How to take control of your money in 2024

- Why Use a Personal Finance App?

- All-in-One Account Aggregation: Seeing the Full Picture

- Building a Budget That Fits Your Life

- Investment Tracking and Portfolio Insights

- Setting Goals and Tracking Progress

- Collaborative Financial Planning

- Personalized Insights and Tips

- Security and Privacy: Peace of Mind with Bank-Level Protection

- Take Control of your Money with Banktrack

- Key Features:

- Pricing and Free Trials

- Finding the Right App for You

This is how you can take control of your money in 2024.

Managing finances can feel overwhelming, especially with multiple bank accounts, credit cards, and investment accounts to track.

But today, the right personal finance app can bring all of your accounts and goals together, making it simpler to manage money, save, invest, and stay on top of your financial life, all in one place.

This guide will explore everything you need to know about personal finance apps: what they can do, how to use them, and why they’re essential for gaining financial peace of mind.

Imagine having a single dashboard where all your financial information is available at a glance, from your checking account and credit card balance to your mortgage and investment accounts.

A good personal finance app does just that by automatically syncing with your accounts and giving you a clear picture of where you stand financially.

This not only saves time but also empowers you to make informed decisions based on a full view of your financial life.

So, whether you’re a budgeting beginner, an experienced investor, or somewhere in between, there’s a personal finance tool out there to help you manage your money in a way that suits your needs.

Why Use a Personal Finance App?

Finance apps aren’t just about tracking expenses or setting up a budget, they’re comprehensive tools that can help you take control of your entire financial picture. They give you the power to:

- Organize all your finances in one place: Forget logging into multiple accounts or sifting through paperwork. A finance app pulls together all your financial data so you can view everything in one location.

- Create a realistic budget: With accurate tracking of all your expenses, a good finance app helps you budget based on actual spending rather than estimates. This makes sticking to a budget far easier.

- Track investments and plan for growth: If you’re investing, a personal finance app can help you monitor your portfolio’s performance, see how your assets are growing, and understand how your investments fit into your long-term financial goals.

- Set and achieve financial goals: Whether it’s saving for a new car or paying off debt, finance apps let you set clear goals and see your progress over time, helping you stay motivated and on track.

- Get personalized insights into spending: Some apps analyze your spending habits and offer tips to improve your financial health, giving you more control over your money.

These features make personal finance apps a must-have for anyone looking to simplify money management. Next, let’s break down the core features and benefits of using these tools.

All-in-One Account Aggregation: Seeing the Full Picture

One of the biggest advantages of a personal finance app is its ability to pull together all your financial accounts, checking and savings, credit cards, loans, and investments, into a single dashboard.

This full visibility lets you see exactly where your money is and where it’s going, helping you make informed decisions without needing multiple logins or statements.

Imagine logging in and seeing your checking balance, credit card debt, savings for an upcoming vacation, and the current value of your investments, all side-by-side.

It’s an instant snapshot of your net worth, spending power, and progress toward financial goals. Some apps even go a step further by categorizing transactions, giving you deeper insights into spending patterns.

Account aggregation also saves time. No more jumping between different banking and investment platforms, just one login to access everything. Plus, the real-time syncing of these accounts ensures that every transaction, payment, and change in account balance is up to date.

Example Use Case: If you have accounts at multiple banks and investment firms, a personal finance app like Banktrack can sync with each one. Every time you make a payment, deposit, or purchase, the app updates automatically, showing you exactly where you stand financially.

Building a Budget That Fits Your Life

Budgeting is one of the most popular features of personal finance tracking apps, but the best tools go beyond simple income and expense tracking.

They let you create a personalized budget with categories that fit your life, like dining out, travel, groceries, and entertainment. You can even set specific limits for each category and roll over any unspent funds from month to month.

With monthly rollovers, you won’t feel punished for spending less one month and a little more the next.

You can save on dining one month and apply the leftover funds toward a bigger restaurant outing the next.

Advanced budgeting tools even provide alerts if you’re close to reaching a category limit, so you can adjust spending without worry.

Example Use Case: Let’s say you want to save $300 a month for a new laptop. In your finance app, you can create a “Tech Savings” category and set aside funds each month, tracking your progress until you reach your goal. You’ll also get a notification if you’ve overspent in other categories, helping you stay on track.

Investment Tracking and Portfolio Insights

If you’re growing your wealth through investments, a wealth tracking app can help you see how each asset fits into your overall financial strategy. You’ll get insights into your portfolio’s performance, asset allocation, and growth trajectory.

Some apps even offer historical tracking so you can see how your investments have grown over time and make informed decisions about future allocations.

With a finance app, you can monitor your stocks, bonds, mutual funds, and other investments in real-time.

This visibility helps you understand the risk and return of each investment and see how it aligns with your long-term goals, whether that’s retirement, buying a home, or growing an emergency fund.

Example Use Case: Imagine you’re investing in both stocks and bonds, aiming for a balanced portfolio. Your finance app can show you the current value of each asset, any gains or losses, and even projections based on past performance. This helps you see if your investments are meeting your goals and make adjustments as needed.

Setting Goals and Tracking Progress

A personal finance app is also a fantastic tool for setting and reaching financial goals. Whether you’re saving for a vacation, a car, or a down payment on a house, finance apps help break big goals into manageable, trackable steps.

You can set monthly or weekly targets, and some apps even offer visual progress trackers to keep you motivated.

Seeing progress toward a goal can be incredibly rewarding, especially if it’s a big one that might otherwise feel out of reach. Each milestone you reach builds confidence and keeps you motivated to save more and spend wisely.

Example Use Case: Say you want to save $5,000 for a dream vacation. By setting up a savings goal in your finance app, you can track every deposit toward this goal and see a progress bar fill up as you save. Watching that bar grow each month is a great motivator!

Collaborative Financial Planning

For people who share finances with a partner or work with a financial advisor, collaborative tools are invaluable. Many cash management tools let you securely share access to your account overview, making it easy to align on spending, budgeting, and saving goals.

This means less time spent explaining finances and more time working together toward common goals.

Collaborative tools are especially helpful for business partners or associates who manage joint finances, or anyone who wants an advisor’s input on their financial journey.

Example Use Case: If you’re managing money with an associate, you can set up a shared account in your finance app. This way, both of you can view and track shared expenses, such as utilities, supplies, and overheads, while still keeping business finances separate.

Personalized Insights and Tips

Some finance apps go the extra mile by offering personalized insights into your spending and saving habits. These insights can help you make smarter financial choices by highlighting areas where you might overspend or under-save.

For example, if you’re spending more on dining out than usual, the app may suggest a monthly target for dining to help you get back on track.

Example Use Case: If you tend to overspend on shopping each month, your finance app might send a gentle reminder or offer suggestions to cut back. This way, you can adjust spending without having to drastically change your lifestyle.

Security and Privacy: Peace of Mind with Bank-Level Protection

One of the biggest concerns people have about using finance apps is security.

A high-quality finance app prioritizes user privacy and data protection by using entity-level encryption, multi-factor authentication, and other security features.

This means your financial data is safe and protected from unauthorized access.

Reliable finance apps also ensure that your account information is read-only. This means that while the app can access your financial data for tracking purposes, it can’t move money or make changes to your accounts.

This added layer of security provides peace of mind, so you can focus on managing your finances without worrying about risks.

Take Control of your Money with Banktrack

Banktrack stands out as the best expense tracking app for you to take control of your money this year.

Users can effectively access real-time financial information thanks to its customizable dashboards and flexible categorization options, which also allow for accurate tracking of income and expenses.

You can easily make informed decisions and stay in constant control of finances with the help of personalized reports and alerts.

Key Features:

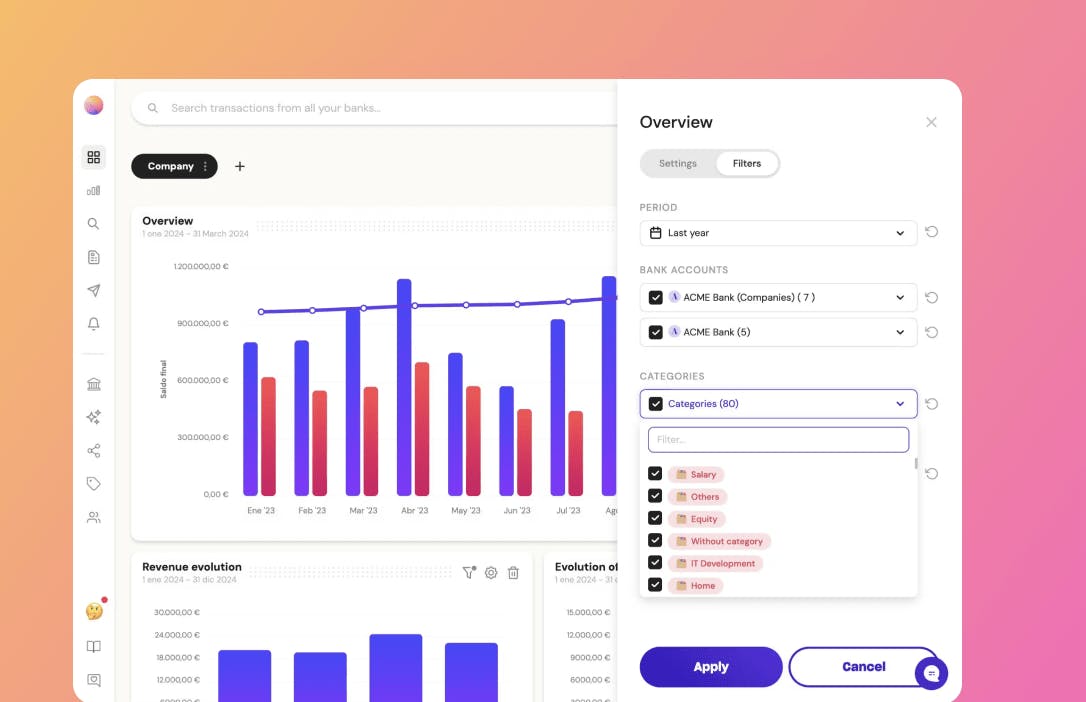

- This wealth tracking app offers customizable dashboards that integrate views from different bank accounts, companies, and financial products, providing users with quick access to essential financial information.

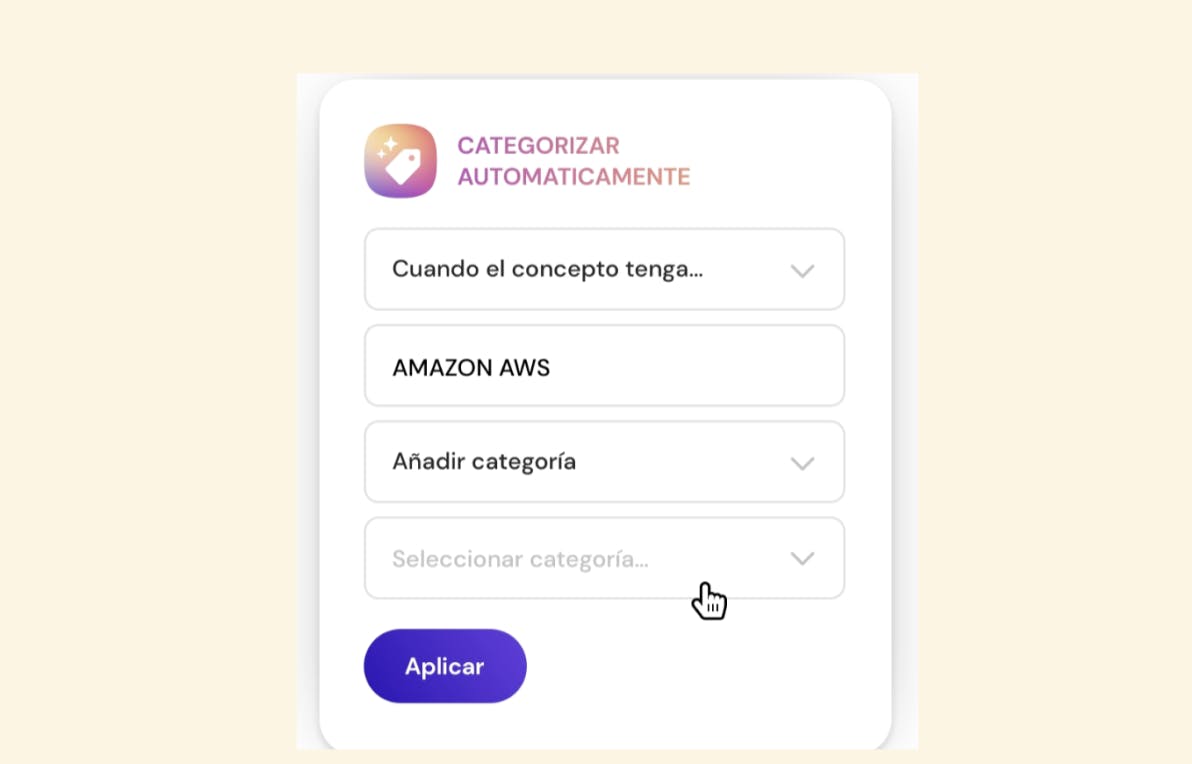

- Users can create and customize categories for revenues expenses, allowing for detailed tracking and understanding of their financial activities.

- The app also provides personalized reports and alerts, enabling users to stay informed about their expenses via various channels such as WhatsApp, SMS, email, Slack, or Telegram.

Take control of your money with an affordable app.

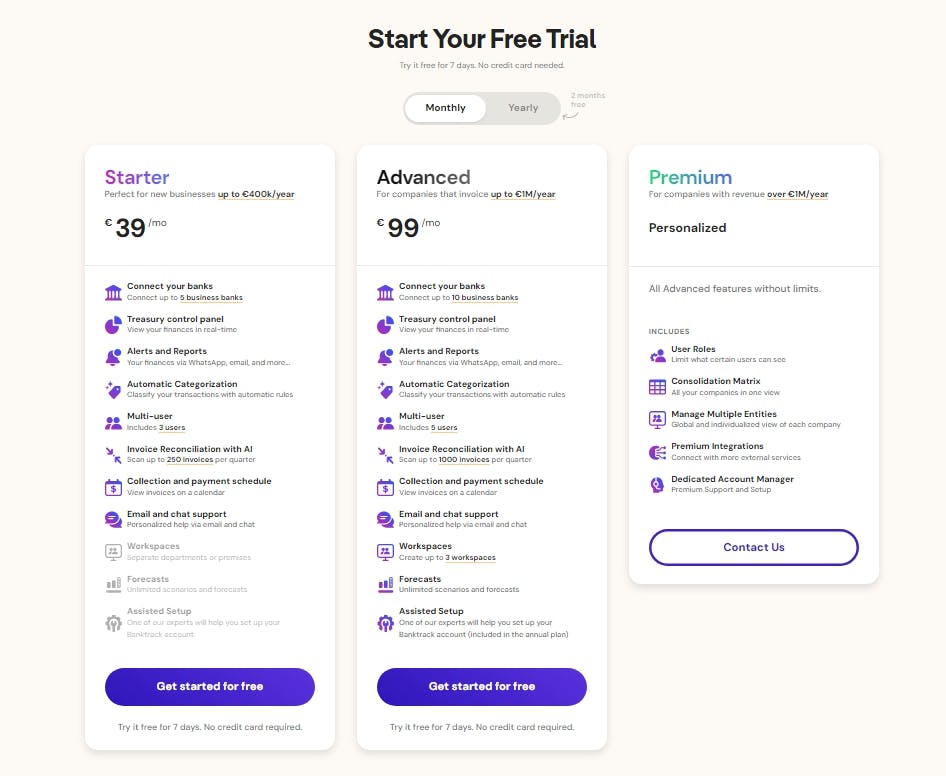

Pricing and Free Trials

Most finance apps operate on a subscription basis, offering a range of pricing options. Some provide a basic free version with limited features, while others offer premium versions with advanced tools. Before committing, many apps offer free trials so you can test the features and see if it’s the right fit.

Want to know more about this? Check out the best subscription manager apps.

If you’re looking for value, check the app’s website for any available promotions.

Many companies offer discounts for annual subscriptions or new users, helping you save even more as you work toward your financial goals.

Finding the Right App for You

Choosing a finance app can feel overwhelming with so many options available. To find the right one, start by listing your top priorities, do you need budgeting, investment tracking, goal setting, or all of the above?

Once you know what you’re looking for, compare a few apps, read reviews, and take advantage of free trials to find the one that fits your lifestyle.

When you find a finance app that clicks, managing your money will become simpler, more organized, and less stressful. You’ll gain clarity, make smarter decisions, and get closer to your financial goals, one step at a time.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed