The 6 best alternatives to Mint

Best alternatives to Mint:

- Banktrack

- YNAB

- Empower

- PocketGuard

- Everydollar

- Rocket Money

If you’re looking for a more fun and less complicated way to manage your finances, you’ve come to the right place!

Mint has been a great companion for many when it comes to organizing their expenses, but it’s not the only tool out there.

Maybe you’re looking for something more personalized, with more features, or something that simply suits your lifestyle better.

Don’t worry, we’ve got you covered! Here’s everything you need to know about the best Mint alternatives that can help you get your finances in order.

Why Look for Other Options?

Mint has been around for years, helping people keep a closer eye on their money.

However, not everyone finds it as convenient or useful. Some complain about too many ads, the lack of certain features, or simply that the interface isn’t as intuitive as they’d like.

And that’s why you’re here! Because, like you, there are people who want something different, and that’s perfectly okay.

Best 6 Alternatives to Mint

To make things easier for you, we’ve compiled a list of the best Mint alternatives, highlighting their strong points so you can choose the one that suits you best. Let’s dive in!

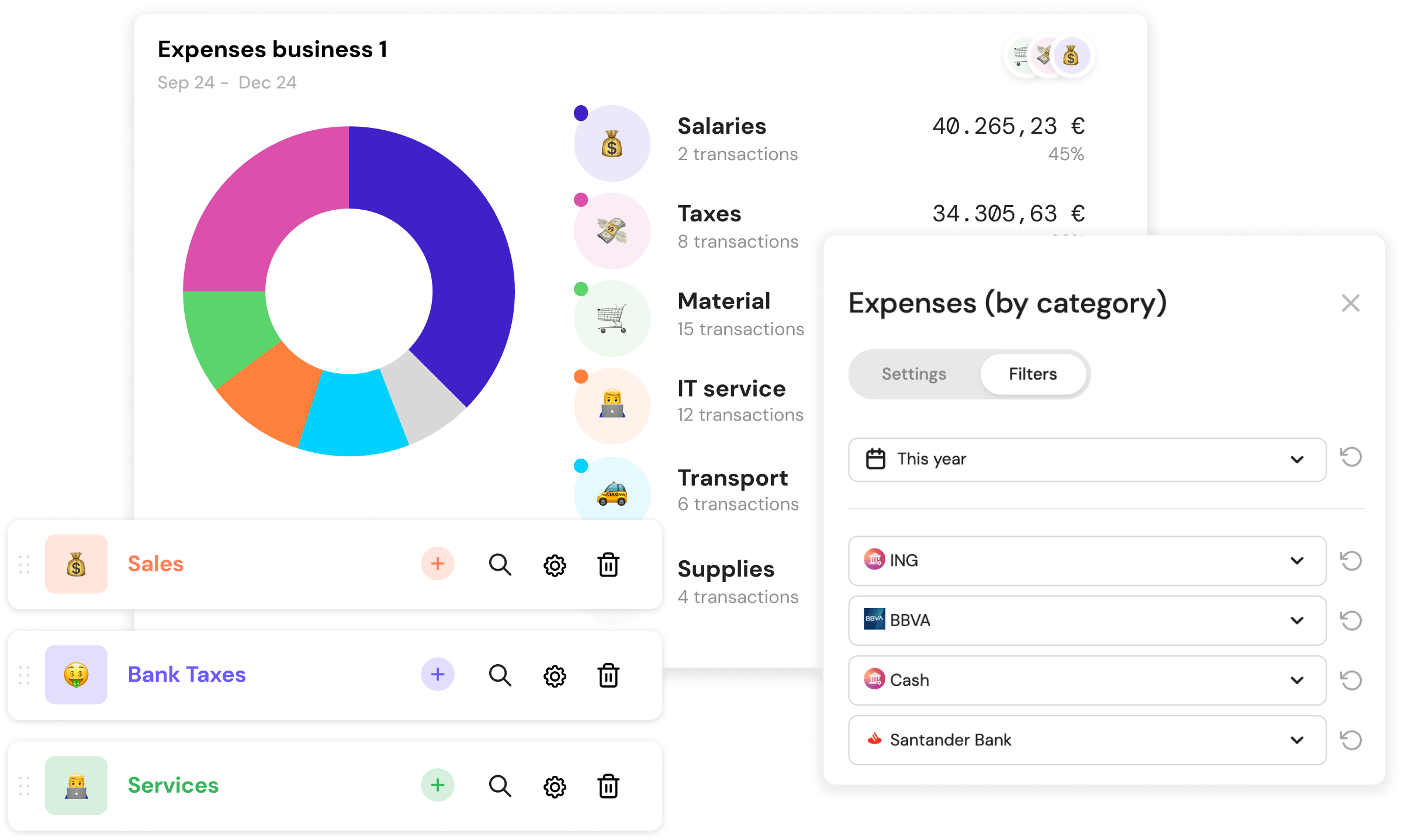

1. Banktrack

Banktrack is an amazing expense tracker app that has earned its place as the best alternative to Mint, especially if you’re looking for a complete solution tailored to your needs. And here’s why:

Main Features:

- Customizable dashboards: What makes Banktrack so special is its ability to create custom dashboards to your liking. Do you have multiple bank accounts, operating expenses, or want to track specific financial metrics? No problem! You can connect all your accounts and get an overview of your finances at a glance, thanks to the highly flexible dashboards that let you keep everything organized.

- Detailed expense categorization: Worried about where your money is going? Banktrack lets you categorize expenses with its powerful treasury management software. You can even create advanced rules to organize your expenses into as many categories as you need.

- Smart alerts: One of the best things about Banktrack is its personalized alerts. It notifies you of everything: duplicate charges, low balances in your accounts, and any other financial issues. And the best part is that you can receive these alerts directly on your favorite channel.

- Adaptable for everyone: Although it’s designed for businesses, Banktrack also adapts to individuals, couples, or families who want to keep a closer eye on their finances.

Why is Banktrack better than Mint?

Simple! Customization is the key. While Mint falls short when it comes to customization options, Banktrack allows you to set up your dashboards according to your financial priorities and keep you informed with smart alerts.

Plus, it offers configurable reports, so you'll always have complete control over your money.

The best part? You can try Banktrack for free and connect all your banks easily. Set up alerts, rules, and dashboards according to your financial needs and discover how to manage your finances like a pro.

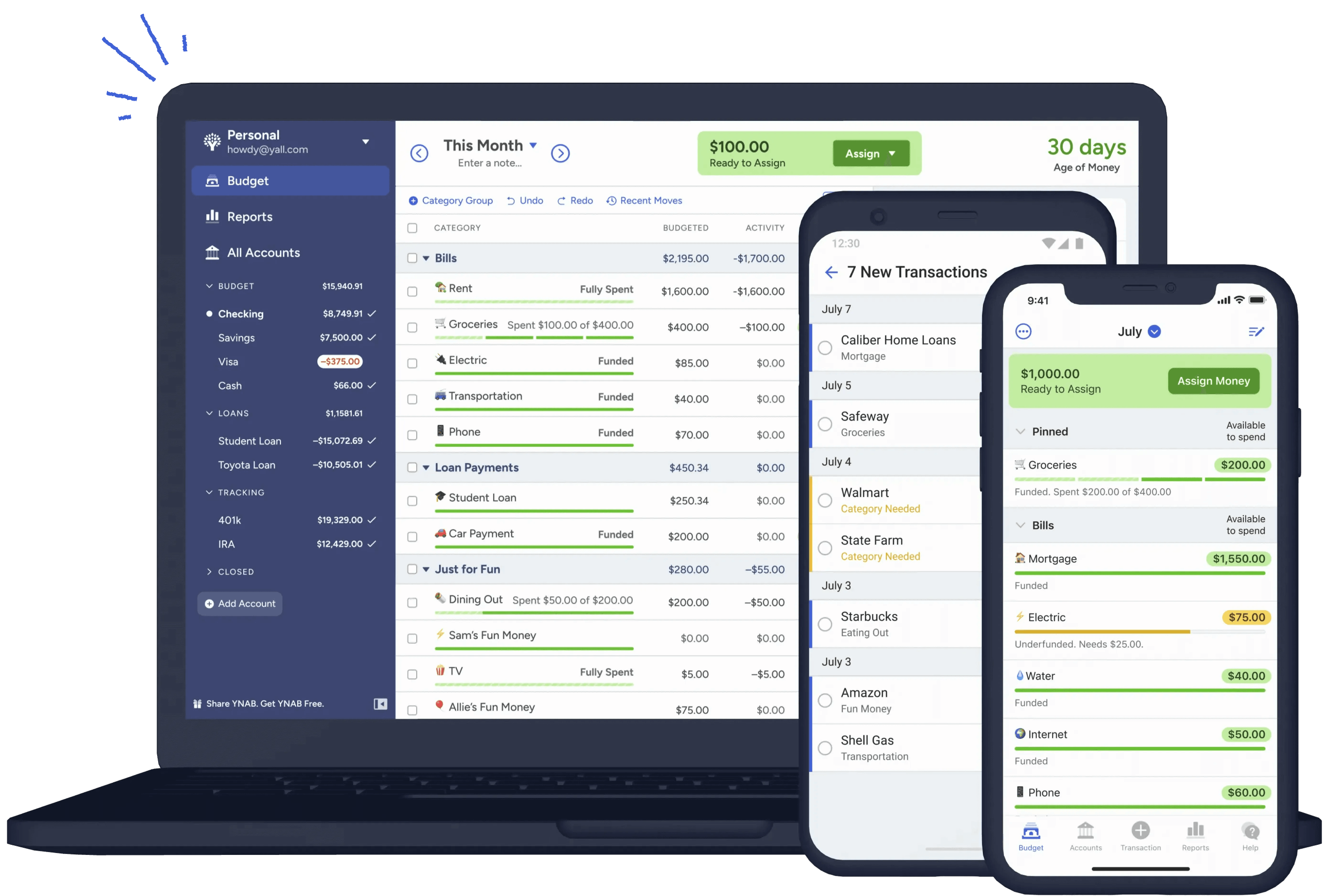

2. YNAB (You Need a Budget)

If you’re someone who believes that money should have a purpose, YNAB might be your ally.

This tool focuses on helping you plan and control your finances in a very mindful way. Let’s take a closer look.

Main Features:

- Focus on realistic budgets: YNAB encourages you to assign a “job” to every dollar you earn. Want to spend less and save more? Then this is your app! With YNAB, you learn to give a purpose to every penny, which changes how you view and manage your money.

- Financial education: One thing users love is that YNAB doesn’t just stop at the tool. It also educates you about finances, offering tutorials and resources to improve your financial habits. It’s like having an economics teacher in your pocket!

- Account synchronization: Just like Mint, you can sync your bank accounts, but you also have the option to add transactions manually if you prefer.

Why does YNAB beat Mint?

While Mint is more passive, YNAB makes you proactive with your money. Here, there’s no room for surprises; you have a plan, and you stick to it.

It does have a monthly cost, but many users see it as an investment because of the value it adds to managing and planning personal finances.

3. Empower

Want a tool that not only tracks your expenses but also manages your investments? Then Empower is for you. This software gives you a much broader perspective on your finances, beyond simple budgeting.

Main Features:

- Investment management: Empower goes beyond simple expense tracking. It shows you how your investments are performing, offering a detailed analysis of your portfolio. Perfect for those looking to grow their money!

- Net worth analysis: Want to know exactly how much you’re worth? This tool provides a complete breakdown of your assets and liabilities, so you can instantly see your net worth.

- Retirement planning: Long-term planning is crucial, and Empower knows it. It allows you to simulate future scenarios so you can plan your retirement in the best possible way.

Why is Empower a better choice than Mint?

If you’re someone who worries about their investments and is looking for something more advanced than simple expense tracking, Empower is your best bet.

Mint falls short compared to the investment tools offered by Empower.

4. PocketGuard

If you’re looking for something simple to control your daily spending and avoid running out of money halfway through the month, PocketGuard is your go-to option.

It’s straightforward, easy to use, and tells you exactly how much you can spend each day.

Main Features:

- Automated budgeting: PocketGuard analyzes your income and expenses and suggests how much you can spend daily so you don’t run out of money before your next paycheck.

- "In My Pocket": This feature shows you how much money you have available after your planned expenses and savings. It’s like having a financial assistant giving you the green light before you spend.

- Subscription management: Tired of those monthly charges you forgot about? PocketGuard helps you identify and manage all your subscriptions, showing you where you could cut expenses.

Why is PocketGuard a better alternative to Mint?

While Mint gives you a more general view of your finances, PocketGuard focuses on helping you keep daily control and cut unnecessary expenses.

If you need an app that keeps you on the right track every day, this is the one for you.

5. EveryDollar

If you’ve heard of Dave Ramsey and his "zero-based budget" method, then you know what we’re talking about. EveryDollar helps you assign a purpose to every dollar you earn, promoting saving and avoiding unnecessary expenses.

Main Features:

- Zero-based budgeting: With EveryDollar, every dollar has a destination. This means it forces you to think carefully about how you spend your money, reducing impulsive spending.

- Easy-to-use interface: Its design is simple and easy to navigate, perfect for those who aren’t finance experts.

- Bank synchronization: You can connect your bank accounts with the paid version to automatically track your expenses.

Why choose EveryDollar over Mint?

Its simplified focus on budgeting makes it an excellent choice for those looking for a straightforward, no-frills tool.

Mint can seem more complex, while EveryDollar gives you what you need, plain and simple.

7. Rocket Money

Another option we couldn’t leave out is Rocket Money. It’s a straightforward subscription management tool designed for those who want financial control without the fuss.

Besides helping you set a budget, it specializes in identifying hidden expenses and simplifying your financial life.

Main Features:

- Subscription identification: One of Rocket Money's strongest points is its ability to find those subscriptions we sometimes forget about (Netflix, Spotify, Amazon Prime, etc.). You can decide which ones to keep and which to cancel with just a few clicks.

- Expense visualization: The app automatically categorizes your expenses, so you get a clear idea of where your money is going each month.

- Savings goals: It lets you set savings goals and track your progress, encouraging you to save consistently.

Why choose Rocket Money over Mint?

It’s simple and direct focus on identifying unnecessary expenses and managing subscriptions makes it ideal for those who want something more intuitive and less complicated.

Which Mint Alternative Is Right for You?

At the end of the day, the best alternative to Mint depends on your personal needs. If you’re feeling overwhelmed by the options, here’s a quick guide:

- If you want customization and complete control: Go for Banktrack. Its ability to customize dashboards and create alerts according to your needs makes it perfect for those who want to stay on top of everything.

- If you’re looking to change your mindset about money: YNAB is the best option, as it teaches you to give every penny a purpose.

- For those who need to closely monitor their investments: Empower is the ideal choice.

- If you prefer something more simple and focused on daily spending: PocketGuard keeps you in check with its focus on daily expenses.

- For fans of the zero-based budget: EveryDollar lets you assign a purpose to every dollar you receive.

- If you’re looking for more advanced and customizable tools: Watson offers sophisticated options through artificial intelligence.

- And if you need to simplify your financial life: Rocket Money helps you identify unnecessary expenses and guides you toward effective saving.

Conclusion

Mint paved the way for millions of people to start managing their money digitally, but it’s clear that the landscape has evolved. Today, users have more specialized and flexible tools to choose from, whether they want advanced investment tracking, daily spending control, or customizable dashboards tailored to their financial priorities.

From Banktrack’s powerful customization and YNAB’s budgeting philosophy to Empower’s investment focus and PocketGuard’s simplicity, each alternative offers something unique. Tools like EveryDollar and Rocket Money prove that financial management doesn’t have to be overwhelming, it can be simple, proactive, and even enjoyable.

Ultimately, the best alternative to Mint depends on your personal goals. If you need full control, choose Banktrack. If you want to reframe how you think about money, YNAB is ideal. And if what you need is to cut through the noise and simplify your finances, PocketGuard or Rocket Money may be the perfect fit.

What matters most is finding a tool that adapts to you, not the other way around. With the right alternative, you’ll not only replace Mint but also upgrade the way you manage, save, and plan for the future.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed