Top 10 Alternatives to Agicap in 2024

These are the 10 best alternatives to Agicap:

- Banktrack – Affordable, intuitive cash flow software.

- QuickBooks Online – Comprehensive accounting and cash flow management.

- Xero – A cloud-based solution for small businesses.

- Wave – Free accounting tools for freelancers and small businesses.

- Zoho Books – Affordable accounting software with workflow automation.

- FreshBooks – An all-in-one solution for business owners.

- Embat – Tailored for corporate giants with growing cash flow needs.

- SAP Cash Management – Enterprise-grade solution with advanced liquidity and cash flow forecasting tools.

- Kyriba – Cloud-based software offering global cash visibility and risk management.

- Coupa – Integrated platform for spend management and cash flow optimization.

Keeping track of cash flow doesn’t have to be a headache, or cost you a fortune. Agicap might be a popular choice for businesses, but let’s be honest: not everyone needs all those extra features, especially when they come with a hefty price tag.

If you’re overpaying for tools you barely use or dealing with clunky customer service, don’t stress, there are smarter, simpler options out there.

In this article, we’ll introduce you to 10 fantastic alternatives to Agicap. These tools are designed to make managing your cash flow easier, more affordable, and actually tailored to your needs. Let’s dive in!

Top 10 Alternatives to Agicap

1. Banktrack

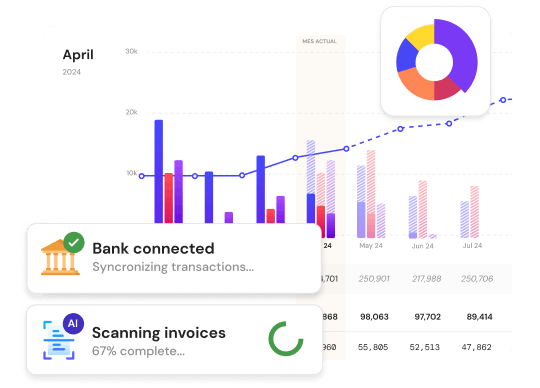

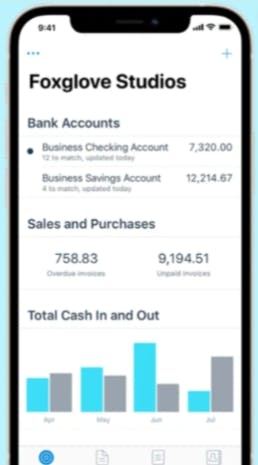

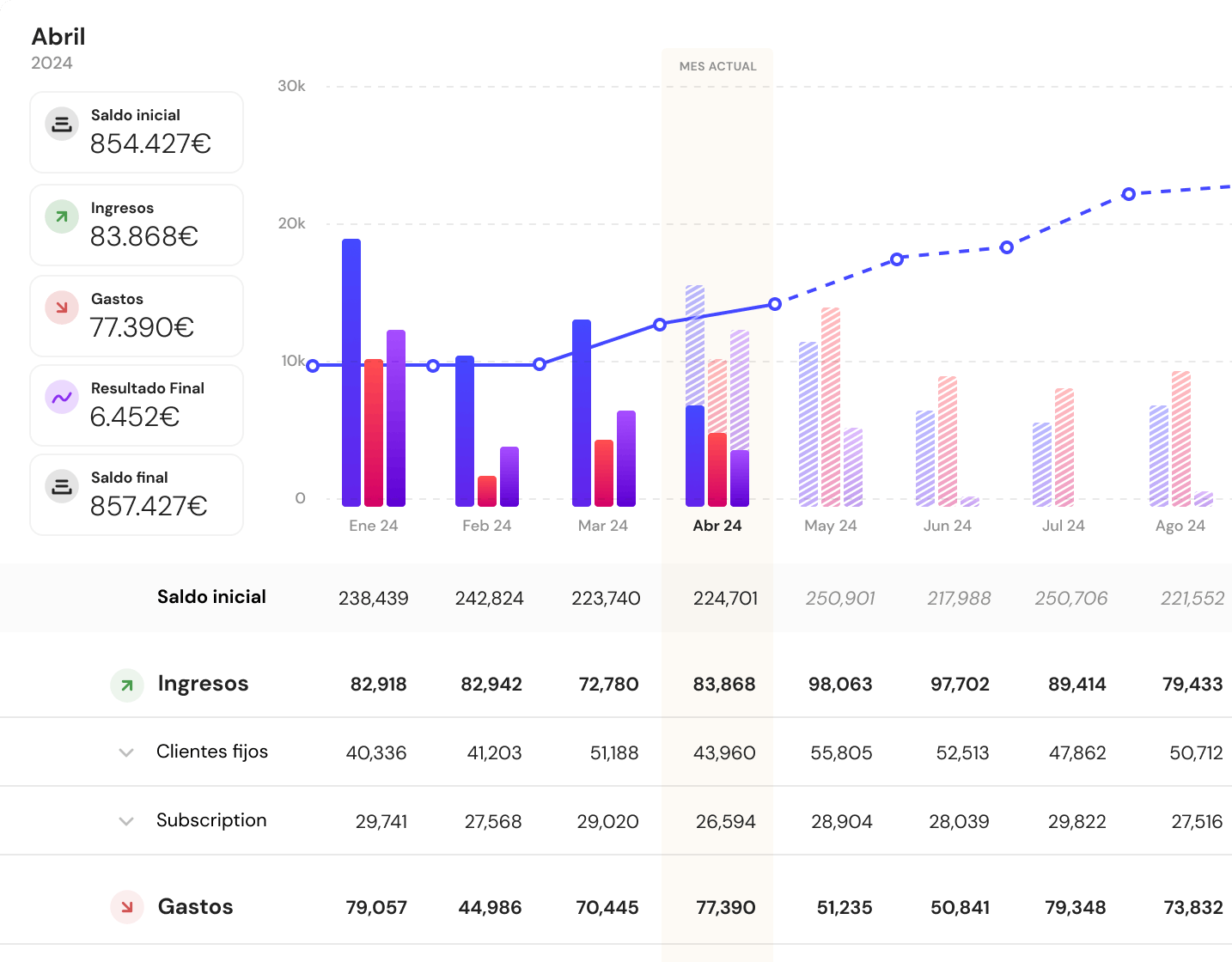

Banktrack stands out as an intuitive and feature-rich cash flow forecasting software, ideal for both individuals and small to medium businesses.

With tools designed to simplify complex financial tasks, Banktrack makes it easy to keep your finances organized while offering tremendous value at an affordable price.

What Makes Banktrack a Top Choice?

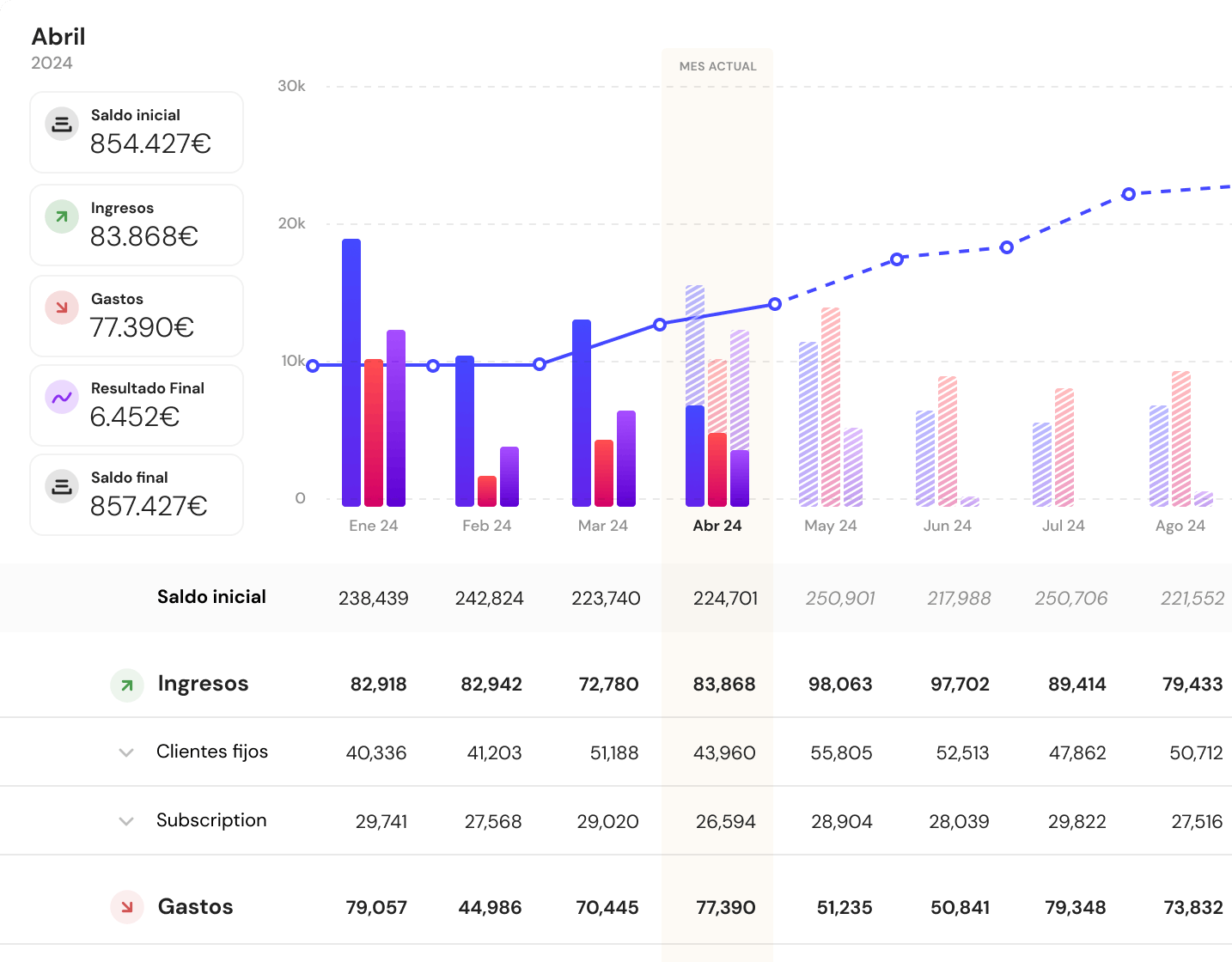

- Customizable Dashboards: Your Financial Snapshot at a Glance

Banktrack's customizable dashboards allow you to create a financial overview tailored to your specific needs.

Whether you want to track income streams, monitor spending categories, or set savings goals, you can design a dashboard that provides clear and actionable insights. This flexibility ensures you always have a real-time snapshot of your financial health, making it easy to stay on top of your finances.

- Seamless Integration with Over 120 Banks

Banktrack syncs effortlessly with both traditional financial institutions and digital neobanks, giving you a single platform to manage all your accounts. From checking and savings accounts to credit cards and investment portfolios, Banktrack’s secure connections via Open Banking and Direct Access provide a unified view of your finances. Say goodbye to juggling multiple apps or websites.

- Customizable Spending Limits and Overspending Alerts

Banktrack helps you take control of your spending by allowing you to set spending limits for different categories. Planning to cut back on dining out or entertainment expenses? Banktrack's real-time alerts notify you about low balances, duplicate charges, upcoming bill payments, and more. These notifications can be customized to your preferred channels, including WhatsApp, Slack, email, Telegram, and SMS, ensuring you stay informed wherever you are.

- Drag-and-Drop Reporting for Clear Insights

With Banktrack’s drag-and-drop reporting interface, creating detailed financial reports has never been easier. Whether you’re analyzing monthly expenses, tracking income trends, or monitoring your savings progress, you can customize your reports and share them with family members, business partners, or financial advisors. - Advanced Security You Can Trust

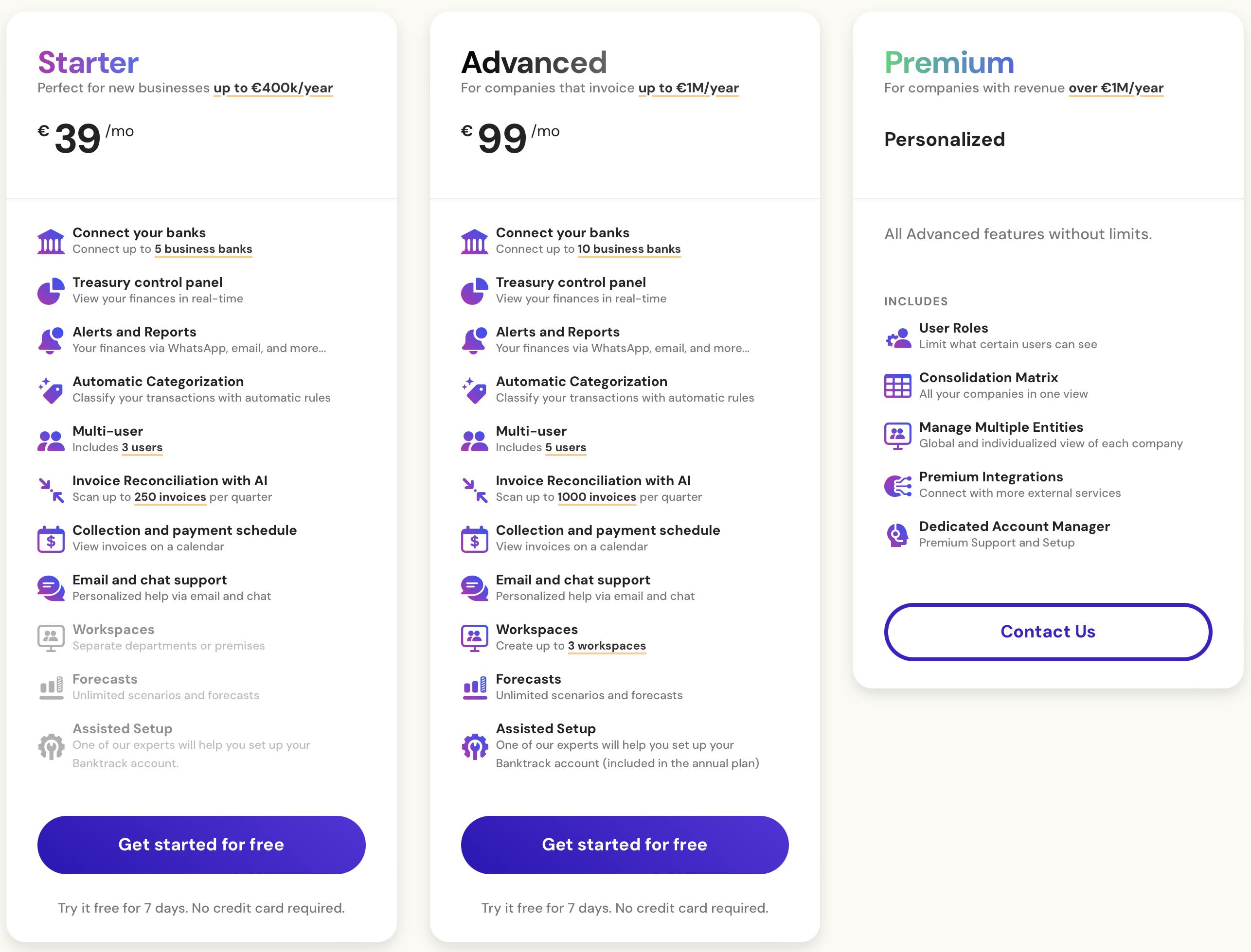

Banktrack takes your privacy and security seriously. With strong encryption and strict login protocols, your financial information is protected from unauthorized access. Its compliance with strict security standards makes it a reliable choice for managing sensitive financial data. - Affordable Pricing for All

Starting at just €39/month, Banktrack offers an affordable solution packed with features. For businesses, the price point is a bargain considering the powerful cash flow and great expense tracking app it is considered to be.

Why Banktrack Is a Must-Try Alternative to Agicap

Unlike Agicap, which targets big enterprises with deep pockets, Banktrack is all about making cash flow management simple, accessible, and budget-friendly. Whether you’re running a small business or just managing your personal finances, it’s designed to keep things hassle-free while delivering powerful tools to stay on top of your money.

Think real-time data, easy integrations, and reports that actually make sense, all without the hefty price tag. With Banktrack, you get everything you need to gain control of your money, minus the unnecessary complexity and cost.

2. QuickBooks Online

QuickBooks Online is a cloud-based accounting platform designed to handle all aspects of financial management, including cash flow tracking, invoicing, and expense management.

Key Features:

- Expense and Income Tracking: Monitor your business finances in real time.

- Customizable Invoicing: Create professional invoices and follow up on payments seamlessly.

- Advanced Cash Flow Forecasting: Gain insights into future financial trends to make informed decisions.

Pricing:

Starts at $25/month, making it a great option for growing businesses.

3. Xero

Xero offers good features for small businesses looking to streamline their financial processes. Its cloud-based platform ensures real-time access to financial data.

Key Features:

- Bank Integrations: Connect with over 800 banks globally for seamless account management.

- Real-Time Financial Monitoring: Stay updated on cash flow, expenses, and profits from anywhere.

- Collaborative Tools: Work easily with your accountant or financial advisor.

Pricing:

Starts at $13/month, providing excellent value for its features.

4. Wave

Wave is a great cash management software for freelancers and small businesses looking for a no-cost solution. It combines essential accounting tools with an intuitive design.

Key Features:

- Free Core Features: Manage invoicing, expense tracking, and basic accounting at no cost.

- Receipt Scanning: Simplify tracking with easy digital uploads.

- User-Friendly Interface: Ideal for those without a financial background.

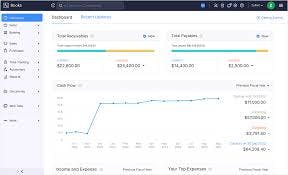

5. Zoho Books

Zoho Books provides advanced accounting tools for SMBs while remaining affordable. It’s particularly strong in automation and workflow management.

Key Features:

- Automation: Set up reminders for payments and automate recurring transactions.

- Tax Management: Simplify tax filing with integrated tools.

- Team Collaboration: Share financial data easily with your team or external accountants.

Pricing:

Plans start at $10/month, making it one of the most budget-friendly tools available.

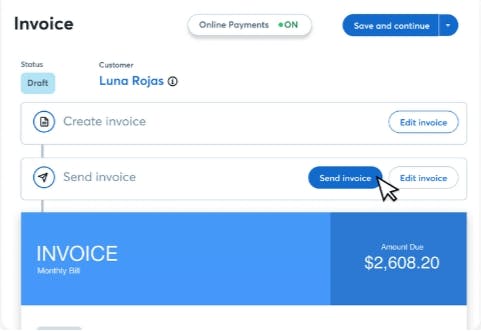

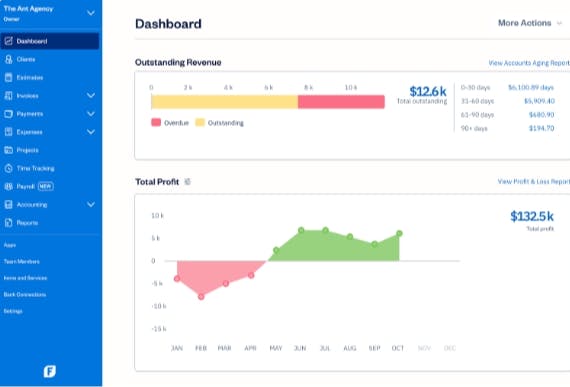

6. FreshBooks

FreshBooks is a flexible platform that focuses on ease of use while offering powerful features like invoicing and time tracking.

Key Features:

- Recurring Billing: Automate invoicing for regular clients.

- Time Tracking: Perfect for businesses that bill clients hourly.

- Detailed Reports: Generate income summaries, expense reports, and more with minimal effort.

Pricing:

Starts at $15/month, suitable for small businesses that need an all-in-one platform.

7. Embat

Embat is designed for corporate giants like those in the IBEX 35, providing strong tools to manage cash flow with precision and strategic insight.

Key Features:

- Strategic Cash Flow Forecasting: Gain advanced projections of your financial future, tailored to the needs of large-scale enterprises, using real-time and historical data.

- Comprehensive Real-Time Insights: Access detailed, up-to-date information on financial balances, transactions, and trends critical for high-level decision-making.

- Enterprise Collaboration: Enable smooth collaboration with internal teams and external advisors, ensuring alignment across departments.

- Multi-Bank Integration: Connect with numerous banking institutions to centralize your financial operations seamlessly.

Pricing:

Custom pricing plans designed for large corporations, ensuring scalability and alignment with the complexity of enterprise needs.

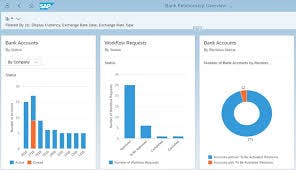

8. SAP Cash Management

SAP Cash Management is designed for large enterprises, providing integrated tools to manage liquidity, forecast cash flow, and ensure real-time visibility across global operations.

Key Features:

- Liquidity Management: Advanced tools for analyzing and managing liquidity at scale.

- Real-Time Insights: Access up-to-date cash flow and account information to make informed decisions.

- Enterprise Integration: Fully integrates with SAP S/4HANA for streamlined financial processes.

Pricing:

Custom pricing tailored to meet the needs of large corporations.

9. Kyriba

Kyriba is an international cloud-based cash and liquidity management solution, empowering enterprises with advanced analytics and risk mitigation tools.

Key Features:

- Global Cash Visibility: Monitor cash positions across multiple geographies in real time.

- Risk Management: Identify and mitigate financial risks with predictive analytics.

- Bank Connectivity: Integrates with hundreds of global banks for seamless treasury operations.

Pricing:

Flexible enterprise pricing based on organizational size and requirements.

10. Coupa

Coupa’s business spend management platform integrates cash management features, enabling enterprises to optimize resources and improve their financial control.

Key Features:

- Spend Visibility: Real-time tracking of expenses to improve cost efficiency.

- Cash Flow Optimization: Tools to maximize working capital and reduce cash cycle times.

- Collaboration Features: Foster alignment across departments and stakeholders.

Pricing:

Custom pricing options designed for enterprises with complex financial needs.

Why Explore Alternatives to Agicap?

Agicap is great, but it’s not for everyone. Here’s why some businesses look for alternatives:

- Cost: Agicap’s pricing can be a hurdle, especially for SMBs with tight budgets.

- Complexity: Its advanced features may feel overwhelming for businesses that need only basic cash flow management.

- Customer Support: Some users find Agicap’s customer support inconsistent, requiring them to re-explain issues to new agents.

Fortunately, there are tools tailored to specific needs, whether you want an affordable cash flow tracker, a strong cash management software, or a flexible ERP with banking features.

Manage your Money Effectively with Banktrack

Banktrack is more than just a cash flow tool; it’s the most complete treasury management software in the market, designed to help you take absolute control of your money.

Whether you’re running a business or managing personal finances, Banktrack has the tools to make your life easier. Give it a try and transform your money management today.

Share this post

Related Posts

Top 5 bank trackers in Switzerland

Managing your finances in Switzerland is easier with the right bank tracker. This guide highlights the top 5 tools designed to help you track expenses, monitor accounts, and optimize your budget.Best 5 alternatives to Embat

Looking for alternatives to Embat? This guide highlights the top 5 project management and collaboration tools that offer great features to enhance team productivityAmplify Gains with Financial Leverage

Financial leverage is the magical tool that lets you borrow money to make even more money. Let us show you how.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed