Guide to liquidity management for businesses

- What is Liquidity Management?

- 4 Key Components of Liquidity Management

- 1. Cash Forecasting:

- 2. Short-term Debt and Investments:

- 3. Credit Lines:

- 4 Accounts Receivable and Payable Optimization:

- 3 Types of Liquidity

- 1. Asset Liquidity:

- 2. Market Liquidity:

- 3. Accounting Liquidity:

- The Importance of Liquidity Risk Management

- How to Assess Liquidity with 3 Simple Metrics

- 1. Current Ratio:

- 2. Quick Ratio:

- 3. Cash Ratio:

- 5 Factors Impacting Liquidity Risk

- Best Practices for Liquidity Management

- 1. Regular Financial Reviews:

- 2. Inventory Management:

- 3. Accounts Management:

- 4. Expense Minimization:

- Conclusion about Liquidity Management

Liquidity management is a crucial aspect of a company's financial strategy, ensuring that a business can meet its short-term obligations and operate smoothly without financial disruptions.

It involves managing cash flow, assets, and liabilities to maintain adequate liquidity levels.

Effective liquidity management impacts a company's working capital and overall financial health, allowing it to avoid unnecessary debt and asset liquidation.

So why not fully understand it so you can foresee these problems?

What is Liquidity Management?

Liquidity management involves proactive strategies to manage a company's cash flow, assets, and liabilities, ensuring that there is enough cash available to meet financial obligations as they arise.

It is vital for maintaining operational stability and avoiding financial distress.

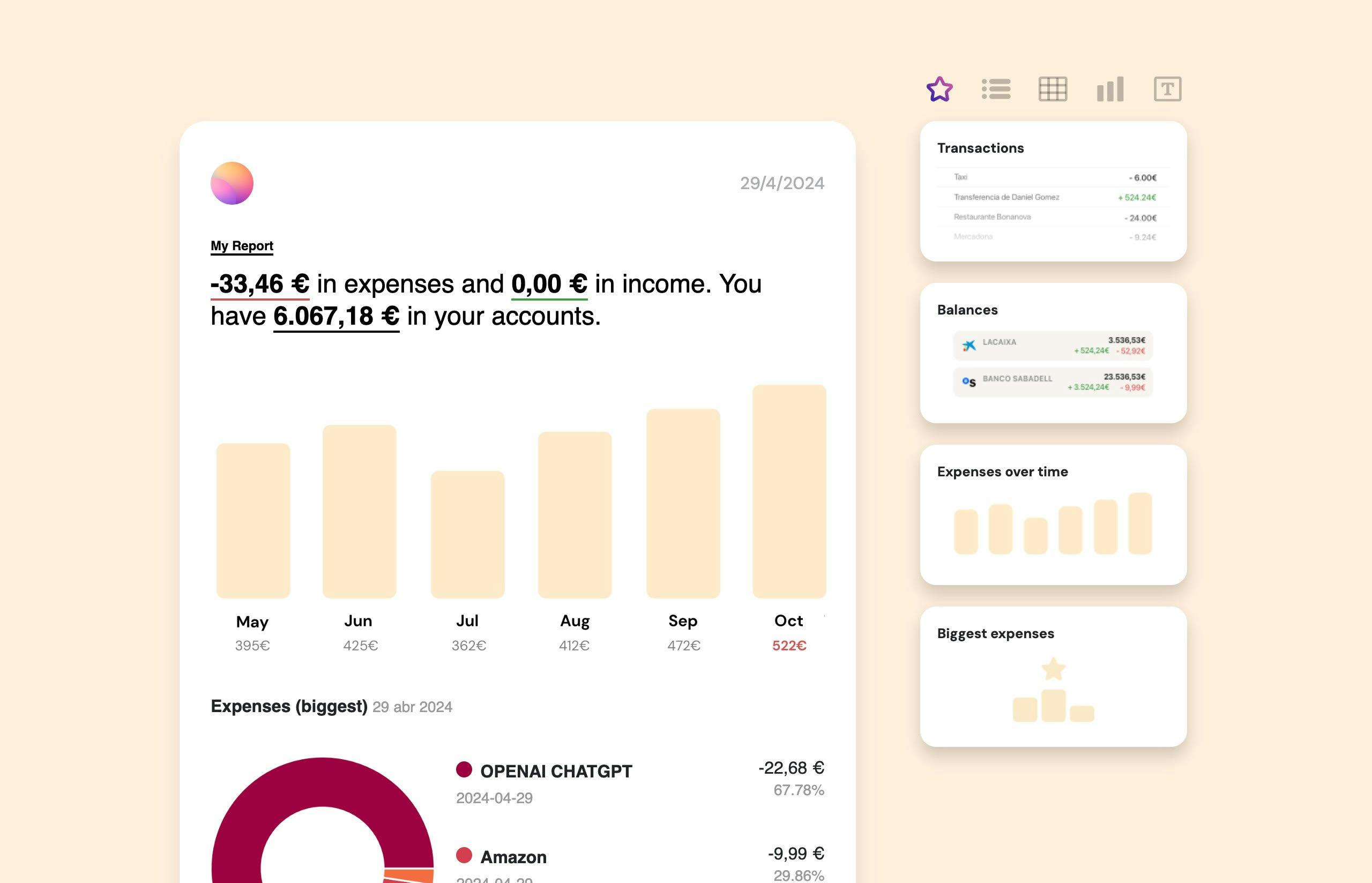

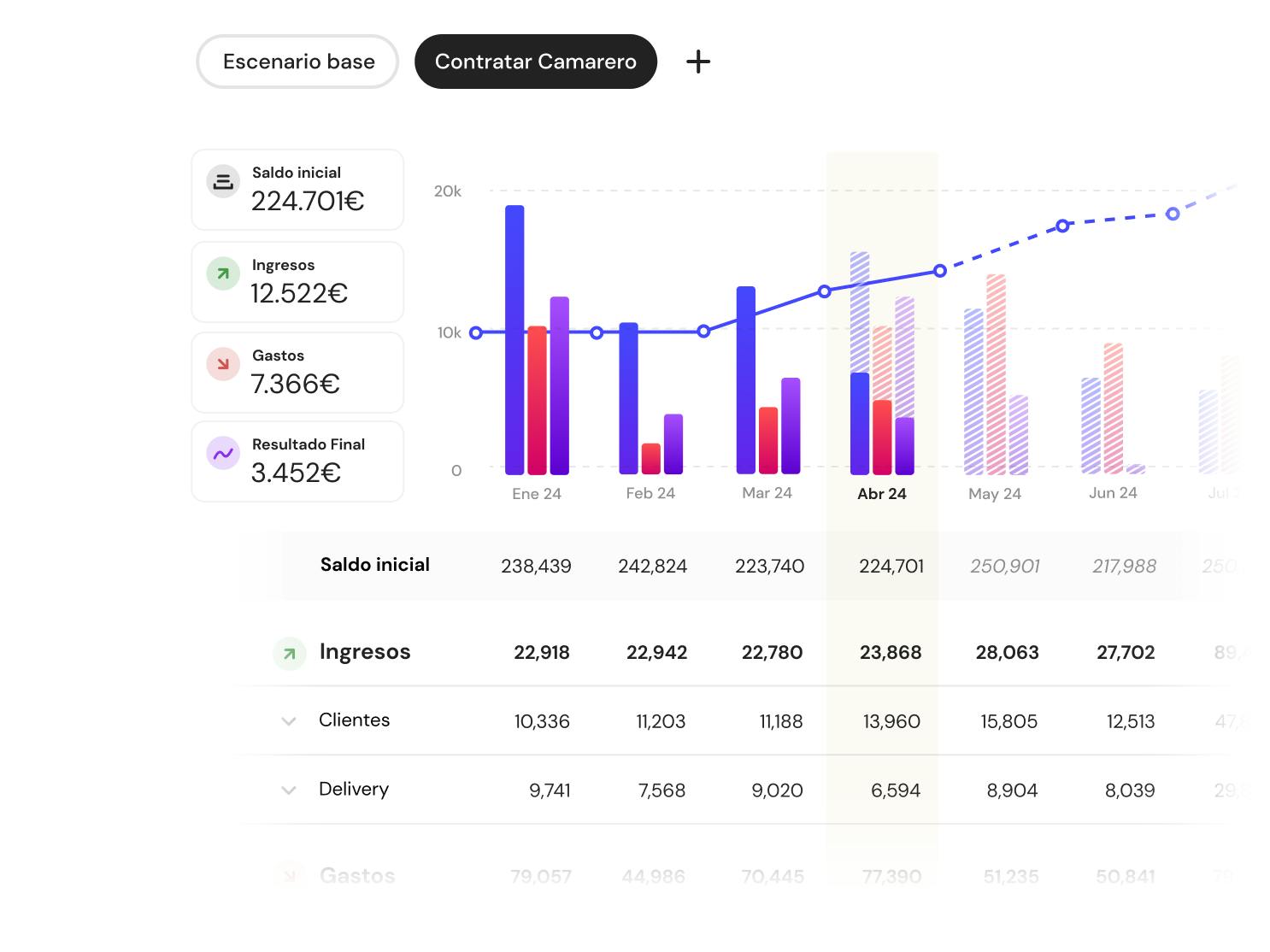

If you want to ensure you have efficient liquidity management you can opt to have a specialized cash liquidity forecasting software.

You can manage your finances in a treasury management software because you will have access to all these features:

- Personalized dashboards

- Integration with multiple bank accounts and products

- Customizable spending metrics

- Automated alerts and reports

- Affordable pricing starting at €16.58 per month

4 Key Components of Liquidity Management

1. Cash Forecasting:

Cash forecasting involves predicting future cash needs based on expected income and expenditures.

Accurate cash forecasts help businesses plan for future financial requirements, avoid cash shortages, and make informed investment decisions.

Methods include historical data analysis, trend analysis, and scenario planning.

2. Short-term Debt and Investments:

Managing short-term debt involves monitoring and optimizing short-term borrowing and investments.

Proper management of short-term debt ensures that the company can meet its obligations without incurring excessive interest costs.

Strategies include optimizing the use of credit lines, managing interest rates, and maintaining a balance between debt and cash reserves.

3. Credit Lines:

Credit lines provide businesses with access to funds for short-term financial needs.

Having access to credit lines ensures that a business can handle unexpected expenses and take advantage of opportunities without depleting cash reserves.

Regularly reviewing and negotiating credit terms with financial institutions helps maintain favorable borrowing conditions.

4 Accounts Receivable and Payable Optimization:

Optimizing accounts receivable and payable involves streamlining invoicing, collections, and payments to improve cash flow.

Efficient cloud cash management, especially of receivables and payables, ensures timely cash inflows and outflows, reducing the risk of liquidity issues.

Implementing invoice reconciliation, offering discounts for early payments, and negotiating favorable payment terms with suppliers are effective practices.

3 Types of Liquidity

1. Asset Liquidity:

Asset liquidity refers to the ease with which assets can be converted into cash without significant loss in value.

Highly liquid assets include cash, marketable securities, and accounts receivable. Less liquid assets include inventory and fixed assets.

2. Market Liquidity:

Market liquidity indicates the availability of buyers and sellers in the market, enabling assets to be bought or sold quickly without affecting their price.

High market liquidity reduces transaction costs and allows businesses to raise funds quickly by selling assets.

3. Accounting Liquidity:

Accounting liquidity measures a company's ability to meet its short-term obligations using its current assets.

Common accounting liquidity ratios include the current ratio, quick ratio, and cash ratio, which assess the company's short-term financial health.

The Importance of Liquidity Risk Management

There are two main factors why liquidity risk management is extremely important.

The first one is supply chain management.

An effective liquidity management helps businesses handle supply chain disruptions by ensuring they have enough cash to pay suppliers and maintain inventory levels.

And what are the strategies to avoid it? Maintaining safety stock, diversifying suppliers, and negotiating flexible payment terms can mitigate supply chain risks.

The second factors is cash flow stability.

Ensuring sufficient cash flow allows businesses to meet obligations such as payroll, rent, and utilities without financial strain.

You can ensure this is always on point by regularly monitoring cash flow, maintaining cash reserves, and optimizing working capital are essential practices.

How to Assess Liquidity with 3 Simple Metrics

1. Current Ratio:

The current ratio compares current assets to current liabilities, indicating the company's ability to cover short-term obligations.

Formula: Current Ratio = Current Assets / Current Liabilities

A higher ratio suggests better liquidity, while a lower ratio indicates potential liquidity issues.

2. Quick Ratio:

The quick ratio, or acid-test ratio, excludes inventory from current assets, providing a stricter measure of liquidity.

Formula: Quick Ratio = (Current Assets - Inventory) / Current Liabilities

A higher quick ratio indicates a strong ability to meet short-term obligations without relying on inventory sales.

3. Cash Ratio:

The cash ratio focuses solely on cash and cash equivalents compared to current liabilities.

Formula: Cash Ratio = Cash and Cash Equivalents / Current Liabilities

A high cash ratio demonstrates a company's ability to cover short-term liabilities using its most liquid assets.

5 Factors Impacting Liquidity Risk

And of course, as to everything, there are factors that will always impact liquidity risk and that are therefore important to keep in mind so that you don't encounter any problems.

- Inventory Levels: Excessive inventory can tie up cash and reduce liquidity, while insufficient inventory can lead to lost sales and operational disruptions.

- Uncollected Receivables: Delayed collections from customers reduce available cash and increase liquidity risk.

- Outstanding Payables: Large amounts of unpaid bills can strain cash flow and increase liquidity risk.

- Credit Limits: Limited access to credit can restrict a company's ability to manage cash flow effectively.

- Seasonality: Seasonal fluctuations in sales and expenses can impact liquidity, requiring careful planning and management.

Best Practices for Liquidity Management

1. Regular Financial Reviews:

Conduct regular reviews of financial statements to monitor cash flow, liquidity ratios, and overall financial health.

Early identification of potential issues allows for timely corrective actions.

2. Inventory Management:

Maintain optimal inventory levels to balance cash flow and meet customer demand.

Techniques include just-in-time inventory, ABC analysis, and regular inventory audits.

3. Accounts Management:

Implement efficient invoicing and collections processes to accelerate cash inflows.

Techniques include electronic invoicing, automated reminders, and offering discounts for early payments.

4. Expense Minimization:

Identify and reduce unnecessary expenses to improve cash flow and liquidity.

Strategies include negotiating better terms with suppliers, reducing overhead costs, and implementing cost-saving technologies.

Conclusion about Liquidity Management

Effective liquidity management is essential for maintaining a company's financial stability and operational efficiency.

This is why, by proactively managing cash flow, assets, and liabilities, businesses can ensure they have the necessary liquidity to meet their obligations and seize opportunities.

Regular monitoring, strategic planning, and adopting best practices in financial management are key to achieving optimal liquidity levels.

Share this post

Related Posts

Verifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.How to do financial planning for business owners

Effective financial planning for business owners is key to managing cash flow, setting goals, and securing long-term growth. It helps make informed decisions and mitigate financial risks.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed