Bridge cash flow vs. short-term working capital

- What is Bridge Cash Flow?

- 3 Characteristics of Bridge Cash Flow

- When to Use Bridge Cash Flow

- What is Short-Term Working Capital?

- 3 Characteristics of Short-Term Working Capital

- When to Use Short-Term Working Capital

- Key Differences Between Bridge Cash Flow and Short-Term Working Capital

- 3 Factors to Help you Decide Which to Use

- 1. Evaluate Your Liquidity Situation

- 2. Consider the Associated Costs

- 3. Plan for the Future

- How Can Banktrack Help You with Bridge Cash Flow and Short-Term Working Capital?

- Banktrack Features for Bridge Cash Flow

- Banktrack Features for Short-Term Working Capital

- Bridge Cash Flow vs. Short-Term Working Capital

What’s the difference between the Bridge Cash Flow and the Short-Term Working Capital and when to use each?

Maintaining a healthy cash flow and having enough capital for daily operations is essential.

Two key concepts to achieve this are Bridge Cash Flow and Short-Term Working Capital.

Although both terms relate to cash management, they have important differences and are used in different contexts.

In this article, we will explore what each of these concepts means, how they differ, and how to determine which one is right for your business.

What is Bridge Cash Flow?

Bridge Cash Flow refers to a temporary solution that a company uses to cover gaps in its cash flow.

These gaps can arise due to a mismatch between income and expenses, such as when a large payment from a customer is expected, but bills or operating expenses need to be paid before that money is received.

3 Characteristics of Bridge Cash Flow

- Temporality: It is a short-term solution used to cover immediate cash needs.

- Flexibility: It is usually obtained through mechanisms such as credit lines, bridge loans, invoice advances, or temporary financing agreements.

- Specific Purpose: Its main goal is to maintain a good operational liquidity management during critical moments until the expected cash flow arrives.

When to Use Bridge Cash Flow

Bridge Cash Flow is useful in situations where a company faces immediate cash needs while awaiting revenues that have not yet materialized. For example:

- Delays in Customer Payments: When a large payment from a customer is expected, but bills need to be covered before that money arrives.

- Large Projects or Contracts: When large contracts have been signed and revenues will come in later stages, but initial expenses need to be covered immediately.

- Unexpected Events: When unforeseen events occur that require unexpected cash outflows, such as urgent repairs or inventory replacements.

What is Short-Term Working Capital?

Short-Term Working Capital refers to the funds a company needs to finance its daily operations. It is the money available to cover day-to-day expenses such as wages, rent, supplies, inventories, and other financial obligations due in the short term (typically within a year).

3 Characteristics of Short-Term Working Capital

- Continuity: Unlike Bridge Cash Flow, which is temporary, short-term working capital is an ongoing need for business operations.

- Operational Cycle: It is used to finance the company’s operating cycle, which includes managing inventories, accounts receivable, and accounts payable.

- Flexibility and Control: Maintaining good short-term working capital allows the company to quickly adapt to market fluctuations and changes in demand.

When to Use Short-Term Working Capital

Short-Term Working Capital is essential for any business that wants to operate efficiently and sustainably. Situations where it is needed include:

- Financing the Operating Cycle: When a company needs to finance inventory, accounts receivable, or any other daily operating expenses.

- Financial Sustainability: To ensure sufficient cash is available to cover financial obligations such as payroll, taxes, and rent.

- Planning and Expansion: To plan for growth without affecting operational liquidity.

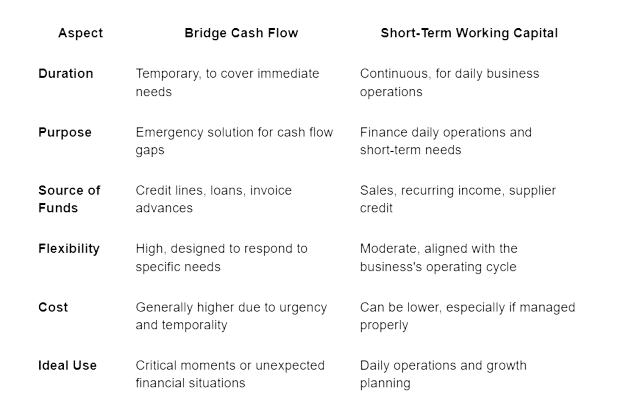

Key Differences Between Bridge Cash Flow and Short-Term Working Capital

While both concepts are related to cash management, there are clear differences between them:

3 Factors to Help you Decide Which to Use

Choosing between Bridge Cash Flow and Short-Term Working Capital depends on your company’s specific financial situation and operational needs.

Here are some guidelines to help you make the best decision:

1. Evaluate Your Liquidity Situation

If your company is facing a temporary liquidity shortage due to a gap between incoming and outgoing payments, Bridge Cash Flow may be the right solution. It is ideal for covering short-term cash needs until revenues normalize.

On the other hand, if your business needs to maintain uninterrupted daily operations and continuously finance inventory, accounts receivable, and operating expenses, you should focus on managing and optimizing your Short-Term Working Capital.

2. Consider the Associated Costs

Bridge Cash Flow, due to its emergency nature, can be more expensive in terms of interest rates or financing fees.

Therefore, it should only be used when absolutely necessary to cover temporary cash flow problems. Short-Term Working Capital, on the other hand, can be managed more economically with good planning and solid relationships with suppliers and customers.

3. Plan for the Future

A financially healthy company should have both elements in its financial strategy.

While Short-Term Working Capital is crucial for daily operations, Bridge Cash Flow is an important tool for managing contingencies or unforeseen events that may affect short-term liquidity.

Having a clear plan for both aspects will help ensure business continuity.

How Can Banktrack Help You with Bridge Cash Flow and Short-Term Working Capital?

Banktrack is an expense report software designed to provide comprehensive financial management, which can be crucial for handling both Bridge Cash Flow and Short-Term Working Capital.

Here’s how:

Banktrack Features for Bridge Cash Flow

Real-Time Alerts: Set up alerts to receive notifications about potential cash flow deficits. These alerts can help you identify when you need Bridge Cash Flow to cover temporary needs.

Advanced Categorization: Create specific categories for emergency or temporary expenses, helping you manage and control the use of bridge cash flow.

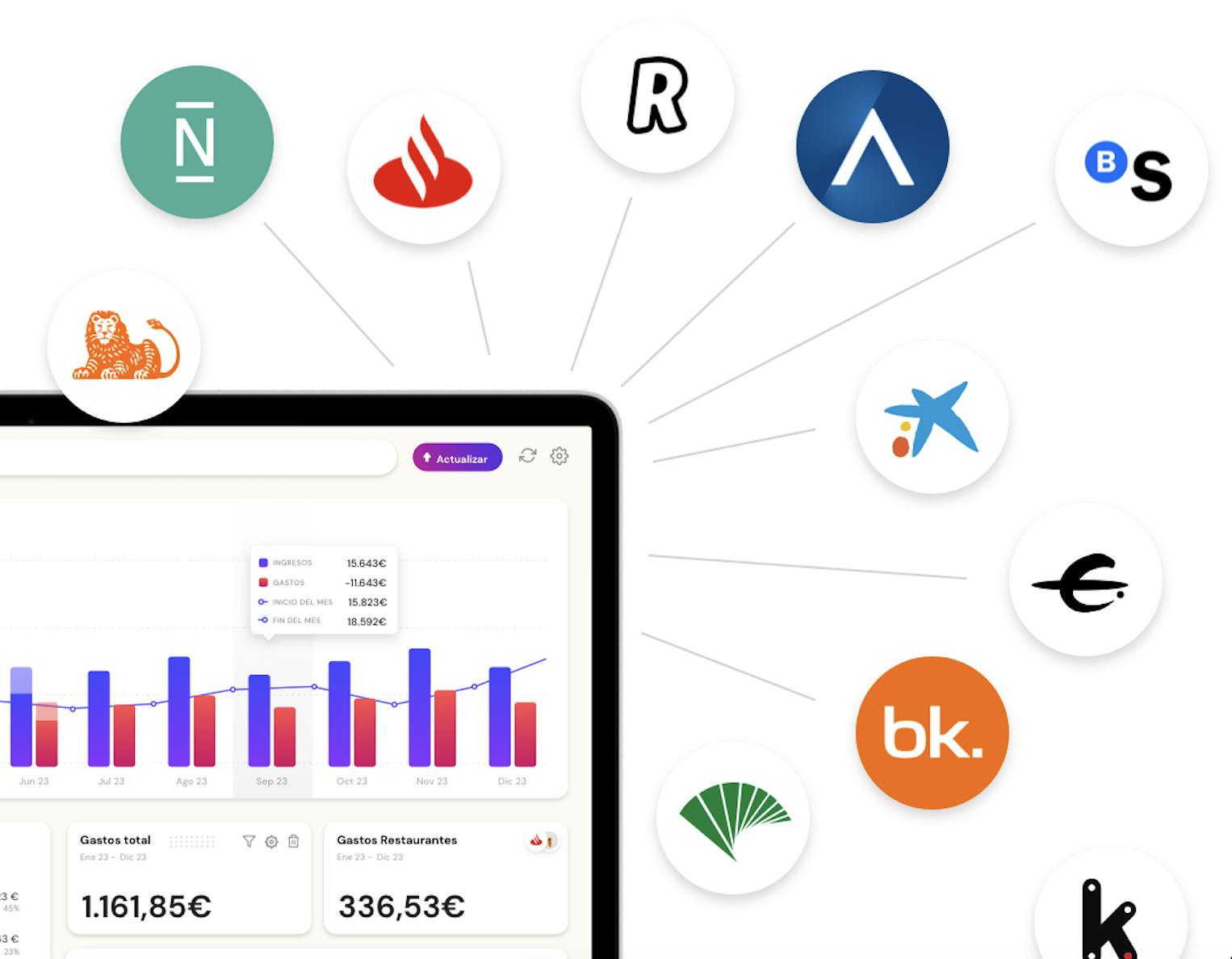

Integration of Multiple Accounts: Connect all your bank accounts and financial products in a single dashboard to have a clear view of your cash flows, enabling you to make quick decisions about the need for bridge cash flow.

Banktrack Features for Short-Term Working Capital

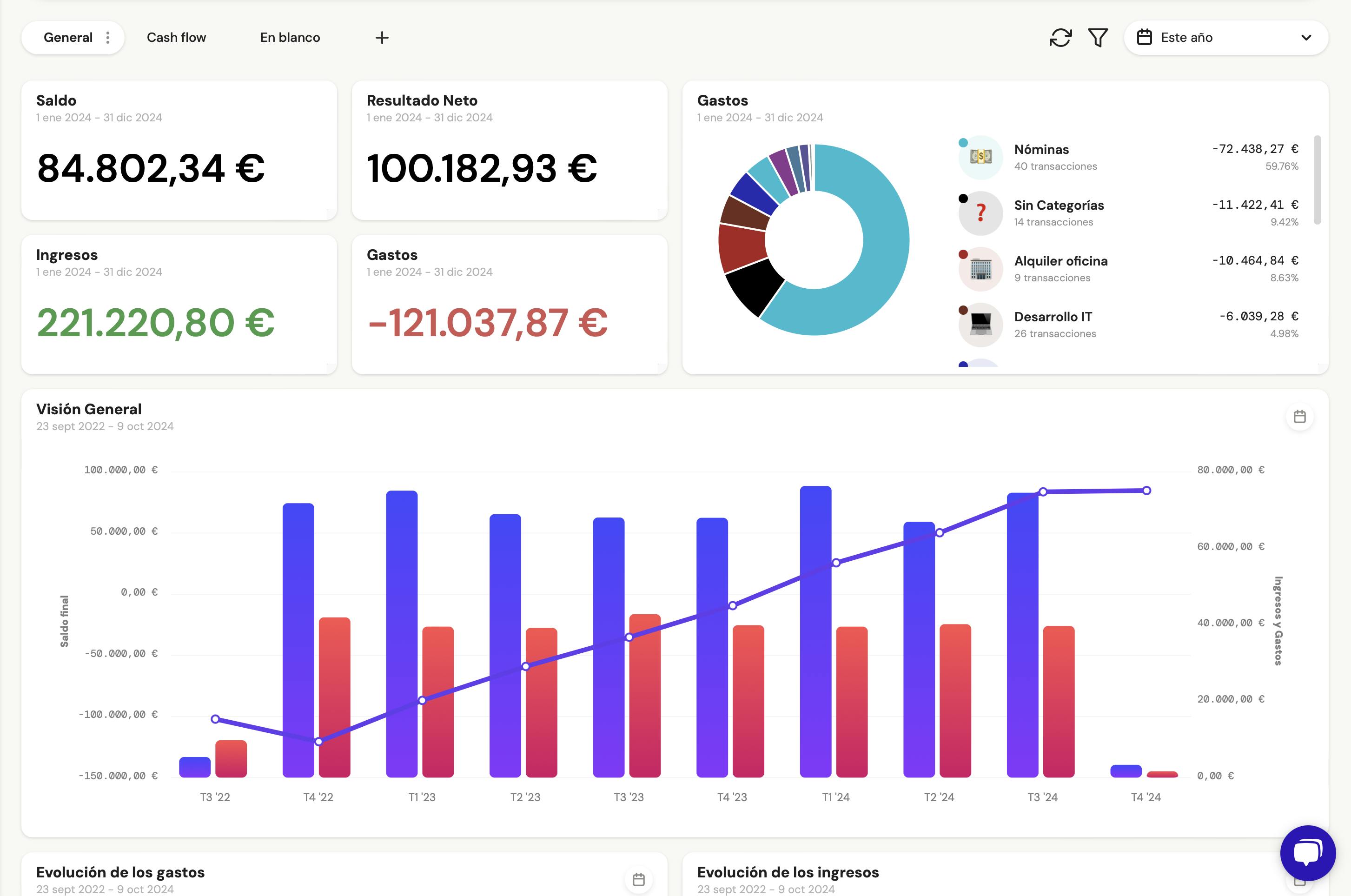

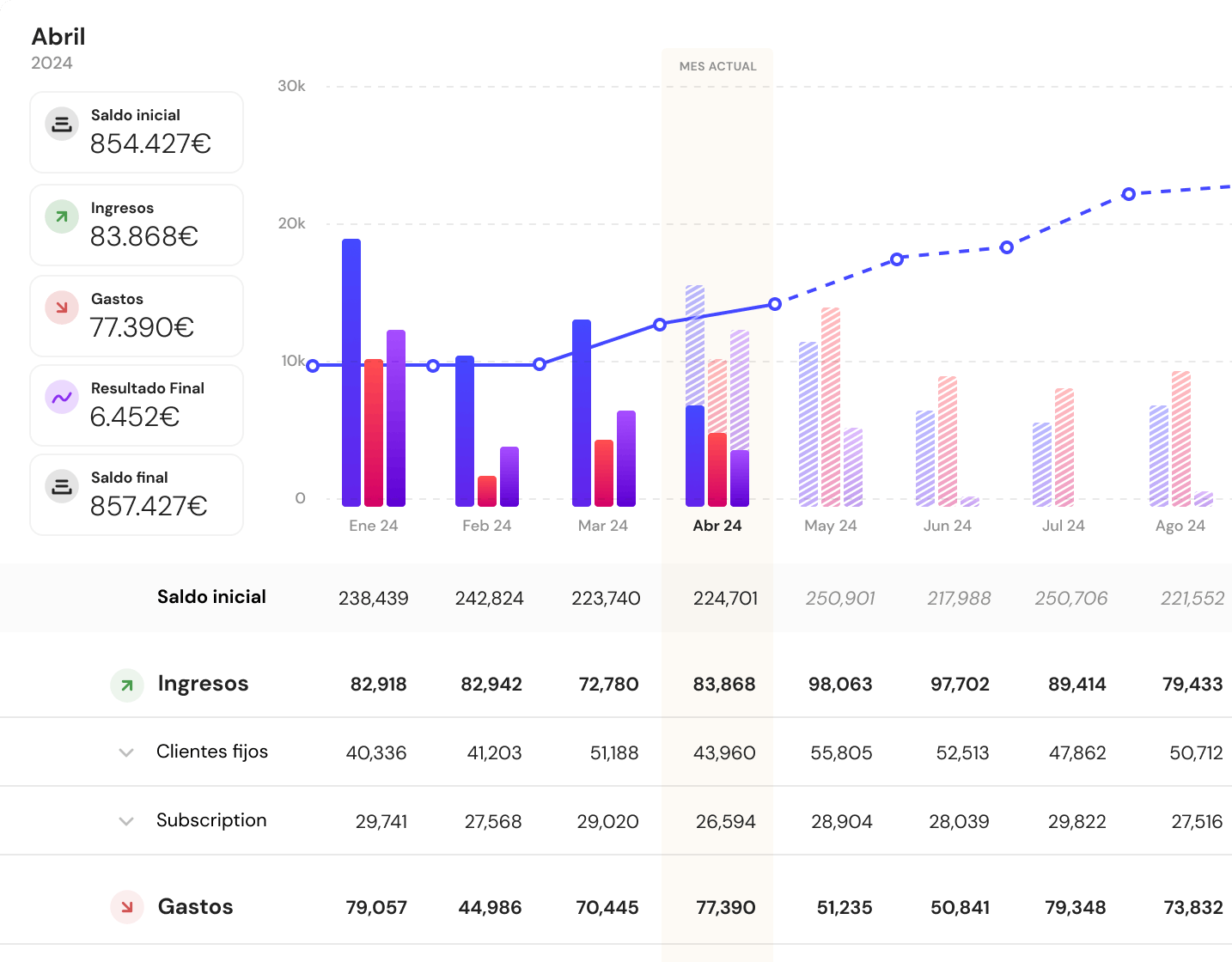

Custom Dashboards: Create specific dashboards to monitor the components of short-term working capital, such as inventories, accounts receivable, and accounts payable, optimizing daily cash management.

Configurable Reports: Generate detailed reports showing how your working capital is being used, making it easier to adjust strategies to improve liquidity and operational efficiency.

Cash Flow Planning: Use income and an expense tracking app to plan and anticipate working capital needs, helping you maintain a positive cash flow at all times.

Smart Alerts: Set up alerts to proactively manage working capital, ensuring you always have enough cash available to cover operating needs.

Bridge Cash Flow vs. Short-Term Working Capital

Both Bridge Cash Flow and Short-Term Working Capital are essential for any company's financial management, but they are used in different contexts and situations. While the former is ideal for covering temporary cash flow gaps, the latter is crucial for the continuous financing of daily operations.

By using tools like Banktrack, you can efficiently manage both aspects, optimizing your resources and ensuring your company's financial health.

With features such as customizable dashboards, advanced categorization, configurable reports, and real-time alerts, Banktrack provides everything you need to make smart financial decisions and keep your business running smoothly.

Remember that having a clear strategy for managing both Bridge Cash Flow and Short-Term Working Capital is key to keeping your business strong and ready for any financial challenge ahead!

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeVerifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.Best 7 bank trackers in the Netherlands

This guide lists the top 7 tools to help you track expenses, monitor accounts, and improve your financial management. Find the perfect tracker to stay on top of your money

Try it now with your data

- Your free account in 2 minutes

- No credit card needed