The Best 8 Tesorio Alternatives in 2025

- Top Tesorio Alternatives

- 1. Banktrack

- 2. Tipalti

- 3. Cashforce

- 4. Float

- 5. Kyriba

- 6. Anaplan

- 7. Planful

- 8. Pulse

- What is Tesorio?

- Key Features to Consider in a Cash Flow Management Software

- 7 Steps to Choose the Right Alternative for Your Business

- 1. Assess Your Business Needs

- 2. Compare Features

- 3. Evaluate Pricing

- 4. Check Customer Support

- 5. Read Reviews and Case Studies

- 6. Take Advantage of Free Trials and Demos

- 7. Consider the Learning Curve

- 8. Think About Long-Term Needs

- 9. Seek Recommendations

- 10. Evaluate Security and Compliance

- Conclusion

- Frequently Asked Questions - FAQs

- What is Banktrack?

- What are the key features of Banktrack?

- How does Banktrack help businesses stay in control of their finances?

- What makes Banktrack a good alternative to Tesorio?

- Is Banktrack suitable for small businesses?

The best Tesorio alternatives:

- Banktrack

- Tipalti

- Cashforce

- Float

- Kyriba

- Anaplan

- Planful

- Pulse

Are you on the hunt for the best Tesorio alternatives?

You've landed in the right spot! Whether you're seeking better features, more competitive pricing, or simply exploring options, this guide will walk you through the top alternatives to Tesorio, a leading cash flow management tool.

We'll dive into the key features, pros and cons, and pricing of each alternative to help you make an informed decision.

So, let's get started!

Top Tesorio Alternatives

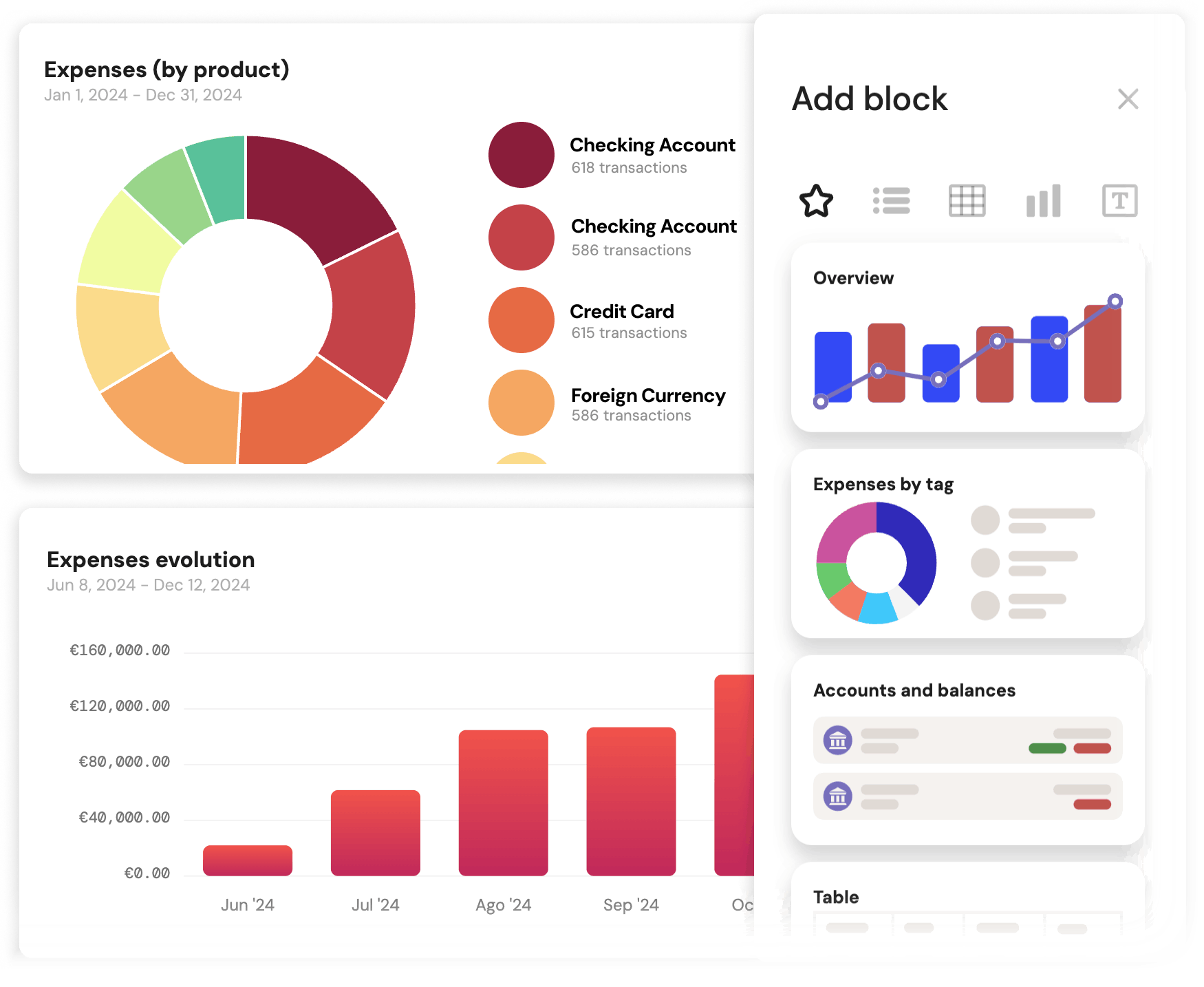

1. Banktrack

Banktrack stands out as the ideal cash management tool for all types of enterprises.

Their ability to adapt to your categorization needs is truly remarkable. With advanced rules, you can create and customize unlimited categories to organize your expenses and income accurately.

This flexibility allows you to keep a detailed track of your finances and understand where your money is being spent.

What's more, Banktrack also offers personalized reports and alerts. You have the option to create custom reports and receive alerts about your expenses through different channels such as WhatsApp, SMS, email, Slack, or Telegram.

You can set up alerts for duplicate charges, low balances, or any other important aspect for you. This feature helps you maintain constant control over your finances and make informed decisions at all times.

Businesses can easily make informed decisions and stay in constant control of their finances with the help of personalized reports and alerts.

Wondering what are all of Banktrack’s features?

Key features:

- Personalized dashboards

- Integration with multiple bank accounts and products

- Customizable spending metrics

- Automated alerts and reports

- Affordable pricing starting at €39 per month

- Forecasts: You can create estimates of cash flow and make sure they are met. Formulas also allow you to add a lot more dynamic functionality to your calculations.

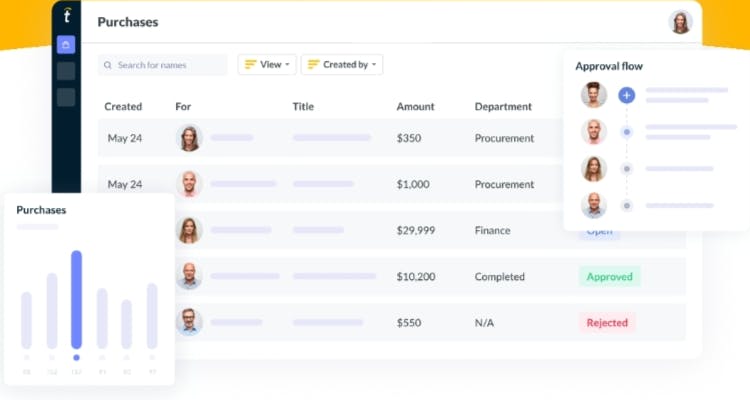

2. Tipalti

Tipalti is a comprehensive accounts payable automation platform that streamlines the entire AP process. It includes invoice management, global payments, and tax compliance.

Pros:

- Robust automation features.

- Supports global payments in multiple currencies.

- Excellent compliance and fraud detection.

Cons:

- Can be complex to implement.

- Higher price point for small businesses.

3. Cashforce

Cashforce focuses on cash flow forecasting and working capital management. It provides deep analytics and integrates with various ERP systems.

Pros:

- Advanced analytics capabilities.

- Strong integration with ERP systems.

- Real-time cash flow forecasting.

Cons:

- Learning curve for new users.

- Higher cost for smaller enterprises.

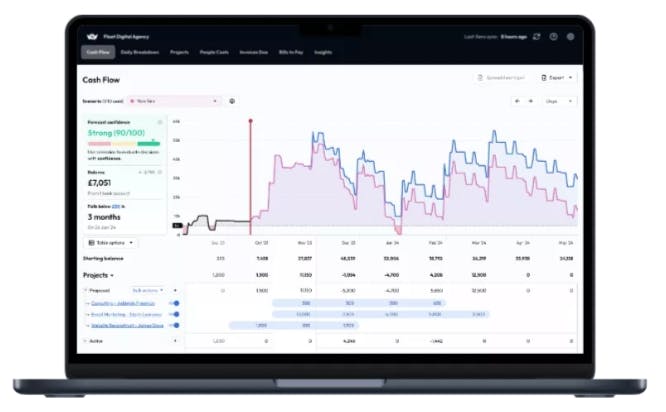

4. Float

Float is a cash flow forecasting tool designed for small to medium-sized businesses. It integrates directly with accounting software like Xero, QuickBooks, and FreeAgent.

Pros:

- User-friendly interface.

- Easy integration with popular accounting software.

- Affordable pricing.

Cons:

- Limited features compared to larger tools.

- Primarily suitable for smaller businesses.

5. Kyriba

Kyriba provides a broad range of financial management solutions, including cash and liquidity management, risk management, and supply chain finance.

Pros:

- Comprehensive suite of financial tools.

- Strong risk management features.

- Scalable for large enterprises.

Cons:

- Can be expensive.

- Complex implementation process.

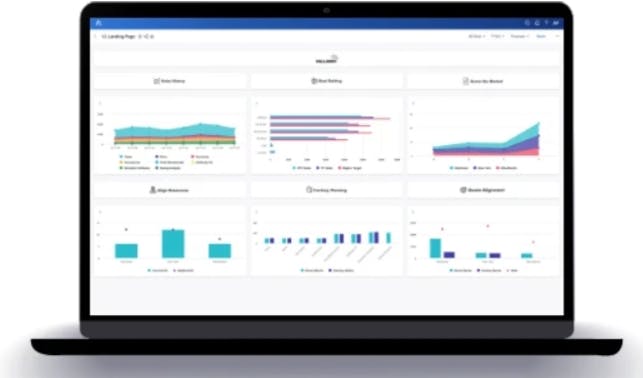

6. Anaplan

Anaplan is a cloud-based planning platform that covers finance, sales, and supply chain operations. It’s known for its flexibility and scalability.

Pros:

- Highly customizable and scalable.

- Integrated business planning features.

- Strong collaboration tools.

Cons:

- Steep learning curve.

- Higher price tag.

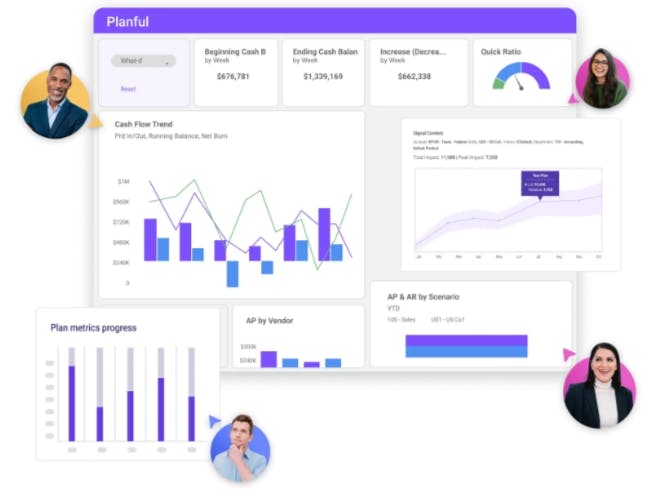

7. Planful

Planful, formerly known as Host Analytics, is an enterprise performance management (EPM) solution that simplifies financial planning, budgeting, and forecasting.

Pros:

- Comprehensive EPM capabilities.

- User-friendly interface.

- Strong customer support.

Cons:

- May be overkill for very small businesses.

- Pricing on the higher side.

8. Pulse

Pulse provides efficient cash flow management solutions tailored for organizing cash flow by customer and project. It features a simple and intuitive interface and integrates seamlessly with accounting software.

Pros:

- Organizes cash flow by customer and project.

- Simple and intuitive interface.

- Affordable pricing. Pulse offers affordable pricing starting at $29 per month, making it an attractive option for small businesses.

Cons:

- Advanced functionalities may require higher-tier subscriptions.

- Limited features compared to more comprehensive tools.

What is Tesorio?

Tesorio is a powerful cash flow management platform that automates the collections process, predicts cash flow with accuracy, and provides actionable insights.

It's designed to help businesses manage their cash incomes, optimize working capital, and streamline financial operations.

But like any tool, it might not fit everyone's needs perfectly, which is why exploring alternatives can be a smart move.

Key Features to Consider in a Cash Flow Management Software

When evaluating cash flow management softwares, here are some important features to look for:

- Automation: The ability to automate invoicing, payments, and collections can save time and reduce errors.

- Forecasting: Accurate cash flow forecasting helps in making informed financial decisions.

- Integration: Seamless integration with existing accounting and ERP systems is essential for smooth operations.

- User-Friendly Interface: A tool that's easy to use can increase adoption rates across your team.

- Scalability: Ensure the tool can grow with your business needs.

7 Steps to Choose the Right Alternative for Your Business

Choosing the right cash flow management tool can seem like a daunting task, but breaking it down into manageable steps can make the process easier.

Here are some key considerations to help you make the best choice for your business:

1. Assess Your Business Needs

Start by identifying the specific needs of your business.

Consider factors such as the size of your company, the complexity of your financial operations, and the specific features you require.

Are you looking for basic cash flow management, or do you need advanced forecasting and analytics?

2. Compare Features

Look at the features offered by each tool. Key features to consider include:

- Automation: Does the tool automate invoicing, payments, and collections?

- Forecasting: Can it accurately predict future cash flow?

- Integration: Will it integrate seamlessly with your existing accounting or ERP systems?

- User Interface: Is the interface user-friendly and easy to navigate?

- Scalability: Can the tool grow with your business?

3. Evaluate Pricing

Consider your budget and compare the pricing models of different tools.

Some tools offer tiered pricing based on the features and number of users, while others might have a flat fee.

Look for a solution that offers the best value for your money without compromising on essential features.

4. Check Customer Support

Good customer support can be a lifesaver, especially when you're implementing a new system.

Check if the provider offers 24/7 support, live chat, or a dedicated account manager.

Read reviews to get a sense of how responsive and helpful their support team is.

5. Read Reviews and Case Studies

Look for reviews from other businesses similar to yours.

Case studies can provide insights into how other companies have successfully implemented and benefited from the tool.

Pay attention to any recurring issues or praises in the reviews.

6. Take Advantage of Free Trials and Demos

Most cash flow management tools offer free trials or demos. Use these to get a hands-on feel for the tool and see if it meets your needs.

During the trial period, test out key features and evaluate the user experience.

7. Consider the Learning Curve

Some tools may offer extensive features but come with a steep learning curve.

Consider how much time you and your team can invest in learning the new system. A tool that's easy to learn and use can save time and increase adoption rates.

8. Think About Long-Term Needs

Choose a tool that not only meets your current needs but can also support your business as it grows.

Look for features that will be useful in the future, such as scalability and the ability to handle more complex financial operations.

9. Seek Recommendations

Talk to other business owners in your network and ask for their recommendations.

Personal experiences can provide valuable insights that you might not find in online reviews.

10. Evaluate Security and Compliance

Ensure the tool complies with relevant financial regulations and has good security measures in place to protect your data.

This is especially important if you'll be handling sensitive financial information.

Conclusion

In the search for the best Tesorio alternatives, Banktrack stands out as a top alternative for a cash management software due to its great feature set and adaptability.

Banktrack is designed to meet the different needs of businesses, offering a high degree of customization and integration that can streamline your cash flow management processes.

Its ability to create unlimited categories for organizing expenses and income, along with personalized reports and alerts, ensures that businesses can maintain a clear and detailed understanding of their financial health.

With affordable pricing starting at €16.58 per month, Banktrack provides excellent value for money, making it a compelling choice for businesses of all sizes.

Frequently Asked Questions - FAQs

What is Banktrack?

Banktrack is a cash management tool designed to help businesses of all sizes manage their finances effectively. It offers features such as personalized dashboards, integration with multiple bank accounts, customizable spending metrics, and automated alerts and reports.

What are the key features of Banktrack?

Key features of Banktrack include personalized dashboards, integration with multiple bank accounts and products, customizable spending metrics, automated alerts and reports, and affordable pricing starting at €16.58 per month.

How does Banktrack help businesses stay in control of their finances?

Banktrack helps businesses stay in control of their finances through personalized reports and alerts. These can be set up for duplicate charges, low balances, or other important financial aspects, delivered via WhatsApp, SMS, email, Slack, or Telegram. This ensures businesses can make informed decisions in real-time.

What makes Banktrack a good alternative to Tesorio?

Banktrack stands out as a good alternative to Tesorio because of its flexibility and affordability. It offers advanced categorization and customization options that allow businesses to tailor the tool to their specific needs, providing detailed insights and control over their financial operations at a competitive price.

Is Banktrack suitable for small businesses?

Yes, Banktrack is suitable for small businesses due to its simple and intuitive interface, affordable pricing, and the ability to customize and organize financial data according to specific needs. It helps small businesses maintain detailed financial records and make informed decisions without a steep learning curve.

Share this post

Related Posts

Advanced cash flow forecasting: techniques and tools

Master advanced cash flow forecasting with top techniques and tools like treasury software, AI analytics, BI platforms, and ERP systems to streamline financial planning and decision-making.Top 5 bank trackers in Switzerland

Managing your finances in Switzerland is easier with the right bank tracker. This guide highlights the top 5 tools designed to help you track expenses, monitor accounts, and optimize your budget.The Best 11 HighRadius Alternatives

These are our top 11 best HighRadius alternatives that can offer similar, if not better, features and benefits for your business to thrive this 2024.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed