How to manage your money when your income is seasonal

- Why Managing Seasonal Income Requires a Unique Approach

- Step 1: Understand Your Income Patterns

- Step 2: Calculate Your Average Monthly Income

- Example:

- Step 3: Build a Lean, Essential Budget

- Prioritize Essential Expenses:

- 50/30/20 Budget with a Seasonal Twist:

- Step 4: Open a Separate Account for “Off-Season” Savings

- How to Use Your Off-Season Fund

- Step 5: Automate Your Bills and Savings

- Automate Your Expenses Like This:

- Step 6: Track Your Spending with Banktrack

- Why Use Banktrack?

- Step 7: Plan for Big Expenses

- Step 8: Adjust for Slow Months

- How to Downsize Your Budget During Slow Months

- Step 9: Diversify Your Income Streams

- Step 10: Build an Emergency Fund

- Emergency Fund Tips:

- Embrace the Flexibility of Seasonal Income with Banktrack

This is how you can manage your money when your income is seasonal.

When you have a seasonal income, budgeting and managing money can be challenging.

With cash flow coming in waves, some months good, others slow, knowing how to handle your finances smartly is essential.

This guide will help you create a system for budgeting, saving, and spending, so you can make it through the dry months without stress.

Why Managing Seasonal Income Requires a Unique Approach

For people with a regular paycheck, budgeting is fairly straightforward.

But if you’re a freelancer, seasonal worker, or anyone with an irregular income, traditional budgeting doesn’t always work.

Without consistent paychecks, it’s harder to predict how much you’ll have each month.

This guide will show you how to:

- Plan for peak and slow seasons

- Create a buffer for lean months

- Build a stable, easy-to-manage budget

By putting these strategies into place, you can enjoy the upsides of a seasonal income without stressing during the slow times.

Step 1: Understand Your Income Patterns

The first step in managing seasonal cash flow is understanding when and how much you earn throughout the year.

Look back at your income over the last year (or a few years, if possible) to spot trends. You might find that:

- Summer months bring in the most income if you work in tourism, landscaping, or similar fields.

- Winter months are busier if you’re in retail, holiday planning, or the entertainment industry.

- Freelancers and gig workers might find income fluctuating randomly, so look for overall peaks and dips. Be sure to keep track of this type of income in an efficient way, for example, you can use a cash management software for freelancers.

This “income map” will give you a sense of when to expect high and low cash flow. Write down these patterns or plot them in a spreadsheet for easy reference.

Step 2: Calculate Your Average Monthly Income

Once you have an idea of how much you make during peak and slow months, calculate your average monthly income:

- Add up your income from the past year.

- Divide by 12 to get an average monthly amount.

This average will act as your baseline budget each month, even when you make more than usual. By sticking to this average, you can save any excess for slower months.

Example:

Let’s say you made $60,000 last year. Dividing that by 12 gives an average monthly income of $5,000.

So, even in months when you make $7,000, aim to live on $5,000, and put the extra $2,000 into savings for future lean months.

Step 3: Build a Lean, Essential Budget

A lean budget focuses on covering only your essential expenses. By setting up a budget based on your average income, you can reduce the risk of overspending during high-earning months.

Prioritize Essential Expenses:

Include things like:

- Rent/mortgage

- Utilities

- Groceries

- Transportation

- Minimum debt payments

Once you’ve covered these basics, allocate funds toward:

- Savings for slow months: This is your lifeline when income is low.

- Emergency fund: Ideally, you’ll want a buffer that covers three to six months of essential expenses.

50/30/20 Budget with a Seasonal Twist:

If you’re looking for a budget structure, try the 50/30/20 budget rule modified for seasonal income:

- 50% for essentials

- 20% for saving during high months (skip or lower this during slow months)

- 30% for discretionary spending (cut down when income dips)

By prioritizing savings during peak months, you’re creating a financial cushion that’ll help during the leaner times.

Step 4: Open a Separate Account for “Off-Season” Savings

Opening a dedicated savings account for slow months can keep your finances organized and avoid the temptation to overspend.

Think of this as your “off-season fund” to help cover your essentials when income is low.

How to Use Your Off-Season Fund

- Deposit excess income during peak months directly into this account.

- Withdraw from this account only during slow months when you need extra cash.

Using a separate account also makes it easier to track your progress and see how long you can last on saved income.

Ideally, aim to save enough to cover three to six months’ worth of expenses, though even a smaller amount can be a helpful buffer.

Step 5: Automate Your Bills and Savings

Automatic transfers are a game-changer, especially when your income fluctuates.

Set up automatic transfers from your main account to your off-season savings account during high months, so saving becomes effortless.

Additionally, automating essential bill payments will help you avoid late fees and keep up with obligations, no matter your income. You can use a bill management app to streamline this process.

Automate Your Expenses Like This:

- Set a monthly transfer from your main account to your off-season fund.

- Automate bill payments for essentials like rent, insurance, and utilities.

- Schedule minimum debt payments to avoid penalties.

By automating these transfers and payments, you can ensure you’re prioritizing savings and bills even if you get busy.

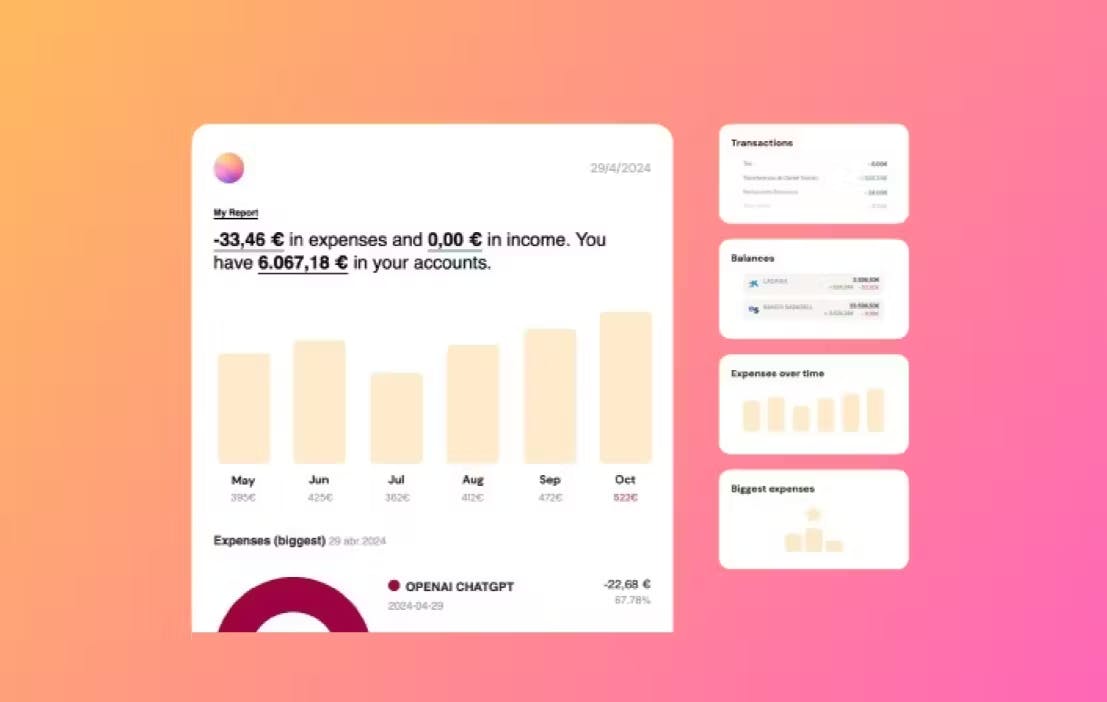

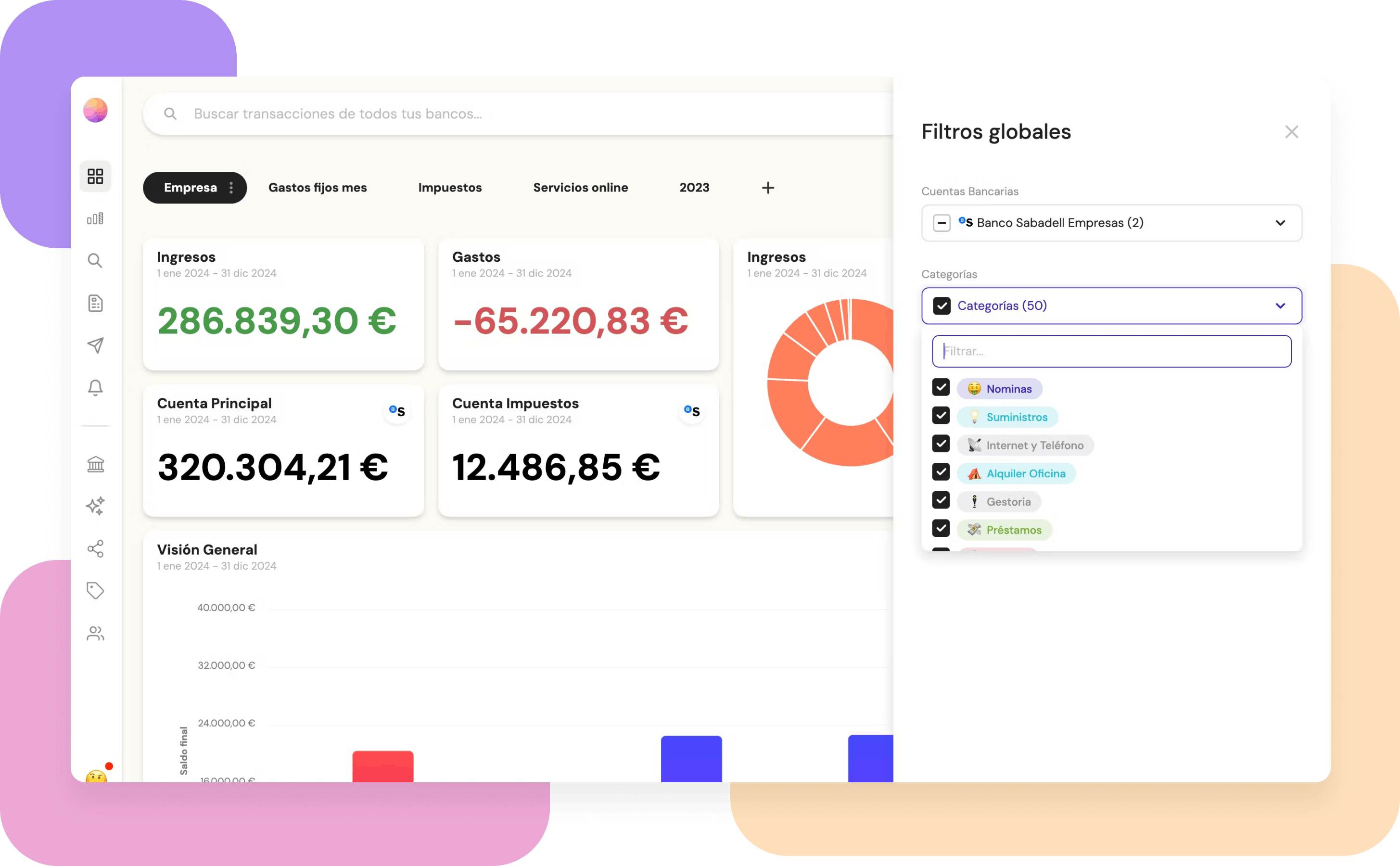

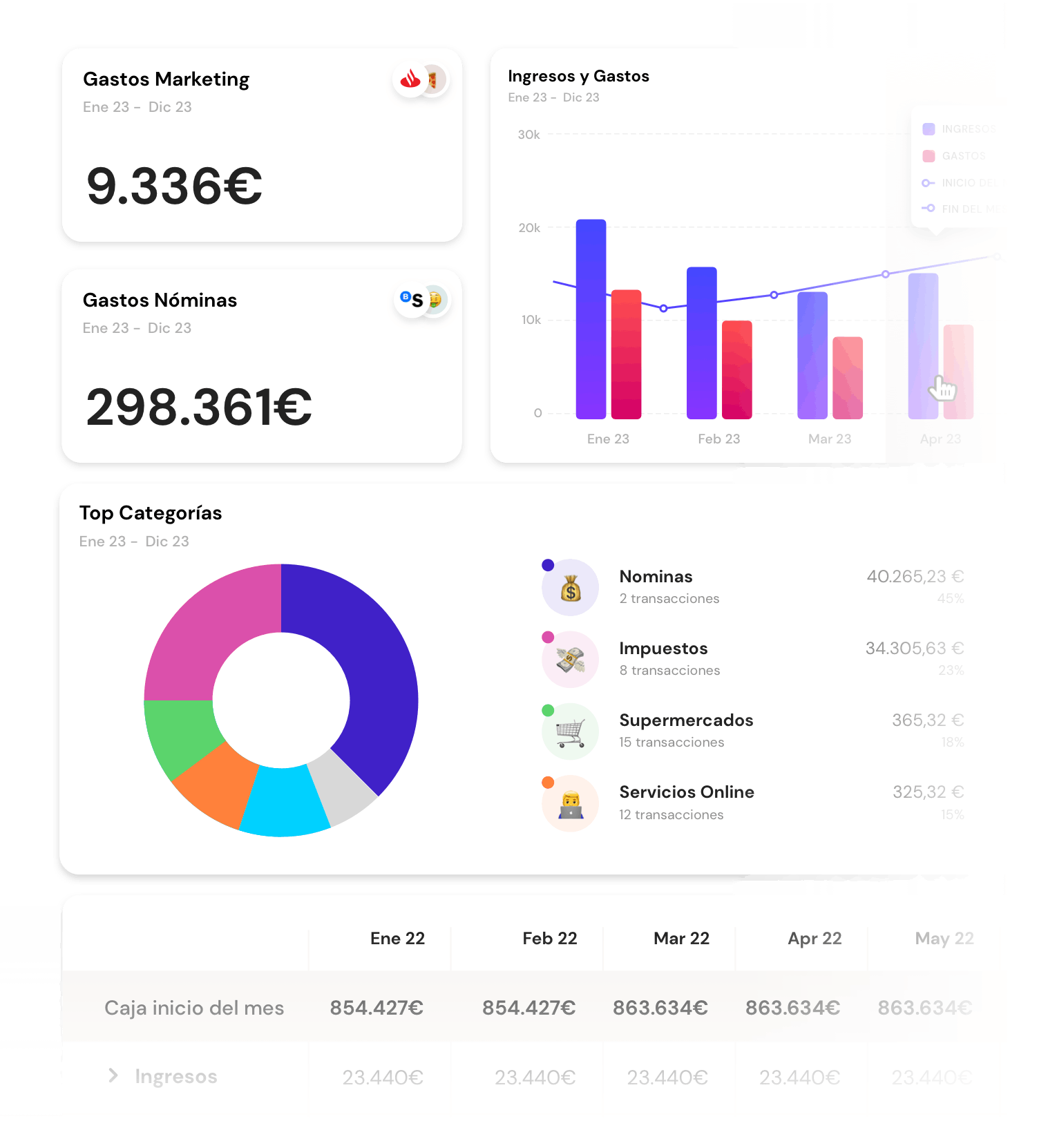

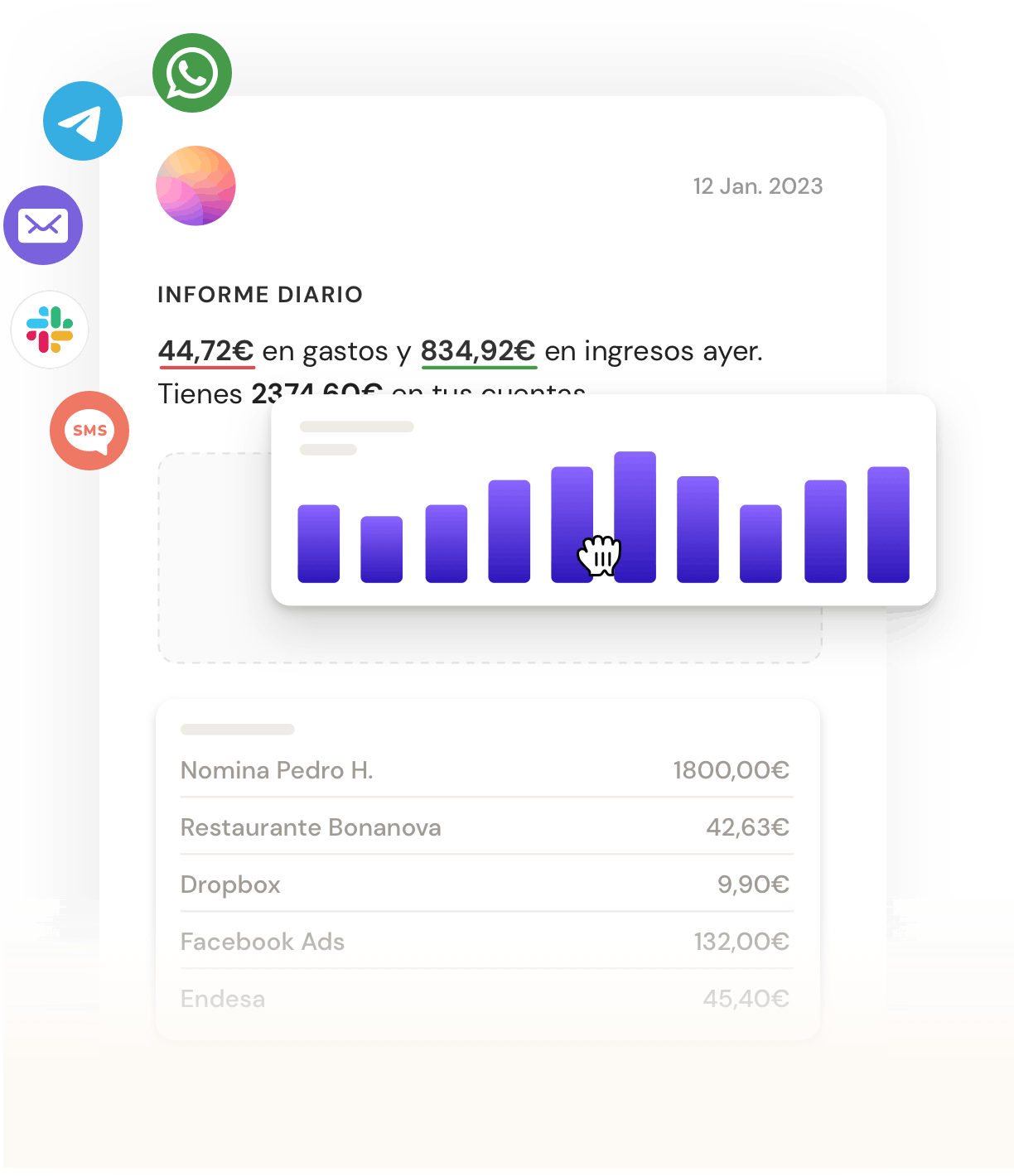

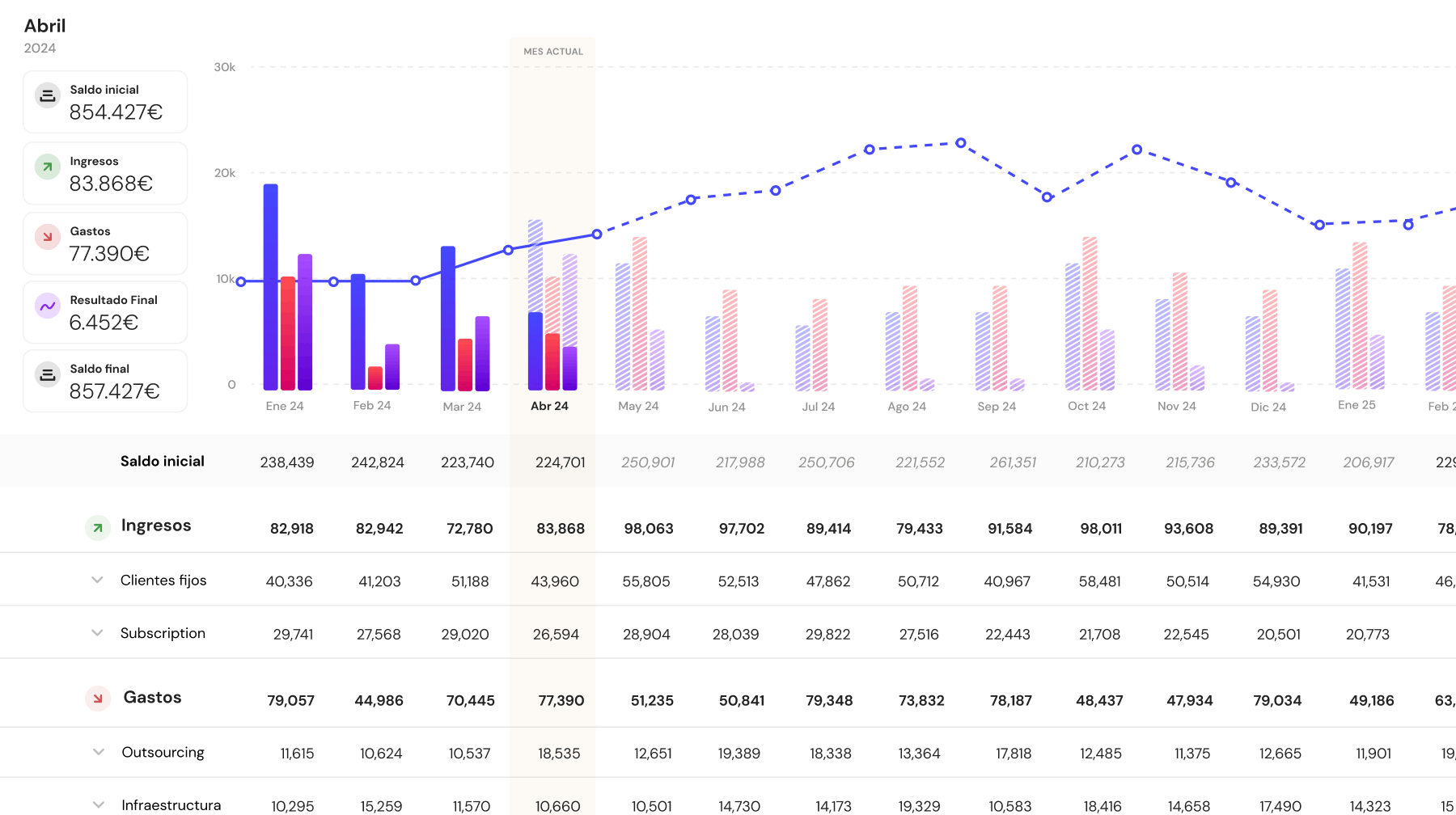

Step 6: Track Your Spending with Banktrack

When income is seasonal, knowing where every dollar goes is essential. Tracking spending helps you stay on budget during high and low months.

Banktrack is a great expense tracking app to keep tabs on your finances, especially for freelancers and gig workers with fluctuating income.

Why Use Banktrack?

Banktrack is a very complete finance tracking software designed to give you full control over your finances.

Here’s how it can make managing seasonal income easier:

- Real-Time Financial Tracking: Connect multiple accounts to Banktrack and get an instant view of your cash flow. This feature is ideal for tracking spending during high-earning months and monitoring balances during slower periods.

- Customizable Reports: With Banktrack, you can generate custom reports for expenses, cash flow, and income. This allows you to analyze spending patterns and adjust your budget as needed.

- Forecasting Tools: Banktrack’s forecasting tools help you plan for future expenses based on past data. This feature is especially helpful for those with seasonal income, as it can help you anticipate lean periods and save accordingly.

Using a tool like Banktrack helps you keep every dollar accounted for, so you’re never caught off-guard by unexpected expenses.

Step 7: Plan for Big Expenses

For seasonal earners, planning for big expenses (like vacations, holidays, or large purchases) is crucial.

Without proper planning, these can disrupt your budget and drain your savings. Here’s how to approach big expenses:

- Save Ahead: Start setting aside a little each month toward big expenses. If you know holiday spending ramps up in December, save a bit from each paycheck.

- Time Large Purchases: Schedule big purchases during peak months when income is high. This minimizes the impact on your budget and keeps your finances stable.

- Consider a Sinking Fund: Open a separate account for large expenses and put small amounts into it each month. This helps spread out the cost over time and reduces financial strain.

Step 8: Adjust for Slow Months

When your income dips, you’ll need to adjust your budget. This might mean cutting back on non-essential spending and living off your saved income.

How to Downsize Your Budget During Slow Months

- Pause Discretionary Spending: Reduce or eliminate non-essentials like dining out or entertainment.

- Use Your Off-Season Fund: Withdraw only what you need to cover essentials.

- Reevaluate Variable Expenses: Look at areas like groceries or utilities to see if you can cut costs temporarily.

By temporarily downsizing, you can extend your savings and avoid taking on debt during slow periods.

Step 9: Diversify Your Income Streams

Relying on a single income source can be risky when your income is seasonal. Adding an extra source of income can give you more financial stability. Here are some ideas:

- Freelance or gig work: Many online platforms offer freelance gigs that allow you to work during slower times.

- Passive income: Investing in stocks, bonds, or rental property can provide extra cash flow.

- Seasonal part-time work: If you’re not working year-round, consider picking up a part-time job during off-seasons.

These additional income streams can smooth out the ups and downs of seasonal work, providing a financial cushion when you need it most.

Step 10: Build an Emergency Fund

An emergency fund is essential for anyone, but it’s especially important when income is unpredictable.

Aim to save enough to cover three to six months of expenses. Having an emergency fund gives you peace of mind and prevents debt from piling up during unexpected situations.

Emergency Fund Tips:

- Save a little each month: Even $50 a month adds up over time.

- Keep it accessible: Choose a high-yield savings account for easy access and potential growth.

- Replenish during peak months: If you have to dip into your emergency fund, prioritize replenishing it during high-income periods.

Embrace the Flexibility of Seasonal Income with Banktrack

Managing money with a seasonal income takes some extra planning, but it’s possible to create stability even with irregular paychecks.

With a strong budget, an off-season fund, and tools like Banktrack, you can make the most of every dollar and feel confident in your financial future.

Share this post

Related Posts

Best 7 Cash Flow Management Tools in Finland for 2025

These are the best cash flow management tools in Finland: Banktrack Procountor Netvisor Visma eAccounting Fennoa Float QuickBooks Online In Finland’s competitive business environment, from Helsinki’s8 MoneyWiz alternatives for personal finance management

Looking for alternatives to MoneyWiz for managing personal finances? Explore 8 top apps that simplify budgeting and track expenses.9 steps to master money management

Mastering money management doesn’t have to be overwhelming. Our 9-step guide offers simple, actionable strategies to help you budget effectively and build a secure financial future.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed