A complete guide to managing overdue invoices

- What are Overdue Invoices

- Common Causes of Overdue Invoices

- Impact of Overdue Invoices on Businesses

- 9 Strategies for Managing Overdue Invoices

- 1. Clear Payment Terms

- 2. Timely Invoicing

- 3. Follow-Up Procedures

- 4. Early Payment Incentives

- 5. Late Payment Penalties

- 6. Client Credit Checks

- 7. Flexible Payment Options

- 8. Effective Communication

- 9. Legal Actions

- Monitoring and Reviewing Invoicing Processes

- Technology and Tools for Invoice Management

- 1. Invoicing Software:

- How to Prevent Overdue Invoices

- 1. Client Education

- 2. Efficient Processes

- 3. Regular Reviews

- 3 Legal and Regulatory Considerations

- 1. Compliance:

- 2. Contracts:

- 3. Dispute Resolution:

- Conclusion

Managing overdue invoices is essential for maintaining healthy cash flow and ensuring the financial stability of a business.

Late payments can significantly disrupt a company’s operations, leading to cash shortages and increased borrowing costs.

Effective management of overdue invoices involves clear communication, strategic follow-up, and the use of technology to streamline processes.

This guide provides an in-depth look at strategies and best practices for managing overdue invoices.

What are Overdue Invoices

Overdue invoices are payments that have not been made by the due date specified in the invoice terms.

These late payments can disrupt cash flow, making it difficult for businesses to meet their own financial obligations.

Understanding the causes and implications of overdue invoices is the first step in managing them effectively.

Common Causes of Overdue Invoices

- Client Education: Educate clients on payment terms and the importance of timely payments. Include payment policies in the client onboarding process.

- Efficient Processes: Simplify and streamline invoicing processes to reduce errors and delays. Implement automation to minimize manual intervention and increase efficiency.

- Regular Reviews: Conduct regular audits to ensure invoices are accurate and sent on time. Monitor performance metrics to evaluate the effectiveness of invoicing strategies.

Impact of Overdue Invoices on Businesses

- Cash Flow Problems: Late payments can lead to cash shortages, affecting the business's ability to pay its own bills and employees.

- Increased Borrowing Costs: Businesses may need to rely on credit to cover shortfalls, leading to higher interest expenses.

- Strained Client Relationships: Persistent overdue invoices can damage relationships with clients, potentially leading to loss of business.

- Operational Disruptions: Lack of funds can hinder day-to-day operations and business growth.

9 Strategies for Managing Overdue Invoices

1. Clear Payment Terms

Begin by defining clear and concise payment terms on all invoices, including due dates and late payment penalties.

It's also crucial to communicate these terms with clients upfront to avoid misunderstandings.

2. Timely Invoicing

Ensure prompt billing by sending invoices immediately after services are rendered or products are delivered.

Using an automated invoicing software or a dedicated bill management app can further streamline this process and reduce delays.

3. Follow-Up Procedures

Establish a routine for follow-up communications. Send friendly reminders before and after the due date to prompt payment, and maintain a consistent follow-up schedule, escalating as necessary.

4. Early Payment Incentives

Encourage timely payments by offering early payment discounts. Implementing loyalty programs that reward clients for consistent, timely payments can also be effective.

5. Late Payment Penalties

To incentivize prompt payments, impose a late payment interest on overdue invoices and charge a flat late fee for overdue payments.

6. Client Credit Checks

Perform credit checks on new clients to assess their financial stability and set credit limits based on their payment history and financial health.

7. Flexible Payment Options

Provide various payment options such as credit card, bank transfer, and online payment systems.

For clients facing financial difficulties, offering installment plans can be beneficial.

8. Effective Communication

Maintain professionalism in all communications regarding overdue invoices.

Engage in open discussions to resolve any disputes or issues that may be delaying payment.

9. Legal Actions

As a last resort, send final demand notices before considering legal action.

If necessary, use collection agencies for persistent overdue invoices and pursue legal proceedings to recover unpaid invoices.

Monitoring and Reviewing Invoicing Processes

Regularly reviewing and refining invoicing processes can help reduce the occurrence of overdue invoices.

Monitoring key metrics, such as the average collection period and the percentage of overdue invoices, provides insights into the effectiveness of current strategies and areas for improvement.

Technology and Tools for Invoice Management

1. Invoicing Software:

Look for software that offers automated invoicing, reminders, and tracking capabilities.

Ensure the software integrates with existing accounting and financial systems. If you are looking for an invoice reconciliation software, you can read about the options available here.

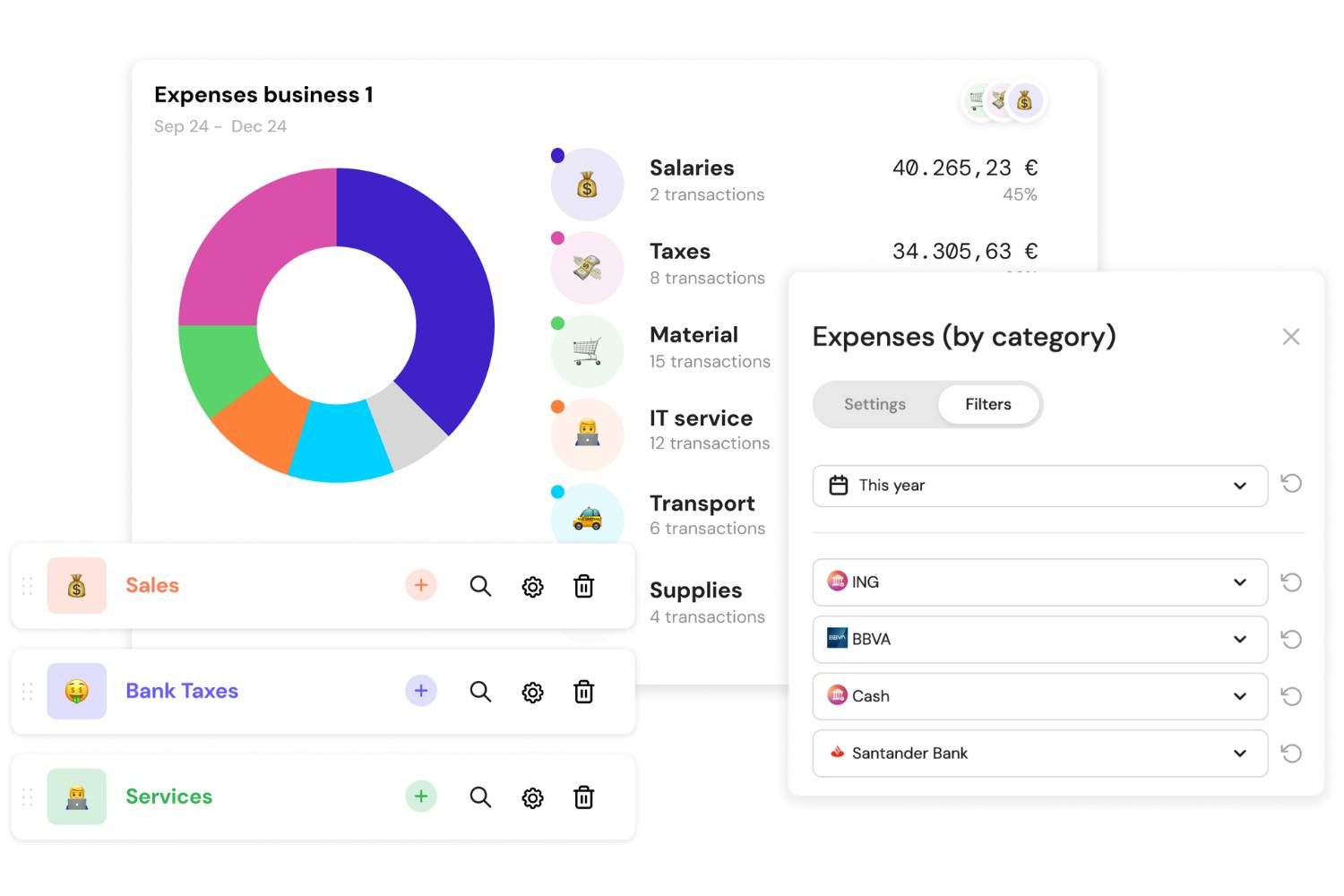

Banktrack, for example, is a specialized tool designed to streamline the bank and invoice process.

Bankrrack is a top choice for reconciling invoices and it is also the best app to view all bank accounts at the same time.

Trusted by over 1,000 entrepreneurs, accountants, and financial directors, it utilizes AI-driven OCR technology for seamless invoice digitization.

Users can upload invoices via WhatsApp, Telegram, email, or drag-and-drop. BankTrack efficiently identifies and associates transactions, ensuring accuracy.

Additionally, Banktrack syncs with over 120 banks through Open Banking (PSD2) and Direct Access, providing secure financial data integration.

Detailed financial reporting and a scalable design make it ideal for businesses of all sizes.

1. Payment Platforms:

You can utilize platforms like online payment systems that facilitate quick and easy payments from clients. For example, look for mobile payment solutions for added convenience.

2. Financial Analytics:

Use financial dashboards to track invoice status and have the best cash flow management tool to view cash flow in real-time. And leverage data analytics to identify patterns and predict future payment behaviors.

How to Prevent Overdue Invoices

1. Client Education

Educate clients on payment terms and the importance of timely payments.

Include payment policies in the client onboarding process.

2. Efficient Processes

Simplify and streamline invoicing processes to reduce errors and delays.

Implement automation to minimize manual intervention and increase efficiency.

3. Regular Reviews

Conduct regular audits to ensure invoices are accurate and sent on time.

Monitor performance metrics to evaluate the effectiveness of invoicing strategies.

3 Legal and Regulatory Considerations

1. Compliance:

Ensure compliance with local, state, and federal regulations regarding invoicing and collections.

Also, keep detailed records of all communications and transactions related to invoices.

2. Contracts:

Draft clear contracts with clients that outline payment terms and conditions. Seek legal advice when drafting contracts to ensure they are enforceable.

3. Dispute Resolution:

Include dispute resolution mechanisms in contracts to handle any disagreements that may arise. Consider mediation as an alternative to litigation for resolving disputes.

Conclusion

Effective management of overdue invoices is essential for maintaining healthy cash flow and ensuring business stability.

By implementing clear payment terms, timely invoicing, consistent follow-up, and leveraging technology, businesses can minimize the occurrence of overdue invoices and maintain positive client relationships.

Regular monitoring and continuous improvement of invoicing processes are key to achieving optimal financial performance.

Share this post

Related Posts

The 6 Best Quipu Alternatives in Spain for 2025

The 6 best Quipu alternatives in Spain for 2025 to simplify invoicing, accounting, and financial management for businesses.How to track your business cash flow: complete guide

Failing to track cash flow properly can lead to serious financial issues. In this article, we provide efficient solutions to manage and optimize it effectively.10 best cash management software for small businesses

Wondering what your options are as a small business to manage your cash flows wisely? We have curated a list of the top 10 best cash management softwares for you.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed