What is a Cash Flow Spreadsheet?

- What is a Cash Flow Spreadsheet?

- 5 Key Components of a Cash Flow Spreadsheet

- Types of Cash Flow Spreadsheets

- Why is a Cash Flow Spreadsheet Important?

- 1. Helps Maintain Financial Stability

- 2. Improves Decision-Making

- 3. Identifies Cash Flow Trends

- 4. Facilitates Budgeting and Forecasting

- 5. Supports Fundraising Efforts

- How to Create a Cash Flow Spreadsheet in 7 Steps

- Step 1: Set Up Your Spreadsheet

- Step 2: Input Opening Balance

- Step 3: List All Cash Inflows

- Step 4: List All Cash Outflows

- Step 5: Calculate Net Cash Flow

- Step 6: Update Closing Balance

- Step 7: Review and Analyze

- 4 Tips for Managing Your Cash Flow Spreadsheet

- How Banktrack Can Help You Manage Your Cash Flow Spreadsheet

- How Banktrack Can Enhance Cash Flow Management

- Why Consider Using Banktrack?

- Why a Cash Flow Spreadsheet is Essential for Financial Success

What is a cash flow spreadsheet? Here is all you need to know about it.

Managing a business's finances effectively is crucial for its survival and growth.

One of the most essential tools for achieving this is a cash flow spreadsheet.

Whether you’re a small business owner, a financial manager, or simply someone looking to understand where your money is going, a cash flow spreadsheet can provide the clarity you need.

In this guide, we’ll explain what a cash flow spreadsheet is, why it’s important, how to create one, and how tools like Banktrack can help streamline the process.

What is a Cash Flow Spreadsheet?

A cash flow spreadsheet is a financial document or tool that helps you track, analyze, and manage the flow of cash in and out of your business over a specific period.

It provides a detailed breakdown of all incoming cash (such as sales revenue, loans, or other income) and outgoing cash (like expenses, salaries, and loan repayments), allowing you to see your net cash position at any point in time.

5 Key Components of a Cash Flow Spreadsheet

A cash flow spreadsheet typically includes the following components:

- Opening Balance: The amount of cash available at the beginning of the period.

- Cash Inflows: All the money coming into the business, such as sales revenue, interest income, or loans.

- Cash Outflows: All the money leaving the business, including operating expenses, rent, salaries, taxes, and loan repayments.

- Net Cash Flow: The difference between cash inflows and outflows over the period. Positive net cash flow indicates more cash coming in than going out, while negative net cash flow indicates the opposite.

- Closing Balance: The amount of cash remaining at the end of the period, which becomes the opening balance for the next period.

Types of Cash Flow Spreadsheets

There are different types of cash flow spreadsheets depending on the specific needs of the business:

- Daily or Weekly Cash Flow Spreadsheet: Tracks cash flow on a daily or weekly basis, ideal for businesses with high transaction volumes or those that need to closely monitor liquidity.

- Monthly Cash Flow Spreadsheet: Provides a broader overview, tracking monthly cash inflows and outflows, suitable for most small to medium-sized businesses.

- Annual Cash Flow Spreadsheet: Offers a long-term perspective, useful for financial planning and strategy.

Why is a Cash Flow Spreadsheet Important?

A cash flow spreadsheet is more than just a list of numbers; it is a vital tool for financial health and decision-making. Here’s why:

1. Helps Maintain Financial Stability

By keeping track of all cash inflows and outflows, a cash flow spreadsheet helps ensure that you always know your current cash position.

This is critical for avoiding situations where you run out of cash to cover expenses, which can lead to missed payments, damaged supplier relationships, or even bankruptcy.

2. Improves Decision-Making

With a clear picture of your cash flow, you can make better financial decisions.

For example, you might decide to delay a non-essential purchase, speed up collections, or take out a short-term loan if you see a potential cash shortfall.

On the other hand, knowing you have a healthy cash reserve might encourage you to invest in growth opportunities.

3. Identifies Cash Flow Trends

A cash flow spreadsheet allows you to analyze trends over time, helping you identify patterns, such as seasonal fluctuations or recurring expenses.

This can help you plan ahead and ensure that you have sufficient cash reserves during lean periods.

4. Facilitates Budgeting and Forecasting

A cash flow spreadsheet is also essential for budgeting and forecasting.

By analyzing past cash flows, you can make more accurate predictions about future cash needs, ensuring that your business remains financially stable.

5. Supports Fundraising Efforts

If you need to raise capital from investors or lenders, a well-maintained cash flow spreadsheet can demonstrate your business's financial health and liquidity management capabilities.

It provides transparency and builds confidence that your business can handle its finances responsibly.

How to Create a Cash Flow Spreadsheet in 7 Steps

Creating a cash flow spreadsheet may seem daunting at first, but it’s quite straightforward once you know the key elements to include. Here’s a step-by-step guide:

Step 1: Set Up Your Spreadsheet

Start by setting up a spreadsheet in a tool like Microsoft Excel, Google Sheets, or another spreadsheet application.

Create columns for each of the key components of cash flow:

- Date

- Description

- Inflows

- Outflows

- Net Cash Flow

- Balance

Step 2: Input Opening Balance

Begin with your opening cash balance. This is the amount of cash you have at the start of the period you’re tracking (e.g., the first day of the month).

Step 3: List All Cash Inflows

Under the inflows column, list all the sources of incoming cash. This could include:

- Sales revenue: Cash received from customers for goods or services.

- Accounts receivable: Payments collected from customers who bought on credit.

- Other income: Such as interest earned, grants, or loans.

Step 4: List All Cash Outflows

Next, under the outflows column, list all the cash payments you expect to make during the period, including:

- Operating expenses: Rent, utilities, office supplies, etc.

- Payroll: Salaries, wages, and benefits paid to employees.

- Loan repayments: Any scheduled loan payments or interest.

- Taxes: Estimated tax payments.

- Capital expenditures: Purchases of equipment or other fixed assets.

Step 5: Calculate Net Cash Flow

For each period (day, week, month), calculate the net cash flow by subtracting total outflows from total inflows.

This will tell you whether you have a positive or negative cash flow for that period.

Step 6: Update Closing Balance

To determine your closing balance, add the net cash flow to your opening balance.

This closing balance becomes the opening balance for the next period.

Step 7: Review and Analyze

Review your cash flow spreadsheet regularly to analyze trends, identify and deal with cash flow problems, and make informed financial decisions.

4 Tips for Managing Your Cash Flow Spreadsheet

- Automate Where Possible: Use formulas to automate calculations in your spreadsheet, reducing the chance of errors and saving time.

- Keep It Up-to-Date: Update your cash flow spreadsheet regularly (daily, weekly, or monthly) to ensure it accurately reflects your financial situation.

- Use Historical Data: Incorporate historical data to identify trends and improve the accuracy of your forecasts.

- Stay Realistic: When forecasting, be realistic about your expected inflows and outflows. Overly optimistic cash flow projections can lead to financial trouble.

How Banktrack Can Help You Manage Your Cash Flow Spreadsheet

While a manually maintained spreadsheet is a great tool for tracking cash flow, using a digital tool like Banktrack can significantly enhance your financial management capabilities.

How Banktrack Can Enhance Cash Flow Management

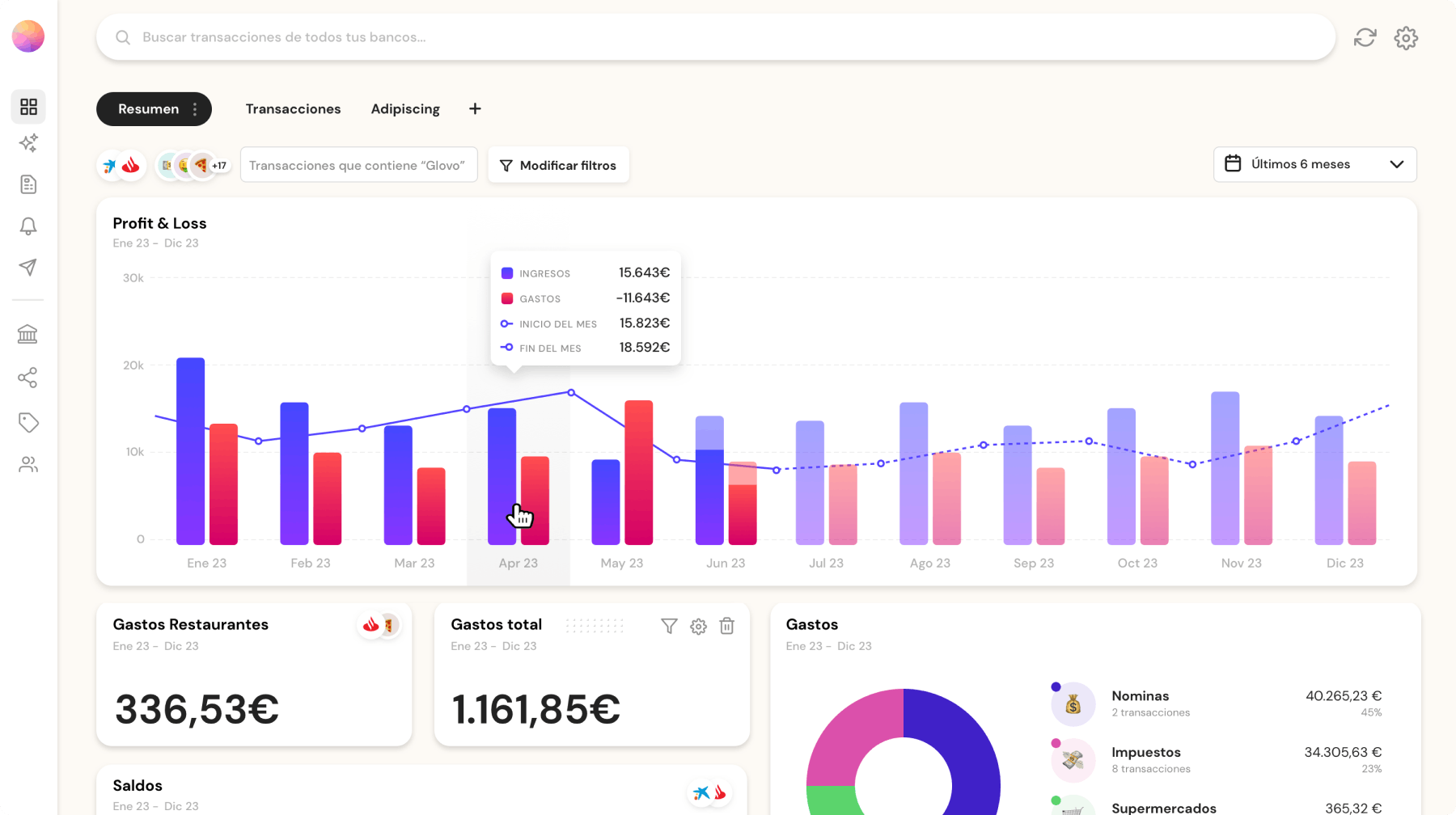

- Custom Dashboards: Banktrack allows you to create custom dashboards that consolidate all your bank accounts and financial transactions in one place. This makes it easy to monitor your cash flow and update your spreadsheet accordingly.

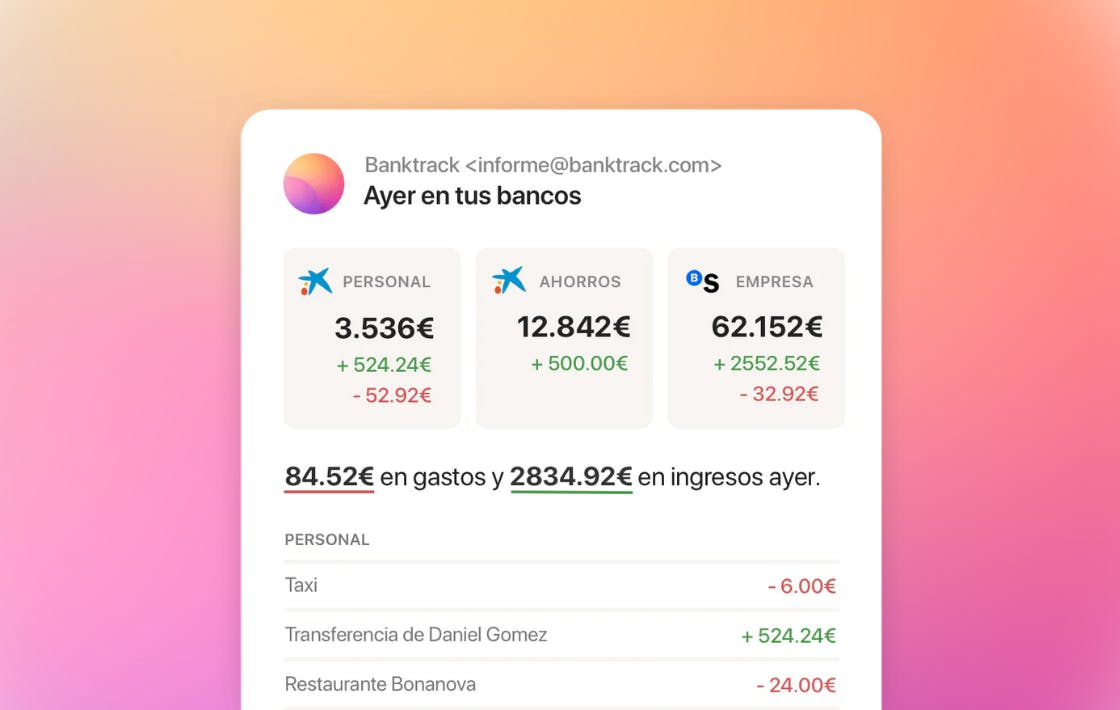

- Real-Time Alerts: Set up real-time alerts to notify you of important cash movements, such as large deposits or withdrawals, allowing you to react quickly to changes in your cash flow.

- Advanced Categorization: Automatically categorize your income and expenses, making it easier to track where your money is going and adjust your cash flow spreadsheet with accurate data.

- Configurable Reports: Generate customizable reports that provide a clear overview of your cash position, helping you identify trends and make informed decisions.

- Integration with Multiple Accounts: Connect multiple bank accounts to a single platform, allowing you to view and manage all cash inflows and outflows without switching between different systems.

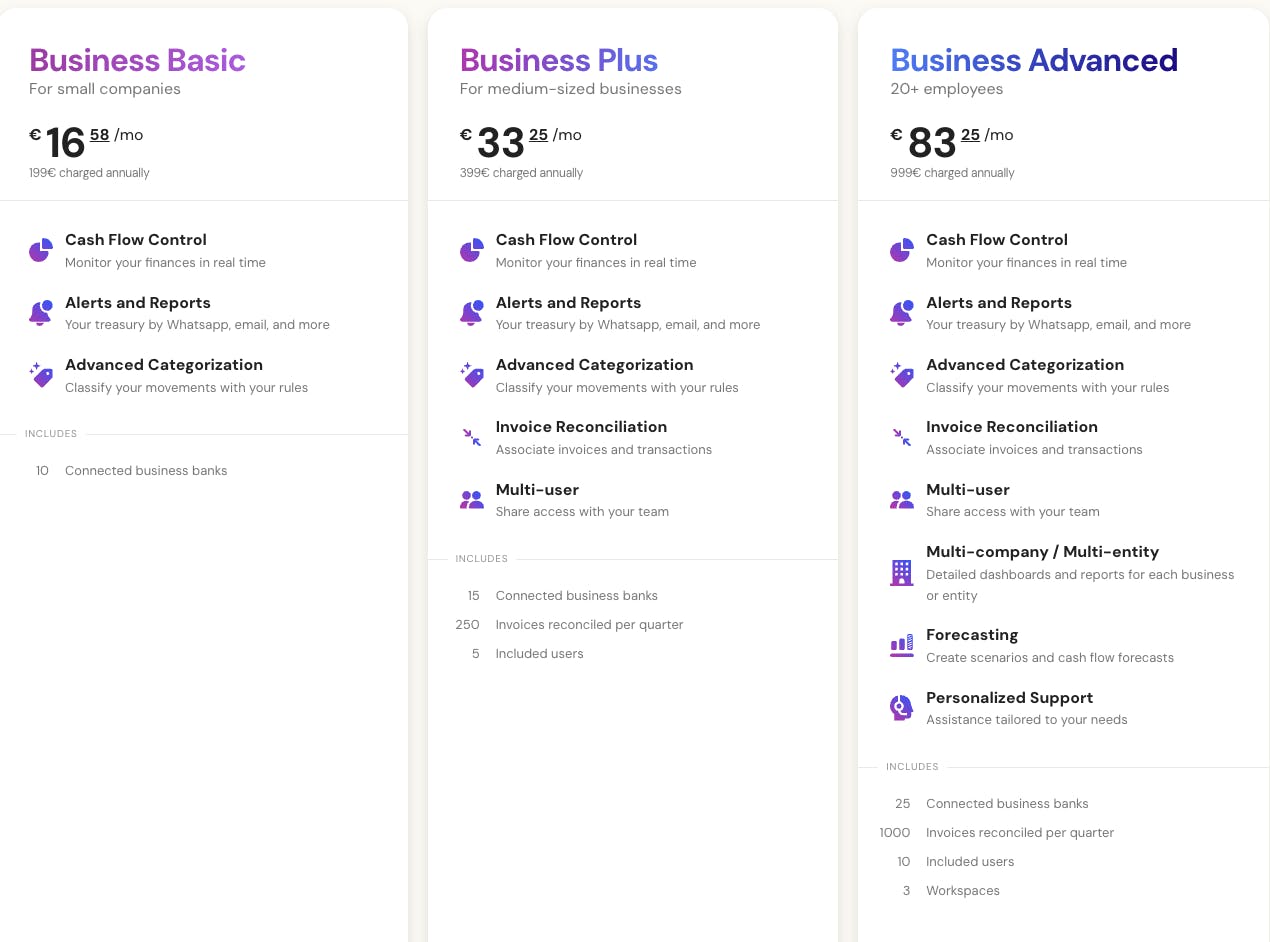

- Affordable and Accessible: With a free trial and affordable plans starting at just €16.58 per month, Banktrack makes advanced cash flow management accessible for businesses of all sizes.

Why Consider Using Banktrack?

Banktrack can save you time and effort by automating many of the tasks associated with managing a cash flow spreadsheet.

Its features help you maintain a clear view of your cash flow, reduce errors, and make better financial decisions.

Whether you’re managing a small business or a larger enterprise, Banktrack provides a user-friendly platform to keep your cash flow healthy.

Why a Cash Flow Spreadsheet is Essential for Financial Success

A cash flow spreadsheet is an indispensable tool for any business looking to maintain financial stability, improve decision-making, and prepare for the future. By keeping track of all cash inflows and outflows, a cash flow spreadsheet helps you understand your financial health, identify trends, and ensure you have enough cash to cover your obligations.

While creating and maintaining a spreadsheet manually is a good start, using a tool like Banktrack can take your cash flow management to the next level. With features like custom dashboards, real-time alerts, advanced categorization, and configurable reports, Banktrack helps you stay on top of your cash flow effortlessly.

So, whether you’re just starting or looking to optimize your financial management practices in 2024, a cash flow spreadsheet.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed