Best 10 cash management software for freelancers

- Why do you Need a Cash Management Software

- Why is Cash Management Important for Freelancers

- Top 10 Cash Management Softwares for Freelancers

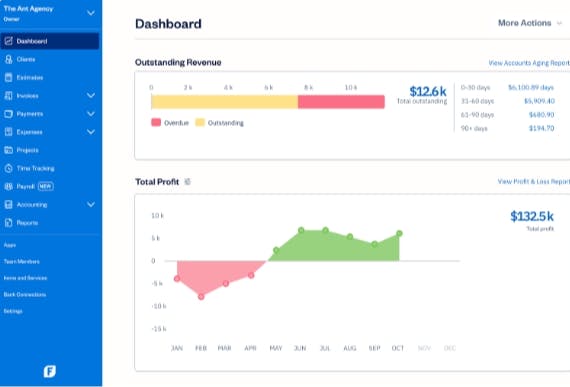

- 1. Banktrack

- 2. FreshBooks

- 3. Wave

- 4. Xero

- 5. Zoho Books

- 6. QuickBooks

- 7. HoneyBook

- 8. ZipBooks

- 9. Expensify

- 10. FreeAgent

- 4 Key Benefits of Cash Management Software for Freelancers

- 6 Features to Look for in Cash Management Software

- 1. Invoicing

- 2. Expense Tracking

- 3. Cash Flow Management

- 4. Financial Reporting

- 5. Integration Capabilities

- 6. Security

The best cash management software for freelancers:

- Banktrack

- QuickBooks

- FreshBooks

- Wave

- Xero

- Zoho Books

- HoneyBooks

- ZipBooks

- Expensify

- FreeAgent

As a freelancer, managing your finances efficiently is crucial.

From tracking income and expenses to handling invoices and taxes, having the right cash management software can make your life a whole lot easier.

In this article, we'll explore some of the best cash management software options available for freelancers, helping you make an informed decision about which one suits your needs best.

Why do you Need a Cash Management Software

Freelancers often have irregular income streams, making it challenging to keep track of finances manually.

Cash management software automates many financial tasks, providing freelancers with a clear overview of their income, expenses, and overall financial health.

Why is Cash Management Important for Freelancers

Efficient cash management is important for freelancers to maintain financial stability, plan for taxes, and ensure they get paid on time.

With the right software, you can streamline invoicing, track expenses, and manage your cash flow more effectively.

Top 10 Cash Management Softwares for Freelancers

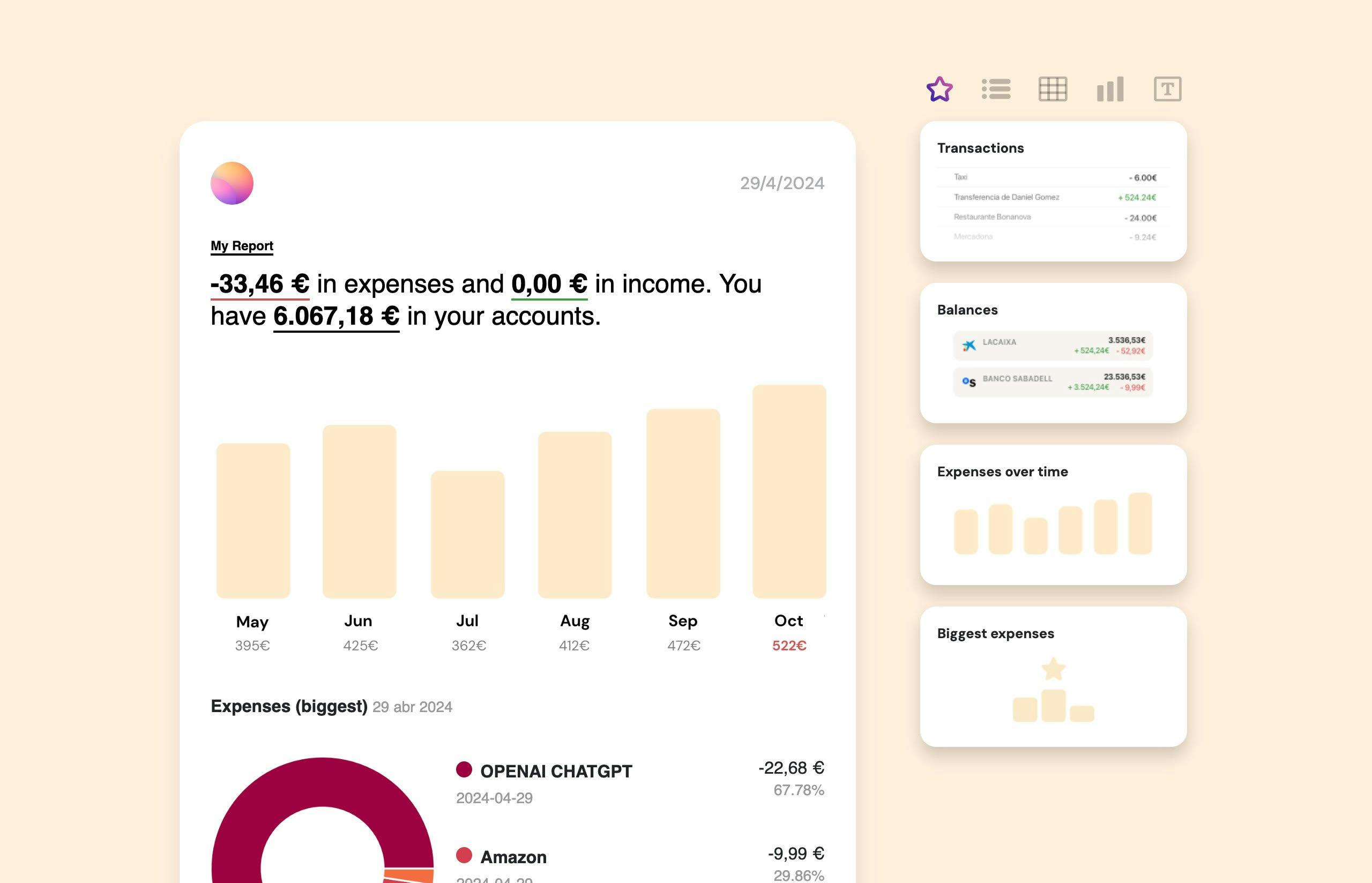

1. Banktrack

Bantrack is an ideal cash management software for freelancers.

Its customizable dashboards enable users to access real-time financial information efficiently, while its flexible categorization options allow for precise tracking of expenses and income.

With personalized reports and alerts, businesses can maintain constant control over their finances and make informed decisions with ease.

It is truly amazing how well Banktrack can adjust to your needs for categorization. You can arrange your income and expenses by creating and customizing an infinite number of categories using sophisticated rules.

Because of this flexibility, you can monitor your finances closely and know exactly where your money is exactly going.

Additionally, Banktrack provides customized reports and alerts. You can choose to generate personalized reports and get notifications regarding your spending via email, Slack, Telegram, WhatsApp, and SMS.

You have the ability to create alerts for any important aspect for you, such as low balances or duplicate charges. With the aid of this feature, you can always stay in control of your money and make wise decisions.

Altogether, these features make Banktrack an excellent option for freelancers to manage their finances.

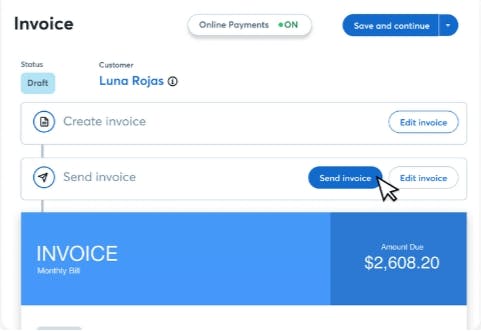

2. FreshBooks

FreshBooks is a cloud-based accounting software designed for small businesses and freelancers. It offers a user-friendly interface and a range of features to streamline financial management tasks.

- Invoicing: Create professional invoices and automate payment reminders to clients.

- Time Tracking: Track billable hours and expenses for accurate invoicing.

- Expense Tracking: Easily track business expenses and attach receipts for tax purposes.

- Reporting: Generate detailed financial reports to gain insights into your business performance.

- Mobile App: Manage your finances on the go with the FreshBooks mobile app.

FreshBooks offers various pricing plans, starting from $15 per month, with a 30-day free trial available.

3. Wave

Wave is a free accounting software solution designed for freelancers, entrepreneurs, and small business owners. It offers a range of features to help you manage your finances more efficiently and within a budget.

- Invoicing: Create and send professional invoices to clients, with options for customization.

- Receipt Scanning: Scan and upload receipts for easy expense tracking and tax preparation.

- Bank Reconciliation: Automatically import and categorize bank transactions for accurate record-keeping.

- Reporting: Generate various financial reports, such as profit and loss statements and sales tax reports.

- Payroll: Run payroll for yourself and your team, with options for direct deposit and tax calculations.

Wave is free to use, with no hidden fees or trial periods. However, it offers paid add-on services, such as payroll and credit card processing.

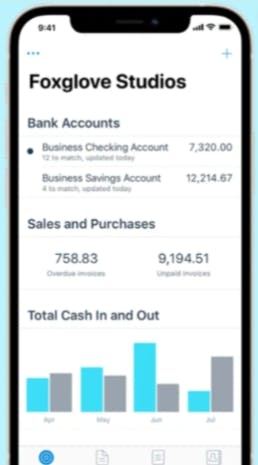

4. Xero

Xero is a cloud-based accounting software solution designed for small businesses, freelancers, and accountants.

- Invoicing: Create and send professional invoices to clients, with options for online payment.

- Expense Claims: Track and manage business expenses, including mileage and travel costs.

- Bank Reconciliation: Automatically import and categorize bank transactions for easy reconciliation.

- Reporting: Generate detailed financial reports to gain insights into your business performance.

- Integration: Seamlessly integrate with other business tools and services, such as PayPal and Shopify.

Xero offers several pricing plans to suit different business needs, with options starting from $11 per month.

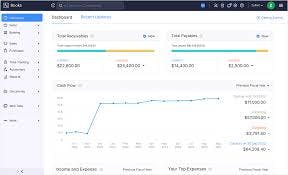

5. Zoho Books

Zoho Books is an online accounting software solution. It offers a range of features to help you manage your finances more efficiently.

- Invoicing: Create professional invoices and send automated payment reminders to clients.

- Expense Tracking: Easily track business expenses and categorize transactions for tax purposes.

- Bank Reconciliation: Automatically import and reconcile bank transactions for accurate record-keeping.

- Reporting: Generate various financial reports, such as profit and loss statements and balance sheets.

- Collaboration: Collaborate with your accountant or team members in real-time.

Zoho Books offers various pricing plans, starting from $9 per month, with a 14-day free trial available.

6. QuickBooks

QuickBooks Self-Employed is a specialized version of QuickBooks designed for freelancers and independent contractors. It offers a range of features to help you track income and expenses and maximize tax deductions.

- Expense Tracking: Easily track business expenses and categorize transactions for tax purposes.

- Invoicing: Create and send professional invoices to clients, with options for online payment.

- Tax Deductions: Automatically track and categorize potential tax deductions to maximize savings.

- Mileage Tracking: Track and categorize business mileage for accurate tax deductions.

- Integration: Seamlessly integrate with other financial tools and services, such as TurboTax and PayPal.

QuickBooks Self-Employed offers several pricing plans, with options starting from $15 per month.

7. HoneyBook

HoneyBook is a cloud-based business management platform designed for creative entrepreneurs, freelancers, and small businesses. It offers features to help you manage your finances, projects, and client communication in one place.

- Invoicing: Create professional invoices and contracts and accept online payments from clients.

- Project Management: Manage projects, tasks, and timelines with customizable workflows.

- Client Communication: Communicate with clients via email and keep track of all interactions in one place.

- Reporting: Generate financial reports to gain insights into your business performance.

- Integration: Seamlessly integrate with other business tools and services, such as Gmail and Google Calendar.

HoneyBook offers various pricing plans, starting from $9 per month, with a 7-day free trial available.

8. ZipBooks

ZipBooks is a cloud-based accounting software solution designed for small businesses, freelancers, and contractors. It offers a range of features to help you manage your finances more efficiently.

- Invoicing: Create and send professional invoices to clients, with options for online payment.

- Expense Tracking: Easily track business expenses and categorize transactions for tax purposes.

- Time Tracking: Track billable hours and projects for accurate invoicing and payroll.

- Reporting: Generate various financial reports, such as profit and loss statements and balance sheets.

- Collaboration: Collaborate with your accountant or team members in real-time.

ZipBooks offers a free plan with limited features, as well as paid plans starting from $15 per month.

9. Expensify

Expensify is an expense management software solution designed for businesses of all sizes, including freelancers and independent contractors. It aims to help you track and manage business expenses more efficiently.

- Expense Tracking: Easily track business expenses and categorize transactions for tax purposes.

- Receipt Scanning: Scan and upload receipts for easy expense tracking and reimbursement.

- Mileage Tracking: Track and categorize business mileage for accurate tax deductions.

- Reporting: Generate detailed expense reports to gain insights into your spending habits.

- Integration: Seamlessly integrate with other financial tools and services, such as QuickBooks and Xero.

Expensify offers several pricing plans to suit different business needs, with options starting from $4.99 per user per month.

10. FreeAgent

FreeAgent is an online accounting software solution designed for freelancers, small businesses, and accountants. It offers a range of features to help you manage your finances more efficiently.

- Invoicing: Create and send professional invoices to clients, with options for online payment.

- Expense Tracking: Easily track business expenses and categorize transactions for tax purposes.

- Bank Reconciliation: Automatically import and reconcile bank transactions for accurate record-keeping.

4 Key Benefits of Cash Management Software for Freelancers

- Enhanced Efficiency: By automating repetitive tasks such as invoice generation, expense tracking, and reconciliation, cash management software allows freelancers to save time and focus on their core business activities.

- Improved Cash Flow: With real-time insights into income and expenses, freelancers can better manage their cash flow, ensuring that they have sufficient funds to cover expenses and invest in growth opportunities.

- Greater Accuracy: Manual financial processes are prone to errors, which can lead to costly mistakes. Cash management software minimizes the risk of errors by automating calculations and providing accurate, up-to-date financial data.

- Financial Insights: Advanced reporting features provide freelancers with valuable insights into their financial performance, allowing them to make informed decisions and identify areas for improvement.

6 Features to Look for in Cash Management Software

When choosing cash management software for your freelance business, it's essential to consider a range of features that will best meet your needs.

Here are some key features to look for:

1. Invoicing

Having an efficient invoicing functionality is crucial for freelancers to ensure timely and accurate billing.

Look for a software that allows you to create professional invoices, customize invoice templates, and automate recurring invoices to save time and improve cash flow.

2. Expense Tracking

Effective expense tracking is essential for managing finances and maintaining accurate records.

Choose a software that enables you to easily track expenses, categorize transactions, and capture receipts digitally for streamlined expense management.

3. Cash Flow Management

Cash flow management tools are vital for freelancers to monitor cash flow in real-time, predict future cash needs, and identify potential cash flow gaps.

Look for a software that provides cash flow forecasting, budgeting, and alerts to help you stay on top of your finances.

4. Financial Reporting

Comprehensive financial reporting capabilities are essential for gaining insights into your financial performance and making informed decisions.

Make sure you have access to customizable reports, dashboards, and analytics to track key metrics and trends.

5. Integration Capabilities

Integration with other business tools such as accounting software, payment gateways, and project management tools is crucial for seamless workflow and data synchronization.

6. Security

Security is crucial when managing financial data.

The cash management software you choose should employ industry-standard security measures such as encryption, multi-factor authentication, and regular data backups to protect your sensitive financial information.

Share this post

Related Posts

Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.Best 5 Apps for Tracking Expenses and Receipts

Find the best apps to streamline expense and receipt tracking. Discover top picks, to simplify your financial management.Top 5 Xero alternatives in 2025

If Xero no longer meets your business needs, explore other accounting solutions that offer better features, pricing, and flexibility for your company.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed