Best 5 Business Expense Tracker Apps for 2024

Here are the best business expense tracker apps:

- Banktrack

- Expensify

- QuickBooks Online

- Zoho Expense

- Certify

Managing business expenses effectively is crucial for maintaining financial health, ensuring tax compliance, and optimizing cash flow.

With numerous options available, choosing the right expense tracker app can be overwhelming.

In this article, we’ll explore the best business expense tracker apps for 2024, including their key features, benefits, and how they can help streamline your financial management.

Top Business Expense Tracker Apps for 2024

1. Banktrack

Banktrack is a versatile business expense tracker app that offers a complete set of features to help businesses manage their finances effectively.

It excels in real-time tracking of expenses, providing strong security measures, and integrating seamlessly with multiple banks.

With Banktrack, businesses can monitor their financial activities closely and make data-driven decisions.

Key Features

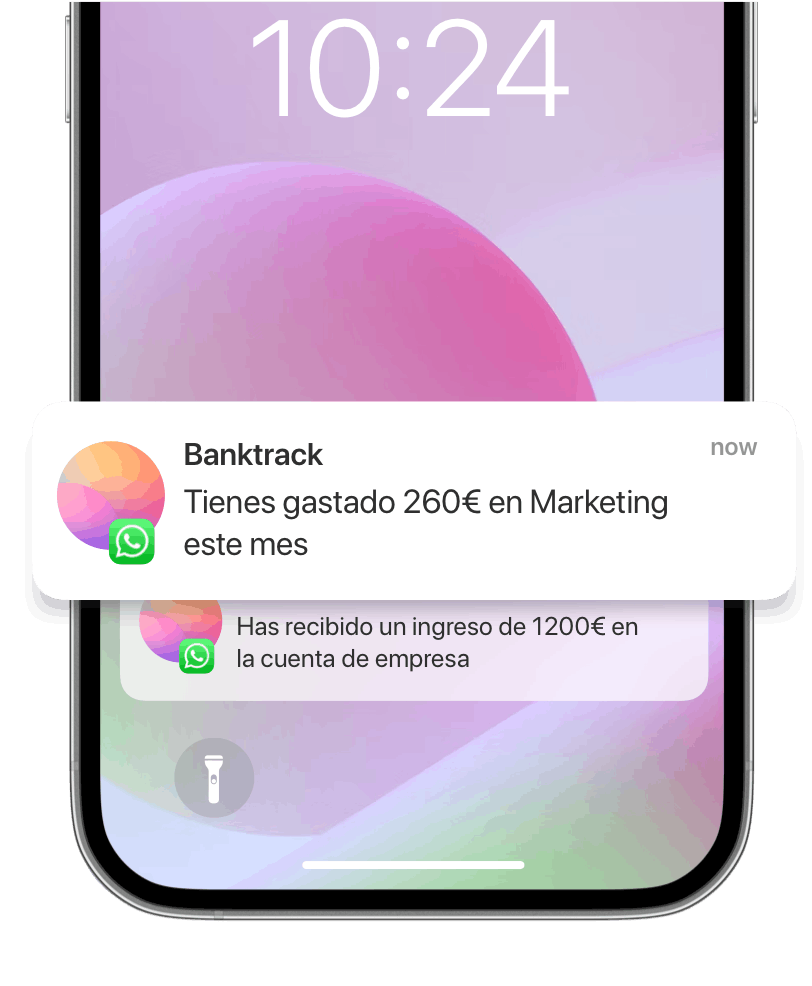

Personalized Reports and Alerts:

- Banktrack provides customized reports and alerts, allowing you to stay informed about your expenses via various channels, including WhatsApp, SMS, email, Slack, or Telegram.

- This feature ensures that you are always up-to-date on your financial activities and can detect any unusual transactions immediately.

Real-Time Transaction Tracking:

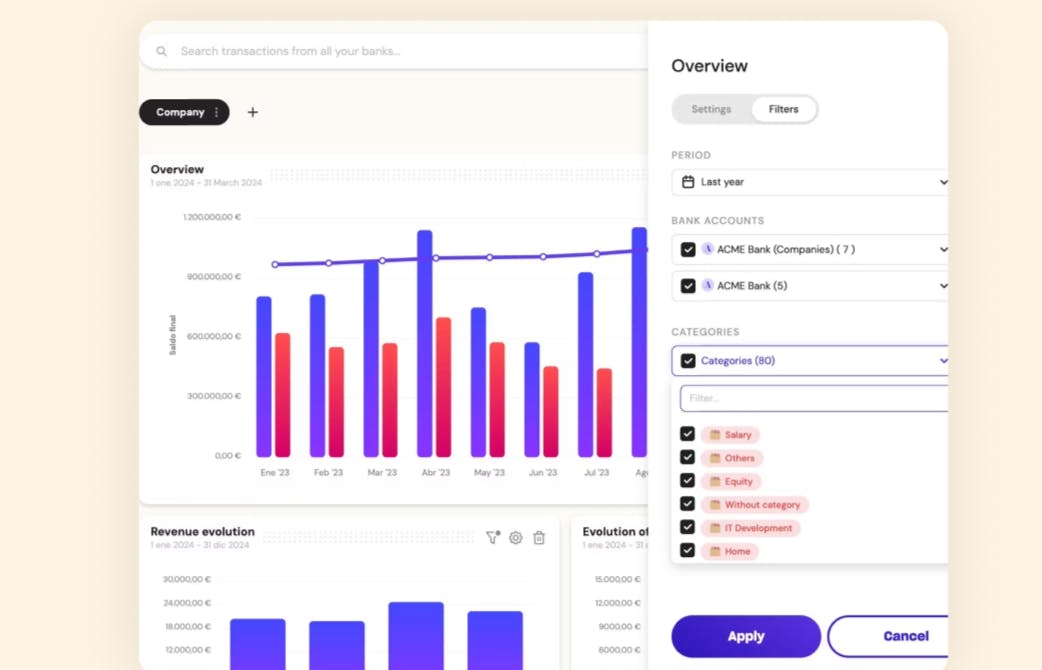

- Customizable Dashboards: Banktrack's dashboards are fully customizable, offering a clear, real-time view of your financial status. Whether you need a summary of your spending, a detailed breakdown of expenses, or a comparison of income and expenses over time, Banktrack makes it easy to manage your money efficiently.

- Flexible Categorization: The platform allows for precise categorization of expenses and income, ensuring you always know where your money is going and coming from. You can create custom categories tailored to your business needs, which helps generate detailed financial reports for informed decision-making.

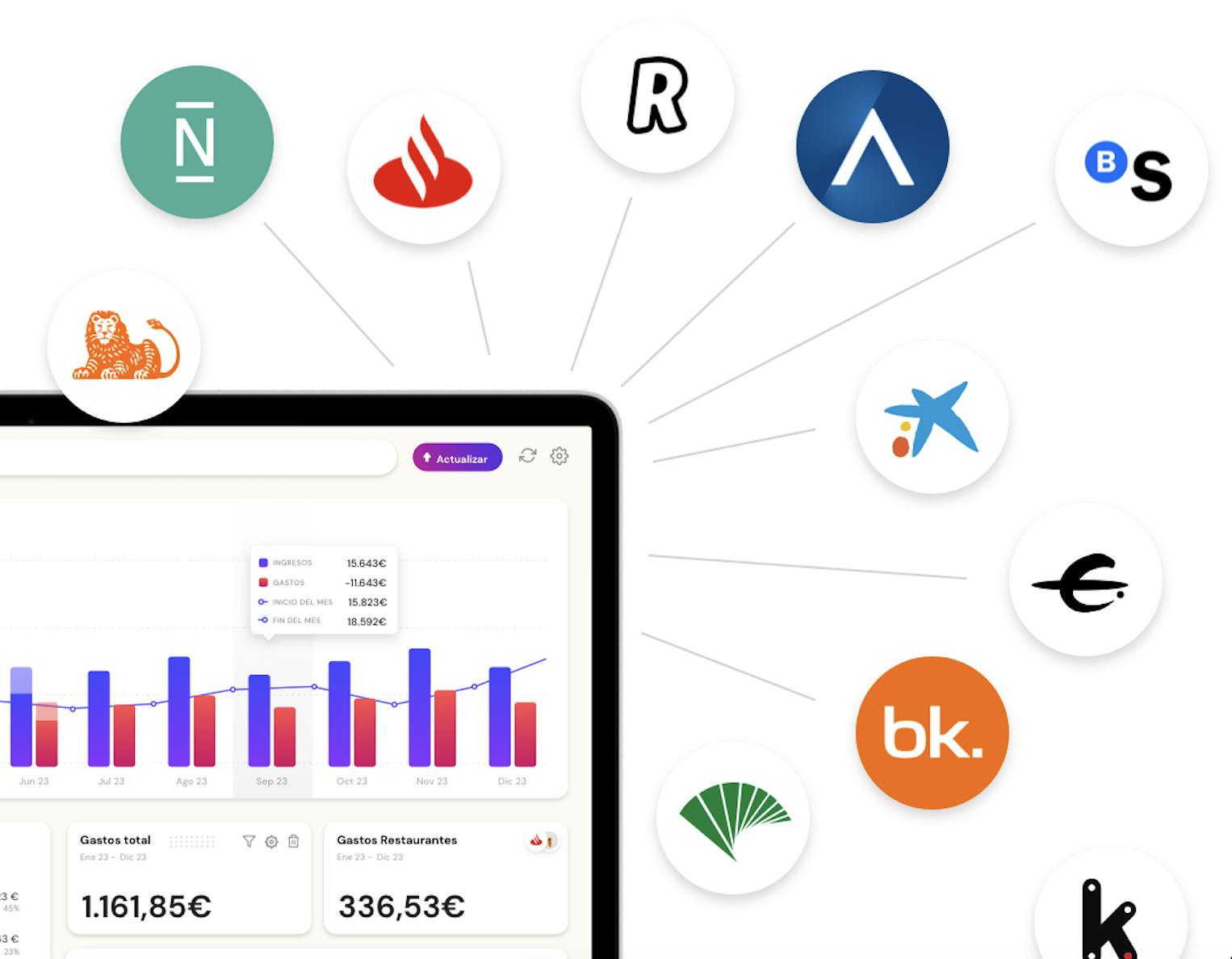

Seamless Bank Integration:

- Extensive Bank Coverage: Banktrack integrates with over 120 banks, including traditional banks and neobanks, allowing you to consolidate all your accounts into one platform for unified management.

Dual Connection Methods:

- Open Banking (PSD2): Provides a secure and standardized way to access your banking data, compliant with the latest European regulations.

- Direct Access: Offers direct connections for banks not covered under PSD2, ensuring efficient integration of financial data from virtually any bank.

Security Measures:

- Authorized Data Providers: Uses only authorized and audited data providers approved by the Bank of Spain, ensuring secure handling of your data.

- Read-Only Access: Provides read-only access to bank accounts, preventing unauthorized transactions.

- No Storage of Banking Passwords: Utilizes a unique access token, meaning your banking passwords are never stored, minimizing the risk of password theft.

- Data Encryption: Encrypts all transaction data, ensuring the confidentiality and security of your financial information.

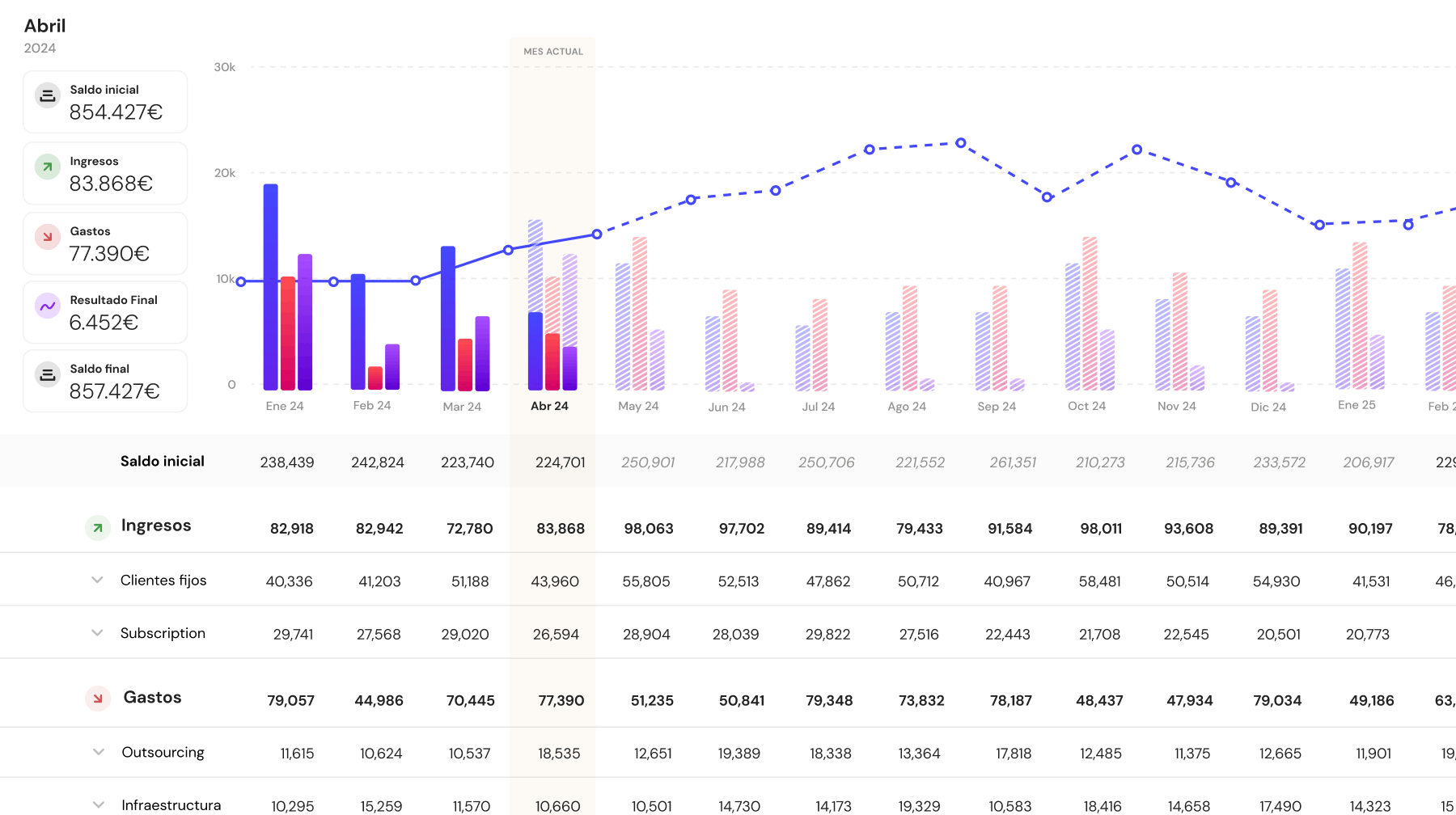

Cash Flow Forecasting:

- Historical Data Analysis: Analyzes historical financial data to predict future cash flow trends, helping you anticipate potential shortfalls or surpluses.

- Dynamic Forecasting: Allows you to create dynamic cash flow forecasts that adjust based on real-time data, ensuring accurate financial projections.

- Are you looking for ways to improve your business’ financial health? Here are some tips to improve cash flow.

Automated Bank Reconciliation:

- Automated Reconciliation: Matches your bank statements with internal records, quickly identifying discrepancies and reducing the risk of errors, ensuring accurate financial records.

2. Expensify

Expensify is a popular expense management app designed for both small businesses and large enterprises.

It simplifies the process of tracking receipts, managing expenses, and creating expense reports.

The app is known for its user-friendly interface and strong integration capabilities.

Key Features

- Receipt Scanning: Automatically captures and categorizes expenses by scanning receipts.

- Automated Expense Reports: Generates expense reports and submits them for approval with a single click.

- Corporate Card Reconciliation: Syncs with corporate credit cards to automate expense tracking.

- Real-Time Policy Enforcement: Ensures compliance with company policies by flagging expenses that do not adhere to set rules.

Pros and Cons

- Pros: Easy to use, integrates with various accounting software, and offers advanced features for expense management.

- Cons: Some features are limited in the free version, and it may be expensive for small businesses.

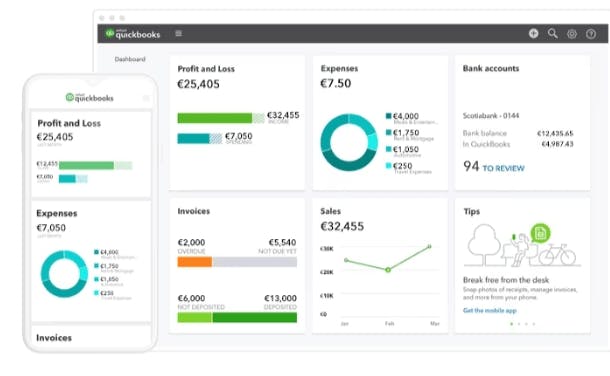

3. QuickBooks Online

QuickBooks Online is a widely used accounting software that also offers strong expense tracking features.

It is ideal for small to medium-sized businesses that need an all-in-one accounting solution.

Key Features

- Expense Categorization: Automatically categorizes expenses and imports transactions from bank accounts and credit cards.

- Receipt Management: Allows users to upload receipts and match them with corresponding transactions.

- Financial Reporting: Provides detailed financial reports, including profit and loss, balance sheets, and cash flow statements.

- Integration: Connects with various third-party apps for payroll, inventory management, and more.

Pros and Cons

- Pros: Comprehensive accounting features, strong integration options, suitable for growing businesses.

- Cons: Requires a subscription, and the learning curve may be steep for beginners.

4. Zoho Expense

Zoho Expense is an expense tracker app that simplifies the process of recording, submitting, and approving business expenses.

It integrates well with other Zoho products, making it a great choice for businesses already using Zoho’s suite of tools.

Key Features

- Automatic Expense Recording: This app tracks expenses and receipts, as well as credit card transactions.

- Multi-Currency Support: Handles expenses in multiple currencies for global businesses.

- Policy Compliance: Automates policy checks to ensure compliance with company rules.

- Integration: Syncs with Zoho Books and other accounting tools.

Pros and Cons

- Pros: User-friendly, integrates well with other Zoho apps, supports multiple currencies.

- Cons: Some features are limited to higher-tier plans.

5. Certify

Certify is a cash management software designed for businesses of all sizes.

It offers an easy-to-use interface and powerful tools for automating expense reporting, streamlining approvals, and managing receipts.

Key Features

- Expense Reporting: Automates the creation and submission of expense reports.

- Mobile App: Allows users to track expenses, capture receipts, and submit reports from their mobile devices.

- Policy Compliance: Flags non-compliant expenses to ensure adherence to company policies.

- Analytics: Provides comprehensive analytics and reporting tools.

Pros and Cons

- Pros: Excellent automation features, mobile-friendly, good for policy compliance.

- Cons: Can be expensive for smaller businesses, limited customization options.

Why Do You Need a Business Expense Tracker App?

Tracking expenses manually can be time-consuming and error-prone.

A business expense tracker app simplifies this process by automatically capturing, categorizing, and analyzing your expenses, ensuring you have an accurate record of your spending.

Here are some of the benefits of using an expense tracker app:

- Saves Time: Automates expense tracking and reduces the manual effort involved in managing receipts and invoices.

- Increases Accuracy: Minimizes human errors by capturing data directly from receipts and bank transactions.

- Improves Financial Visibility: Provides real-time insights into your business expenses, helping you make informed decisions.

- Ensures Compliance: Keeps you prepared for audits and helps you adhere to tax regulations by maintaining detailed records of all expenses.

Choose Banktrack as the Best Business Expense Tracker App

Choosing the right expense tracker app for your business depends on your specific requirements, budget, and desired features.

Banktrack stands out for its real-time transaction tracking, extensive bank integration, strong security measures, and dynamic cash flow forecasting, making it an excellent choice for businesses looking for a complete solution.

Ultimately, the best business expense tracker app will depend on your needs and the level of detail you require in managing your expenses.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed