The potential of EBITA to evaluate cash flow

- What is EBITA?

- The Importance of EBITA

- Differences Between EBITA, EBITDA, and EBIT

- Calculating EBITA

- Practical Example

- EBITA Margin

- What Constitutes a Good EBITA?

- Limitations of EBITA

- 5 Advanced EBITA Analysis Techniques

- 1. EBITA Trends Over Time

- 2. EBITA in Financial Forecasting

- 3. EBITA and Business Valuation

- 4. EBITA in Performance Incentives

- 5. Adjusted EBITA

- 3 Real-World Examples of EBITA Application

- How Can you Benefit from Analyzing EBITA

EBITA is a very useful metric to evaluate cash flow.

Ever wondered how businesses gauge their true operational performance? Meet EBITA!

It's like a financial superhero, stripping away the clutter of interest, taxes, and amortization to reveal a company’s pure operational muscle.

Whether you're an investor, a business owner, or just curious, understanding EBITA can give you a clearer picture of a company's cash flow and profitability.

Let’s dive into how this metric works, why it’s important, and how it stacks up against other financial indicators.

What is EBITA?

But first of all, let's define some terms. What is EBITA?

EBITA stands for Earnings Before Interest, Taxes, and Amortization.

It’s a financial metric used to evaluate a company's operational profitability and cash flow, excluding non-operational expenses like interest and taxes, and the non-cash expense of amortization.

This metric focuses on the company's core operations and provides a clearer picture of its true financial health.

The Importance of EBITA

EBITA is significant for several reasons:

- Operational Focus: By excluding interest, taxes, and amortization, EBITA highlights the operational performance of a company. It strips away factors that are not directly related to the day-to-day operations, allowing for a purer assessment of operational efficiency.

- Cash Flow Indicator: EBITA is an essential indicator of a company’s ability to generate cash from operations. It helps investors and management understand how much cash is available for reinvestment, dividends, or debt repayment.

- Comparison Tool: EBITA is particularly useful for comparing companies within the same industry. Since it excludes financial and non-operational factors, it provides a level playing field for evaluating operational performance.

Differences Between EBITA, EBITDA, and EBIT

Understanding the differences between EBITA, EBITDA, and EBIT is crucial for financial analysis:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): This metric includes depreciation in addition to amortization. It is helpful for companies with significant capital expenditures on physical assets, as it excludes both the non-cash charges of depreciation and amortization.

- EBIT (Earnings Before Interest and Taxes): EBIT excludes only interest and taxes, providing a broader view of profitability. However, it includes both depreciation and amortization, which can vary significantly between companies.

- EBITA: EBITA excludes amortization but includes depreciation. This makes it ideal for companies with substantial investments in intangible assets, such as patents or goodwill, providing a clearer picture of corporate cash flow management, which can also be gained by having a specialized software.

Calculating EBITA

There are two primary ways to calculate EBITA:

- From EBT (Earnings Before Tax):

EBITA = EBT + interest expense + amortisation expense

- From EBIT (Earnings Before Interest and Taxes):

EBITA = EBIT + amortisation expense

Practical Example

Consider a company with the following financials:

- Earnings Before Tax (EBT): $500,000

- Interest Expense: $100,000

- Amortization Expense: $50,000

The EBITA would be calculated as follows:

EBITA=500,000+100,000+50,000=650,000 = 500,000 + 100,000 + 50,000 = 650,000EBITA=500,000+100,000+50,000=650,000

This calculation shows that the company has an EBITA of $650,000, indicating the cash generated from its operations before considering interest, taxes, and amortization.

EBITA Margin

EBITA Margin is a crucial ratio for evaluating a company’s profitability relative to its revenue:

EBITA Margin= EBITA / revenue

For example, if a company has revenue of $2,000,000 and an EBITA of $650,000:

EBITA Margin = 650,000 / 2,000,000 = 32.5%

This margin helps compare the efficiency of different companies within the same industry, as it indicates what percentage of revenue is converted into cash earnings.

What Constitutes a Good EBITA?

Determining what constitutes a good EBITA depends on several factors:

- Industry Standards: EBITA can vary significantly between industries. For instance, technology companies may have higher EBITA margins due to lower operational costs compared to manufacturing firms.

- Company Growth Phase: Startups and high-growth companies may have lower EBITA due to initial high investment costs, while mature companies typically show higher EBITA.

- Comparative Analysis: Comparing EBITA to peers within the same industry provides a benchmark. A higher EBITA compared to industry averages suggests strong operational performance and cash generation.

Limitations of EBITA

While EBITA is a useful metric, it does have limitations:

- Exclusion of Important Costs: By excluding interest, taxes, and amortization, EBITA might overlook significant expenses that affect the company’s net profitability.

- Non-GAAP Measure: EBITA is a non-GAAP (Generally Accepted Accounting Principles) measure, meaning it is not regulated or standardized. Companies might calculate it differently, leading to inconsistencies.

- Overemphasis on Operational Performance: Solely relying on EBITA might ignore the broader financial health of the company, including its leverage, tax strategies, and depreciation policies.

5 Advanced EBITA Analysis Techniques

1. EBITA Trends Over Time

One way to gain deeper insights from EBITA is to analyze its trends over time. Looking at historical EBITA data can help identify patterns, growth trajectories, and potential red flags. For example:

- Consistent Growth: Steady increases in EBITA over several quarters or years can indicate a healthy, growing business.

- Volatility: Large fluctuations in EBITA may signal operational instability or exposure to external factors like market conditions or regulatory changes.

- Declines: A declining EBITA trend might suggest underlying issues in the company’s core operations that need addressing.

2. EBITA in Financial Forecasting

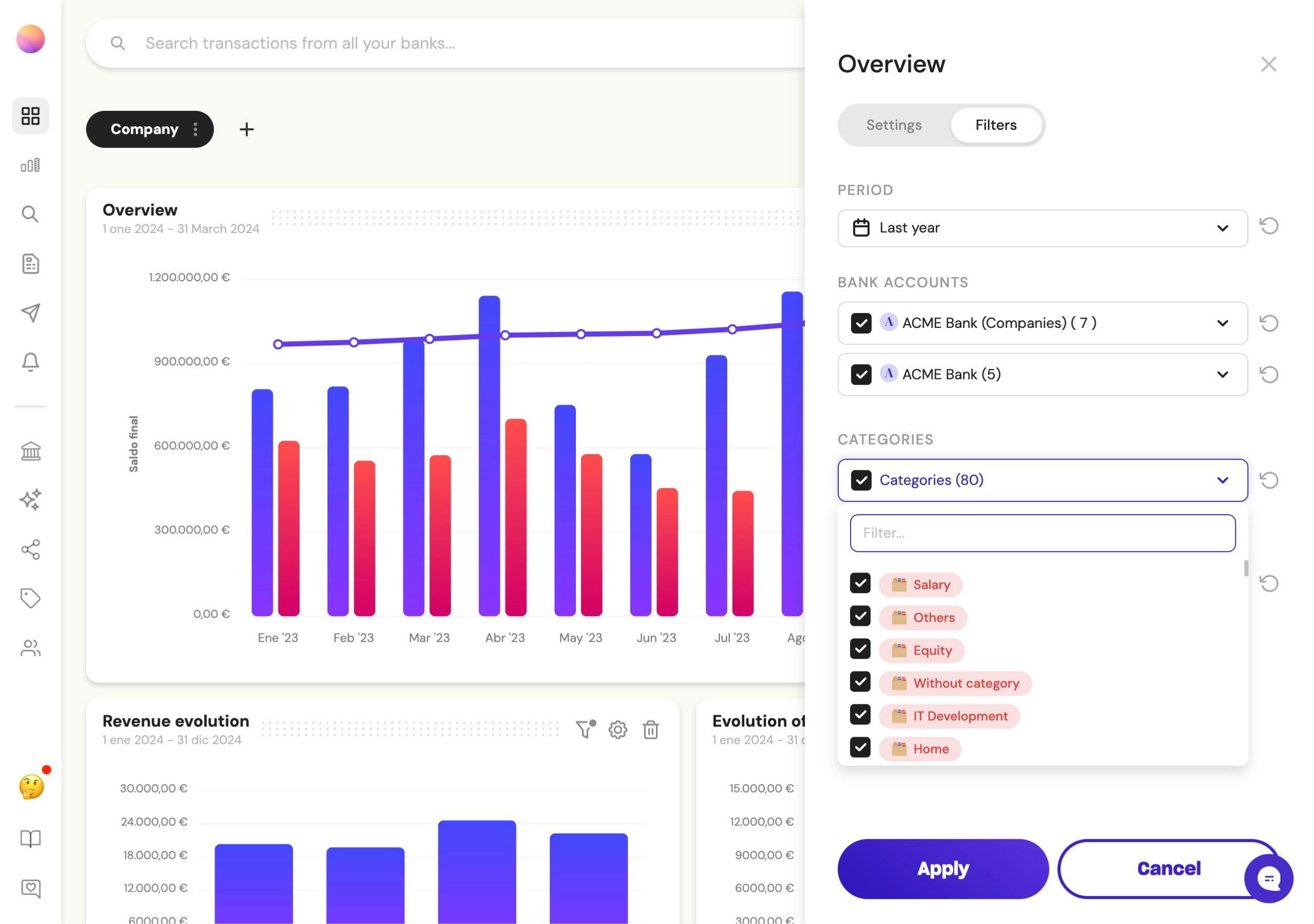

EBITA is a valuable tool that can enhance your software for real time cashflow forecasting. By projecting future EBITA based on historical data and expected changes in the business environment, companies can:

- Set Performance Targets: Establish realistic EBITA targets for future periods to guide operational improvements.

- Plan Investments: Use projected EBITA to determine how much cash will be available for reinvestments, expansions, or acquisitions.

- Manage Debt: Assess future EBITA to ensure the company can meet its debt obligations and maintain healthy leverage ratios.

3. EBITA and Business Valuation

EBITA plays a critical role in business valuation, especially in mergers and acquisitions (M&A). Potential buyers often look at EBITA to determine how much they are willing to pay for a company. Key considerations include:

- EBITA Multiples: Buyers might use EBITA multiples, derived from industry benchmarks or comparable transactions, to value a company. For example, if the industry average EBITA multiple is 8x and a company’s EBITA is $10 million, the business might be valued at $80 million.

- Synergies: In M&A scenarios, buyers also consider potential synergies that could enhance EBITA post-acquisition. This includes cost savings, revenue enhancements, and operational efficiencies.

4. EBITA in Performance Incentives

Many companies use EBITA as a basis for performance incentives and executive compensation.

Tying bonuses and incentives to EBITA targets aligns management’s interests with those of shareholders, focusing on improving operational efficiency and cash flow management software.

However, it’s crucial to set appropriate targets and consider potential unintended consequences, such as excessive cost-cutting that might harm long-term growth.

5. Adjusted EBITA

In some cases, companies use adjusted EBITA, which makes additional adjustments to the standard EBITA calculation. These adjustments can include:

- Non-Recurring Items: Removing one-time expenses or revenues that do not reflect ongoing operations, such as restructuring costs or legal settlements.

- Extraordinary Items: Excluding unusual and infrequent events that significantly impact financial performance.

- Stock-Based Compensation: Adjusting for non-cash expenses related to stock options and grants.

3 Real-World Examples of EBITA Application

To illustrate the practical application of EBITA, let’s look at a few real-world scenarios:

- Tech Startup: A technology startup invests heavily in R&D and marketing, leading to significant amortization of intangible assets. By focusing on EBITA, investors can better understand the company’s operational cash flow without the noise of high amortization expenses.

- Manufacturing Firm: A manufacturing company with substantial interest expenses from debt-financed equipment purchases uses EBITA to assess its operational efficiency. This helps in making informed decisions about cost management and pricing strategies.

- Retail Chain: A retail chain evaluates its store performance by calculating EBITA for each location. This allows management to identify high-performing stores and address issues in underperforming ones.

How Can you Benefit from Analyzing EBITA

Understanding EBITA is crucial for investors and business managers to evaluate a company’s operational performance and cash profitability effectively.

Why? Because this metric provides insights into the company's ability to generate and forecast cash flow, which is vital for sustaining operations, funding growth, and providing returns to shareholders.

By focusing on EBITA, stakeholders can make more informed financial decisions, ensuring a comprehensive evaluation of a company’s true financial health.

Share this post

Related Posts

The 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.How to track your business cash flow: complete guide

Failing to track cash flow properly can lead to serious financial issues. In this article, we provide efficient solutions to manage and optimize it effectively.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed