The Ultimate Guide to Financing Plans

- What is a Financing Plan?

- 6 Main Points of a Financing Plan

- 6 Different Types of Financing Plans

- 1. Personal Loans

- 2. Mortgage Financing

- 3. Auto Loans

- 4. Credit Card Financing

- 5. Business Financing

- 6. Student Loans

- How to Choose the Right Financing Plan in 5 Steps

- 1. Know Your Financial Situation

- 2. Compare Interest Rates

- 3. Understand the Terms and Conditions

- 4. Consider Your Repayment Ability

- 5. Look for Flexible Options

- Create a 5 Step Financing Plan for Your Business

- 1. Determine Your Funding Needs

- 2. Explore Financing Options

- 3. Prepare Financial Projections

- 4. Develop a Repayment Strategy

- 5. Monitor and Adjust

- Manage Your Finances with a Personal Finance Software

- Why Use a Personal Finance Software?

- User-Friendly Interface and Multi-Device Accessibility

- Expense Tracking and Categorization

- Budget Customization and Flexibility

- Automated Transactions and Syncing

- Goal Setting and Tracking

- Top-Notch Security Measures

- 4 Benefits of a Good Financing Plan

- 1. Achieve Your Financial Goal

- 2. Manage Your Cash Flow

- 3. Build Your Credit History

- 4. Leverage Investment Opportunities

- The 4 Most Common Risks of Financing Plans

- 1. High-Interest Costs

- 2. Debt Accumulation

- 3. Impact on Credit Score

- 4. Risk of Losing Collateral

- 4 Common Mistakes to Avoid

- 1. Focusing Only on the Monthly Payment

- 2. Not Shopping Around

- 3. Overestimating Your Repayment Ability

- 4. Ignoring the Fine Print

- Why Use Banktrack as your Personal Finance Software

- Frequently Asked Questions (FAQs)

- What is the difference between secured and unsecured loans?

- How can I improve my chances of getting approved for a loan?

- Is it better to finance a purchase or pay in cash?

- Can I negotiate the terms of a financing plan?

- What should I do if I can’t make a payment?

This is the ultimate guide to financing plans that has all the information you need to make informed decisions.

Ever felt like you're drowning in the sea of financial jargon? You’re not alone.

Financing plans can seem like a maze of complicated terms, numbers, and choices.

But don't worry! This guide is here to break things down into bite-sized, easy-to-understand pieces.

Whether you’re dreaming of a new house, a shiny car, or even just getting your finances in order, understanding financing plans is key to making those dreams a reality.

Let’s dive in and make sense of it all.

What is a Financing Plan?

Alright, let’s start with the financial planning basics. A financing plan is like a roadmap for managing money, especially when you need to borrow some.

Think of it as your trusty guide that helps you figure out where the money will come from, how much you’ll need, how long it will take to pay back, and, of course, how much it will cost you in the end.

6 Main Points of a Financing Plan

A financing plan has some key factors you should consider:

- Loan Amount: The amount of money you’re borrowing.

- Interest Rates: This is what the lender charges you for borrowing their money—kind of like a rental fee.

- Repayment Schedule: This is the timeline for paying back the loan, usually broken down into monthly payments.

- Collateral: Something valuable (like a house or car) that you promise to give the lender if you can’t pay back the loan.

- Credit Terms: The conditions under which you get the loan, like the interest rate and the length of time you have to pay it back.

- Down Payment: A chunk of money you pay upfront, reducing the amount you need to borrow.

6 Different Types of Financing Plans

Now that you know the basics, let’s explore the different types of financing plans available.

No matter what you are looking for, there’s a financing plan out there with your name on it.

1. Personal Loans

Personal loans are like the Swiss Army knife of financing. They’re versatile, and you can use them for pretty much anything; paying off debt, covering medical expenses, or even taking that dream vacation.

They usually come with fixed interest rates, so your payments stay the same each month, which is nice if you like predictability.

2. Mortgage Financing

If you’re thinking about buying a house, a mortgage is the way to go. This is a special type of loan designed just for real estate.

You get a big chunk of money to buy the house, and then you pay it back (with interest) over a long time, usually 15 to 30 years.

The house itself acts as collateral, so if you can’t pay, the lender can take it back.

3. Auto Loans

Looking to hit the open road in a new car? An auto loan can help you get there.

These loans are specifically for buying vehicles and are usually secured by the car you’re purchasing. They can have fixed or variable interest rates, depending on the lender.

4. Credit Card Financing

Credit cards are super convenient for everyday purchases, and they can be a lifesaver in emergencies.

However, they often come with high-interest rates, so it’s best to pay off the balance as quickly as possible. Otherwise, that $20 pizza you charged could end up costing you $30 or more, no toppings included!

5. Business Financing

Starting or growing a business? You’ll likely need some financing to get things rolling.

Business loans, lines of credit, and equipment financing are all options to consider.

These can help cover everything from startup costs to daily operating expenses.

6. Student Loans

Education is expensive, but student loans can help you cover the costs.

These loans are specifically designed to pay for tuition, books, and other school-related expenses. They can be government-backed or private, each with different interest rates and repayment terms.

How to Choose the Right Financing Plan in 5 Steps

With so many options, how do you choose the right financing plan? Here’s how to find the one that fits you best.

1. Know Your Financial Situation

Before jumping into any financing plan, take a good look at your finances.

- How much do you earn?

- What are your monthly expenses?

- How much debt do you already have?

- And, most importantly, what’s your credit score?

Knowing where you stand financially will help you figure out what you can afford.

2. Compare Interest Rates

Interest rates are a big deal, they determine how much extra you’ll pay on top of what you borrow.

A lower interest rate means you’ll pay less in the long run. So, look around! Don’t just take the first offer that comes your way.

Compare rates from different lenders to find the best deal.

3. Understand the Terms and Conditions

Reading the fine print might not be fun, but it’s crucial.

You need to understand all the details of your financing plan, like any hidden fees, penalties for late payments, and options for early repayment.

Remember, it’s better to know upfront than to be surprised later!

4. Consider Your Repayment Ability

It’s tempting to go for the biggest loan possible, but be realistic.

Can you comfortably handle the monthly payments without stretching yourself too thin?

Missing payments can hurt your credit score and lead to more financial stress.

5. Look for Flexible Options

Some financing plans offer flexibility, like the ability to adjust your payment schedule or refinance later.

If your financial situation might change (like if you’re expecting a raise or planning to start a family), these options could be a lifesaver.

Create a 5 Step Financing Plan for Your Business

For entrepreneurs and business owners, a solid financing plan is a key ingredient for success. Here’s how to create one that truly works:

1. Determine Your Funding Needs

Start by figuring out exactly how much money you need.

Are you looking to start a new business, expand an existing one, or purchase equipment?

The amount of funding required will guide your financing options.

2. Explore Financing Options

There are many ways to finance a business, including loans, lines of credit, venture capital, and crowdfunding.

Each option has its own pros and cons, so research thoroughly to find the best fit for your business needs.

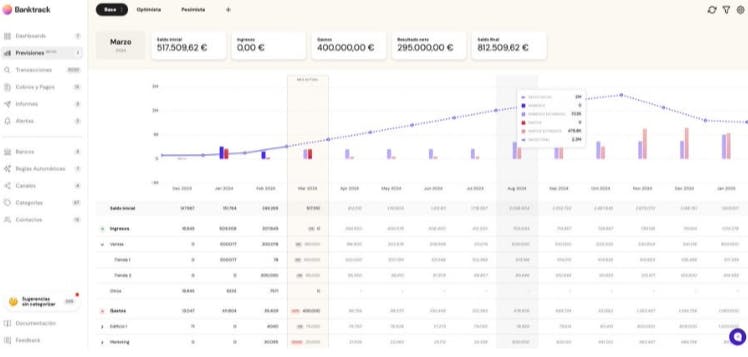

3. Prepare Financial Projections

Lenders and investors want to see that you have a clear plan for how you’ll use the money and how you plan to repay it.

Prepare detailed financial and cash flow projections that include your budget, expected revenue, and repayment plan.

4. Develop a Repayment Strategy

Outline a clear repayment strategy, including how and when you’ll make payments.

Make sure your plan is realistic and aligns with your business’s cash flow.

5. Monitor and Adjust

Once you have your financing in place, keep an eye on your financial situation and be ready to make adjustments if needed.

Regularly review your financing plan and make changes as necessary to stay on track.

Manage Your Finances with a Personal Finance Software

Keeping track of your finances can feel like juggling a dozen balls at once, there’s budgeting, tracking expenses, managing savings, and staying on top of bills.

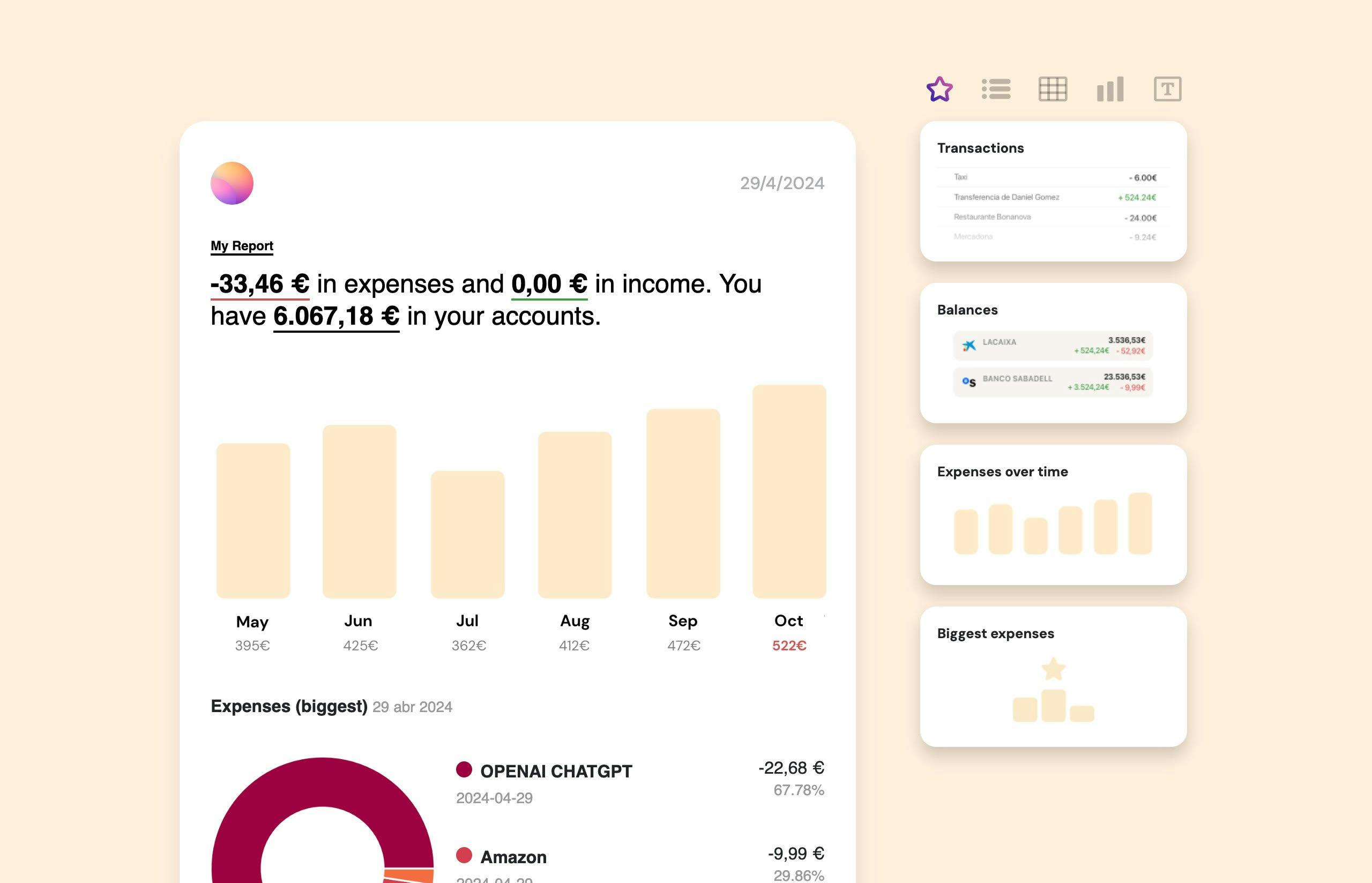

But what if you could simplify all of this with a personal finance software that does the heavy lifting for you? Use Banktrack, a powerful tool designed to help you manage your money more efficiently.

Why Use a Personal Finance Software?

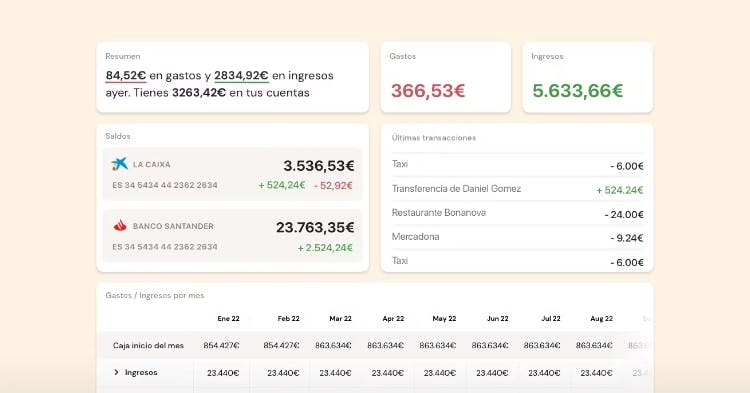

A personal finance tracking software offers a centralized place where you can manage all aspects of your financial life.

From tracking expenses to setting budgets and monitoring your progress toward financial goals, these tools are designed to make your life easier and your financial decisions smarter. But not all finance apps are created equal.

A good personal finance app needs to be user-friendly, accessible across multiple devices, and have many advanced and helpful features to meet your needs.

User-Friendly Interface and Multi-Device Accessibility

Having a finance app that’s both easy to use and accessible wherever you are is crucial.

Banktrack shines in this area with its intuitive interface that’s perfect for both tech-savvy users and those who prefer simplicity.

The app is designed to work perfectly across desktop and mobile platforms, making sure you can access your financial data anytime, anywhere. Whether you’re at home, in the office, or on the go, Banktrack keeps you connected to your finances with ease.

Expense Tracking and Categorization

Banktrack is an excellent expense tracking app and has great categorization tools. Imagine having a dashboard where you can effortlessly categorize your expenses, set spending limits, and generate customizable reports that give you deep insights into your spending patterns.

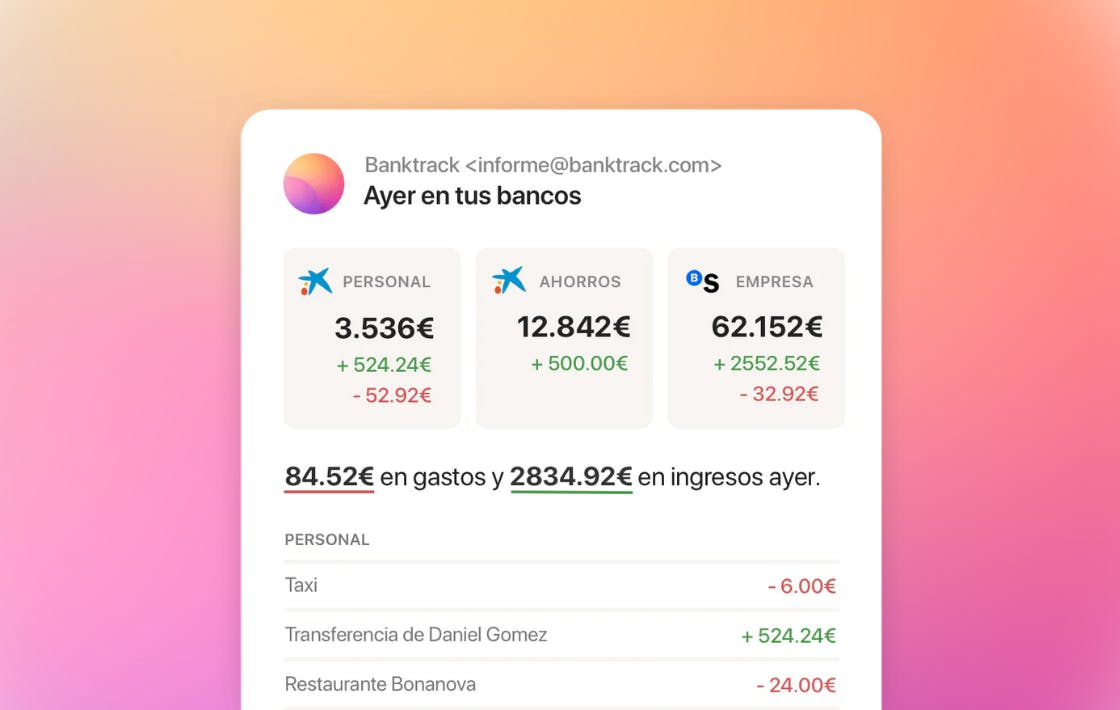

In addition, with Banktrack, you have the best app to link all bank accounts and consolidate views from all different accounts, companies, and financial products into one integrated platform. This flexibility ensures that you get the exact information you need when you need it, helping you manage your cash flow effectively.

Budget Customization and Flexibility

Every individual has its own financial goals, and your budgeting software should reflect that.

Banktrack allows you to set spending limits in various categories and receive personalized notifications when you’re nearing those limits or if any unusual activity is detected.

With features like custom financial reports that you can send via WhatsApp, SMS, email, Slack, or Telegram, Banktrack provides a level of control and visibility over your finances that’s hard to beat.

The drag-and-drop interface makes customization a breeze, allowing you to tailor your budget to fit your lifestyle.

Automated Transactions and Syncing

If the thought of manually syncing your financial data across different accounts gives you a headache, you should know that Banktrack is an expense tracker software with bank sync features.

It integrates with over 120 banks, including both traditional and neobanks, using either Open Banking (PSD2) or Direct Access connections.

This means you can sync all your financial data securely and efficiently, without lifting a finger. Whether it’s expenditures, revenues, or transfers, Banktrack ensures that all your financial information is up to date.

Goal Setting and Tracking

Setting and tracking financial goals is a key component of any successful financial plan.

Banktrack allows you to set achievable savings goals, debt repayment targets, and other milestones, with progress tracking features that keep you motivated.

Whether you’re saving for a vacation, paying off a loan, or building an emergency fund, Banktrack helps you stay on track.

Top-Notch Security Measures

When it comes to managing and planning your finances, security is the top priority. Banktrack takes security seriously, making sure that your personal and banking data is protected at all times.

Importantly, Banktrack does not have access to make transactions in your bank accounts; it only has read access to your data.

This means your banking passwords are never stored, as the connection process is handled through a unique access token. Additionally, all transaction data is encrypted, ensuring your financial information remains confidential and secure.

4 Benefits of a Good Financing Plan

So, what’s in it for you? A well-structured financing plan can offer several perks that make it worth your while.

1. Achieve Your Financial Goal

Whether you want to buy a house, start a business, or just get your finances in order, a good financing plan can help you get there.

It’s like having a roadmap to your goals, with clear steps to follow along the way.

2. Manage Your Cash Flow

A financing plan can help you manage your cash flow by spreading out the cost of big purchases over time.

This way, you don’t have to drain your savings account all at once. Instead, you can make smaller, more manageable payments.

3. Build Your Credit History

If you make your payments on time, a financing plan can help you build a strong credit history. This can make it easier to get loans in the future and even qualify for better interest rates.

4. Leverage Investment Opportunities

With the right financing plan, you can take advantage of investment opportunities that you might not have been able to afford otherwise.

Whether it’s buying property, starting a business, or investing in the stock market, financing can help you grow your wealth.

The 4 Most Common Risks of Financing Plans

Of course, financing plans aren’t all sunshine and rainbows. There are some risks you need to be aware of. But don’t worry, we’ll help you avoid them.

1. High-Interest Costs

Some financing options, like credit cards and certain personal loans, come with high-interest rates. If you’re not careful, you could end up paying a lot more than you borrowed.

That’s why it’s so important to understand the total cost of financing before you sign on the dotted line.

2. Debt Accumulation

If you’re not careful, financing plans can lead to debt accumulation.

It’s easy to take on more debt than you can handle, especially if you’re not keeping track of all your loans and credit card balances. Before you know it, you could find yourself buried in debt.

3. Impact on Credit Score

Your credit score is like your financial report card. If you miss payments or default on a loan, it can take a serious hit.

A bad credit score can make it harder to get loans in the future, and you might end up paying higher interest rates.

4. Risk of Losing Collateral

With secured loans, like mortgages or auto loans, you’re putting up something valuable as collateral.

If you can’t make your payments, the lender can take your collateral. This could mean losing your home, car, or other assets. So, it’s important to be sure you can handle the payments before taking out a secured loan.

4 Common Mistakes to Avoid

We all make mistakes, but when it comes to financing, they can be costly. Here are some common pitfalls to avoid.

1. Focusing Only on the Monthly Payment

It’s easy to focus solely on how much you’ll pay each month, but it’s crucial to consider the total cost of the loan.

Low monthly payments might seem attractive, but they can come with longer loan terms and higher overall costs.

Always calculate the total amount you'll end up paying, including interest and fees.

2. Not Shopping Around

Just like you wouldn’t buy the first car you see without comparing options, don’t settle for the first financing plan that comes your way.

Different lenders offer different terms, so take the time to compare rates, fees, and conditions. It’s worth the effort to find the best deal for your situation.

3. Overestimating Your Repayment Ability

It’s tempting to think that you can handle a larger loan or more debt than you really can.

Be realistic about your financial situation and what you can afford to repay each month.

Overestimating your ability to make payments can lead to missed payments and increased debt.

4. Ignoring the Fine Print

It might be boring, but reading the fine print of any financing agreement is essential.

Hidden fees, penalties for early repayment, and other conditions can have a significant impact on your loan. Make sure you understand all the terms before agreeing to anything.

Why Use Banktrack as your Personal Finance Software

With the right information and a bit of planning, you can make smart financial decisions that help you achieve your goals. Remember to understand the basics, compare your options, and choose a plan that fits your needs and budget.

With its user-friendly interface, strong expense tracking, flexible budgeting, automated syncing, and top-notch security, Banktrack provides the tools you need to take control of your finances. Whether you’re a budgeting novice or a seasoned pro, Banktrack offers the features and flexibility to help you achieve your financial goals, all while making the process as smooth as possible.

Additionally, remember that a well-structured financing plan can help you reach your dreams, whether it’s buying a new home, starting a business, or just managing your money better. By avoiding common mistakes and following best practices, you can set yourself up for financial success.

So go ahead, take charge of your finances and make those dreams a reality!

Frequently Asked Questions (FAQs)

What is the difference between secured and unsecured loans?

Secured loans require collateral (like your home or car) to back the loan. If you default, the lender can take the collateral. Unsecured loans don’t require collateral but usually come with higher interest rates because they’re riskier for lenders.

How can I improve my chances of getting approved for a loan?

To boost your chances, improve your credit score by paying bills on time, reducing debt, and ensuring a good credit history. Additionally, provide clear and accurate information about your financial situation when applying for the loan.

Is it better to finance a purchase or pay in cash?

It depends on your situation. Financing can help you keep more cash on hand and spread out payments, but you’ll pay interest. Paying in cash avoids interest but can deplete your savings. Consider your financial goals and cash flow when deciding.

Can I negotiate the terms of a financing plan?

Yes! Many lenders are open to negotiating terms, including interest rates and repayment schedules. It never hurts to ask, just make sure to get any agreed-upon changes in writing.

What should I do if I can’t make a payment?

If you’re having trouble making a payment, contact your lender as soon as possible. They may offer options like a grace period, deferment, or restructuring of your loan. Addressing the issue early can help avoid more serious consequences.

Share this post

Related Posts

The 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.Automated invoice management for businesses: tools and benefits

Automated invoice management streamlines processing, reduces errors, and saves time. With AI and OCR, businesses can digitize invoices, track payments, and improve financial control efficiently.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed