7 Best Financial Projection Apps in 2025

- 7 Best Financial Projection Apps in 2025

- 1. Banktrack

- 2. Float

- 3. Pulse

- 4. Futrli

- 5. Agicap

- 6. Anaplan

- 7. Excel & Google Sheets

- What Is a Financial Projection App?

- Why Your Business Needs One

- Key Features to Look For

- Challenges They Solve

- Trends in Financial Projection Apps in 2025

- Benefits of Using a Projection App

- Conclusion

These are the best financial projection apps:

- Banktrack

- Float

- Pulse

- Futrli

- Agicap

- Anaplan

- Excel & Google Sheets

Running a business without financial projections is like driving at night without headlights. You might still move forward, but you won’t see the risks coming, and sooner or later, you’ll crash.

That’s why more startups, scale-ups, and even small businesses are turning to financial projection apps. These tools help you forecast revenues, expenses, and cash flows so you can make informed decisions, attract investors, and avoid liquidity crises.

In this guide, we’ll cover everything you need to know about financial projection apps: what they are, why they matter, what features to look for, the challenges they solve, and a list of the best options available in 2025.

7 Best Financial Projection Apps in 2025

Here’s a breakdown of the top apps startups and businesses can use this year.

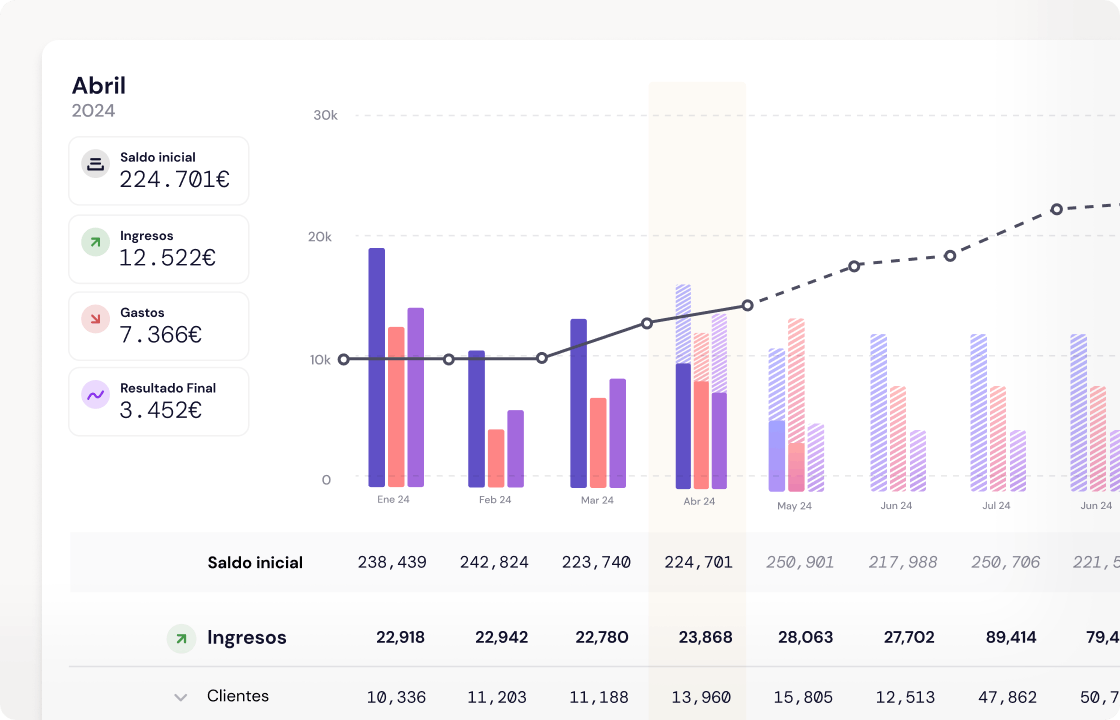

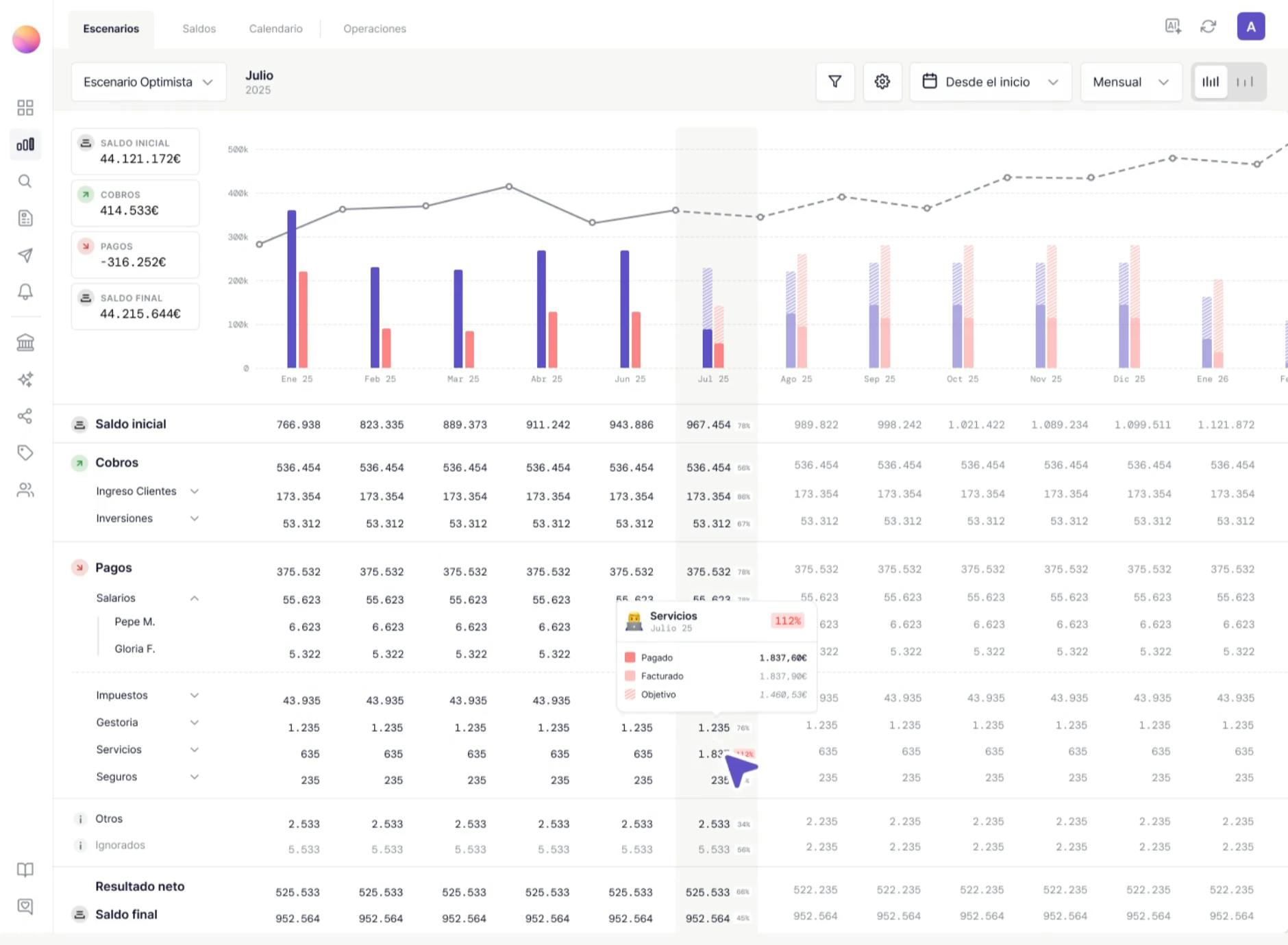

1. Banktrack

Banktrack is more than a forecasting tool, it’s a full treasury management software. It combines real-time banking integrations with cash flow forecasting, scenario planning, and regulatory compliance (including Verifactu in Spain).

Highlights:

- Syncs with 120+ banks worldwide.

- Real-time dashboards for MRR, burn rate, and liquidity.

- Scenario forecasting for fundraising delays, client churn, or expansion.

- Automatic invoice reconciliation.

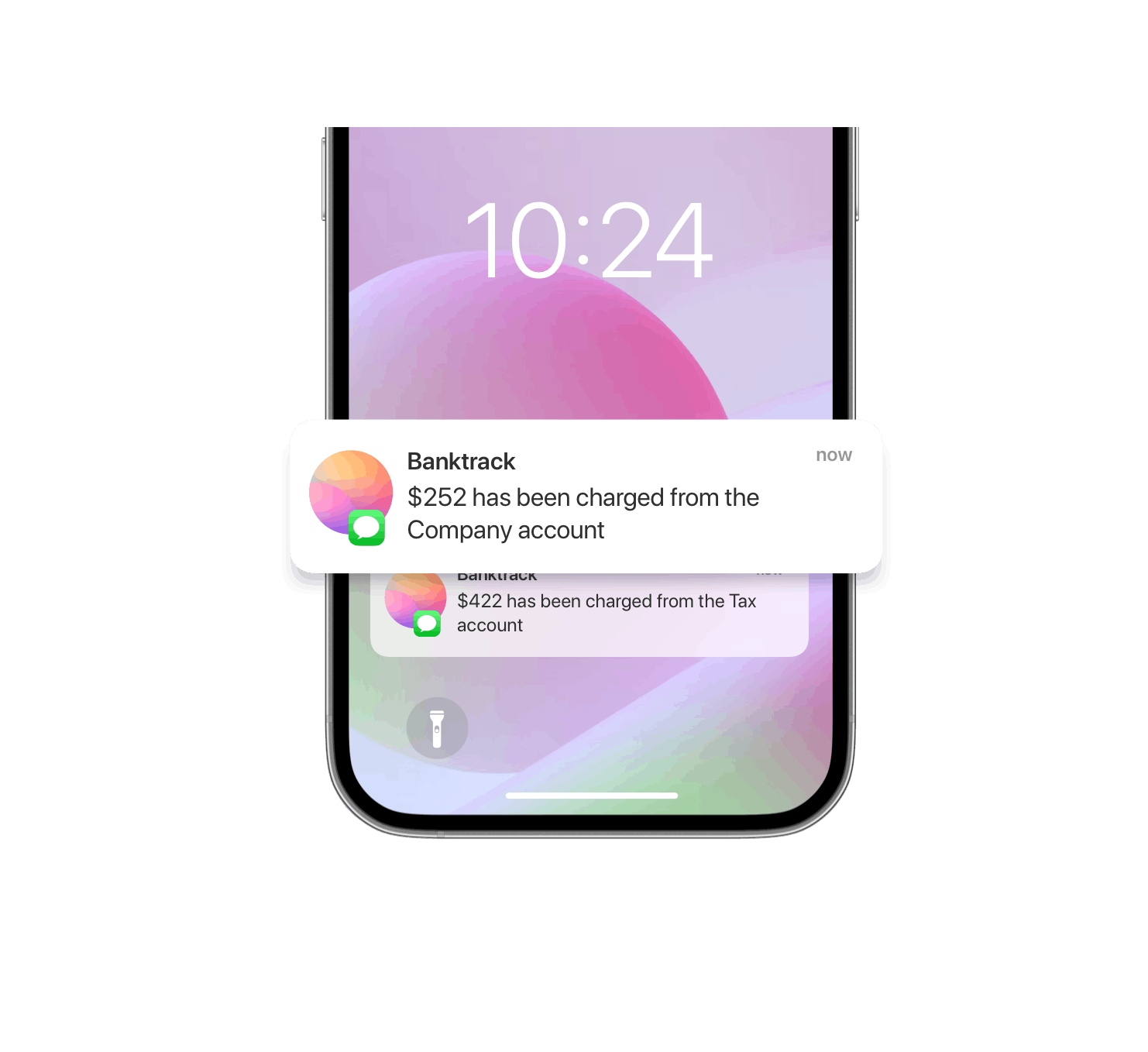

- Alerts for unusual spending or low balances.

- Multi-entity and multi-currency support.

- Exportable, investor-ready reports.

Why it’s #1: Banktrack gives startups the full picture, compliance, forecasting, and decision support, all in one.

2. Float

Float is ideal if your business already uses Xero, QuickBooks, or FreeAgent. It integrates directly into your accounting stack, pulling in actuals and turning them into forecasts.

Strengths:

- Seamless two-way sync with accounting tools.

- Weekly and monthly cash flow visibility.

- Simple scenario planning for growth or downturns.

- Easy variance reporting (forecast vs actual).

Best for: startups with established accounting systems that want forecasting without overhauling their workflow.

3. Pulse

Pulse is a lightweight cash flow forecasting app designed for small teams. It’s intuitive, visual, and easy to update, perfect for founders without finance backgrounds.

Strengths:

- Straightforward input of income and expenses.

- Clear, color-coded dashboards.

- Basic scenario planning.

- Collaboration with advisors and investors.

Best for: early-stage startups that need visibility without complexity.

4. Futrli

Futrli uses AI to create forecasts across P&L, balance sheet, and cash flow. It integrates with accounting software and helps startups model complex financial scenarios.

Strengths:

- AI-driven insights based on historical data.

- Multi-model forecasts (cash, profit, balance sheet).

- Customizable KPIs for SaaS metrics like churn or ARPU.

Best for: SaaS or data-driven startups that want predictive analytics alongside forecasting.

5. Agicap

Agicap is a European favorite for companies managing multiple bank accounts. It centralizes balances, projections, and budgets in one dashboard.

Strengths:

- Strong European banking integrations.

- Real-time liquidity dashboards.

- Easy budget vs actual tracking.

- Team collaboration features.

Best for: startups with multiple bank accounts or subsidiaries that need consolidated visibility.

Not really convinced? Here are some Agicap alternatives.

6. Anaplan

Anaplan is enterprise-grade financial modeling software. While complex and expensive, it’s powerful for startups that have scaled into global operations.

Strengths:

- Multi-scenario and multi-department planning.

- Extensive ERP and CRM integrations.

- Predictive analytics for long-term strategy.

Best for: later-stage startups or scale-ups with large teams and complex operations.

7. Excel & Google Sheets

Despite their flaws, spreadsheets remain the go-to option for many founders at the earliest stages. They’re cheap, flexible, and customizable, but prone to errors and not scalable.

Strengths:

- Total customization freedom.

- Easy to start, low (or no) cost.

- Collaboration possible in Google Sheets.

Best for: pre-seed startups before they’re ready to invest in a proper tool.

What Is a Financial Projection App?

A financial projection app is software that helps businesses predict their future financial performance. Instead of relying on spreadsheets that are error-prone and hard to maintain, these apps provide ready-to-use dashboards, scenario modeling, and real-time updates.

The core idea is simple: feed in your revenue assumptions, expenses, and data sources (bank accounts, accounting software, CRMs), and the app generates projections of cash flow, profit and loss, and runway visibility.

Why Your Business Needs One

Financial projection apps are not just for CFOs or large companies. They’re increasingly vital for startups and SMEs because they:

- Save time by automating data import and calculations.

- Improve accuracy compared to manual spreadsheets.

- Enable scenario analysis to answer “what if we double ad spend?” or “what if churn rises?”

- Provide investor-ready reports that build trust.

- Give real-time visibility into liquidity and burn rate.

- Support collaboration between founders, finance teams, and advisors.

Key Features to Look For

When choosing a financial projection app, pay close attention to whether it offers:

- Data integration with banks, accounting tools, and PSPs like Stripe or PayPal.

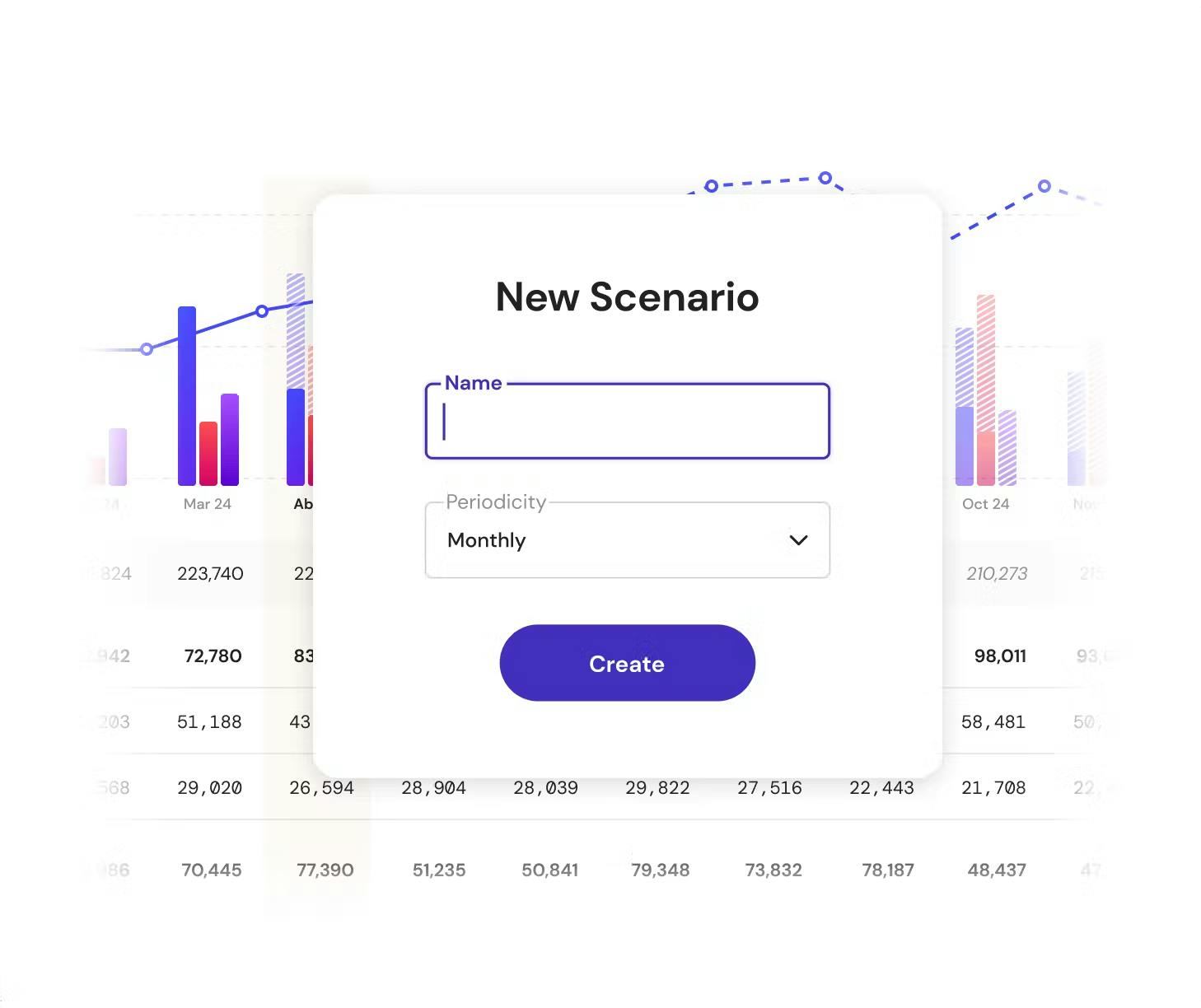

- Scenario modeling for optimistic, base, and worst-case forecasts.

- Multi-time horizons (weekly, monthly, yearly).

- Cash flow dashboards with burn rate and runway.

- Alerts and notifications for low balances or deviations.

- Collaboration features for teams and external advisors.

- Export options for pitch decks and board meetings.

- Scalability to grow with your business.

Challenges They Solve

Without these apps, many businesses face:

- Spreadsheet errors that break entire models.

- Delayed visibility of cash positions.

- Difficulty running multiple scenarios without complex formulas.

- Time wasted on repetitive admin tasks.

- Investor distrust when forecasts look inconsistent or outdated.

Financial projection apps remove these barriers by automating, centralizing, and standardizing the forecasting process.

Trends in Financial Projection Apps in 2025

- AI-driven automation: systems that adjust forecasts dynamically.

- Open Banking integrations: real-time bank feeds reduce reconciliation work.

- Scenario-first design: tools now prioritize “what-if” analysis over static forecasts.

- Investor-ready outputs: built-in pitch deck and board-report exports.

- Regulatory compliance: integration with tax and invoicing laws like Verifactu in Spain.

Benefits of Using a Projection App

- Save time: less manual entry, more focus on strategy.

- Improve survival odds: anticipate cash crunches early.

- Attract investors: clean, credible financials build trust.

- Make better decisions: hiring, marketing, and expansion are guided by data.

- Scale seamlessly: modern apps grow with your business.

Conclusion

A financial projection app isn’t just a nice-to-have, in 2025, it’s essential for startups and SMEs that want to survive and grow. From the early days of running forecasts in Google Sheets to adopting advanced tools like Banktrack, every business needs a clear, forward-looking view of its financial health.

The best choice depends on your stage:

- Early-stage founders → Spreadsheets or Pulse.

- Growing startups → Float or Agicap.

- Scaling fast → Futrli or Anaplan.

- For the most complete solution → Banktrack stands out as the top option.

Financial projections are no longer just for investors, they’re the roadmap your business needs to make decisions with confidence.

Share this post

Related Posts

The 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.The 7 Best Fintonic Alternatives in Spain for 2025

The 7 best Fintonic alternatives in Spain for 2025 to track expenses, manage budgets, and improve personal financial control.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed