Top 5 Best bank trackers in Portugal

- 5 Bank Tracker Available in Portugal

- 1. Banktrack

- 2. Toshl Finance

- 3. N26

- 4. Revolut

- 5. Emma

- 5 Tips to Choose the Right Bank Tracker in Portugal

- Why Banktrack is the Top Bank Tracker in Portugal

- Frequently Asked Questions

- Do I need a Portuguese bank account to use a bank tracker in Portugal?

- Is it safe to connect my bank account to a bank tracker?

- Can I use a bank tracker to manage shared expenses?

5 Bank Tracker Available in Portugal

- Banktrack

- Toshl Finance

- N26

- Revolut

- Emma

Keeping on top of personal finances can be complicated, especially in Portugal, where you might be balancing expenses like rent, food, transportation, and enjoying all the country has to offer.

Whether you’re a full-time resident or here for an extended stay, a bank tracker can simplify your finances, giving you clear insights into spending patterns and helping you work toward your financial goals.

In this guide, we’ll walk you through everything you need to know about using a bank tracker in Portugal, from top recommendations to handy tips on getting the most out of these tools.

5 Bank Tracker Available in Portugal

Several bank trackers are designed to work well in Portugal, offering a range of features suited to different financial needs. Below are some top options to consider:

1. Banktrack

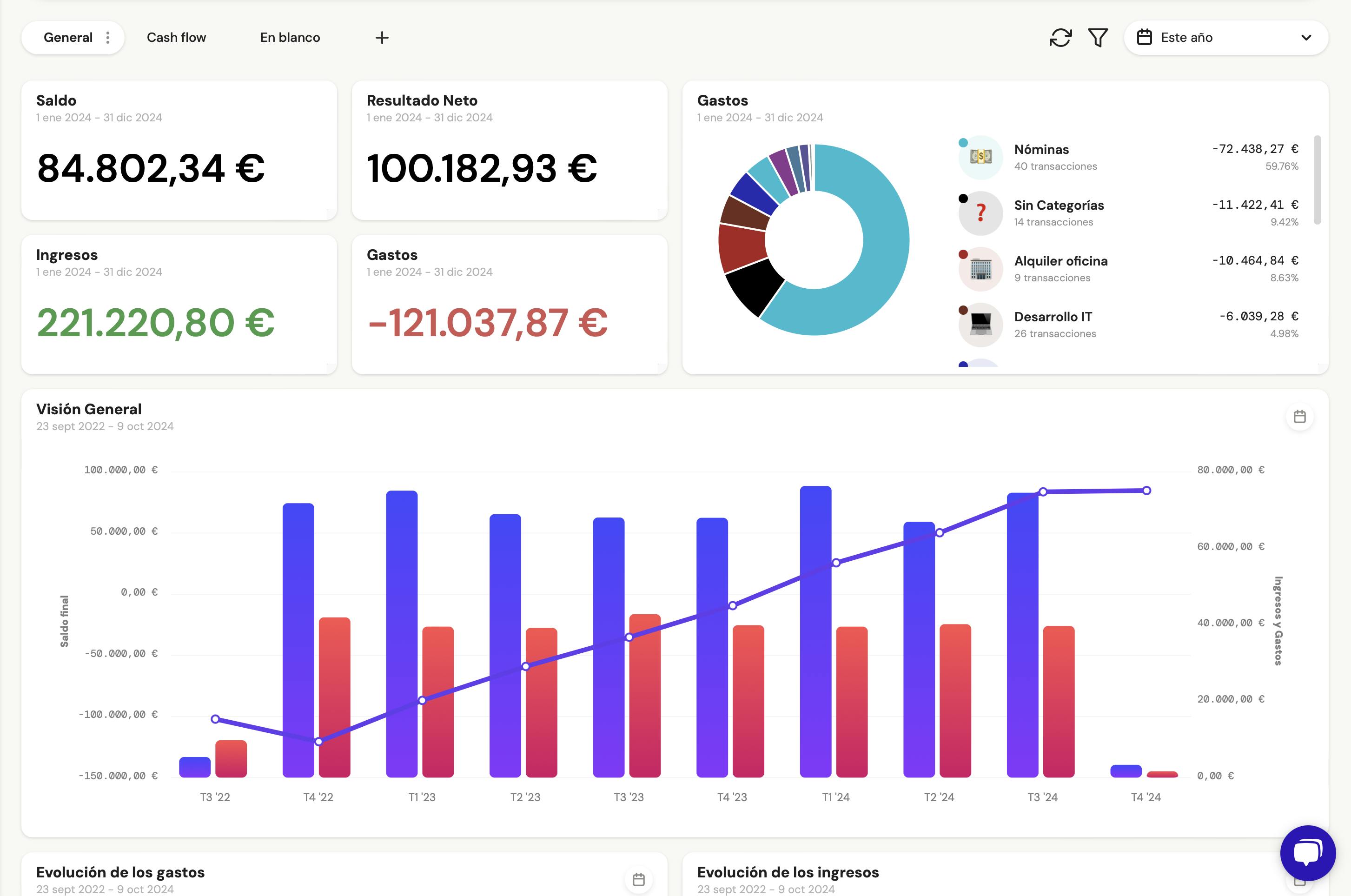

Banktrack stands out as the best expense tracking app for individuals and businesses.

When it comes to managing your finances, you need a tool that not only tracks your expenses but also integrates perfectly with your bank accounts, provides strong security, and offers advanced features to optimize your financial performance.

Banktrack is that expense tracker software with bank sync features.

It allows you to effectively access real-time financial information with its customizable dashboards and flexible categories, making it easy to track both income and expenses.

With Banktrack, you can create personalized reports and receive alerts that help you stay on top of your finances.

Features:

- Personalized Dashboards: Tailor your financial overview to focus on what matters most to you, from income streams to spending habits.

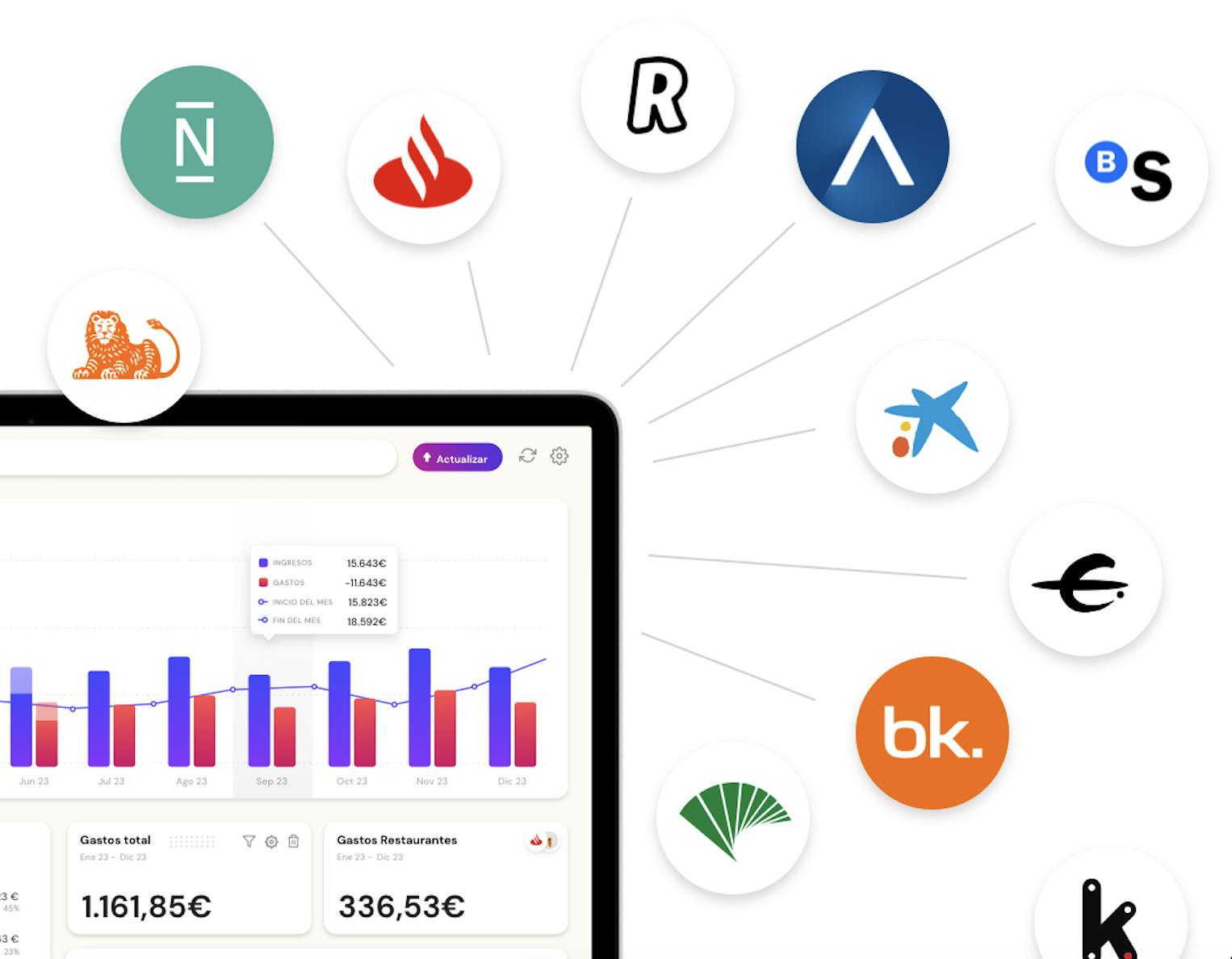

- Integration with Multiple Accounts: It is the best app to link all bank accounts, as it syncs with over 120 banks, including both traditional and neobanks, using Open Banking or Direct Access.

- Customizable Spending Limits: Set limits in different categories, and receive notifications when you're nearing your spending cap, have a low balance, or spot a duplicate charge.

- Automated Alerts and Reports: Get real-time notifications and reports through your preferred channels: WhatsApp, SMS, email, Slack, or Telegram.

- Drag-and-Drop Interface: Banktrack’s easy-to-use interface allows you to create, customize, and send financial reports with just a few clicks.

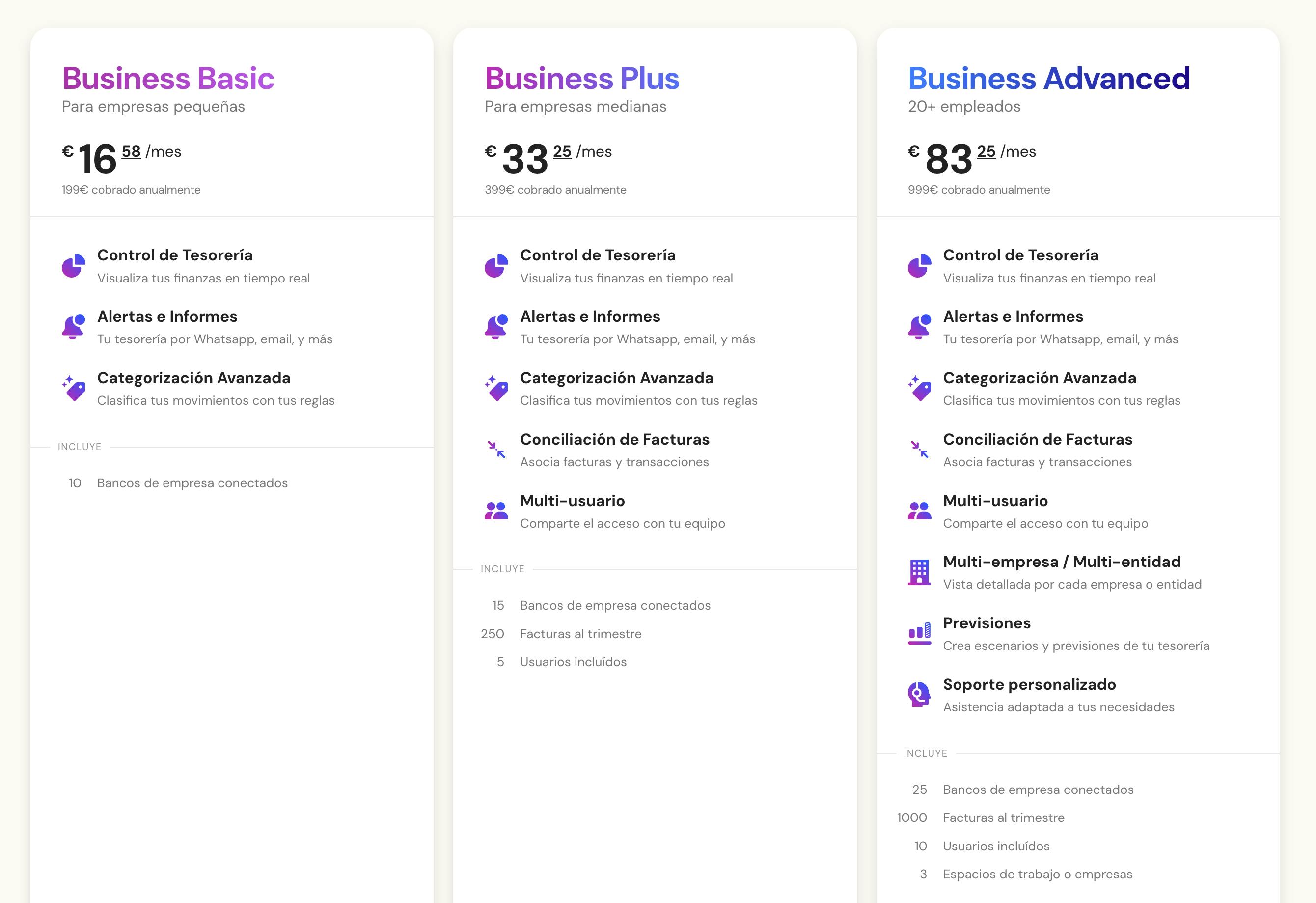

- Affordable Pricing: Plans start at just €16.58 per month, offering great value for businesses or individuals looking to manage their cash flow efficiently.

Banktrack also offers automated transaction syncing, ensuring that your financial data is up to date without manual input. You can monitor expenses, revenues, and set financial goals that help you stay on track with your budgeting efforts.

When it comes to security, Banktrack takes protection seriously. It uses encryption to safeguard all your transaction data, and it never stores your banking passwords.

Banktrack only has "read access" to your account information, meaning it can't make any transactions on your behalf.

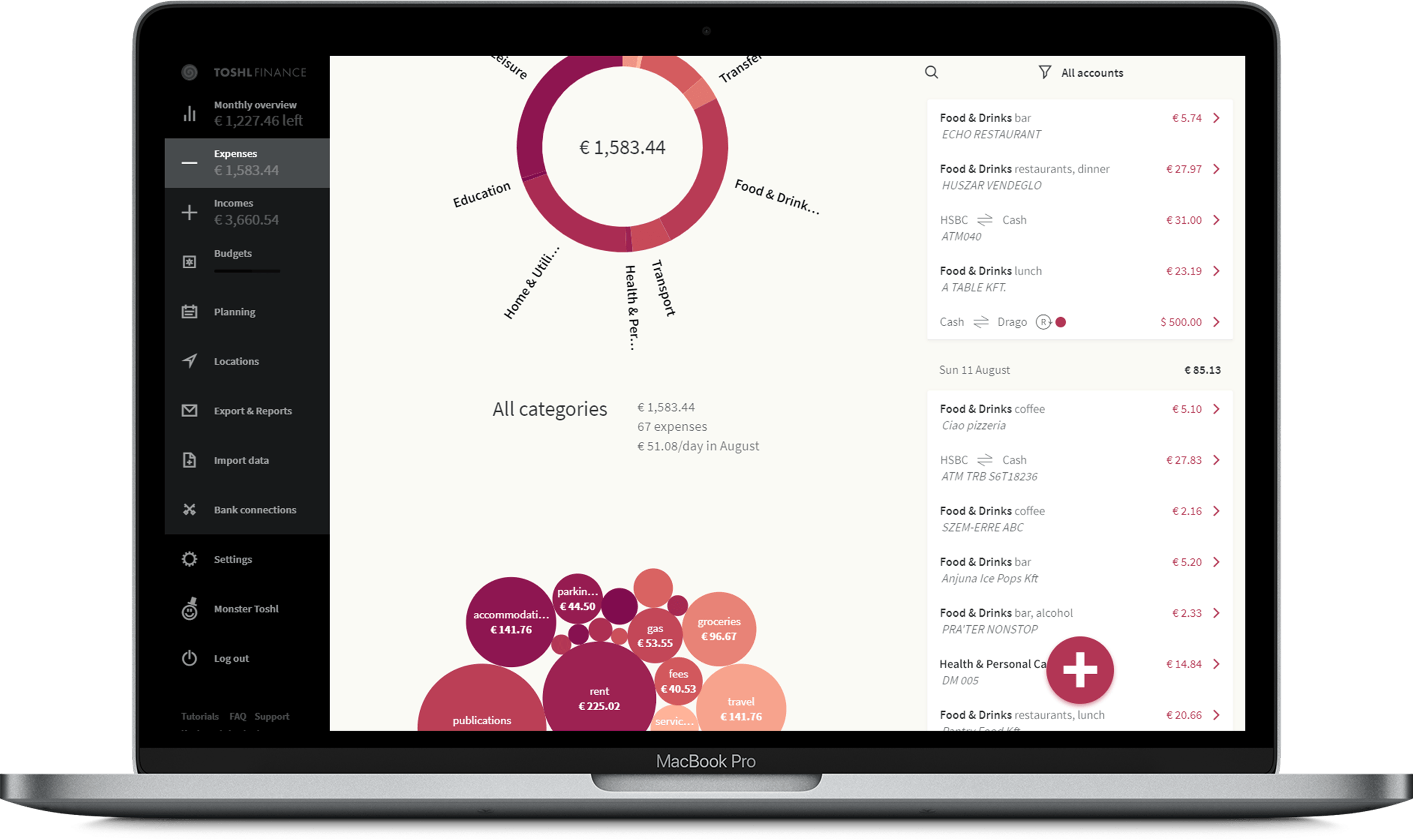

2. Toshl Finance

Toshl Finance offers currency support, which is helpful if you’re dealing with euros and other currencies. It's easy-to-navigate interface makes it a choice for those who want a solution to keep track of everyday spending in Portugal.

You can also create shared budgets for group expenses, which is convenient if you’re sharing costs with friends or family.

Features:

- Multi-currency support, perfect for international users.

- User-friendly interface for quick tracking and budget adjustments.

- Allows budget-sharing options for group expenses.

3. N26

N26 is a digital bank that integrates tracking within its banking app, providing real-time notifications for each transaction.

It’s for young professionals and frequent travelers in Portugal, offering free euro withdrawals across the Eurozone and low-cost international transfers.

With built-in financial tracking, N26 simplifies budgeting and gives you immediate feedback on your spending habits.

Features

- Real-time transaction notifications.

- Free euro withdrawals across Europe, with low international fees.

- Financial tracking integrated into the banking app.

4. Revolut

Revolut is a choice for its straightforward approach to banking and tracking, especially among those who frequently travel or have multi-currency accounts.

Revolut’s built-in analytics provide insights into your spending by category, and you can set savings goals within the app.

Plus, Revolut’s multi-currency support makes it a good option for managing foreign transactions.

If you are particularly interested in this function that allows you to have a clear view of your expenses, you may be interested in the top 5 best cash visibility tools in 2024.

Features

- Tracks spending by category and offers insights.

- Allows savings goals to help you stay on track.

- Supports multiple currencies, ideal for those who travel often.

5. Emma

Emma is a financial tracker that’s for users who want a more personalized budgeting experience in Portugal. Known for its user-friendly interface, Emma syncs with major banks to track expenses, categorize spending, and show insights into your finances.

One of Emma’s standout features is its ability to detect and help you manage subscriptions, great for avoiding surprise renewals. It’s designed to simplify your financial overview while offering tools to help you save and budget more effectively.

Features:

- Connects with major Portuguese banks and offers detailed spending breakdowns.

- Identifies and manages recurring subscriptions, so you stay aware of monthly commitments.

- Offers budget-setting tools with a fun, visual approach, motivating users to reach their savings goals.

5 Tips to Choose the Right Bank Tracker in Portugal

With several options available, consider the following factors to find the best bank tracker for your needs:

1. Bank Compatibility

Ensure the tracker is compatible with major Portuguese banks like Caixa Geral de Depósitos, Millennium BCP, and Novo Banco. This is essential for smooth data syncing.

2. Currency Options

Some trackers offer better multi-currency support than others. If you have international accounts, this feature is helpful to keep all your finances organized in one place.

3. Security Features

Look for secure options like two-factor authentication and encryption to keep your financial data safe.

4. Cost and Subscription Plans

Some bank trackers are free, while others come with premium features at a cost. Check your budget to decide if a free option is sufficient or if a premium service would be more beneficial.

5. User Interface

A user-friendly interface will encourage you to use the tracker consistently. Look for intuitive designs that make tracking expenses quick and easy.

Why Banktrack is the Top Bank Tracker in Portugal

In Portugal, using a bank tracker is a smart way to stay on top of your finances, avoid extra fees, and keep your spending in check.

Banktrack stands out for its intuitive design, customizable options, and seamless integration with local banks. With features like real-time alerts, goal-setting tools, and spending controls, it’s an excellent choice for managing your money effectively.

Whether you’re handling personal finances or business expenses, Banktrack provides the flexibility and support you need. It also prioritizes security, ensuring your financial data is well-protected.

Frequently Asked Questions

Do I need a Portuguese bank account to use a bank tracker in Portugal?

Not necessarily. Many trackers support international accounts, but for local transactions, a Portuguese bank account can provide more accuracy.

Is it safe to connect my bank account to a bank tracker?

Yes, as long as you’re using a trusted app with strong encryption and two-factor authentication. Always check the app’s privacy and data security policies to ensure they align with your comfort level.

Can I use a bank tracker to manage shared expenses?

Yes! Many bank trackers let you split bills and manage shared expenses, making them perfect for group trips or household costs.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed