Top 11 best invoice reconciliation software this 2024

- What is an Invoice Reconciliation Software

- Top 11 Invoice Reconciliation Software this 2024

- 1. Banktrack

- 2. Oracle Netsuite

- 3. Zoho Books

- 4. Xero

- 5. SolveXia

- 6. Nanonets

- 7. QuickBooks

- 8. Sage

- 9. Upflow

- 10. Floqast

- 11. SAP

- 5 Key Features to Look For in an Invoice Reconciliation Software

- 10 Advantages of Using a Reconciliation Software:

The best invoice reconciliation software this 2024:

- Banktrack

- Oracle Netsuite

- Zoho Books

- Xero

- SolveXia

- Naonets

- QuickBooks

- Sage

- Upflow

- Floqast

- SAP

In today’s business world, efficiency is key. You know that.

For any enterprise, creating and managing invoices is a critical task. To streamline this process and ensure accuracy, investing in the right invoice reconciliation software is paramount.

In 2024, several cutting-edge solutions have emerged, offering advanced features to meet the diverse needs of modern businesses.

What is an Invoice Reconciliation Software

Before delving into the best options available, it's important to understand what an invoice reconciliation software is and what it entails.

Let’s first begin by understanding what reconciliation is. It is the financial process of reconciling two sets of records to make sure they match. Reconciliation comes in various forms, but they all involve comparing statements from the outside with documents from within.

Businesses can be sure that their financial statements and overall health are accurately reflected by using it as an internal control.

Therefore, a reconciliation software is designed to automate and simplify the process of matching and reconciling invoices with corresponding transactions.

By taking advantage of technology, businesses can minimize errors, save time, and maintain precise financial records.

Top 11 Invoice Reconciliation Software this 2024

1. Banktrack

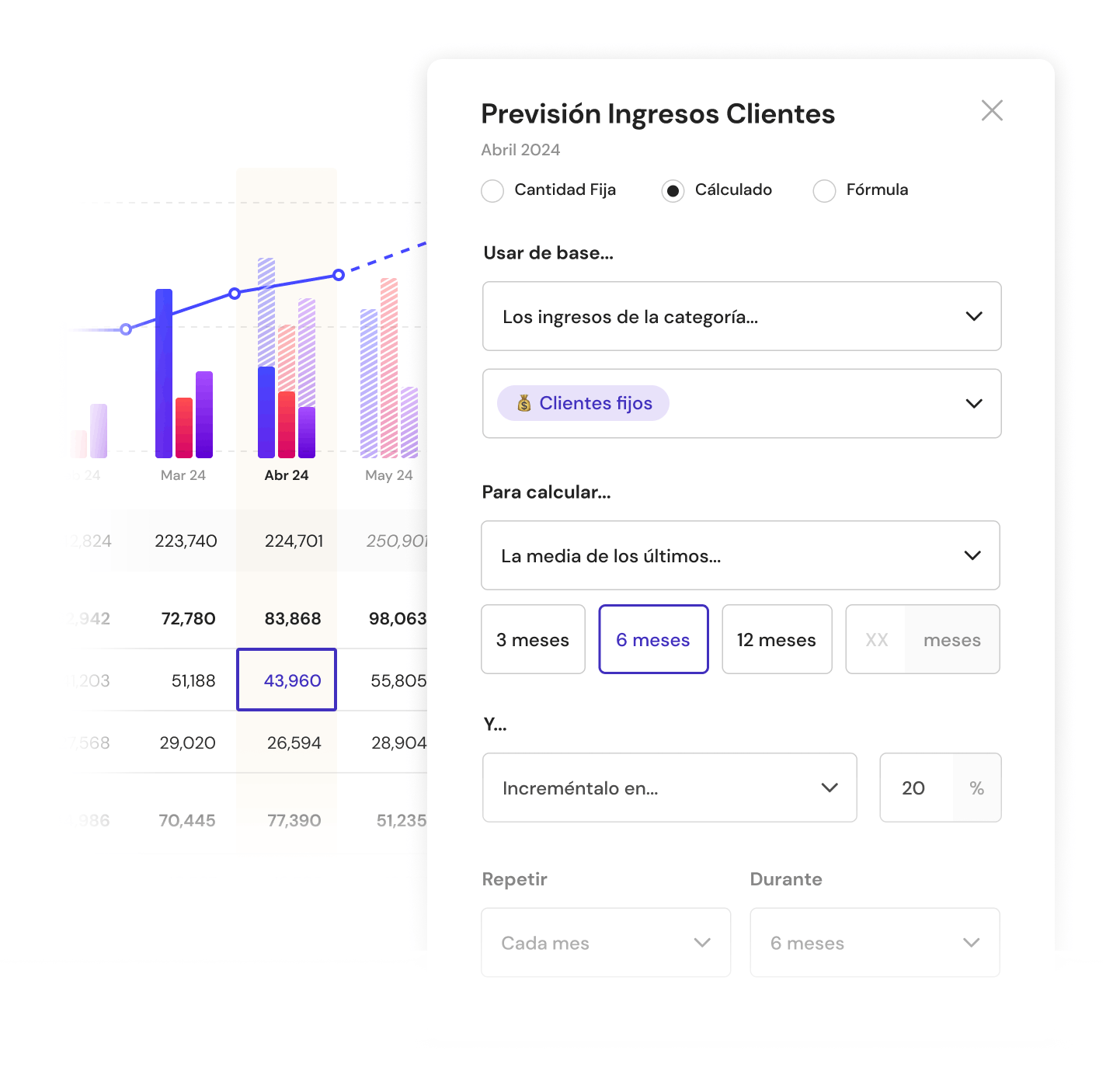

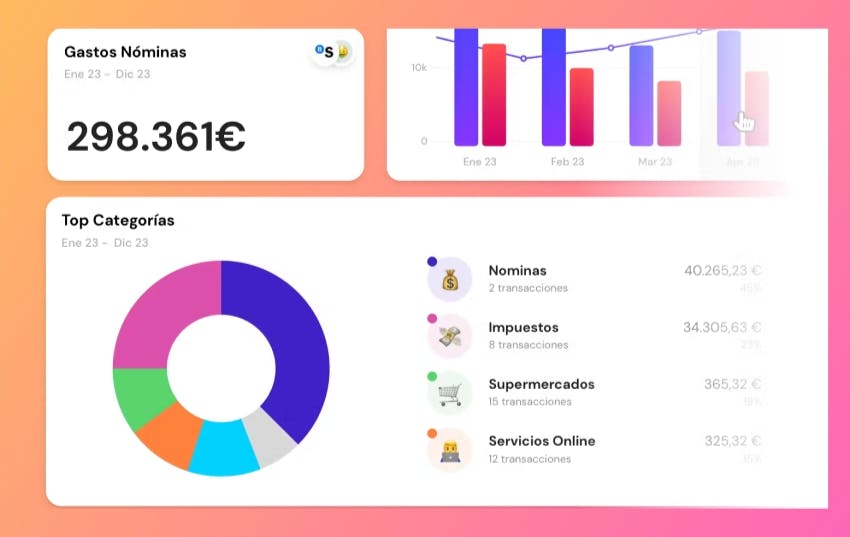

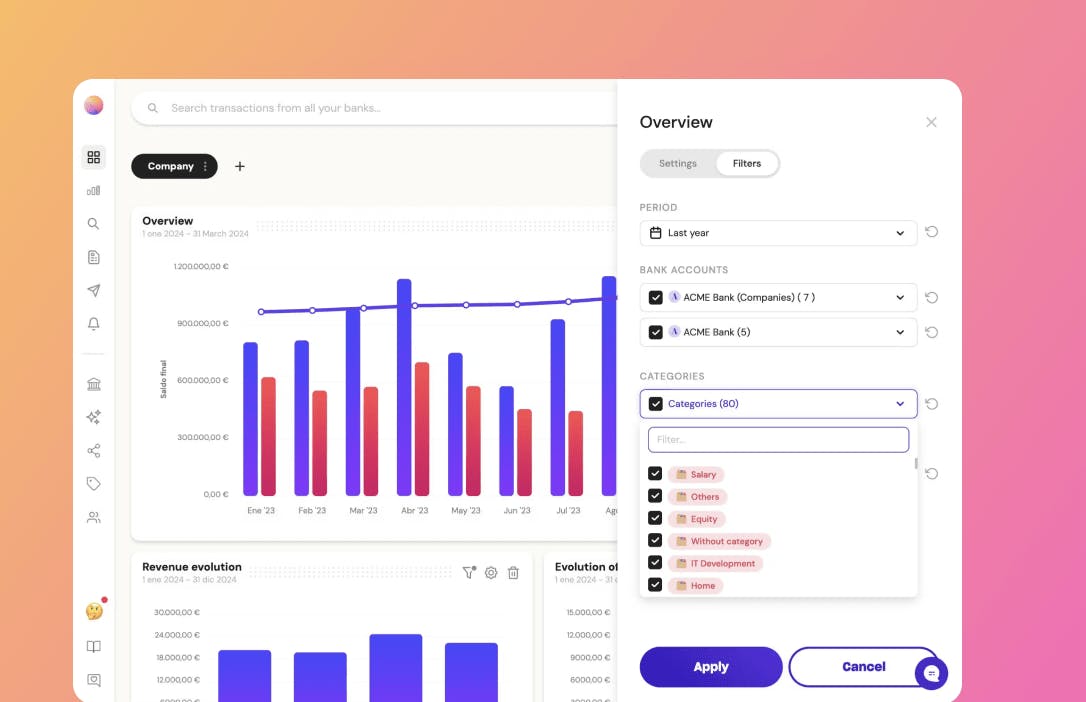

BankTrack is a specialized tool designed to streamline the bank and invoice reconciliation process.

You can reconcile your invoices and bank transactions automatically and accurately with BankTrack.

Used by over 1,000 entrepreneurs, accountants, and financial directors, BankTrack offers automatic invoice digitization powered by AI-driven OCR technology.

How?

Easy: Upload your invoices anytime, from anywhere, via WhatsApp, Telegram, email, or by dragging and dropping them directly into Banktrack.

The platform then automatically identifies and associates your invoice transactions, ensuring accuracy and efficiency.

But that’s not all, Banktrack offers a bank aggregator feature, allowing users to sync with over 120 banks, including traditional and neobanks.

Depending on the bank, Banktrack provides two types of connections:

- Open Banking (PSD2)

- Direct Access

This further ensures efficient and secure integration of your financial data.

In addition, BankTrack also provides detailed financial reporting, offering insights into a company's financial health.

Its secure and scalable design makes it suitable for businesses of various sizes, ensuring that financial data is protected and can accommodate growing data volumes.

But that is not all, you can access Banktrack for a very affordable price. Its plans are very flexible and tailored to each business' needs.

2. Oracle Netsuite

Oracle Netsuite is a cloud cash management software designed to streamline the financials of a business.

It offers real-time financial reporting, enabling companies to gain insights into their financial health and make informed decisions quickly.

The platform supports automated billing processes, reducing manual effort and errors associated with invoicing.

Customizable dashboards allow users to tailor their view to specific needs, making it easier to track key performance indicators.

Additionally, Oracle Netsuite provides industry-specific solutions, ensuring that businesses across various sectors can benefit from its tailored functionalities.

3. Zoho Books

Zoho Books is an accounting software designed to simplify financial management for small to medium-sized businesses.

Banktrack is an app to view all bank accounts as it features automated bank feeds, which saves time by automatically taking transactions from bank accounts. The collaborative client portal facilitates communication and document sharing between accountants and clients.

Zoho Books covers a wide range of accounting and tax management needs, including online payment processing and customizable invoice templates.

Its powerful analytical reporting tools provide detailed insights into financial performance, while the reconciliation feature ensures accuracy by matching transactions.

The software also allows users to create customizable rules for matching transactions, enhancing workflow efficiency.

4. Xero

Xero is a user-friendly, cloud-based accounting platform that caters to businesses of all sizes. Its scalability ensures that it can grow with a business, accommodating increased data and users without compromising performance.

Xero's intuitive design makes it accessible for users with varying levels of accounting knowledge. The platform emphasizes security, employing multiple layers of protection to safeguard financial data.

Key features include:

- Invoicing

- Bank reconciliation

- Inventory management

- Financial reporting

All designed to help businesses manage their finances more efficiently and accurately.

5. SolveXia

SolveXia is a good automation platform focused on financial processes and data analytics. It excels in automating reconciliation tasks, significantly reducing the time and effort required for these processes.

The software also handles complex calculations, such as those needed for reinsurance and commission payments. SolveXia's data analytics capabilities provide deep insights into financial data, aiding in strategic decision-making.

The platform is built with high security standards, ensuring that sensitive financial information remains protected. Additionally, SolveXia is scalable, making it suitable for businesses of various sizes and industries.

6. Nanonets

Nanonets uses advanced machine learning to automate document processing, making it a powerful tool for businesses that handle large volumes of paperwork. It extracts data from documents accurately, saving time and reducing manual data entry errors.

The platform's data matching capabilities ensure that extracted information is consistent and accurate. Workflow automation features streamline business processes, improving efficiency and productivity.

Nanonets also offers a centralized repository for storing and managing documents, ensuring easy access and retrieval of information when needed.

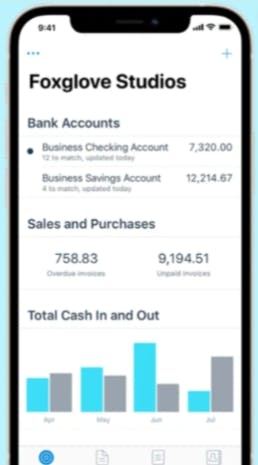

7. QuickBooks

QuickBooks is a widely-used accounting software known for its comprehensive feature set and user-friendly interface. It automates the matching of payments with invoices, simplifying the accounts receivable process.

The bank reconciliation tool ensures that financial records are accurate by comparing them with bank statements. QuickBooks is designed to be intuitive, making it accessible for users without extensive accounting knowledge.

Its feature set includes:

- Invoicing

- Personal finance tracker

- Payroll management

- Financial reporting

This makes it a versatile solution for small to medium-sized businesses.

8. Sage

Sage offers integrated reconciliation solutions that streamline the process of matching financial transactions.

Its compliance management tools help businesses adhere to regulatory requirements, reducing the risk of non-compliance.

Sage is designed to support various accounting needs, from basic bookkeeping to more complex financial management tasks.

The software's user-friendly interface and strong features make it a reliable choice for businesses looking to maintain accurate financial records and ensure compliance with industry standards.

9. Upflow

Upflow focuses on optimizing the accounts receivable process with its reconciliation capabilities and automated payment management features.

The platform provides real-time updates and notifications, ensuring that businesses stay informed about their financial status.

Upflow's automation tools help reduce the manual effort involved in managing payments, improving efficiency and accuracy.

The software is designed to integrate with existing accounting systems, making it a valuable addition to a company's financial management toolkit.

10. Floqast

Floqast specializes in enhancing the financial close process with its reconciliation functionality and accounting close management tools.

The platform provides a structured approach to managing the financial close, ensuring that all tasks are completed accurately and on time.

Floqast's auditable processes help maintain transparency and accountability, making it easier to track changes and identify discrepancies.

The software also includes features designed to improve the overall efficiency of the financial closing process, helping businesses close their books faster and with greater accuracy.

11. SAP

SAP is an enterprise-level software suite that includes reconciliation solutions as part of its comprehensive business management tools.

Its account reconciliation feature ensures that financial records are accurate and consistent. SAP also facilitates the matching of payments with invoices, reducing errors and improving efficiency.

The software's integration capabilities allow it to connect with other business management tools, providing a unified platform for managing various aspects of a business. SAP is designed to support large enterprises with complex financial needs, offering scalable solutions that can grow with the business.

5 Key Features to Look For in an Invoice Reconciliation Software

When choosing the best invoice reconciliation software for your business, certain features are non-negotiable.

Here are some key aspects to consider:

- Automation and Integration: Opt for software that seamlessly integrates with your existing accounting systems and automates the reconciliation process from end to end. This ensures smooth operations and eliminates manual errors.

- Accuracy and Precision: The software should be capable of accurately matching invoices with corresponding transactions, even in cases of large data volumes. Look for solutions that utilize advanced algorithms and machine learning for enhanced accuracy.

- Customization Options: Every business has unique requirements. Choose software that offers customization options to tailor the reconciliation process according to your specific needs. This flexibility ensures optimal performance and efficiency.

- Real-Time Reporting: Timely insights are crucial for making informed decisions. Select software that provides real-time reporting and analytics, allowing you to monitor the reconciliation process and identify discrepancies promptly.

- Security Measures: Protecting sensitive financial data is paramount. Ensure that the software adheres to industry-standard security protocols and offers features such as encryption and multi-factor authentication to safeguard your information.

10 Advantages of Using a Reconciliation Software:

Implementing payment reconciliation software provides numerous benefits for businesses:

- Enhanced Efficiency: Automating repetitive reconciliation tasks saves significant time and reduces manual labor, allowing employees to focus on strategic initiatives.

- High Accuracy: The software uses sophisticated algorithms to systematically compare and match transaction records, minimizing errors and discrepancies in financial data.

- Cost Reduction: Streamlining reconciliation processes and cutting down on manual work results in cost savings related to labor and potential error correction.

- Improved Compliance: Payment reconciliation software ensures adherence to regulatory requirements and financial compliance by maintaining precise and transparent financial records.

- Greater Visibility: Real-time insights and analytics offer enhanced visibility into financial transactions, aiding in informed decision-making and strategic planning.

- Quicker Decision-Making: Access to timely and accurate financial information enables businesses to make faster decisions. This is thanks to a cash flow management tool, a budget tracking app or its forecasting capabilities.

- Scalability: Designed to handle increasing transaction volumes and growing business needs, the software provides scalability without sacrificing performance.

- Fraud Reduction: By quickly identifying discrepancies and irregularities in financial transactions, the software helps reduce the risk of fraud and unauthorized activities.

- Customer Satisfaction: Ensuring accurate and timely reconciliation means customers are billed correctly and payments are processed efficiently, enhancing customer satisfaction and loyalty.

- Strategic Insights: Analyzing reconciliation data provides valuable insights into payment trends, customer behavior, and operational efficiency, helping businesses optimize processes and drive growth.

Share this post

Related Posts

Best 6 Expense Tracker Software with Bank Sync features

Managing money isn’t exactly anyone’s idea of fun, but it is definitely important and it can even be simpler than you think. Let us show you how.Top 10 Best Business Cash Management Tools

Improve cash flow visibility and support decision-making today with the best business cash management tools. Find your perfect match in this comparison!Best 7 Anaplan alternatives in 2024

Regardless of the size of your company, selecting the best cash management software is essential. Find the top 7 alternatives for Anaplan here.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed