Best 11 alternatives to Monarch Money

These are the best alternatives to Monarch Money:

- Banktrack

- YNAB (You Need A Budget)

- Personal Capital

- Tiller Money

- Mint

- Quicken

- PocketSmith

- Simplify by Quicken

- Emma

- Goodbudget

- CountAbout

If you’re exploring personal finance apps, Monarch Money is a popular choice, but it’s not the only one.

Several great alternatives offer unique features and benefits, catering to different financial needs and goals.

Here’s a guide to the top alternatives to Monarch Money that can help you manage your money more effectively, from budgeting and goal tracking to investment monitoring and more.

Top 11 alternatives to Monarch Money

1. Banktrack

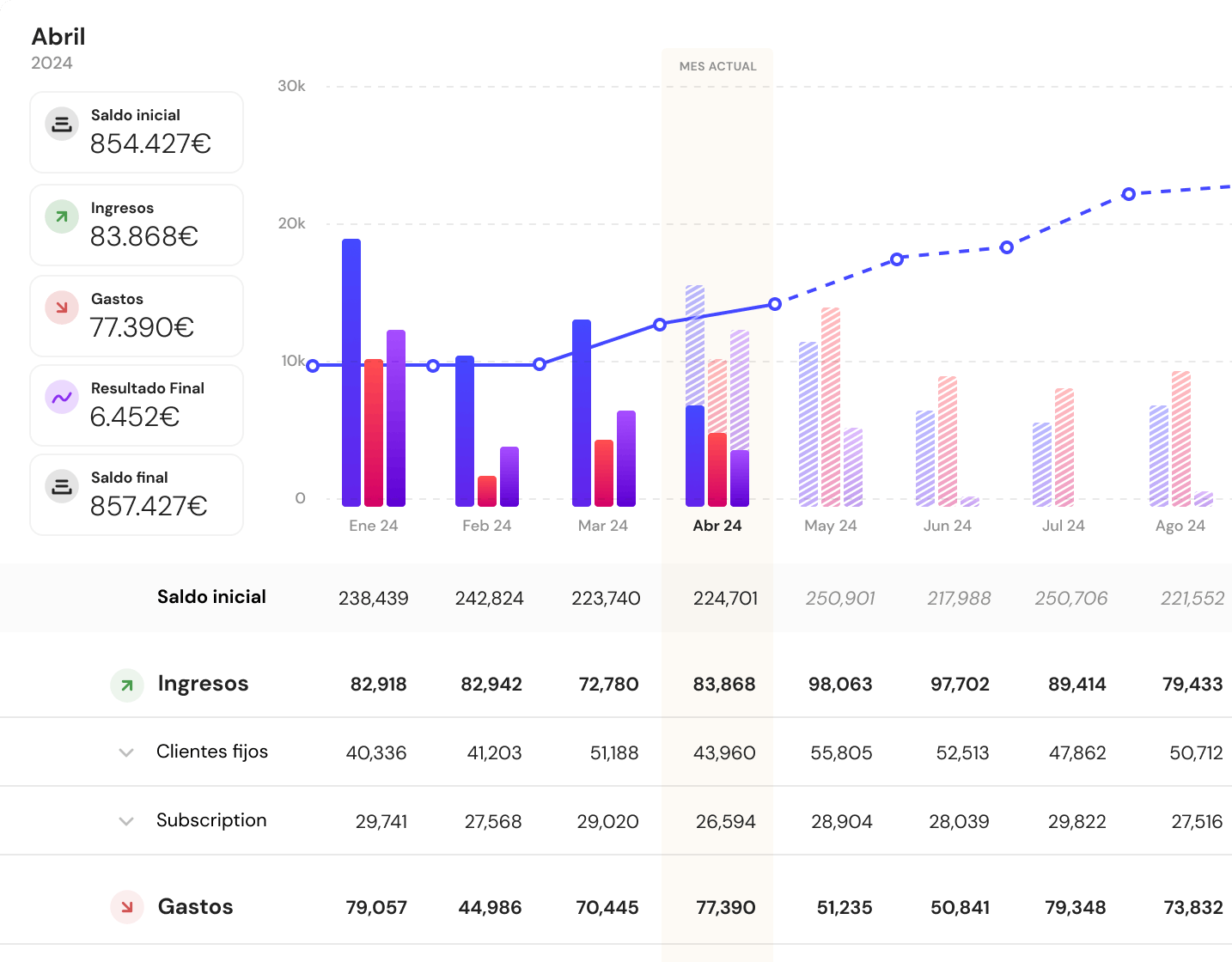

When it comes to tracking expenses and managing finances, Banktrack has established itself as an outstanding alternative to popular apps like Monarch Money.

It’s not just an expense tracker, it’s a fully customizable cash management software that adapts to your specific needs, whether for personal finance, family budgeting, or business expense management.

Key Features of Banktrack

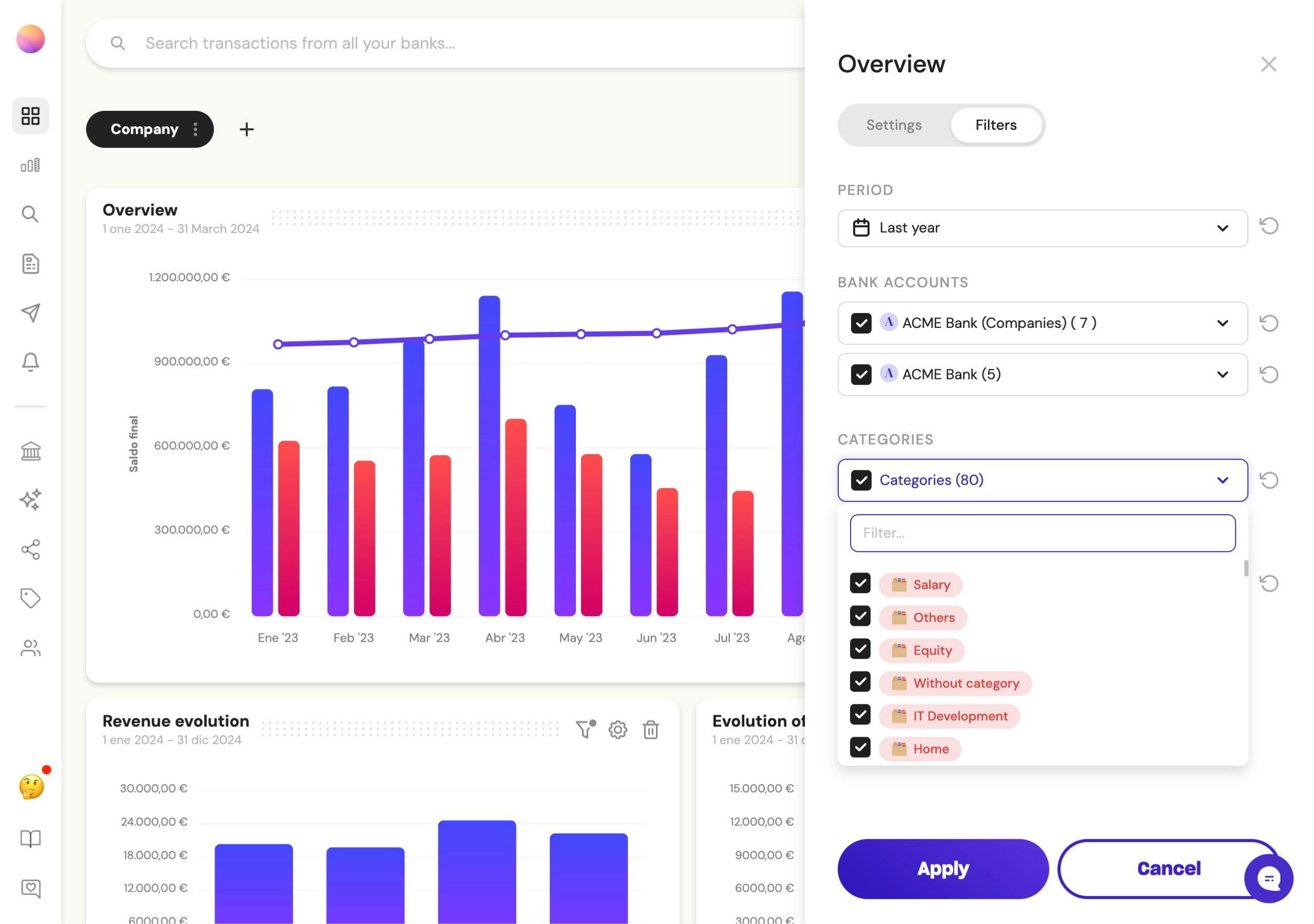

Customizable Dashboards

Banktrack offers unparalleled flexibility with its customizable dashboards, allowing you to design a financial overview that fits your unique needs.

If you have multiple bank accounts, business expenses, or want to track specific financial metrics, Banktrack’s dashboard setup has you covered.

You can connect all your accounts in one place, enabling you to get an overview of your entire financial picture at a glance.

These dashboards are user-friendly, highly flexible, and keep everything organized, making it easy to monitor cash flow, savings, and spending.

Detailed Expense Categorization

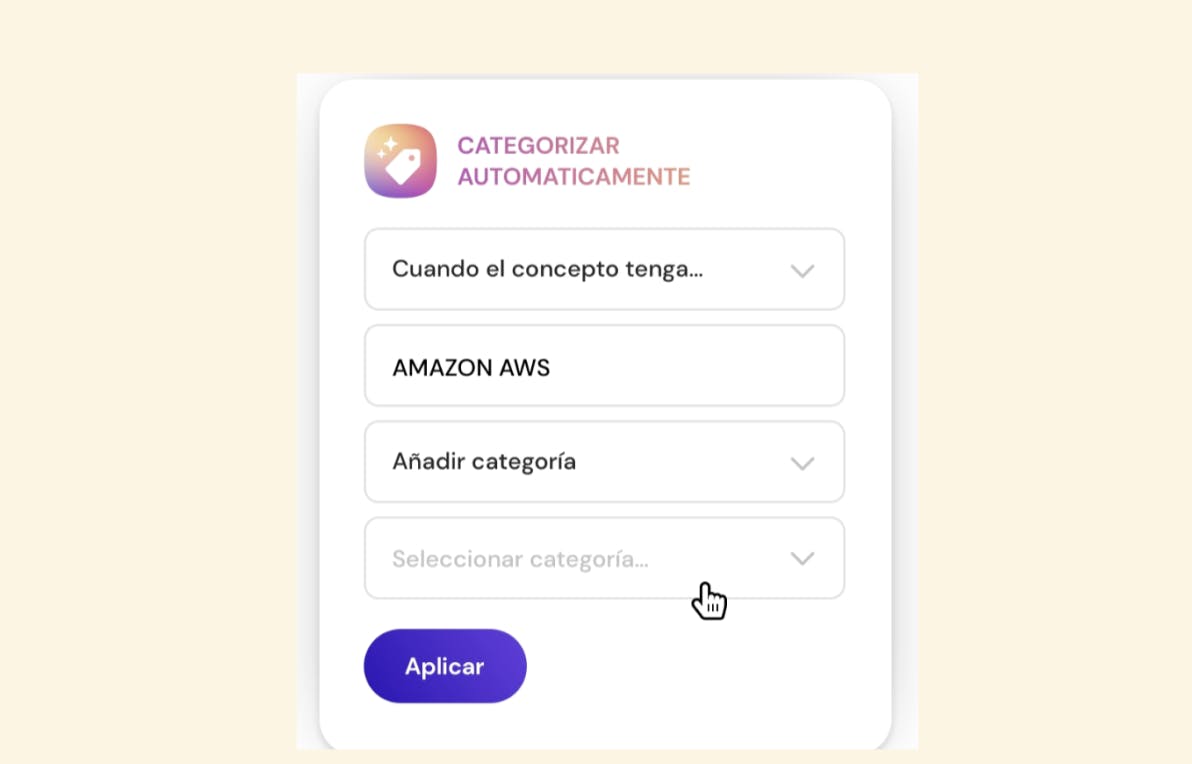

One of the most powerful features of Banktrack is its ability to categorize expenses in detail.

You’re not limited to basic categories, Banktrack’s treasury management software allows for advanced customization, enabling you to create rules for organizing expenses into as many categories as needed.

This level of detail is invaluable for those who want to get specific insights into where their money goes and for businesses or individuals tracking multiple types of expenses.

Smart Alerts for Proactive Management

Banktrack’s alert system is highly personalized, keeping you informed about critical financial activities.

You’ll receive notifications for duplicate charges, low balances, and other financial events that may need attention.

These alerts can be sent directly to your preferred channel, whether it’s email, SMS, or within the app, allowing you to stay on top of your finances without constantly checking in.

Adaptable for Personal and Business Use

While Banktrack is designed with businesses in mind, it’s equally useful for individuals, couples, or families.

The adaptable structure allows users to track expenses, set goals, and create financial plans tailored to personal or household finances.

This versatility makes it ideal for anyone looking to monitor spending, set savings goals, or manage shared expenses effectively.

If you’re considering Banktrack, you may also want to explore Agicap alternatives. Both tools are widely used in Europe for treasury management and financial forecasting, but Agicap users often switch to Banktrack for its stronger automation and cash flow visibility.

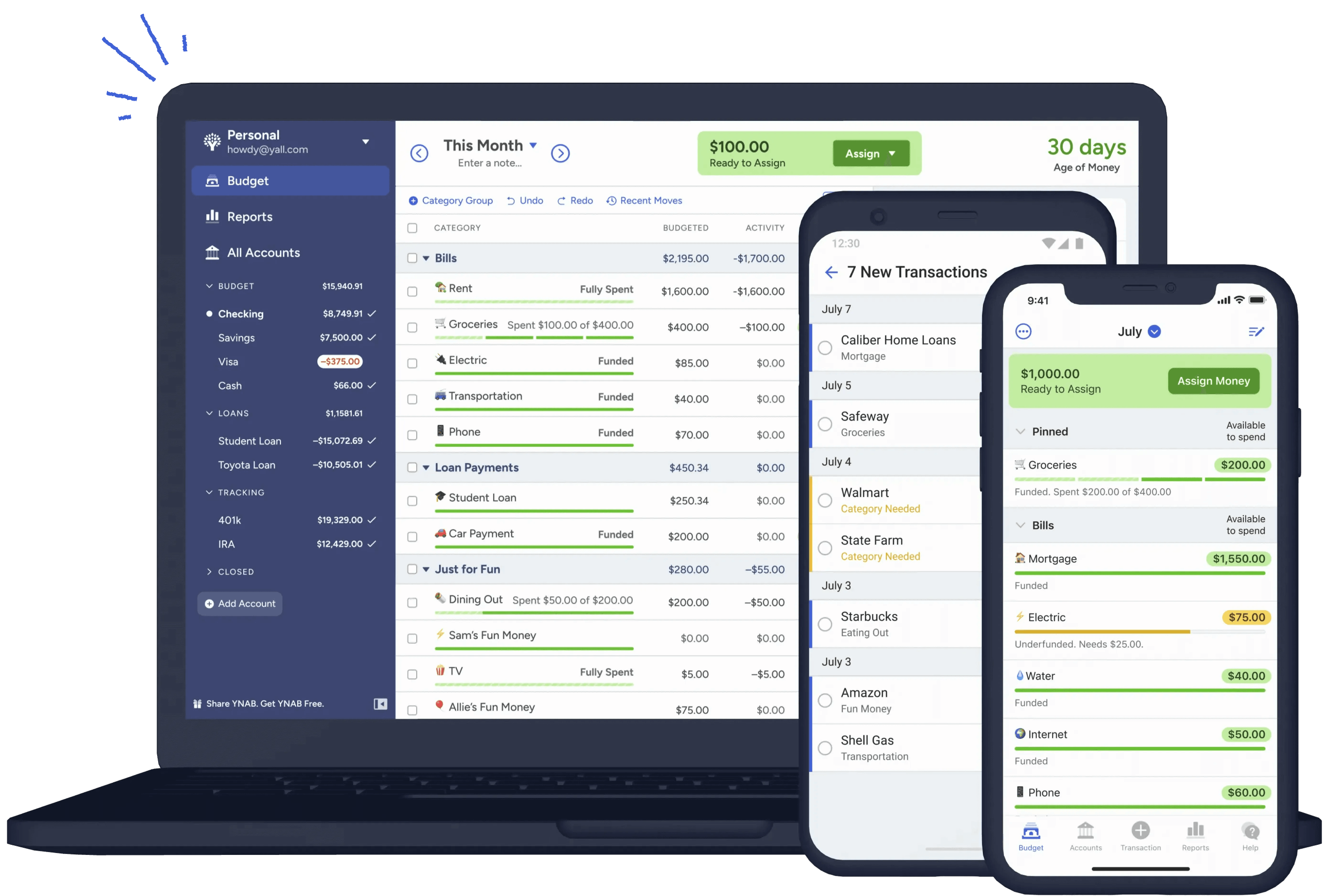

2. YNAB (You Need A Budget)

Best for people who want a proactive approach to budgeting.

YNAB is built around a unique, proactive budgeting philosophy. Unlike many apps that simply track spending, YNAB encourages you to assign each dollar a “job,” helping you save, pay off debt, and plan for expenses.

It’s ideal for people who want a more hands-on budgeting tool.

- Key Features: Zero-based budgeting, goal tracking, debt payoff tools, extensive educational resources

- Pros: Focuses on mindful spending, strong budgeting structure, great for debt reduction

- Cons: No direct investment tracking, learning curve for new users

- Price: $14.99/month or $99/year, with a 34-day free trial

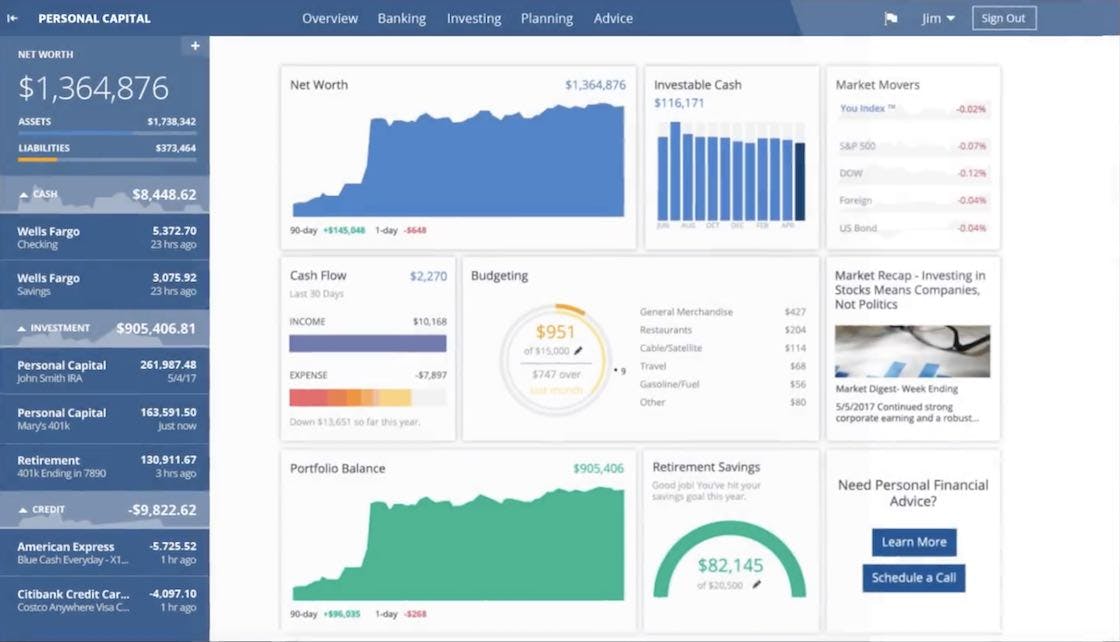

3. Personal Capital

Best for investors who want detailed investment analysis alongside budgeting.

Personal Capital combines personal finance tools with a strong investment management platform, making it ideal for people who want to track both everyday spending and long-term investments.

It provides insights into your net worth, cash flow, portfolio performance, and asset allocation.

- Key Features: Budgeting, net worth tracking, retirement planning, investment tracking and analysis

- Pros: Strong investment tracking, retirement planning tools, free to use

- Cons: Limited budgeting features compared to other apps, upselling on advisory services

- Price: Free for budgeting and investment tracking; paid advisory services available

4. Tiller Money

Best for spreadsheet enthusiasts who want custom control over their finances.

Tiller Money stands out by integrating your financial data directly into Google Sheets or Excel, allowing you to build custom financial reports and budgets.

It’s ideal for those who enjoy working with spreadsheets and want detailed, personalized control over their financial tracking.

- Key Features: Automated financial data syncing in spreadsheets, customizable templates, Google Sheets and Excel integration

- Pros: Highly customizable, perfect for data lovers, flexible budgeting options

- Cons: Learning curve for those new to spreadsheets, no mobile app

- Price: $79/year, with a 30-day free trial

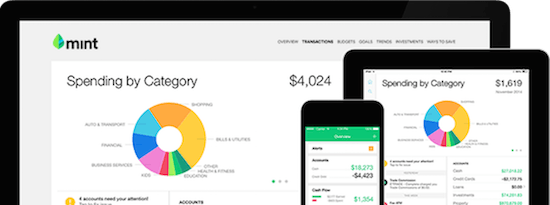

5. Mint

Best for users looking for a free and comprehensive budgeting expense tracking app.

Mint is a popular and well-rounded personal finance app offering budgeting, expense tracking, and bill reminders.

It’s user-friendly and free, making it an accessible choice for those seeking a straightforward app without a monthly fee.

- Key Features: Budgeting, expense tracking, bill reminders, credit score tracking

- Pros: Free to use, easy to set up, useful for basic money management

- Cons: Ads and upselling, lacks investment tracking depth

- Price: Free with ads

Continue reading if you are interested in finding other Mint alternatives.

6. Quicken

Best for users who want a desktop-focused solution with extensive financial tracking.

Quicken has been a long-standing name in personal finance apps, offering strong features for budgeting, bill management, and investment tracking.

With options for both desktop and mobile, it’s ideal for those who prefer working on a computer and want detailed financial control.

- Key Features: Budgeting, bill payment, investment tracking, tax reporting, customizable reports

- Pros: Desktop-friendly, highly detailed, reliable for long-term planning

- Cons: Monthly subscription required, complex for new users

- Price: Starts at $35.99/year

Not sure if this is the right fit? Here are some other alternatives to Quicken.

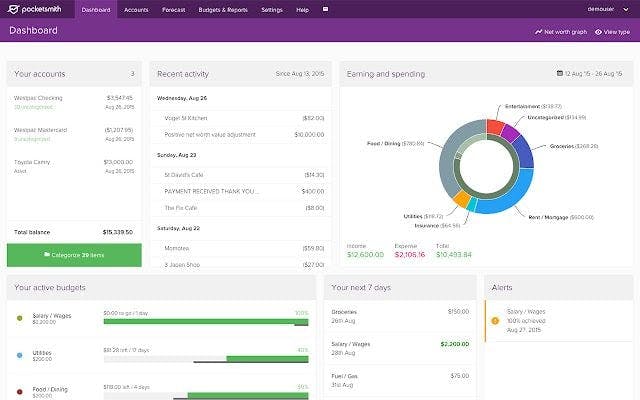

7. PocketSmith

Best for those who prefer a future-focused approach with cash flow projections.

PocketSmith is unique in that it lets you forecast your finances up to 30 years into the future. With a focus on cash flow projections, it’s a helpful tool for those looking to see the long-term impact of today’s financial decisions.

- Key Features: Cash flow forecasting, budgeting, goal setting, calendar-based planning

- Pros: Forecasting feature for long-term planning, flexible budgeting tools

- Cons: Limited investment tracking, no direct data syncing with some banks

- Price: Free basic version; premium plans start at $9.95/month

8. Simplifi by Quicken

Best for people looking for a streamlined, mobile-focused budgeting tool.

Simplifi by Quicken is a newer app designed with mobile users in mind, offering intuitive budgeting tools and spending insights. It’s a great option for people who want a simplified version of Quicken with a modern interface and on-the-go access.

- Key Features: Budgeting, spending insights, goal setting, subscription tracking

- Pros: Easy to use, focuses on daily spending management, mobile-friendly

- Cons: Limited investment tracking, subscription cost

- Price: $3.99/month or $39.99/year, with a 30-day free trial

9. Emma

Best for people who want a fun, visual approach to budgeting and expense tracking.

Emma stands out with its fun, visual design and engaging insights into your finances. It’s designed for younger users or those new to budgeting who want a friendly approach to money management without complex features.

- Key Features: Expense tracking, acts as a subscription manager app, has fun financial insights, goal setting

- Pros: Engaging design, easy setup, free basic version available

- Cons: Not ideal for in-depth investment tracking or detailed budgeting

- Price: Free basic version; premium plans start at $5/month

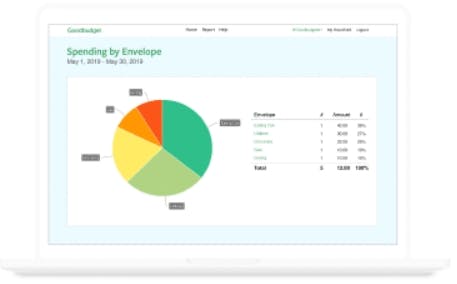

10. Goodbudget

Best for users who prefer an envelope-based budgeting system.

Goodbudget is based on the envelope budgeting method, where you allocate funds to specific “envelopes” or categories. It’s a simple, effective way to manage spending without overcomplicating things, ideal for those focused solely on budgeting.

- Key Features: Envelope budgeting, spending tracking, debt management, syncing with other users

- Pros: Simple and easy to understand, perfect for envelope budgeters

- Cons: No direct bank syncing, lacks investment tracking

- Price: Free version; premium version is $7/month or $60/year

11. CountAbout

Best for users who want a versatile finance app with budgeting and transaction importing.

CountAbout allows users to import transactions from other platforms like Mint and Quicken, making it easy to switch. It offers detailed budgeting and expense tracking, with a user-friendly layout.

- Key Features: Budgeting, customizable categories, transaction importing, mobile access

- Pros: Easy data importing, simple to use, web and mobile access

- Cons: Limited investment tracking, no free version

- Price: Starts at $9.99/year for basic; $39.99/year for premium

Why consider an alternative to Monarch Money?

While Monarch Money provides a solid set of budgeting and investment tracking features, some people may find they want additional tools, simpler interfaces, or different pricing options.

This list covers alternatives that excel in these areas, giving you options to find the best fit for your financial style and goals.

Getting started with Banktrack

To experience the benefits of Banktrack, you can create an account and start customizing your dashboards and categories to suit your financial needs.

Banktrack’s intuitive setup allows you to connect all your accounts and manage your cash flow seamlessly, helping you make the most of every dollar.

For those looking for a powerful, adaptable, and highly customizable expense tracker and financial management tool, Banktrack is an unbeatable alternative to Monarch Money.

Try it today and discover how you can gain better financial control and insight.

Share this post

Related Posts

The 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.The 10 best alternatives to Quicken in 2024

These are the best alternatives to Quicken, featuring tools that make managing your finances, budgeting, and tracking expenses easier and more efficient.Best 10 Tools for Bank of America Expense Tracking

Discover the top 10 tools to simplify Bank of America expense tracking, making managing your finances easy and even a bit fun!

Try it now with your data

- Your free account in 2 minutes

- No credit card needed