Top 5 Best Cash Visibility Tools in 2024

- Top 5 Best Cash Visibility Tools

- 1. Banktrack

- Comprehensive Transaction Tracking

- Seamless Bank Integration

- Robust Security Measures

- Advanced Cash Flow Forecasting

- Automated Bank Reconciliation

- Advanced Reporting and Analysis Tools

- 2. QuickBooks Online

- 3. Xero

- 4. FreshBooks

- 5. Wave

- Why Cash Visibility is Important

- Improved Decision Making

- Enhanced Cash Flow Management

- Increased Financial Stability

- Why Banktrack is the Best Cash Visibility Tool for Your

Top 5 cash visibility tools to enhance financial management:

- Banktrack

- QuickBooks Online

- Xero

- FreshBooks

- Wave

Managing finances is tricky, potentially disastrous, and most people just aren’t naturally good at it.

That’s where a cash visibility tool comes in handy, it’s like having a safety net for your financial acrobatics.

Let’s dive into why you need one of these tools, explore some popular options, and all the benefits this can have for you or your business.

What is a Cash Visibility Tool?

A cash visibility tool is basically a window into your financial soul. It lets you see all your financial transactions in real-time, track where your money is coming from and going to, and forecast your future cash flow.

This means you can spot potential issues before they spiral out of control, make better financial decisions, and keep your business running smoothly without those late-night panic attacks.

Top 5 Best Cash Visibility Tools

There are plenty of fish in the financial software sea, but here are some that are actually worth reeling in:

1. Banktrack

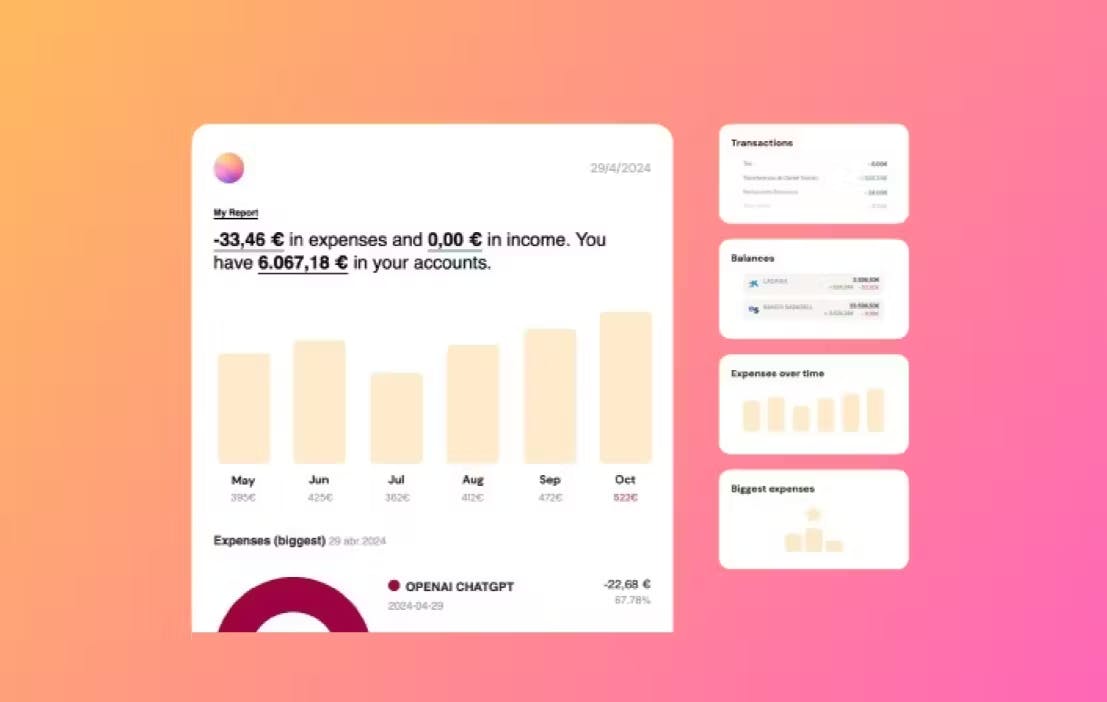

Banktrack is a quite complete cash flow management tool designed to give you the visibility you need into your cash flow, streamline your financial operations, and secure your financial data.

With seamless bank integration, real-time transaction tracking, and advanced forecasting capabilities, Banktrack simplifies financial management and helps you make informed decisions with confidence.

Whether you're a startup, an established business or an individual, Banktrack is the best solution for keeping your finances in check.

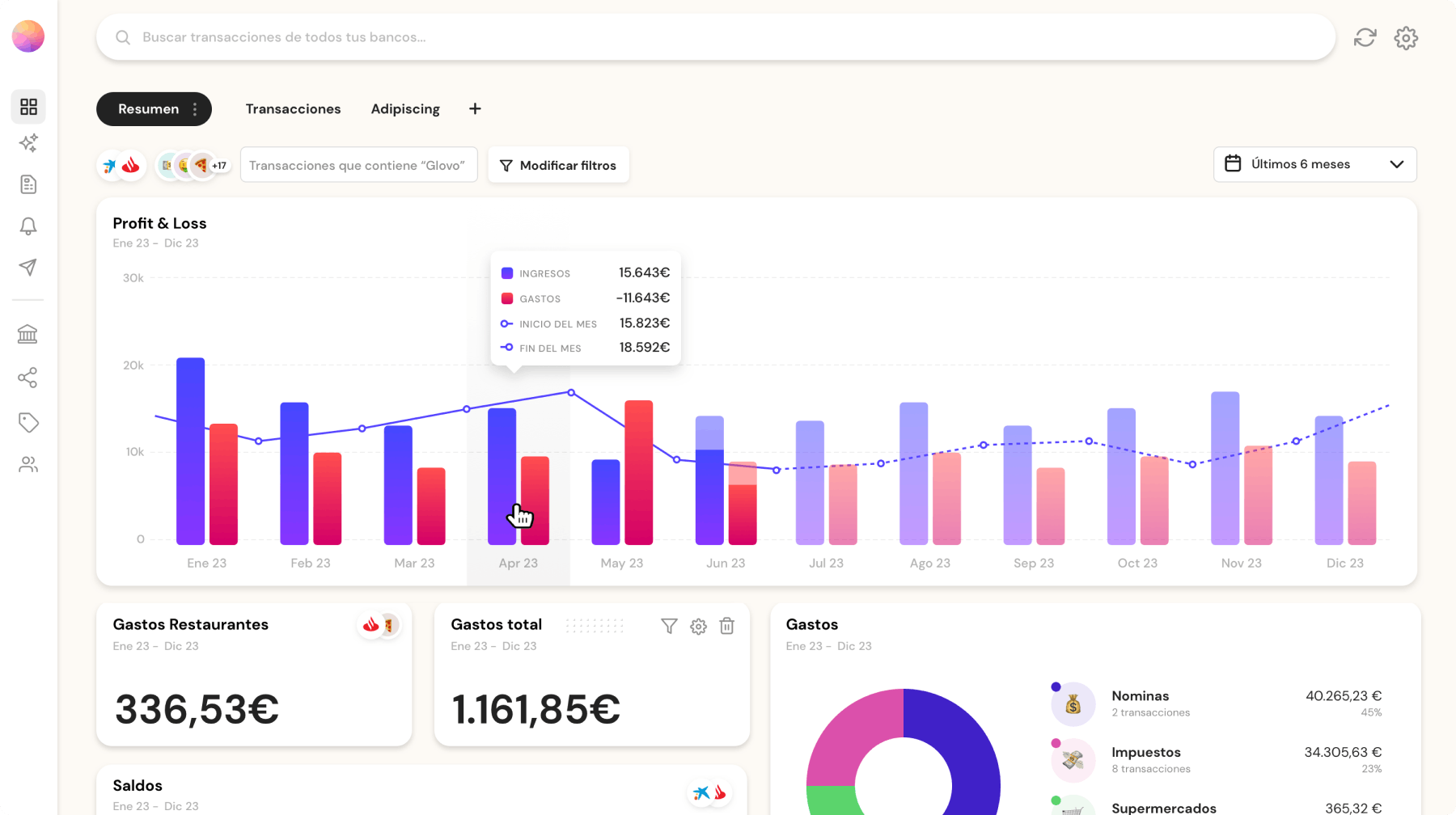

Comprehensive Transaction Tracking

Banktrack excels in tracking every financial move you make:

Customizable Dashboards

Tailor your dashboards to see exactly what you need. Whether it’s a broad overview or detailed breakdowns, Banktrack has you covered.

Flexible Categorization

Precisely categorize your income and expenses, so you know exactly where your money is coming from and going to.

This makes generating detailed reports a breeze and helps you make informed decisions.

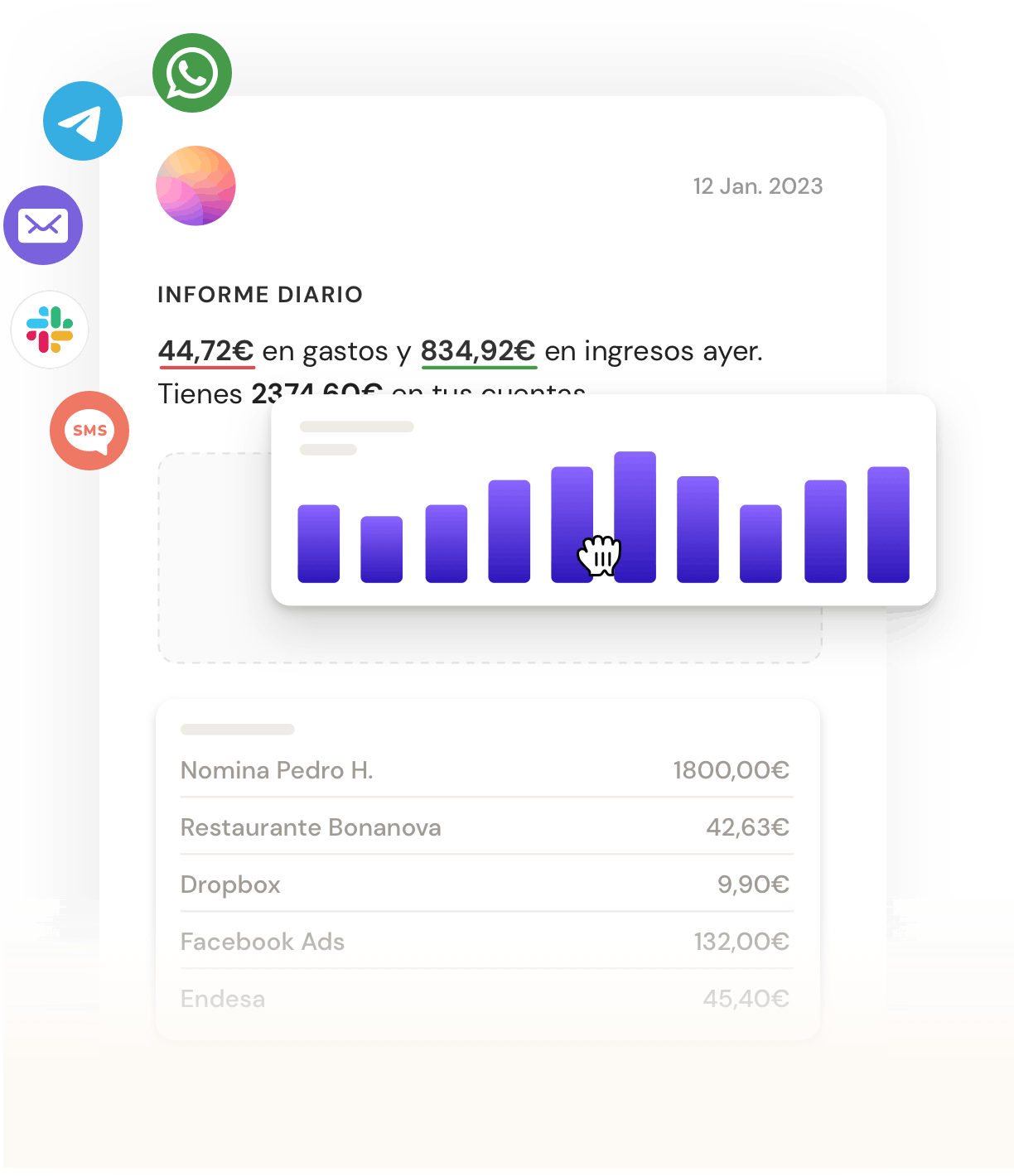

Seamless Bank Integration

No more manually entering data or dealing with clunky imports. Banktrack syncs with over 120 banks, including both traditional banks and neobanks.

Extensive Bank Coverage

Whether you’re using a big-name bank or a trendy neobank, Banktrack can integrate them all into one platform.

Dual Connection Methods

Choose between Open Banking (PSD2) for secure, standardized data access, or Direct Access for banks outside the PSD2 umbrella.

Either way, your data syncs seamlessly.

Robust Security Measures

Financial security is no joke, and Banktrack takes it seriously:

Authorized Data Providers

Only authorized and audited providers approved by the Banks handle your data.

Read-Only Access

Banktrack only gets read access to your accounts, so it can’t conduct transactions, adding an extra layer of security.

No Storage of Banking Passwords

Connections are made via a unique access token, so your passwords are never stored.

Data Encryption

All transaction data is encrypted, ensuring your financial information remains confidential and secure.

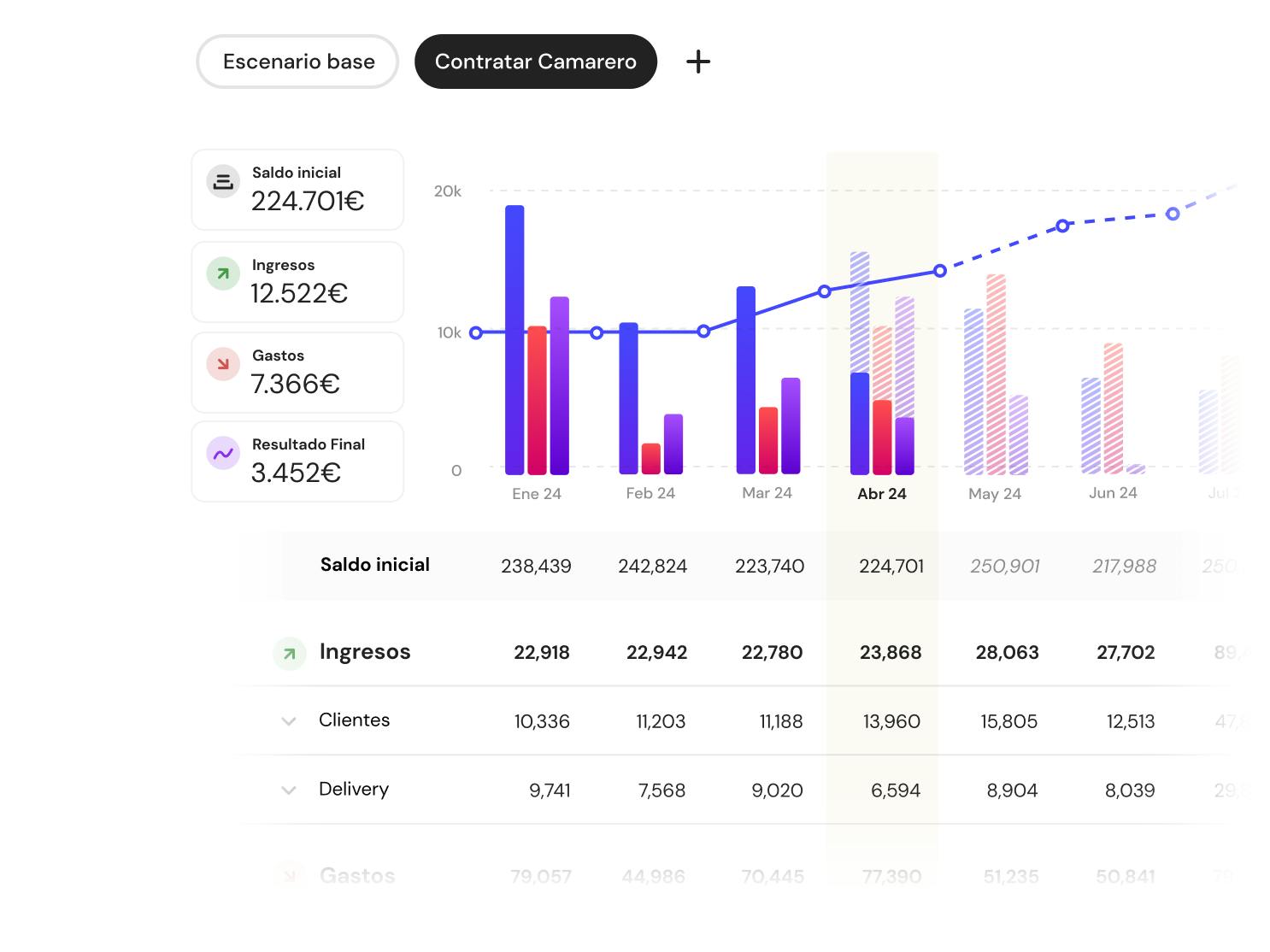

Advanced Cash Flow Forecasting

Predict your financial future with Banktrack’s forecasting tools:

Historical Data Analysis

Analyze past data to predict future cash flow trends, helping you plan better and avoid surprises.

Dynamic Forecasting

Create forecasts that adjust in real-time based on your actual data, keeping your projections accurate and up-to-date.

Automated Bank Reconciliation

Save time and avoid errors with automated bank reconciliation:

Automated Reconciliation

Automatically match your bank statements with your internal records, identifying discrepancies quickly.

Simplified Processes for Startups

Especially useful for startups managing multiple bank accounts, this feature simplifies reconciliation and reduces the risk of errors.

Advanced Reporting and Analysis Tools

Get deeper insights with advanced tools:

Customizable Reports

Create reports tailored to your specific needs, adding dynamic functionality to your financial analysis.

Goal Tracking

Set financial goals and track your progress towards achieving them, helping you stay on target.

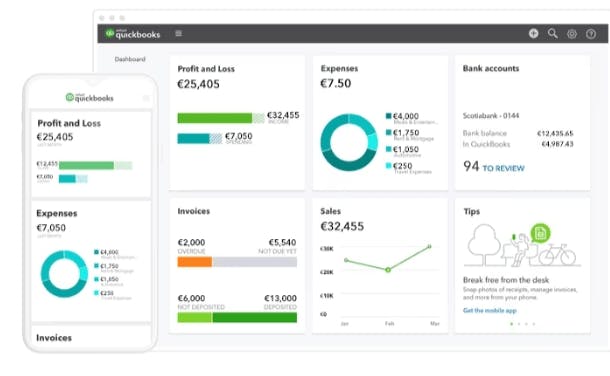

2. QuickBooks Online

QuickBooks Online is like the Swiss Army knife of accounting software. It offers:

- Real-Time Financial Tracking: Keep an eye on your income and expenses as they happen.

- Cash Flow Forecasting: Predict your future cash needs based on historical data.

- Bank Integration: Automatically import and categorize transactions from your bank accounts.

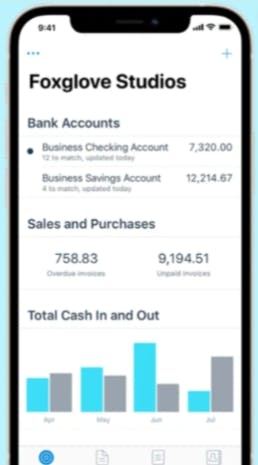

3. Xero

Xero is another top choice, beloved by small business owners and accountants. Key features include:

- Customizable Dashboards: See your financial data just the way you like it.

- Bank Reconciliation: Automatically match bank transactions with your internal records.

- Expense Tracking: Understand where your money is going with detailed expense reports.

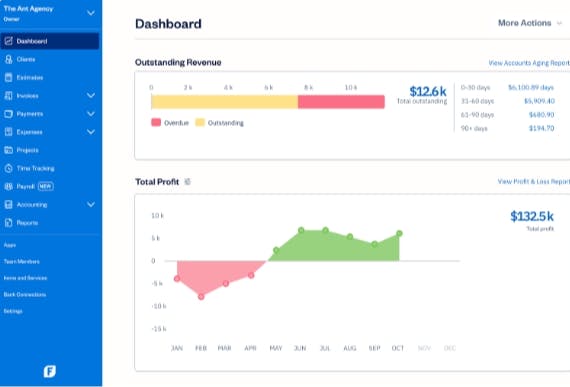

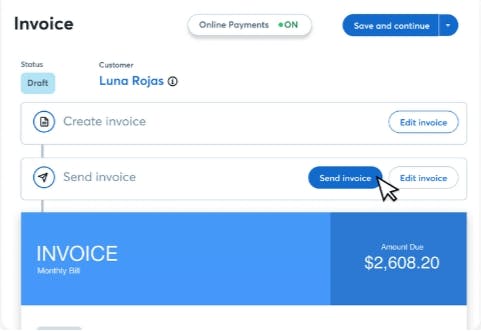

4. FreshBooks

FreshBooks is perfect for those who like their accounting software to be as user-friendly as possible. It offers:

- Expense Tracking: Easily monitor and categorize your expenses.

- Invoicing and Payments: Manage invoices and payments to keep cash flowing smoothly.

- Financial Reports: Generate detailed reports to see how you’re doing.

5. Wave

Wave is the best free option out there, ideal for small businesses and freelancers. It includes:

- Income and Expense Tracking: An expense tracker app keeps tabs on your cash flow without spending a dime.

- Bank Connections: Link your bank accounts to automatically import transactions.

- Financial Reporting: Generate insightful reports to help with decision-making.

Why Cash Visibility is Important

Improved Decision Making

Knowing your financial status at any given moment means you can make decisions based on actual data instead of wild guesses.

You can see where you’re overspending, where you might need to invest more, and generally just have a clearer picture of your financial health.

Enhanced Cash Flow Management

By keeping a close eye on your cash flow, you can spot patterns and trends.

A cash flow management tool can help you prepare for lean periods and make the most of flush times, avoiding those awkward moments when you realize you can’t pay your bills.

Increased Financial Stability

With a solid grasp of your financial situation, you can ensure you’ve always got enough cash on hand to meet your obligations.

This means fewer sleepless nights and more stability for your business.

Why Banktrack is the Best Cash Visibility Tool for Your

While the above tools are great, Banktrack stands out in several ways.

- Comprehensive Transaction Tracking: Get real-time, customizable insights into every financial movement, ensuring you always know exactly where your money is going and coming from.

- Seamless Bank Integration: Sync with over 120 banks effortlessly, including both traditional and neobanks, for a unified view of all your accounts.

- Robust Security: Enjoy peace of mind with read-only access, no storage of passwords, and advanced encryption to keep your data secure.

- Advanced Forecasting: Use historical data to do a cash flow projection, identify trends and make dynamic forecasts that adjust in real-time.

- Automated Reconciliation: Streamline your bank reconciliation process with automation, reducing errors and saving you valuable time.

A cash visibility tool can provide the insights you need to manage your finances effectively, make informed decisions, optimize cash flow, and achieve greater financial stability.

While there are several great options out there, Banktrack stands out as the best. With its transaction tracking, seamless bank integration, strong security measures, advanced cash flow forecasting, automated bank reconciliation, and advanced reporting and analysis tools, Banktrack is the best tool for enhancing cash visibility.

Whether you’re a startup trying to keep your head above water or an established business looking to optimize your finances, Banktrack has got you covered.

Share this post

Related Posts

The 8 best alternatives to Spendee in 2025

Looking for a fresh way to manage your budget? Check out these top Spendee alternatives to help you track spending, set goals, control your finances.Best 6 Expense Tracker Software with Bank Sync features

Managing money isn’t exactly anyone’s idea of fun, but it is definitely important and it can even be simpler than you think. Let us show you how.Top 5 Best bank trackers in Portugal

Explore 5 bank tracker apps available in Portugal to easily manage budgets, track expenses, and gain control over your finances in 2024.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed