The 6 Best SaaS Financial Projections for Founders in 2025

- 6 Best Tools for SaaS Financial Projections

- 1. Banktrack – Best All-in-One for SaaS Startups

- 2. ChartMogul

- 3. Baremetrics

- 4. Futrli

- 5. Anaplan

- 6. Excel/Google Sheets

- What Are SaaS Financial Projections?

- Why Financial Projections Matter for SaaS Startups

- Key SaaS Metrics to Include in Projections

- 5 Core Components of SaaS Financial Projections

- 1. Revenue Forecasts

- 2. Expense Forecasts

- 3. Cash Flow Forecasts

- 4. Profit & Loss Projections

- 5. Balance Sheet Forecast

- Methods for Building SaaS Projections

- Challenges in SaaS Financial Projections

- Best Practices for SaaS Projections

- Trends in SaaS Financial Forecasting in 2025

- Benefits of SaaS Financial Projections

- How to Build Your SaaS Projections

- Conclusion

These are the best SaaS financial projections for founders:

- Banktrack

- ChartMogul

- Baremetrics

- Futrli

- Anaplan

- Excel/Google Sheets

If you’re running a SaaS startup, you already know that numbers matter. Investors want to see how your business grows, how predictable your revenues are, and how long you can sustain your burn rate.

But building convincing financial projections is not just about impressing VCs, it’s about running your company with clarity and foresight.

This guide walks through the essentials of SaaS financial projections: what they are, why they matter, how to build them, the key metrics every SaaS founder should track, and the best tools to use.

6 Best Tools for SaaS Financial Projections

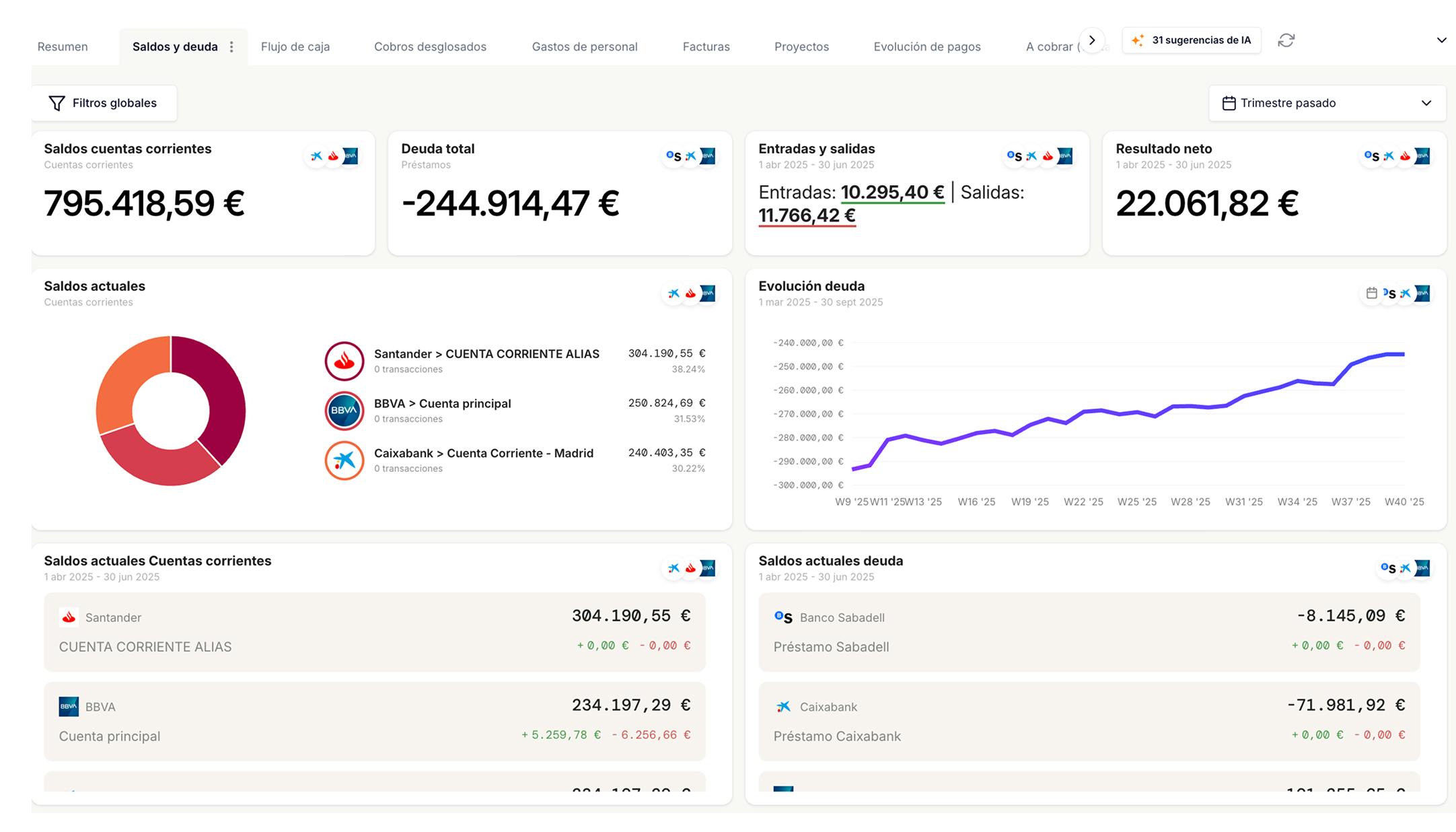

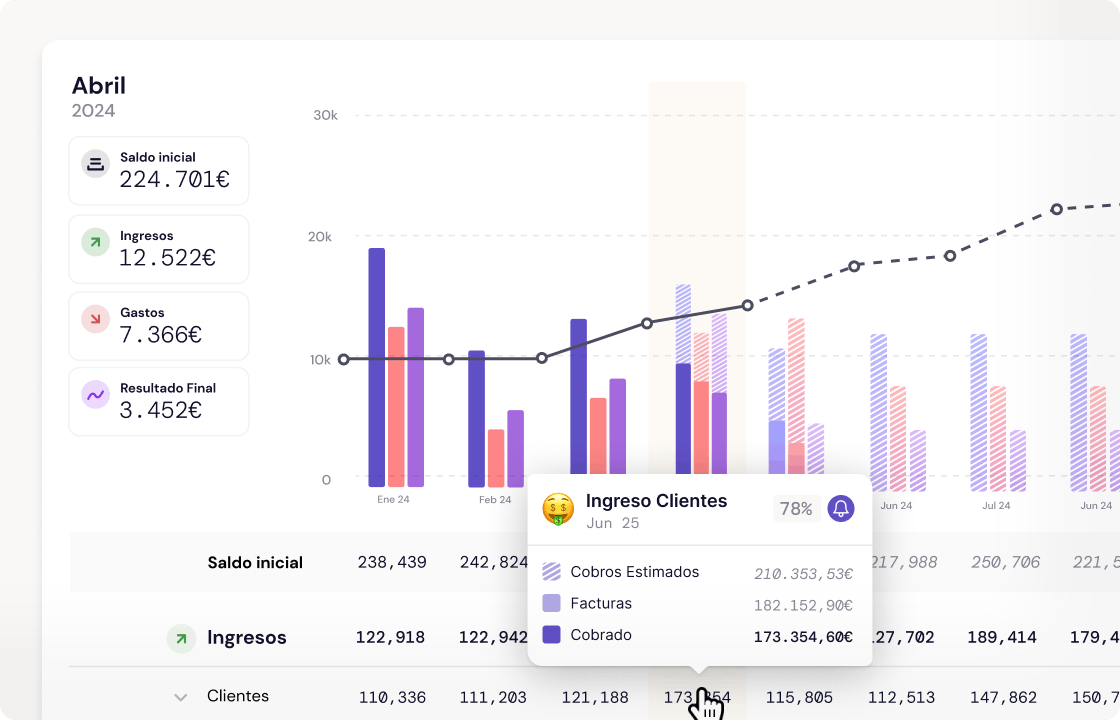

1. Banktrack – Best All-in-One for SaaS Startups

Banktrack isn’t just about compliance, it’s a cash flow and treasury management software. For SaaS founders, it provides a single view of revenues, expenses, and forecasts.

What it offers:

- Integration with 120+ banks and PSPs (Stripe, PayPal, etc.).

- Real-time MRR/ARR dashboards.

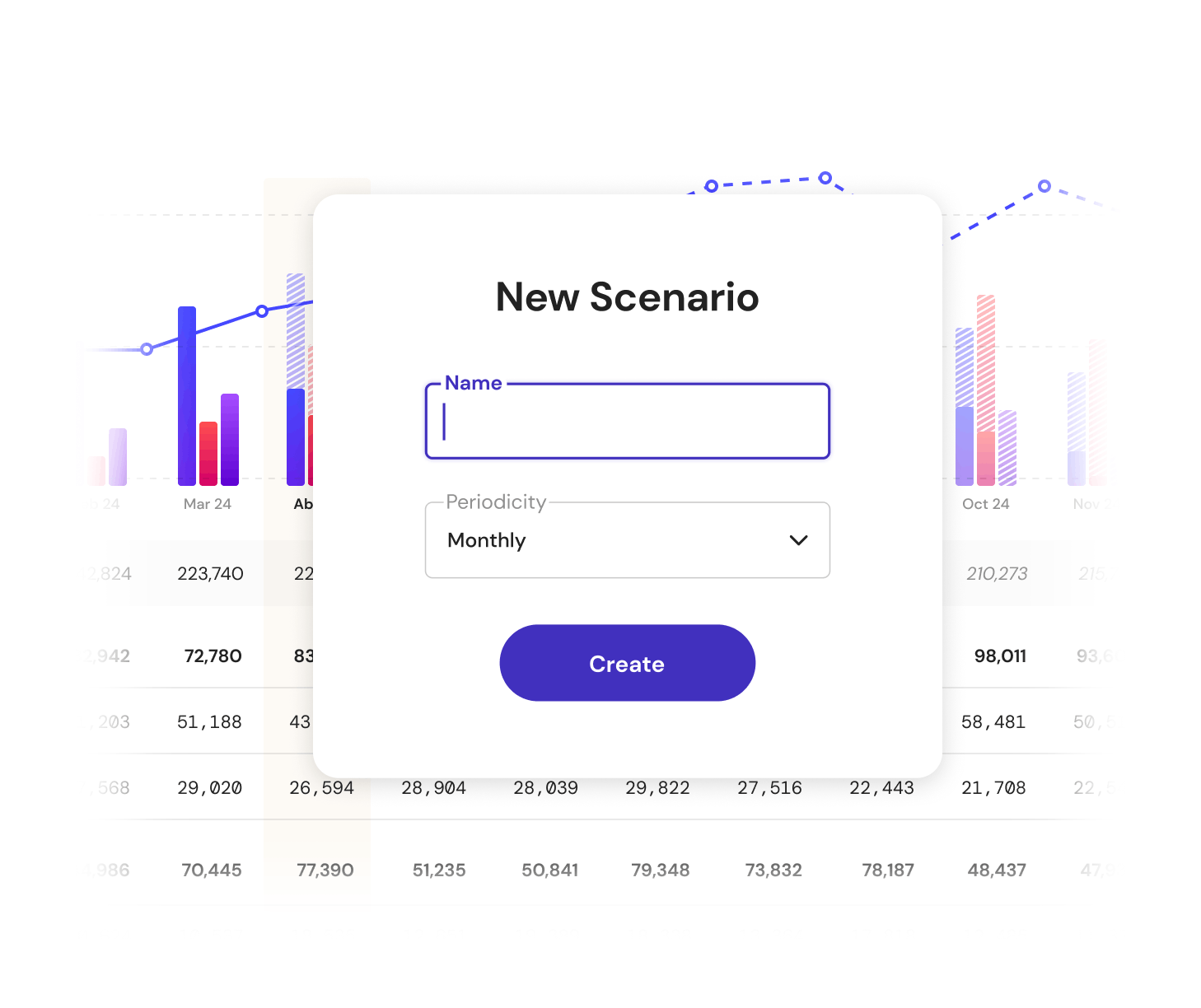

- Scenario forecasting (delayed fundraising, increased churn, aggressive growth).

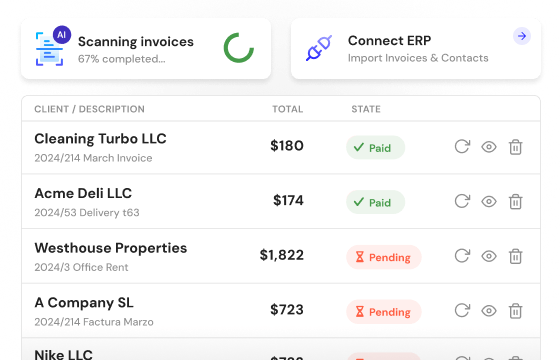

- Automatic reconciliation of invoices and bank data.

- Alerts for anomalies in revenue or burn.

- Verifactu-compliant invoicing (essential in Spain and EU).

Why it works for SaaS: Banktrack goes beyond generic accounting, it gives founders runway visibility, revenue predictability, and compliance peace of mind. It’s the tool that answers both “Are we compliant?” and “Can we survive until Series A?”

2. ChartMogul

Focused on subscription analytics, ChartMogul is excellent for SaaS startups tracking MRR, ARR, churn, and cohort analysis.

- Deep subscription insights from Stripe, Braintree, Chargebee, etc.

- Helps refine assumptions for financial projections.

- Lacks full treasury and compliance features, but powerful for revenue modeling.

3. Baremetrics

Similar to ChartMogul, Baremetrics provides visual SaaS metrics, scenario forecasting, and churn analysis.

- Great for understanding customer lifetime value and revenue expansion.

- Easy to use for founders without finance backgrounds.

- Better for SaaS-specific forecasting than general accounting tools.

4. Futrli

An AI-powered forecasting platform that integrates accounting and cash flow with scenario planning.

- Predicts financial outcomes based on historical data.

- Good for startups wanting more complex multi-year modeling.

- Less SaaS-specific than Baremetrics or ChartMogul, but broader in scope.

5. Anaplan

Enterprise-level financial modeling tool. Useful for later-stage SaaS companies scaling globally.

- Complex modeling across revenue, costs, and workforce planning.

- Very powerful, but expensive and requires dedicated finance teams.

6. Excel/Google Sheets

The default tool for early SaaS founders. Flexible, but prone to errors and very manual.

- Good for early-stage founders building first models.

- Hard to maintain beyond seed stage.

- Limited in scenario testing and automation.

What Are SaaS Financial Projections?

Financial projections are forward-looking estimates of your startup’s revenues, expenses, and cash flows. In a SaaS context, they typically span 3–5 years and include both monthly and annual breakdowns.

Unlike traditional businesses, SaaS companies rely on recurring revenue, making projections more complex but also more predictable once you track the right metrics.

Why Financial Projections Matter for SaaS Startups

- Fundraising: Investors expect clear, data-driven projections before committing capital. Your financial model is often the backbone of a pitch deck.

- Decision-making: Should you increase headcount? Enter a new market? Projections help weigh risks against expected ROI.

- Runway visibility: Cash is king, projections show how long you can survive before the next funding round.

- Operational planning: Hiring, marketing budgets, and infrastructure costs must align with expected revenues.

- Investor trust: Consistent projections (that you actually deliver on) build credibility.

Key SaaS Metrics to Include in Projections

Unlike other industries, SaaS relies on metrics tied to subscriptions, churn, and lifetime value. These should form the core of your projections:

- MRR (Monthly Recurring Revenue): The heartbeat of SaaS. Shows predictable income streams.

- ARR (Annual Recurring Revenue): Long-term view of subscription revenue.

- CAC (Customer Acquisition Cost): What you spend to get a new customer.

- LTV (Customer Lifetime Value): Revenue generated by a customer before they churn.

- Churn Rate: Percentage of customers lost per month or year.

- Gross Margin: Revenue minus cost of service delivery (servers, support, etc.).

- Burn Rate: How fast you’re spending cash each month.

- Runway: How many months until you run out of cash at current burn.

- Payback Period: How long it takes to recover CAC.

- Expansion Revenue: Upsells, cross-sells, or increased usage from existing customers.

5 Core Components of SaaS Financial Projections

1. Revenue Forecasts

Start with assumptions about:

- New customer acquisition (by channel).

- Average revenue per account (ARPA).

- Upsell/cross-sell opportunities.

- Churn impact.

Revenue in SaaS is not linear, it compounds when retention is strong.

2. Expense Forecasts

Expenses usually include:

- Salaries (often the largest cost).

- Marketing and sales spend.

- Product development.

- Infrastructure and software costs.

- G&A (general and administrative).

3. Cash Flow Forecasts

This shows when money enters and leaves the business. A SaaS company can be profitable on paper but still run out of cash if invoices are delayed or burn is too high.

4. Profit & Loss Projections

A standard P&L should show expected revenues, gross profit, operating profit, and net income over the projection period.

5. Balance Sheet Forecast

Less critical for early-stage SaaS, but important for larger companies or those raising institutional funding.

Methods for Building SaaS Projections

- Top-Down Forecasting: Estimate market size (TAM/SAM/SOM), then assume a share you will capture. Useful for investors but often too optimistic.

- Bottom-Up Forecasting: Start with realistic assumptions:

- Number of leads generated.

- Conversion rates.

- CAC per channel.

- Churn rates.

Produces more credible projections. - Scenario Forecasting: Always build three cases:

- Base case: realistic.

- Optimistic case: faster growth, lower churn.

- Pessimistic case: delays, higher burn.

Challenges in SaaS Financial Projections

- Unpredictable churn: One big customer leaving can distort forecasts.

- CAC variability: Paid channels fluctuate in cost-effectiveness.

- Market shifts: Regulatory, competitive, or economic changes can impact growth.

- Scaling costs: Support, infrastructure, and compliance costs rise non-linearly.

- Over-optimism: Founders often underestimate expenses and overestimate growth.

Best Practices for SaaS Projections

- Use historical data as soon as you have it, don’t just guess.

- Keep assumptions transparent: show what drives each number.

- Update monthly: projections must evolve with reality.

- Focus on unit economics (CAC vs LTV).

- Plan for fundraising cycles: ensure your runway lasts until the next round.

- Use tools, not just spreadsheets: automation reduces errors and saves time.

Trends in SaaS Financial Forecasting in 2025

- AI-assisted projections: Tools auto-detect churn risks or anomalies.

- Real-time dashboards: Investors want live metrics, not quarterly updates.

- Regulatory integration: Tools like Banktrack build compliance directly into finance.

- Scenario-first planning: Founders run multiple fundraising or growth scenarios instantly.

- Investor-ready outputs: Export forecasts into decks with VC-friendly formatting.

As SaaS teams move toward live financial visibility, the technical challenge shifts from modeling numbers to processing large volumes of financial events in real time. Subscription changes, invoices, payments, refunds, and bank transactions must be ingested and queried continuously without slowing down dashboards or forecasts.

This is why modern financial platforms increasingly rely on architectures evaluated through comparisons such as ClickHouse vs Tinybird. These approaches make it possible to ingest financial data in real time and run sub-second analytics without the operational overhead of managing databases, pipelines, or APIs, enabling live forecasting and investor-ready dashboards at scale.

Benefits of SaaS Financial Projections

- Stronger fundraising outcomes — investors see clarity and credibility.

- Runway extension — avoid cash crises by planning early.

- Better hiring decisions — know when to add staff without jeopardizing survival.

- Marketing ROI clarity — see CAC vs LTV in real terms.

- Peace of mind — founders sleep better when they know the numbers.

How to Build Your SaaS Projections

- Collect data on current MRR, churn, CAC, and expenses.

- Define key assumptions: growth rates, hiring plans, marketing spend.

- Build three scenarios: base, optimistic, pessimistic.

- Project revenues (new customers, expansions, churn).

- Estimate expenses by category.

- Create cash flow forecasts month by month.

- Review and adjust monthly.

- Use a tool like Banktrack to automate data input and scenario building.

Conclusion

For SaaS startups, financial projections are not just an investor requirement, they are the foundation for survival and growth. They tell you how long your runway is, when to raise funds, whether you can afford to hire, and how to balance growth against burn.

The smartest founders embrace cash flow forecasting early, track unit economics closely, and use tools like Banktrack to automate the heavy lifting. With real-time data, scenario modeling, and compliance built-in, you don’t just guess your future, you plan it.

In 2025, SaaS success is not only about building a great product. It’s about proving, with numbers, that you can turn growth into a sustainable, scalable business.

Share this post

Related Posts

7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.Verifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed