Top 6 Bank Tracker Softwares in Canada

- 6 Best Bank Trackers Available in Canada

- 1. Banktrack

- 2. Mint

- 3. You Need a Budget (YNAB)

- 4. KOHO

- 5. Wealthica

- 6. PocketSmith

- What is a Bank Tracker?

- Why Should You Use a Bank Tracker in Canada?

- 1. Avoid Overdraft Fees

- 2. Spot Fraud Quickly

- 3. Easily Manage Your Budget

- 4. Track Your Investments

- 5. Set and Reach Savings Goals

- 5 Features to Look for in a Bank Tracker

- 1. Real-Time Notifications

- 2. Customizable Budgets

- 3. Security

- 4. Works Across Multiple Devices

- 5. Goal Setting

- How to Choose the Right Bank Tracker for You

These are the best tracker softwares in Canada:

- Banktrack

- Mint

- You Need a Budget (YNAB)

- KOHO

- Wealthica

- PocketSmith

Keeping track of your finances doesn’t have to be difficult.

With a bank tracker, you can easily monitor your spending, savings, and overall financial health.

In Canada, bank trackers are becoming more popular as a tool for managing personal and business finances.

Whether you're looking to save money, avoid overdraft fees, or keep an eye on your investments, a bank tracker can help you stay on top of everything.

We will break down what a bank tracker is, why it's useful, and how you can choose the right one for your needs in Canada.

6 Best Bank Trackers Available in Canada

Here are some of the best options available in Canada:

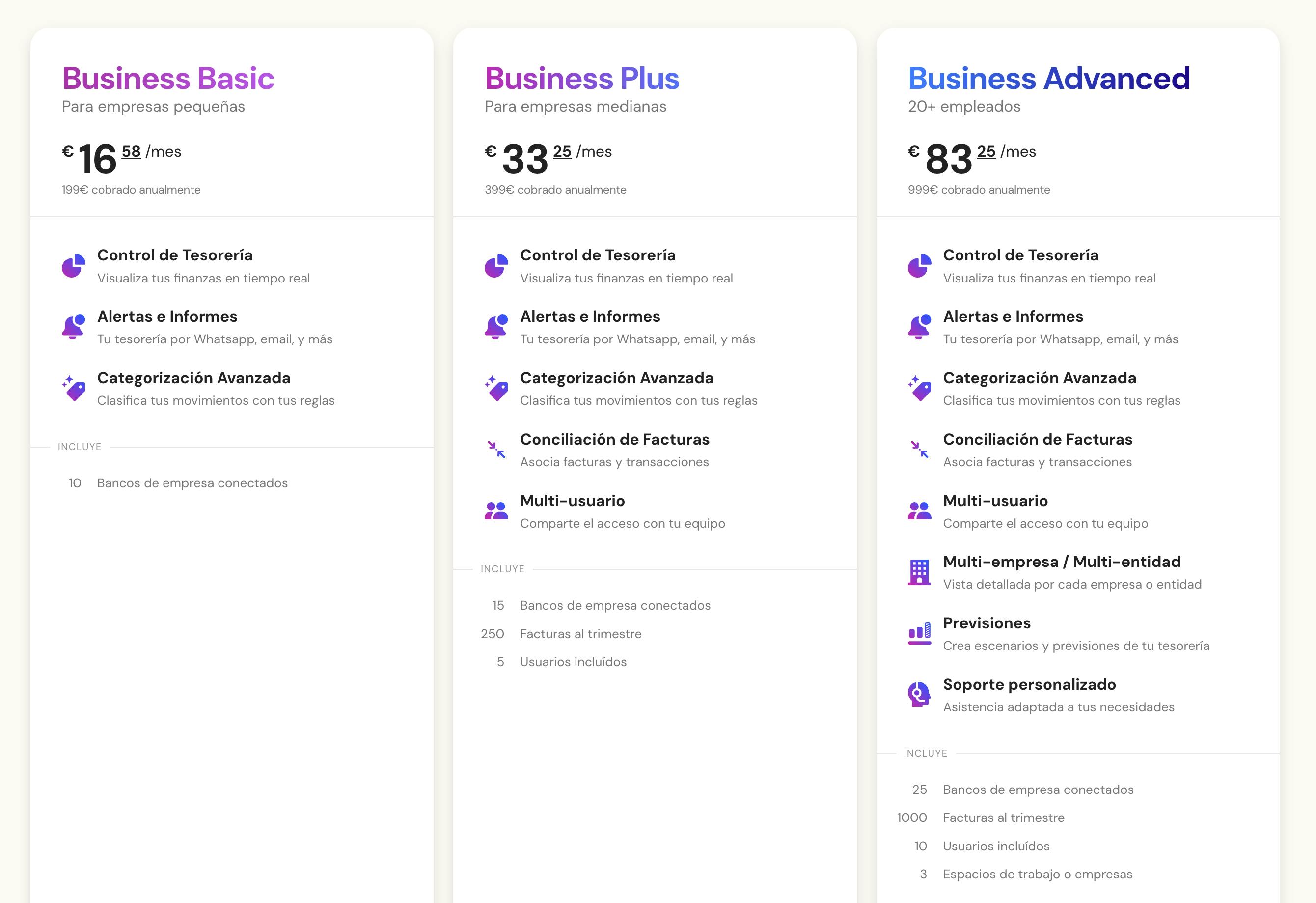

1. Banktrack

Banktrack stands out as the best expense tracking app for individuals and businesses.

When it comes to managing your finances, you need a tool that not only tracks your expenses but also integrates perfectly with your bank accounts, provides strong security, and offers advanced features to optimize your financial performance.

Banktrack is that expense tracker software with bank sync features.

It allows you to effectively access real-time financial information with its customizable dashboards and flexible categories, making it easy to track both income and expenses.

With Banktrack, you can create personalized reports and receive alerts that help you stay on top of your finances.

Key Features:

- Personalized Dashboards: Tailor your financial overview to focus on what matters most to you, from income streams to spending habits.

- Integration with Multiple Accounts: It is the best app to link all bank accounts, as it syncs with over 120 banks, including both traditional and neobanks, using Open Banking or Direct Access.

- Customizable Spending Limits: Set limits in different categories, and receive notifications when you're nearing your spending cap, have a low balance, or spot a duplicate charge.

- Automated Alerts and Reports: Get real-time notifications and reports through your preferred channels: WhatsApp, SMS, email, Slack, or Telegram.

- Drag-and-Drop Interface: Banktrack’s easy-to-use interface allows you to create, customize, and send financial reports with just a few clicks.

- Affordable Pricing: Plans start at just €16.58 per month, offering great value for businesses or individuals looking to manage their cash flow efficiently.

Banktrack also offers automated transaction syncing, ensuring that your financial data is up to date without manual input. You can monitor expenses, revenues, and set financial goals that help you stay on track with your budgeting efforts.

When it comes to security, Banktrack takes protection seriously. It uses encryption to safeguard all your transaction data, and it never stores your banking passwords.

Banktrack only has "read access" to your account information, meaning it can't make any transactions on your behalf.

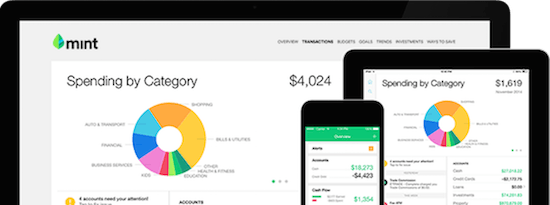

2. Mint

Mint is one of the most popular free bank trackers.

It connects to most Canadian banks and allows you to track all your accounts, credit cards, and investments in one place.

You can also set budgets, get bill reminders, and monitor your credit score.

- Pros: Free to use, user-friendly, detailed reports on spending.

- Cons: Ads within the app can be annoying for some users.

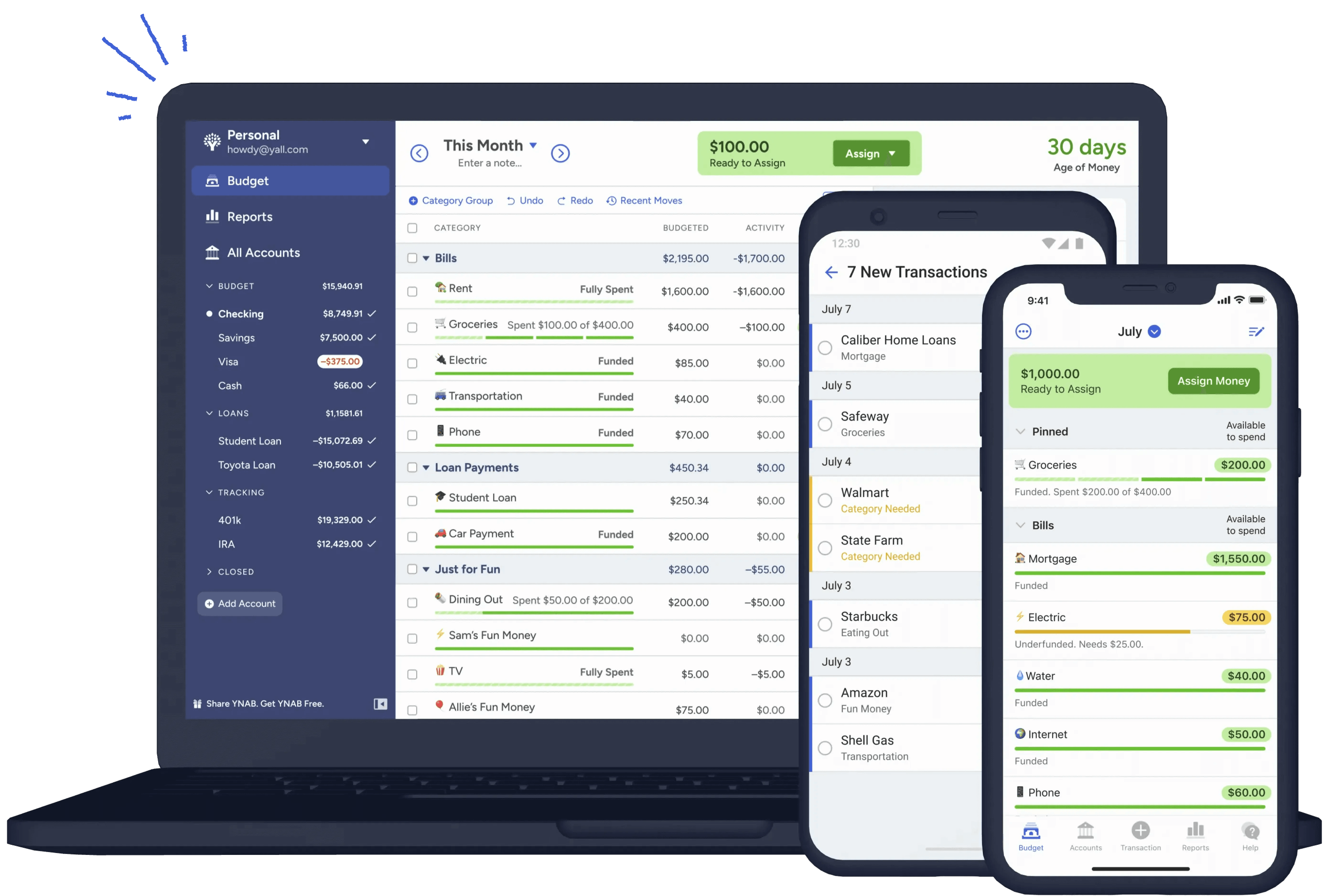

3. You Need a Budget (YNAB)

YNAB is a paid app that focuses on helping you create a budget and stick to it.

Here is how you can determine if you need a business budgeting software as opposed to a bank tracker software.

It’s great for people who want more control over their spending and saving.

- Pros: Excellent budgeting features, helps you save more money.

- Cons: Subscription cost, which might be a deal-breaker for some.

4. KOHO

KOHO is more than just a bank tracker, it’s also a prepaid Visa card.

You can load money onto your card, and KOHO will help you track your spending. It even offers cashback rewards.

- Pros: Easy to use, no fees, cashback on purchases.

- Cons: Limited investment tracking features.

5. Wealthica

Wealthica is designed for Canadians who want to keep track of their investments.

It connects to many Canadian financial institutions and gives you a detailed look at your entire financial portfolio.

- Pros: Great for investment tracking, free to use.

- Cons: Less focus on everyday spending.

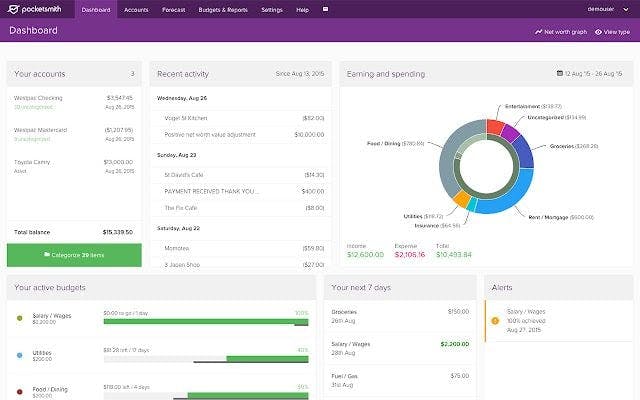

6. PocketSmith

PocketSmith is a flexible financial tracker that includes budgeting tools and cash flow forecasting.

It’s a great option if you want to see a long-term view of your financial health.

- Pros: Advanced forecasting, supports multiple accounts.

- Cons: May feel too complex for basic users.

What is a Bank Tracker?

A bank tracker is an app or tool that helps you keep an eye on your bank accounts, credit cards, and even investments. It shows you your transactions in real-time, so you always know how much money you have and where it’s going.

Some bank trackers also offer extra features like budgeting tools, savings goal trackers, and notifications that alert you to important account changes, like a low balance or a big transaction.

Why Should You Use a Bank Tracker in Canada?

There are many reasons to use a bank tracker, but here are some of the most important ones:

1. Avoid Overdraft Fees

Overdraft fees can add up quickly. A bank tracker lets you know when your balance is low, so you don’t accidentally spend more than you have.

This can help you avoid those annoying overdraft fees that banks charge.

For example, Banktrack sends personalized alerts directly to your preferred social app, notifying you when your balance is low or when there’s any important activity that needs your attention.

2. Spot Fraud Quickly

Unfortunately, fraud happens. With a bank tracker, you can get alerts as soon as a transaction occurs.

If you see something you didn’t authorize, you can act fast and contact your bank before the problem gets worse.

3. Easily Manage Your Budget

A bank tracker can also help you budget better. By showing you exactly where your money is going, it’s easier to see how much you’re spending on things like groceries, entertainment, or rent.

If you are particularly interested in this feature that allows you to have a clear overview of your expenses, you may be interested in a cash visibility tool.

Some trackers, like Banktrack, even let you set up spending limits for different categories, helping you stick to your budget.

4. Track Your Investments

For those who invest in stocks, mutual funds, or other financial products, some bank trackers let you keep track of your investments as well.

This way, you can see everything, your bank accounts, credit cards, and investments, all in one place.

5. Set and Reach Savings Goals

If you’re saving up for a vacation, a house, or just building an emergency fund, a bank tracker can help.

You can set savings goals and track your progress over time. Some apps even let you set up automatic transfers to your savings account, making it easier to save without thinking about it.

5 Features to Look for in a Bank Tracker

When choosing a bank tracker, there are a few important features you should keep in mind:

1. Real-Time Notifications

Make sure the bank tracker offers real-time updates.

This means you'll get notified the moment a transaction happens, so you can keep a close watch on your money.

2. Customizable Budgets

A good bank tracker will let you set up your own budget categories.

This way, you can track your spending on specific things like groceries, transportation, or dining out, and stay within your limits.

3. Security

Security is super important when it comes to your financial information. Look for a tracker that offers features like two-factor authentication and encryption to keep your data safe.

4. Works Across Multiple Devices

It’s useful to have access to your bank tracker on your phone, tablet, and computer. This way, you can always check your finances no matter where you are.

5. Goal Setting

If saving money is one of your priorities, look for a bank tracker that lets you set savings goals. You’ll be able to track your progress and get motivated to keep saving.

How to Choose the Right Bank Tracker for You

Choosing the right bank tracker depends on your financial goals. Here are a few things to consider:

- Budget: Some bank trackers are free, while others charge a monthly or yearly fee. If you’re serious about budgeting and financial planning, it might be worth paying for a more feature-rich app.

- Features: Do you want a basic tool that helps you track spending, or do you need something more advanced that includes investment tracking and savings goals?

- Ease of Use: If you prefer simple, straightforward apps, choose one that’s easy to navigate. Some apps are packed with features, but that can also make them harder to use.

- Security: Always make sure the tracker you choose uses strong security features like encryption and two-factor authentication.

Share this post

Related Posts

Best 6 Grocery Expense Tracker Apps for 2025

Tracking grocery spending is essential for budget control. Use apps or simple methods to reduce costs and avoid overspending.Top 5 bank trackers in Switzerland

Managing your finances in Switzerland is easier with the right bank tracker. This guide highlights the top 5 tools designed to help you track expenses, monitor accounts, and optimize your budget.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed