The 6 Best Quipu Alternatives in Spain for 2025

- Why Consider Quipu Alternatives?

- The 6 Best Quipu Alternatives in Spain

- 1. Banktrack

- 2. Sage 50 (Sage Business Cloud)

- 3. Anfix

- 4. Billin

- 5. Zoho Books

- 6. Xero

- Business Challenges Without the Right Software

- Trends in Business Management Software (2025)

- How to Choose the Right Alternative to Quipu

- 5 Benefits of Digitalizing Your Finances

- Conclusion

These are the best Quipu alternatives for this year:

- Banktrack

- Sage 50

- Anfix

- Billin

- Zoho Books

- Xero

Managing finances as a freelancer or small business owner in Spain has never been more important.

Between the demands of invoicing, tracking expenses, and staying compliant with Spanish tax obligations, manual processes are no longer enough.

That’s why tools like Quipu have become popular among freelancers and SMEs: they simplify tax management, generate models like 303 (VAT) or 130 (IRPF), and keep expenses organized.

But Quipu is not the only option. Some businesses need more advanced forecasting, others want international features, and some prefer simpler or more affordable solutions.

In this guide, we’ll explore the best alternatives to Quipu in Spain for 2025, analyzing their strengths, weaknesses, and best use cases.

Why Consider Quipu Alternatives?

While Quipu is a strong platform, there are reasons why freelancers or SMEs might look elsewhere:

- Pricing flexibility: Some platforms offer free plans or cheaper options.

- Advanced features: Businesses may need forecasting, treasury control, or project management.

- International capabilities: Quipu is designed for Spain; those working abroad might need multi-currency and global compliance.

- Scalability: Growing companies may require ERP-level features beyond basic invoicing and expenses.

- Specialization: Some tools are stronger in invoicing, others in accounting, or others in tax compliance.

The 6 Best Quipu Alternatives in Spain

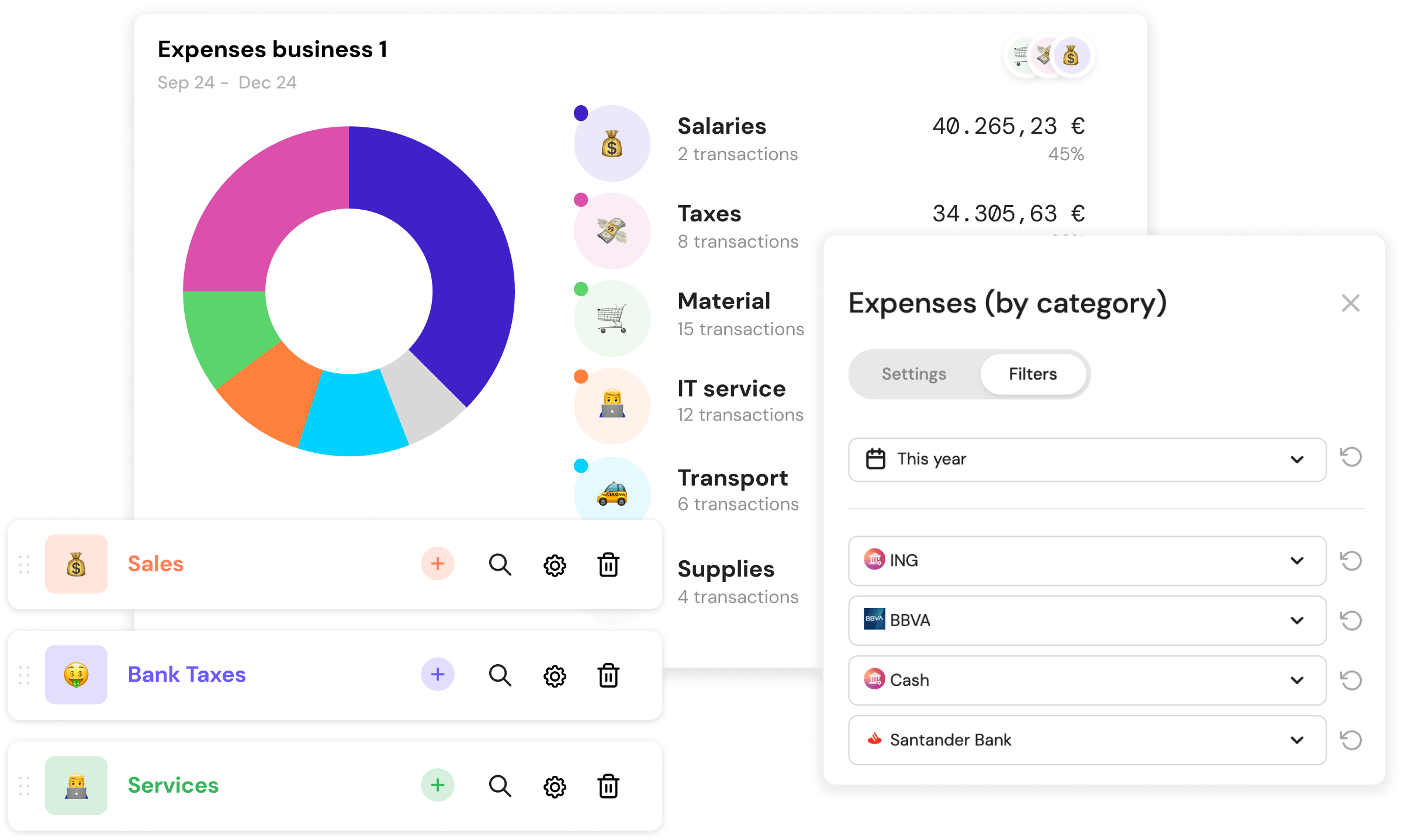

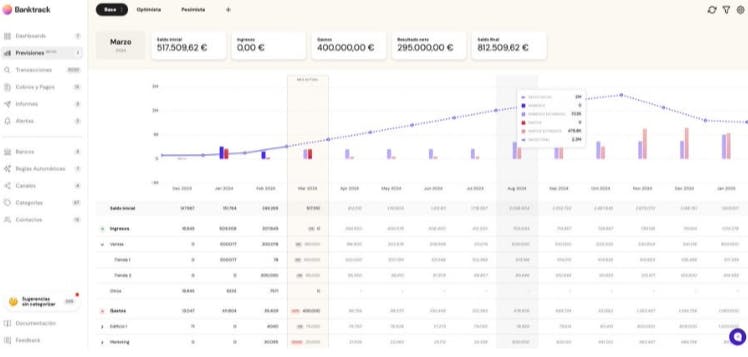

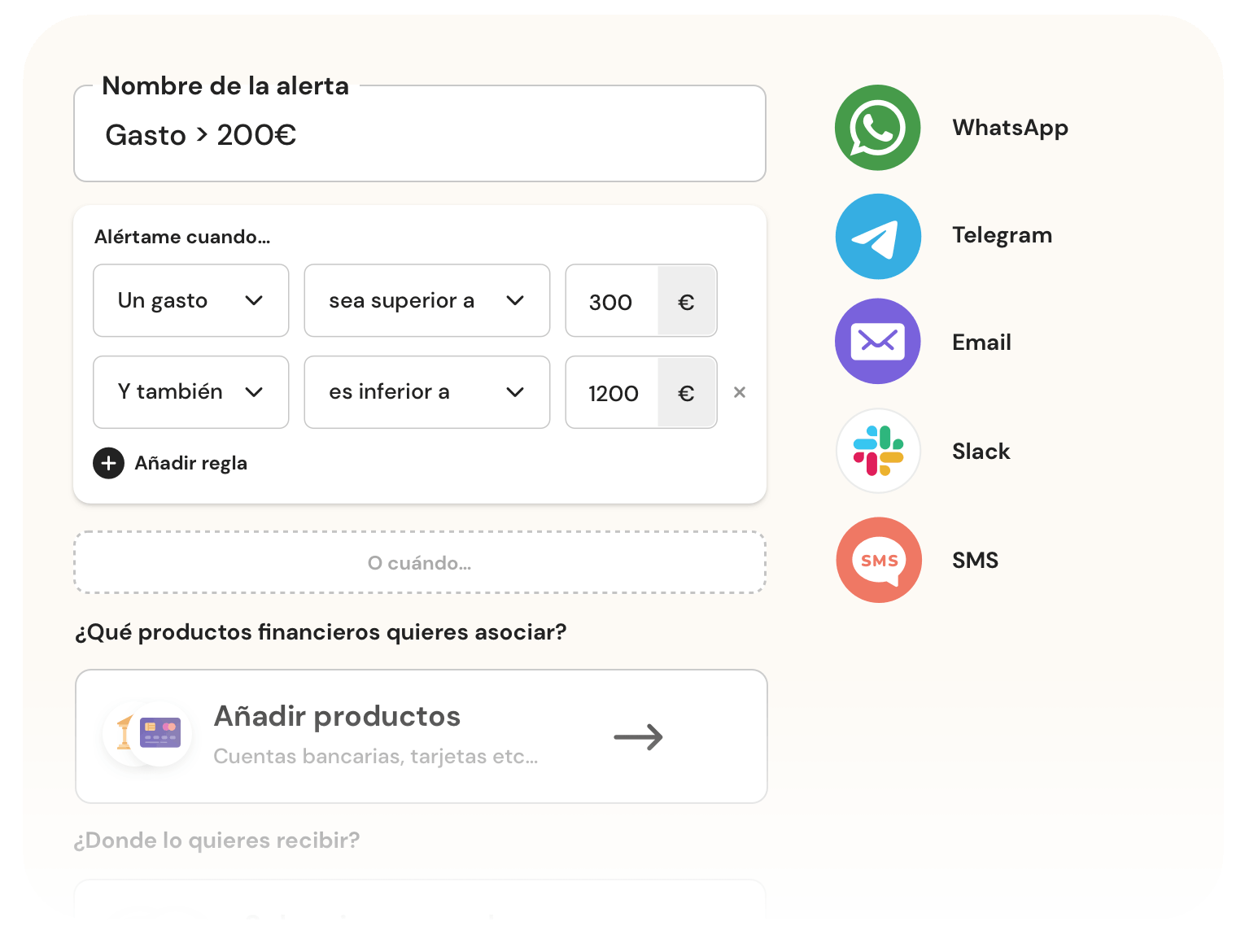

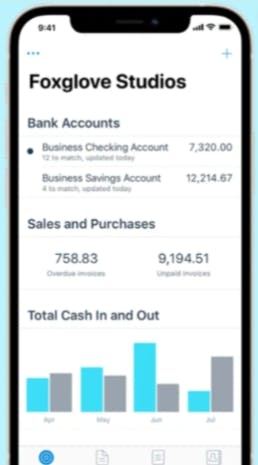

1. Banktrack

Best for cash flow forecasting and treasury control

Banktrack is a cash management software designed to give businesses a complete picture of their cash flow. Unlike Quipu, which focuses primarily on tax automation, Banktrack specializes in treasury management and scenario planning.

Key features:

- Connects with 120+ Spanish and European banks in real time

- Automatic categorization of expenses and income.

- Scenario-based forecasting to anticipate liquidity changes.

- Automatic invoice reconciliation (via email, WhatsApp, or drag & drop).

- Custom alerts for unusual payments, low balances, or duplicate charges.

- Exportable financial reports for accountants or investors.

Best for: SMEs, agencies, or clinics that want visibility into the future, not just the past.

2. Sage 50 (Sage Business Cloud)

Best for robust accounting

Sage is one of the most established accounting software providers in Spain. Sage 50 offers advanced accounting and ERP functions that go well beyond Quipu’s scope.

Key features:

- Advanced accounting functions.

- Inventory and stock management.

- Detailed financial reporting.

- Audit-ready compliance.

Best for: Medium-sized businesses that need solid, recognized accounting software.

3. Anfix

Best for accountant collaboration

Anfix is a Spanish cloud accounting solution designed for real-time collaboration with external accountants. Unlike Quipu, it allows seamless integration between the company and its gestoría (tax advisor).

Key features:

- Electronic invoicing.

- Real-time bank synchronization.

- Shared access with accountants.

- Automated tax compliance.

Best for: SMEs or freelancers that work closely with external accountants.

4. Billin

Best for invoicing and payments

Billin is designed to simplify invoicing, making it fast and intuitive. It’s lighter than Quipu and particularly strong in managing client payments.

Key features:

- Quick invoice creation.

- Recurring invoicing.

- Payment reminders.

- Simple reporting.

Best for: Freelancers and microbusinesses that need straightforward invoicing.

5. Zoho Books

Best for integration with digital ecosystems

Zoho Books is part of the global Zoho suite, which makes it perfect if you’re already using Zoho CRM, Zoho Projects, or Zoho Mail. It’s more internationally focused than Quipu.

Key features:

- Invoicing, expenses, and reporting.

- Multi-currency support.

- Native integrations with other Zoho apps.

- Workflow automation.

Best for: Digital businesses and startups that want to centralize operations in one ecosystem.

6. Xero

Best for international clients

Xero is a global accounting platform with powerful dashboards and integrations. While Quipu is designed for Spain’s tax system, Xero is more suitable for international operations.

Key features:

- Multi-currency support.

- Integration with 800+ apps.

- Real-time dashboards.

- Profitability tracking by client or project.

Best for: Businesses working with international clients and suppliers.

Business Challenges Without the Right Software

Many Spanish freelancers and SMEs still use spreadsheets or outdated tools. This creates:

- Lack of real-time visibility – no accurate view of cash flow.

- Human error – mistakes in invoices, expenses, or tax returns.

- Time wasted – repetitive manual tasks steal hours each week.

- Scaling issues – managing multiple clients or projects becomes chaotic without centralization.

Modern financial software eliminates these problems, enabling businesses to work smarter, faster, and with fewer risks.

Trends in Business Management Software (2025)

The market is evolving rapidly, and several trends are shaping the way companies manage their finances:

- Smart automation – anomaly detection, auto-corrections, and draft tax forms.

- Open Banking – real-time bank integrations reduce reconciliation errors.

- Electronic invoicing compliance – Spanish laws require certified e-invoicing.

- Scenario forecasting – model liquidity for different business outcomes.

- Modular SaaS – scalable platforms that grow with your company.

How to Choose the Right Alternative to Quipu

Ask yourself:

- What’s the size of your business? Freelancers vs SMEs have different needs.

- Do you need invoicing only, or full accounting + project management?

- Do you require cash flow forecasting to avoid liquidity gaps?

- Do you work with international clients? Multi-currency support may be essential.

- What’s your budget? Free options exist, while more advanced platforms cost €10–€39/month.

5 Benefits of Digitalizing Your Finances

- Time savings – less manual admin, more focus on clients and growth.

- Improved financial control – see income, expenses, and balances in real time.

- Legal compliance – automatic Spanish tax forms and e-invoicing.

- Better decision-making – data-driven forecasts replace guesswork.

- Scalability – start small and grow without switching platforms.

Conclusion

For freelancers and SMEs in Spain, financial management is no longer just about keeping receipts and filling in tax forms. It’s about gaining visibility, anticipating challenges, and freeing up time to focus on growth.

While Quipu has become a trusted tool for many, the market now offers a wide range of alternatives, each with unique strengths.

The most important step isn’t choosing the “best” tool universally, but choosing the one that fits your business model, workflow, and growth plans. By adopting the right digital solution, professionals can transform finance from a stressful obligation into a strategic asset that drives long-term success.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed