5 best bank trackers in Italy

- 5 Best Bank Tracker in Italy

- 1. Banktrack

- 2. Spendee

- 3. N26

- 4. Revolut

- 5. Moneyhub

- 5 Tips to Choose the Right Bank Tracker in Italy

- Making the Most Out of Your Bank Tracker

- Why Banktrack is the Best Bank Tracker in Italy

- Frequently Asked Questions

- Do I need an Italian bank account to use a bank tracker in Italy?

- Is it safe to connect my bank accounts to a bank tracker?

- Can I use a bank tracker to split expenses with friends?

5 Best Bank Tracker in Italy

- Backtracker

- Spendee

- N26

- Revolut

- Money

Managing money is critical, especially in a place as lively as Italy. Between rent, restaurants, transportation and weekend getaways, controlling expenses can seem like a big deal.

Whether you've lived here for years, just arrived, or are only visiting, a bank tracker in Italy can make life so much easier.

In this guide, we’ll walk you through why a bank tracker is such a game-changer, how to pick the right one, and the best tools to help you stay on top of your finances like a pro.

5 Best Bank Tracker in Italy

Bank trackers are more than just apps, they’re tools that can help you achieve your financial goals, from staying on budget to saving up.

Here’s a look at some of the best options you can use in Italy, each with unique features to fit different lifestyles.

1. Banktrack

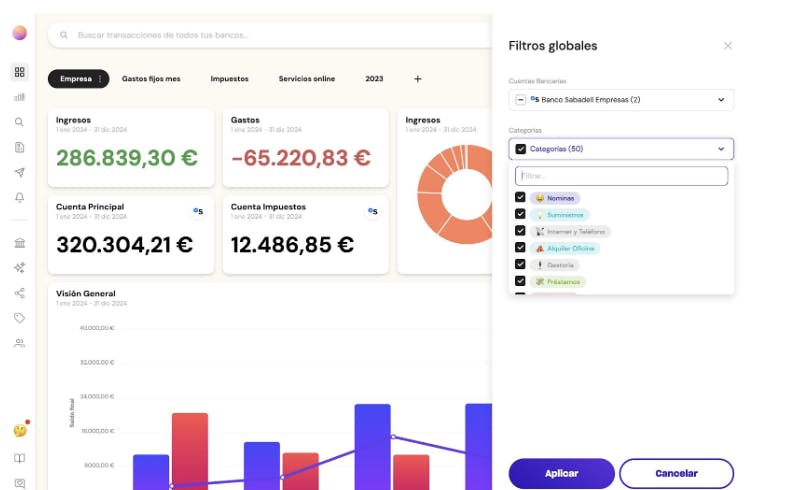

Banktrack is the leading expense tracker app for users in Italy, offering powerful tools that make managing your finances easier and more efficient.

With real-time tracking, customizable dashboards, and seamless integration with multiple banks, Banktrack is the best option for both individuals and businesses.

Key Features:

- Customizable Dashboards: Banktrack lets you personalize your financial dashboard to focus on what’s important to you.

Whether it’s tracking expenses, monitoring savings, or managing business accounts, you can tailor your dashboard to fit your financial goals. Read more about the best 5 business expense tracker apps for 2024.

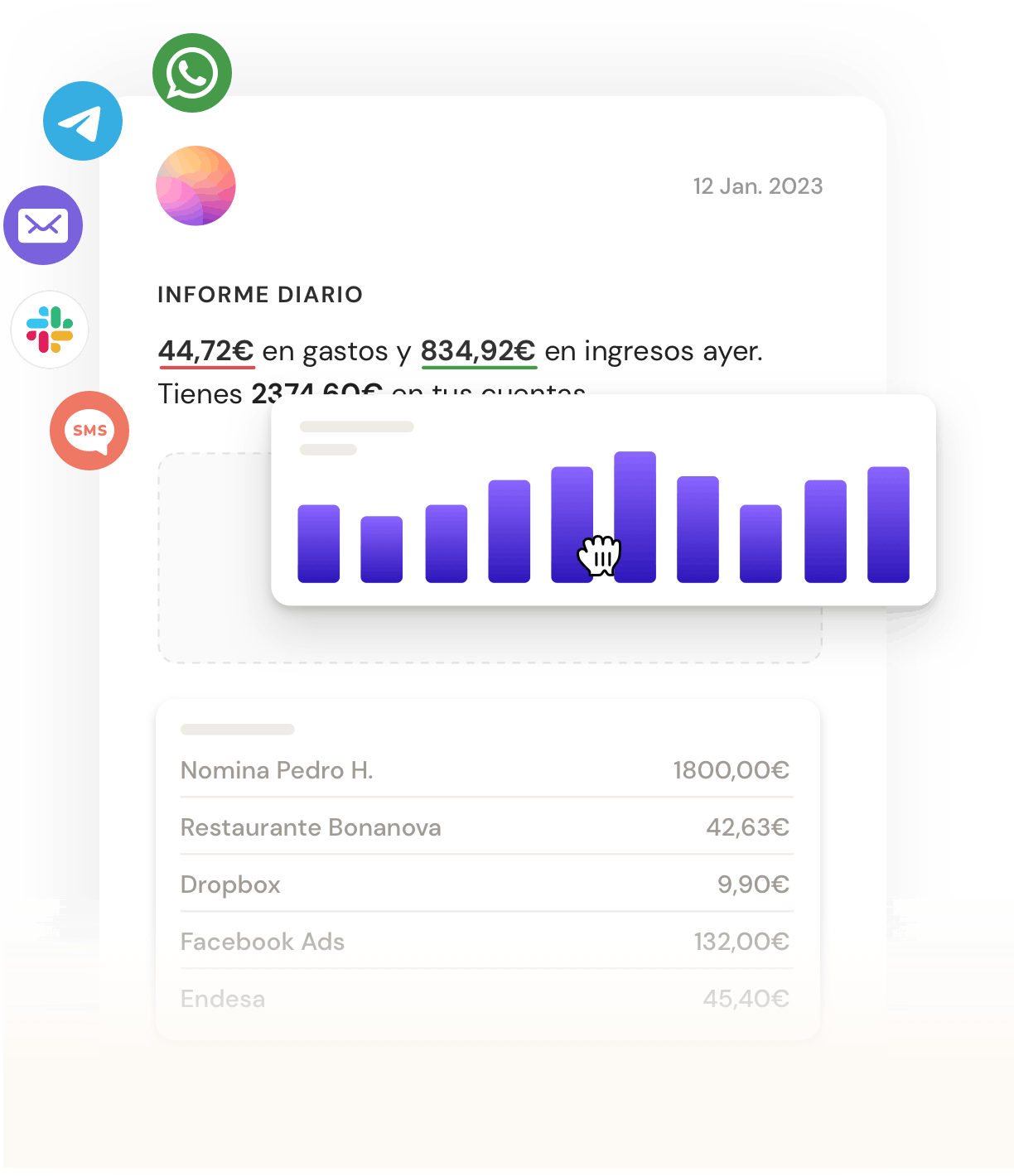

- Real-Time Alerts: Banktrack sends real-time notifications to your preferred platform, such as WhatsApp, SMS, email, or Slack. You’ll get instant alerts for low balances, spending limits, or unusual account activity.

- Spending Limits and Budgeting: Set spending limits for different categories like dining, groceries, and bills. Banktrack will alert you when you’re close to reaching your spending limit, helping you stay within your budget.

- Automated Reports: Generate and customize financial reports, which can be sent via WhatsApp, email, or other platforms. This is especially helpful for businesses or freelancers needing to keep track of expenses.

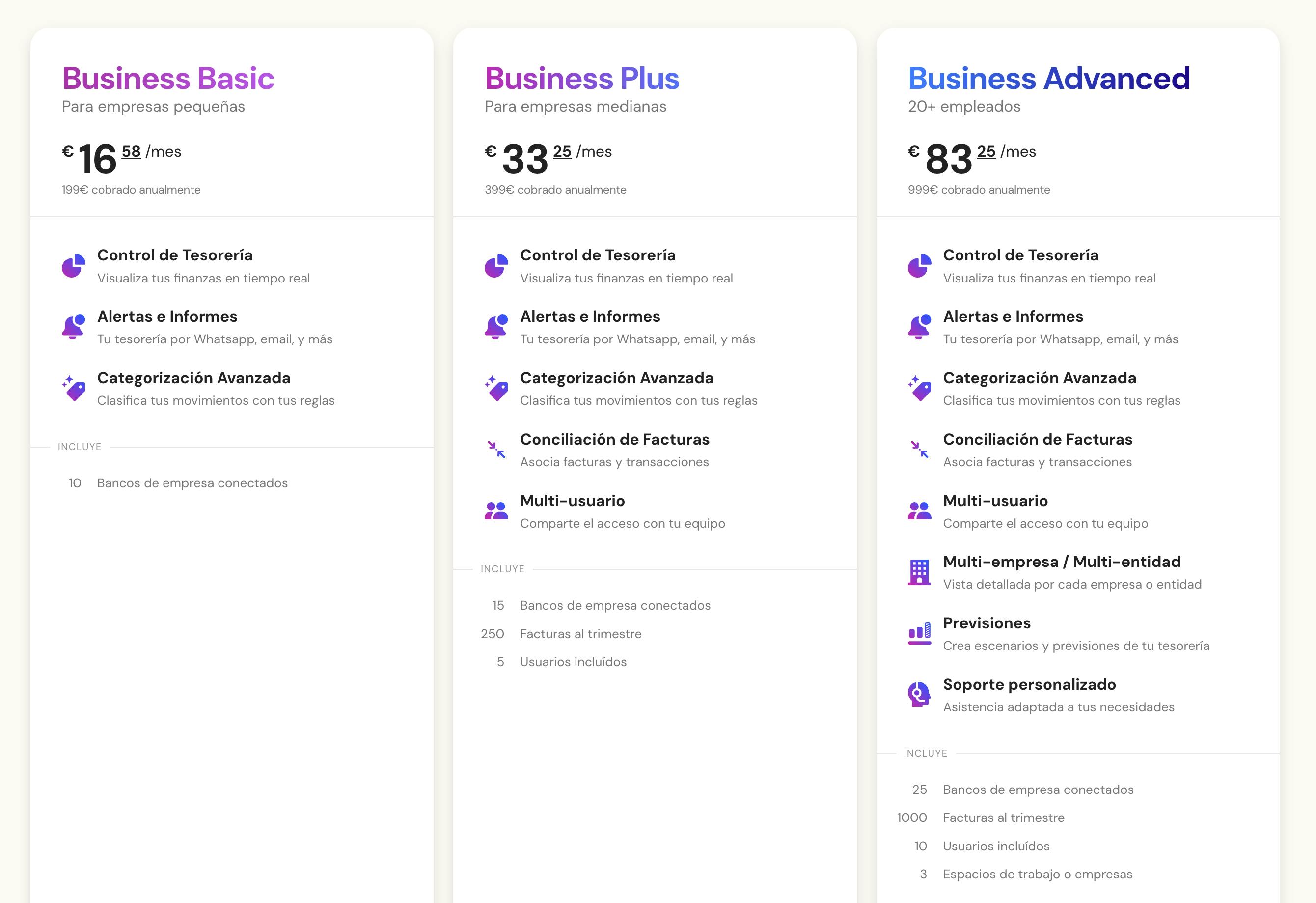

- Affordable Pricing: Banktrack offers affordable pricing, starting at just €16.58 per month, making it an accessible solution for individuals and businesses alike.

2. Spendee

If you’re an expat, international student, or someone who juggles multiple currencies, Spendee is a great fit. With Spendee, you can manage different currencies in one place, making it for those who travel often or send money abroad.

Moreover, it lets you create shared wallets for expenses with roommates, partners, or travel companions.

Key Features:

- Supports multiple currencies, ideal for international users.

- Lets you split bills with others, making shared expenses easier to manage.

- Provides real-time spending insights.

3. N26

N26 is a mobile banking, but it offers much more than a typical bank account. It includes advanced tracking features within its app, so you can see exactly where your money goes each month.

N26 is among young professionals and travelers because it offers free withdrawals in the eurozone and minimal fees. Setup is straightforward and can be completed from anywhere within the EU.

Key Features:

- Direct integration of banking and tracking within one app.

- Offers free cash withdrawals in euros across the eurozone.

- Real-time transaction updates help you stay on top of spending.

4. Revolut

Revolut is more than just a bank tracker; it’s a digital banking app that offers a range of features, including budgeting tools, currency exchange, and even cryptocurrency trading.

With Revolut, you can track spending by category, set monthly budgets, and receive real-time notifications on transactions. Revolut is used by travelers and expats for its excellent foreign exchange rates and easy access to international accounts.

Key Features:

- Supports multiple currencies with competitive exchange rates.

- Offers detailed tracking by category and spending limits.

- Allows international transactions and crypto options.

5. Moneyhub

Moneyhub’s analytics go beyond simple tracking. It shows you exactly how much you’re spending on different categories and can help you identify areas where you could save.

Moneyhub even lets you set up financial goals and track your progress towards them, making it a top choice for goal-oriented users.

Key Features:

- Provides detailed insights and analytics by spending category.

- Allows for setting and tracking financial goals.

- Helps with saving strategies through goal planning.

5 Tips to Choose the Right Bank Tracker in Italy

With so many choices, it can be tough to find the bank tracker that’s best for you. Here’s a breakdown of what to look for when making your decision:

1. Bank Compatibility

Make sure your bank tracker can connect with Italian banks like UniCredit, Intesa Sanpaolo, and Banco BPM. Compatibility is key to ensuring that your financial data syncs smoothly.

2. Currency Options

Some bank trackers handle multiple currencies better than others. This feature is especially useful if you frequently travel or hold foreign accounts.

3. Security Features

Look for two-factor authentication and data encryption to protect your information. Security is essential, especially if you’re linking multiple accounts or sensitive financial data.

4. Cost and Subscriptions

Some bank trackers are free, while others offer advanced features at a monthly fee. If you’re serious about managing your finances, investing in a premium app may be worth it, but always consider your budget.

5. Ease of Use

The best app for you is one you feel comfortable using regularly. Make sure the interface is intuitive and easy to navigate.

Making the Most Out of Your Bank Tracker

Once you’ve found the bank tracker that works for you, it’s time to put it to good use. Here are some tips for maximizing your tracker’s potential and getting closer to your financial goals:

- Set Monthly Budgets for Key Categories: Whether it’s groceries, transportation, or dining out, creating monthly limits can keep you aware of your spending. Most trackers let you set specific budgets and will alert you if you’re nearing your limit.

- Activate Alerts and Notifications: Many trackers allow you to set alerts for unusual activity or when you’re close to overspending. This feature can be invaluable for staying on budget, especially if you’re managing multiple accounts.

Have a look at the best app to link all bank accounts.

- Review Your Spending Regularly: Take a moment each week to review your expenses. This habit can help you identify areas where you may be overspending and make adjustments in real time.

- Plan Your Savings Goals: Some trackers let you set specific goals, such as a travel fund or an emergency fund, and help you track your progress. Watching your savings grow can be a huge motivator to stick to your plan.

Why Banktrack is the Best Bank Tracker in Italy

Using a bank tracker in Italy is a smart way to manage your finances, avoid unexpected fees, and keep your spending under control.

Banktrack excels as a top choice in Italy thanks to its user-friendly design, customizable features, and smooth integration with Italian banks.

With real-time alerts, goal-setting tools, and spending controls, Banktrack provides all the essentials for effective financial management.

Whether you're handling personal accounts or managing business expenses, Banktrack offers the flexibility and tools you need to succeed.

Banktrack also prioritizes security, incorporating strong data protection measures to ensure your financial information stays safe, making it a reliable and powerful tool for anyone managing their finances in Italy.

Frequently Asked Questions

Do I need an Italian bank account to use a bank tracker in Italy?

No, not necessarily. Many trackers allow you to link international accounts, though linking an Italian account can provide more accurate tracking for local transactions and fees.

Is it safe to connect my bank accounts to a bank tracker?

Yes, provided you use a reputable app with strong encryption and two-factor authentication. Be sure to check each app’s privacy policy and data protection measures.

Can I use a bank tracker to split expenses with friends?

Absolutely! Many trackers include features to split bills, which can be helpful for roommates or group travel expenses. It’s an easy way to track who owes what and avoid awkward conversations about money.

Share this post

Related Posts

Best 8 SMS-Based Expense Tracker

An SMS-based expense tracker allows you to track spending effortlessly by logging your expenses via text messages.Best 6 Household Expense Manager Apps for 2025

Looking for the best tools to manage household expenses? Check out the top expense manager apps that make budgeting and tracking spending simple.Best 7 bank trackers in the Netherlands

This guide lists the top 7 tools to help you track expenses, monitor accounts, and improve your financial management. Find the perfect tracker to stay on top of your money

Try it now with your data

- Your free account in 2 minutes

- No credit card needed