7 best Centime alternatives in 2024

- What are Business Cash Management Tools?

- Key Features to Consider

- 1. Banktrack is your Expense Tracking App

- Custom Dashboards

- Adapted Categories

- Custom Reports and Alerts

- Forecasts

- Affordable Prices:

- 2. Scoro

- 3. PlanGuru

- 4. Google Docs

- 5. QuickBooks

- 6. Vena Solutions

- 7. Cube

- How Can Banktrack Help your Business

- Frequently Asked Questions (FAQs)

- Are alternative cash management tools as reliable as Centime?

- How do I choose the right cash management tool for my business?

- What are some key features to consider when evaluating alternatives to Centime?

- What makes Banktrack stand out as an alternative to Centime?

- What are some other alternatives to Centime worth considering?

In today's economy, every cent counts. For this reason, you may be wondering what the top Centime alternatives are.

- Banktrack

- Scoro

- PlanGuru

- Google docs

- Quickbooks

- Vena Solutions

- Cube

While Centime has been a popular choice for many businesses, exploring alternatives can offer unique benefits and tailored solutions that maybe you didn't even know they existed.

In this guide, we will delve into alternative business cash management tools to help you optimize your finances and enhance operational efficiency.

What are Business Cash Management Tools?

Business cash management tools are designed to help organizations effectively manage their cash flow, liquidity, and financial transactions.

From invoicing and expense tracking to budgeting and forecasting, these tools offer a range of features to streamline financial processes and improve decision-making.

When considering alternatives to Centime, it is important to evaluate each option based on your specific business needs and objectives.

Key Features to Consider

Before exploring alternatives to Centime, it is important to identify the key features and functionalities that are important to your business, this way you will be able to identify the best option for your needs.

Some essential features to consider include:

1. Invoicing and Billing

Efficient invoicing and billing capabilities are essential for managing cash flow and ensuring timely payments from customers.

2. Expense Tracking

Robust expense tracking features allow businesses to monitor and categorize expenses, identify cost-saving opportunities, and maintain accurate financial records.

3. Budgeting and Forecasting

Comprehensive budgeting and forecasting tools help businesses plan and allocate financial resources effectively, enabling informed decision-making and strategic growth.

4. Integration with Banking Systems

Seamless integration with banking systems enables automated bank reconciliation, real-time transaction monitoring, and improved visibility into cash flow.

1. Banktrack is your Expense Tracking App

Banktrack is the best expense tracking app for the year 2024.

Let us explain why it is considered the best option:

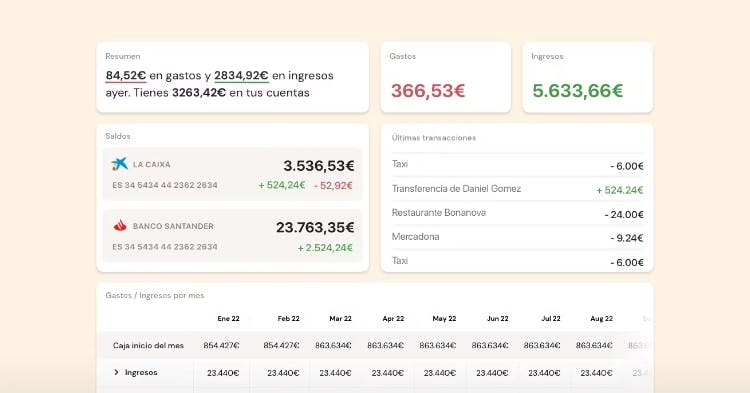

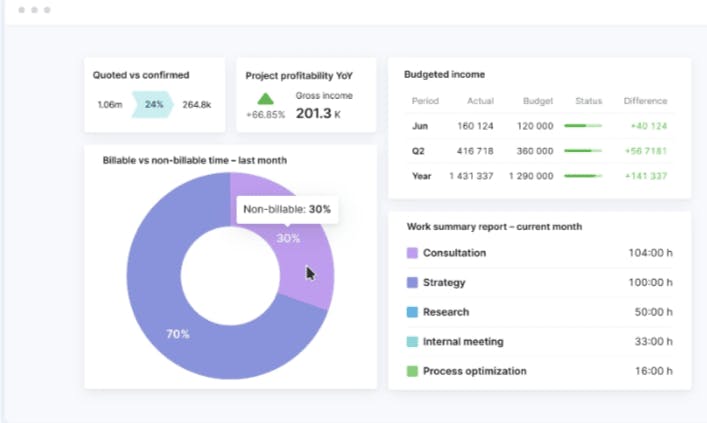

Custom Dashboards

Banktrack stands out for its ability to create custom dashboards that combine views from different bank accounts, businesses, and financial products.

This flexibility allows you to quickly access the necessary information to manage your expenses efficiently.

Adapted Categories

A good cash management software offers categories tailored to your expenses, meaning you can customize them according to your needs.

With advanced rules, you can create and adjust unlimited categories to organize your expenses and income as you wish.

This flexibility enables you to track your finances and understand where your money is being spent.

Custom Reports and Alerts

Banktrack also provides custom reports and alerts.

You can create tailor-made reports and receive alerts about your expenses through various channels such as WhatsApp, SMS, email, Slack, or Telegram.

These alerts can be set up to notify you about duplicate charges, low balances, or other important aspects, helping you maintain constant control over your finances and make informed decisions at all times.

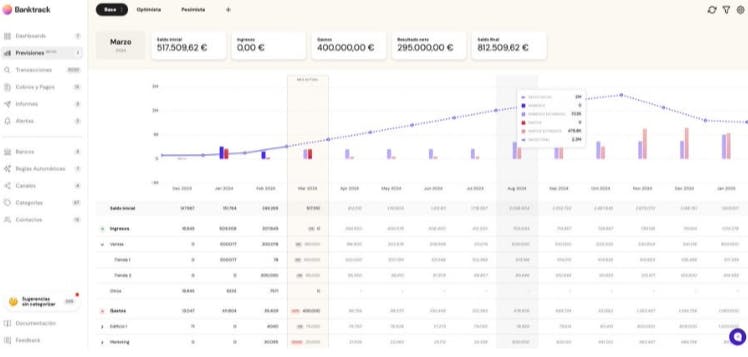

Forecasts

With the latest version of a cash liquidity forecasting software like Banktrack, you can make cash flow forecasts and estimates, and ensure they are met!

Additionally, you can use formulas to make calculations much more dynamic and visual.

Affordable Prices:

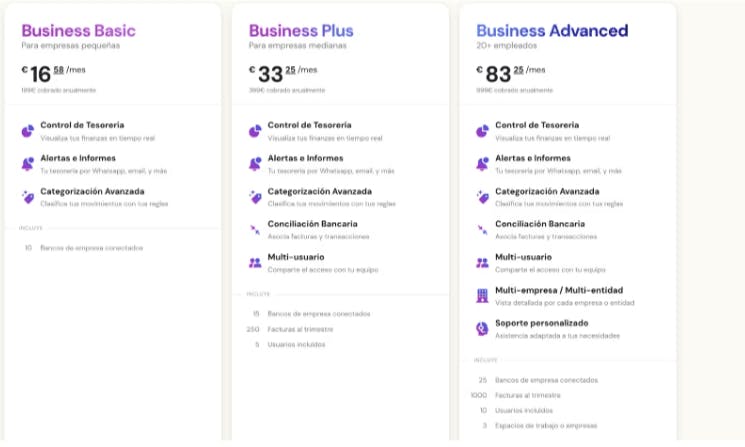

Banktrack offers a variety of pricing plans with different functionalities at affordable prices.

For example, the "Business Basic" plan allows the connection of up to 10 bank accounts for just €16.58 per month, which is not always easily found in other similar services.

2. Scoro

With the integration of project management, sales tracking, invoicing, and cash flow management, Scoro provides businesses with a comprehensive solution.

Although the basic version might not have as many advanced financial features as the higher-tier plans, upgrading gives you access to a plethora of tools that can help you grow and streamline your business.

Key Features:

- Comprehensive business management tools

- Project management and sales pipeline tracking

- Supplier management and invoicing

- Customizable reporting options

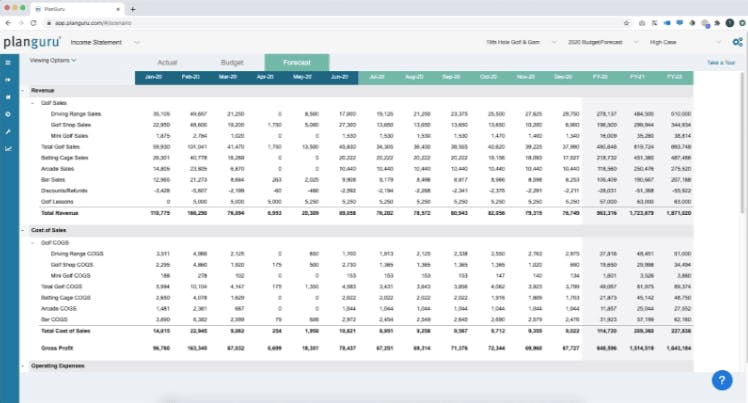

3. PlanGuru

With the help of PlanGuru's forecasting and budgeting tools, companies can examine financial data and make well-informed decisions about their future.

Users can gain valuable insights into their cash flow and optimize their financial processes by integrating with QuickBooks and Excel.

Key Features:

- Budgeting and forecasting tools

- Integration with QuickBooks and Excel

- Educational resources for users

- 14-day free trial and 30-day money-back guarantee

4. Google Docs

Google Docs offers a variety of cash flow management templates that can be downloaded, giving businesses affordable options.

These templates provide a straightforward and approachable way to manage cash flow on your own, even though they might not have all the sophisticated features found in specialized software.

Important characteristics:

- Numerous cash flow management templates that can be downloaded

- Free or inexpensive options

- Quick accessibility and simplicity of use

- Minimal customer service and fundamental features

5. QuickBooks

QuickBooks is another popular accounting program that is well-known for its user-friendliness and basic cash flow management features.

Although QuickBooks might not have all the sophisticated features of specialized cash management software, it is still a good option for companies that already use the platform for bookkeeping.

Important characteristics:

- Rudimentary cash flow management instruments

- Capabilities for billing and invoicing

- Analysis and reporting of financial data

- Smooth compatibility with accounting software

6. Vena Solutions

Vena Solutions provides cash management and financial planning services via the cloud, utilizing Excel to provide a comfortable user interface.

Vena's extensive feature set and adaptable reporting options make it an invaluable resource for companies of all kinds, even though certain users may find the learning curve for some tools to be quite steep.

Important characteristics:

- Cloud-based cash management and financial planning

- Excel-based interface for a comfortable and familiar use

- Support representatives with expertise and online training resources

- Adaptable reporting choices and mobile assistance

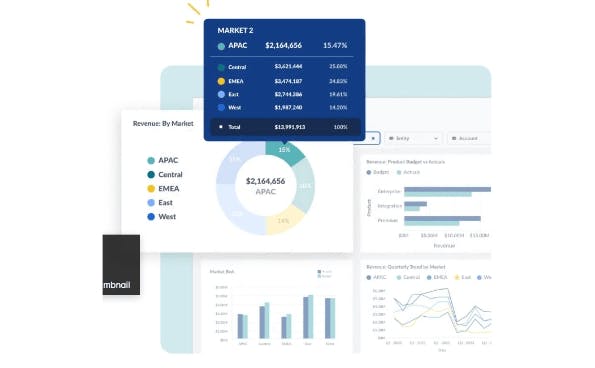

7. Cube

Cube simplifies cash flow management through the use of customizable reporting options and automated data consolidation.

Cube's ability to analyze data and generate customized reports makes it a valuable tool for businesses looking for effective financial management solutions, even though some users may find certain features to be challenging to use at first.

Important characteristics:

- Consolidating data automatically from spreadsheets

- Personalized reports and dashboards

- Tools for scenario planning and analysis

- Integration with accounting software

Not really a fan of Cube? We got you covered, here are some additional best Cube alternatives.

How Can Banktrack Help your Business

In today's economy, every penny counts, this makes efficient cash management tools absolutely indispensable for businesses. You do not want to overspend and you also want to know where your money is going.

While Centime has been a popular choice, exploring alternatives is essential to find the right fit for your organization's needs. Don't just settle with a platform that is not your fit.

We have highlighted the importance of business cash management tools and provided insights into key features to consider when evaluating alternatives. Whether it's invoicing, expense tracking, budgeting, or integration with banking systems, there are several options available to streamline financial operations and enhance decision-making although Banktrack stands out amongst them.

By choosing Banktrack, businesses can optimize their finances and improve their operational efficiency.

Frequently Asked Questions (FAQs)

Are alternative cash management tools as reliable as Centime?

Of course, there are a lot of cash management tools out there, for example, the best Bottomline alternatives offer similar reliability and functionality as Centime, with the added benefit of customization and flexibility.

How do I choose the right cash management tool for my business?

When choosing a cash management tool, consider factors such as your business size, industry-specific needs, budget, and desired features and functionalities.

What are some key features to consider when evaluating alternatives to Centime?

You should look for a bill management app, invoicing and strong expense tracking features. Also, comprehensive budgeting and forecasting tools are needed and seamless integration with banking systems so that Banktrack can act like an app to view all your bank accounts.

What makes Banktrack stand out as an alternative to Centime?

Banktrack offers custom dashboards, adapted categories for expenses, custom reports and alerts, forecasts, and affordable pricing plans, making it a comprehensive and cost-effective solution for expense tracking.

What are some other alternatives to Centime worth considering?

Other alternatives worth considering include Banktrack, Scoro, which offers comprehensive business management tools, and PlanGuru, known for its budgeting and forecasting features and integration with QuickBooks and Excel.

Share this post

Related Posts

A guide to intercompany transactions in 2025

Intercompany transactions are financial dealings that occur between related entities within a corporate group.Deferred Payments: An In-Depth Overview

A deferred payment is a financial arrangement where the payment for a purchase or a loan is delayed until a future date.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed