Best 10 Tools for Bank of America Expense Tracking

- Best 10 Tools for Bank of America Expense Tracking

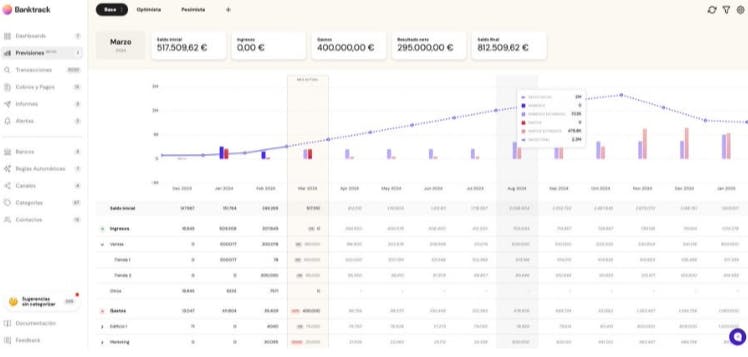

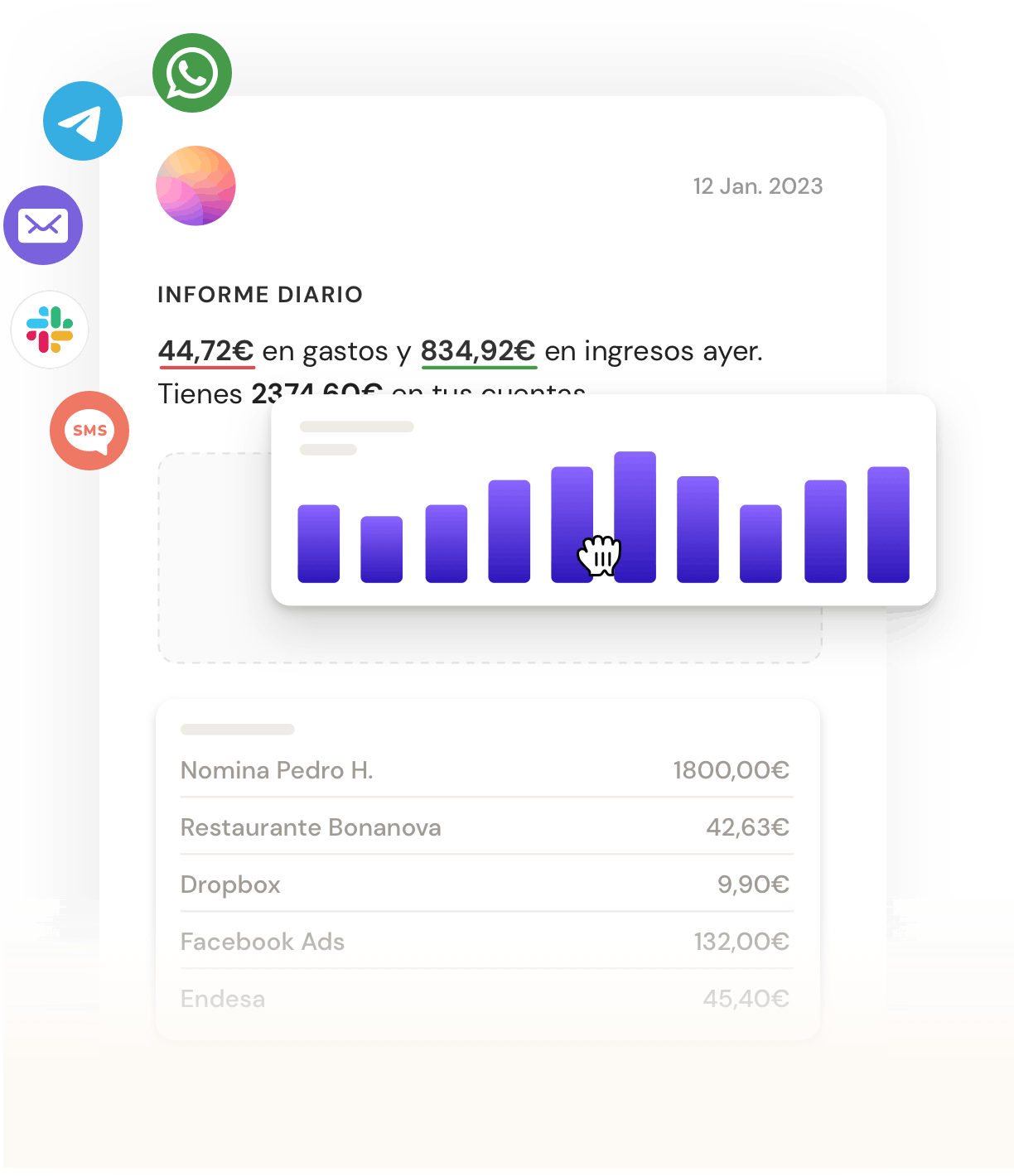

- 1. Banktrack

- 2. Bank of America Mobile App

- 3. Mint

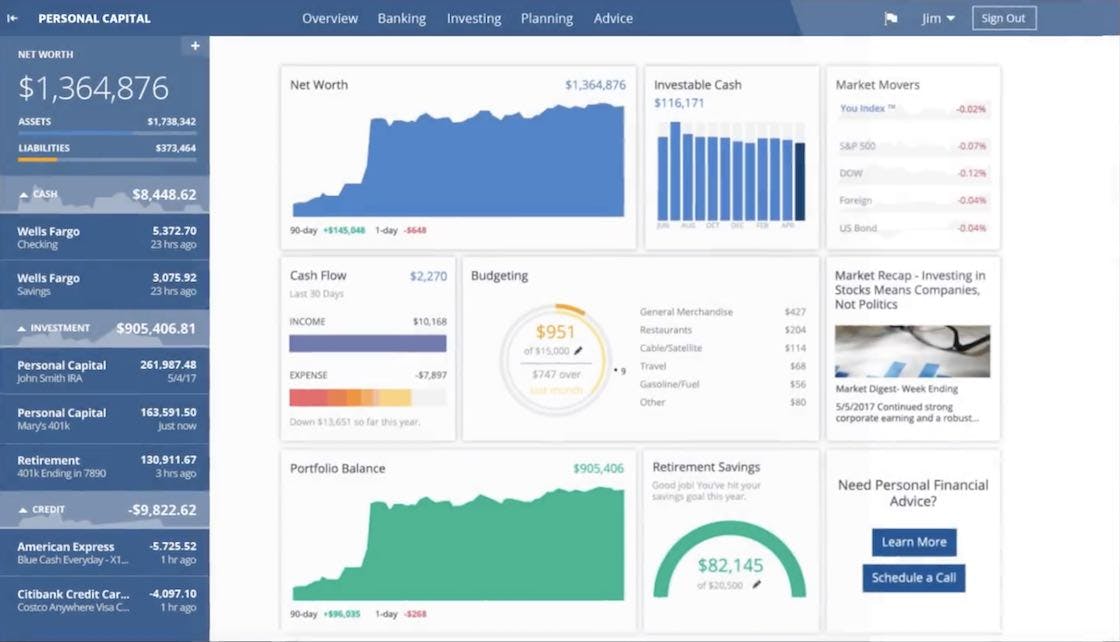

- 4. Personal Capital

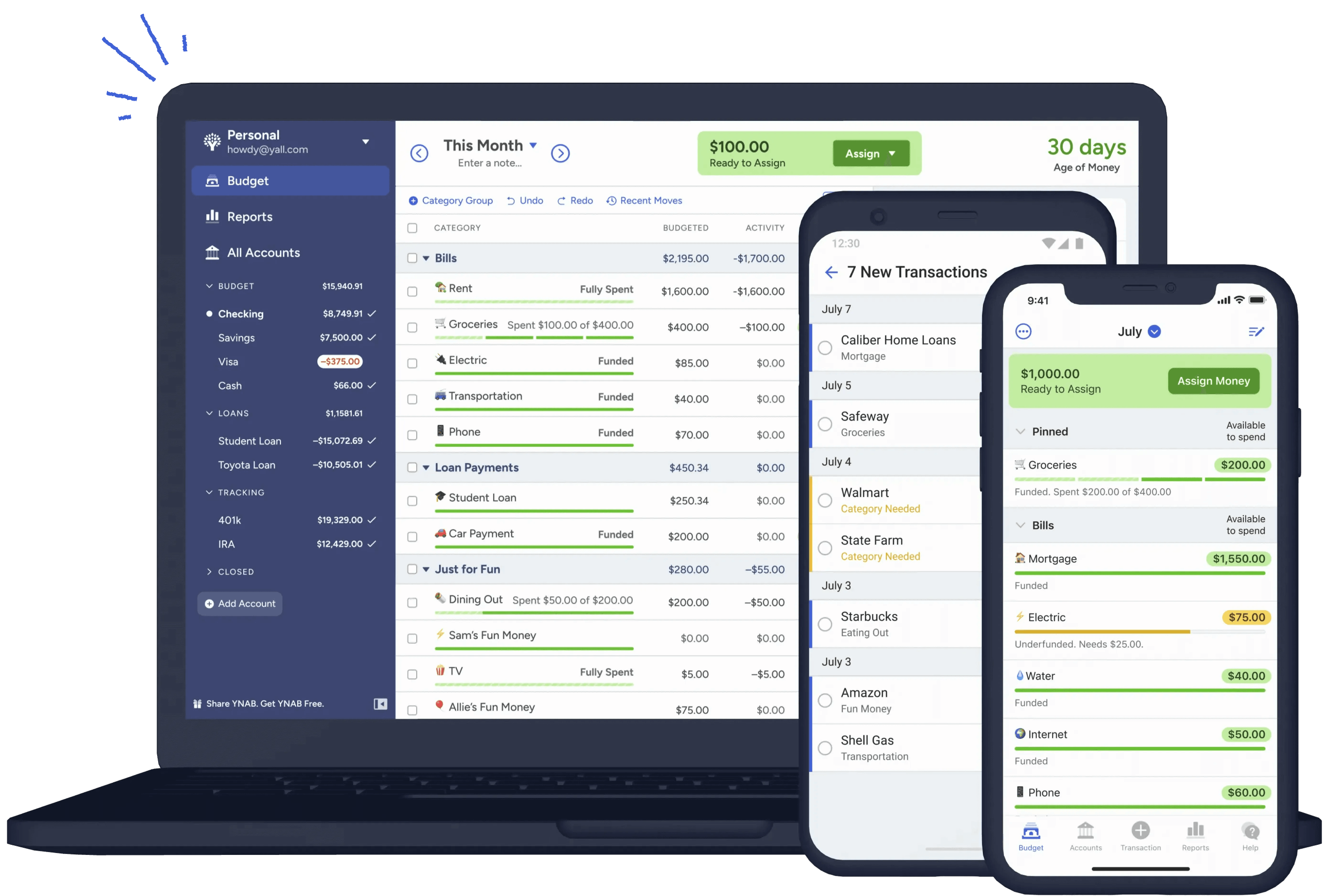

- 5. YNAB (You Need a Budget)

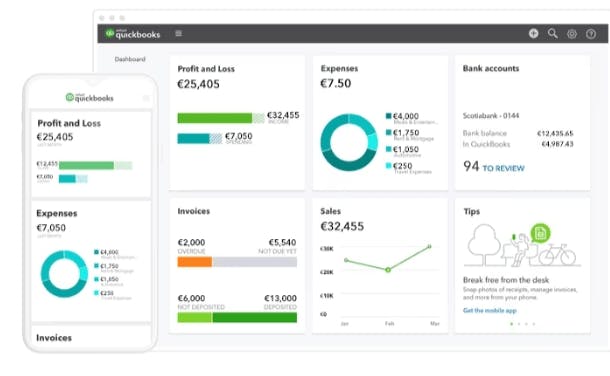

- 6. QuickBooks

- 7. Expensify

- 8. Tiller Money

- 9. EveryDollar

- 10. PocketGuard

- 5 Reasons why Expense Tracking is Important for Financial Health

- 1. Creating a Realistic Budget

- 2. Achieving Financial Goals

- 3. Preventing Overspending

- 4. Simplifying Tax Preparation

- 5. Enhancing Financial Awareness

- Top 7 Features to Look for in Expense Tracking Tools

- .1. Real-Time Bank Synchronization

- 2. Automatic Expense Categorization

- 3. Budgeting Capabilities

- 4. Comprehensive Reporting

- 5. Multi-Account Integration

- 6. Alerts and Notifications

- 7. Cloud Backup

- 5 Steps to Integrate Expense Tracking Tools with Bank of America

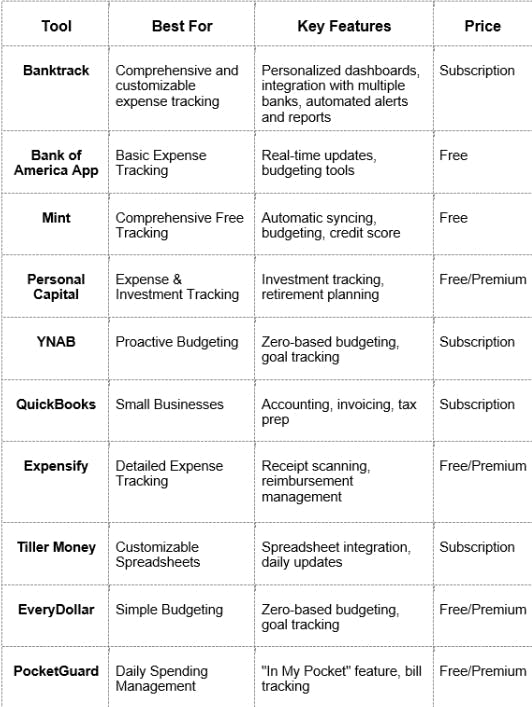

- Detailed Comparison of the Best Tools

- 3 Common Mistakes to Avoid in Expense Tracking

- 1. Ignoring Small Purchases

- Failing to Categorize Expenses Correctly

- Not Reviewing Your Expenses Regularly

- Why Choose Banktrack for Expense Tracking

The best tools for bank of America expense tracking:

- Banktrack

- Bank of America Mobile App

- Mint

- Personal Capital

- YNAB (You Need a Budget)

- QuickBooks

- Expensify

- Tiller Money

- EveryDollar

- PocketGuard

Tracking expenses can feel like a chore, but with the right tools, it’s a breeze!

Whether you're a Bank of America customer looking to stay on top of your spending or a pro at managing finances, these top 10 tools will make expense tracking simple and even a little fun.

Best 10 Tools for Bank of America Expense Tracking

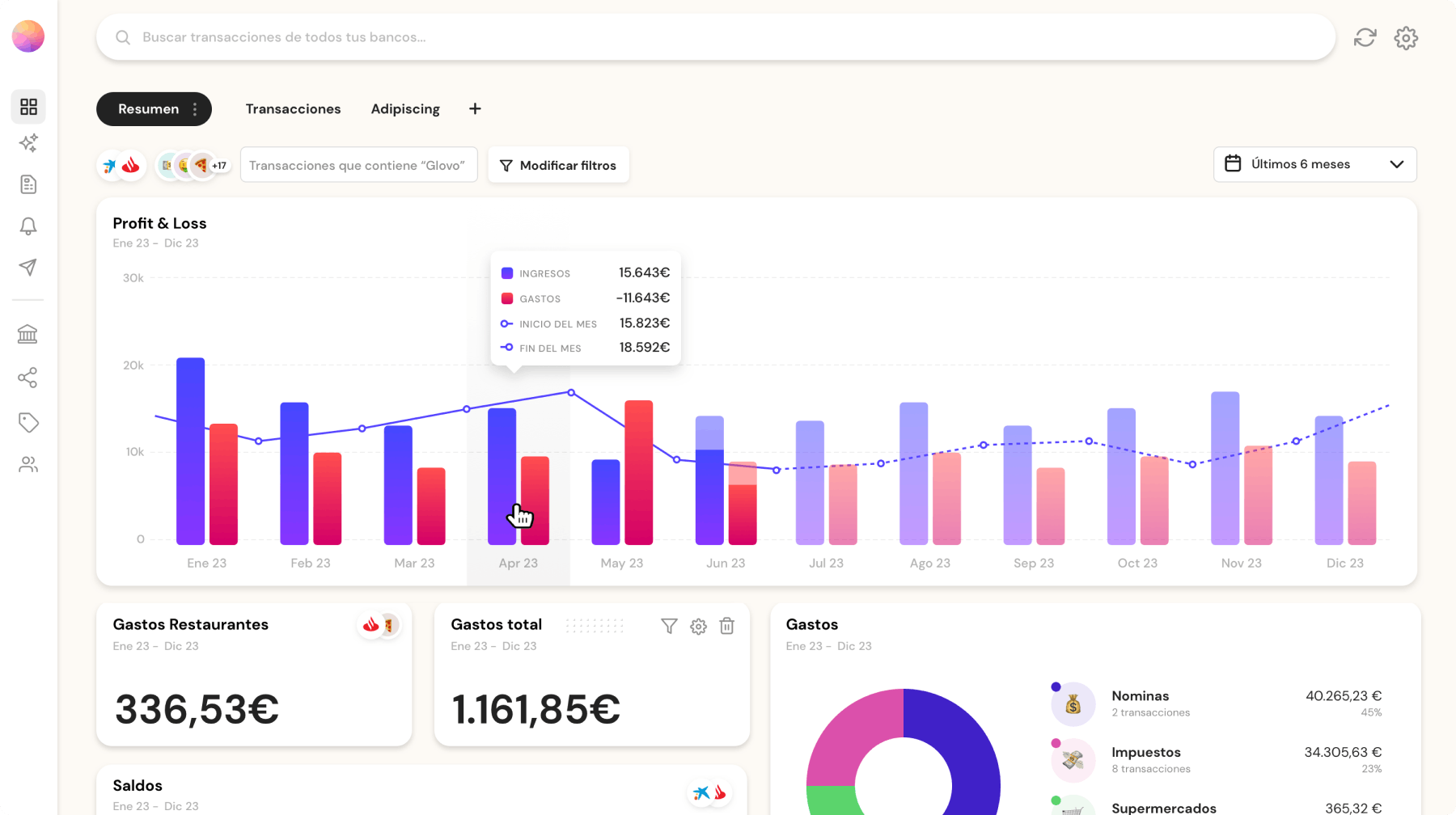

1. Banktrack

The reason why banktrack is the top choice in this ranking is simply because it is far more complete than any other tool, plus, it has integration with the Bank of America Mobile App. So why not have it all, right?

Users can effectively access real-time financial information thanks to its customizable dashboards and flexible categorization options, which also allow for accurate tracking of income and expenses.

Now, what does this mean? That businesses can easily make informed decisions and stay in constant control of their finances with the help of personalized reports and alerts.

Banktrack stands out as the best expense tracking app for all types of enterprises.

Key Features:

- Personalized dashboards

- Integration with multiple bank accounts and products

- Customizable spending metrics

- Automated alerts and reports

- Affordable pricing starting at €16.58 per month

These are the simple features, let’s now dive deeper into what they mean and where they can get you.

1. Transaction Tracking

Customizable Dashboards

Banktrack provides fully customizable dashboards that fit and adjust to your needs.

These dashboards offer a clear, real-time view of your financial status, allowing you to manage your money efficiently.

Whether you need a quick overview of your spending, a detailed breakdown of expenses, or a complete analysis of income and expenses over time, Banktrack’s dashboards deliver the insights you need to stay on top of your finances.

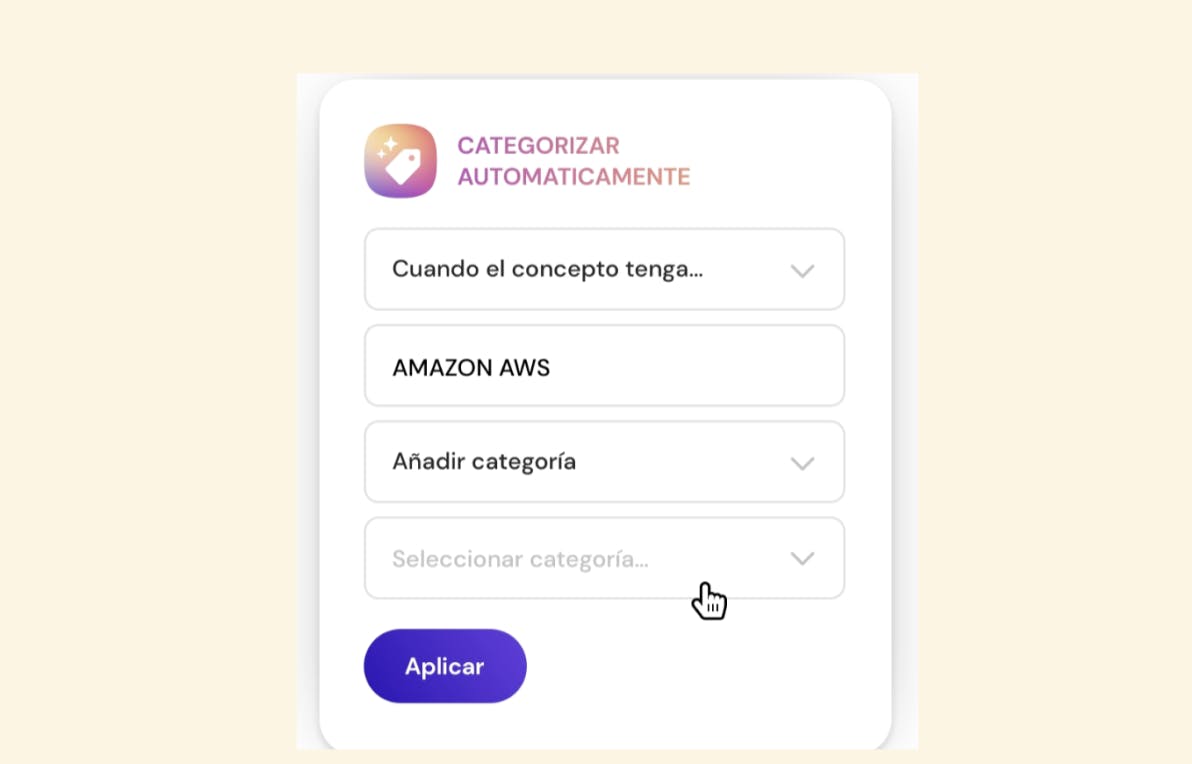

Flexible Categorization

Banktrack offers flexible categorization options that allow you to categorize expenses and income accurately. The platform supports custom categories tailored to your specific financial situation, making it easier to track and analyze your spending and income effectively.

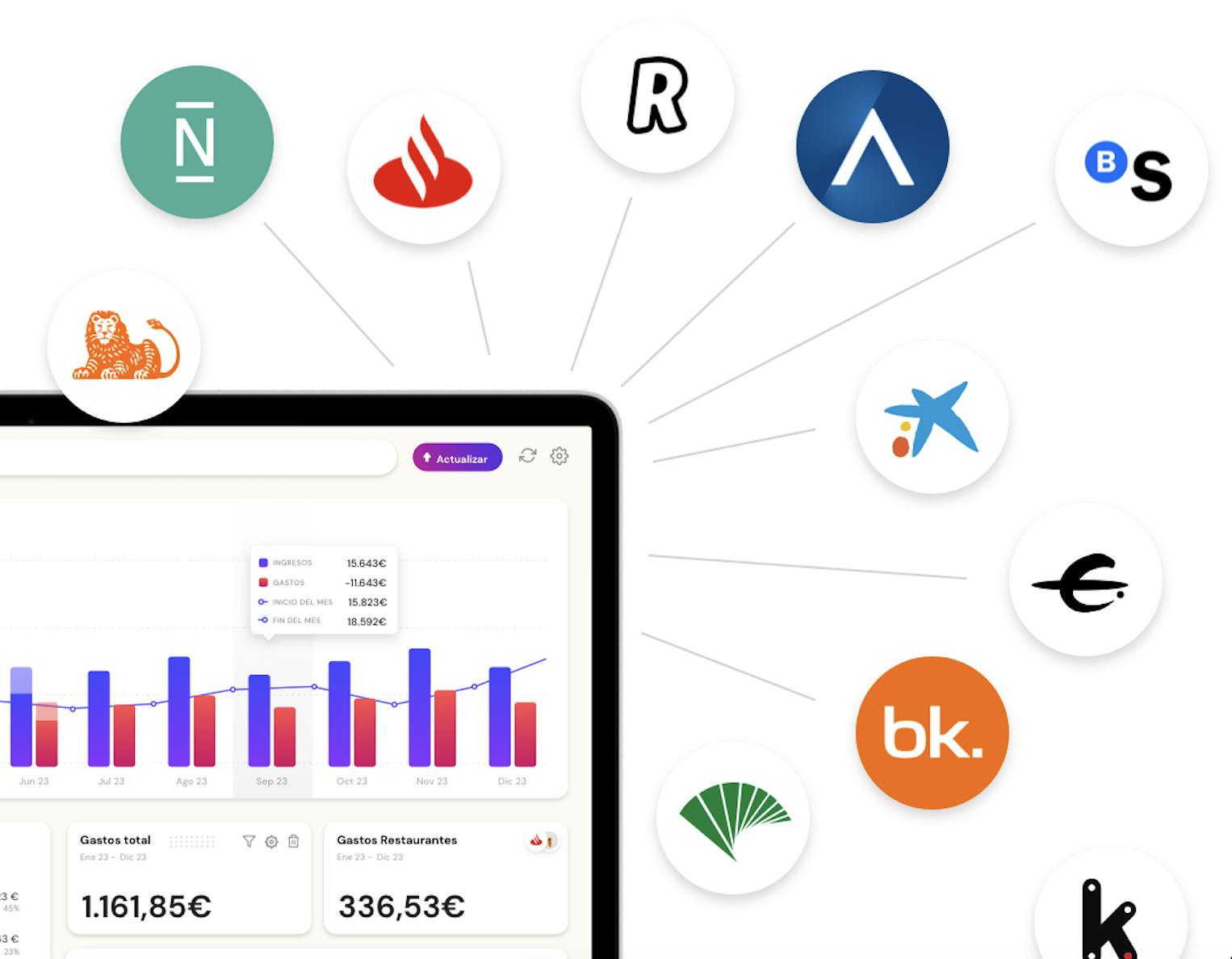

2. Seamless Bank Integration

Extensive Bank Coverage

The best apps automatically link with your bank accounts, including Bank of America, and categorize transactions without requiring manual input. This is precisely one of the best features of Banktrack, its ability to sync with over 120 banks, including traditional banks and neobanks.

This extensive coverage ensures that regardless of where your business banks, you can integrate all your accounts into one platform, including the Bank of America.

This integration makes it easier to manage your finances by providing a single, unified view of all your financial data.

Dual Connection Methods

Banktrack offers two secure methods for connecting to your bank accounts:

- Open Banking (PSD2): This method complies with the latest European regulations and provides a secure and standardized way to access your banking data.

- Direct Access: For banks not covered under PSD2, Banktrack offers direct access connections, ensuring that you can integrate financial data from virtually any bank.

3. Strong Security Measures

Authorized Data Providers

Banktrack prioritizes the security of your financial data by using only authorized and audited data providers approved by the Bank of Spain.

This ensures that your data is handled securely and in compliance with stringent regulatory standards, giving you peace of mind that your financial information is protected.

Read-Only Access

Banktrack operates on a read-only basis, meaning it can view and import your financial data but cannot conduct transactions.

This feature adds an extra layer of security, ensuring that unauthorized transactions cannot occur, and your accounts remain safe from tampering.

No Storage of Banking Passwords

Banktrack prioritizes security by not storing your banking passwords.

The connection process is handled through a unique access token, which minimizes the risk of password theft and unauthorized access to your accounts.

Data Encryption

All transaction data within Banktrack’s systems is encrypted, ensuring that your financial information remains confidential and secure.

This encryption protects your data from unauthorized access, keeping your financial details private.

4. Advanced Cash Flow Forecasting

Historical Data Analysis

Banktrack’s cash flow forecasting features use historical financial data to predict future cash flow trends.

This analysis helps you anticipate potential shortfalls and surpluses, allowing for more accurate and effective financial planning.

With insights into future cash flow, you can make better decisions and prepare for both expected and unexpected events.

Dynamic Forecasting

Banktrack offers dynamic cash flow forecasting that adjusts based on real-time data.

This feature makes sure that your financial projections are always accurate and up-to-date, allowing you to stay flexible and responsive to changes in your financial situation.

5. Automated Bank Reconciliation

Automated Reconciliation

Bank reconciliation can be a tedious and error-prone process, but Banktrack automates this task, making it efficient and reliable.

The platform automatically matches your bank statements with your internal records, quickly identifying and resolving discrepancies. This automated reconciliation process reduces the risk of errors and ensures that your financial records are always accurate, saving you time and effort.

2. Bank of America Mobile App

The Bank of America Mobile App is the go-to option for tracking expenses directly within your bank’s ecosystem.

It offers basic expense tracking features integrated with your bank account, making it a convenient choice for those who prefer not to use third-party apps.

If you're primarily interested in a lower-scale tool, you might want to explore the available apps for personal finance tracking.

Key Features

- Real-Time Transaction Updates: Automatically updates your transactions in real-time.

- Categorization: Expenses are automatically categorized, with the option to adjust categories.

- Budgeting Tools: Set spending limits and track your progress directly in the app.

- Security: Includes features like fingerprint sign-in, Face ID, and transaction alerts.

Pros and Cons

Pros:

- Seamless integration with Bank of America accounts.

- Strong security features tailored to your bank.

- No need for third-party software or subscriptions.

Cons:

- Limited features compared to specialized expense tracking tools.

- Basic reporting and analytics.

3. Mint

Mint by Intuit is one of the most popular free personal finance tools available.

It is an expense tracker software with bank sync features, including automatic bank syncing, budgeting, and credit score monitoring.

Key Features

- Automatic Bank Syncing: Syncs with Bank of America and other financial institutions to import transactions.

- Expense Categorization: Automatically categorizes expenses and provides options for manual adjustments.

- Budgeting Tools: Create budgets, track spending, and receive alerts when nearing limits.

- Bill Reminders: Keep track of upcoming bills to avoid late fees.

- Credit Score Monitoring: Access your credit score for free and monitor changes over time.

Pros and Cons

Pros:

- Free to use with a wide range of features.

- Comprehensive budgeting and expense tracking.

- Strong reporting capabilities.

Cons:

- Ad-supported, which can be intrusive.

- Limited customization options for categories.

- Security concerns due to the platform’s access to multiple financial accounts.

4. Personal Capital

Empower, formerly known as personal capital, is a small business expense tracking software focused on investment management.

It’s particularly well-suited for users or small businesses who want to manage their day-to-day expenses alongside long-term financial planning.

Are you interested in a deeper dive into the financial plans?

Key Features

- Account Aggregation: Syncs with multiple accounts, including Bank of America, to provide a full financial picture.

- Investment Tracking: Monitor investments, including stocks, bonds, and retirement accounts.

- Expense Categorization: Automatically categorizes spending with customizable options.

- Retirement Planning: Tools for tracking retirement savings and forecasting future needs.

- Net Worth Tracking: Calculates and tracks your net worth over time.

Pros and Cons

Pros:

- Combines expense tracking with investment management.

- Excellent investment for high-net-worth individuals.

- Strong security features and financial insights.

Cons:

- Not ideal for those only interested in basic expense tracking.

- Premium services come with higher fees.

5. YNAB (You Need a Budget)

YNAB is a budgeting-first tool that focuses on helping users allocate every dollar they earn.

It’s ideal for those serious about getting control over their finances, with a focus on proactive money management.

Key Features

- Proactive Budgeting: Encourages users to budget every dollar to a specific category.

- Bank Syncing: Automatically syncs with Bank of America for real-time updates.

- Goal Tracking: Helps users set and track financial goals, such as saving or paying off debt.

- Education and Support: Offers extensive educational resources to improve budgeting skills.

Pros and Cons

Pros:

- Strong focus on budgeting and proactive money management.

- Educational tools that help improve financial literacy.

- High user satisfaction with customer support.

Cons:

- Subscription-based model, which may deter some users.

- Requires a learning curve to get the most out of the tool.

6. QuickBooks

QuickBooks is a powerful accounting software that offers extensive expense tracking features, making it ideal for small businesses, freelancers, and those who need to track expenses for tax purposes.

Key Features

- Expense Management: Track expenses, categorize them, and attach receipts for easy record-keeping.

- Invoicing: Create and send invoices directly from the platform.

- Tax Preparation: Simplifies tax filing with easy export of expenses and income.

- Bank Syncing: Automatically syncs with Bank of America for real-time tracking.

Pros and Cons

Pros:

- Comprehensive accounting and expense tracking features.

- Ideal for small businesses and freelancers.

- Strong reporting and analytics, including profit and loss statements.

Cons:

- Higher cost compared to personal expense tracking tools.

- More complex interface that might overwhelm new users.

7. Expensify

Expensify is a specialized tool designed for managing expenses, particularly popular among businesses for handling employee reimbursements.

It’s also suitable for individuals who require detailed expense tracking and receipt management.

Key Features

- Receipt Scanning: Take a picture of your receipt, and Expensify will automatically create an expense entry.

- Automatic Categorization: Automatically categorizes expenses, with options for manual adjustments.

- Reimbursement Management: Streamlines the process of reimbursing employees or yourself.

- Bank Syncing: Syncs with Bank of America for automatic transaction tracking.

Pros and Cons

Pros:

- Excellent for detailed expense tracking and receipt management.

- Simplifies expense reporting for businesses and individuals.

- Integrates well with various accounting software.

Cons:

- Best suited for business users, with advanced features that may be overkill for personal use.

- Subscription required for premium features.

8. Tiller Money

Tiller Money is a great tool that integrates your Bank of America transactions into customizable spreadsheets, allowing you to track your expenses in a format that’s tailored to your preferences.

Key Features

- Spreadsheet Integration: Automatically imports transactions into Google Sheets or Excel.

- Customization: Create and customize your own budget and tracking templates.

- Daily Updates: Receive daily emails summarizing your transactions and balances.

- Security: Bank-grade security ensures your data is safe.

Pros and Cons

Pros:

- Ultimate flexibility with spreadsheet-based tracking.

- Ideal for users who prefer a hands-on approach to budgeting.

- Daily updates keep your financial data current.

Cons:

- Requires familiarity with spreadsheets, which may be a barrier for some users.

- Subscription fee for access to features.

9. EveryDollar

EveryDollar, developed by the team behind Dave Ramsey’s financial advice, is a simple and effective budgeting tool that helps users plan their expenses and track spending against their budgets.

Key Features

- Zero-Based Budgeting: Allocate every dollar of your income to specific categories, ensuring nothing is unaccounted for.

- Bank Syncing: Syncs with Bank of America for automatic transaction updates.

- Goal Tracking: Set and track progress towards financial goals like paying off debt or saving for a major purchase.

- User-Friendly Interface: Simple, clean interface designed for easy use.

Pros and Cons

Pros:

- Strong focus on budgeting and financial goals.

- User-friendly, with minimal learning curve.

- Based on proven financial principles.

Cons:

- Limited advanced features for detailed expense tracking.

- Subscription required for bank syncing and premium features.

10. PocketGuard

PocketGuard is a user-friendly app designed to help you see exactly how much disposable income you have after accounting for bills, goals, and necessities.

It’s ideal for those who need help managing day-to-day spending.

Key Features

- In My Pocket: Shows you how much money you have available to spend after bills and savings.

- Bank Syncing: Automatically syncs with Bank of America for real-time updates.

- Budgeting Tools: Helps you create a budget and track spending against it.

- Bill Tracking: Automatically detects and tracks your recurring bills.

Pros and Cons

Pros:

- Simple, easy-to-use interface.

- Focuses on helping users avoid overspending.

- Automatic bill tracking and categorization.

Cons:

- Limited advanced features for detailed expense tracking.

- Some features require a premium subscription.

5 Reasons why Expense Tracking is Important for Financial Health

1. Creating a Realistic Budget

Expense tracking is the foundation of effective budgeting.

By understanding where your money is going, you can create a budget that reflects your actual spending habits, rather than estimates.

This approach ensures that all necessary expenses are covered while leaving room for savings and investments.

2. Achieving Financial Goals

Tracking your expenses plays a critical role in achieving financial goals, whether it’s saving for a vacation, paying off debt, or investing in retirement.

By monitoring where every dollar goes, you can identify areas to cut back and reallocate funds towards your goals.

3. Preventing Overspending

One of the most common financial pitfalls is overspending, often due to a lack of awareness about where your money is going.

Expense tracking allows you to see exactly how much you’re spending in each category, helping to curb unnecessary expenditures.

4. Simplifying Tax Preparation

For business owners and freelancers, accurate expense tracking is vital for tax preparation.

By categorizing expenses throughout the year, you can simplify the process of filing taxes and maximize deductions.

5. Enhancing Financial Awareness

Knowing where your money is going each month gives you the power to make informed decisions that improve cash flow for better financial health.

This awareness helps you avoid debt, maintain a healthy credit score, and build a stronger financial future.

Top 7 Features to Look for in Expense Tracking Tools

.1. Real-Time Bank Synchronization

Real-time synchronization with your Bank of America account ensures that your transactions are always up-to-date.

This feature eliminates the need to manually input data, reducing errors and saving time.

2. Automatic Expense Categorization

Automatic categorization saves you the hassle of sorting through transactions manually.

The tool should accurately categorize expenses and allow you to adjust categories as needed.

3. Budgeting Capabilities

The ability to set and monitor budgets for different spending categories is crucial.

Look for tools that allow you to create monthly, quarterly, or annual budgets and alert you when you’re approaching your limits.

4. Comprehensive Reporting

Detailed reports provide insights into your spending habits, helping you identify trends and make data-driven decisions.

The best tools offer customizable reports that you can tailor to your specific needs.

5. Multi-Account Integration

If you manage multiple financial accounts (e.g., checking, savings, credit cards), your expense tracking tool should integrate all of them, providing a clear view of your finances.

6. Alerts and Notifications

Real-time alerts for large transactions, budget overruns, or upcoming bills can help you stay on top of your finances and avoid costly mistakes.

7. Cloud Backup

Cloud backup ensures that your data is safe and accessible from any device.

This feature is crucial for maintaining data integrity and providing peace of mind.

5 Steps to Integrate Expense Tracking Tools with Bank of America

Integrating your Bank of America account with an expense tracking app is usually straightforward.

Most tools offer simple steps to connect your bank accounts securely.

Here's a general guide:

- Download the Expense Tracking Tool: Ensure the tool you choose is compatible with Bank of America.

- Create an Account: Sign up for the tool using your email and create a secure password.

- Connect Your Bank of America Account: Navigate to the account settings and select the option to add a bank account.

- Authorize the Connection: You’ll be redirected to a secure Bank of America login page to authorize the connection.

- Start Tracking: Once connected, the tool will automatically import and categorize your transactions.

Detailed Comparison of the Best Tools

While each tool has its strengths, the best one for you depends on your specific needs.

3 Common Mistakes to Avoid in Expense Tracking

1. Ignoring Small Purchases

Small, frequent purchases can add up quickly. Don’t ignore them when tracking expenses; they can greatly impact your budget.

Failing to Categorize Expenses Correctly

Accurate categorization is key to understanding your spending habits. Make sure each expense is correctly categorized to get a true picture of where your money is going.

This is where Banktrack’s customizable categories come in handy!

Not Reviewing Your Expenses Regularly

Regular reviews of your expense reports help you stay on track with your financial goals.

Set aside time each week or month to review your spending and adjust your budget as needed.

Why Choose Banktrack for Expense Tracking

Banktrack is the best option for tracking your expenses from the Bank of America because it combines superior transaction tracking, bank integration, strong security measures, advanced cash flow forecasting, and automated bank reconciliation.

Whether you're a business owner looking to improve financial management or an individual seeking a powerful tool to manage personal finances, Banktrack offers everything you need to optimize your financial performance securely and efficiently.

Share this post

Related Posts

Best 11 alternatives to Monarch Money

These are the best 11 alternatives to Monarch Money for budgeting and finance tracking in 2024.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed