2024

Take charge of your finances in 2024 with practical tips on budgeting, saving, investing, and managing debt. Start the new year strong by mastering your money.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed