Best 6 Subscription Manager Apps for 2025

These are the best subscription manager apps:

- Banktrack

- Rocket Money

- Bobby

- Hiatus

- Trim

- Subby

With the growing number of digital services, streaming platforms, software tools, and other recurring subscriptions, it can be challenging to keep track of all your monthly payments.

Subscription manager apps help you manage all your subscriptions in one place, ensuring you never miss a payment and allowing you to identify and cancel any services you no longer use.

In this article, we’ll explore the best subscription manager apps available in 2025 and how they can help you save time and money.

Top 6 Subscription Manager Apps for 2025

1. Banktrack

Banktrack is a cash management software that excels not only in tracking expenses but also in managing subscriptions effectively. How? Let us explain you.

With its seamless integration with multiple banks and real-time transaction tracking, Banktrack, as the best app to link all bank accounts, helps you keep a close eye on all your recurring payments, ensuring you stay on top of your subscriptions.

It even gives you detailed visuals to help you understand where your money goes and control your expenses in subscriptions more effectively.

Paying off debt is about more than money, that is why Banktrack offers all the following features:

Key Features

Subscription Monitoring and Alerts:

- Real-Time Alerts: Receive instant notifications via WhatsApp, SMS, email, Slack, or Telegram when a subscription payment is due, canceled, or renewed. This feature helps you stay informed about your recurring payments and avoid unwanted charges.

- Automated Tracking: Banktrack is also a great expense tracking app as it identifies and tracks recurring payments, categorizing them as subscriptions. This makes it easy to see all your subscriptions in one place, without having to manually input each one.

Seamless Bank Integration:

- Extensive Bank Coverage: Banktrack integrates with over 120 banks, allowing you to sync all your accounts in one platform. This bank integration ensures that you never miss a subscription payment, as every transaction is automatically tracked.

Dual Connection Methods:

- Open Banking (PSD2): Provides secure, standardized access to your banking data, compliant with the latest European regulations.

- Direct Access: Offers direct connections for banks not covered under PSD2, ensuring complete financial data integration.

Customizable Dashboards and Reports:

- Dashboard Overview: Create custom dashboards to view all your subscriptions at a glance. This real-time overview helps you understand your spending on subscriptions and identify opportunities to cut costs.

- Detailed Reports: Generate detailed reports that show how much you’re spending on subscriptions each month, helping you make informed decisions about which services to keep or cancel.

Strong Security Measures:

- Authorized Data Providers: Uses only authorized and audited data providers approved by the Bank of Spain, ensuring your financial data is handled securely.

- Read-Only Access: Banktrack has read-only access to your accounts, meaning it can view and import data without making any changes, adding an extra layer of security.

- Data Encryption: All data is encrypted to protect your financial information from unauthorized access.

Pros and Cons

- Pros: Comprehensive subscription tracking, real-time alerts, customizable dashboards, seamless bank integration, and strong security measures.

- Cons: Some features may require a premium subscription.

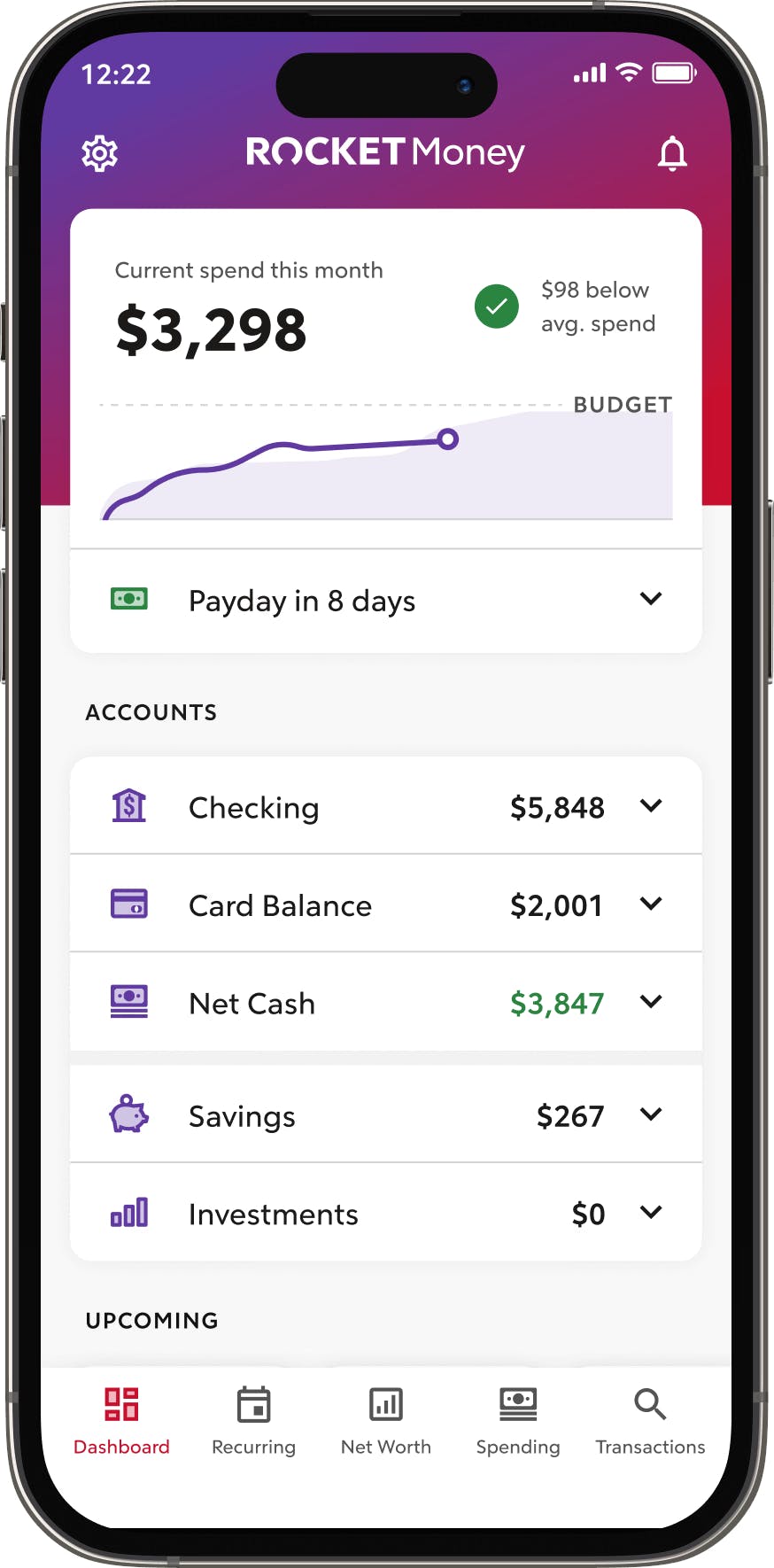

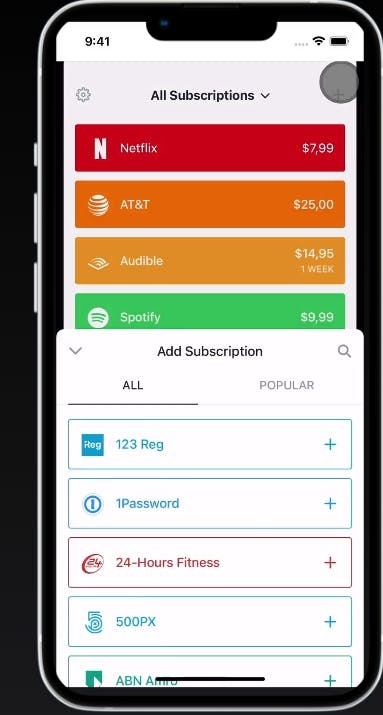

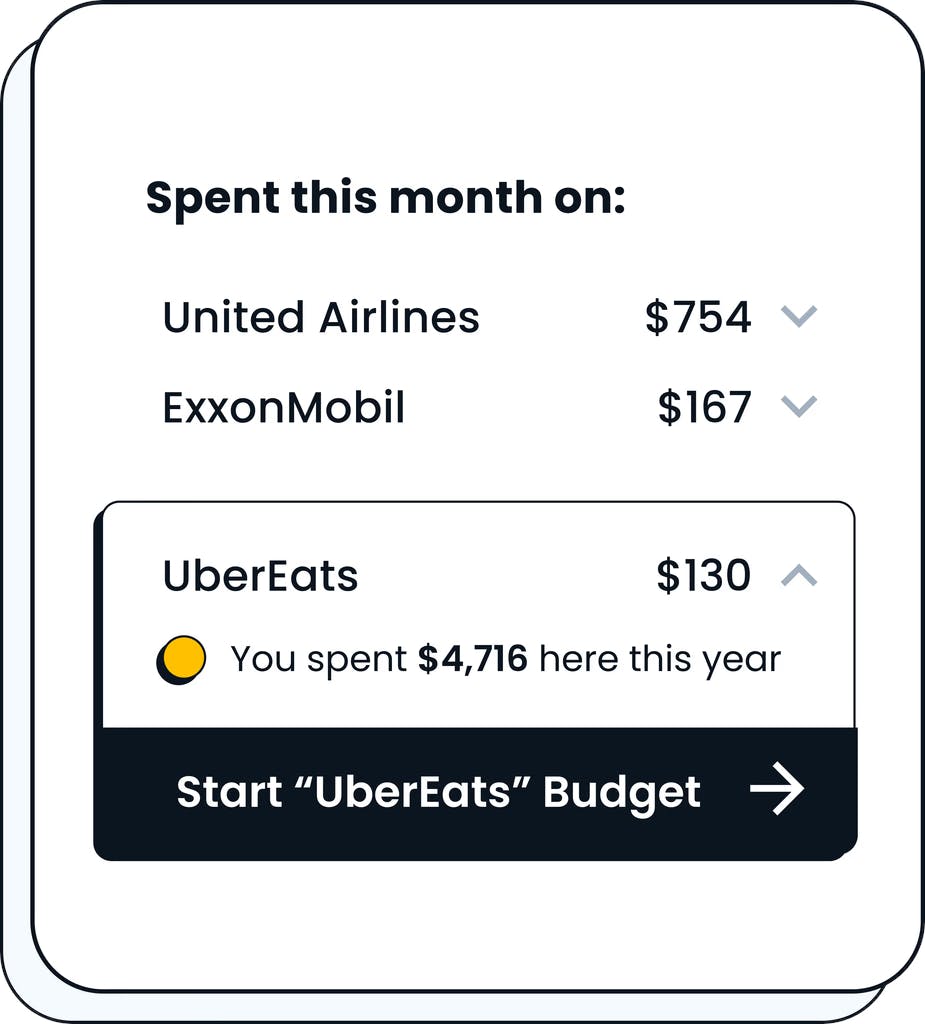

2. Truebill (Rocket Money)

Truebill, now rebranded as Rocket Money, is one of the most popular subscription manager apps on the market.

It helps users manage their subscriptions, lower their bills, and improve their overall financial health.

Key Features

- Subscription Cancellation: Easily cancel unwanted subscriptions directly through the app.

- Bill Negotiation: Rocket Money can negotiate your bills (e.g., cable, internet) to help you save money.

- Spending Insights: Provides insights into your spending habits, helping you identify areas where you can save.

- Budgeting Tools: Offers budgeting features to help you plan and manage your finances more effectively.

Pros and Cons

- Pros: Intuitive interface, subscription cancellation, bill negotiation, and spending insights.

- Cons: Limited features in the free version, some services require a fee.

3. Bobby

Bobby is a simple and user-friendly subscription manager app designed to help you keep track of all your recurring payments in one place.

It doesn’t connect to your bank accounts, which makes it ideal for users who prefer a more manual approach.

Key Features

- Manual Subscription Entry: Add and manage your subscriptions manually, ensuring complete control over what is tracked.

- Custom Reminders: Set custom reminders for upcoming payments, so you never miss a due date.

- Currency Support: Supports multiple currencies, making it ideal for users with international subscriptions.

Pros and Cons

- Pros: Easy to use, great for manual entry, supports multiple currencies.

- Cons: No automatic bank integration, relies on manual input.

If you’re also considering Mint but want to see how it compares to other tools, don’t miss our full guide on the best mint alternatives. It highlights apps that may offer more flexibility and features depending on your financial needs.

4. Hiatus

Hiatus is a bill management app that focuses on helping users save money by tracking subscriptions, negotiating bills, and providing insights into their spending.

Key Features

- Subscription Tracking: Automatically tracks all recurring payments and provides reminders for upcoming charges.

- Bill Negotiation: Negotiates bills like cable, phone, and internet to help you lower costs.

- Spending Insights: Offers detailed insights into your spending habits and trends.

- Automatic Savings: Identifies and suggests savings opportunities based on your subscriptions and spending patterns.

Pros and Cons

- Pros: Automatic tracking, bill negotiation services, spending insights.

- Cons: Some features require a premium subscription, limited availability outside the U.S.

5. Trim

Trim is a financial management app that helps users save money by managing subscriptions, negotiating bills, and finding better rates on services.

It’s particularly useful for those looking to cut costs on monthly bills and subscriptions.

Key Features

- Subscription Management: Identifies all your subscriptions and helps you cancel the ones you don’t want.

- Bill Negotiation: Automatically negotiates bills like cable, internet, and medical bills.

- Debt Payoff Planner: Provides a tool for creating a debt payoff plan based on your income and expenses.

- Savings Alerts: Sends alerts when it finds opportunities to save on subscriptions or bills.

Pros and Cons

- Pros: Good bill negotiation features, savings alerts, debt payoff planner.

- Cons: Some services require a fee, limited international availability.

6. Subby

Subby is a subscription manager app designed to help users track all their recurring payments easily.

It’s particularly useful for those who want a simple, no-frills app to manage their subscriptions.

Key Features

- Custom Notifications: Set reminders for upcoming payments and get notified before charges occur.

- Expense Tracking: Provides an overview of all your subscriptions and total monthly costs.

- Multiple Device Sync: Syncs across multiple devices, making it easy to manage subscriptions on the go.

Pros and Cons

- Pros: Simple and easy to use, customizable notifications, multi-device support.

- Cons: Limited features compared to more comprehensive apps, no automatic bank integration.

Why Use a Subscription Manager App?

Using a subscription manager app offers several benefits that can help you stay on top of your recurring payments:

- Avoid Unwanted Charges: Keep track of all your subscriptions and cancel the ones you no longer need or use.

- Stay Organized: View all your subscriptions in one place, making it easier to manage your finances.

- Save Money: Identify duplicate or unused subscriptions to cut down on unnecessary expenses.

- Never Miss a Payment: Get reminders for upcoming payments to avoid late fees or service interruptions.

Why Banktrack is the Best Subscription Manager App

Banktrack offers a complete solution for managing cash and subscriptions, making it the best choice in 2025 for anyone looking to keep track of their recurring payments.

With real-time monitoring and alerts, seamless bank integration, customizable dashboards, and strong security measures, Banktrack provides everything you need to stay on top of your subscriptions and avoid unwanted charges.

Its ability to automatically track and categorize subscriptions, provide instant alerts, and generate detailed reports ensures you always have a clear view of your spending.

Coupled with its cost-saving features and user-friendly interface, Banktrack is the ultimate tool for anyone looking to manage their subscriptions effectively and take control of their finances.

Share this post

Related Posts

Best 11 alternatives to Monarch Money

These are the best 11 alternatives to Monarch Money for budgeting and finance tracking in 2024.Best 5 short-term cash forecasting methods

Discover effective short-term cash forecasting methods like receipts and disbursements, rolling forecasts, and scenario planning to optimize your business’s liquidity.Top 6 best budgeting tools

Simplify money management and help you take control of your finances. Find the perfect app to track expenses, set goals, and save smarter.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed