Top 10 Small Business Expense Tracking Softwares

- Top 10 Expense Tracking Softwares for Small Businesses

- 1. Banktrack

- 2. PlanGuru

- 3. Float

- 4. Scoro

- 5. CashAnalytics

- 6. Pulse

- 7. QuickBooks

- 8. Google Docs

- 9. Cube

- 10. Vena Solutions

- 4 Reasons Why Expense Tracking Matters

- 1. Keep Your Budget in Check

- 2. Maximize Those Tax Deductions

- 3. Improve Your Budgeting and Forecasting

- 4. Manage Your Cash Flow Like a Pro

- Top 5 Tips for Effective Expense Tracking

- 1. Categorize Your Expenses

- 2. Expense Tracker Software

- 3. Keep and Digitize Your Receipts

- 4. Reconcile Regularly

- 5. Establish an Expense Policy

- Why Choose Banktrack?

Top 10 small business expense tracking softwares:

- Banktrack

- PlanGuru

- Float

- Scoro

- CashAnalytics

- Pulse

- QuickBooks

- Google Docs

- Cube

- Vena Solutions

Managing your small business finances can be really stressful and overwhelming at times.

That is why, in 2024, keeping track of your expenses and managing your cash flow is more critical than ever.

This guide will walk you through why it matters, offer practical tips, and review the top tools to keep your financial house in order.

Top 10 Expense Tracking Softwares for Small Businesses

Ready to get a handle on your cash flow?

These top tools will help you manage your finances with ease in 2024.

1. Banktrack

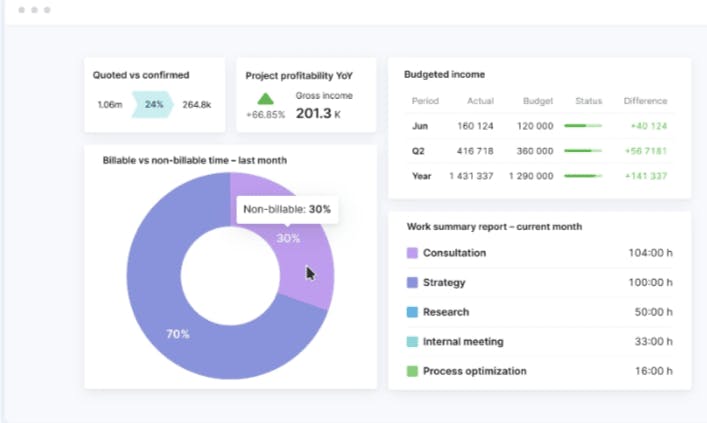

Banktrack is like having a personal accountant who especially likes customizing dashboards. It stands out as an exceptional tool for small and medium-sized businesses looking to manage their finances efficiently.

It’s not just about tracking expenses; it’s about gaining full control over your financial operations with a user-friendly interface.

Plus, it also integrates all your bank accounts and allows you to create personalized views of your financial data.

Customizable Dashboards for All Your Needs

One of Banktrack’s greatest features is its customizable dashboards. Imagine having all your financial information neatly displayed in one place, exactly how you like it. Whether you need to see a broad overview or dive deep into specific data, Banktrack lets you tailor your dashboard to fit your exact business needs.

You can even link multiple bank accounts, track different enterprises, and organize products, all in a single dashboard.

As you can see, the flexibility is what makes it powerful; it adapts as your business evolves.

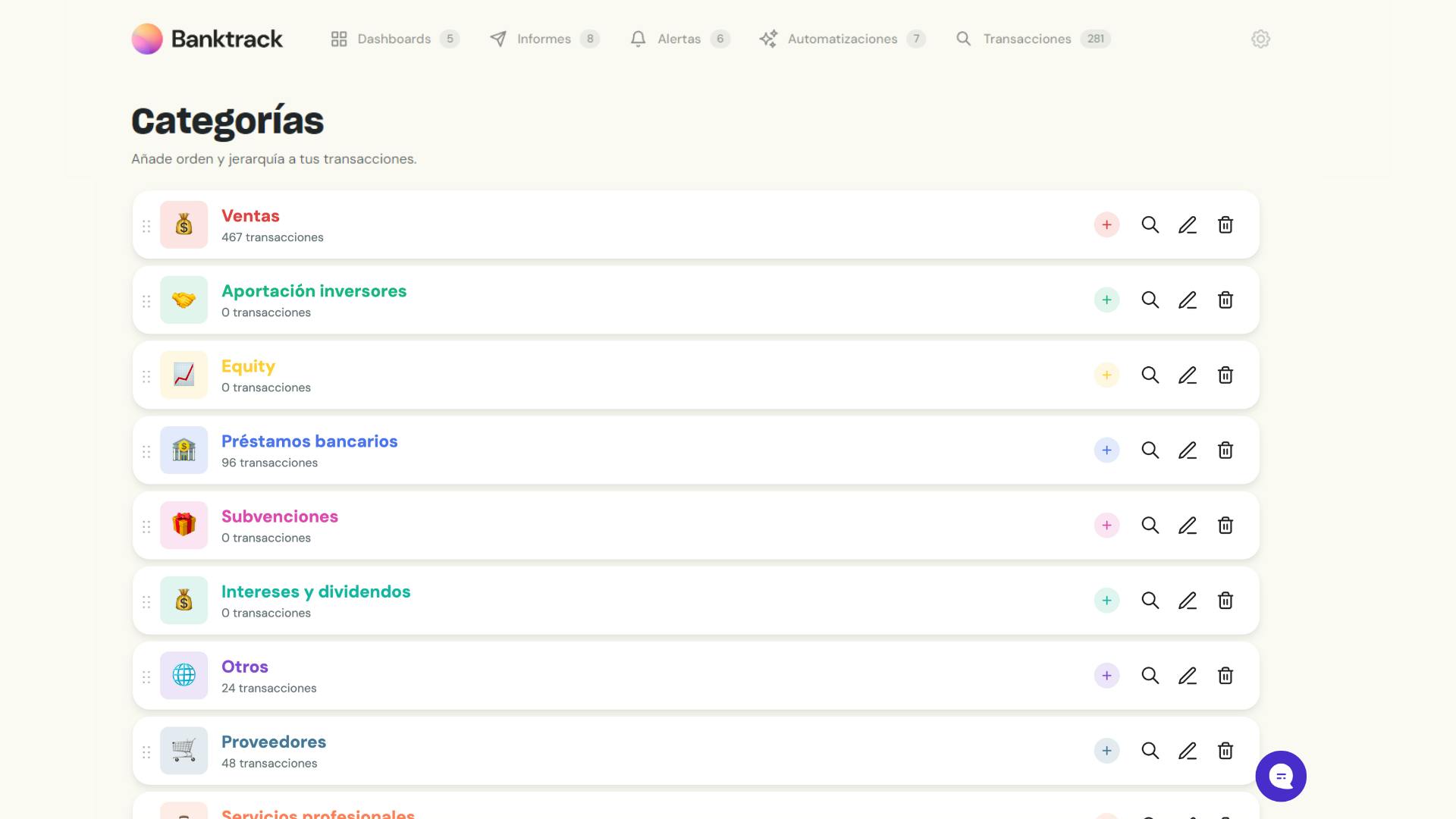

Advanced Categorization

Knowing where every penny goes is crucial, and Banktrack makes this process incredibly easy with its advanced categorization features. You can create unlimited categories to track every type of income and expenditure.

Have a new expense category pop up? No problem! You can customize and tweak your categories on the go, ensuring that your financial data is always organized and up-to-date. This gives you a clearer picture of your cash flow, helping you identify spending patterns and make informed financial decisions.

Personalized Reports and Alerts

Banktrack doesn’t just help you track your spending, it actively keeps you informed with personalized reports and alerts. You can set up custom reports to be generated at specific times, focusing on the metrics that matter most to you.

But that’s not all. Banktrack offers a variety of alert options, ensuring you’re always on top of your finances. Whether it’s via WhatsApp, SMS, email, Slack, or Telegram, you’ll receive alerts about critical financial activities, such as low balances, duplicate charges, or any other red flags you set up.

This feature means you can take action immediately, rather than finding out when it’s too late. It’s like having a financial assistant keeping an eye on your money 24/7.

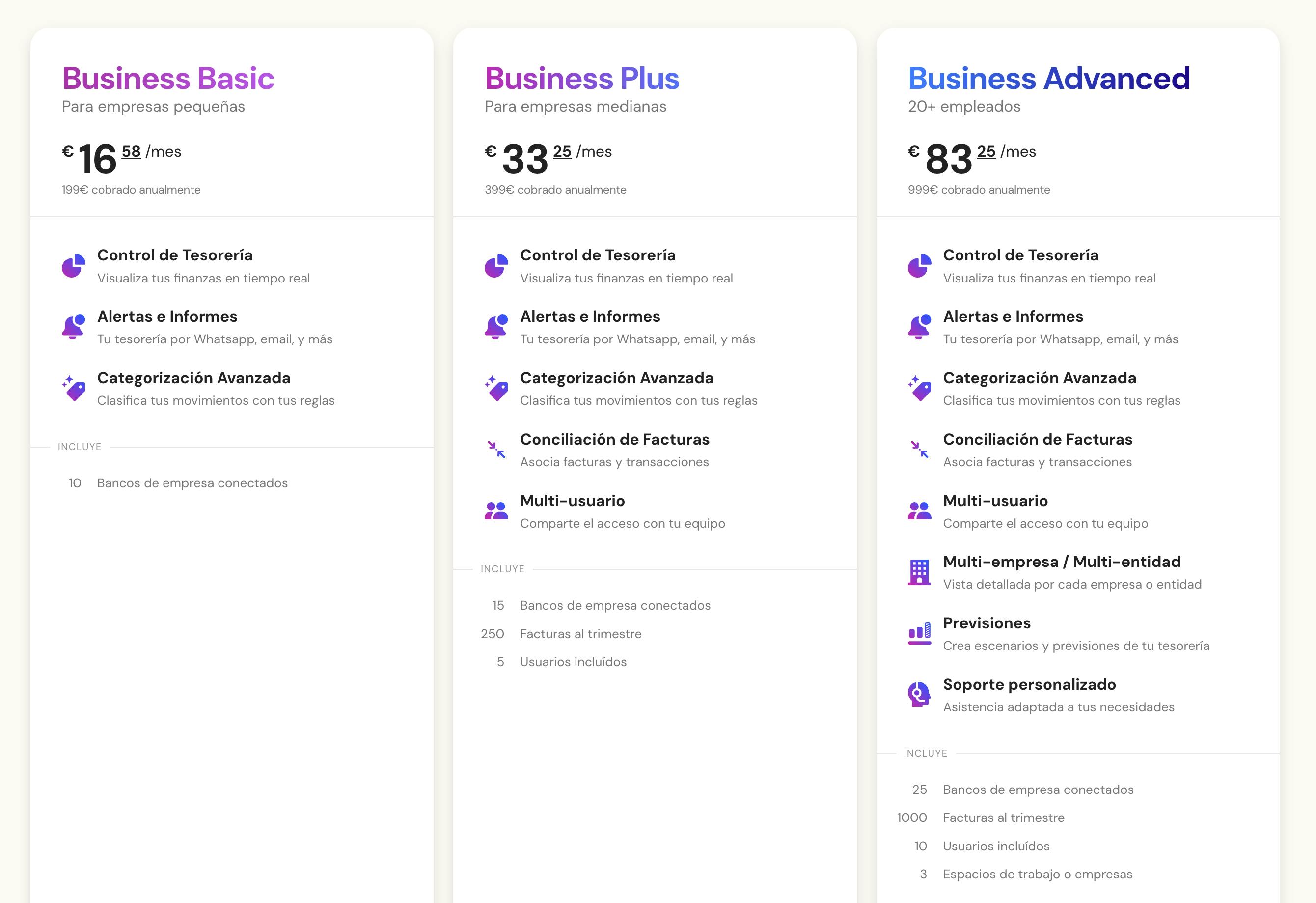

Simple Pricing for Great Features

Despite all these advanced features, Banktrack is priced quite reasonably, making it accessible for small businesses.

At just €16.58 per month, you get a complete cash management solution without breaking the bank!

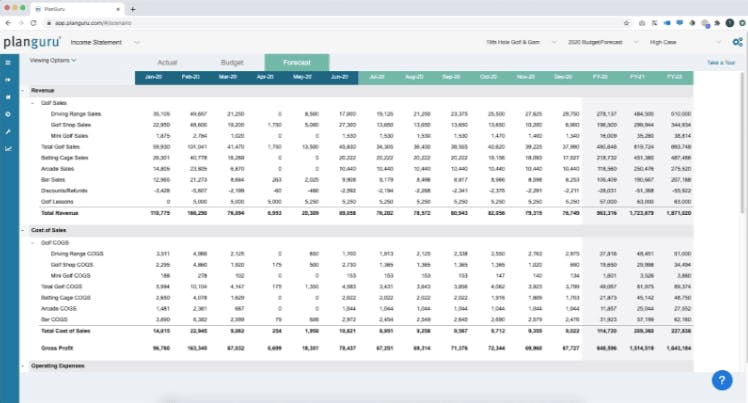

2. PlanGuru

PlanGuru is a treasury cash flow forecasting tool that helps you see into the financial future.

It integrates with QuickBooks and Excel, making it easier to plan for what’s ahead.

Features:

- Long-Term Forecasting: Plan budgets and forecasts up to 10 years.

- Integration: Works with QuickBooks and Excel.

- Educational Resources: Access tutorials and demos.

Price: Starts at $99 per month, with a 14-day free trial.

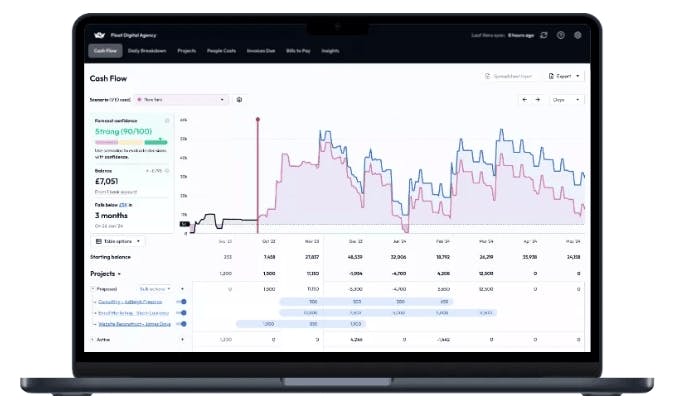

3. Float

Float is designed to be as easy as possible, with a sleek interface for managing budgets and forecasts.

Features:

- User-Friendly: Easy to navigate and set up forecasts.

- Multi-User Support: The Essential plan supports up to three users.

- Expert Reviews: Premium plans offer expert reviews of your forecasts.

Price: Starts at $59 per month.

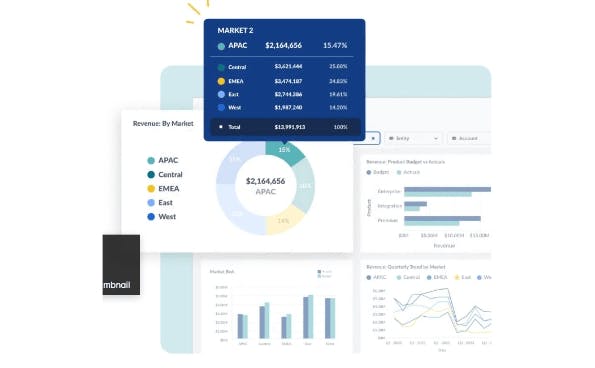

4. Scoro

Scoro is a very complete business cash management tool. It not only handles cash-flow but also offers project management, invoicing, and more.

Features:

- Comprehensive Tools: Includes project management and invoicing.

- High Functionality: Over 100 capabilities for managing your business.

- Onboarding Support: Help with setup for an extra fee.

Price: Starts at $63 per user per month, plus a setup fee.

5. CashAnalytics

CashAnalytics is geared towards larger businesses with its advanced forecasting and multi-currency features.

Features:

- Multi-Currency Tracking: Manage transactions in different currencies.

- Advanced Analytics: Detailed insights into cash-flow forecasting.

- Automation: Streamlines forecasting processes.

Price: Starts at $500 per month.

6. Pulse

Pulse is all about keeping things simple. Its cash-flow management solution for corporates and project tracking features make it a smart choice for managing cash.

Features:

- Project Tracking: Manage cash flow by project or client.

- QuickBooks Integration: Syncs with QuickBooks for easy financial planning.

- Ease of Use: Simple design for straightforward tracking.

Price: Starts at $29 per month.

7. QuickBooks

QuickBooks is the old reliable in the accounting world, offering solid cash-flow forecasting and financial management features.

Features:

- Comprehensive Reporting: Detailed financial reports and forecasts.

- Integration: Works with many other financial tools.

- Scalability: Suitable for growing businesses.

Price: Starts at $50 per month.

8. Google Docs

Google Docs offers free templates for cash-flow management. It’s basic but can be a good starting point for simple tracking.

Features:

- Free Templates: No cost for basic cash-flow management.

- Simple Tracking: Good for straightforward financial needs.

- Collaborative: Share and work on documents with your team.

Price: Free, with optional Google Workspace plans for added features.

9. Cube

Cube combines the power of spreadsheets with automated data management, making it ideal for those who love their Excel but want a bit more.

Features:

- Data Automation: Automate data transfers from spreadsheets.

- Custom Dashboards: Tailor dashboards to your needs.

- Scenario Planning: Test different financial scenarios.

Price: Custom pricing based on needs.

10. Vena Solutions

Vena Solutions blends Excel’s familiarity with cloud-based functionality for complete personal financial tracking.

Features:

- Excel Interface: Use Excel for data entry and analysis.

- Cloud-Based: Access data from anywhere.

- Flexible Reporting: Create detailed reports and dashboards.

Price: Custom pricing based on business requirements.

4 Reasons Why Expense Tracking Matters

An expense tracking app is basically your business’s financial diary.

By keeping track of every penny that flows in and out, you make sure everything adds up and that you don’t accidentally spend more than you earn.

Here’s why it’s essential:

1. Keep Your Budget in Check

Think of expense tracking as your financial GPS. Without it, you might end up lost in a sea of receipts and invoices.

Recording every expense helps you stick to your budget, avoid overspending, and make sure your money is being used wisely.

Benefits:

- Better Budgeting: Helps you create realistic budgets and stick to them.

- Smart Decisions: Provides data to make better choices about where to invest or cut costs.

- Catch Problems Early: Spot issues before they become big problems. Think of it like discovering a flat tire before your road trip.

2. Maximize Those Tax Deductions

Tax time isn’t exactly the most exciting part of running a business, but a good expense tracker app can make it a lot less stressful.

By keeping detailed records, you can make sure you don’t miss out on deductions that could save you some money.

Benefits:

- Claim All Deductions: Make sure you get every deduction you’re entitled to.

- Reduce Tax Bills: Save money on your taxes with accurate records with a bill management app.

- Simplify Filing: Makes tax season smoother and less of a headache.

3. Improve Your Budgeting and Forecasting

Expense tracking isn’t just about recording what’s already happened. It’s also about planning for the future. By analyzing past spending, you can create more accurate budgets and forecasts.

Benefits:

- Accurate Projections: Helps you predict future financial needs based on past data.

- Strategic Planning: Assists in making informed decisions about your business’s direction.

- Efficient Resource Use: Ensures you use your resources effectively.

4. Manage Your Cash Flow Like a Pro

Cash flow is the lifeblood of your business, without it, you might find yourself in deep trouble.

Keeping track of your expenses helps you manage cash flow better and avoid those nail-biting moments when the bills come due.

Benefits:

- Avoid Cash Crunches: Keep enough cash on hand to cover your expenses.

- Seize Opportunities: Have the funds available for new opportunities.

- Financial Stability: Maintain a steady financial footing.

Top 5 Tips for Effective Expense Tracking

Tracking expenses doesn’t have to be as boring as it sounds.

With a few of these practices, you can make it easier and even a bit enjoyable.

1. Categorize Your Expenses

Trying to manage your finances without categorizing your expenses can be an absolute disaster. Group your spending into categories with Banktrack like “Office Supplies,” “Travel,” and “Utilities” to make tracking simpler.

Some tips are:

- Create Clear Categories: Define categories that reflect your business activities.

- Use Subcategories: Break them down further if needed (e.g., “Printer Ink” under “Office Supplies”).

- Stay Consistent: Use the same naming conventions for clarity.

2. Expense Tracker Software

An expense tracker software with bank sync features is the best friend you could ever have by your side. These tools automate much of the process, saving you time and reducing errors.

Features to Look For:

- Automation: Automate data entry and sync with your bank accounts.

- Reporting: Look for tools that generate useful reports.

- Integration: Ensure it works well with other financial tools you use.

3. Keep and Digitize Your Receipts

Receipts can pile up faster than you can say “tax audit.” Keep them organized, digitally, if possible.

A software can help you snap a pic of each receipt and store it neatly.

Tips:

- Go Digital: Use apps to digitize and store receipts.

- Organize by Category: Sort receipts into digital folders by category.

- Backup Regularly: Protect your receipts with regular backups.

4. Reconcile Regularly

An invoice reconciliation software does your homework, making sure everything adds up.

Regularly compare your expense records with bank statements to catch mistakes and keep everything accurate.

Steps:

- Schedule Regular Checks: Monthly or quarterly works well.

- Match Records: Compare your expenses with bank statements.

- Fix Mistakes: Correct any errors you find.

5. Establish an Expense Policy

Creating an expense policy for your team is like setting ground rules for a game.

It keeps everyone on the same page about what expenses are covered, how to submit them, and what limits apply.

Components:

- Reimbursable Expenses: Define what expenses can be reimbursed.

- Submission Process: Outline how and when to submit expense reports.

- Spending Limits: Set clear limits to avoid overspending.

Why Choose Banktrack?

Banktrack isn’t just another cash management tool; it’s a partner in your business's financial journey.

Here’s why it’s a top choice:

- Flexibility: Customize everything from dashboards to expense categories.

- Control: Stay on top of your finances with real-time alerts and personalized reports.

- Affordability: Get top-tier financial management features at a small business-friendly price.

In summary, Banktrack is more than just software; it’s a comprehensive financial management solution that adapts to your business needs.

With its great features and user-friendly interface, it’s no wonder that Banktrack is considered one of the best cash management tools for small businesses today.

Whether you’re a startup or an established business, Banktrack offers the tools you need to manage your finances effectively and efficiently.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed