How to do a cash flow projection in 9 steps

- What is Cash Flow Projection?

- 9 Steps to Create a Cash Flow Projection

- 1. Choose the Type of Projection Model

- 2. Gather Historical Data and Sales Information

- 3. Project Cash Inflows

- 4. Estimate Cash Outflows

- 5. Calculate Opening and Closing Balances

- 6. Account for Timing and Payment Terms

- 7. Calculate Net Cash Flow

- 8. Build Contingency Plans

- 9. Implement Rolling Forecasts

- 5 Benefits of Cash Flow Projection

- 1. Improved Cash Flow Planning

- 2. Proactive Shortfall Management

- 3. Enhanced Decision-Making

- 4. Utilizing Cash Surplus

- 5. Managing Foreign Exchange Risk

- 4 Common Mistakes in Cash Flow Forecasting

- 1. Over-Optimistic Sales Forecasts

- 2. Ignoring Seasonal Variations

- 3. Relying on Averages

- 4. Inadequate Data Integration

- The Role of Technology in Cash Flow Forecasting

- 1. Real-Time Data Access

- 2. Predictive Analytics

- 3. Automation

- 4. AI-Driven Forecasting

- How Banktrack can help you with Cash Flow Projection

Cash flow projection is an indispensable financial practice for businesses of all sizes.

It helps predict future cash inflows and outflows, providing valuable insights for making informed financial decisions.

This guide will walk you through the process of creating accurate cash flow projections, their benefits, and common pitfalls to avoid.

What is Cash Flow Projection?

Cash flow projection involves estimating the money that will flow in and out of a business over a specific period.

This process includes predicting sales, receivables, expenses, and other financial obligations.

By forecasting cash flow, businesses can anticipate periods of surplus or shortage, allowing for better financial planning and decision-making.

9 Steps to Create a Cash Flow Projection

Creating a cash flow projection involves several key steps that help ensure accuracy and relevance. Here’s a detailed breakdown:

1. Choose the Type of Projection Model

The first step in creating a cash flow projection is to determine the type of projection model that best suits your business needs.

Short-term projections typically cover a period of 3-12 months and are useful for immediate planning and monitoring.

Long-term projections, on the other hand, extend beyond 12 months and provide insights for strategic decision-making and future planning.

A combination approach, using both short-term and long-term projections, can address both immediate and long-range goals effectively.

2. Gather Historical Data and Sales Information

Collecting relevant historical financial data is crucial for creating an accurate cash flow projection. This includes cash inflows and outflows from previous periods, as well as sales information.

Analyzing past sales data helps identify patterns related to seasonality, customer payment behaviors, and market trends.

Many finance teams utilize accounting software to aggregate a range of historical and transactional data, making this process more efficient.

3. Project Cash Inflows

Estimating future cash inflows is a critical component of cash flow projection. This involves forecasting sales based on historical data and market insights.

Factors such as payment terms and collection periods should be considered to refine these projections. For example, if your business experiences seasonal fluctuations, incorporating these trends into your projections can enhance their accuracy.

4. Estimate Cash Outflows

Identifying and categorizing various cash outflow components, such as operating expenses, loan repayments, supplier payments, and taxes, is the next step.

Using historical data and expense forecasts, you can estimate the timing and amounts of these outflows. This step ensures that all potential cash outflows are accounted for in your projection.

5. Calculate Opening and Closing Balances

The opening balance for each period represents the cash available at the beginning of that period. This can be calculated by taking the previous period's closing balance.

The closing balance is determined by adding the projected cash inflows and subtracting the estimated cash outflows from the opening balance. This calculation provides a clear view of the expected cash position at the end of each period.

6. Account for Timing and Payment Terms

Accurate cash flow projections must account for the timing of cash movements. This includes considering the payment terms agreed upon with customers and suppliers.

Aligning your projections with these terms ensures a more realistic cash flow timeline, helping you manage cash effectively.

7. Calculate Net Cash Flow

Net cash flow is calculated by subtracting cash outflows from cash inflows for each period.

This metric provides a clear picture of the business’s future cash position and helps identify periods of surplus or shortage.

Regularly calculating net cash flow allows for timely adjustments to your financial strategy.

8. Build Contingency Plans

Incorporating contingency plans into your cash flow projections helps mitigate the impact of unexpected events, such as economic downturns or late payments.

Creating buffers in your projections can help handle unforeseen circumstances, ensuring your business remains resilient in the face of challenges.

9. Implement Rolling Forecasts

Rolling forecasts involve regularly updating and refining your cash flow projections based on actual performance and changing circumstances.

This approach provides a dynamic view of your cash flow, allowing for adjustments and increased accuracy over time.

5 Benefits of Cash Flow Projection

1. Improved Cash Flow Planning

Cash flow projections help businesses determine how much cash is needed to achieve various objectives, such as paying for supplies, wages, and taxes.

By planning for these needs in advance, businesses can avoid cash shortages and ensure smooth operations.

2. Proactive Shortfall Management

Detecting potential cash shortages in advance allows businesses to take necessary measures to prevent financial crises.

For instance, obtaining additional funds or adjusting payment schedules can help manage cash flow effectively.

3. Enhanced Decision-Making

Accurate cash flow projections provide a solid foundation for making informed financial decisions.

Whether it’s deciding to invest in new equipment, expand operations, or manage existing resources, having a clear view of future cash flows enables better strategic planning.

4. Utilizing Cash Surplus

Identifying periods of cash surplus enables businesses to make the most of excess funds.

Whether investing in growth opportunities or building a competitive advantage, utilizing surplus cash effectively can drive long-term success.

5. Managing Foreign Exchange Risk

For businesses involved in international transactions, cash flow projections help identify and manage risks associated with foreign exchange fluctuations.

By predicting these risks, businesses can implement effective hedging strategies to mitigate their impact.

4 Common Mistakes in Cash Flow Forecasting

1. Over-Optimistic Sales Forecasts

One of the most common mistakes in cash flow forecasting is overestimating future sales. This can lead to cash flow problems if actual sales fall short of expectations.

To avoid this, businesses should set realistic sales goals based on historical data and current market conditions.

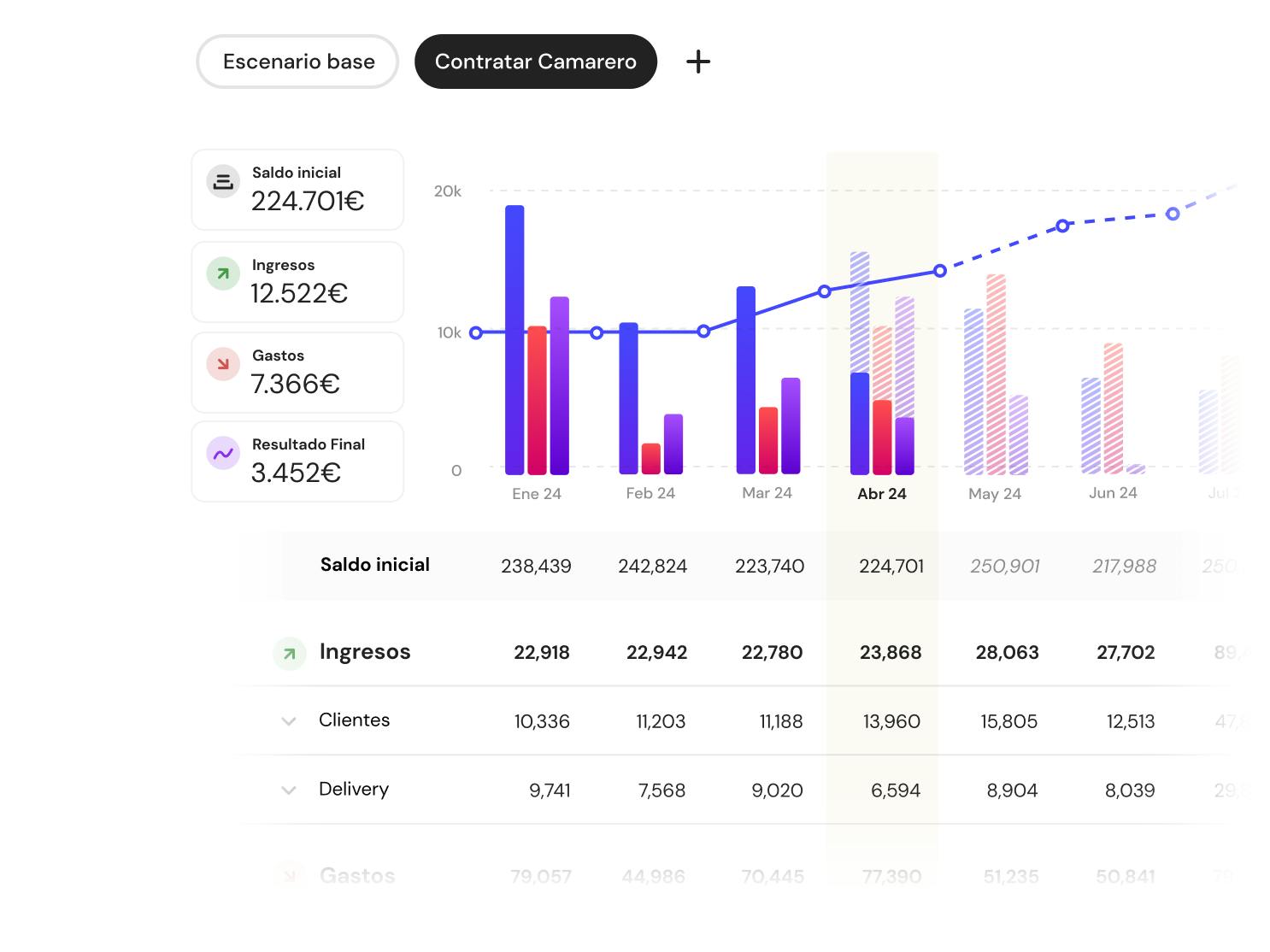

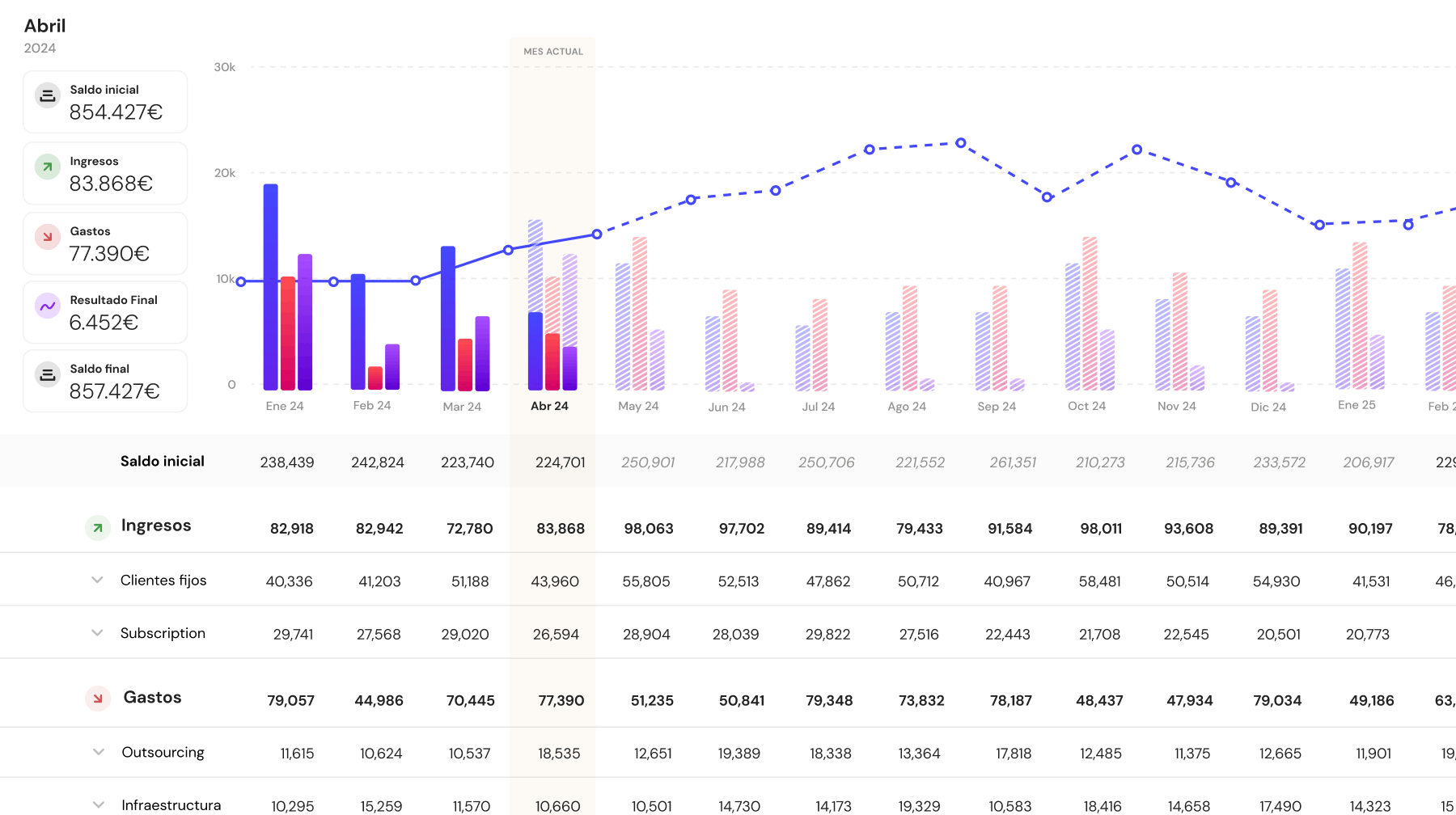

One good way of making sure you are making a good forecast is by using a cash liquidity forecasting software. The reason is very simple. It already gives you a forecasting feature.

With this tool, you are able to create forecasts with fixed amounts or based on the history of income and expenses from previous months.

In addition, it allows you to create scenarios to evaluate the impact on your treasury of potential investments, staff additions, variations in sales volume, delays in collections, and other relevant factors.

2. Ignoring Seasonal Variations

Failing to account for seasonal fluctuations in sales can significantly affect cash flow accuracy.

By analyzing past sales patterns and understanding the business environment, firms can prepare more accurate forecasts that consider these variations.

3. Relying on Averages

Using average estimates for cash flow components can be misleading. Changes in customer payment behavior or market conditions can impact cash flow significantly.

Therefore, businesses should use detailed data and specific models to predict cash flow more accurately.

4. Inadequate Data Integration

Lack of centralized data sources can lead to inaccurate forecasts. Integrating data from various systems, such as ERPs, TMS, and bank portals, is crucial for precise forecasting.

This integration ensures that all relevant information is considered in the cash flow projection.

The Role of Technology in Cash Flow Forecasting

Advancements in technology have revolutionized cash flow forecasting, making it more accurate and efficient. Here’s how technology can enhance cash flow projection:

1. Real-Time Data Access

Immediate access to real-time financial data enables frequent re-forecasting and projections.

This ensures that the latest information is always considered, enhancing the accuracy of cash flow forecasts.

2. Predictive Analytics

Advanced analytics and machine learning techniques help identify complex relationships within data, improving future cash flow predictions.

These techniques complement human judgment and provide deeper insights into cash flow trends.

3. Automation

Automating manual elements of the forecasting process reduces errors and increases efficiency.

Automated data flows, formatting, and spreadsheet manipulation minimize manual interventions, allowing finance teams to focus on strategic tasks.

4. AI-Driven Forecasting

Artificial intelligence (AI) and machine learning enable real-time re-forecasting by continuously analyzing multiple data streams.

AI can identify patterns from vast datasets, detect errors in human judgment, and optimize forecasting models, making cash flow predictions more accurate and reliable.

How Banktrack can help you with Cash Flow Projection

Cash flow projection is a vital tool for effective financial management.

Bantrack is one of the best cash flow management tools and it might help manage finances.

Create dynamic forecasts of your expenses and income and avoid surprises.

Create scenarios to evaluate the impact on your treasury of potential investments, staff additions, variations in sales volume, delays in collections, and other relevant factors.

Share this post

Related Posts

Advanced cash flow forecasting: techniques and tools

Master advanced cash flow forecasting with top techniques and tools like treasury software, AI analytics, BI platforms, and ERP systems to streamline financial planning and decision-making.Top 10 Alternatives to Agicap in 2024

Find smarter, budget-friendly alternatives to Agicap for smarter cash flow management this year.Best 6 Practices for Managing Cash Effectively

Mastering cash management keeps your business on point, letting you tackle bills, increase growth chances, and handle surprises with ease!

Try it now with your data

- Your free account in 2 minutes

- No credit card needed