How to do a business plan with financial projections

- What Are Business Plan Financial Projections?

- Why Are Financial Projections Critical for a Business Plan?

- 5 Key Components of Financial Projections

- 1. Revenue Projections

- 2. Expense Forecasts

- 3. Cash Flow Projections

- 4. Profit and Loss Statement

- 5. Break-Even Analysis

- How Banktrack Enhances Financial Projections

- 1. Automated Data Integration

- 2. Cash Flow Insights

- 3. Customizable Spending Metrics

- 4. Scenario Planning

- 5. Real-Time Forecasting Updates

- 6. Easy-to-Generate Reports

- Best Practices for Creating Financial Projections with Banktrack

- Banktrack: The Ultimate Tool for Business Plan Projections

- Ready to Simplify Your Financial Projections?

This is how you can do a business plan with financial projections

Financial projections are the backbone of a solid business plan.

Whether you’re launching a startup, expanding your current business, or seeking funding, clear and accurate financial forecasts demonstrate your ability to manage resources, plan for growth, and generate returns.

This guide will help you understand the importance of financial projections, the key components to include in your business plan, and how tools like Banktrack can simplify the process, making it more accurate and efficient.

What Are Business Plan Financial Projections?

Financial projections are estimates of your business's future revenue, expenses, and profitability.

They provide a detailed roadmap of your financial goals and strategies for achieving them. Investors, lenders, and stakeholders often review these projections to evaluate the viability of your business idea or plan.

Projections typically include:

- Income Statement (Profit & Loss Statement): Forecast of revenue, costs, and net profit.

- Cash Flow Statement: Prediction of cash inflows and outflows to ensure liquidity.

- Balance Sheet: Overview of your assets, liabilities, and equity at a specific point in time.

Why Are Financial Projections Critical for a Business Plan?

- Attracting Investors and Securing Funding: Projections show potential investors or lenders that your business has a clear path to profitability.

- Strategic Decision-Making: They guide critical decisions, such as resource allocation, hiring, and scaling.

- Risk Management: Projections help identify potential financial challenges and prepare contingency plans.

- Performance Tracking: Comparing actual results to projections allows you to measure success and adjust your strategies accordingly.

5 Key Components of Financial Projections

1. Revenue Projections

Estimate how much money your business will generate from sales. Break this down into different revenue streams and include assumptions, such as pricing, market demand, and customer growth.

2. Expense Forecasts

Predict your fixed and variable costs, including rent, utilities, payroll, marketing, and inventory. Clearly define one-time costs (e.g., startup costs) versus recurring expenses.

3. Cash Flow Projections

Outline how cash will move in and out of your business, ensuring there’s enough liquidity to cover operational expenses.

4. Profit and Loss Statement

Summarize your expected profitability by calculating revenue minus expenses. This gives a snapshot of your business’s financial health over time.

5. Break-Even Analysis

Determine the point where your revenue matches your expenses. This helps you understand when your business will start generating a profit.

How Banktrack Enhances Financial Projections

Creating financial projections can be a time-consuming and complex process, especially when managing multiple data points.

Banktrack simplifies the task by automating data collection, generating reports, and providing insights to improve the accuracy of your forecasts.

Here’s how Banktrack can help you create better financial projections for your business plan:

1. Automated Data Integration

Banktrack connects directly to your bank accounts and financial products, pulling real-time data to streamline your projections.

Instead of manually entering income and expense data, this cash management software ensures all financial transactions are accounted for automatically.

This reduces errors and saves time, giving you more bandwidth to focus on strategy.

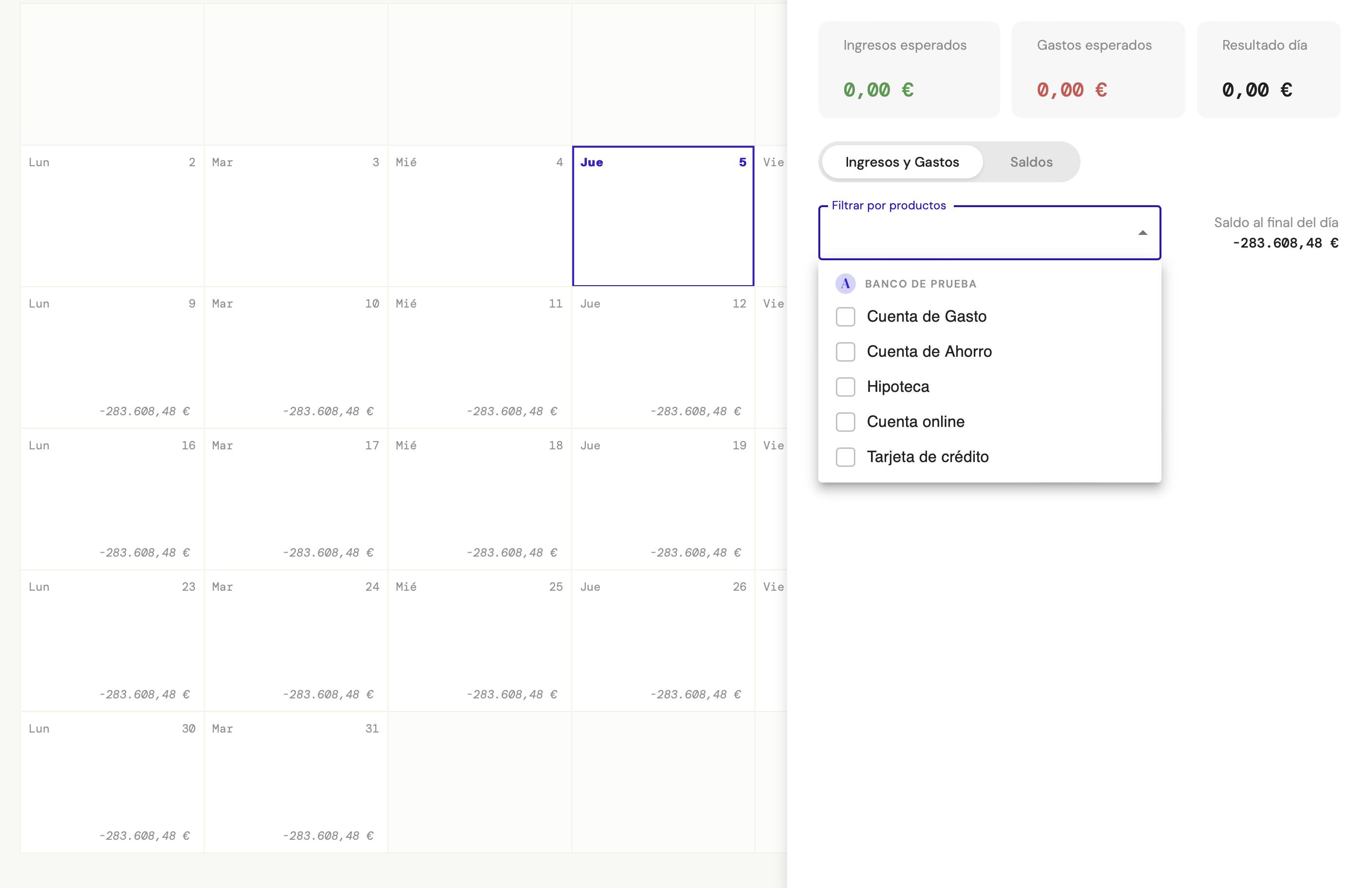

2. Cash Flow Insights

Banktrack excels in tracking and forecasting cash flow. Its customizable dashboards let you monitor cash inflows and outflows, ensuring your cash flow projections are accurate and up-to-date.

This real-time tracking makes it easier to forecast liquidity for upcoming operational expenses, seasonal fluctuations, or growth initiatives.

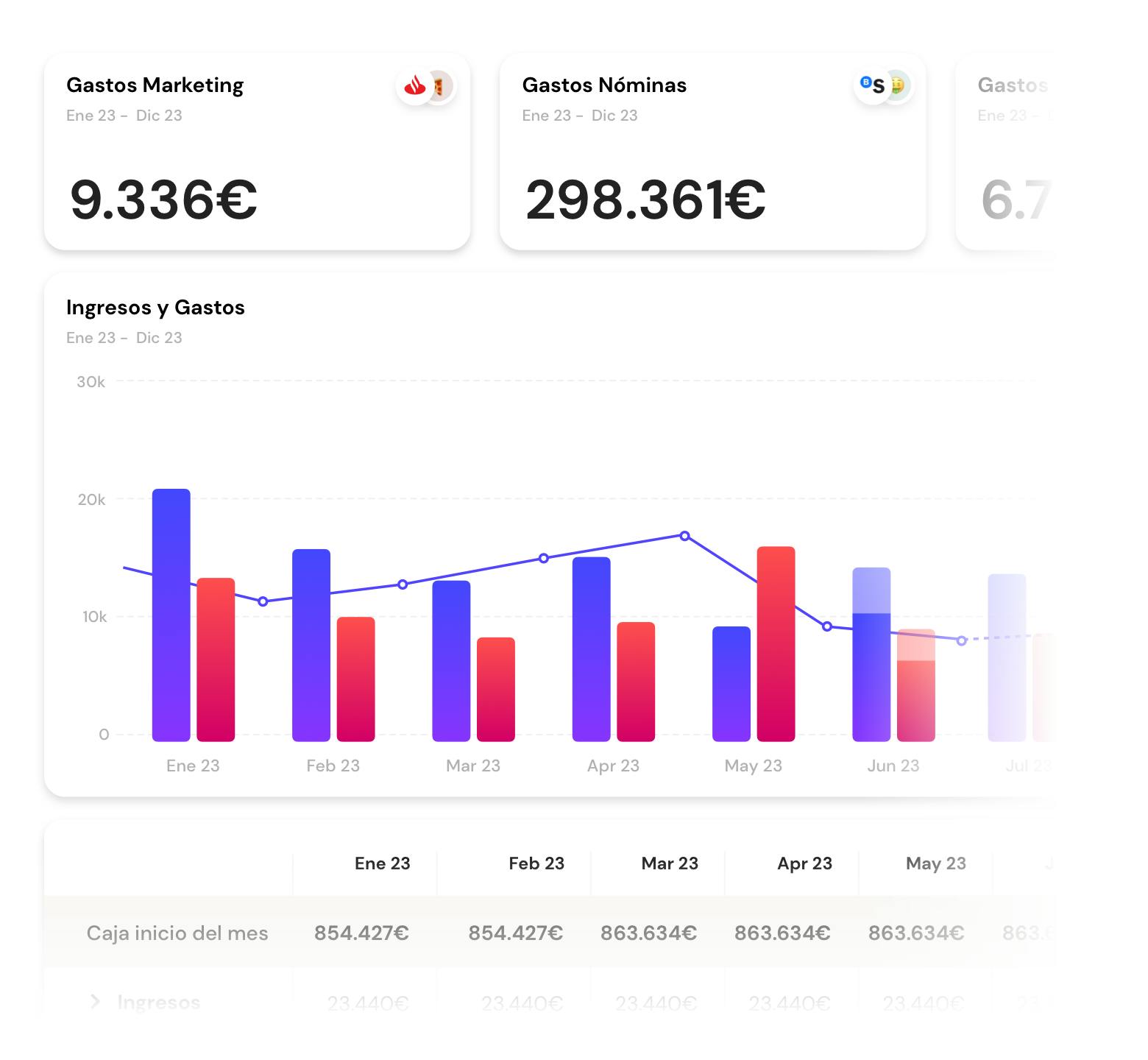

3. Customizable Spending Metrics

For detailed expense forecasts, Banktrack allows you to categorize and analyze spending trends.

This makes it easy to break down costs into fixed and variable expenses, helping you fine-tune your profit and loss projections and keep a very good track of business expenses.

The software’s visual reports provide a clear picture of where your money is going, so you can identify areas for optimization. This can also make it easier for you to deal with cash flow problems effectively.

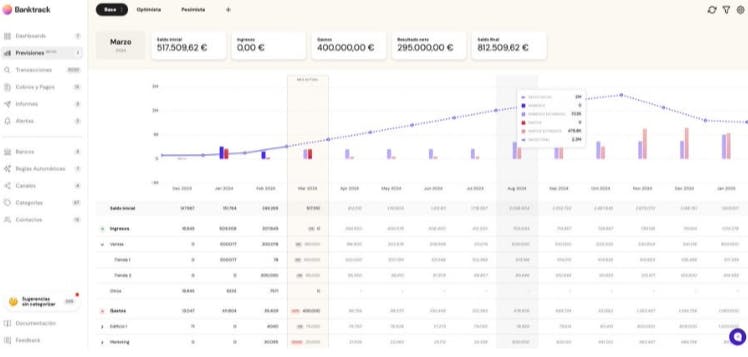

4. Scenario Planning

When creating financial projections for your business plan, you often need to consider multiple scenarios.

For example, what happens if sales grow faster than expected? Or what if there’s an unexpected increase in costs?

Banktrack enables you to create and compare multiple financial scenarios, helping you present a comprehensive and well-prepared business plan to investors or stakeholders.

5. Real-Time Forecasting Updates

Projections aren’t static, they evolve as your business grows and conditions change. Banktrack’s real-time updates ensure your financial projections stay current.

With every transaction automatically reflected in your forecasts, you’ll always have the most accurate data at your fingertips.

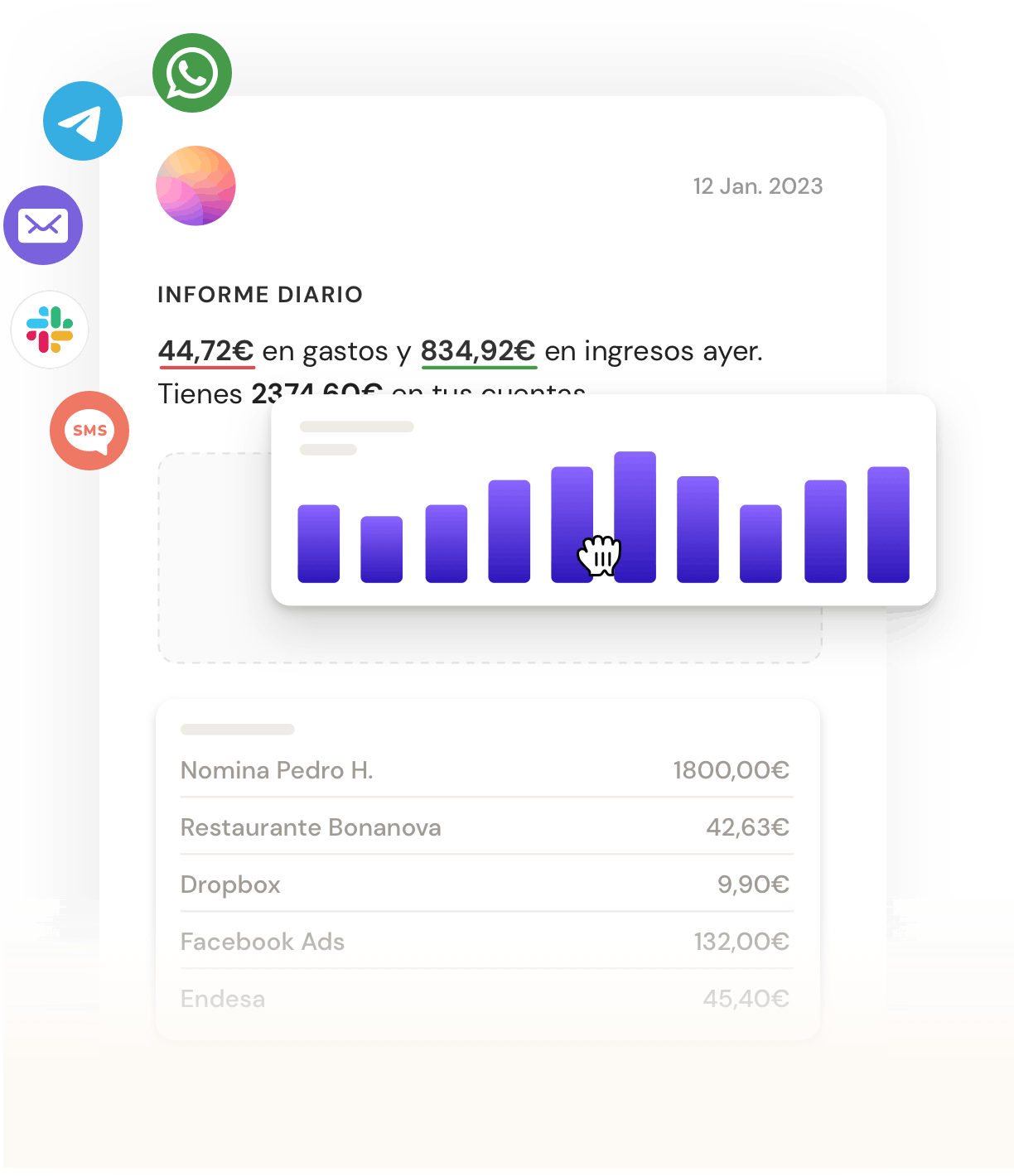

6. Easy-to-Generate Reports

Banktrack simplifies the process of creating professional-grade reports for your business plan.

From income statements to cash flow projections, the software generates clear, concise, and visually appealing documents that are ready to share with investors, lenders, or partners.

Best Practices for Creating Financial Projections with Banktrack

- Start with Accurate Data: Use Banktrack to integrate all your financial accounts and ensure your projections are based on real-time, reliable information.

- Be Conservative: When forecasting revenue, use conservative estimates to avoid overestimating growth potential.

- Update Regularly: As your business evolves, update your projections in Banktrack to reflect new opportunities, expenses, or changes in the market.

- Prepare for Contingencies: Use Banktrack’s scenario planning features to model potential challenges and outline solutions.

Banktrack: The Ultimate Tool for Business Plan Projections

Financial projections are the foundation of a strong business plan, and Banktrack makes creating them easier, faster, and more reliable.

Its automated tools, real-time insights, and strong reporting capabilities ensure your projections are not only accurate but also professional and investor-ready.

By incorporating Banktrack into your financial planning process, you can:

- Save time on manual calculations.

- Improve the accuracy of your projections.

- Present polished, data-driven financial forecasts that instill confidence in stakeholders.

Ready to Simplify Your Financial Projections?

Take the guesswork out of your business plan with Banktrack. Start today and create financial projections that set your business up for success. Try Banktrack now and take control of your financial future!

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed