8 MoneyWiz alternatives for personal finance management

- Best 9 MoneyWiz Alternatives in 2025

- 1. Banktrack

- 2. YNAB (You Need a Budget)

- 3. Mint

- 4. Goodbudget

- 5. Quicken

- 6. PocketSmith

- 7. Spendee

- 8. Moneydance

- Frequently Asked Questions (FAQs)

- What’s the most effective way to start managing personal finances?

- How can I stay consistent with expense tracking?

- What are some effective strategies for saving money regularly?

Best 8 MoneyWiz alternatives for personal finance management

- Banktrack

- YNAB

- Mint

- Goodbudget

- Quicken

- PocketSmith

- Spendee

- Moneydance

Managing finances effectively is key to building a solid, long-lasting business, and the right treasury management software can make a huge difference.

If you're looking to improve reporting, streamline system integration, or get a better handle on cash flow, exploring alternatives to MoneyWiz could be just the solution.

This article covers the 8 MoneyWiz alternatives for personal finance management, diving into their strengths, practical insights, and how they can help keep your business competitive in today’s fast-paced market.

Best 9 MoneyWiz Alternatives in 2025

1. Banktrack

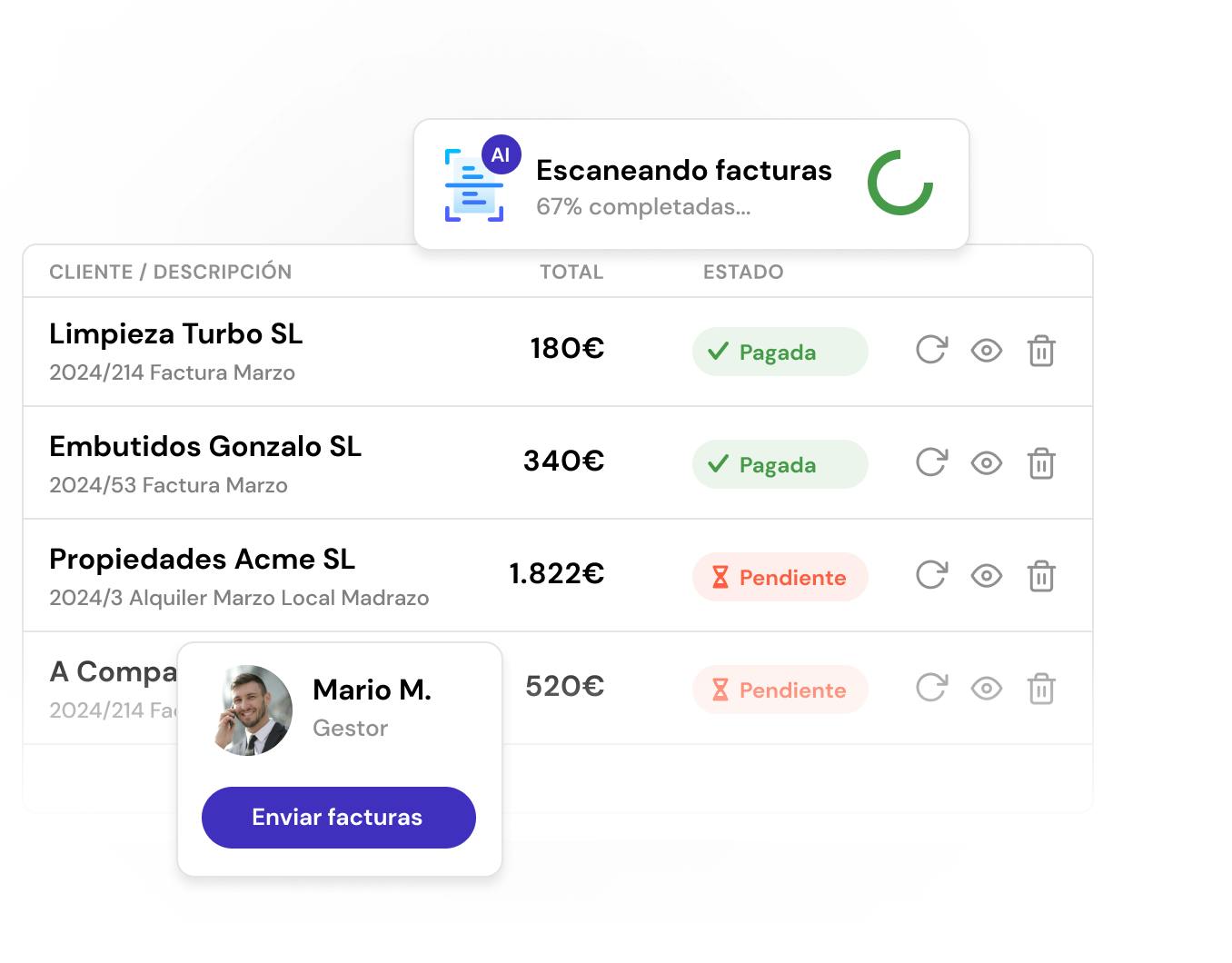

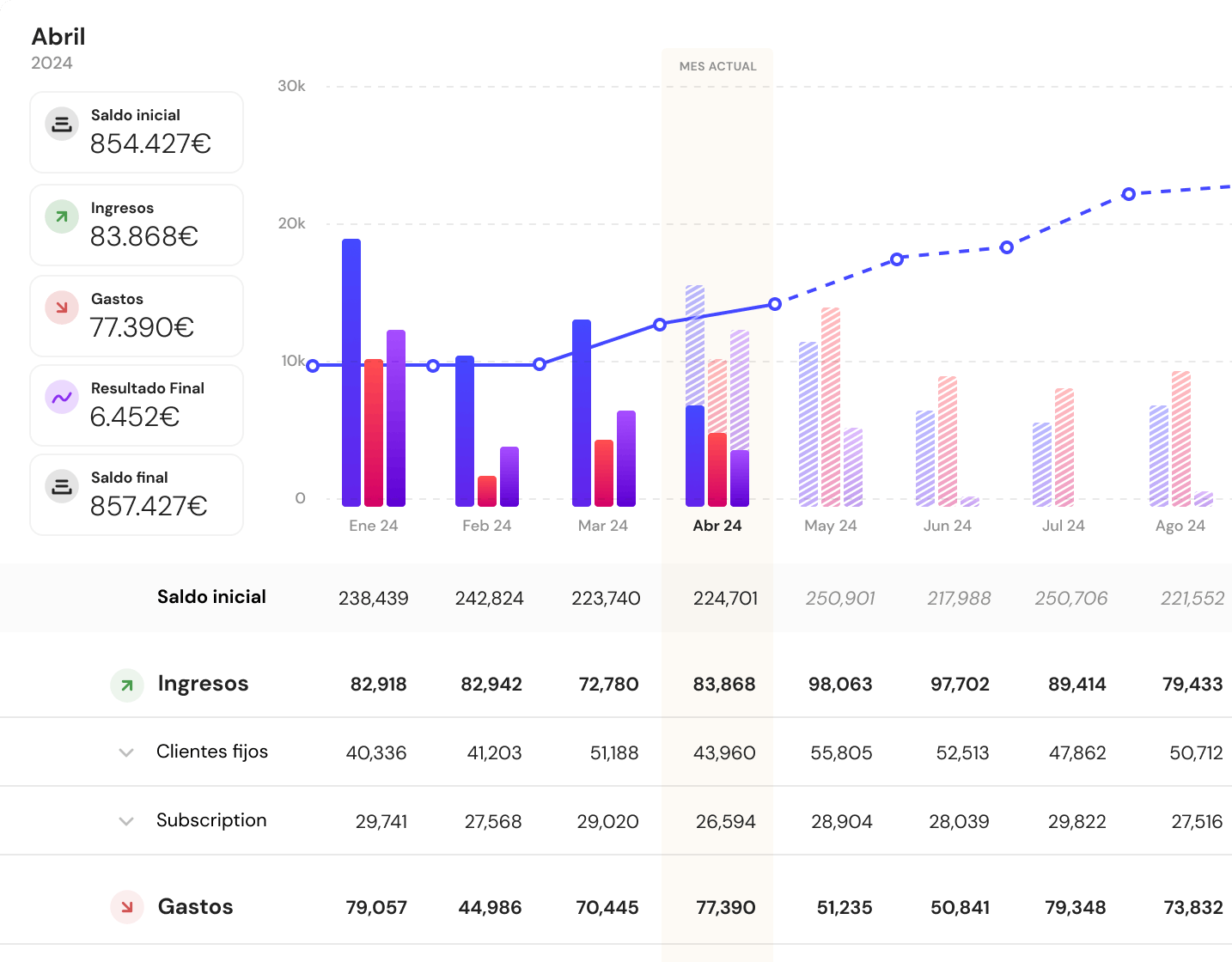

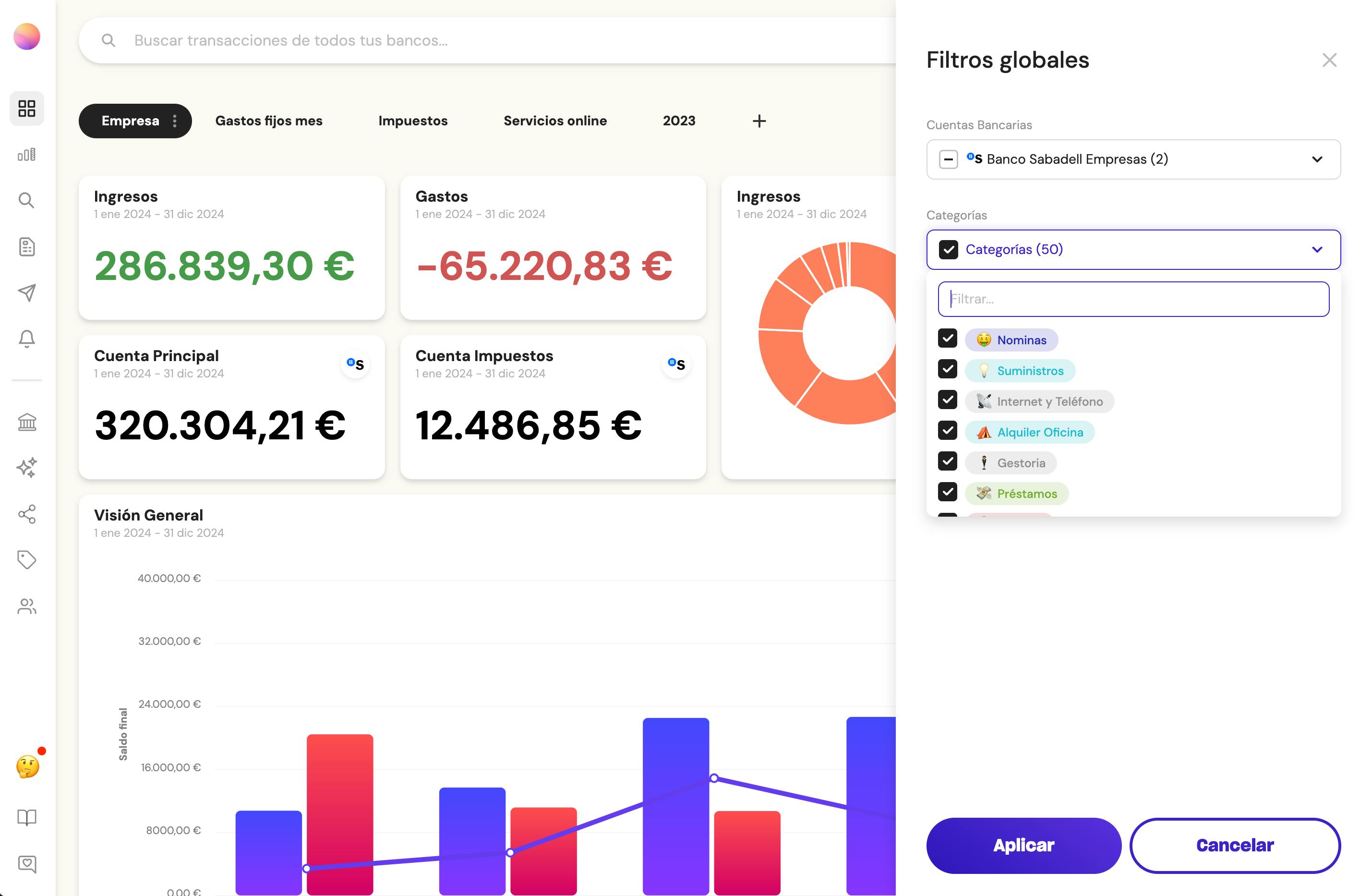

Banktrack is a flexible business expense tracker app that offers a complete set of features to help businesses manage their finances effectively.

This software offers customizable dashboards and reports, allowing users to monitor income, expenses, and forecasts in real-time.

With integration to various banks, it simplifies the tracking of multiple accounts, making it an excellent fit for businesses of all sizes. Are you looking for an app that links all bank accounts?

Key Features:

- Real-time financial tracking: Get a global view of your income, expenses, and cash flow.

- Automated invoice management: Automatic reconciliation of invoices and easy digitalization of financial documents.

- Accurate forecasting: historical data to generate reliable cash flow forecasts, enabling better financial decision-making.

- Custom reports: Tailor reports to your business needs for better financial analysis and performance tracking.

Why Choose Banktrack?

Banktrack combines features with user-friendly design, making it a top choice for businesses aiming to streamline financial processes. Its advanced forecasting and automated invoice management simplify complex tasks and provide clear cash flow insights.

Banktrack's customizable dashboard provides quick views of essential financial metrics, saving time and enabling fast, informed decision making.

In addition, its integration capabilities enable perfect connections with other financial tools and banking systems, increasing overall efficiency.

For companies looking to improve financial management and obtain critical information, Banktrack offers an intuitive and efficient platform.

Managing finances effectively is key to building a solid, long-lasting business, and the right treasury management software can make a huge difference.

2. YNAB (You Need a Budget)

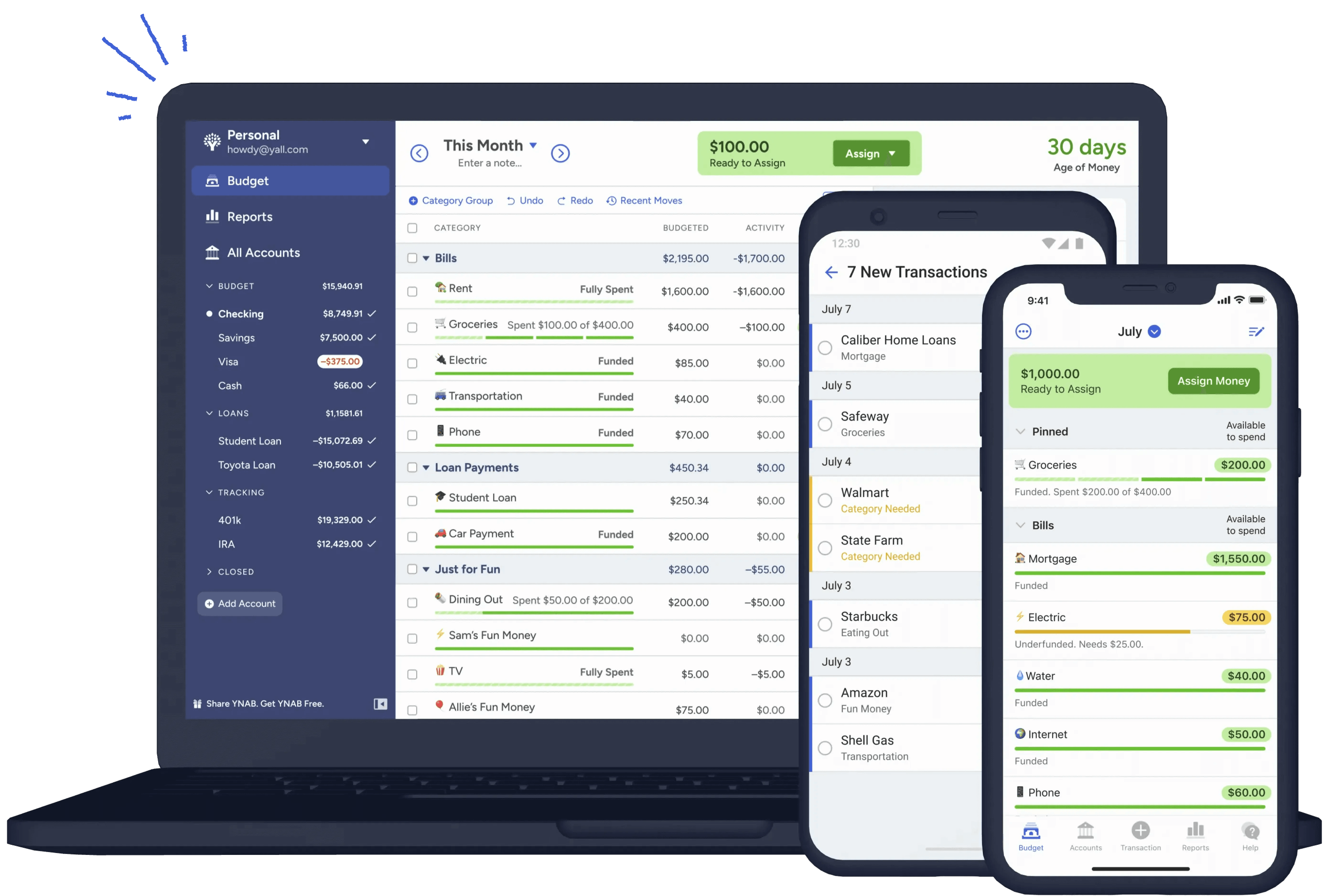

YNAB is a budgeting app focused on helping users allocate each dollar to a specific purpose, promoting financial discipline.

Key Features:

- Zero-Based Budgeting: Every dollar is assigned a job, reducing unnecessary spending.

- Real-Time Syncing: Syncs across multiple devices, making it easy for couples or families to stay on the same page.

- Financial Education: YNAB offers extensive educational resources and guides for users.

Who Should Use YNAB?

YNAB is for users looking to gain control over their finances, especially those focused on proactive budgeting and debt relieve.

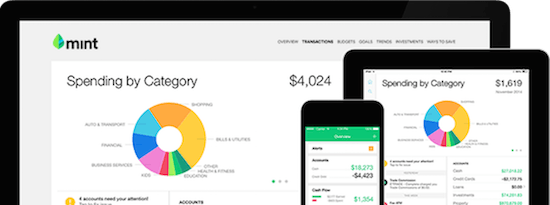

3. Mint

Mint is a free, user-friendly app that covers budgeting, expense tracking, and financial goal setting. Have a look at the best expense tracking app in 2025.

Key Features:

- Automatic Categorization: Mint automatically categorizes expenses, providing a clear view of spending patterns.

- Credit Score Monitoring: Users can monitor their credit score for free.

- Bill Reminders: Mint provides reminders for upcoming bills to avoid late payments.

Who Should Use Mint?

Mint is a choice for beginners looking for a free app with a wide range of budgeting tools and additional features like credit score tracking.

Looking for other tools that could replace Mint or offer different features? Check out our full guide on the best mint alternatives, where we compare apps that may better suit your budgeting style and financial goals.

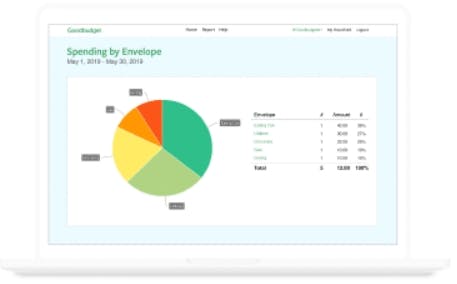

4. Goodbudget

Goodbudget uses an envelope-based budgeting system, allowing users to set aside money for specific categories or goals.

Key Features:

- Digital Envelopes: Users can allocate funds into virtual envelopes for better spending control.

- Debt Tracking: Helps users plan and track debt repayments.

- Cross-Device Sync: Ideal for families, as Goodbudget syncs across devices for shared budgeting.

Who Should Use Goodbudget?

Goodbudget is for users who prefer a simple, envelope-style budgeting approach to manage their spending.

5. Quicken

Quicken is a financial tool known for its many features, from budgeting to investment tracking and even real estate management.

Key Features:

- Customizable Budgets: Users can create detailed budgets and track spending in specific categories.

- Investment Tracking: Quicken includes tools for managing and tracking investments.

- Real Estate Management: Users can manage rental properties or other assets within the app.

Who Should Use Quicken?

Quicken is for users who want an all-in-one tool, particularly those managing investments and real estate.

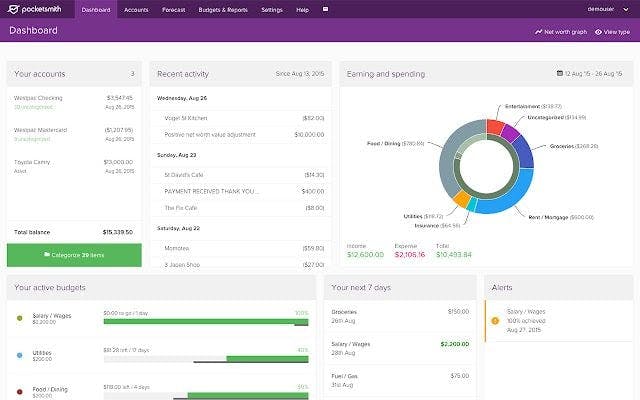

6. PocketSmith

PocketSmith offers forecasting tools, allowing users to project their financial future based on current income and expenses.

Key Features:

- Financial Forecasting: PocketSmith uses financial projections to help users plan long-term.

- Calendar-Based Budgeting: Users can visualize budgets over time on a calendar.

- Multi-Currency Support: Supports multiple currencies, making it great for international users.

Who Should Use PocketSmith?

PocketSmith is for users interested in forecasting and visualizing future financial scenarios.

7. Spendee

Spendee offers a customizable, user-friendly interface for expense tracking and budgeting, along with multi-currency support.

Key Features:

- Shared Wallets: Users can create shared wallets for group or family budgets.

- Currency Support: Spendee is suitable for users who need to track expenses in multiple currencies.

- Bill Reminders: Helps users keep track of recurring expenses.

Who Should Use Spendee?

Spendee is ideal for users looking for a visually appealing app with collaborative budgeting features.

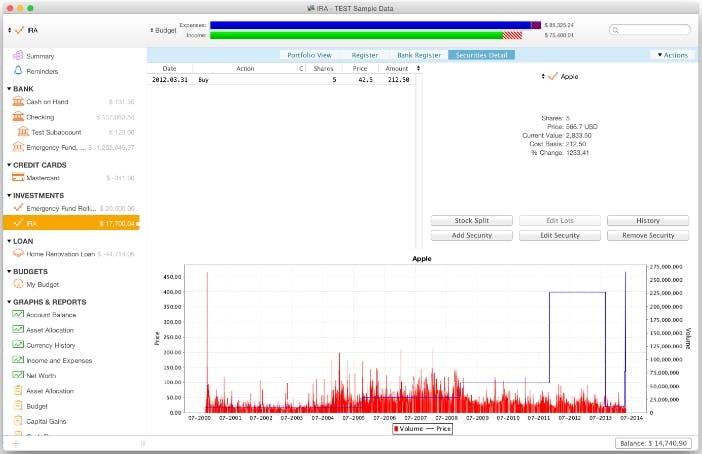

8. Moneydance

Moneydance is a desktop-based personal finance software known for its great tools for budgeting, expense tracking, and investment management.

Key Features:

- Investment Tracking: Moneydance allows users to track investments and monitor stock performance.

- Bank Sync: Connects with banks to automatically download and transaction categorization

- Graphing and Reporting: Offers detailed reports and graphs for analyzing spending trends.

Who Should Use Moneydance?

Moneydance is ideal for users seeking a desktop-based solution with robust investment tracking and reporting.

Frequently Asked Questions (FAQs)

What’s the most effective way to start managing personal finances?

Creating a budget is the cornerstone of personal finance management. Start by tracking your monthly income and expenses, then set clear categories for essential expenses, savings, and discretionary spending. Banktrack is the app you need to manage your personal finances in the best way.

How can I stay consistent with expense tracking?

Using personal finance apps with automatic tracking and categorization can save time and reduce the risk of missed entries. Set weekly or monthly reminders to review and update your finances, which keeps your tracking consistent without overwhelming you.

What are some effective strategies for saving money regularly?

Allocate a portion of each paycheck to savings before covering other expenses. Setting up automatic transfers to a savings account, and using budgeting apps can help reinforce this habit. Consider setting specific savings goals, like emergency funds or travel, to stay motivated.

Share this post

Related Posts

Best 8 Cash Flow Management Tools in Norway for 2025

Explore top cash flow management tools in Norway for 2025, featuring automation and real-time analytics to optimize business finances.Top 8 alternatives to 1Money in 2025

These are the top 8 alternatives to 1Money for personal finance management. Find the best apps for budgeting, expense tracking, and financial planning.6 bank tracker apps in Germany in 2025

Looking for reliable bank tracker apps in Germany? Here are six options to help you monitor spending, manage budgets, and stay on top of your finances.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed