The 8 Best Odoo Alternatives for Businesses in 2025

- Best 8 Odoo alternatives for businesses

- 1. Banktrack

- 2. Oracle NetSuite

- 3. SAP Business One

- 4. Microsoft Dynamics 365 Business Central

- 5. Sage Intacct

- 6. Acumatica

- 7. ERPNext

- 8. Dolibarr

- How to Choose the Right Odoo Alternative

- 6 Trends in ERP and Business Management Software

- 8 Benefits of Modern ERP Systems

- Conclusion

These are the best Odoo alternatives:

- Banktrack

- Oracle NetSuite

- SAP Business One

- Microsoft Dynamics 365 Business Central

- Sage Intacct

- Acumatica

- ERPNext

- Dolibarr

Odoo has become one of the most recognized ERP platforms worldwide. With its modular approach, it allows businesses to manage everything from accounting to HR, CRM, and supply chain in a single system.

However, not all companies find Odoo the right fit. Some struggle with complex implementation, others face high customization costs, and many look for solutions that provide stronger financial control, forecasting, or regulatory compliance.

For those reasons, more and more companies in 2025 are exploring alternatives to Odoo. Below, we highlight the best options available, starting with the one that is rapidly becoming the benchmark for modern business finance.

Best 8 Odoo alternatives for businesses

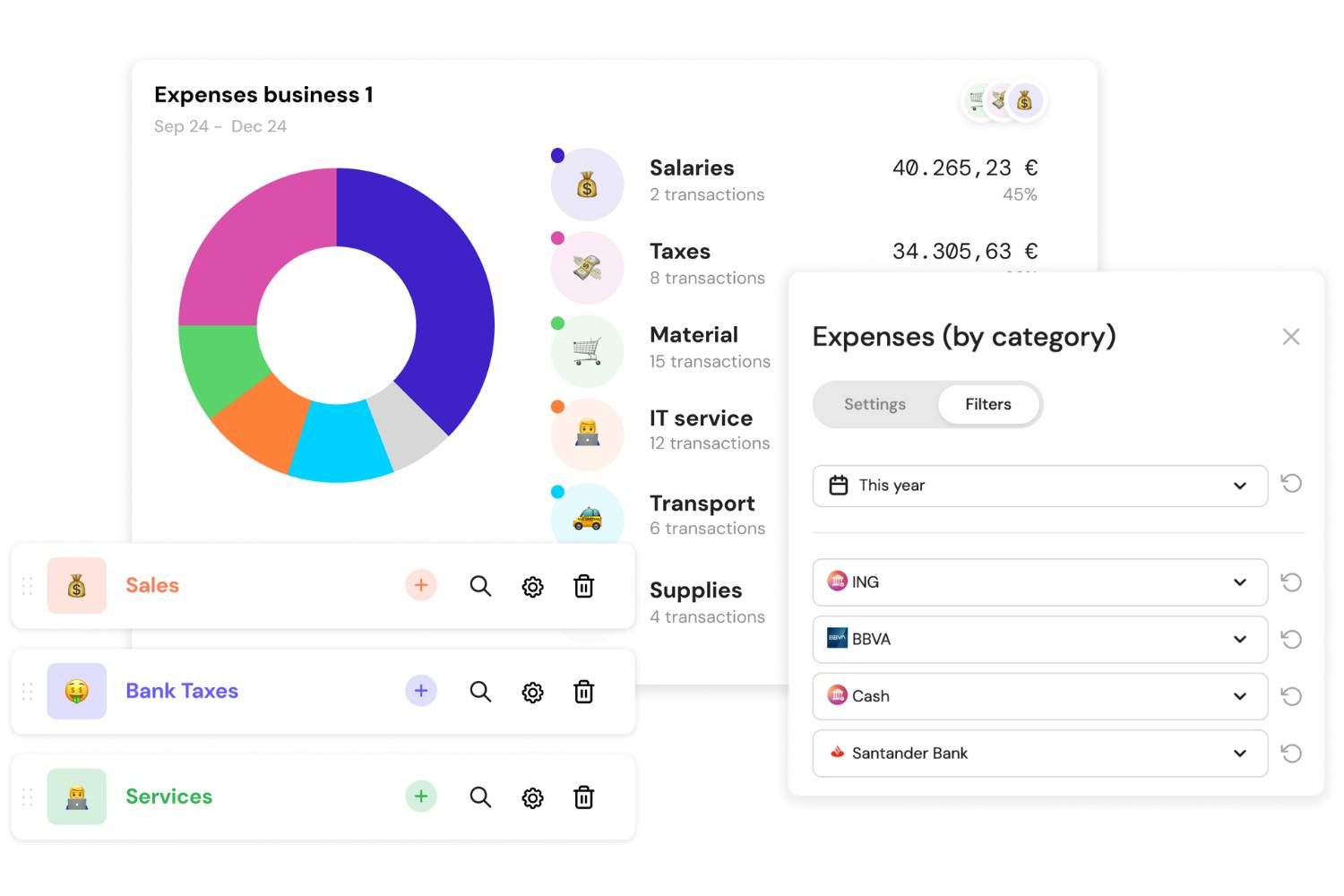

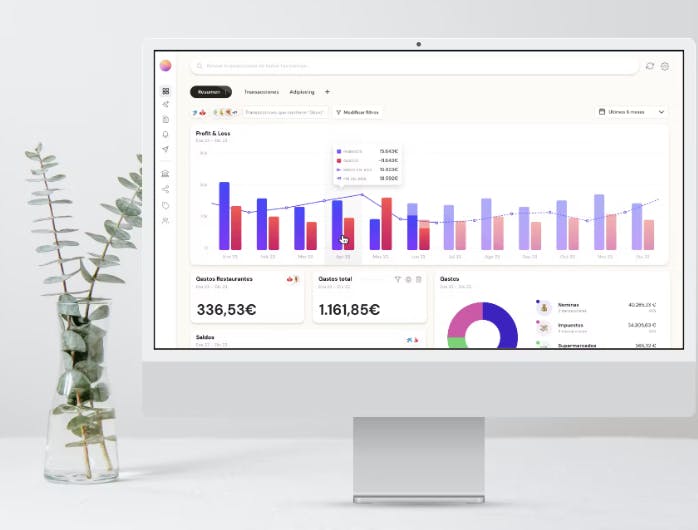

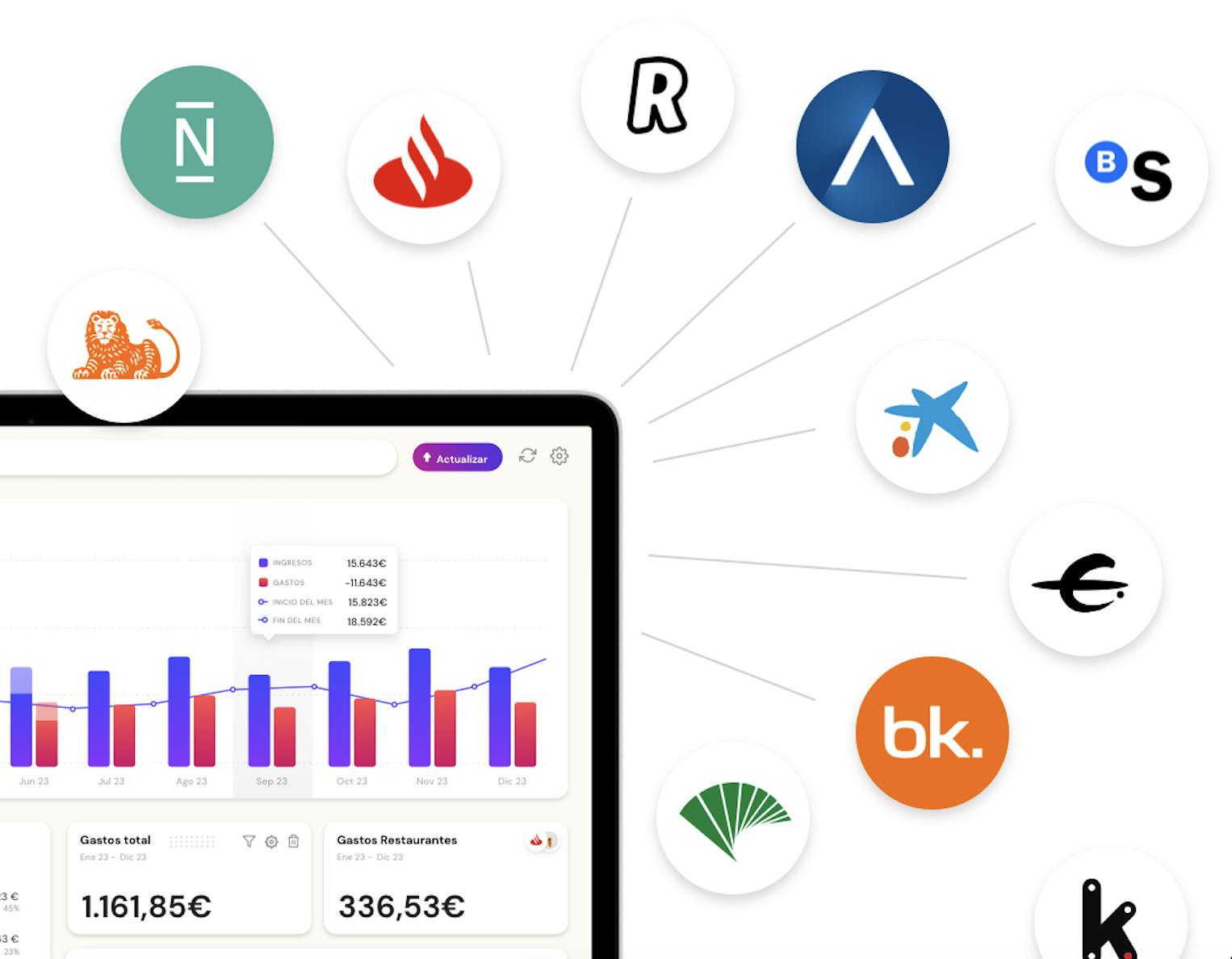

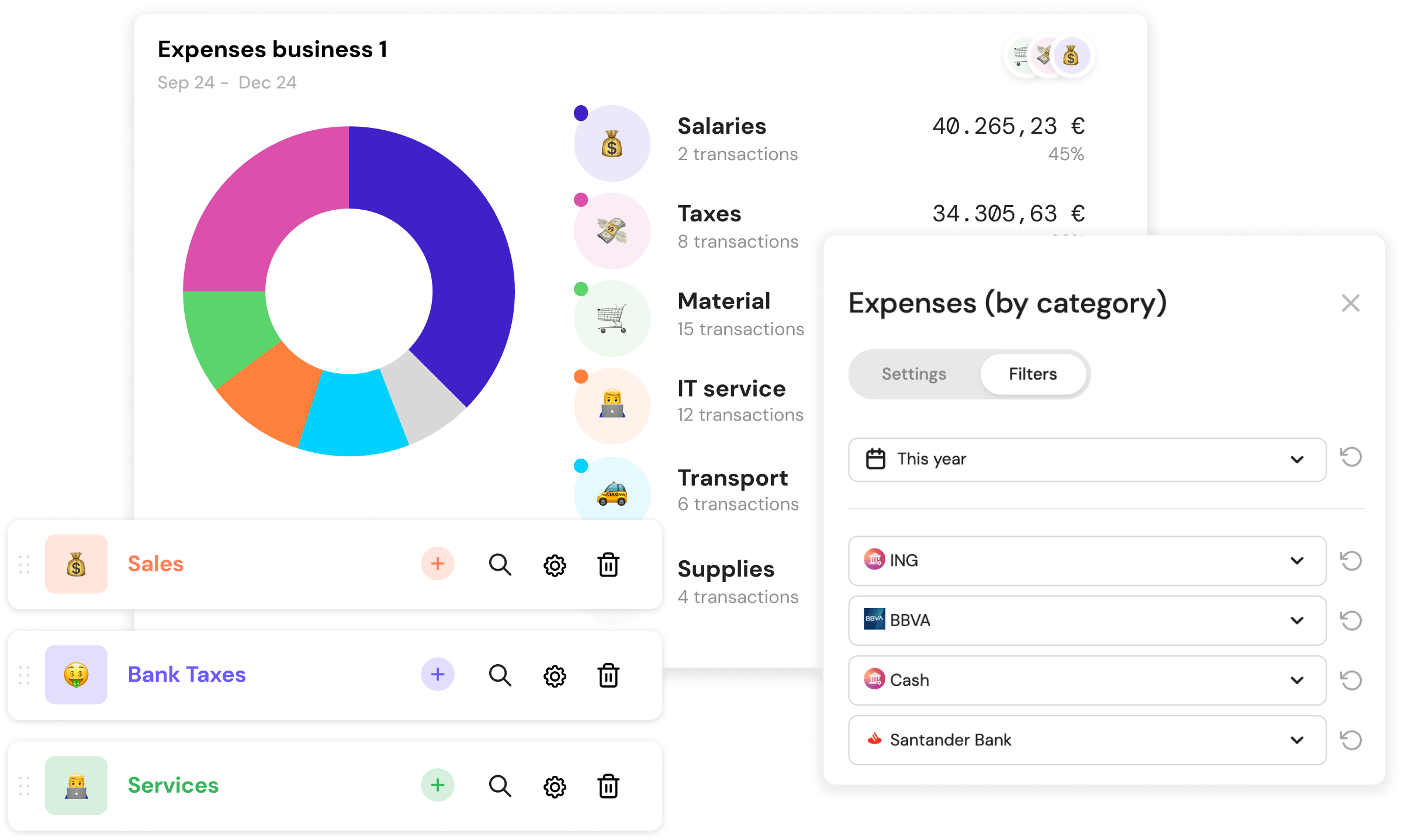

1. Banktrack

The most complete Odoo alternative for financial visibility and cash flow forecasting

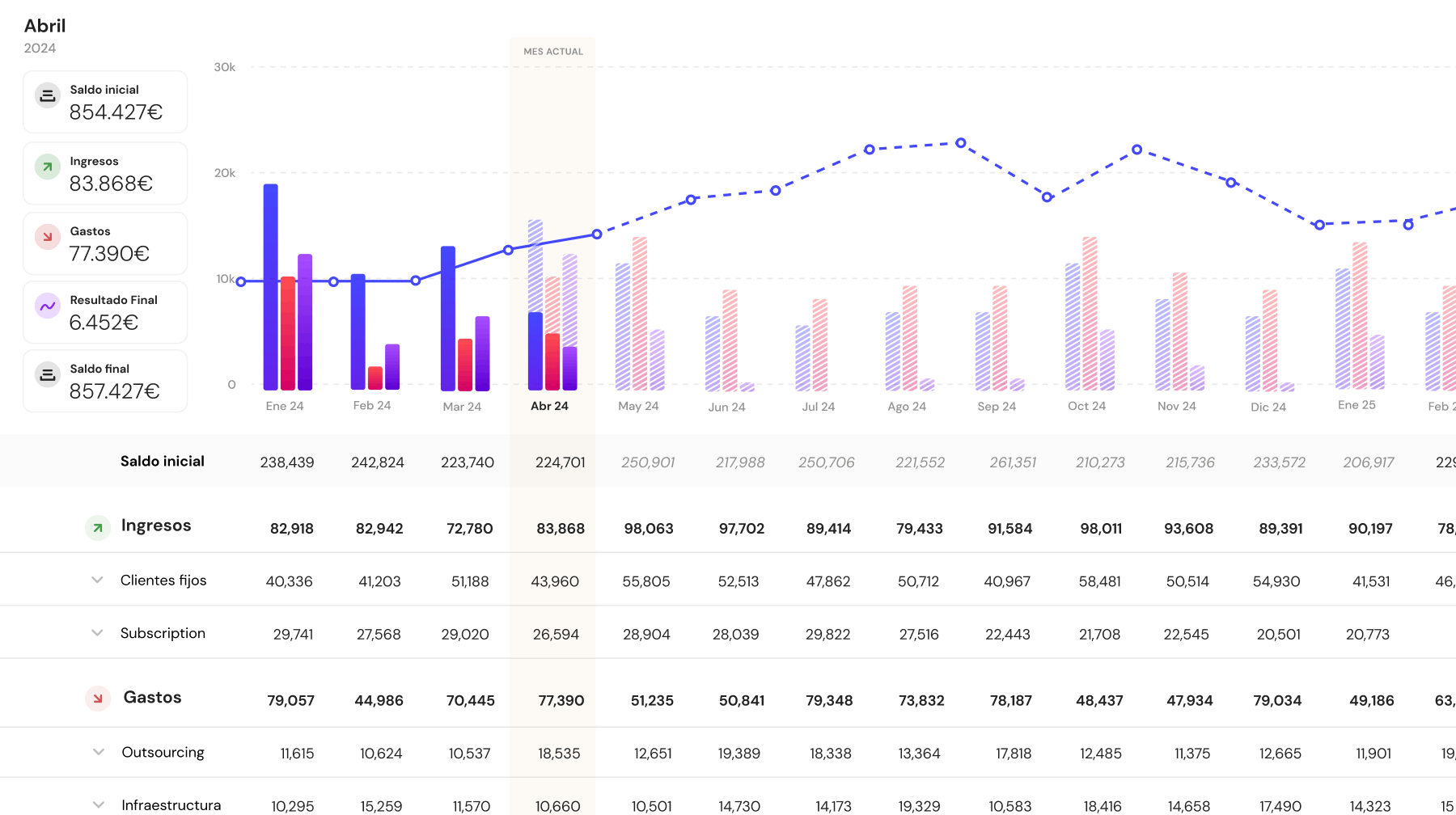

Banktrack stands out as the best treasury management software for businesses that want real-time financial control, predictive insights, and a scalable system that doesn’t require complex implementation.

Unlike Odoo, which covers multiple areas but can feel heavy or fragmented, Banktrack is laser-focused on helping companies master their finances, anticipate liquidity needs, and stay compliant with modern regulations.

Why Banktrack is #1

Most ERPs, including Odoo, focus on recording what has already happened. Banktrack goes further: it allows businesses to predict what will happen next. With its scenario-based forecasting tools, real-time banking integration, and intelligent alerts, Banktrack empowers decision-makers to act before problems arise.

Key Features

- Bank synchronization with 120+ institutions: Real-time updates from Spanish and international banks ensure no delays in financial reporting.

- Automatic expense and income categorization: Reduces manual work by classifying transactions into projects, clients, or departments.

- Scenario forecasting: Model “what-if” situations like hiring staff, launching a new product, or dealing with revenue drops.

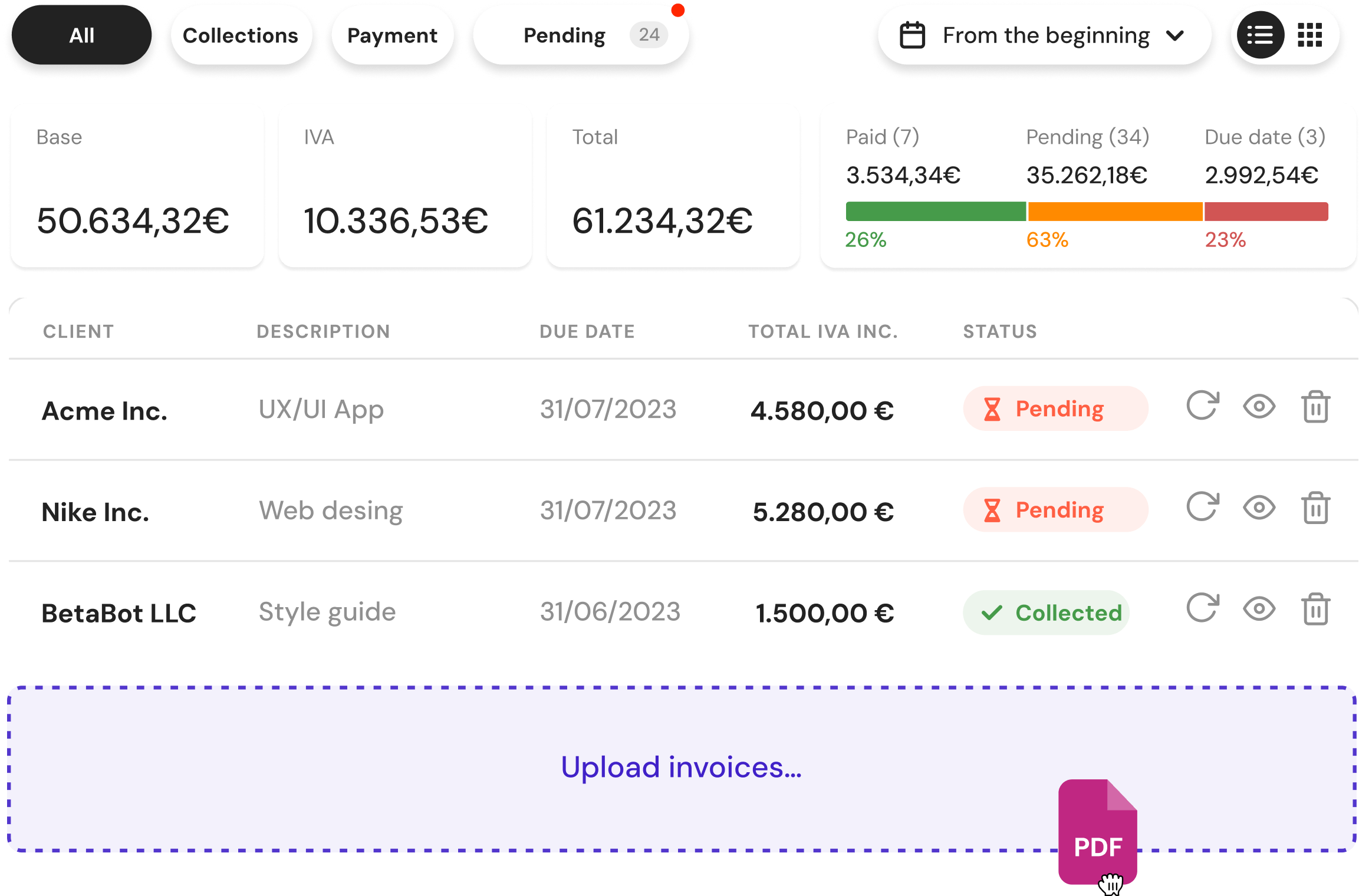

- Invoice reconciliation: Upload via email, WhatsApp, or drag-and-drop, matched automatically with payments.

- Custom alerts: Notifications for unusual payments, duplicate charges, low balances, or overdue invoices.

- Multi-channel reporting: Exportable dashboards and reports for management, accountants, or investors.

- E-invoicing compliance: Fully adapted to Spain’s new digital invoicing regulations.

Best For

- SMEs and mid-sized companies that want to move beyond spreadsheets.

- Businesses with multiple accounts, clients, or projects that need clarity on cash flow.

- Companies seeking compliance-ready solutions without heavy IT setup.

Why Choose Banktrack Over Odoo

Odoo offers breadth, but Banktrack delivers depth where most businesses need it most: financial clarity, liquidity forecasting, and regulatory compliance. It is easier to deploy, faster to adopt, and built specifically for businesses that want to anticipate the future, not just record the past.

2. Oracle NetSuite

Enterprise-grade ERP with global reach.

NetSuite offers a complete suite for finance, e-commerce, supply chain, and HR. It is especially popular among companies with international operations that need scalability and strong compliance.

Best for: Enterprises and fast-growing companies.

3. SAP Business One

ERP for mid-sized companies.

SAP Business One delivers robust financials, CRM, and analytics, with strong industry-specific modules. It is a reliable alternative for businesses that want structure and local support.

Best for: Mid-sized businesses seeking stability.

4. Microsoft Dynamics 365 Business Central

ERP and CRM in one.

This solution integrates accounting, HR, sales, and marketing with the broader Microsoft ecosystem. It is particularly appealing to companies already using Microsoft 365 tools.

Best for: Businesses deeply embedded in Microsoft software.

5. Sage Intacct

Finance-first ERP.

Sage Intacct is built around accounting and compliance. While Odoo offers accounting as a module, Intacct’s core strength lies in its financial reliability and ability to handle complex, multi-entity environments.

Best for: Finance-driven organizations.

6. Acumatica

Flexible and customizable ERP.

Acumatica provides accounting, CRM, inventory, and project management in a cloud-based platform. Its strength lies in flexibility and vendor-backed customization.

Best for: SMEs that need flexibility with strong vendor support.

7. ERPNext

Open-source alternative.

ERPNext is the closest open-source competitor to Odoo, with modules for HR, accounting, CRM, and manufacturing. It has a simpler interface and an active global community.

Best for: Businesses seeking open-source freedom without Odoo’s complexity.

8. Dolibarr

Lightweight ERP/CRM.

Dolibarr is another open-source system, but lighter and easier to implement than ERPNext. It offers core ERP and CRM features without requiring extensive configuration.

Best for: Small businesses and freelancers.

How to Choose the Right Odoo Alternative

Ask these questions to guide your decision:

- Size & structure: Freelancers vs growing SMEs vs enterprise-scale?

- Primary needs: Accounting, project management, e-commerce, or full ERP?

- Forecasting: Is visibility into multi-month cash flow essential?

- International operations: Do you need multi-currency or global tax compliance?

- Budget & growth path: Are you looking for something lightweight or scalable long-term?

6 Trends in ERP and Business Management Software

The ERP industry is evolving rapidly, with several clear trends dominating 2025:

- Smart automation and AI: Platforms are integrating AI to handle anomaly detection, suggest corrections, and automate reporting. This reduces manual work and minimizes errors.

- Real-time financial data through Open Banking: Integration with banks allows businesses to see their financial data in real time, eliminating reconciliation delays and enabling faster decisions.

- Compliance with e-invoicing regulations: With new requirements such as Spain’s e-invoicing laws, modern ERP systems include built-in compliance to ensure invoices are secure, traceable, and audit-ready.

- Scenario forecasting: Companies increasingly demand tools that model future scenarios. ERP platforms now allow businesses to simulate revenue changes, hiring decisions, or investment plans to predict cash flow impact.

- Modular SaaS and scalability: Businesses want to start small and scale up without migrating. Modern ERPs are built modularly, so companies can pay for only what they need and expand over time.

- Security and data protection: ERP providers are doubling down on cybersecurity, offering encryption, multi-factor authentication, and GDPR compliance to ensure trust and reliability.

8 Benefits of Modern ERP Systems

The value of modern ERP platforms goes beyond digitalizing accounting. They reshape how businesses operate.

- Efficiency and productivity: Automation reduces time spent on repetitive tasks like reconciliations, report generation, or invoice management. Teams focus on strategy and growth instead.

- Stronger cash flow management: With real-time dashboards, companies can see where money is going and prepare for fluctuations in liquidity. Forecasting ensures financial resilience.

- Legal compliance: Automatic generation of tax reports and integration with e-invoicing regulations minimize the risk of penalties. Compliance is built in, not an afterthought.

- Informed decisions: Data-driven insights empower managers to make better decisions, whether about hiring, expansion, or reducing costs.

- Scalability: Businesses can start with basic modules and expand into full ERP functionality without needing to switch systems, ensuring smooth long-term growth.

- Collaboration across teams: When all departments share a single platform, silos disappear. Finance, HR, sales, and operations work together with a unified data source.

- Client and partner trust: Professional invoicing, transparent reporting, and secure systems create confidence among clients and suppliers.

- Competitive advantage: Companies with modern ERP systems move faster, adapt better, and are more resilient to market changes than competitors still relying on outdated tools.

Conclusion

In 2025, the ERP market offers more choice than ever. While Odoo remains a powerful platform, it is no longer the only option. Companies now expect systems that are easier to implement, more compliant with regulations, and capable of providing predictive insights.

The most important shift is not just moving away from manual processes, but adopting tools that turn financial management into a strategic advantage.

Whether your business is a small startup, a mid-sized firm, or a fast-scaling enterprise, the right ERP platform will help you save time, reduce risks, and prepare confidently for the future.

Share this post

Related Posts

7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.The 6 Best Quipu Alternatives in Spain for 2025

The 6 best Quipu alternatives in Spain for 2025 to simplify invoicing, accounting, and financial management for businesses.10 best cash management software for small businesses

Wondering what your options are as a small business to manage your cash flows wisely? We have curated a list of the top 10 best cash management softwares for you.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed