Best 7 cash management software for startups

- What is a Cash Management Software?

- Key Features

- Top Cash Management Software for Startups

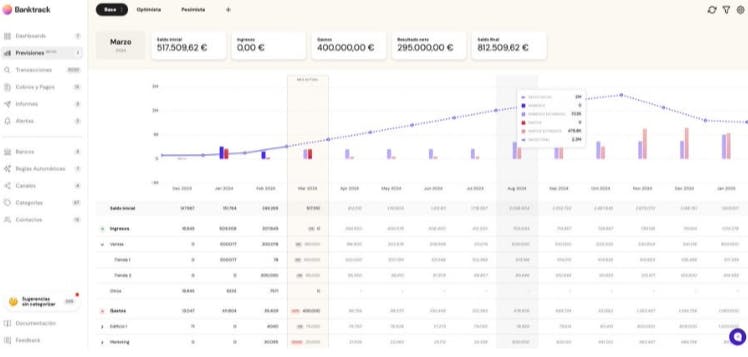

- 1. Banktrack

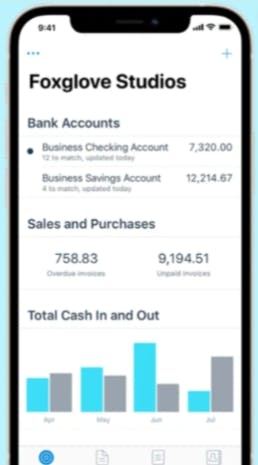

- 2. QuickBooks

- 3. Xero

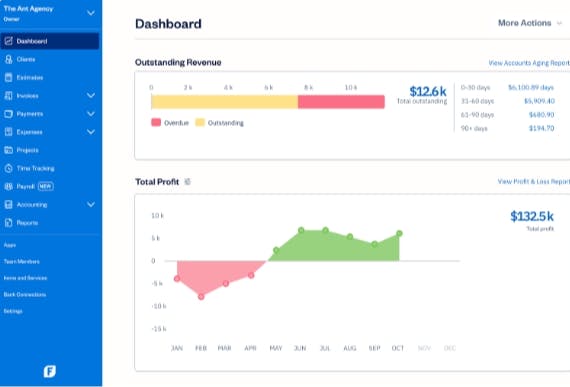

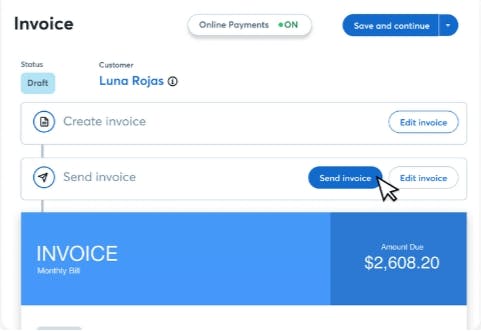

- 4. FreshBooks

- 5. Wave

- 6. Zoho Books

- 7. Sage

- 4 Benefits of Using Cash Management Software

- 1. Improved Financial Accuracy

- 2. Enhanced Cash Flow Visibility

- 3. Time and Cost Efficiency

- 4. Risk Mitigation

- How to Choose the Right Software for Your Startup in 4 Steps

- 1. Assessing Your Business Needs

- 2. Budget Considerations

- 3. Scalability

- 4. Trial Periods and Demos

- Steps to Successful Implementation

- Training Your Team

- Integrating with Existing Systems

- How Can Banktrack Help You

- Frequently Asked Questions - (FAQs)

- What is cash management software?

- How does cash management software improve cash flow?

- Is cash management software secure?

- Can cash management software be customized for my business?

- How do I choose the best cash management software for my startup?

Best cash management software for startups:

- Banktrack

- QuickBooks

- Xero

- FreshBooks

- Wave

- Zoho Books

- Sage

Managing cash flow is a critical task for any startup.

This is why a proper cash management can mean the difference between success and failure.

Thankfully, there are a variety of cash management software options available to help startups simplify their financial processes and make informed decisions.

In this article, we'll dive deep into the best cash management software for startups, exploring their features, benefits, and how to choose the right one for your business.

What is a Cash Management Software?

A cash flow management tool designed to help businesses manage their cash flow efficiently.

It includes various features that allow companies to track, analyze, and optimize their financial transactions and balances.

Key Features

- Automated Cash Flow Forecasting: Predict future cash needs and surpluses.

- Integration with Banking Systems: Find the best app to link your bank accounts for real-time updates.

- Real-time Financial Monitoring: Get up-to-the-minute insights into your financial status.

- Robust Security Measures: Protect sensitive financial data with advanced security protocols.

- User-friendly Interface: Easy navigation and use, even for non-accountants.

Top Cash Management Software for Startups

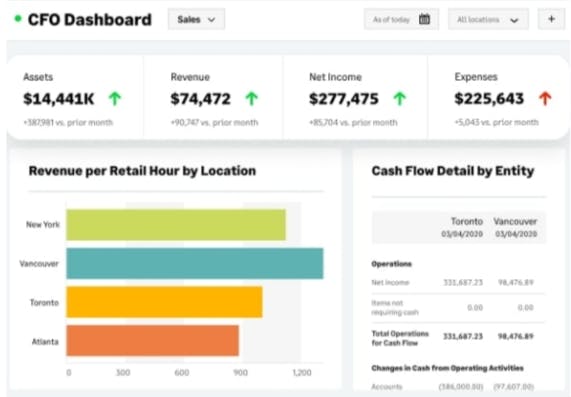

1. Banktrack

Banktrack is a very complete cash management tool, helping businesses track their financial transactions, manage cash flow, and optimize their financial performance.

What Makes Banktrack Stand Out?

- Transaction Tracking: Monitor all financial transactions in real-time. Its customizable dashboards enable users to access real-time financial information efficiently, while its flexible categorization options allow for precise tracking of expenses and income.

- Cash Flow Forecasting: Predict future cash flow based on historical data with a software for real time cash flow forecasting.

- Bank Reconciliation: Automates the process of reconciling bank statements with internal records.

This makes it perfect for startups who work and are associated with different bank accounts or who intertwine their bank statements as it makes the process easier for them.

- Forecasts: You can create estimates of cash flow and make sure they are met. Formulas also allow you to add a lot more dynamic functionality to your calculations.

2. QuickBooks

QuickBooks offers several accounting tools, including:

- Invoicing

- It is one of the best expense tracker apps

- Bank integration

Its user-friendly interface makes it accessible for users with different levels of accounting knowledge. Being one of the most widely used accounting software, QuickBooks benefits from a large community, providing many resources and support for users.

The customer support provided by QuickBooks is said to be very good, having multiple channels such as chat, phone, and a detailed knowledge base.

However, the software can be pricey, especially if you need premium features or have a larger team, as costs can add up with higher-tier plans and additional users.

3. Xero

Xero is known for its invoicing, payroll, bank reconciliation, and financial reporting capabilities.

As a cloud cash management software, it allows users to access their accounts from anywhere and easily integrates with various third-party applications, which is particularly useful for businesses looking to streamline their operations.

Xero is also designed to facilitate collaboration among team members.

On the downside, the functionality in Xero's lower-tier plans is somewhat limited, which might require businesses to opt for more expensive plans to access necessary features.

4. FreshBooks

FreshBooks stands out for its set of following features:

- Time tracking

- Project management

- Expense tracking

- Invoicing features

It is particularly well-suited for service-based businesses due to its intuitive interface and ease of use. FreshBooks excels in managing client interactions and project workflows, making it an ideal choice for freelancers and small service-oriented businesses.

However, when compared to other accounting software options, FreshBooks offers limited accounting capabilities, which might be a drawback for businesses requiring more complete accounting solutions.

5. Wave

Wave has essential accounting features such as:

- Invoicing

- Receipt scanning

- Bank reconciliation

Plus, they are all for free! making it an attractive option for small businesses or startups with tight budgets.

Its straightforward interface and basic functionality cover the needs of many small enterprises.

However, Wave's customer support is limited compared to other paid solutions, and it lacks advanced features that growing businesses might require. This makes it suitable primarily for very small businesses with simple accounting needs.

6. Zoho Books

Zoho Books offers automated workflows, multi-currency handling, and client portals.

It integrates with other Zoho products, making it a great option for businesses already using Zoho's suite of tools. The software is affordable, providing a cost-effective cash management software for small to medium-sized businesses.

However, Zoho Books has a steeper learning curve due to its extensive features, which may require more time for new users to fully understand. Additionally, its third-party integrations are somewhat limited compared to competitors like Banktrack, QuickBooks and Xero, which might be a concern for businesses relying on a variety of external applications.

7. Sage

Sage is a good cash management option, with features like:

- Invoicing

- Payroll

- Inventory management

- Financial reporting

It is designed to cater to both small businesses and larger enterprises. Sage’s flexibility allows it to be customized to fit specific business needs, making it a versatile tool for various industries.

The software also offers strong compliance and reporting capabilities, which are crucial for businesses in regulated sectors.

However, Sage can be complex to set up and use, which might require professional assistance or additional training. Additionally, while Sage offers quite a complete ser of features, it can be more expensive compared to some other options, especially for smaller businesses.

4 Benefits of Using Cash Management Software

1. Improved Financial Accuracy

Manual cash management can lead to errors. Software ensures precision by automating calculations and tracking.

2. Enhanced Cash Flow Visibility

Gain a clear view of your cash flow in real-time, helping you make informed financial decisions.

3. Time and Cost Efficiency

Automating financial tasks saves time and reduces the cost associated with manual processing.

4. Risk Mitigation

Identify and mitigate financial risks early through comprehensive monitoring and reporting features.

How to Choose the Right Software for Your Startup in 4 Steps

Selecting the perfect cash management software for your startup can be a game-changer. Here’s a detailed guide to help you make an informed decision:

1. Assessing Your Business Needs

The first step is to pinpoint the specific financial tasks your startup requires help with. Are you looking for assistance with:

- Invoicing: Do you need to streamline your invoice reconciliation reprocess?

- Payroll: Is managing employee payments a challenge?

- Expense Tracking: Are you struggling to keep track of your business expenses?

- Financial Reporting: Do you need detailed financial reports to make informed decisions?

Understanding these needs will guide you in choosing software that addresses your pain points.

2. Budget Considerations

A budget tracking app is absolutely crucial. Determine how much you can afford to spend on cash management software. Here’s how to approach it:

- Evaluate Pricing Plans: Compare different software pricing plans. Some may offer basic features at a lower cost, while others might provide comprehensive solutions at a higher price.

- Look for Hidden Costs: Be aware of additional costs such as setup fees, training, and ongoing support.

3. Scalability

Your startup will grow, and so should your software. Ensure the software can scale with your business by:

- Checking for Advanced Features: Look for software that offers more advanced features as your needs evolve.

- Ensuring Flexibility: The software should adapt to increasing transaction volumes and additional users without compromising performance.

4. Trial Periods and Demos

Before committing to a purchase, take advantage of free trials and demos:

- Test the Software: Use the trial period to test all features and ensure they meet your needs.

- Evaluate User Experience: Check if the software is user-friendly and intuitive for your team.

Successful implementation is key to reaping the benefits of your chosen software. Here’s a step-by-step guide:

Steps to Successful Implementation

- Plan: Outline your financial management goals. Determine the specific functionalities you need from the software.

- Choose Software: Select the software that best fits your outlined needs and budget.

- Set Up: Integrate the software with your existing systems. Input your financial data to get started.

- Train Your Team: Provide comprehensive training sessions. Offer resources such as manuals and tutorials to ensure everyone knows how to use the software effectively.

- Monitor and Adjust: Continuously monitor your cash flow using the software. Make adjustments based on the insights provided to optimize your financial management.

Training Your Team

Make sure your team is comfortable using the new software by:

- Organizing Training Sessions: Conduct thorough training sessions to demonstrate how to use the software.

- Providing Resources: Supply manuals, video tutorials, and ongoing support to help your team master the software.

Integrating with Existing Systems

Seamless integration with your current systems is vital:

- Check Compatibility: Ensure the software is compatible with your existing accounting systems and banking institutions.

- Facilitate Data Transfer: Make sure the data transfer process is smooth and that all historical financial data is accurately migrated.

How Can Banktrack Help You

Choosing the right cash management software is very important for the financial health of your startup.

By understanding the features, benefits, and implementation process, you can select the software that best meets your needs.

Remember, the right tool will not only streamline your financial processes but also provide valuable insights to help your business grow. Choose wisely!

Frequently Asked Questions - (FAQs)

What is cash management software?

Cash management software is a tool designed to help businesses manage their cash flow efficiently through features like automated forecasting, real-time monitoring, and integration with banking systems.

How does cash management software improve cash flow?

It improves cash flow by providing accurate forecasts, real-time financial data, and tools for efficient financial management, helping businesses make informed decisions.

Is cash management software secure?

Yes, most cash management software includes robust security measures to protect sensitive financial data, such as encryption and secure login protocols.

Can cash management software be customized for my business?

Many cash management software options offer customization features, allowing businesses to tailor the software to their specific needs and workflows.

How do I choose the best cash management software for my startup?

Consider your business needs, budget, scalability, and take advantage of free trials or demos to test the software before making a decision

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real time6 bank tracker apps in Germany in 2025

Looking for reliable bank tracker apps in Germany? Here are six options to help you monitor spending, manage budgets, and stay on top of your finances.The Worst 9 Limitations of Cash Flow Forecasting

Cash flow forecasting predicts how much cash will come in out over a certain period. Here are 12 limitations that you should have in mind.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed