Best 8 SMS-Based Expense Tracker

- Top 8 SMS-Based Expense Trackers in 2024

- 1. Banktrack

- 2. Goodbudget

- 2. Walnut

- 3. Spendee

- 4. Money Lover

- 5. SMSOrganizer by Microsoft

- 6. Splitwise

- 7. Expensify

- Why Use an SMS-Based Expense Tracker?

- 1. Simplicity and Convenience

- 2. Instant Updates

- 3. Accessibility

- Choosing the Best SMS-Based Expense Tracker for Your Needs

These are the best SMS-Based expense tracker:

- Banktrack

- Goodbudget

- Walnut

- Spendee

- Money Lover

- SMSOrganizer by Microsoft

- Splitwise

- Expensify

Managing expenses remotely can be challenging, especially if you don't always have internet access or prefer a simple method to record transactions.

In this article, we’ll review the best SMS-based expense trackers available in 2024, so you can choose the one that best fits your needs.

Top 8 SMS-Based Expense Trackers in 2024

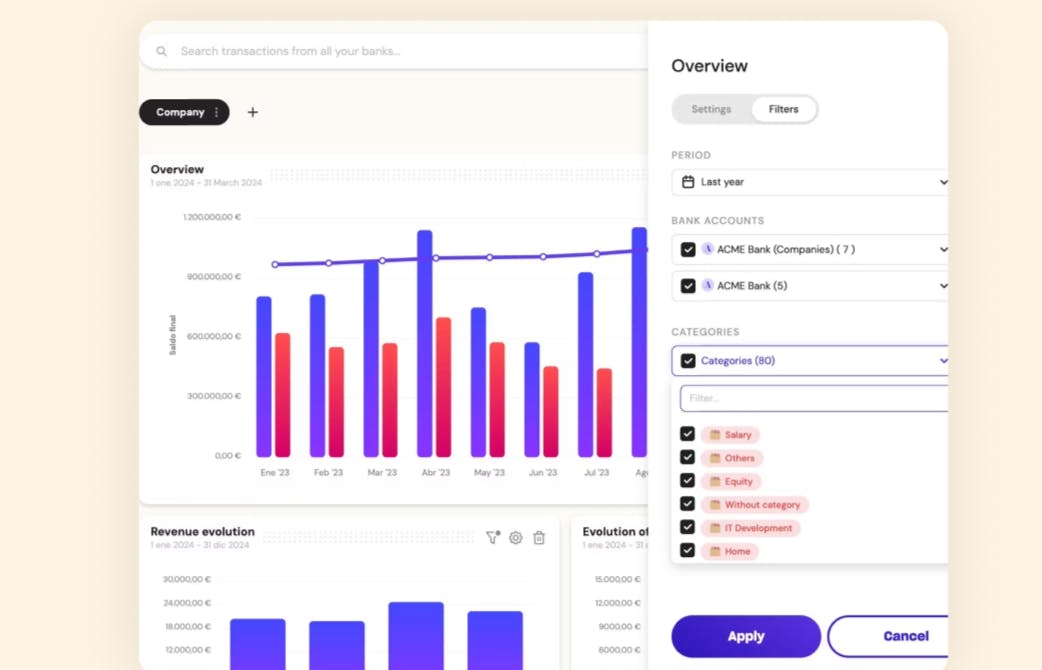

1. Banktrack

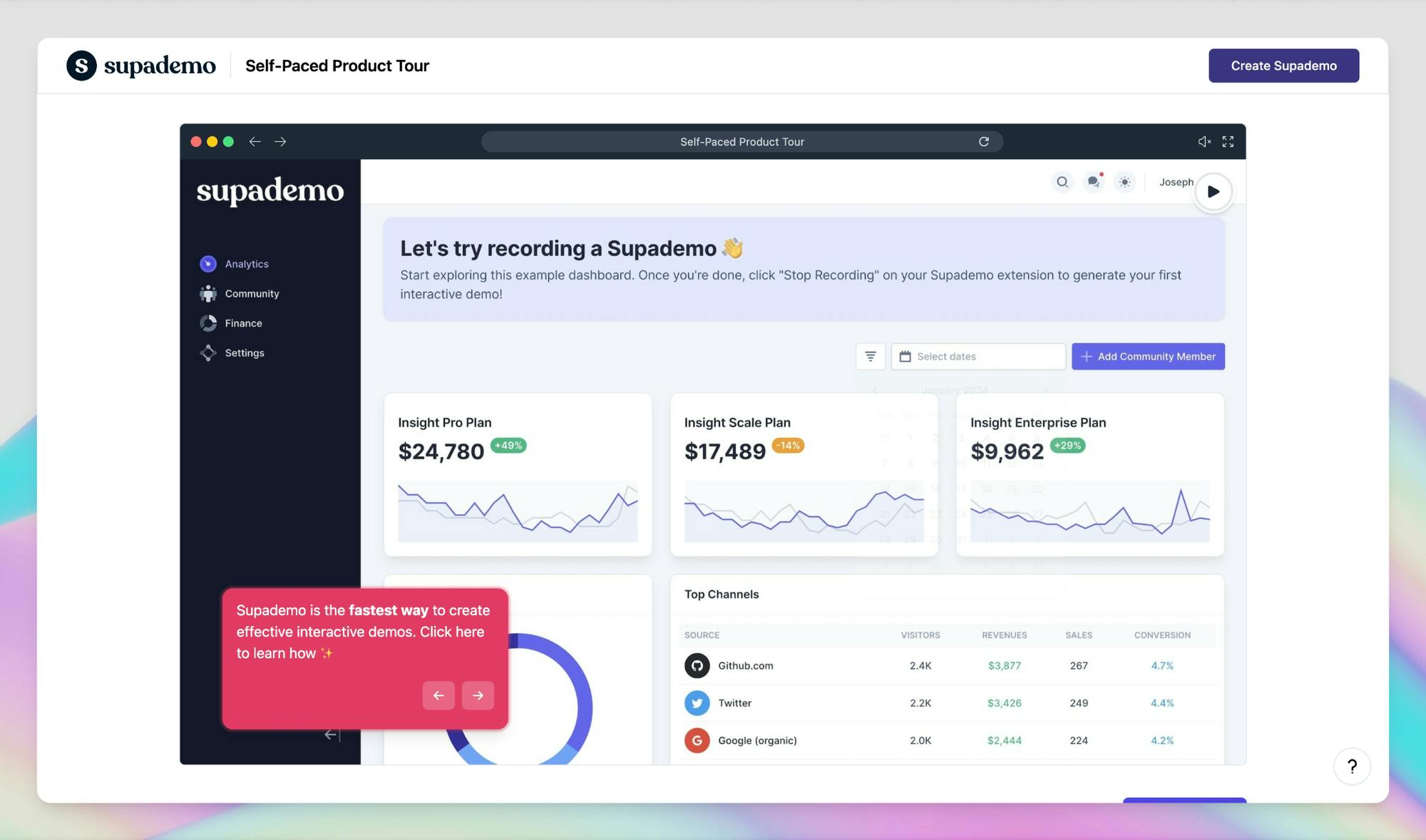

Banktrack is a versatile expense tracking app that offers a wide range of features that make managing your finances more straightforward and efficient.

One of its unique capabilities is sending personalized alerts via SMS, which helps you stay informed about your expenses and financial activities in real-time.

Here’s a closer look at how Banktrack can help you manage your finances effectively, including its SMS alert feature.

1. Personalized Reports and Alerts

Banktrack provides users with personalized reports and alerts, allowing them to stay informed about their expenses through various channels like WhatsApp, SMS, email, Slack, or Telegram.

This feature ensures you are always up-to-date with your financial activities, helping you monitor spending patterns and detect any unusual transactions immediately.

- SMS Alerts: Receive notifications for specific categories or thresholds you set, such as when you reach a spending limit, when a large transaction is detected, or when your account balance falls below a certain amount. This proactive approach helps you stay on top of your finances, even on the go.

2. Real-Time Transaction Tracking

Banktrack is exceptional at transaction tracking, providing real-time monitoring of all financial activities, which is crucial for maintaining control over your cash flow.

- Customizable Dashboards: Create dashboards tailored to your specific financial needs. Whether you need an overview of your spending, a detailed breakdown of expenses, or a comparison of income and expenses over time, Banktrack's customizable dashboards provide a clear, real-time view of your financial status.

- Flexible Categorization: The platform allows for precise categorization of expenses and income, ensuring you always understand where your money is going and where it’s coming from.

You can create custom categories that align with your specific needs, making it easier to track and analyze your financial data. This flexibility is essential for generating detailed financial reports and making informed decisions.

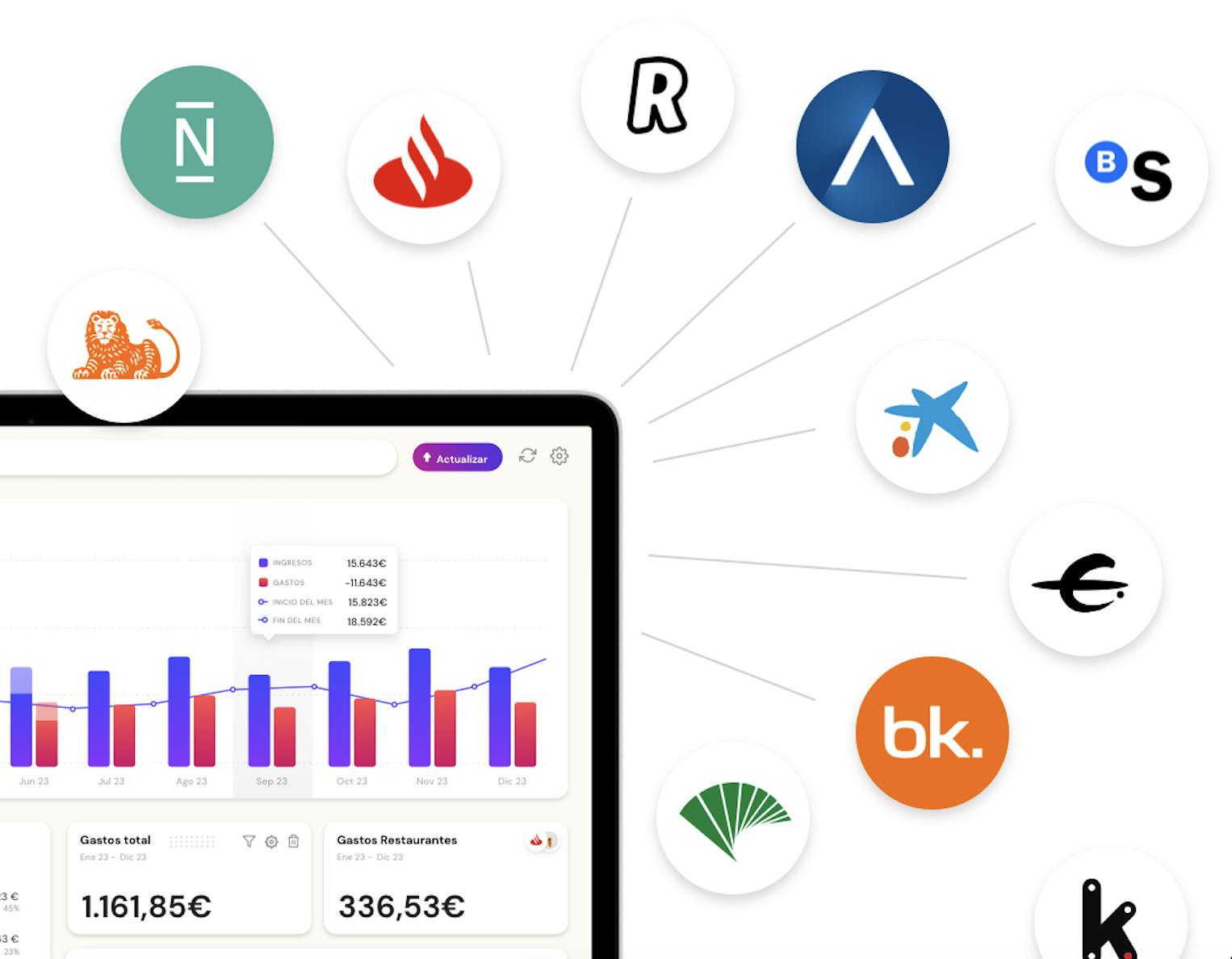

3. Seamless Bank Integration

Banktrack simplifies the integration of financial data by syncing with a wide array of banks, eliminating the need for manual data entry.

- Extensive Bank Coverage: The platform syncs with over 120 banks, including both traditional banks and neobanks, this makes it the best app to link all bank accounts. It ensures that, regardless of where you bank, all your financial accounts can be integrated into one platform, making it easier to manage your finances.

- Dual Connection Methods:

- Open Banking (PSD2): Compliant with European regulations, this method provides a secure, standardized way to access your banking data.

- Direct Access: For banks not covered under PSD2, Banktrack offers direct access connections, allowing for seamless integration of financial data from virtually any bank.

These connection methods ensure efficient and secure integration, saving you the hassle of manually entering transactions.

4. Strong Security Measures

Banktrack prioritizes the security of your financial information with multiple layers of protection:

- Authorized Data Providers: Banktrack uses only authorized and audited data providers approved by the Bank of Spain, ensuring your data is handled securely.

- Read-Only Access: The app only has read-only access to your bank accounts, which means it can view and import financial data but cannot conduct transactions, providing an additional layer of security against unauthorized activities.

- No Storage of Banking Passwords: The connection process uses a unique access token, meaning your banking passwords are never stored, minimizing the risk of password theft.

- Data Encryption: All transaction data is encrypted within Banktrack’s systems, ensuring the confidentiality and security of your financial information.

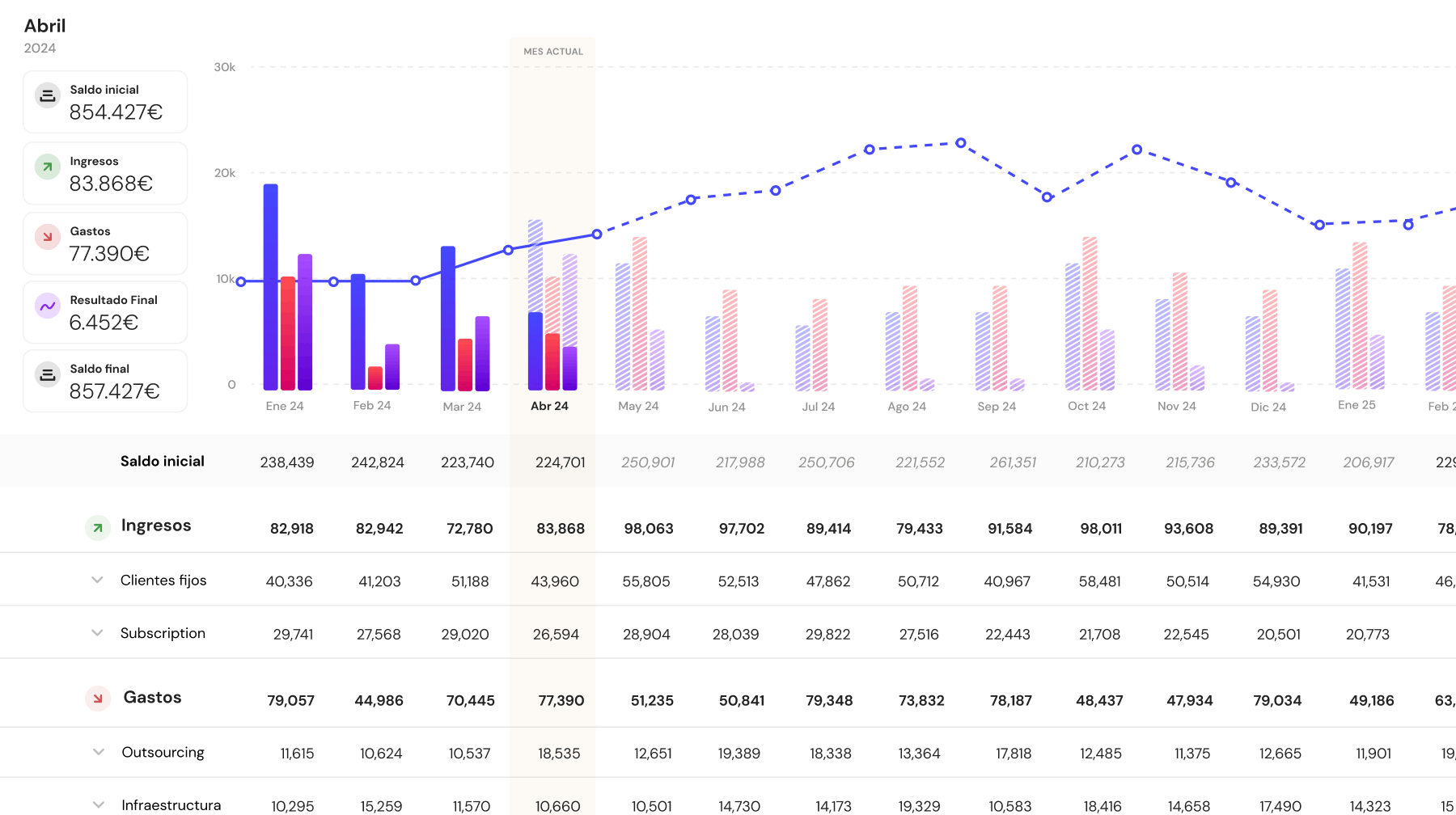

5. Cash Flow Forecasting

Predicting and understanding cash flow is vital for maintaining business stability and planning for growth. Banktrack offers powerful cash flow forecasting tools:

- Historical Data Analysis: Analyzes your historical financial data to predict future cash flow trends, helping you anticipate potential shortfalls or surpluses for better financial planning.

- Dynamic Forecasting: Banktrack is a treasury cash flow forecasting software that allows you to create dynamic cash flow forecasts that adjust based on real-time data, ensuring your financial projections are always accurate and up-to-date.

Want to be as accurate as possible? Here is a list on how to do a cash flow projection in 9 steps.

For readers who want to explore more advanced tools beyond SMS expense tracking, check out this guide to the best treasury management software.

It explains how platforms like Banktrack go beyond expense alerts to offer full-scale treasury forecasting, liquidity planning, and financial control for growing businesses.

6. Bank Reconciliation

Reconciling bank statements with internal records can be tedious and prone to errors, but Banktrack makes this process seamless:

- Automated Reconciliation: Automatically matches your bank statements with internal records, quickly identifying discrepancies and reducing the risk of errors. This ensures that your financial records are always accurate.

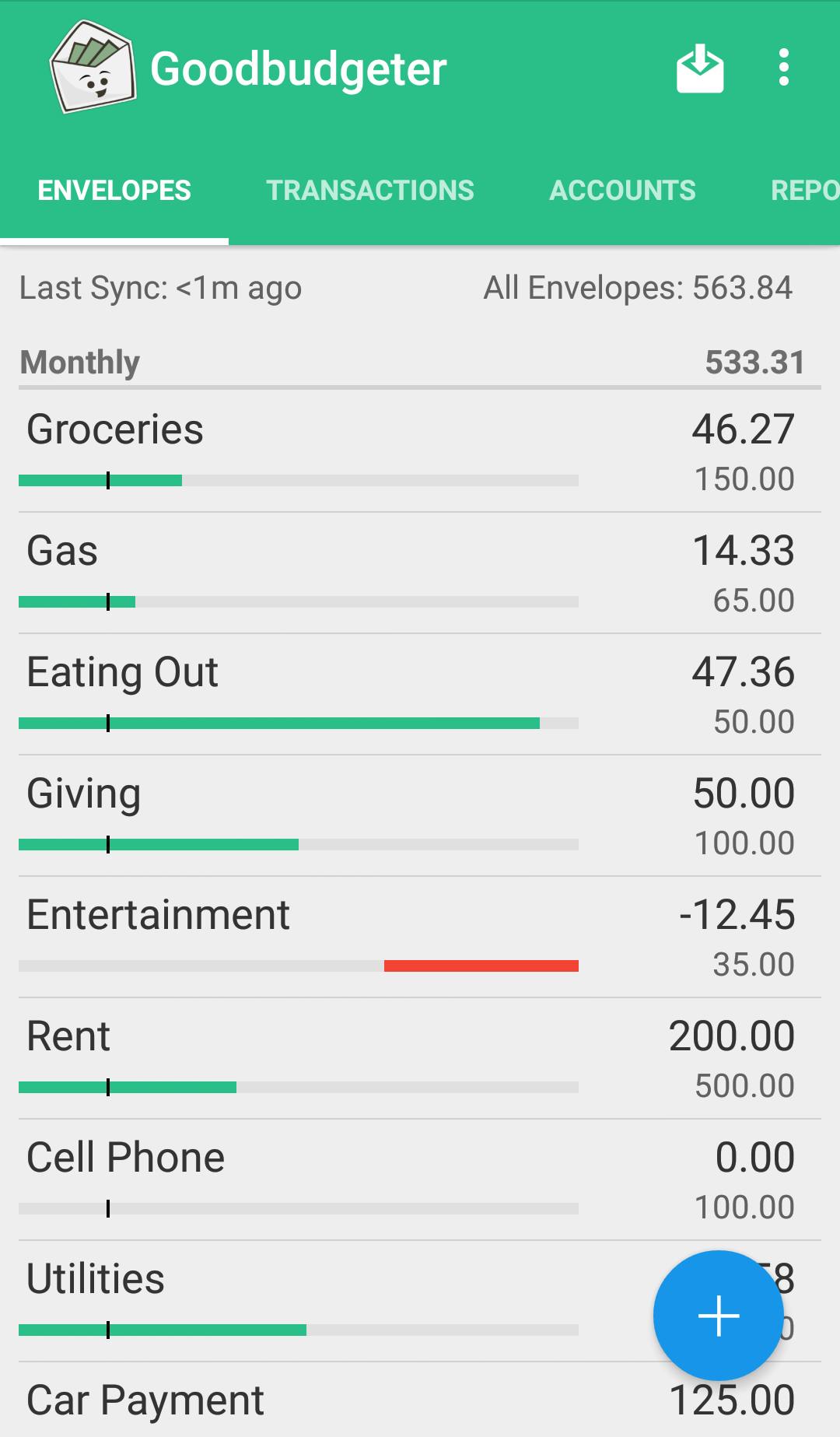

2. Goodbudget

Goodbudget is a popular budgeting tool that also supports SMS-based expense tracking.

It uses the "envelope method" to help users allocate funds to different categories and monitor spending against their budget.

Not sure if you need one? Check how to determine if you need a business budgeting software.

With Goodbudget, you can log expenses by sending an SMS to a designated number, and the app will automatically update your budget categories.

Key Features

- SMS Logging: Track expenses by sending a text message.

- Envelope Budgeting: Helps manage spending by dividing income into different categories.

- Multi-Device Sync: Syncs across multiple devices, making it great for family or shared budgeting.

Pros and Cons

- Pros: Easy to use, offers real-time updates, great for families or shared finances.

- Cons: Requires initial setup via the app or website.

2. Walnut

Walnut is a leading expense tracking app in India that utilizes SMS data for tracking expenses.

It automatically reads transactional SMS messages from banks and merchants to categorize and track your spending.

Walnut is perfect for users who want automated expense tracking without manually entering each transaction.

Key Features

- Auto-Tracking via SMS: Automatically reads and categorizes SMS messages from banks.

- Expense Categorization: Groups expenses for better management.

- Monthly Summaries: Provides insights into spending patterns and summaries.

Pros and Cons

- Pros: Automated tracking, easy manual entry, robust categorization.

- Cons: Limited availability outside of India, relies heavily on SMS data.

3. Spendee

Spendee is a versatile budgeting app that supports SMS-based expense tracking.

It connects to your bank accounts for automatic updates and allows you to manually enter transactions via SMS, making it a flexible choice for users who want to track expenses in various ways.

Key Features

- SMS Expense Logging: Manually add expenses via SMS.

- Bank Integration: Connects to multiple banks for automatic updates.

- Custom Categories: Allows users to create personalized expense categories.

Pros and Cons

- Pros: Supports both manual and automatic tracking, multi-currency support.

- Cons: Some features are only available with a premium subscription.

4. Money Lover

Money Lover is an expense tracker that offers multiple ways to manage money, including SMS-based tracking.

The app can automatically read SMS alerts from banks to track expenses, and users can also manually add transactions via SMS or directly through the app.

Key Features

- Automatic SMS Detection: Reads and categorizes expenses from SMS alerts.

- Detailed Reports: Provides financial insights through comprehensive reports.

- Budget Planning: Offers tools for budgeting and setting financial goals.

Pros and Cons

- Pros: Multiple input methods, excellent analytics, customizable budgeting tools.

- Cons: Some advanced features require a subscription.

5. SMSOrganizer by Microsoft

SMSOrganizer by Microsoft is an SMS management tool that automatically categorizes and summarizes expense-related messages from banks, credit card companies, and merchants.

Although not a dedicated expense tracker, it’s an excellent option for passive tracking via SMS.

Key Features

- Automatic Categorization: Organizes and highlights expense messages.

- Spending Summaries: Provides monthly spending summaries based on SMS data.

- Bill Reminders: Sends reminders for upcoming bills and due dates.

Pros and Cons

- Pros: Automated tracking, free to use, efficient SMS management.

- Cons: Only available on Android, limited budgeting features.

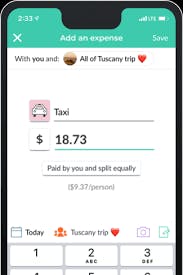

6. Splitwise

Splitwise is primarily designed for splitting bills among groups, but it also supports SMS-based expense tracking.

Users can manually add expenses via SMS, making it ideal for tracking shared costs and group spending.

Key Features

- SMS Expense Entry: Allows users to log expenses via SMS.

- Shared Expense Management: Tracks who owes what within a group.

- Expense Summaries: Provides a clear overview of shared expenses.

Pros and Cons

- Pros: Great for managing group expenses, easy SMS input.

- Cons: Not ideal for individual expense tracking and budgeting.

7. Expensify

Expensify is a powerful expense cash management software suitable for both personal and business expenses.

It offers SMS-based expense entry, which is particularly useful for quick expense logging, like tracking mileage or cash expenses.

Key Features

- SMS Entry: Enables users to log expenses via SMS quickly.

- Receipt Scanning: Offers automatic receipt scanning and expense categorization.

- Expense Reports: Generates detailed reports for both personal and business use.

Pros and Cons

- Pros: Comprehensive features, integrates with accounting software, easy SMS entry.

- Cons: Advanced features require a paid subscription, SMS tracking is a secondary feature.

Why Use an SMS-Based Expense Tracker?

1. Simplicity and Convenience

An SMS-based expense tracker offers a simple and efficient way to log expenses without relying on a smartphone app or internet connection.

Just send a text message, and your transaction is recorded. This is particularly useful for people who frequently travel or those who prefer a no-frills approach to managing their finances.

2. Instant Updates

By using SMS, you can instantly update your expenses, ensuring that your financial records are always up to date.

This real-time logging can help prevent overspending and provide a clear picture of your financial situation.

3. Accessibility

SMS-based trackers are accessible to anyone with a mobile phone.

You don't need a smartphone or data plan to use these tools, making them ideal for users in areas with limited internet access or those who prefer to manage expenses without a dedicated app.

Choosing the Best SMS-Based Expense Tracker for Your Needs

Banktrack’s SMS alerts feature provides valuable notifications about your financial activities, helping you stay on top of your expenses in real-time.

Combined with strong transaction tracking, seamless bank integration, powerful cash flow forecasting, and great security measures, Banktrack is a comprehensive tool for managing your finances effectively.

Whether you're an individual looking to track expenses, a business seeking to optimize cash flow or you are looking for a budget app for couples, Banktrack offers a range of features to suit your financial management needs.

Ultimately, the right SMS-based expense tracker will depend on your unique requirements, regional availability, and the level of detail you need in managing your finances.

Share this post

Related Posts

Best 11 alternatives to Monarch Money

These are the best 11 alternatives to Monarch Money for budgeting and finance tracking in 2024.Best 7 bank trackers in the Netherlands

This guide lists the top 7 tools to help you track expenses, monitor accounts, and improve your financial management. Find the perfect tracker to stay on top of your money

Try it now with your data

- Your free account in 2 minutes

- No credit card needed