What is the Best Bank Tracker in the US

- 5 Best Bank Trackers in the US

- 1. Banktrack

- 2. Mint

- 3. You Need a Budget (YNAB)

- 4. Personal Capital

- 5. Simplifi by Quicken

- What is a Bank Tracker?

- 5 Reasons to Use a Bank Tracker in the US

- 1. Avoid Overdraft Fees and Late Payments

- 2. Detect Fraud and Unauthorized Transactions Early

- 3. Budget More Effectively

- 4. Monitor Multiple Accounts Easily

- 5. Set and Achieve Financial Goals

- 6 Key Features to Look for in a Bank Tracker

- 1. Real-Time Notifications

- 2. Customizable Budget Categories

- 3. Strong Security Features

- 4. Cross-Platform Access

- 5. Integration with Multiple Accounts

- 6. Goal Setting and Progress Tracking

- How to Choose the Right Bank Tracker for You

- 1. Your Financial Goals

- 2. Number of Accounts

- 3. Pricing

- 4. User-Friendly Interface

- 5. Security

- Why Banktrack is the Best Bank Tracker in the US

We have the best bank tracker in the US amongst this list:

- Banktrack

- Mint

- You Need a Budget (YNAB)

- Personal Capital

- Simplifi by Quicken

Managing your money doesn’t have to be a headache.

Whether you’re juggling multiple accounts, trying to stick to a budget, or simply aiming to save more, a bank tracker can really help in how you handle your finances.

Think about it, having a tool that gives you real-time insights, keeps an eye on your spending, and helps you avoid those sneaky fees is a game-changer.

In this guide, we’re diving into the world of bank trackers and why they’re a must-have for anyone serious about managing their money in the US. We’ll explore how they work, and highlight the best options available.

5 Best Bank Trackers in the US

Let’s explore some of the best options available in the US.

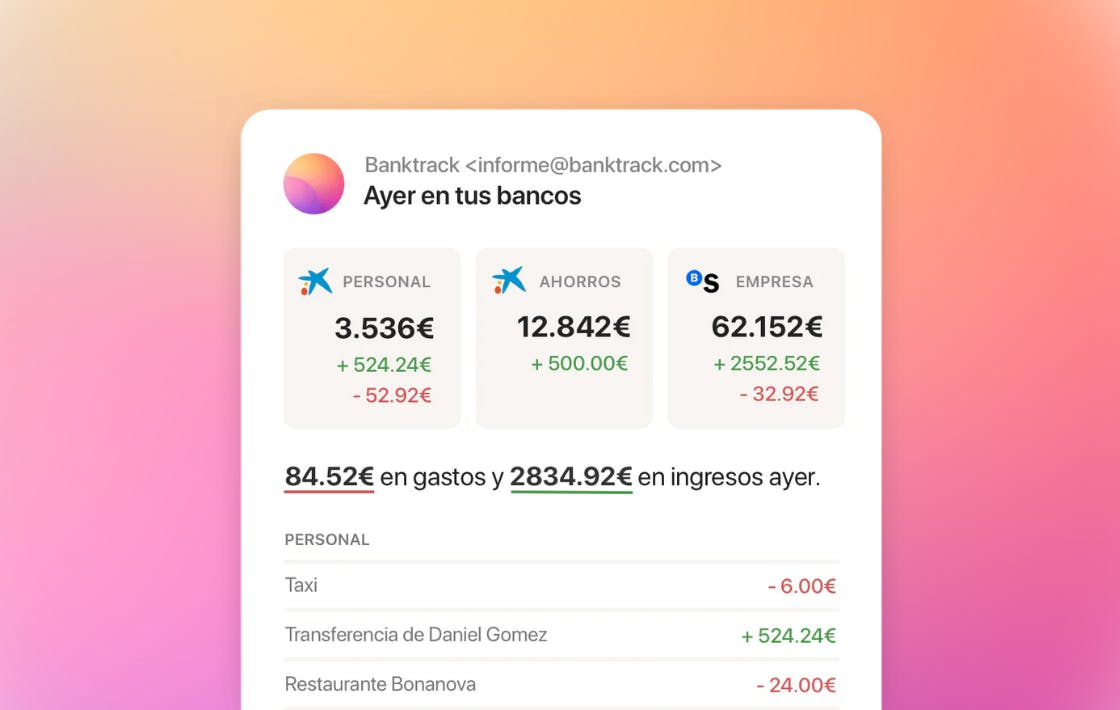

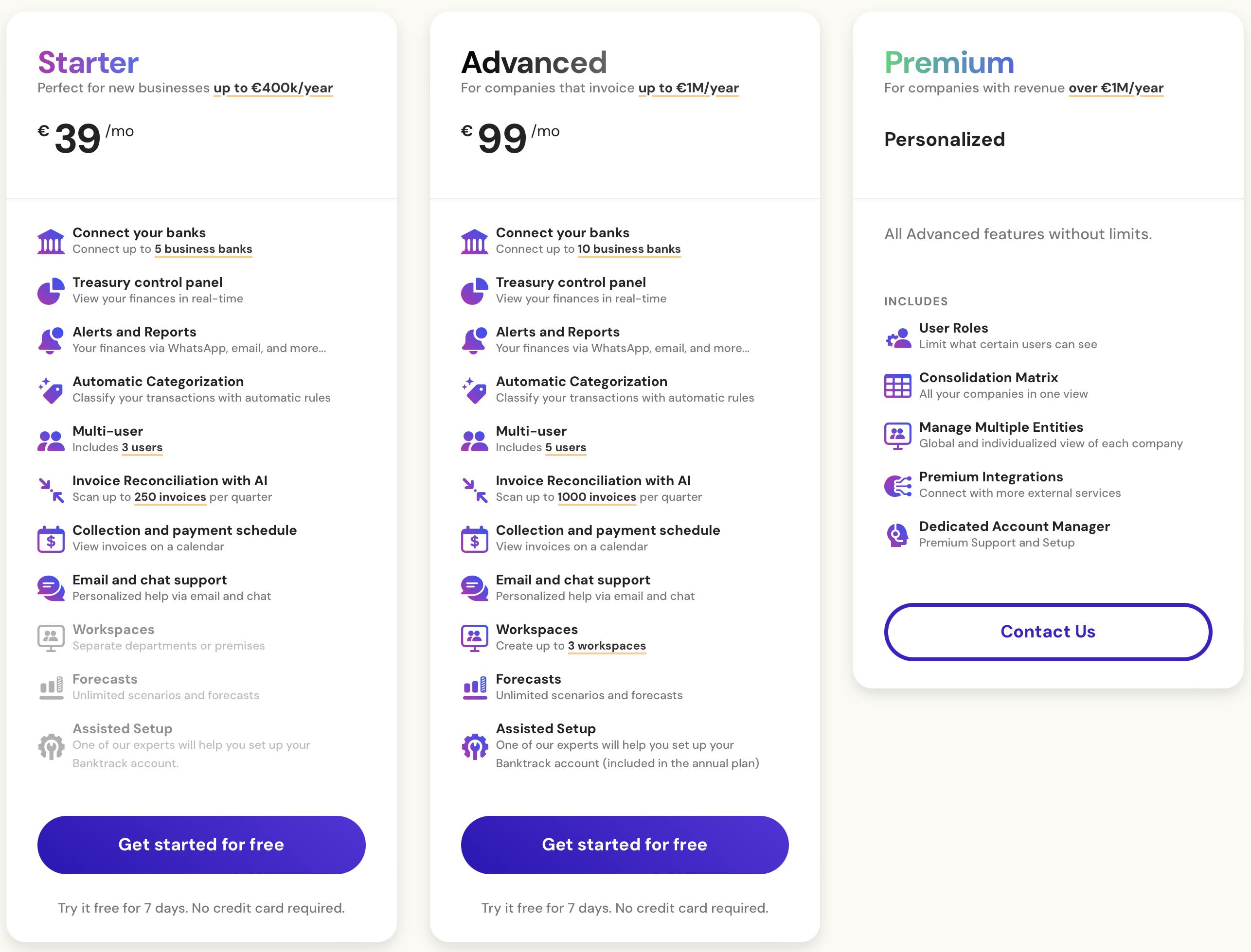

1. Banktrack

Banktrack is the leading expense tracker app for users in the US, offering powerful features that make managing your finances easier and more efficient.

With real-time tracking, customizable dashboards, and seamless integration with multiple banks, Banktrack is the best option for both individuals and businesses.

Key Features:

- Customizable Dashboards: Banktrack lets you personalize your financial dashboard to focus on what’s important to you. Whether it’s tracking expenses, monitoring savings, or managing business accounts, you can tailor your dashboard to fit your financial goals.

- Real-Time Alerts: Banktrack sends real-time notifications to your preferred platform, such as WhatsApp, SMS, email, or Slack. You’ll get instant alerts for low balances, spending limits, or unusual account activity.

- Integration with Multiple Banks: Banktrack is the best app to link all bank accounts because it connects with over 120 banks, including major US banks, allowing you to sync all your accounts in one place for a complete financial overview.

- Spending Limits and Budgeting: Set spending limits for different categories like dining, groceries, and bills. Banktrack will alert you when you’re close to reaching your spending limit, helping you stay within your budget.

- Automated Reports: Generate and customize financial reports, which can be sent via WhatsApp, email, or other platforms. This is especially helpful for businesses or freelancers needing to keep track of expenses.

- Affordable Pricing: Banktrack offers affordable pricing, starting at just €16.58 per month, making it an accessible solution for individuals and businesses alike.

2. Mint

Mint is one of the most popular free bill management app in the US.

It connects to most US financial institutions, allowing you to monitor your accounts, credit cards, and investments in one place.

Mint offers budgeting tools, bill reminders, and even credit score monitoring.

- Pros: Free to use, easy-to-read financial summaries, detailed spending breakdowns.

- Cons: Ads in the app can be distracting for some users.

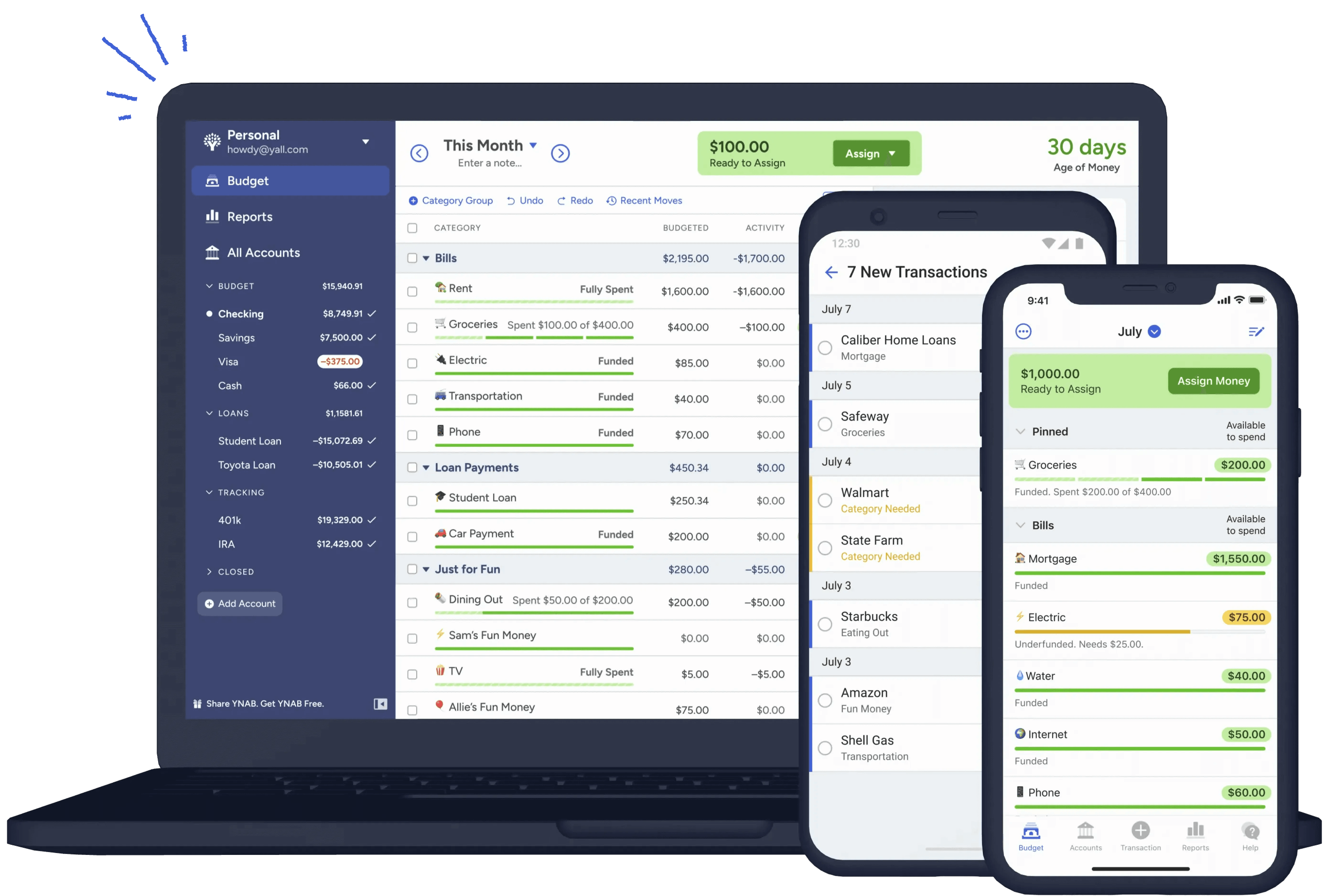

3. You Need a Budget (YNAB)

YNAB is a paid budgeting app designed to help users manage their money proactively.

It encourages users to "give every dollar a job," helping them stay disciplined with their spending and saving.

- Pros: Excellent for budgeting, great for managing both short-term and long-term financial goals.

- Cons: Subscription fee might be a downside for some users.

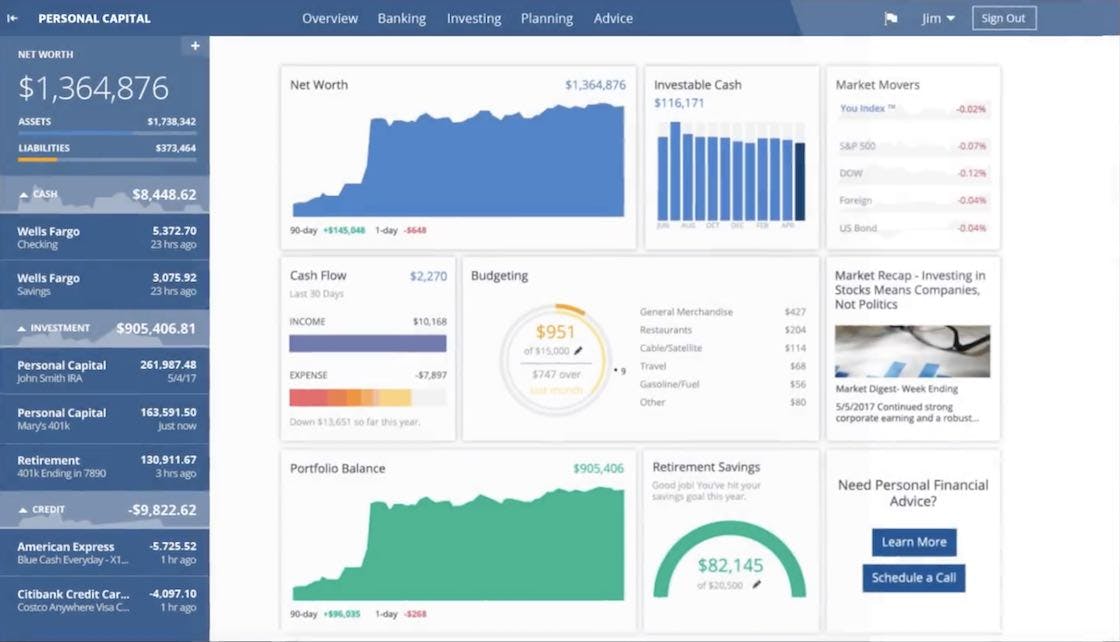

4. Personal Capital

Personal Capital, now rebranded to Empower, is ideal for users who want to track both their spending and their investments.

It provides a detailed overview of your financial health, including net worth, and offers strong investment tracking tools.

It is also very well seen by many as a good cash visibility tool because of this.

- Pros: Great for tracking investments and net worth, integrates with most US banks and financial institutions.

- Cons: Some advanced features require a premium subscription.

5. Simplifi by Quicken

Simplifi by Quicken is a modern, user-friendly bank tracker that allows users to manage their finances with ease.

It offers customizable budgets, real-time spending tracking, and easy integration with multiple US banks.

- Pros: Simple and easy to use, real-time updates, customizable categories.

- Cons: Requires a subscription after a 30-day trial period.

What is a Bank Tracker?

A bank tracker is a tool, usually in the form of an app or software, that helps you monitor your bank accounts, spending, and financial health in real time. It connects to your bank accounts, allowing you to track transactions, set budgets, monitor savings, and sometimes even track investments.

By categorizing transactions and sending alerts for important account activities, a bank tracker gives you a clearer picture of where your money is going.

Bank trackers make it easy to manage all your financial accounts in one place. This simplifies the process of managing your finances and helps you make smarter financial choices.

5 Reasons to Use a Bank Tracker in the US

There are many benefits to using a bank tracker, from improving your budgeting to detecting fraud early.

Here are some key reasons why using a bank tracker in the US can be a valuable addition to your financial toolkit:

1. Avoid Overdraft Fees and Late Payments

Overdraft fees and missed payments can add up quickly. With a bank tracker, you can set up real-time notifications to alert you when your balance is low or when a bill is due.

This helps you avoid costly penalties and keeps your finances on track.

2. Detect Fraud and Unauthorized Transactions Early

Fraud is a growing concern, but a bank tracker helps you stay on top of your transactions.

By monitoring your accounts in real-time, you’ll receive alerts when something unusual happens, like an unauthorized purchase. You can take immediate action and contact your bank to resolve the issue.

3. Budget More Effectively

A bank tracker makes budgeting much simpler by categorizing your spending and showing you exactly where your money is going. Many trackers allow you to set spending limits in categories like groceries, dining, and entertainment.

If you get close to your spending limit, the app will alert you, helping you stay on track with your budget.

4. Monitor Multiple Accounts Easily

For those managing multiple accounts, a bank tracker allows you to see all your financial activity in one place.

This eliminates the hassle of logging into several accounts separately and gives you a complete view of your financial situation.

5. Set and Achieve Financial Goals

Whether you’re saving for a vacation, a home, or building an emergency fund, a bank tracker helps you set and track your financial goals.

Some apps allow you to automate savings by scheduling transfers into your savings account or investment funds.

6 Key Features to Look for in a Bank Tracker

When selecting a bank tracker in the US, it’s important to choose one that fits your financial needs. Here are some key features to consider when choosing a bank tracker:

1. Real-Time Notifications

A good bank tracker will provide real-time alerts for important activities such as low balances, large transactions, or upcoming bill payments.

These notifications help you stay on top of your finances and prevent overspending or missed payments.

2. Customizable Budget Categories

It’s important to choose a bank tracker that allows you to create custom categories for your spending.

This feature enables you to track spending in specific areas, like groceries, rent, or travel, and set limits for each category.

3. Strong Security Features

Your financial information is sensitive, so your bank tracker should have strong security measures.

Look for encryption, two-factor authentication, and other data protection features to ensure your information is secure.

4. Cross-Platform Access

You should be able to access your bank tracker from any device, whether it’s your phone, tablet, or computer.

Cross-platform access ensures that you can monitor your finances anytime and anywhere.

5. Integration with Multiple Accounts

If you have multiple bank accounts, credit cards, or investment accounts, choose a bank tracker that can integrate them all into one platform.

This provides a complete view of your financial health and makes managing your money easier.

6. Goal Setting and Progress Tracking

For long-term financial planning, a bank tracker that helps you set and track financial goals can be incredibly useful.

Whether you’re saving for a big purchase or trying to pay off debt, goal-setting tools keep you motivated and show your progress.

How to Choose the Right Bank Tracker for You

Choosing the right bank tracker depends on your financial needs and goals.

Here are a few things to consider when deciding which tool is best for you:

1. Your Financial Goals

Are you primarily focused on budgeting, or are you looking for a tool that helps with investment tracking as well?

Depending on your financial goals, certain bank trackers may be better suited for you.

2. Number of Accounts

If you have multiple accounts, such as personal, business, or investment accounts, you’ll want a bank tracker that can integrate all of them into one platform.

This will give you a complete overview of your financial health.

3. Pricing

Some bank trackers are free, while others charge a subscription fee. If you’re willing to pay for more advanced features, it might be worth investing in a premium app like YNAB or Banktrack.

However, if you just need basic tracking, free options like Mint might be sufficient.

4. User-Friendly Interface

If you prefer a simple, easy-to-use app, look for a bank tracker that’s intuitive and straightforward.

Some tools offer advanced features, but they can be overwhelming for users who just need basic functionality.

5. Security

Make sure the bank tracker you choose has strong security measures to protect your financial information.

Look for encryption, two-factor authentication, and other data protection features.

Why Banktrack is the Best Bank Tracker in the US

Using a bank tracker in the US is a smart way to manage your finances, avoid unnecessary fees, and stay on top of your spending.

Banktrack excels because of its user-friendly design, customizable features, and perfect integration with banks. Its real-time alerts, goal-setting tools, and spending controls make it the best option for staying in control of your finances.

Whether you’re managing personal accounts or business expenses, Banktrack provides the flexibility and tools you need to succeed. It also offers strong security features, ensuring that your financial data is protected.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed