Best 6 Billing Software Adapted to Verifactu in 2025

- What is the Verifactu system and how does it work?

- Best 6 Billing Software Adapted to Verifactu

- 1. Banktrack

- 2. Holded

- 3. Quipu

- 4. A3Factura

- 5. FacturaDirecta

- 6. Sage 50cloud

- Webinar: “Get Up to Date with Verifactu”

- Features of the Verifactu System

- 4 Advantages of Verifactu in Billing and Anti-Fraud

- 1. Global advantages

- 2. For invoice issuers

- 3. For invoice recipients

- 4. For consumers

- Who is required to implement it?

- Mandatory for:

- Exempt:

- Implementation Timeline

- Current Status of Verifactu in 2025

- How are Verifactu invoices issued?

- Requirements:

- Identification:

- Registry process:

- AEAT notification:

- 7 Steps to Implement Verifactu in Your Business

- Get Ahead with Banktrack

- Compliance guarantees:

- Additional benefits:

- Conclusion

These are the top 6 billing software solutions adapted to Verifactu:

- Banktrack

- Holded

- Quipu

- A3Factura

- FacturaDirecta

- Sage50 Cloud

The Verifactu system represents a fundamental change in the way companies, freelancers, and professionals in Spain manage and issue electronic invoices.

Driven by the Spanish Tax Agency (AEAT) and framed within Law 11/2021 on measures to prevent and fight tax fraud, this system seeks to increase transparency, combat fraud, and accelerate the digitalization of the Spanish economy.

Below, we explain in depth what Verifactu is, how it works, which are the best software options for it, their advantages, who it affects, and how you can adapt it to your business or professional activity smoothly.

What is the Verifactu system and how does it work?

Verifactu is a new invoicing and registration standard that ensures every issued invoice is unique, verifiable, unalterable, and available, if desired, in real time to the Tax Agency.

Verifactu allows two modes of operation:

- With automatic submission to the AEAT: each invoice is sent at the time of issuance.

- Without automatic submission: the invoice is securely stored with a digital seal and submitted if required.

Best 6 Billing Software Adapted to Verifactu

1. Banktrack

Banktrack is much more than a billing system.

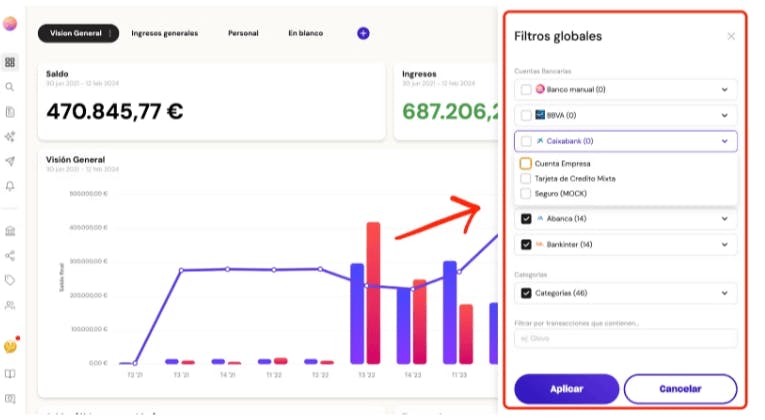

It is a comprehensive treasury management software that allows you to issue Verifactu-compliant electronic invoices while managing the company’s entire cash flow.

Key features:

- Bank reconciliation with more than 120 banks.

- Real-time cash flow visualization.

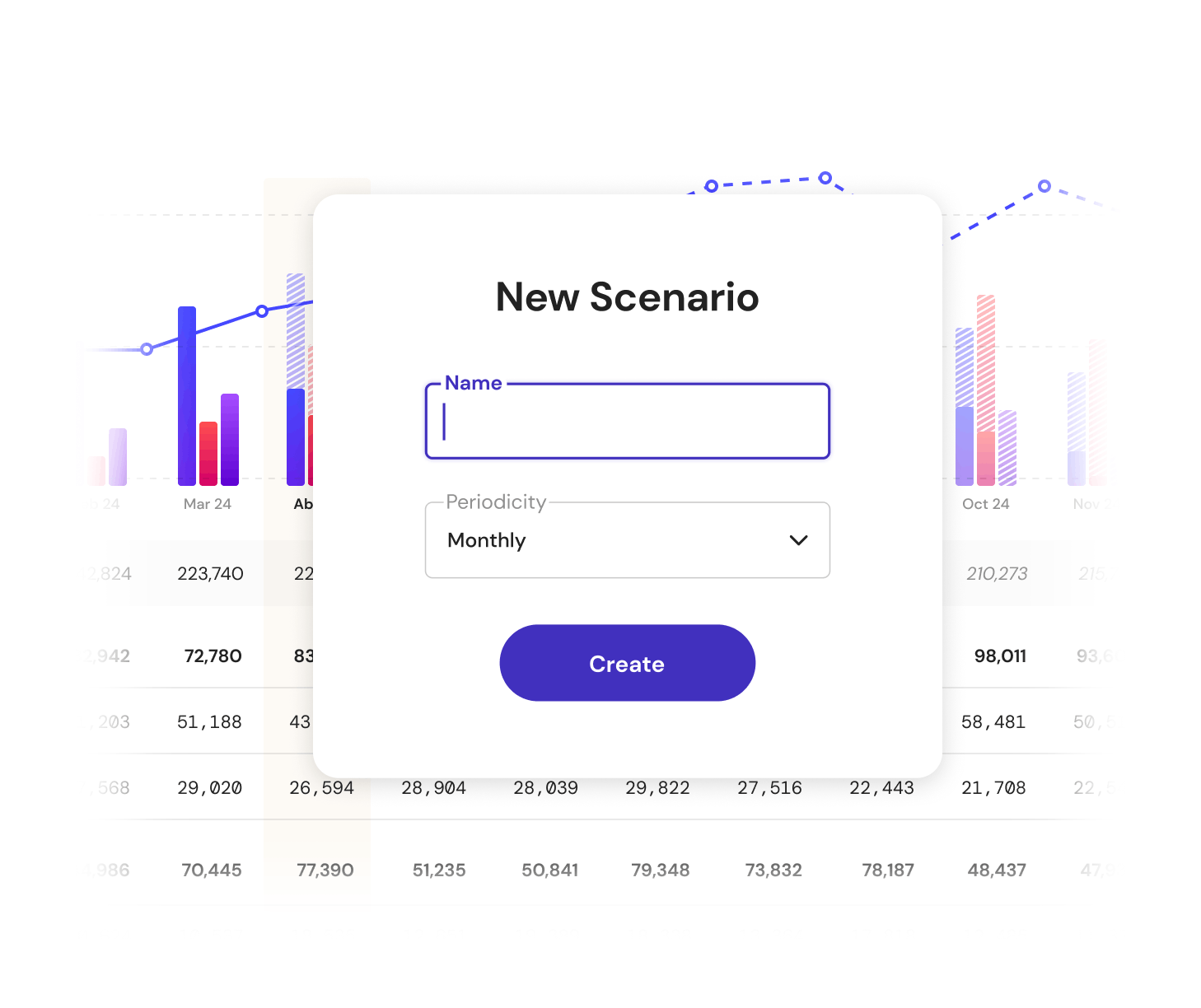

- Financial forecasting by scenarios.

- Ticket and invoice digitization via WhatsApp or email.

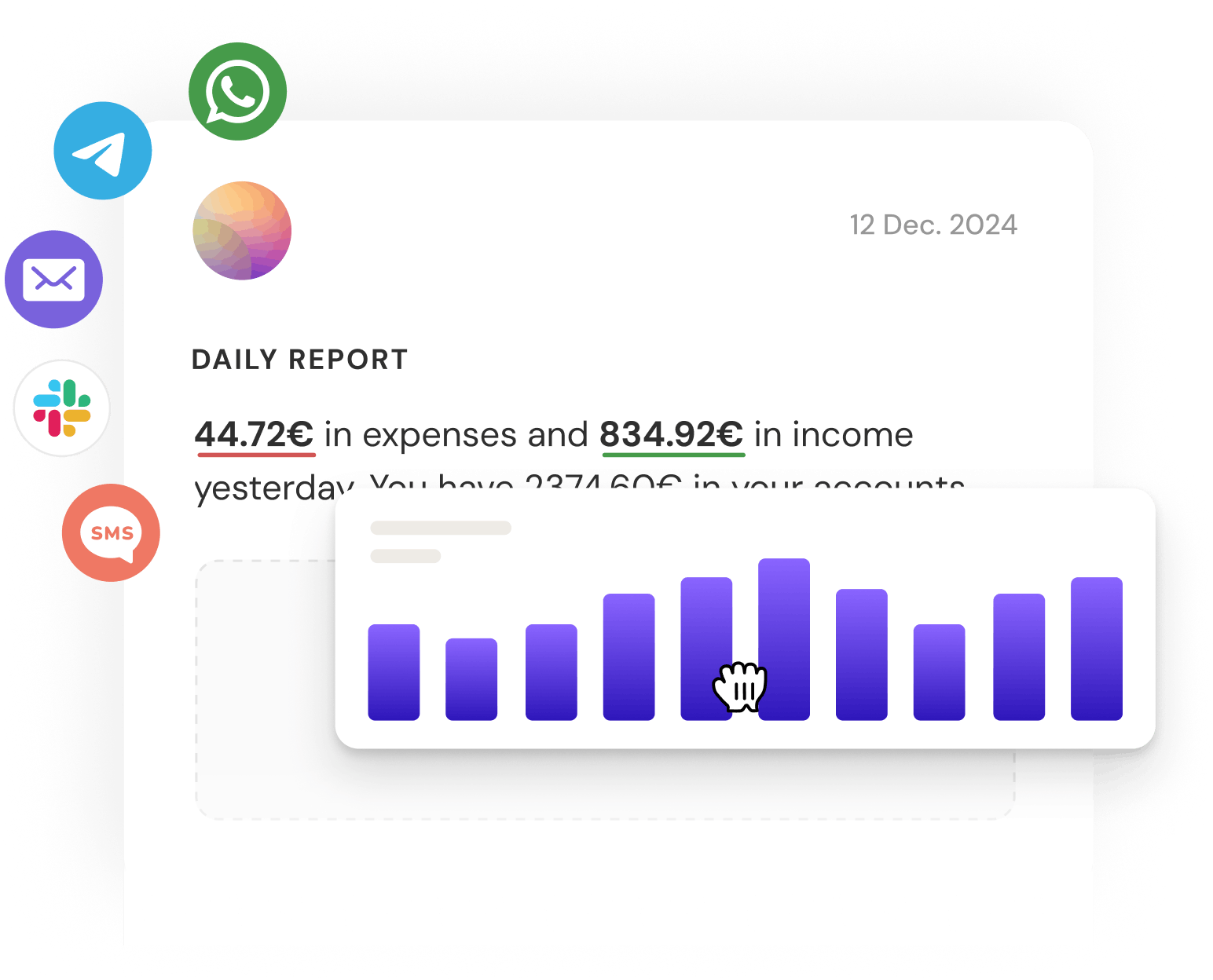

- Automatic reports and alerts via SMS, Slack, Telegram, and more.

Ideal for: SMEs, firms, and companies with active financial operations that want centralized accounting and tax control. Perfect for those managing multiple bank accounts and needing cash flow forecasting.

2. Holded

Holded is a complete cloud-based ERP covering billing, accounting, CRM, and project management. It has been fully adapted to Verifactu, allowing automatic generation of QR codes and hashes on all issued invoices.

Highlights:

- Visual and intuitive interface.

- Automation of invoices, payments, and quotes.

- Integrations with Shopify, Stripe, Zapier, or banks.

- Stock, team, and client management in one panel.

Ideal for: startups, agencies, e-commerce, and SMEs seeking an all-in-one solution.

3. Quipu

Quipu is a billing software especially useful for freelancers and small businesses that need to automate daily tax management.

Includes:

- Issuing Verifactu-adapted invoices.

- OCR scanning of tickets and receipts.

- Banking connection and automatic reconciliation.

- Generation of tax forms such as 303 and 130.

Ideal for: freelancers wanting compliance, time savings, and easy document sharing with their accountants.

Not convincing enough? Here are some Quipu alternatives.

4. A3Factura

Developed by Wolters Kluwer, A3Factura is a professional tool designed for companies and firms already working with the A3ASESOR suite. It is fully compatible with Verifactu.

Key features:

- Structured invoices with hash and electronic signature.

- Sending invoices to integrated accounting firms.

- Complete accounting traceability and monitoring.

- Tools for managing due dates, collections, and payments.

Ideal for: businesses with complex accounting processes that prefer to stay within the A3 ecosystem.

5. FacturaDirecta

FacturaDirecta offers a practical, fast, and legal solution for issuing Verifactu-compliant invoices. Its platform is focused on simplifying billing as much as possible.

Offers:

- Editable, professional templates.

- Payment and collection control.

- Invoice issuing and sending in seconds.

- Integration with accounting firms or downloadable reports for manual submission.

Ideal for: freelancers and professionals seeking simplicity without losing legal compliance.

6. Sage 50cloud

Sage 50cloud combines traditional accounting with the advantages of the cloud and is fully adapted to Verifactu. A consolidated tool in the market, it’s ideal for those who need a reliable, professional environment.

Highlights:

- Secure invoice registry with full traceability.

- Automatic bank integration for real-time reconciliation.

- Advanced management of accounting, taxes, and quarterly returns.

- Remote access to accounting data from any device.

Ideal for: medium-sized companies, accounting firms, and businesses needing a robust solution with strong technical support and advanced features.

Webinar: “Get Up to Date with Verifactu”

Several platforms have organized free webinars to prepare businesses and freelancers for Verifactu.

These online events explain the necessary technical changes, errors to avoid, and how to adapt tools like Banktrack.

Webinar benefits:

- Clear up doubts with tax and technical experts.

- See real implementation examples.

- Learn how similar businesses are handling it.

Features of the Verifactu System

- Immutability: invoices cannot be altered once issued.

- Public verifiability: through a scannable QR code.

- Transparency with the AEAT: optional real-time submission.

- Full audit trail: technical record of all operations is kept.

4 Advantages of Verifactu in Billing and Anti-Fraud

1. Global advantages

- Improves traceability and control across the billing cycle.

- Establishes a uniform system for companies in any sector.

2. For invoice issuers

- Simplifies relations with the Tax Agency.

- Prevents penalties for duplicates or numbering errors.

- Reduces human error and improves internal organization.

3. For invoice recipients

- Receive verified documents valid for tax deductions.

- Lower risk of supplier errors or fraud.

4. For consumers

- Builds trust in companies using verifiable systems.

- Promotes fair and transparent commerce.

Who is required to implement it?

Mandatory for:

- All taxpayers issuing invoices subject to VAT.

- Companies with electronic VAT record books.

- Professionals using billing software, even if invoicing only individuals.

Exempt:

- Activities outside VAT scope or with administrative exemptions.

Implementation Timeline

- Large companies (> €8M turnover): July 2024.

- Freelancers and SMEs: during 2025, within 12 months from publication of the final regulation.

Recommendation: don’t wait until the last minute. Early adaptation allows testing, error correction, and staff training.

Current Status of Verifactu in 2025

In 2025, Verifactu is in an advanced implementation phase. Large companies have completed integrations, and smaller ones are in transition.

The AEAT continues publishing technical notes and best practices. Most leading software is already compliant.

How are Verifactu invoices issued?

- Generated via compatible software.

- Includes a legend confirming Verifactu compliance.

- Internally recorded (and, if applicable, sent to AEAT).

- Client receives a PDF or XML with all verification elements.

Requirements:

- Updated Verifactu-compliant software.

- Valid digital certificate.

- Secure internet connection.

- Proper registration with the Tax Agency as an issuer.

Identification:

- Digital hash fingerprint.

- Text: “Verifiable invoice with Verifactu under Law 11/2021.”

- Consecutive, uninterrupted numbering.

Registry process:

The software must log:

- Exact date and time of issuance.

- Full invoice content.

- Generated hash.

- Tax ID.

These are stored securely and must be available for AEAT audits.

AEAT notification:

- With automatic submission: AEAT receives each invoice immediately.

- Without submission: records are kept legally valid and presented during inspections.

7 Steps to Implement Verifactu in Your Business

- Audit your current billing system.

- Ask your provider about Verifactu support.

- Obtain a digital certificate if you don’t have one.

- Configure QR and hash generation.

- Train administrative staff.

- Run internal tests before going live.

- Decide whether to enable automatic submission.

Get Ahead with Banktrack

Banktrack is expense management software designed to ensure full compliance with Verifactu and the Anti-Fraud Law.

It is one of the most complete platforms to issue verifiable electronic invoices and centralize financial and tax management in one tool.

Compliance guarantees:

- Includes legal legend on every document.

- Stores issuance records with date, time, and unique ID.

- Supports both automatic and non-automatic AEAT modes.

- Meets the technical traceability required by the Tax Agency.

Additional benefits:

- Automatic reconciliation with bank transactions.

- Multi-channel report delivery.

- Advanced cash flow forecasting.

- Encrypted, validated data security.

Getting ahead with Banktrack allows you to avoid mistakes, meet deadlines, and show transparency to both clients and the administration.

It also integrates billing, accounting, CRM, and document management.

Conclusion

Verifactu is an opportunity to improve operations, reduce errors, and keep invoices organized, verifiable, and secure.

Early adoption ensures a stress-free transition and strengthens your image with clients and the Tax Agency.

Do not see it as an imposition, but as a competitive advantage.

Law 11/2021 on fighting tax fraud requires all businesses to use software that prevents altering invoices after issuance. Verifactu is the technical and legal response to this requirement.

Share this post

Related Posts

Verifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.The 8 Best Odoo Alternatives for Businesses in 2025

The 8 best Odoo alternatives for businesses in 2025 to streamline operations, CRM, and accounting with efficient software.The 7 Best Fintonic Alternatives in Spain for 2025

The 7 best Fintonic alternatives in Spain for 2025 to track expenses, manage budgets, and improve personal financial control.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed