How to do financial planning for business owners

- What is financial planning?

- What does financial planning mean for business owners?

- 1. Have clear control over cash flow

- 2. Make data-driven strategic decisions

- 3. Prevent risks and be prepared for emergencies

- 4. Optimize taxes

- 5. Balance business and personal goals

- 6. Facilitate access to external financing

- How to create a financial plan if you are the owner

- 1. Initial financial audit

- 2. Define clear financial goals

- 3. Create the business budget

- 4. Tax planning

- 5. Create an emergency fund

- 6. Investment and growth plan

- 7. Establish a monitoring and continuous adjustment system

- 8. Retirement and exit planning (optional)

- 9. Review and execution

- 5 best financial planning software for business owners

- 1. Banktrack

- 2. QuickBooks

- 3. Xero

- 4. Wave

- 5. FreshBooks

- Benefits of having financial planning software as a business owner

- 1. Centralization of all your accounts in one place

- 2. Cash flow forecasting and management

- 3. Automatic invoice management and reconciliation

- 4. Reduction of human errors in transaction recording

- 5. Real-Time financial reports

- Frequently asked questions for creating a financial plan as a business owner

- 1. How can I set a realistic budget for my business?

- 2. What financial metrics are essential for tracking my plan?

- 3. How do I manage financial risks in my plan?

- 4. How do I project long-term cash flow accurately?

What is financial planning?

Financial planning is the process of strategically managing economic resources to achieve specific short-, medium-, and long-term goals.

This process involves assessing the current financial situation, setting clear objectives, designing a plan to achieve them, and regularly monitoring results to make adjustments if necessary.

In a business context, financial planning includes aspects such as cash flow, budgets, investment, tax planning, and strategies to ensure business sustainability and growth.

What does financial planning mean for business owners?

For business owners, financial planning is essential because it allows them to:

1. Have clear control over cash flow

Business owners need to know how much money is coming in and going out of their business to ensure they can cover operational expenses, pay employees and suppliers, and keep the business running.

2. Make data-driven strategic decisions

Good financial planning provides valuable information to make decisions on investments, expansion, hiring, or acquiring equipment.

3. Prevent risks and be prepared for emergencies

Having a financial plan helps create emergency funds that protect the business in unforeseen situations, such as an economic crisis or a sales decline.

4. Optimize taxes

Through proper tax planning, business owners can take advantage of tax incentives, deductions, and legal strategies to reduce their tax burden.

5. Balance business and personal goals

Many entrepreneurs confuse personal finances with business finances.

Financial planning allows them to establish a clear separation and work on personal goals, such as retirement, without affecting business operations.

6. Facilitate access to external financing

A solid financial plan is a key tool to present to banks, investors, or potential partners, as it demonstrates that the business is viable and well-managed.

How to create a financial plan if you are the owner

1. Initial financial audit

Before creating any plan, it’s crucial to understand your company’s current financial situation. This phase includes:

- Reviewing current financial statements (balance sheet, income statement, cash flow).

- Identifying assets and liabilities: Knowing what your business owns and owes.

- Evaluating cash flow: Reviewing current income and expenses to understand your liquidity.

- Analyzing profitability and profit margins: Identifying which parts of your business are most profitable.

Objective: Understand the financial reality of your company to make informed decisions.

2. Define clear financial goals

Setting clear and achievable goals is vital to guide your planning. These goals can include:

- Short term (less than 1 year): example: improve cash flow, reduce debt, or increase sales by a certain percentage.

- Medium term (1-3 years): example: expand the product or service line, or increase profitability by a certain percentage.

- Long term (3-5 years or more): example: open new branches, merge or sell the business, or create a retirement fund for the owner.

Objective: Have clarity on what you want to achieve with the financial plan.

3. Create the business budget

The budget is a projection of income and expenses that helps you plan how resources will be distributed over time. Steps include:

- Estimating income: project revenue based on sales, seasonality, and other factors.

- Determining fixed and variable costs: operational costs such as salaries, rent, supplies, and variable costs related to production or sales.

- Planning for investments and extraordinary expenses: including equipment, marketing, expansion, etc.

Objective: Have a clear plan for resource allocation and control spending.

4. Tax planning

Tax optimization is a crucial part of financial planning. Some key activities include:

- Understanding tax obligations: knowing how much and when taxes are due.

- Taking advantage of tax incentives and deductions: depending on the country, there may be tax benefits to reduce the tax burden.

- Hiring a specialized accountant: to ensure the business complies with tax regulations and optimizes tax strategies.

Objective: minimize the tax impact while complying with regulations.

5. Create an emergency fund

Every business should be prepared for unexpected events (economic crises, cash flow problems, unexpected expenses). An emergency fund is crucial to cover these difficult periods.

- Calculate the emergency fund: a suitable fund is usually equivalent to 3-6 months of operating expenses.

- Define accessibility: ensure that the fund is easily accessible but not used for other purposes.

Objective: Have a financial "cushion" to ensure the business survives during tough times.

6. Investment and growth plan

Investment is key to business development. This step should consider:

- Reinvesting profits: use a portion of profits to finance new opportunities (innovation, marketing, expansion).

- Diversifying investments: consider investing in other products, markets, or even assets outside the business.

- Evaluating risks: ensure investments do not jeopardize the financial stability of the business.

Objective: ensure the business grows profitably and sustainably.

7. Establish a monitoring and continuous adjustment system

A financial plan is not static; it should adapt to changes in the business and the market. Some actions include:

- Periodic review of results: review your financial statements monthly or quarterly.

- Adjustments to the budget and goals: if something is not working, adjust your expectations and strategies.

- Performance analysis: are you meeting the goals? If not, what changes are necessary?

Objective: Have a dynamic system that allows for quick adjustments and keeps the business on track.

8. Retirement and exit planning (optional)

If you are the business owner, you should also think about your personal future:

- Retirement plans: define how you will save for retirement, whether through a business pension plan or a personal one.

- Exit plan: if you ever plan to sell or transfer the business, have a clear plan for how to do so.

Objective: Ensure a smooth transition when the time comes.

9. Review and execution

The last step is to implement the plan. Once everything is organized:

- Implement strategies: execute plans for investment, cash flow control, and others.

- Professional advice: don’t hesitate to seek help from financial advisors, accountants, and other experts if needed.

5 best financial planning software for business owners

1. Banktrack

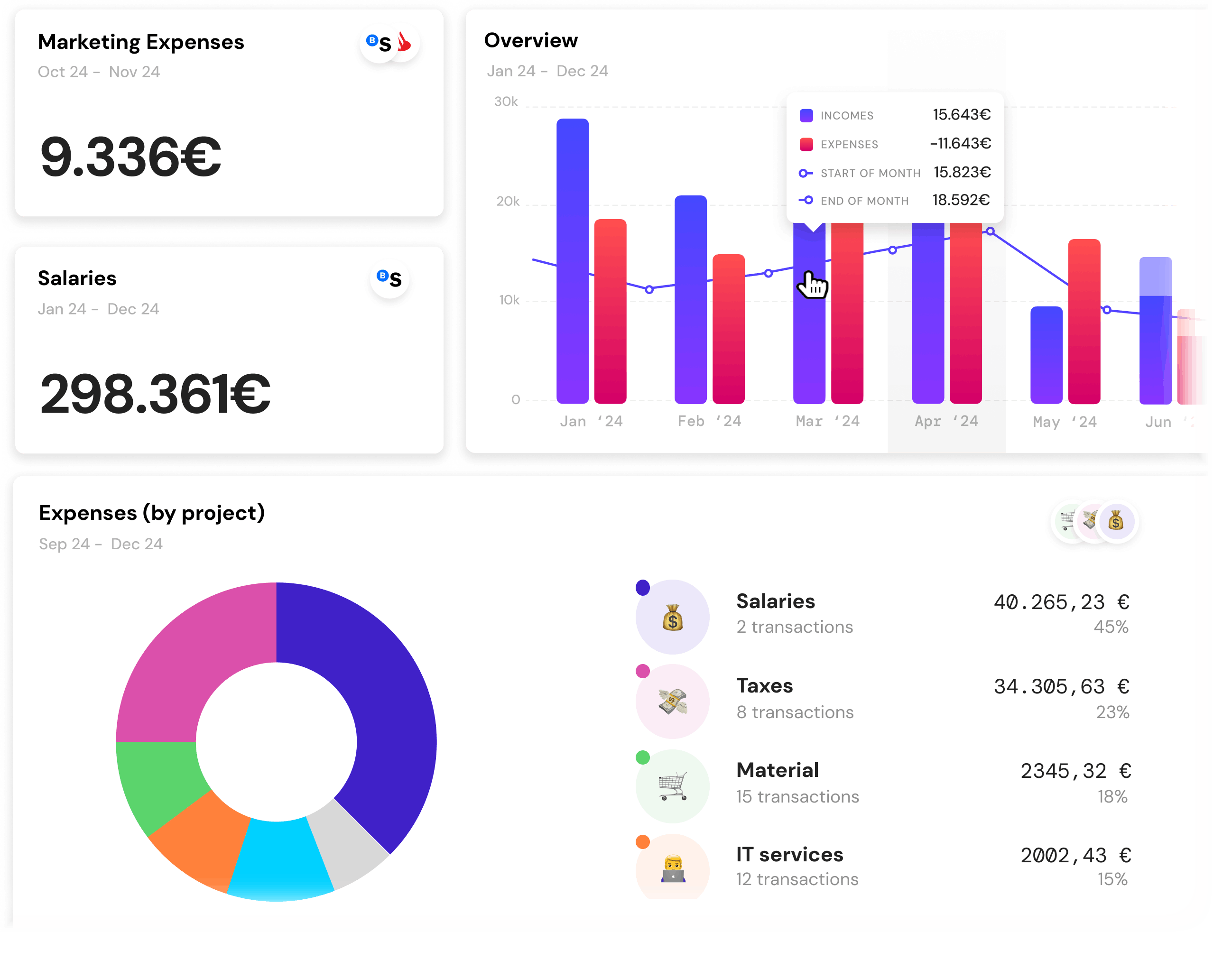

Banktrack is a financial planning software that integrates various features to help you manage your business finances efficiently:

- OCR technology: with Banktrack, you can digitize tickets, invoices, and expenses in minutes by simply taking a photo and sending it via email or WhatsApp. OCR technology will handle digitization and associate it with your transactions.

- Connection with all your bank accounts: you can link all your business bank accounts for a unified view of all expenses and income.

- Real-time updates: banktrack allows you to track your business's bank account expenses in real time, helping you identify patterns for improving cash flow management.

- Digitizing receipts and invoices via multiple channels: you and your employees can send all expense receipts through WhatsApp or email, automatically linking them to the corresponding transactions, simplifying expense tracking.

- Bank reconciliation: banktrack automates the comparison between your bank transactions and invoices, associating them accurately and error-free. It also alerts you to discrepancies so you can quickly correct them, keeping your accounting up-to-date and precise.

- ERP integration: Banktrack integrates with your ERP system, syncing financial data automatically for centralized management without duplication.

- Transaction categorization by projects: you can automatically categorize transactions by the projects your company is involved in, making it easier to track income and expenses for each initiative and improve financial management.

- Automatic rules: create custom rules to automatically categorize transactions by projects, departments, or specific expense types, saving time and ensuring precise classification.

- Ultra-customizable reports: generate reports fully tailored to your needs by selecting categories, dates, and specific details, allowing you to gain clear insights into your business with just a few clicks.

- Alerts: set up real-time alerts to receive notifications about duplicated expenses, limits, due dates, or any other relevant events.

2. QuickBooks

QuickBooks is an accounting and financial planning software widely used by small and medium-sized businesses due to its ease of use, full functionality, and affordable pricing.

Features:

- Accounting and tax management.

- Cash flow control and financial forecasting.

- Detailed reports of profits and losses, balance sheets, etc.

- Integration with bank accounts and other tools.

3. Xero

Xero is a cloud-based accounting solution popular among small and medium-sized businesses, focusing on collaboration and simplicity.

Features:

- Cash flow management, budgets, and forecasts.

- Automatic bank reconciliation.

- Real-time financial reports.

- Collaboration features for teams and accountants.

4. Wave

Wave is a popular tool for small businesses in the U.S., especially known for offering a free version with basic accounting and financial planning features.

Features:

- Accounting, invoicing, and payment tracking.

- Cash flow, income, and loss reports.

- Bank reconciliation.

- Integrated online payment options.

Wave is widely adopted by small businesses and freelancers because it's free, though premium features are also available.

5. FreshBooks

FreshBooks is an accounting and invoicing platform that is particularly popular among freelancers and small businesses.

Features:

- Billing and payment management.

- Cash flow and profitability reports.

- Time and project tracking.

- Integration with banking tools and other applications.

It is especially known among freelancers and small businesses in sectors such as design, web development, and professional services.

Benefits of having financial planning software as a business owner

1. Centralization of all your accounts in one place

You can connect all your bank accounts, credit cards, and other sources of income and expenses into one platform.

This allows you to see your entire financial landscape in real time without needing to check multiple documents or platforms.

This saves time and provides a clear, quick overview of your financial situation.

2. Cash flow forecasting and management

You can create detailed projections of your cash flow, which helps you anticipate future income and expenses.

This enables you to identify potential liquidity issues in advance and make decisions to ensure that there is always enough money available to operate, pay suppliers, and meet other commitments.

3. Automatic invoice management and reconciliation

The software simplifies invoice management by allowing you to issue, track, and pay invoices efficiently.

It also allows you to automatically reconcile your invoices with the payments made, reducing the risk of human errors and ensuring that all payments and collections are correctly recorded.

4. Reduction of human errors in transaction recording

By automating the process of recording transactions and performing bank reconciliations, you significantly reduce the human errors that can occur when manually entering data.

This ensures your accounting is accurate, preventing potential tax or financial issues due to incorrect records.

5. Real-Time financial reports

Financial reports, such as balance sheets and income statements, are automatically updated and available in real time.

This gives you a clear view of your business’s financial health at any given moment, helping you make informed decisions and plan for the future without surprises.

Frequently asked questions for creating a financial plan as a business owner

1. How can I set a realistic budget for my business?

Perform a detailed analysis of historical income and expenses, adjusting projections based on factors like seasonality, market changes, and expected growth.

Use scenario analysis tools to predict different economic and financial conditions.

2. What financial metrics are essential for tracking my plan?

Monitor key metrics like operating cash flow, profit margins, return on invested capital (ROIC), and liquidity ratios.

These metrics provide a comprehensive view of financial health and allow you to detect potential deviations in real time.

3. How do I manage financial risks in my plan?

Identify key risks (market fluctuations, interest rates, inflation) and create contingency reserves.

Implement sensitivity analysis to measure how changes in critical variables impact your financial projections and adjust your mitigation strategies accordingly.

4. How do I project long-term cash flow accurately?

Use forecasting tools that integrate historical data, sales expectations, and seasonal patterns.

Ensure you incorporate variability analysis to adjust projections based on unforeseen events and economic cycles.

Establish a range for cash flow, not just a single exact figure.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed